North America Tetra Pak Carton Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD9297

December 2024

81

About the Report

North America Tetra Pak Carton Market Overview

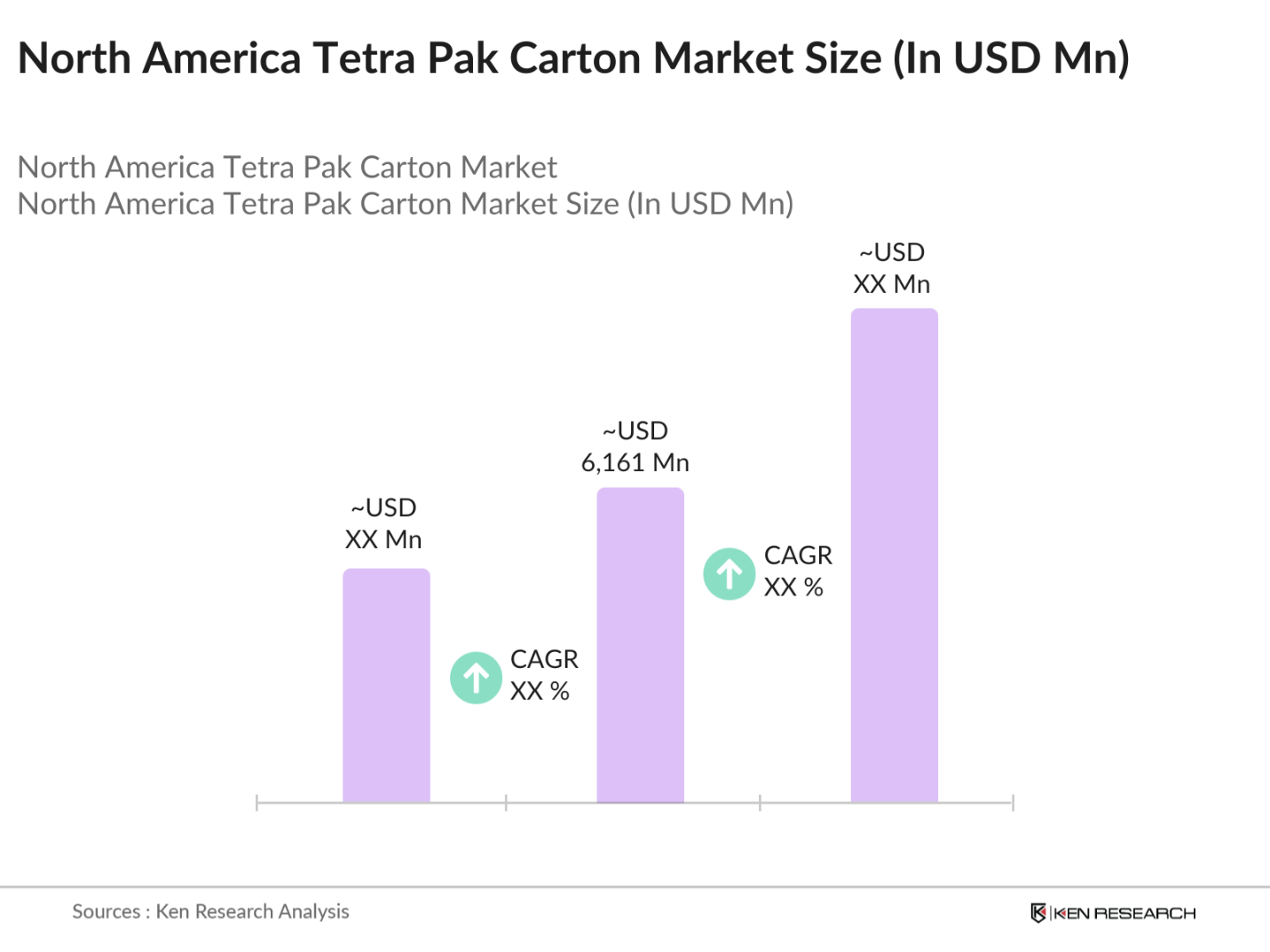

- The North America Tetra Pak Carton market is valued at USD 6,161 million, based on a five-year historical analysis. This market is primarily driven by the increasing consumer demand for sustainable packaging solutions and the preference for ready-to-drink beverages in eco-friendly containers. With growing environmental awareness and the rise of aseptic packaging technology, Tetra Pak cartons are being widely adopted across the beverage, dairy, and food sectors, particularly for their ability to extend shelf life and maintain product quality without preservatives.

- The United States leads the market due to its large consumer base and advanced packaging technologies. Canada and Mexico also play significant roles, with growing investments in sustainable packaging and expanding beverage industries. These countries' focus on environmental sustainability and innovation in packaging solutions has solidified their dominance in the market.

- Countries such as Canada and Germany have set aggressive targets for packaging waste reduction, aiming to recycle 90% of packaging materials by 2025. In 2023, these policies resulted in a 5% year-on-year increase in recycled packaging waste, encouraging the adoption of liquid cartons due to their recyclability.

North America Tetra Pak Carton Market Segmentation

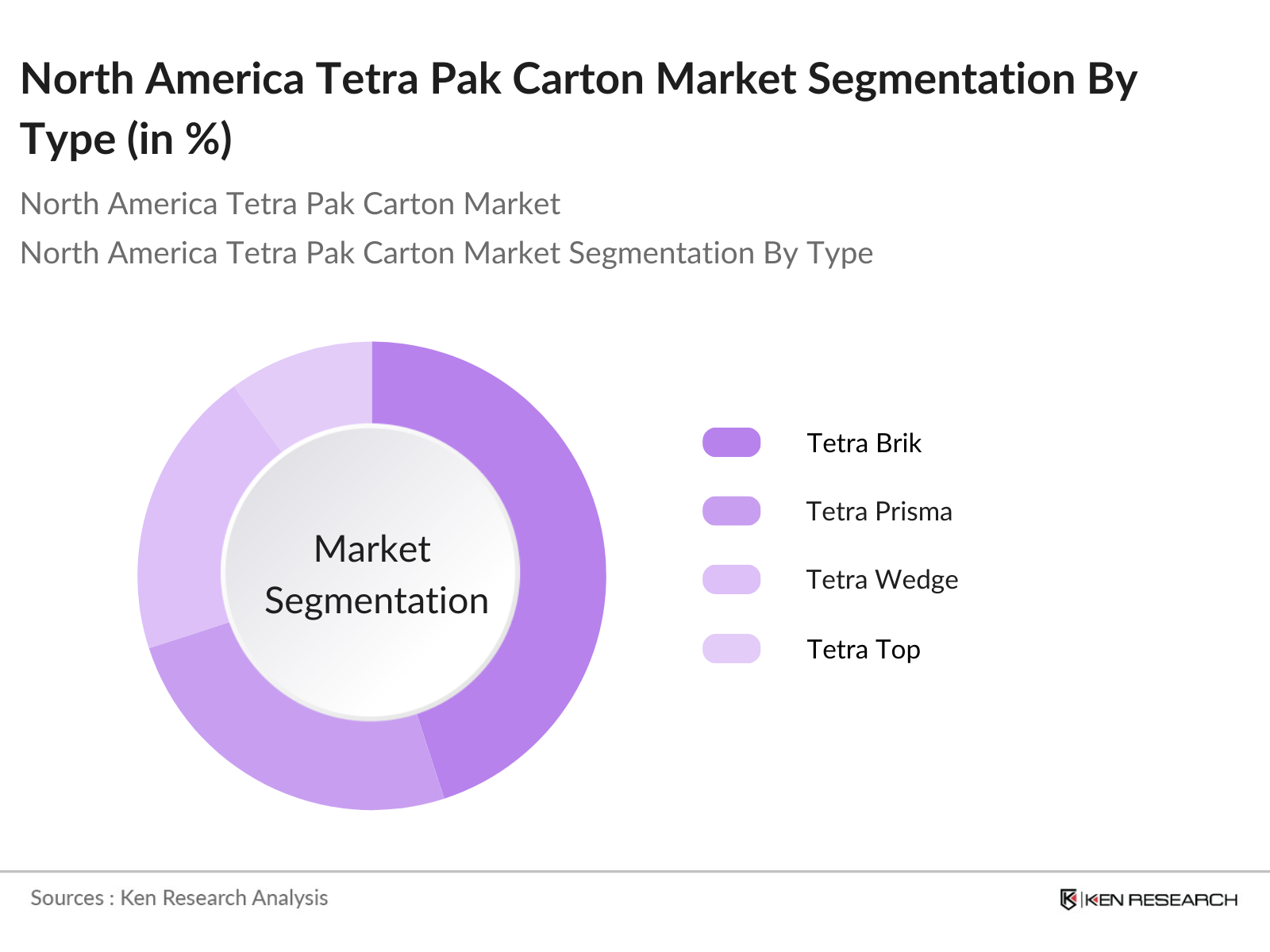

By Type: The market is segmented by type into Tetra Brik, Tetra Prisma, Tetra Wedge, and Tetra Top. Among these, Tetra Brik holds a dominant market share due to its versatility and widespread use in packaging various liquid products. Its efficient design allows for easy stacking and storage, making it a preferred choice for manufacturers and retailers.

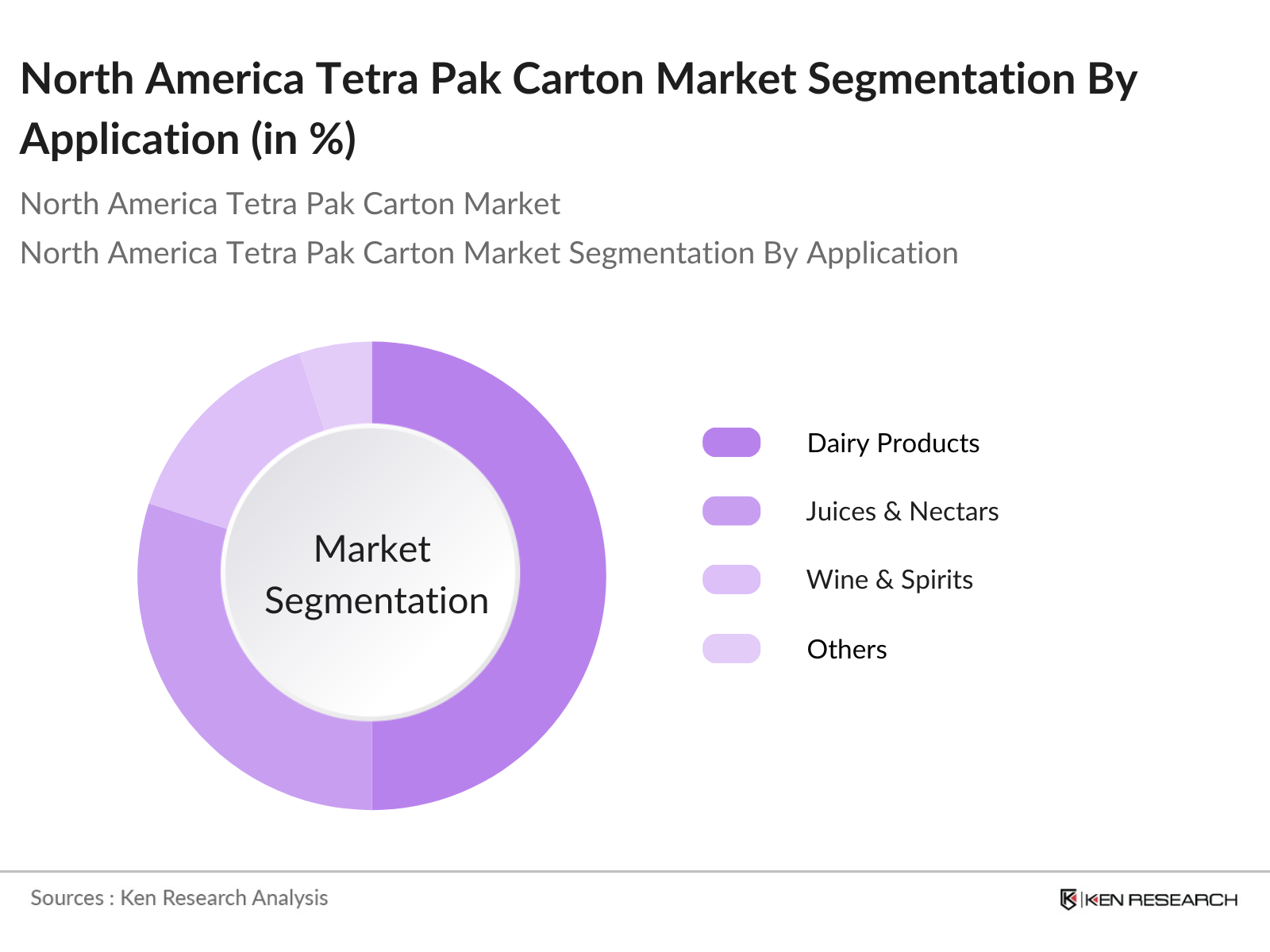

By Application: The market is also segmented by application into dairy products, juices and nectars, wine and spirits, and others. Dairy products dominate this segment, driven by the high consumption of milk and related products in North America. Tetra Pak cartons provide an extended shelf life and maintain the nutritional value of dairy products, making them a popular packaging choice in this category.

North America Tetra Pak Carton Market Competitive Landscape

The North American Tetra Pak carton market is characterized by the presence of several key players who drive innovation and maintain competitive pricing. These companies focus on sustainable packaging solutions and have established strong distribution networks across the region.

North America Tetra Pak Carton Industry Analysis

Growth Drivers

- Consumer Demand for Sustainable Packaging: The global demand for sustainable packaging has risen sharply due to increased awareness of environmental issues. For instance, in 2023, over 8 million metric tons of plastic waste entered the ocean annually, with only 9% of plastic being effectively recycled, according to the World Bank. Liquid cartons, made primarily of renewable materials like paperboard, offer a viable alternative, reducing dependency on fossil-based packaging. Additionally, paper-based products account for 40% of the global packaging market, underlining the shift towards greener solutions.

- Preference for Ready-to-Drink Beverages: Global consumption of ready-to-drink (RTD) beverages is rising due to changing lifestyles. In 2023, global urbanization levels reached 57%, as per the UN Population Division, contributing to increased demand for convenience-driven products. For example, in middle-income nations, RTD beverages contributed 30% of the beverage sectors growth. Liquid cartons cater to this segment by ensuring lightweight, portable, and sustainable packaging for these beverages.

- Eco-Friendly Advantages of Liquid Cartons: Liquid cartons offer significant eco-friendly advantages due to their recyclability and reduced carbon footprint. A study by the European Commission in 2023 revealed that packaging materials like paperboard used in liquid cartons emit 60% less CO during production compared to plastic packaging. Furthermore, paperboard's renewable content stands at 75% to 85%, making it one of the most sustainable packaging solutions globally.

Market Challenges

- Competition from Glass and Plastic Packaging: Glass and plastic packaging still dominate key markets, representing 50% of global packaging use, according to the World Bank in 2023. Plastic alone accounts for 350 million metric tons of global production annually, while glass maintains its stronghold in luxury and premium beverage segments due to its perceived quality. Liquid cartons face challenges in breaking into these established markets despite their sustainability advantages.

- Recycling Infrastructure Limitations: Recycling infrastructure remains a significant challenge, particularly in low- and middle-income countries where recycling rates average just 10%-12%, according to the 2023 World Bank Waste Management Report. Many countries lack the facilities to process composite materials like liquid cartons, which often combine paperboard with aluminum and plastic layers. Addressing this issue is critical for improving global recycling efficiency.

North America Tetra Pak Carton Market Future Outlook

Over the next five years, the North American Tetra Pak carton market is expected to experience significant growth. This expansion will be driven by continuous advancements in packaging technology, increasing consumer demand for eco-friendly solutions, and supportive government regulations promoting sustainable practices. The focus on reducing plastic waste and enhancing recyclability will further propel the market forward.

Market Opportunities

- Technological Advancements in Packaging: Technological innovations in liquid carton manufacturing, such as digital printing and bio-based coatings, present new opportunities. The World Banks 2023 Productivity Report highlights that automation and digital technologies could enhance production efficiency by 20%-30% in emerging markets. These advancements enable customization, improving consumer engagement and reducing waste during production.

- Expansion into Emerging Beverage Segments: Emerging beverage categories, such as plant-based drinks and functional beverages, are experiencing rapid growth. In 2023, the global consumption of plant-based beverages grew by 18 billion liters, driven by health-conscious consumers. Liquid cartons, being lightweight and preservative-friendly, are well-suited for these products, aligning with market needs.

Scope of the Report

|

By Type |

Tetra Brik |

|

By Size |

Small (Less than 250 ml) |

|

By Application |

Dairy Products |

|

By Material |

Paperboard |

|

By Country |

United States |

Products

Key Target Audience

Beverage Manufacturers

Dairy Producers

Packaging Material Suppliers

Retailers and Distributors

Environmental Agencies (e.g., Environmental Protection Agency)

Government and Regulatory Bodies (e.g., Food and Drug Administration)

Investment and Venture Capitalist Firms

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report

Tetra Laval

International Paper

Amcor

Elopak

SIG Combibloc Group Ltd.

Weyerhaeuser

Reynolds Group Holdings

Refresco Gerber

Stora Enso

Mondi Group

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Demand for Sustainable Packaging

3.1.2 Preference for Ready-to-Drink Beverages

3.1.3 Eco-Friendly Advantages of Liquid Cartons

3.2 Market Challenges

3.2.1 Competition from Glass and Plastic Packaging

3.2.2 Recycling Infrastructure Limitations

3.2.3 Fluctuating Raw Material Prices

3.3 Opportunities

3.3.1 Technological Advancements in Packaging

3.3.2 Expansion into Emerging Beverage Segments

3.3.3 Government Initiatives Promoting Sustainable Packaging

3.4 Trends

3.4.1 Adoption of Renewable Materials

3.4.2 Integration of Smart Packaging Solutions

3.4.3 Increased Use of Aseptic Packaging

3.5 Government Regulations

3.5.1 Packaging Waste Reduction Policies

3.5.2 Food Safety Standards

3.5.3 Recycling and Sustainability Mandates

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Type (in Value %)

4.1.1 Tetra Brik

4.1.2 Tetra Prisma

4.1.3 Tetra Wedge

4.1.4 Tetra Top

4.2 By Size (in Value %)

4.2.1 Small (Less than 250 ml)

4.2.2 Medium (250 ml to 500 ml)

4.2.3 Large (500 ml to 1 liter)

4.2.4 Extra-Large (More than 1 liter)

4.3 By Application (in Value %)

4.3.1 Dairy Products

4.3.2 Juices and Nectars

4.3.3 Wine and Spirits

4.3.4 Others

4.4 By Material (in Value %)

4.4.1 Paperboard

4.4.2 Polyethylene

4.4.3 Aluminum

4.5 By Country (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tetra Laval

5.1.2 International Paper

5.1.3 Weyerhaeuser

5.1.4 Amcor

5.1.5 Elopak

5.1.6 Reynolds Group Holdings

5.1.7 Refresco Gerber

5.1.8 Stora Enso

5.1.9 SIG Combibloc Group Ltd.

5.1.10 Mondi Group

5.1.11 WestRock Company

5.1.12 Visy

5.1.13 Pactiv Evergreen

5.1.14 IPI S.r.l.

5.1.15 Greatview Aseptic Packaging Co. Ltd.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, Sustainability Initiatives, Recent Developments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Type (in Value %)

8.2 By Size (in Value %)

8.3 By Application (in Value %)

8.4 By Material (in Value %)

8.5 By Country (in Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Tetra Pak Carton Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Tetra Pak Carton Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Tetra Pak Carton Market.

Frequently Asked Questions

01. How big is the North America Tetra Pak Carton Market?

The North America Tetra Pak Carton market is valued at USD 6,161 million, based on a five-year historical analysis. This market is primarily driven by the increasing consumer demand for sustainable packaging solutions and the preference for ready-to-drink beverages in eco-friendly containers.

02. What are the main challenges in the North America Tetra Pak Carton Market?

The primary challenges in the North America Tetra Pak Carton Market include high competition from alternative packaging materials like glass and plastic, which are still popular among certain consumer groups. Additionally, the limited recycling infrastructure in some regions restricts the reuse of Tetra Pak materials, posing a significant challenge to the markets sustainability goals.

03. Who are the major players in the North America Tetra Pak Carton Market?

Key players in this market include Tetra Laval, International Paper, Amcor, SIG Combibloc, and Elopak. These companies dominate due to their extensive product portfolios, sustainability initiatives, and established relationships with major beverage and dairy manufacturers in the region, making them influential in the industry.

04. What are the growth drivers of the North America Tetra Pak Carton Market?

The market is propelled by the rising consumer preference for environmentally friendly and convenient packaging, along with the strong demand for aseptic packaging in the beverage and dairy sectors. Advancements in renewable materials and supportive government regulations aimed at reducing plastic use are also driving market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.