North America Thermal Imaging Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD4411

December 2024

84

About the Report

North America Thermal Imaging Market Overview

- The North America thermal imaging market is experiencing steady growth, currently valued at USD 1.3 Bn, driven by increased demand for thermal imaging devices across sectors such as defense, industrial, and commercial applications. Thermal imaging technology is gaining prominence due to its ability to detect heat signatures, providing visibility in low-light or obscured conditions, which is particularly valuable for military operations and surveillance. As of 2024, the market is significantly influenced by advancements in infrared sensors and optics, which improve the precision and cost-effectiveness of thermal cameras.

- The U.S. and Canada are key markets driving the adoption of thermal imaging technology, supported by growing investments in defense and security sectors, particularly for border surveillance and critical infrastructure protection. The U.S. Department of Defense (DoD) continues to be a significant consumer of thermal imaging technology, with new contracts awarded to industry leaders for enhancing night vision capabilities. Additionally, thermal imaging is becoming more prevalent in commercial applications, including building inspections, firefighting, and medical diagnostics.

- Government regulations, especially in the defense sector, are critical in shaping the thermal imaging market. In 2023, the U.S. government enforced stricter export control regulations under the International Traffic in Arms Regulations (ITAR), affecting the export of thermal imaging equipment to certain countries. These regulations ensure that advanced thermal imaging technology is restricted to allies, thereby limiting the risk of misuse. However, such regulations also slow the export growth potential for manufacturers, particularly in regions outside North America.

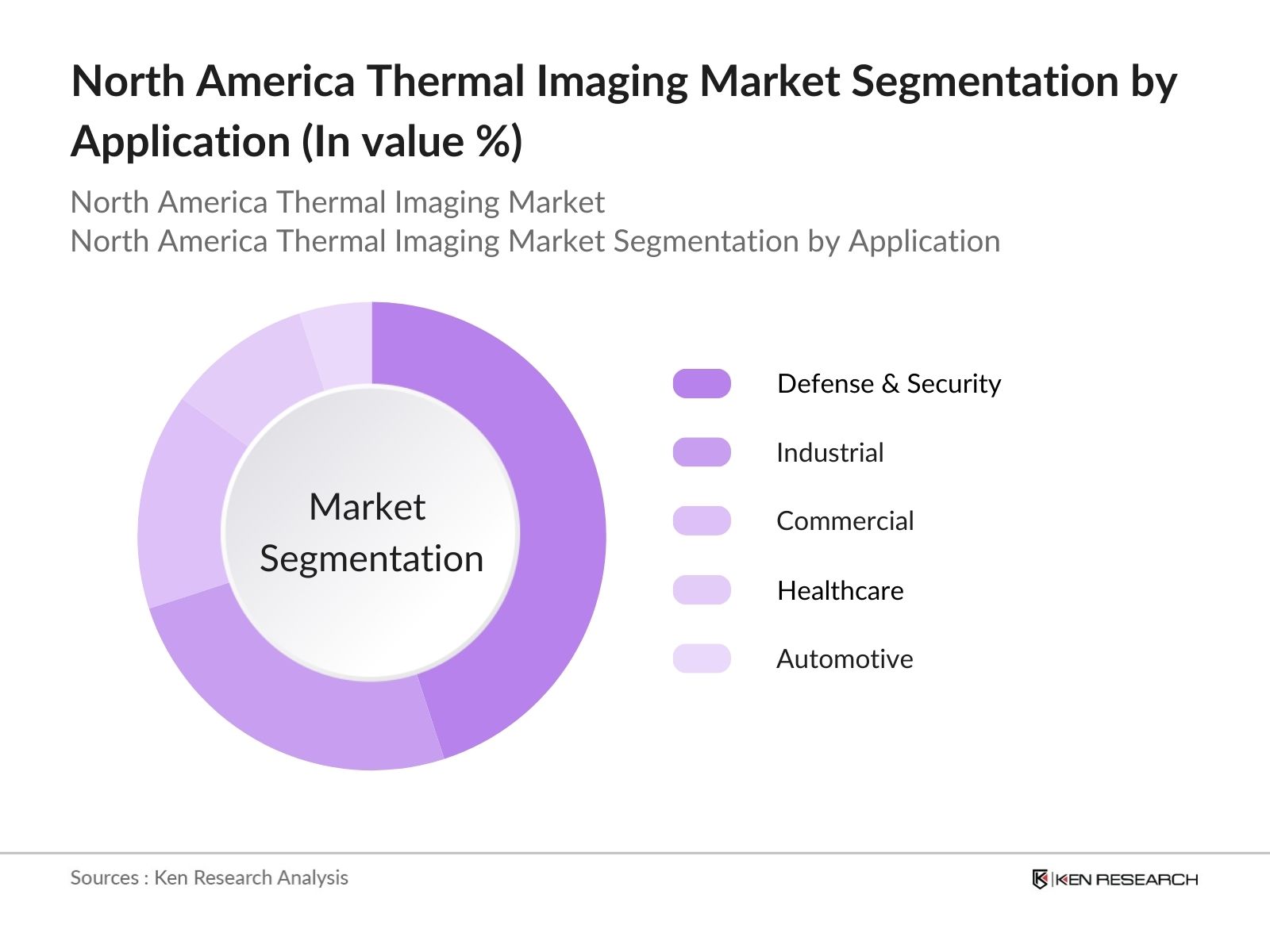

North America Thermal Imaging Market Segmentation

- By Application: The market is segmented by application into defense & security, healthcare, automotive, industrial, and commercial. The defense & security segment dominates the market, driven by the extensive use of thermal imaging for surveillance, targeting, and reconnaissance. In 2023, the U.S. government allocated significant funds to bolster thermal imaging technologies in defense, particularly for border security and night-time surveillance, highlighting its importance in national security operations.

- By Technology: The market is segmented by technology into cooled and uncooled thermal imaging. Uncooled thermal imaging technology holds a dominant position in this market, driven by its cost-effectiveness and wide adoption in commercial and industrial applications. Its use in predictive maintenance, building inspections, and firefighting has made it a preferred choice in these sectors. Additionally, it is gaining traction in automotive applications, especially for driver assistance systems and autonomous vehicles.

North America Thermal Imaging Market Competitive Landscape

The North America thermal imaging market is highly competitive, with several major players continuously innovating to improve the performance and reduce the cost of thermal imaging devices. Key companies include FLIR Systems (now part of Teledyne Technologies), Lockheed Martin, Raytheon Technologies, and L3Harris Technologies. These companies are investing heavily in research and development to introduce next-generation thermal imaging systems for both military and civilian use.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

R&D Focus |

Annual Revenue (2023) |

Employees |

Strategic Partnerships |

Defense Contracts |

Technological Innovations |

|

FLIR Systems (Teledyne) |

1978 |

Wilsonville, OR |

|||||||

|

Lockheed Martin |

1995 |

Bethesda, MD |

|||||||

|

Raytheon Technologies |

2020 |

Waltham, MA |

|||||||

|

L3Harris Technologies |

2019 |

Melbourne, FL |

|||||||

|

Axis Communications |

1984 |

Lund, Sweden |

North America Thermal Imaging Industry Analysis

Growth Drivers:

- Increased Defense and Security Investments: In 2023, the U.S. Department of Defense allocated USD 916billion for defense expenditure, with a significant portion directed towards enhancing surveillance and security technologies, including thermal imaging systems. Thermal imaging is widely used in border security, combat operations, and surveillance. With continued geopolitical tensions, the U.S. has increased procurement of advanced thermal imaging for military vehicles, drones, and infantry units. According to the Stockholm International Peace Research Institute (SIPRI), the U.S. is expected to maintain high defense spending, further boosting demand for thermal imaging equipment.

- Industrial Safety and Maintenance: Thermal imaging has expanded into commercial sectors such as firefighting, building inspections, and HVAC system monitoring. In the U.S., over 1.5 million fire incidents were recorded in 2023, with thermal imaging devices being crucial in search and rescue operations, enabling firefighters to see through smoke. Additionally, the U.S. construction sector growing rapidly, utilizes thermal imaging for detecting insulation leaks, moisture, and electrical issues, promoting energy efficiency in buildings. This growing adoption across commercial sectors supports market expansion.

- Growing Industrial Adoption: Thermal imaging technology has gained widespread adoption in industrial safety and maintenance, particularly in oil and gas, automotive, and manufacturing sectors. In 2024, the U.S. industrial sector is expected to contribute USD 2.9 trillion to the economy, with safety and preventive maintenance playing crucial roles. Thermal cameras are extensively used for predictive maintenance to detect overheating equipment and prevent failures. Increasing industrial safety regulations by OSHA (Occupational Safety and Health Administration) require regular inspections using advanced imaging systems, thereby driving adoption.

Market Challenges:

- High Cost of Advanced Thermal Imaging Systems: Advanced thermal imaging systems are a significant investment, especially for industries like construction, industrial maintenance, and security. The upfront cost can be a barrier for small and medium-sized businesses, which may face budget constraints when trying to adopt this technology. This issue is more pronounced in non-military sectors, where the return on investment may not be as immediate or apparent. As a result, the high cost of thermal imaging systems slows their broader adoption in commercial and industrial applications, limiting their use to larger corporations with the financial capacity to invest in such technologies.

- Technical Limitations in Some Applications: While thermal imaging technology offers significant advantages, it faces limitations in sensitivity and detection range, particularly in long-distance or low-temperature environments. Some industrial inspections or surveillance operations require higher sensitivity and precision than current thermal imaging systems provide, which affects the reliability of detection. As a result, users in the energy and utility sectors have reported the need for more advanced systems. These limitations restrict the broader deployment of thermal imaging in critical applications.

North America Thermal Imaging Market Future Outlook

The North America thermal imaging market is expected to continue its growth through the forecasted period, driven by innovations in sensor technology, increasing defense expenditures, and expanding applications in the commercial sector. The market will likely see more cost-effective, high-performance devices, making thermal imaging accessible to a broader range of industries.

Future Market Opportunities:

- Expansion in Healthcare Sector: Thermal imaging is gaining traction in healthcare, particularly for medical diagnostics and fever screening. With increasing demand for non-invasive diagnostic tools, hospitals and clinics in the U.S. are adopting thermal imaging technology to monitor body temperature and detect abnormalities in patients. In 2023, the U.S. healthcare sector contributed USD 4.3 trillion to the economy, and thermal imaging is being utilized in areas like oncology, where it helps in early detection of tumors. This growing application in healthcare presents significant opportunities for market expansion.

- Integration with AI and IoT: The integration of thermal imaging systems with AI and IoT platforms is revolutionizing industries such as automotive, manufacturing, and smart cities. In 2023, the U.S. spent USD 3.3 billion on AI-related technologies, which are being combined with thermal imaging for real-time data analytics and automation in industrial and security applications. AI-powered thermal imaging can detect faults, anomalies, and inefficiencies in real time, providing significant advantages to industries focused on operational efficiency and preventive maintenance.

Scope of the Report

|

By Application |

Defense & Security Industrial (Predictive Maintenance, Process Monitoring) Commercial (Building Inspections, Firefighting) Healthcare (Medical Diagnostics, Fever Detection) Automotive (Driver Assistance Systems, Autonomous Vehicles) |

|

By Technology |

Cooled Thermal Imaging Uncooled Thermal Imaging |

|

By Wavelength |

Short-Wave Infrared (SWIR) Mid-Wave Infrared (MWIR) Long-Wave Infrared (LWIR) |

|

By End-User |

Government (Defense, Border Security) Industrial (Energy, Manufacturing) Commercial (Buildings, Fire Safety) Healthcare (Hospitals, Diagnostic Centers) |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Defense and Security Agencies (U.S. Department of Defense, Canadian Armed Forces)

Industrial Manufacturers (Energy, Manufacturing Sectors)

Healthcare Institutions (Hospitals, Diagnostic Centers)

Automotive Companies (Driver Assistance Systems, Autonomous Vehicles)

Commercial Building Inspectors

Government and Regulatory Bodies (ITAR, U.S. Department of Homeland Security)

Investors and Venture Capitalist Firms

Environmental Monitoring Agencies (U.S. Environmental Protection Agency)

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

FLIR Systems (Teledyne Technologies)

Lockheed Martin Corporation

Raytheon Technologies

L3Harris Technologies

Axis Communications

Leonardo DRS

Northrop Grumman Corporation

BAE Systems

Seek Thermal

Testo Inc.

Honeywell International Inc.

Opgal Optronics

Fluke Corporation

Thales Group

ULIS (Lynred)

Table of Contents

1. North America Thermal Imaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Thermal Imaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Thermal Imaging Market Analysis

3.1. Growth Drivers

3.1.1. Increased Defense and Security Investments (Defense Expenditure)

3.1.2. Growing Industrial Adoption (Industrial Safety and Maintenance)

3.1.3. Rising Commercial Applications (Building Inspections, Firefighting)

3.1.4. Government Support and Regulations (Surveillance and Security Initiatives)

3.2. Market Challenges

3.2.1. High Cost of Advanced Thermal Imaging Systems (Cost Constraints)

3.2.2. Technical Limitations in Some Applications (Sensitivity, Range)

3.2.3. Export Restrictions (ITAR Regulations, Export Limitations)

3.2.4. Limited Integration in Non-Military Applications (Commercial Sector Slowdown)

3.3. Opportunities

3.3.1. Expansion in Healthcare Sector (Medical Diagnostics)

3.3.2. Integration with AI and IoT (Automation and Analytics)

3.3.3. Increasing Adoption in Emerging Markets (Latin America, APAC Expansion)

3.3.4. Growth in Renewable Energy Sector (Thermal Inspection of Solar Panels, Wind Farms)

3.4. Trends

3.4.1. Enhanced Thermal Camera Sensitivity (Higher Resolution, Better Detection)

3.4.2. Use of Dual-Sensor Cameras (Visible Light and Thermal Imaging Combination)

3.4.3. Portability and Miniaturization of Devices (Handheld and Wearable Systems)

3.4.4. Integration with Drones for Aerial Surveillance (Border Security, Infrastructure Monitoring)

3.5. Government Regulation

3.5.1. U.S. Department of Defense Contracts (Military Contracts, Procurement Policies)

3.5.2. ITAR Regulations (Export Controls and Licensing Requirements)

3.5.3. Safety Standards and Compliance (Regulation for Civil and Commercial Use)

3.5.4. Environmental Monitoring Mandates (Emission and Pollution Tracking)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Thermal Imaging Market Segmentation

4.1. By Application (In Value %)

4.1.1. Defense & Security

4.1.2. Industrial (Predictive Maintenance, Process Monitoring)

4.1.3. Commercial (Building Inspections, Firefighting)

4.1.4. Healthcare (Medical Diagnostics, Fever Detection)

4.1.5. Automotive (Driver Assistance Systems, Autonomous Vehicles)

4.2. By Technology (In Value %)

4.2.1. Cooled Thermal Imaging

4.2.2. Uncooled Thermal Imaging

4.3. By Wavelength (In Value %)

4.3.1. Short-Wave Infrared (SWIR)

4.3.2. Mid-Wave Infrared (MWIR)

4.3.3. Long-Wave Infrared (LWIR)

4.4. By End-User (In Value %)

4.4.1. Government (Defense, Border Security)

4.4.2. Industrial (Energy, Manufacturing)

4.4.3. Commercial (Buildings, Fire Safety)

4.4.4. Healthcare (Hospitals, Diagnostic Centers)

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Thermal Imaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. FLIR Systems (Teledyne Technologies)

5.1.2. Lockheed Martin Corporation

5.1.3. Raytheon Technologies

5.1.4. L3Harris Technologies

5.1.5. BAE Systems

5.1.6. Leonardo DRS

5.1.7. Thales Group

5.1.8. Northrop Grumman Corporation

5.1.9. Honeywell International Inc.

5.1.10. Axis Communications

5.1.11. Fluke Corporation

5.1.12. Seek Thermal

5.1.13. ULIS (Lynred)

5.1.14. Opgal Optronics

5.1.15. Testo Inc.

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Strategic Initiatives

5.2.6. Market Share

5.2.7. R&D Expenditure

5.2.8. Product Innovations

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Thermal Imaging Market Regulatory Framework

6.1. Defense and Military Regulations

6.2. ITAR Compliance

6.3. Export Control Policies

6.4. Environmental and Civil Regulations

7. North America Thermal Imaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Thermal Imaging Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Technology (In Value %)

8.3. By Wavelength (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Thermal Imaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves identifying the key variables that impact the thermal imaging market in North America. This includes understanding the role of major stakeholders such as defense contractors, industrial manufacturers, and commercial players. Extensive desk research and proprietary databases are utilized to identify these critical variables.

Step 2: Market Analysis and Construction

This phase focuses on gathering and analyzing historical data from the North American thermal imaging market, including its growth trends, market penetration, and technological advancements. Key data sources include government reports, market analysis, and company financial reports to ensure reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses are developed based on the analysis and subsequently validated through consultations with industry experts. Interviews are conducted with thermal imaging manufacturers, distributors, and end-users to gather insights on market trends and performance, ensuring that the data is accurate and actionable.

Step 4: Research Synthesis and Final Output

In the final phase, all gathered data is synthesized and verified through further consultation with industry stakeholders. This involves direct interaction with thermal imaging companies to verify product performance, sales trends, and consumer preferences, ensuring the reports comprehensive and accurate market analysis.

Frequently Asked Questions

01. How big is the North America Thermal Imaging Market?

The North America thermal imaging market is valued at USD 1.3 billion, driven by increasing demand for applications in defense, industrial, and commercial sectors.

02. What are the challenges in the North America Thermal Imaging Market?

Challenges in the North America thermal imaging market include high costs of advanced thermal imaging systems, export restrictions due to ITAR regulations, and limited integration in certain commercial sectors.

03. Who are the major players in the North America Thermal Imaging Market?

Key players in the North America thermal imaging market include FLIR Systems (Teledyne Technologies), Lockheed Martin, Raytheon Technologies, L3Harris Technologies, and Axis Communications.

04. What are the growth drivers of the North America Thermal Imaging Market?

Growth in the North America thermal imaging market is propelled by increasing investments in defense and security, rising industrial applications in predictive maintenance, and the expansion of healthcare applications for diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.