North America Tractor Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD2559

October 2024

81

About the Report

North America Tractor Market Overview

- The North America Tractor Market was valued at USD 18 billion is driven by increased demand for agricultural mechanization, advances in tractor technology, and government initiatives supporting farmers. The market will growth primarily due to the adoption of precision farming and autonomous tractor technology.

- Major players in the market include John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, and Mahindra & Mahindra. These companies dominate the market through a combination of product innovation, extensive distribution networks, and strong brand recognition.

- In 2023, John Deere introduced advancements in autonomous tractors aimed at large-scale farming operations. The company has been focusing on developing its autonomous 8R tractor, which allows for remote operation via a mobile device, enhancing efficiency and productivity for farmers.

- California, Texas, and Iowa, dominate the market, due to its vast agricultural output, while Texas and Iowa benefit from large-scale farming and ranching operations, supported by government subsidies for modern equipment.

North America Tractor Market Segmentation

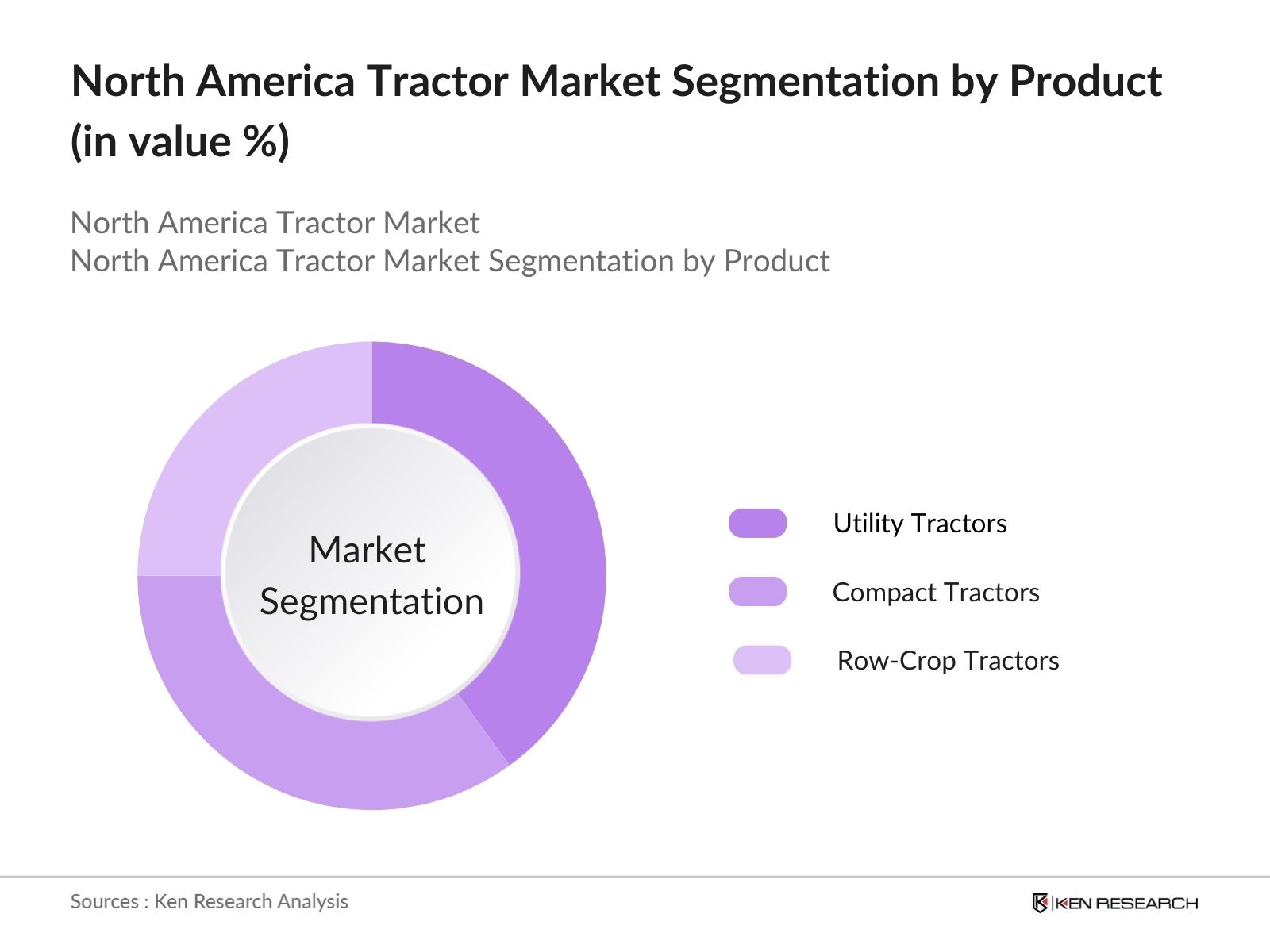

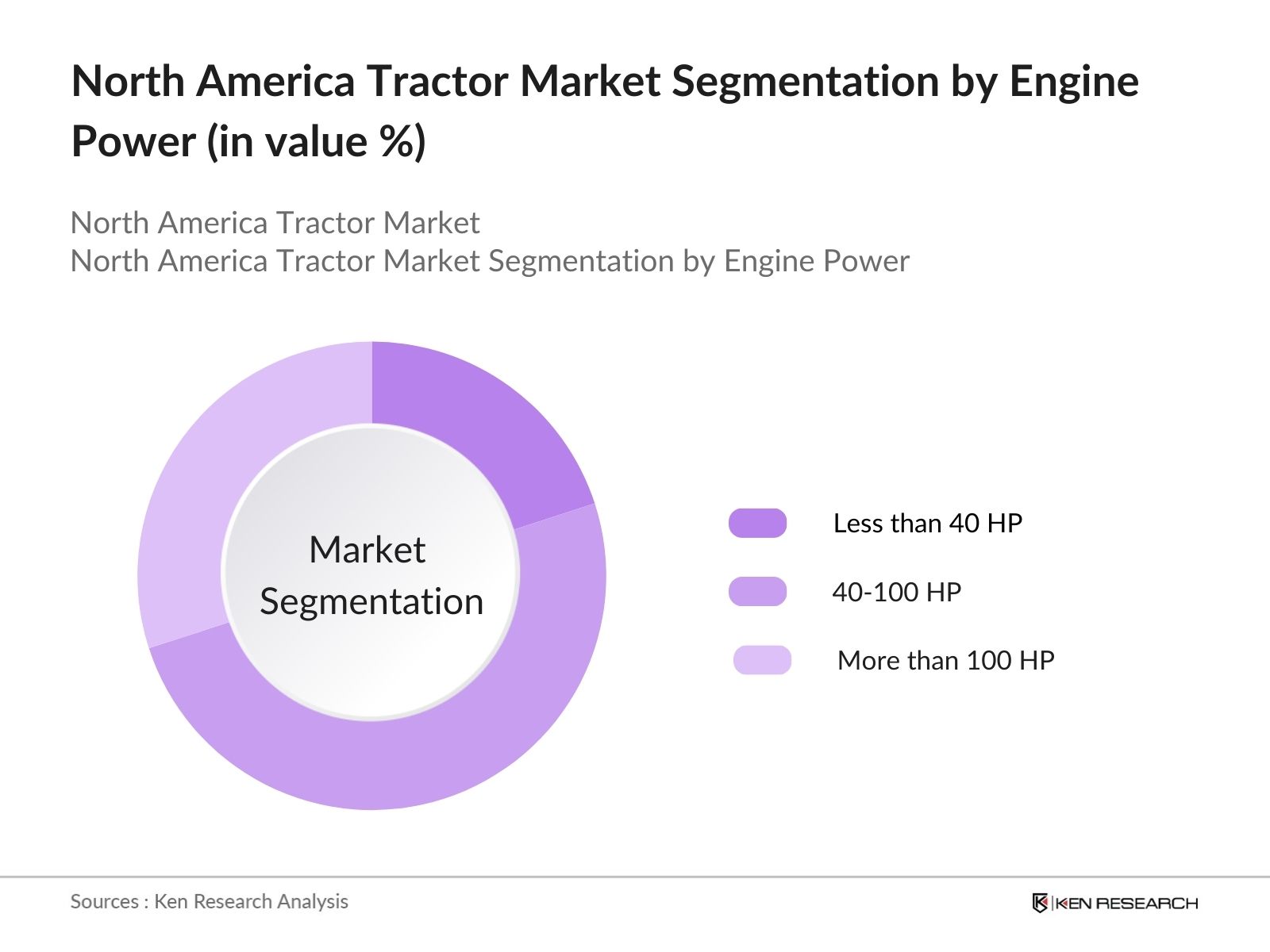

The market is segmented into various factors like product, engine power, and region.

By Product: The market is segmented by product into compact tractors, utility tractors, and row-crop tractors. Utility tractors dominated the market, by their versatility across a range of agricultural applications and affordability for small to mid-sized farms have contributed to their widespread adoption.

By Engine Power: The market is segmented by engine power into less than 40 HP, 40-100 HP, and more than 100 HP tractors. Tractors with 40-100 HP held a dominant market share as they offered the best balance between power and affordability, catering to both small and large-scale farms.

By Region: The market is segmented by region into the United States and Canada. The United States dominated the market with its large-scale agriculture, higher adoption of advanced technologies, and government support for precision farming.

North America Tractor Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

John Deere |

1837 |

Moline, Illinois |

|

CNH Industrial |

2013 |

London, UK |

|

AGCO Corporation |

1990 |

Duluth, Georgia |

|

Kubota Corporation |

1890 |

Osaka, Japan |

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

- Kubota Corporation: Kubota Corporation indeed made headlines in 2024 with the unveiling of its first electric tractor, known as the New Agri Concept, during the CES 2024 event. This prototype is designed to be a fully electric, multi-purpose vehicle aimed at reducing greenhouse gas emissions in agriculture, aligning with global sustainability efforts. The tractor features advanced technologies such as artificial intelligence (AI), automation, and rapid charging capabilities, allowing it to charge from 10% to 80% in less than six minutes.

- CNH Industrial: Intelsat and CNH Industrial have struck a deal to add Intelsat's satcom network to CNH's agricultural and construction equipment, aiming to beat SpaceX and John Deere's partnership by months. The companies plan to connect millions of vehicles, starting in Brazil in Q3 2024 and worldwide by mid-2025.

North America Tractor Market Analysis

Market Growth Drivers

- Increased Adoption of Autonomous Tractors: The market is seeing a rapid uptake in autonomous tractor systems. By 2024, more than 30,000 autonomous tractors are expected to be operational in the U.S. alone. These tractors are helping to reduce labor costs and improve operational efficiency. The USDA has estimated that farms using autonomous tractors can save USD 200 per acre annually due to lower fuel consumption and optimized crop yields.

- Government Investment in Precision Agriculture: The USDA's investments in precision agriculture, totaling almost $200 million, have been a major driver of adoption.Additionally, the USDA's $160 million investment to establish the National Center for Resilient and Regenerative Precision Agriculture at the University of Nebraska-Lincoln will further accelerate innovation and adoption in the sector.

- Growing Demand for High-Horsepower Tractors: U.S. sales of 4-wheel-drive tractors increased in August 2024, reflecting a growing demand for larger agricultural equipment despite an overall decline in total tractor sales. This trend indicates resilience in the market, driven by the need for enhanced productivity in farming operations.

Market Challenges

- Lack of Skilled Workforce for Advanced Machinery: The market is facing a shortage of skilled workers capable of operating and maintaining advanced tractors. According to industry estimates, more than 50,000 specialized technicians will be needed by 2025 to manage these new machines. This shortage is creating bottlenecks, as farmers report delays of up to 12 months for acquiring and servicing advanced tractors, leading to potential losses.

- Slow Rate of Technology Adoption Among Small Farms: Although large farms are rapidly adopting advanced tractors, smaller farmsconstituting nearly 85% of North American farming operationsare lagging behind. Fewer than 10,000 small farms have integrated smart tractor technology, largely due to the high cost and lack of awareness of its benefits. This slow rate of adoption is hindering overall market growth, particularly in regions with fragmented farm holdings.

Government Initiatives

- Canadas Green Agricultural Initiative: The Sustainable Canadian Agricultural Partnership (Sustainable CAP) is a five-year initiative (2023-2028) with a budget of $3.5 billion aimed at enhancing Canadas agricultural sector. It allocates $1 billion for federal programs and $2.5 billion for cost-shared initiatives, focusing on climate change, innovation, and market development to boost competitiveness and resiliency.

- Grants for Autonomous Tractor Research and Development: In 2024, the U.S. Department of Energy provided USD 300 million in grants for research and development in autonomous farming machinery, with a particular focus on AI-powered tractors. These grants are expected to speed up the commercialization of advanced tractors, reducing the average downtime for farm operations by 15%.

North America Tractor Market Future Outlook

Future trends include a surge in electric tractor adoption, increased integration of AI and IoT in tractors, a rise in demand for high-horsepower autonomous tractors, and stricter sustainability regulations shaping the market.

Future Market Trends

- Surge in Electric Tractor Adoption: By 2028, electric tractors will become a mainstream option for farmers, with over 100,000 units expected to be in operation across North America. This shift is driven by government incentives and the need for more sustainable agricultural practices. As the price of electric tractors drops and battery life improves, it is estimated that farms will save operational costs by 2028, while reducing their carbon footprint by margins.

- Increased Integration of AI and IoT in Farming Equipment: AI and IoT integration will revolutionize the tractor market by 2028, with more than half of tractors in North America equipped with real-time data analytics and AI-driven decision-making capabilities. These advancements will help optimize resource use, reducing water and fertilizer consumption.

Scope of the Report

|

By Product |

Utility Tractors Compact Tractors Row-Crop Tractors |

|

By Engine Power |

Less than 40 HP 40-100 HP More than 100 HP |

|

By Region |

USA Canda |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Agricultural Machinery Manufacturers

Government Regulatory Bodies (USDA)

Large-Scale Farms

Tractor Parts Manufacturers

Bank and Financial Institutions

Venture Capitalist

Companies

Players Mentioned in the Report:

John Deere

CNH Industrial

AGCO Corporation

Kubota Corporation

Mahindra & Mahindra

Fendt

Massey Ferguson

New Holland

Case IH

Valtra

Claas

Versatile

Yanmar

TYM Tractors

LS Tractor

Table of Contents

1. North America Tractor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Growth Drivers, Restraints, Opportunities)

1.4. Value Chain Analysis

2. North America Tractor Market Size (in USD Billion)

2.1. Historical Market Size (Operational, Financial Data)

2.2. Year-on-Year Growth Analysis (Units Sold, Revenue Generated)

2.3. Key Market Milestones and Developments

3. North America Tractor Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Autonomous Tractors

3.1.2. Government Initiatives Supporting Mechanization

3.1.3. Expansion of Large-Scale Farming

3.1.4. Electric and Low-Emission Tractor Adoption

3.2. Restraints

3.2.1. High Initial Investment in Smart Tractors

3.2.2. Shortage of Skilled Labor

3.2.3. Maintenance Challenges for Advanced Machinery

3.2.4. Regulatory Pressures on Emissions

3.3. Opportunities

3.3.1. Technological Innovation in Tractor Automation

3.3.2. Expansion into Precision Agriculture

3.3.3. Partnerships for Smart Farming Solutions

3.3.4. Sustainable Agriculture Practices

3.4. Market Trends

3.4.1. Integration of AI and IoT in Tractors

3.4.2. Transition Towards Electric Tractors

3.4.3. Increased Adoption of High-Horsepower Models

3.4.4. Expansion of Leasing Programs for Small Farms

3.5. Government Regulations

3.5.1. Emission Standards for Agricultural Machinery

3.5.2. Subsidies for Electric Tractors

3.5.3. Precision Agriculture Funding Programs

3.5.4. Import Regulations on Tractor Components

3.6. SWOT Analysis

3.7. Ecosystem Stakeholders (Suppliers, Distributors, Farmers)

3.8. Competitive Ecosystem Analysis

4. North America Tractor Market Segmentation

4.1. By Product Type (in value %)

4.1.1. Utility Tractors

4.1.2. Row-Crop Tractors

4.1.3. Compact Tractors

4.2. By Engine Power (in value %)

4.2.1. Less than 40 HP

4.2.2. 40-100 HP

4.2.3. More than 100 HP

4.3. By Region (in value %)

4.3.1. United States

4.3.2. Canada

5. North America Tractor Market Competitive Landscape

5.1. Market Share Analysis (Financial and Operational)

5.2. Detailed Profiles of Major Players

5.2.1. John Deere

5.2.2. CNH Industrial

5.2.3. AGCO Corporation

5.2.4. Kubota Corporation

5.2.5. Mahindra & Mahindra

5.2.6. Fendt

5.2.7. Massey Ferguson

5.2.8. Case IH

5.2.9. Valtra

5.2.10. Versatile

5.2.11. Yanmar

5.2.12. New Holland

5.2.13. TYM Tractors

5.2.14. LS Tractor

5.2.15. Claas

5.3. Cross Comparison (Inception Year, Revenue, Employees, Key Strategies)

5.4. Mergers and Acquisitions

5.5. Strategic Partnerships and Collaborations

5.6. New Product Launches and Innovations

6. North America Tractor Market Regulatory Framework

6.1. Emission Standards

6.2. Safety and Compliance Regulations

6.3. Import and Export Laws

6.4. Certification Requirements for Smart and Electric Tractors

7. North America Tractor Market Future Outlook

7.1. Projections for the Next Five Years (Operational, Financial Data)

7.2. Key Drivers of Future Market Growth

7.3. Technological Disruptions and Future Trends

7.4. Sustainability and Environmental Impact Considerations

8. Analyst Recommendations for North America Tractor Market

8.1. Market Entry Strategies for New Players

8.2. Expansion Opportunities for Existing Players

8.3. Product Differentiation Strategies

8.4. Recommendations for Technological Adoption and Investment

9. Conclusion and Analyst Insights

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Tractor industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple tractor manufacturers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such tractor manufacturers companies.

Frequently Asked Questions

01 How big is the North America Tractor market?

The North America Tractor Market was valued at USD 18 billion is driven by increased demand for agricultural mechanization, advances in tractor technology, and government initiatives supporting farmers.

02 What are the challenges in the North America Tractor market?

Challenges in the North America Tractor market include the high cost of advanced tractors, lack of skilled workers, regulatory pressures on emissions, and slow technology adoption among smaller farms.

03 Who are the major players in the North America Tractor market?

Key players in the North America Tractor market include John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, and Mahindra & Mahindra.

04 What are the main growth drivers of the North America Tractor market?

The growth of the North America Tractor market is driven by the adoption of autonomous tractors, government support for precision farming, rising demand for high-horsepower tractors, and the shift toward electric tractors for sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.