North America Terahertz Technology Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5454

December 2024

98

About the Report

North America Terahertz Technology Market Overview

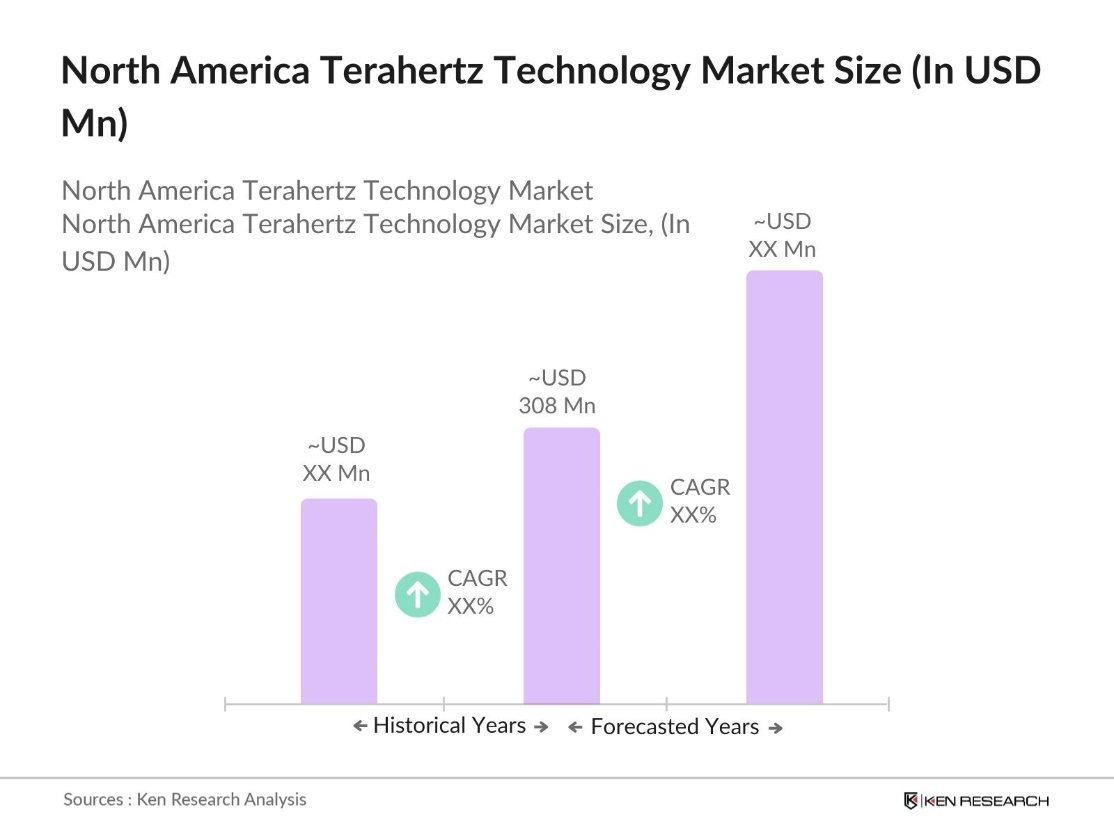

- The North America Terahertz Technology Market is valued at USD 308 million based on a five-year historical analysis. This growth is driven by the increasing demand for non-invasive testing across industries, including aerospace, medical imaging, and security applications. The market's expansion is further fueled by advancements in wireless communication, particularly with the anticipated deployment of 6G networks, which will significantly increase the adoption of terahertz technologies.

- The dominant regions in the North America Terahertz Technology market include the United States and Canada. The U.S. leads due to its advanced R&D facilities, strong government funding for defense and security applications, and the presence of key technology companies. Meanwhile, Canadas dominance is driven by its growing aerospace industry and increasing investments in healthcare technologies that rely on terahertz imaging systems.

- In February 2024, researchers at MIT developed terahertz-powered anti-tampering tags that are smaller and more affordable than traditional RFID tags. These tags incorporate microscopic metal particles into the adhesive, which attaches the tag to objects. Measuring just 4 square millimeters, the light-powered tags are designed for seamless integration into large-scale supply chains, offering a more efficient and cost-effective solution for anti-tampering purposes.

North America Terahertz Technology Market Segmentation

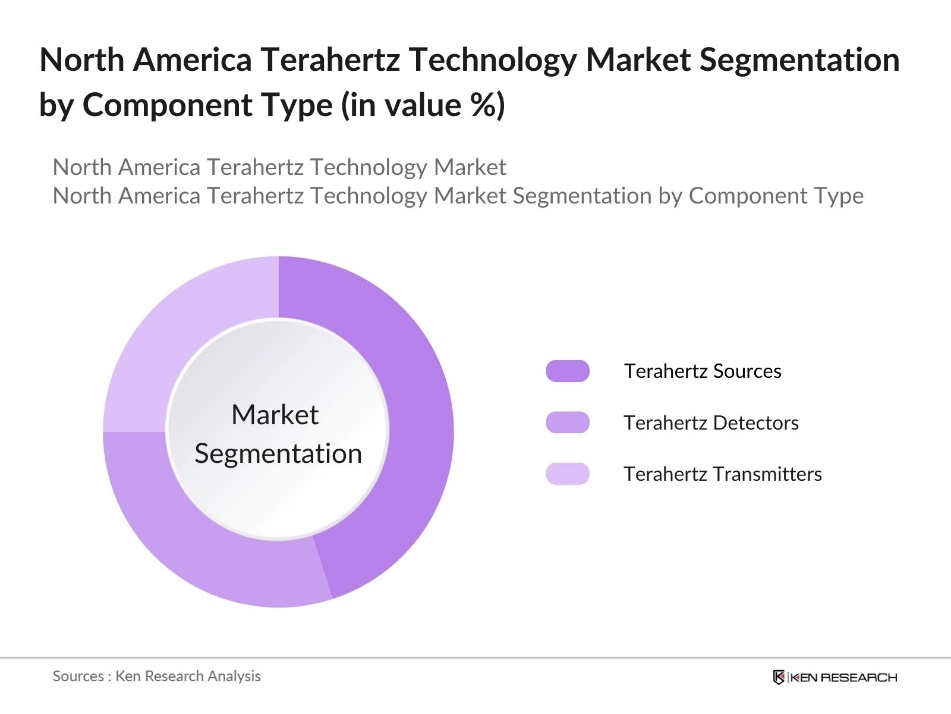

By Component Type: The North America Terahertz Technology market is segmented by component type into Terahertz Sources, Terahertz Detectors, and Terahertz Transmitters. Among these, Terahertz Sources hold the dominant market share due to their essential role in generating terahertz waves for applications such as imaging and spectroscopy. The demand for reliable and efficient terahertz sources is high, especially in the defense and security industries, where accurate detection and identification of materials are crucial.

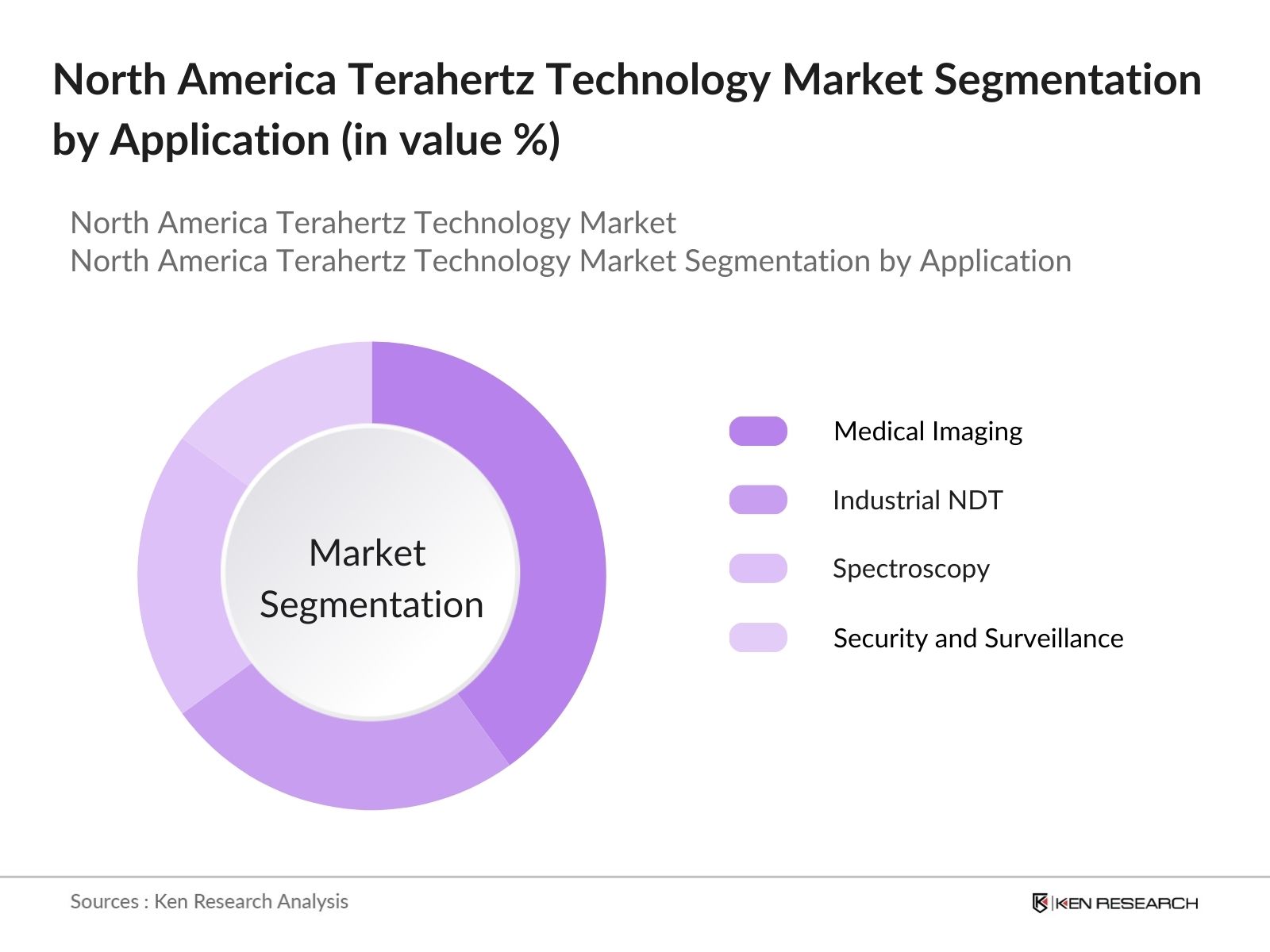

By Application: The North America Terahertz Technology market is segmented by application into Medical Imaging, Industrial Non-Destructive Testing (NDT), Spectroscopy, and Security and Surveillance. Medical Imaging dominates this segment due to the increasing use of terahertz technology in early cancer detection and other non-invasive diagnostic applications. The ability of terahertz waves to penetrate tissues without harmful radiation makes them highly suitable for medical use, especially in regions with high healthcare expenditure like the U.S.

North America Terahertz Technology Market Competitive Landscape

The market is dominated by a few key players, most of which are headquartered in the U.S. and Europe. These companies control a significant portion of the market through strategic collaborations, technological advancements, and expanding application areas.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

R&D Spending |

Product Portfolio Size |

Number of Patents |

Global Market Reach |

Major Application Focus |

|

TeraView Ltd. |

2001 |

Cambridge, UK |

||||||

|

Menlo Systems GmbH |

2001 |

Munich, Germany |

||||||

|

Luna Innovations Inc. |

1990 |

Roanoke, USA |

||||||

|

Advanced Photonix Inc. |

1988 |

Ann Arbor, USA |

||||||

|

Toptica Photonics AG |

1998 |

Munich, Germany |

North America Terahertz Technology Industry Analysis

Growth Drivers

- Expansion in Wireless Communication: Terahertz technology plays a crucial role in advancing next-generation wireless communication, especially for 6G networks. The Federal Communications Commission (FCC) is preparing to allocate terahertz frequencies for commercial use as 6G technology progresses. The U.S. Department of Defense (DoD) has indeed allocated $600 million for various wireless technologies, primarily focusing on 5G applications, as part of its efforts to enhance military capabilities, further accelerating the integration of terahertz technology.

- Government Investment in Research & Development: Government investment in research and development (R&D) for terahertz technology has been substantial. In 2022, the NSF announced a broader funding initiative of $42.4 million for semiconductor research, which may include some aspects related to terahertz technology, but this is not exclusively for terahertz research. This sustained funding enables the continuous development and commercialization of terahertz systems in North America.

- Growing Adoption in Medical Imaging: The adoption of terahertz technology in medical imaging is expanding due to its non-ionizing radiation and ability to detect early-stage cancers and skin diseases. The technology offers a safer alternative to traditional imaging methods, reducing the risk of radiation exposure for patients. Terahertz medical imaging systems are being implemented in hospitals and research centers across North America, demonstrating their potential in providing more precise and non-invasive diagnostics.

Market Challenges

- High Production Costs of Terahertz Systems: The high production costs of terahertz systems remain a significant challenge for broader adoption. The manufacturing of terahertz components, such as detectors and sources, requires precision engineering, which makes the technology expensive to produce. This cost barrier limits the accessibility of terahertz systems, especially for smaller businesses and industries. While there have been efforts to reduce costs incrementally, the expense associated with specialized materials and processes continues to hinder the widespread market penetration of terahertz technology, particularly in sectors requiring high-end industrial applications.

- Complexity of Technology Integration: Integrating terahertz systems into existing industrial and medical infrastructures presents another challenge. Terahertz technology often requires customized installations and modifications to fit into current workflows, making the integration process complex. Industries like aerospace and healthcare may face significant upfront costs for system upgrades and adjustments. Additionally, interpreting data from terahertz imaging systems can be complicated, requiring specialized expertise and equipment, which adds another layer of complexity to adoption in sectors like healthcare, where precision and clarity in diagnostic tools are critical.

North America Terahertz Technology Market Future Outlook

Over the next five years, the North America Terahertz Technology market is expected to experience considerable growth driven by increasing R&D investments, advancements in communication technologies, and the expansion of non-destructive testing in industries like aerospace and defense. The demand for terahertz solutions in medical imaging is also set to rise as healthcare infrastructure improves and governments prioritize early detection of critical diseases such as cancer.

Market Opportunities

- Application in Security and Surveillance: Terahertz technology presents strong growth potential in security and surveillance, particularly for detecting concealed weapons and explosives. Its ability to detect non-metallic objects, which traditional scanners often miss, makes it valuable for enhancing security at airports and border checkpoints. As safety measures evolve, terahertz systems are increasingly being adopted to improve threat detection and national security efforts in key sectors.

- Advancements in Spectroscopy and Sensing Applications: Terahertz spectroscopy is advancing in industries like pharmaceuticals and chemicals, where it's used for material characterization and quality control. The technology offers precise, non-destructive analysis of molecular compositions, benefiting drug development and production. As industries seek more accurate and non-invasive testing methods, terahertz spectroscopy is gaining traction, creating significant growth opportunities for sectors requiring high-precision analytical tools.

Scope of the Report

|

By Component Type |

Terahertz Sources Terahertz Detectors Terahertz Transmitters |

|

By Application |

Medical Imaging Industrial NDT Spectroscopy Security and Surveillance |

|

By Technology |

Photonic Electronic |

|

By End-Use Industry |

Aerospace & Defense Healthcare Telecommunications Manufacturing |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Terahertz Technology Manufacturers

Wireless Communication Companies

Biotechnology Firms

High-Tech Startups in Imaging Technologies

Government and Regulatory Bodies (FCC, Health Canada)

Investor and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

TeraView Ltd.

Menlo Systems GmbH

Luna Innovations Inc.

Advanced Photonix Inc.

Toptica Photonics AG

Bruker Corporation

Zomega Terahertz Corporation

Insight Product Company

Digital Barriers PLC

Hbner GmbH & Co. KG

Thorlabs, Inc.

TeraSense Group Inc.

Microtech Instruments, Inc.

Asqella Oy

EKSPLA

Table of Contents

1. North America Terahertz Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Terahertz Technology Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Terahertz Technology Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Non-Destructive Testing (NDT) in Aerospace and Defense

3.1.2. Growing Adoption in Medical Imaging

3.1.3. Expansion in Wireless Communication (6G)

3.1.4. Government Investment in Research & Development

3.2. Market Challenges

3.2.1. High Production Costs of Terahertz Systems

3.2.2. Complexity of Technology Integration

3.2.3. Limited Adoption due to Regulatory Constraints

3.3. Opportunities

3.3.1. Application in Security and Surveillance

3.3.2. Advancements in Spectroscopy and Sensing Applications

3.3.3. Potential Use in Pharmaceutical Quality Control

3.4. Trends

3.4.1. Miniaturization of Terahertz Devices

3.4.2. Increasing Use in Wireless Communication and 6G Networks

3.4.3. Adoption of Terahertz Imaging in the Food Industry

3.5. Government Regulation

3.5.1. FCC Guidelines for Terahertz Communications

3.5.2. Funding Programs for Terahertz Research

3.5.3. Regulatory Policies on Terahertz Frequency Spectrum Usage

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Terahertz Technology Market Segmentation

4.1. By Component Type (in Value %)

4.1.1. Terahertz Sources

4.1.2. Terahertz Detectors

4.1.3. Terahertz Transmitters

4.2. By Application (in Value %)

4.2.1. Medical Imaging

4.2.2. Industrial NDT

4.2.3. Spectroscopy

4.2.4. Security and Surveillance

4.3. By Technology (in Value %)

4.3.1. Photonic

4.3.2. Electronic

4.4. By End-Use Industry (in Value %)

4.4.1. Aerospace & Defense

4.4.2. Healthcare

4.4.3. Telecommunications

4.4.4. Manufacturing

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Terahertz Technology Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. TeraView Ltd.

5.1.2. Menlo Systems GmbH

5.1.3. Luna Innovations Incorporated

5.1.4. Advanced Photonix Inc.

5.1.5. Bruker Corporation

5.1.6. TOPTICA Photonics AG

5.1.7. Hbner GmbH & Co. KG

5.1.8. Insight Product Company

5.1.9. TeraSense Group Inc.

5.1.10. Zomega Terahertz Corporation

5.1.11. Thorlabs, Inc.

5.1.12. Digital Barriers PLC

5.1.13. EKSPLA

5.1.14. Microtech Instruments, Inc.

5.1.15. Asqella Oy

5.2. Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Technology Focus, Global Presence, Partnerships, Terahertz Spectrum Expertise, and Production Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Terahertz Technology Market Regulatory Framework

6.1. Spectrum Allocation and Usage Regulations

6.2. Industry Compliance Standards

6.3. Certification and Licensing Procedures

7. North America Terahertz Technology Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Terahertz Technology Future Market Segmentation

8.1. By Component Type (in Value %)

8.2. By Application (in Value %)

8.3. By Technology (in Value %)

8.4. By End-Use Industry (in Value %)

8.5. By Region (in Value %)

9. North America Terahertz Technology Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all key stakeholders within the North America Terahertz Technology market. Desk research, leveraging proprietary and secondary databases, is conducted to identify critical variables affecting the market, such as technological advancements, regulatory policies, and funding trends.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, usage in various industries, and revenue streams are analyzed. This includes evaluating product demand across applications like medical imaging and industrial NDT to estimate current market size.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are tested and validated through consultations with industry experts. Insights from these interviews are instrumental in refining revenue estimates and understanding operational challenges.

Step 4: Research Synthesis and Final Output

The final phase entails direct interviews with terahertz technology manufacturers and key stakeholders to ensure the accuracy of collected data. This step serves to cross-check the results of the bottom-up approach and consolidate the final market analysis.

Frequently Asked Questions

01. How big is the North America Terahertz Technology Market?

The North America Terahertz Technology Market was valued at USD 308 million, driven by advancements in non-destructive testing and medical imaging technologies.

02. What are the challenges in the North America Terahertz Technology Market?

Key challenges in North America Terahertz Technology Market include the high cost of production for terahertz systems and the complexity of integrating terahertz technologies into existing infrastructures.

03. Who are the major players in the North America Terahertz Technology Market?

Major players in the North America Terahertz Technology Market include TeraView Ltd., Menlo Systems GmbH, Luna Innovations Inc., and Advanced Photonix Inc., which dominate due to their advanced R&D capabilities and strong global presence.

04. What are the growth drivers of the North America Terahertz Technology Market?

The North America Terahertz Technology Market growth drivers include the increasing demand for non-invasive testing in aerospace and defense industries and the growing adoption of terahertz systems in medical imaging and wireless communication.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.