North America Thermos Bottle Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10840

November 2024

96

About the Report

North America Thermos Bottle Market Overview

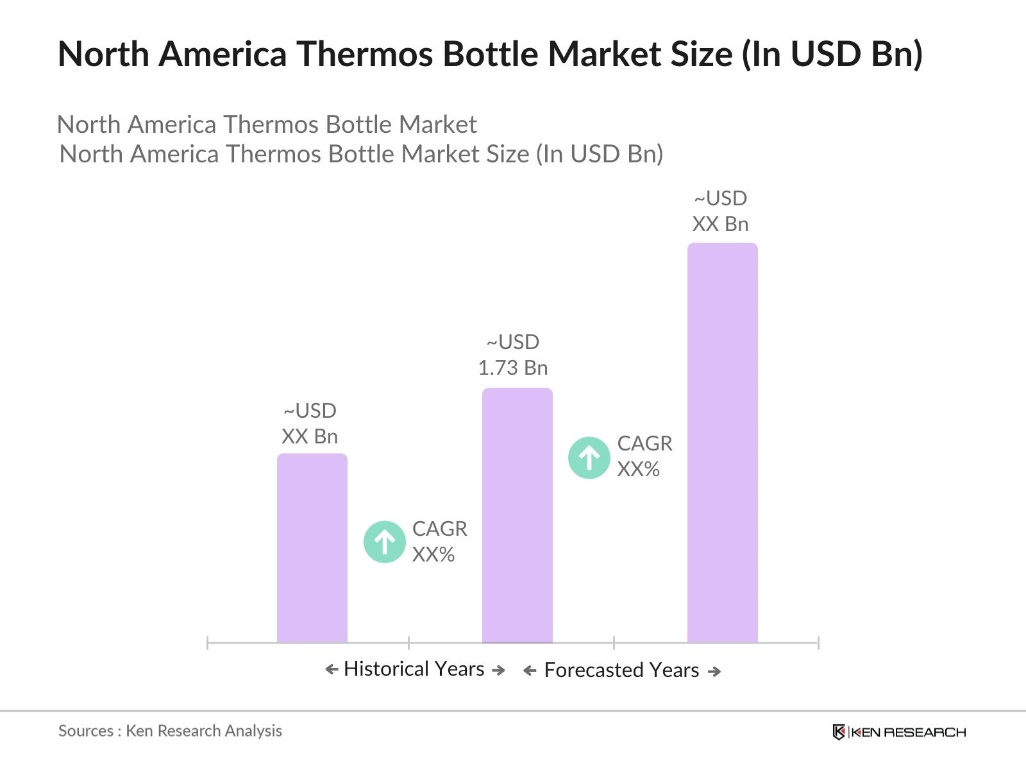

- The North America Thermos Bottle market is valued at USD 1.73 billion, supported by an analysis of five-year trends in consumer preference for reusable and insulated bottles. This shift is largely driven by heightened awareness around sustainability, the preference for eco-friendly products, and consumer demand for convenience in beverage portability.

- The United States dominates the North American Thermos Bottle market, primarily due to its strong consumer base and cultural preference for outdoor recreational activities. Urban centers like New York and Los Angeles are pivotal due to a high concentration of health and sustainability-conscious consumers. Canada also contributes significantly, with cities like Toronto and Vancouver exhibiting high demand, influenced by eco-friendly lifestyle trends and a robust retail sector that promotes reusable drinkware.

- Thermos bottles must meet stringent material safety standards regulated by the U.S. FDA, especially for products involving plastics and metals. The FDA in 2023 outlined that all consumer drinkware must be free of harmful chemicals like BPA and phthalates, driving manufacturers toward safer materials. Compliance with these standards is critical, as non-compliance can result in fines or restrictions on product distribution.

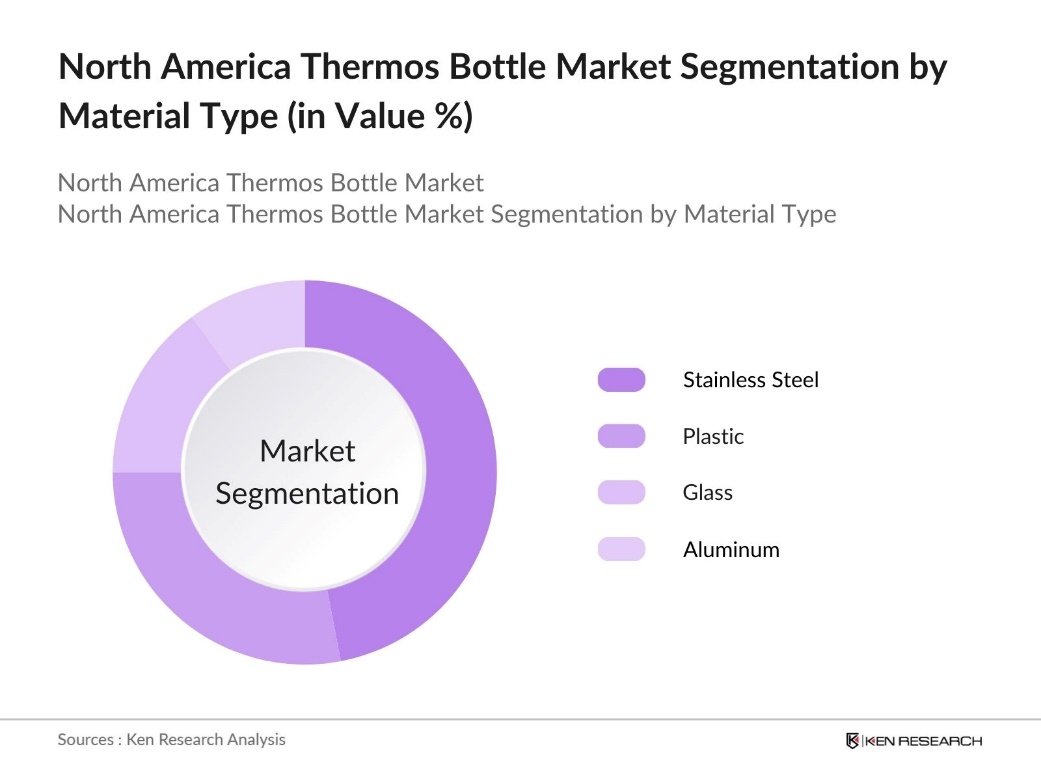

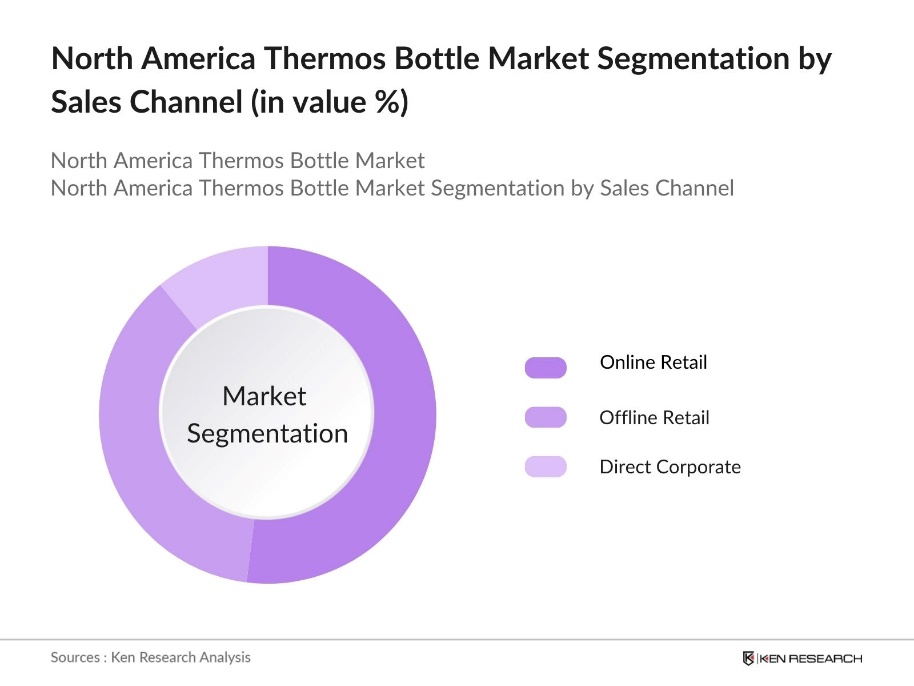

North America Thermos Bottle Market Segmentation

By Material Type: The market is segmented by material type into stainless steel, plastic, glass, and aluminum. Recently, stainless steel thermos bottles have gained a dominant market share within this segment due to their durability, non-reactive nature, and aesthetic appeal. Consumers favor stainless steel bottles for their capacity to keep beverages hot or cold for extended periods. These bottles are also viewed as eco-friendly, contributing to their popularity in urban centers where sustainability is prioritized.

By Sales Channel: The market is segmented by sales channel into offline retail (supermarkets, specialty stores), online retail (e-commerce platforms), and direct corporate sales. Online retail holds a dominant position due to the convenience and extensive variety it offers. Many consumers prefer online shopping for thermos bottles due to a wider range of brands, styles, and easy price comparisons. Major e-commerce platforms also provide promotional discounts, driving the market share for online sales.

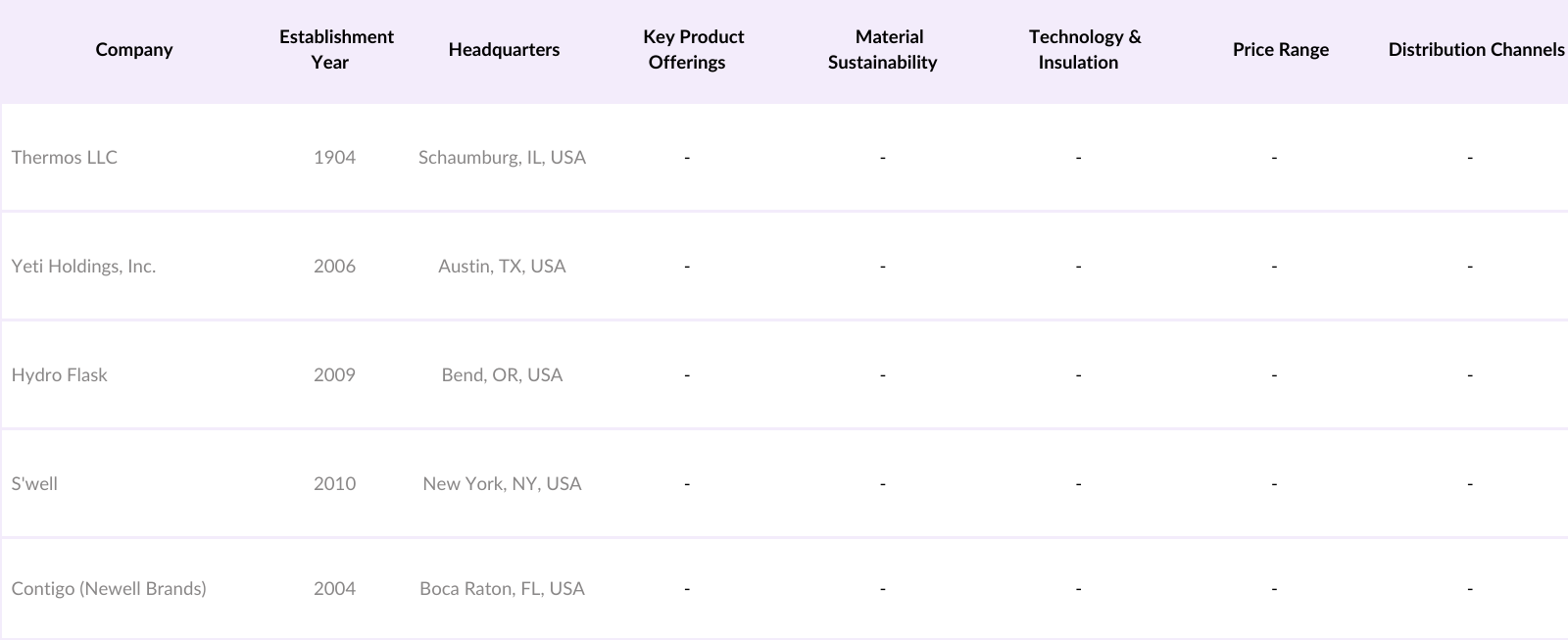

North America Thermos Bottle Market Competitive Landscape

The North America thermos bottle market is dominated by key players, showcasing a mix of local and global brands that leverage advanced manufacturing capabilities, sustainable practices, and strong branding. The market concentration reflects the prominence of brands like Yeti Holdings and Hydro Flask, who consistently lead in innovation and consumer appeal.

North America Thermos Bottle Industry Analysis

Growth Drivers

- Rise in Outdoor Recreational Activities: The North American market has seen a notable increase in outdoor recreational activities such as hiking, camping, and sports, with 57 million U.S. residents engaging in hiking in 2023, according to the Bureau of Economic Analysis. This rise fuels demand for thermos bottles, as these activities often necessitate durable, temperature-preserving hydration solutions. The increased focus on adventure and outdoor experiences among young consumers aligns with higher disposable incomes.

- Growing Health and Sustainability Awareness: Awareness of health and sustainability is growing in North America, with consumers increasingly favoring reusable hydration solutions to reduce single-use plastics. The U.S. Environmental Protection Agency (EPA) unveiled a draft National Strategy to Prevent Plastic Pollution on April 21, 2023, which could significantly impact industries like packaging, retail, plastic manufacturing, solid waste management, and recycling facilities, among others.. Thermos bottles, often crafted from stainless steel or sustainable materials, align with this trend, supporting the rise in eco-conscious purchases.

- Increased Corporate Gifting Culture: Corporate gifting in North America is on the rise, with businesses increasingly choosing practical items like thermos bottles to strengthen relationships with clients and employees. Durable and eco-friendly, thermos bottles align with companies values, making them a popular sustainable gift choice. This shift toward meaningful, reusable items reflects a growing trend in corporate culture to prioritize brand alignment and lasting utility in gift selections.

Market Challenges

- High Price Sensitivity Among Consumers: Price sensitivity is a significant challenge in the North American thermos bottle market, as many consumers prioritize affordability in hydration options. Economic factors influence spending on premium products, particularly among households with limited disposable income. This makes it challenging for high-end thermos brands to appeal to cost-conscious buyers who may opt for less expensive alternatives, affecting sales in the premium segment.

- Availability of Alternative Hydration Solutions: The presence of various alternative hydration options, like reusable water bottles and hydration packs, impacts the demand for thermos bottles. Many consumers favor these options for their convenience and affordability. Additionally, recent innovations, such as self-cleaning bottles, attract tech-savvy individuals, presenting further competition for thermos bottles, especially among younger consumers looking for unique features.

North America Thermos Bottle Market Future Outlook

The North America thermos bottle market is poised for sustained growth driven by the ongoing trend of environmentally friendly products and increasing consumer awareness of sustainable solutions. The market will benefit from innovations in insulation technology, catering to the growing demand for longer-lasting thermal capabilities in bottles. Additionally, advancements in sustainable materials, such as biodegradable and recyclable options, are expected to fuel further demand.

Market Opportunities

- Adoption of Sustainable Materials: Thermos bottle manufacturers have a promising opportunity to meet growing consumer demand for eco-friendly products by adopting sustainable materials. Many consumers now seek items made from recyclable or biodegradable resources, such as stainless steel or bamboo, aligning with environmental goals. This shift opens avenues for thermos brands to create eco-conscious designs, appealing to environmentally aware buyers and enhancing brand loyalty through sustainable choices.

- Expansion into New Regional Markets: Expanding the thermos bottle market into new regions across North America offers significant growth potential, particularly in underserved rural and suburban areas. Consumers in these regions increasingly turn to online platforms for specialty products, allowing thermos brands to broaden their reach. Targeting these areas can help brands tap into a largely unexplored market, where access to diverse hydration options may be limited, enhancing market penetration.

Scope of the Report

|

Material Type |

Stainless Steel |

|

Capacity |

Less than 500 ml |

|

Sales Channel |

Offline Retail (Supermarkets, Specialty Stores) |

|

End-User Application |

Household |

|

Region |

United States |

Products

Key Target Audience

E-commerce Platforms

Outdoor and Adventure Equipment Manufacture

Premium Beverage Manufactures

Government and Regulatory Bodies (e.g., Environmental Protection Agency)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Thermos LLC

Yeti Holdings, Inc.

Hydro Flask

Swell

Contigo (Newell Brands)

Stanley PMI

CamelBak Products, LLC

Zojirushi America Corporation

Corkcicle

Bubba Brands, Inc.

Table of Contents

1. North America Thermos Bottle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Thermos Bottle Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Thermos Bottle Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Outdoor Recreational Activities

3.1.2 Growing Health and Sustainability Awareness

3.1.3 Increased Corporate Gifting Culture

3.1.4 Expanding E-commerce and Specialty Retail Channels

3.2 Market Challenges

3.2.1 High Price Sensitivity Among Consumers

3.2.2 Availability of Alternative Hydration Solutions

3.2.3 Environmental Concerns Regarding Plastic Thermos Bottles

3.3 Opportunities

3.3.1 Adoption of Sustainable Materials

3.3.2 Expansion into New Regional Markets

3.3.3 Innovations in Design and Insulation Technology

3.4 Trends

3.4.1 Preference for Customizable and Stylish Bottles

3.4.2 Rising Demand for Smart Thermos Bottles

3.4.3 Collaboration with Sports and Fitness Brands

3.5 Government Regulations

3.5.1 Material Safety Standards (FDA and Environmental Standards)

3.5.2 Recycling and Disposal Regulations

3.5.3 Import Tariffs on Thermos Bottle Materials

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. North America Thermos Bottle Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Stainless Steel

4.1.2 Plastic

4.1.3 Glass

4.1.4 Aluminum

4.2 By Capacity (In Value %)

4.2.1 Less than 500 ml

4.2.2 500-1000 ml

4.2.3 Above 1000 ml

4.3 By Sales Channel (In Value %)

4.3.1 Offline Retail (Supermarkets, Specialty Stores)

4.3.2 Online Retail (E-commerce)

4.3.3 Direct Corporate Sales

4.4 By End-User Application (In Value %)

4.4.1 Household

4.4.2 Corporate and Institutional

4.4.3 Sports and Outdoor

4.4.4 Food and Beverage Service

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Thermos Bottle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Thermos LLC

5.1.2 Yeti Holdings, Inc.

5.1.3 Hydro Flask

5.1.4 Swell

5.1.5 Contigo (Newell Brands)

5.1.6 Stanley PMI

5.1.7 CamelBak Products, LLC

5.1.8 Zojirushi America Corporation

5.1.9 Corkcicle

5.1.10 Bubba Brands, Inc.

5.1.11 Igloo Products Corporation

5.1.12 MIRA Brands

5.1.13 Takeya USA Corporation

5.1.14 Simple Modern

5.1.15 Ello Products

5.2 Cross Comparison Parameters (Product Innovation, Sustainability Practices, Distribution Network, Market Penetration, Brand Positioning, Revenue, Customer Engagement, Regional Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 R&D and Technology Advancements

5.8 Marketing and Advertising Spend

5.9 Private Equity and Venture Capital Funding

6. North America Thermos Bottle Market Regulatory Framework

6.1 Material Compliance Standards

6.2 Recycling Protocols and Eco-Certification Requirements

6.3 Import and Export Regulations

6.4 Labeling and Marketing Regulations

7. North America Thermos Bottle Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Drivers Influencing Future Market Growth

8. North America Thermos Bottle Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Capacity (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By End-User Application (In Value %)

8.5. By Region (In Value %)

9. North America Thermos Bottle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Analysis

9.3 Customer Retention Strategies

9.4 Channel Optimization Tactics

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial stage, a thorough mapping of industry stakeholders was conducted to understand the North America thermos bottle market ecosystem. Extensive desk research and analysis of secondary databases were undertaken to define key variables that impact market dynamics.

Step 2: Market Analysis and Data Compilation

In this step, historical market data were analyzed to gauge the penetration and sales of thermos bottles across North America. Sales ratios, product popularity, and consumer adoption rates were evaluated to establish reliable revenue and usage statistics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through consultations with industry experts and thermos bottle manufacturers. Insights from these consultations helped refine the understanding of consumer preferences and industry trends.

Step 4: Synthesis and Final Output

The final stage involved consolidating data from both top-down and bottom-up approaches. Direct engagement with key thermos bottle manufacturers provided comprehensive insights into production, consumer demand, and segmental market shares, resulting in a precise analysis of the North America thermos bottle market.

Frequently Asked Questions

01 How big is the North America Thermos Bottle Market?

The North America thermos bottle market is valued at USD 1.73 billion, driven by increasing consumer preference for sustainable and reusable beverage containers.

02 What are the key drivers of the North America Thermos Bottle Market?

Key drivers in North America thermos bottle market include rising environmental awareness, consumer demand for durable and insulated bottles, and increasing health consciousness that promotes reusable over disposable options.

03 Which cities dominate the North America Thermos Bottle Market?

Cities like New York, Los Angeles, and Toronto dominate the North America thermos bottle market due to their high concentration of eco-conscious consumers and access to premium retail and online distribution channels.

04 Who are the major players in the North America Thermos Bottle Market?

Major players in North America thermos bottle market include Thermos LLC, Yeti Holdings, Hydro Flask, Swell, and Contigo, who lead in innovation, brand loyalty, and sustainable practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.