North America Textile Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD4100

November 2024

84

About the Report

North America Textile Market Overview

-

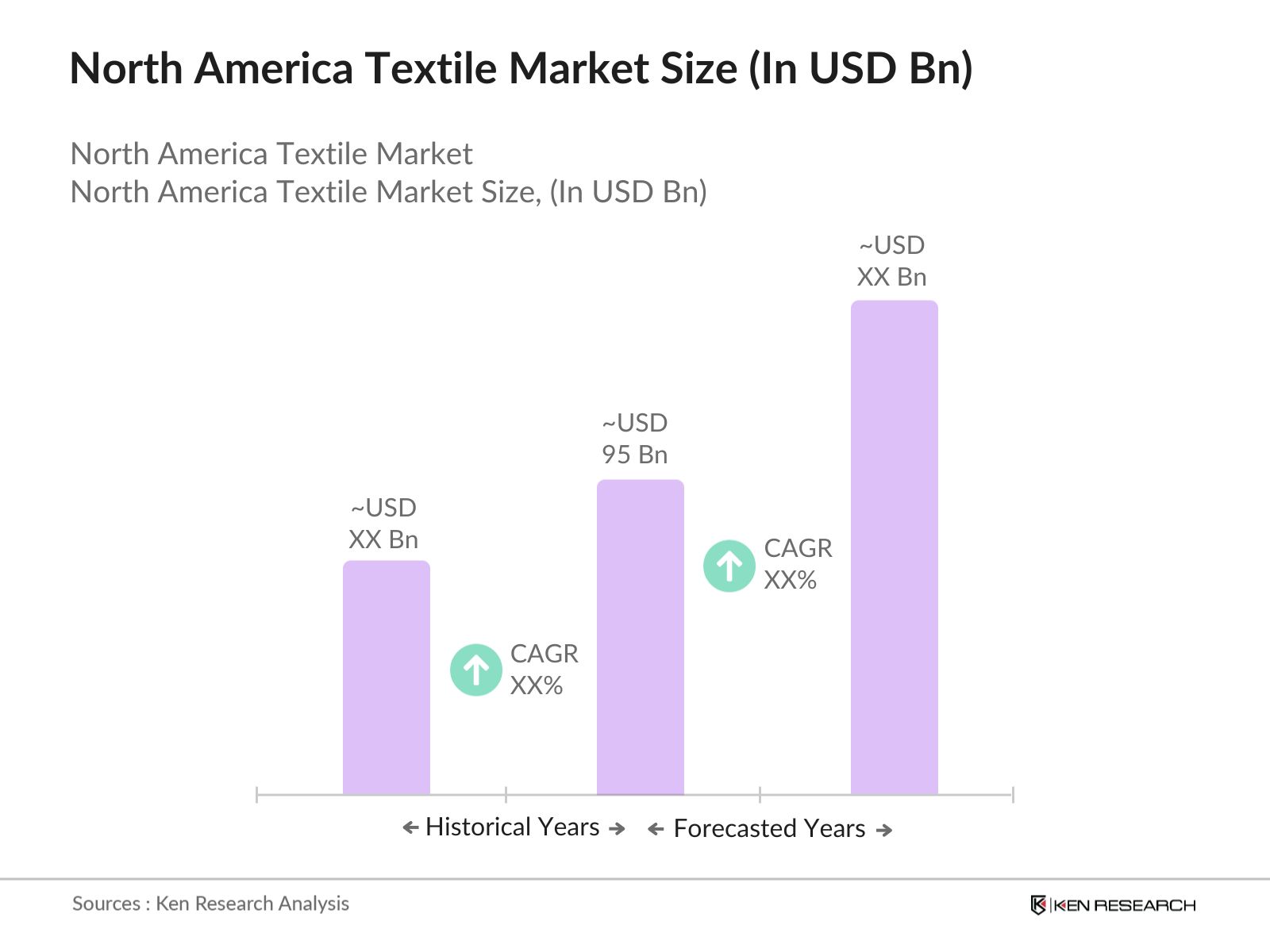

North America Textile Market is valued at USD 95 billion, driven by the increasing demand for sustainable materials and advancements in textile manufacturing processes. The industry's growth has been bolstered by the expanding e-commerce sector and increased consumer awareness of eco-friendly fabrics. The rise in fast fashion, coupled with the automotive and healthcare sectors' growing need for technical textiles, continues to fuel market expansion.

- Key cities like New York, Los Angeles, and Mexico City dominate the North America textile market due to their established fashion hubs, access to a diverse talent pool, and proximity to major supply chains. These cities are integral for fashion-forward trends, logistics efficiency, and having a well-developed infrastructure for textile production, enabling them to lead the market without relying on a large share of production numbers.

- Environmental standards in North America are increasingly stringent for textile manufacturers. The U.S. Environmental Protection Agency (EPA) implemented new air and water pollution control regulations in 2023, affecting textile dyeing and finishing processes. These regulations require manufacturers to adopt cleaner technologies, reducing emissions by 15% compared to 2022 levels, which imposes penalties for non-compliance with sustainability targets in textile production.

North America Textile Market Segmentation

By Product Type: The North America textile market is segmented by product type into natural fibers, synthetic fibers, nonwoven fabrics, and technical textiles. Recently, synthetic fibers such as polyester and nylon have taken a dominant market share under this segmentation, driven by their durability, affordability, and versatility in various applications like apparel, automotive, and industrial uses. Synthetic fibers are cost-effective and easier to produce in large volumes, making them favorable for brands that seek scalability and consistency in material performance.

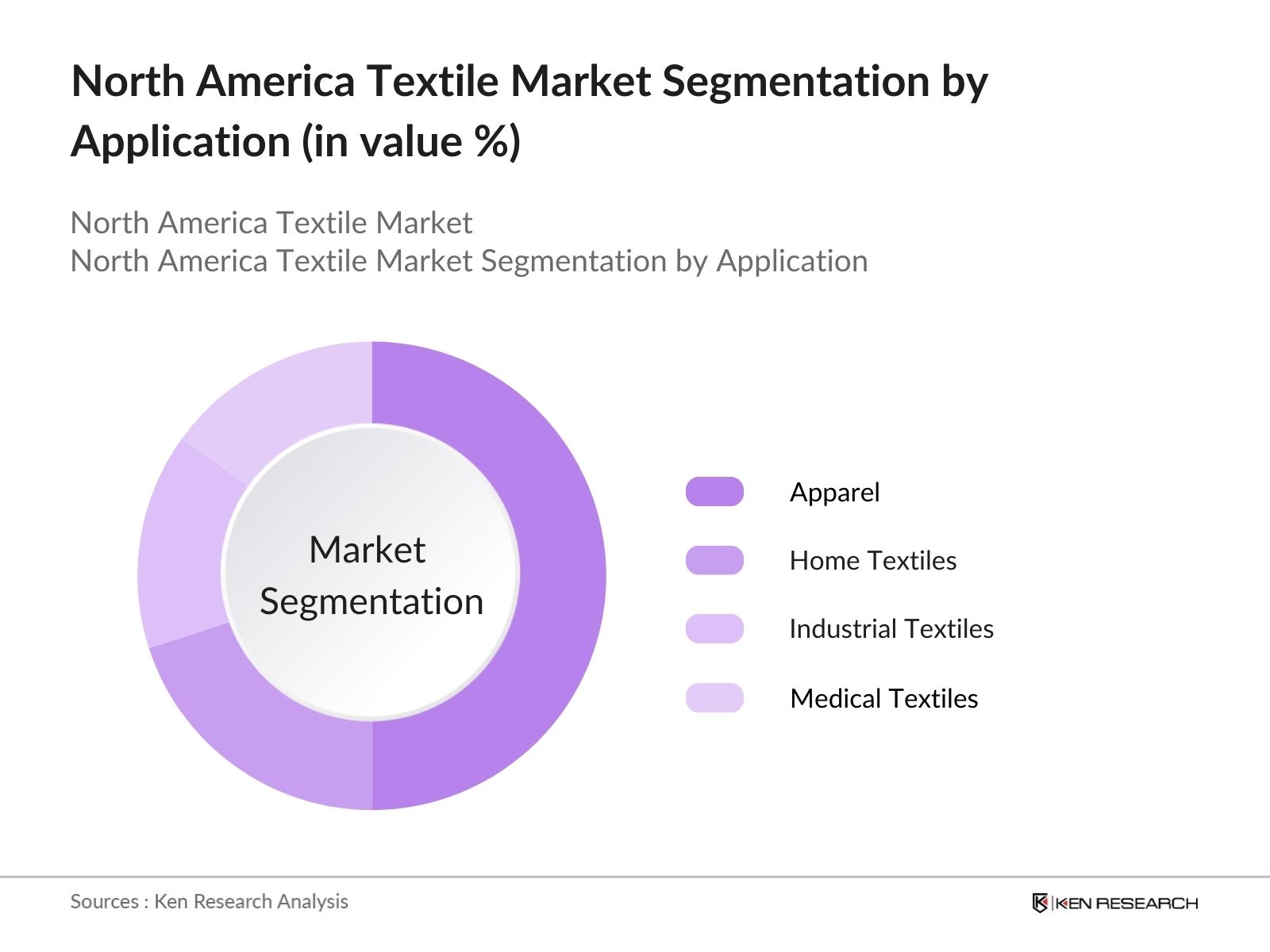

By Application: The textile market is segmented by application into apparel, home textiles, industrial textiles, and medical textiles. Apparel remains the leading sub-segment due to the sheer demand for both fashion and everyday clothing, which is continually fueled by changing consumer trends, brand loyalty, and online retail growth. The presence of large retail chains, combined with the e-commerce boom, has allowed this segment to maintain its lead in market share.

|

|

|---|

North America Textile Market Competitive Landscape

The North America textile market is dominated by key players with extensive production capacities and strong distribution networks. The market's competitive landscape is shaped by both established companies and emerging innovators, with sustainability, innovation, and cost competitiveness playing pivotal roles.

|

Company Name |

Year of Establishment |

Headquarters |

Market Penetration |

Revenue (USD Bn) |

Product Portfolio |

Sustainability Initiatives |

Global Reach |

Partnerships |

|

DuPont |

1802 |

Delaware, USA |

- |

- |

- |

- |

- |

- |

|

Invista |

2004 |

Wichita, USA |

- |

- |

- |

- |

- |

- |

|

Albany International |

1895 |

New York, USA |

- |

- |

- |

- |

- |

- |

|

Milliken & Company |

1865 |

South Carolina |

- |

- |

- |

- |

- |

- |

|

American & Efird LLC |

1891 |

North Carolina |

- |

- |

- |

- |

- |

- |

The North American textile market is highly competitive, with companies focusing on technological innovation, sustainability, and expanding their production capacities to meet the growing demand. Global companies like DuPont and Milliken have dominated with their vast portfolios, while regional players like American & Efird maintain a strong presence with specialty products.

North America Textile Market Analysis

Growth Drivers

- Industrial Growth: The North American textile industry has witnessed substantial industrial growth, driven by advancements in manufacturing technologies and automation. The U.S. manufacturing output for textiles was valued at over $64 billion in 2023, reflecting the sectors robust production capacity. Increased investment in textile machinery and manufacturing plants has spurred production efficiency, particularly in the U.S. and Canada.

- Demand for Sustainable Textiles: Sustainable textiles are becoming a significant growth driver in North America due to consumer preferences for eco-friendly materials. The U.S. sustainable textile market has seen an annual production of 1.2 million metric tons of sustainable fibers in 2023, driven by demand for organic cotton and recycled polyester. Policies like the Textile Recycling Act passed in several U.S. states in 2022 promote the use of recycled materials.

- Fashion Industry Expansion: The expansion of the fashion industry in North America has significantly boosted textile demand. The U.S. apparel market, valued at approximately $280 billion in 2023, remains a primary driver for textile consumption. Fashion retailers are expanding rapidly, with an estimated 23,000 fashion stores operational across North America by mid-2024. The increasing number of fashion shows and industry events further elevates demand for high-quality textiles.

Challenges

- Raw Material Volatility: Volatility in the prices of raw materials such as cotton and polyester poses significant challenges for North American textile manufacturers. In 2023, the price of raw cotton fluctuated between $0.80 and $1.10 per pound, affecting cost structures across the supply chain. The U.S. imported approximately 12 million bales of cotton in 2023, making the industry highly susceptible to global price changes. The reliance on imported raw materials, particularly from China and India, adds to the risk of price fluctuations due to trade tensions and supply chain disruptions.

- Environmental Regulations: Strict environmental regulations in the U.S. and Canada are impacting the textile industry, with companies required to adhere to standards set by the Environmental Protection Agency (EPA) and similar bodies. The U.S. introduced stringent wastewater treatment guidelines in 2022, requiring textile manufacturers to reduce their environmental footprint. In Canada, regulations such as the 2023 Sustainable Textile Regulation mandate the use of eco-friendly dyes and chemicals.

North America Textile Market Future Outlook

North American textile market is poised for steady growth, driven by a combination of factors such as advancements in textile recycling technologies, increasing demand for technical textiles in automotive and construction industries, and a growing consumer preference for sustainable and organic materials. As governments in the region push for stronger environmental regulations, the market will see increased investment in green production methods.

Market Opportunities

- Technological Advancements: The adoption of advanced manufacturing technologies such as AI-powered textile production and automation presents significant opportunities for the North American textile market. In 2023, the U.S. textile industry invested $2.7 billion in smart manufacturing technologies, aiming to increase production efficiency and reduce waste. Automated weaving and sewing technologies have cut production time by 25% compared to 2022. As a result, companies are more competitive, and production capacities are expanding to meet growing demand for textiles domestically.

- Textile Recycling: Textile recycling is emerging as a lucrative opportunity in North America, with recycling initiatives gaining momentum across the region. The U.S. recycled approximately 2.5 million tons of textile waste in 2023, supported by government incentives such as tax credits for companies engaged in recycling. Canada is also making strides, with Ontario leading in textile waste reduction programs, collecting 1.3 million tons of textiles for recycling in 2023. This shift towards a circular economy is creating new business opportunities for companies that focus on sustainable practices.

Scope of the Report

|

Segments |

Sub-Segments |

|

Product Type |

Natural Fibers (Cotton, Wool, Silk, Linen) |

|

Synthetic Fibers (Polyester, Nylon, etc.) |

|

|

Nonwoven Fabrics |

|

|

Technical Textiles |

|

|

Application |

Apparel |

|

Home Textiles |

|

|

Industrial Textiles |

|

|

Medical Textiles |

|

|

End-Use |

Fashion and Apparel Industry |

|

Healthcare |

|

|

Automotive |

|

|

Construction |

|

|

Manufacturing Process |

Knitting |

|

Weaving |

|

|

Nonwoven Production |

|

|

Dyeing and Finishing |

|

|

Region |

United States |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

Textile Manufacturers

Automotive and Aerospace Companies

Medical Device Manufacturers

Apparel and Fashion Retailers

Home Textile Producers

Fashion Technology Companies

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Canada Ministry of Environment)

Investors and Venture Capitalist Firms

Companies

Major Players

DuPont

Invista

Albany International

Milliken & Company

American & Efird LLC

Cone Denim

Guilford Performance Textiles

Beverly Knits

Glen Raven, Inc.

Elevate Textiles

Table of Contents

1. North America Textile Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Textile Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Textile Market Analysis

3.1 Growth Drivers

3.1.1 Industrial Growth

3.1.2 Demand for Sustainable Textiles

3.1.3 Fashion Industry Expansion

3.1.4 E-Commerce Surge

3.2 Market Challenges

3.2.1 Raw Material Volatility

3.2.2 Environmental Regulations

3.2.3 Labor Cost

3.2.4 Trade Disruptions

3.3 Opportunities

3.3.1 Technological Advancements

3.3.2 Textile Recycling

3.3.3 Expanding Nonwoven Textiles Market

3.3.4 Smart Textiles

3.4 Trends

3.4.1 Eco-Friendly Fibers

3.4.2 Circular Economy

3.4.3 Customization

3.4.4 Smart Manufacturing

3.5 Government Regulation

3.5.1 Environmental Standards

3.5.2 Import-Export Tariffs

3.5.3 Labor Laws

3.5.4 Recycling Initiatives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Textile Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Natural Fibers (Cotton, Wool, Silk, Linen)

4.1.2 Synthetic Fibers (Polyester, Nylon, Acrylic, Spandex)

4.1.3 Nonwoven Fabrics

4.1.4 Technical Textiles

4.2 By Application (In Value %)

4.2.1 Apparel

4.2.2 Home Textiles

4.2.3 Industrial Textiles

4.2.4 Medical Textiles

4.3 By End-Use (In Value %)

4.3.1 Fashion and Apparel Industry

4.3.2 Healthcare

4.3.3 Automotive

4.3.4 Construction

4.4 By Manufacturing Process (In Value %)

4.4.1 Knitting

4.4.2 Weaving

4.4.3 Nonwoven Production

4.4.4 Dyeing and Finishing

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Textile Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DuPont

5.1.2 Invista

5.1.3 Albany International Corp.

5.1.4 Milliken & Company

5.1.5 American & Efird LLC

5.1.6 Cone Denim

5.1.7 Guilford Performance Textiles

5.1.8 Beverly Knits

5.1.9 Glen Raven, Inc.

5.1.10 Elevate Textiles

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Textile Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. North America Textile Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Textile Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-Use (In Value %)

8.4 By Manufacturing Process (In Value %)

8.5 By Region (In Value %)

9. North America Textile Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the North America textile ecosystem, identifying critical stakeholders including manufacturers, suppliers, and end-users. Extensive secondary research is conducted to gather industry-level data from government databases, company reports, and trusted publications.

Step 2: Market Analysis and Construction

Historical market data is compiled and analyzed, covering key parameters like production capacity, supply-demand dynamics, and revenue streams. Special attention is given to technological trends and government policies impacting the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formulated based on the initial analysis and validated through interviews with key industry players. This step ensures that the data reflects real-world dynamics and includes insights directly from manufacturers and distributors.

Step 4: Research Synthesis and Final Output

All insights are synthesized into a comprehensive market report, ensuring accuracy and thoroughness. Data from bottom-up approaches is verified and complemented through engagement with textile industry professionals.

Frequently Asked Questions

01. How big is the North America Textile Market?

The North America Textile Market is valued at USD 95 billion, driven by the rise of sustainable materials, advancements in textile technology, and the increasing demand from sectors such as fashion, automotive, and healthcare.

02. What are the challenges in the North America Textile Market?

Key challenges of North America Textile Market include fluctuating raw material costs, environmental regulations, and labor shortages. Additionally, the market faces increasing competition from low-cost textile manufacturers in other regions, impacting profit margins.

03. Who are the major players in the North America Textile Market?

Key players in North America Textile Market include DuPont, Invista, Albany International, Milliken & Company, and American & Efird LLC. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the North America Textile Market?

North America Textile Market is fueled by factors such as the growing demand for eco-friendly textiles, advancements in digital manufacturing, and the rising use of technical textiles in industries like automotive and construction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.