North America Transponder Satellite Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD973

December 2024

84

About the Report

North America Transponder Satellite Market Overview

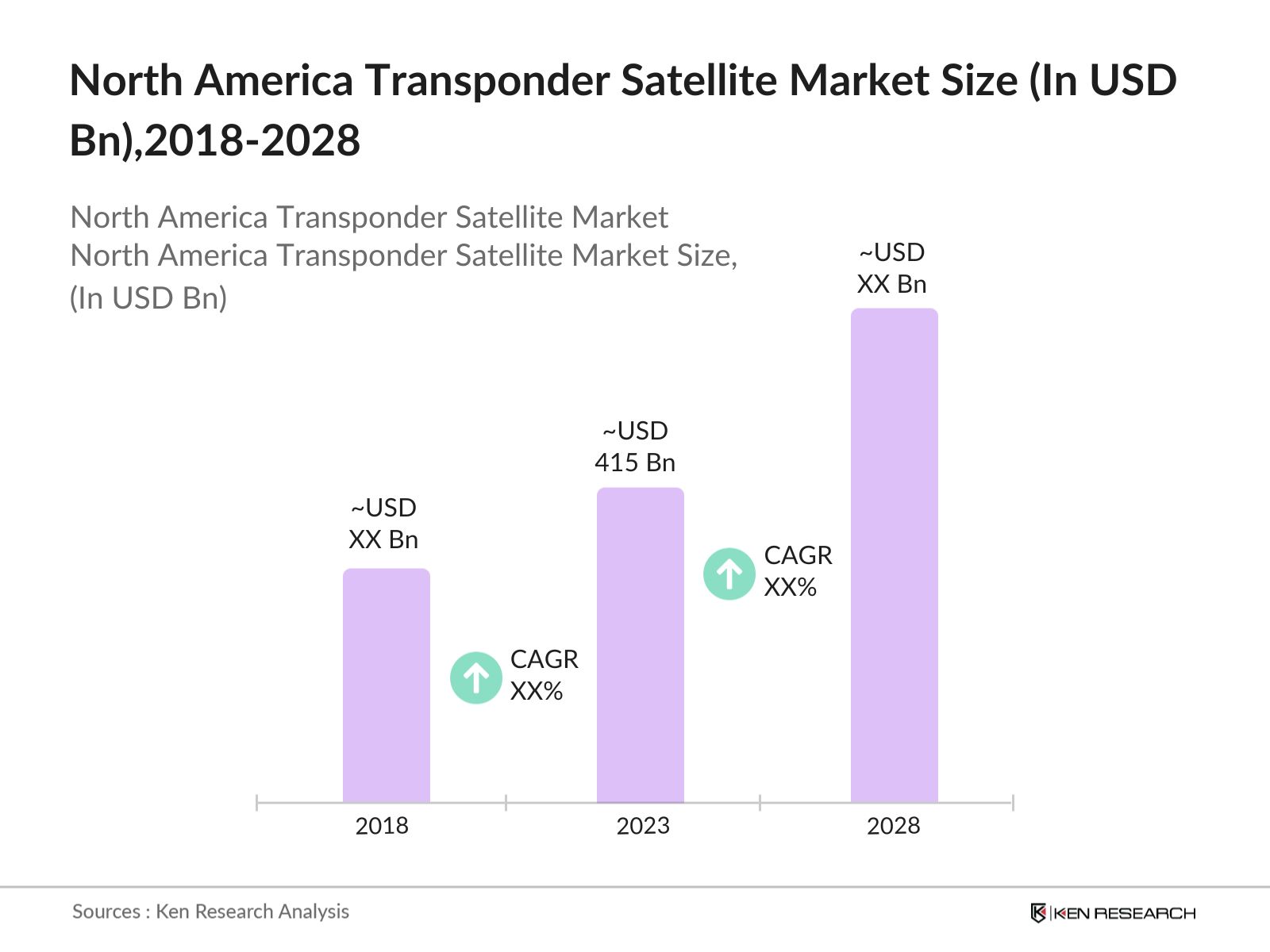

- North America Transponder Satellite Market was valued at USD 415 billion in 2023, driven by increasing demand for controlled release and targeted delivery in various industries. The market's growth is propelled by advancements in pharmaceuticals, food and beverages, and agrochemicals sectors, which benefit from microencapsulation technologies for improved product stability and efficacy.

- Major players in the North America Satellite Transponder Market include SES S.A., Intelsat, Eutelsat Communications, Telesat Canada, and EchoStar Corporation. These companies dominate due to their extensive satellite fleets and robust distribution networks.

- In 2024, SES announced plans to acquire Intelsat for $3.1 billion, a move aimed at strengthening its position in the satellite communications market. This merger is expected to create a significant player in the industry will enhance their ability to compete against non-geostationary operators like Starlink.

- Cities like Los Angeles, New York, and Washington D.C. dominate the market due to their strategic importance in media, telecommunications, and government operations. Los Angeles is a major hub for content production and broadcasting, driving significant demand for satellite transponders.

North America Transponder Satellite Market Segmentation

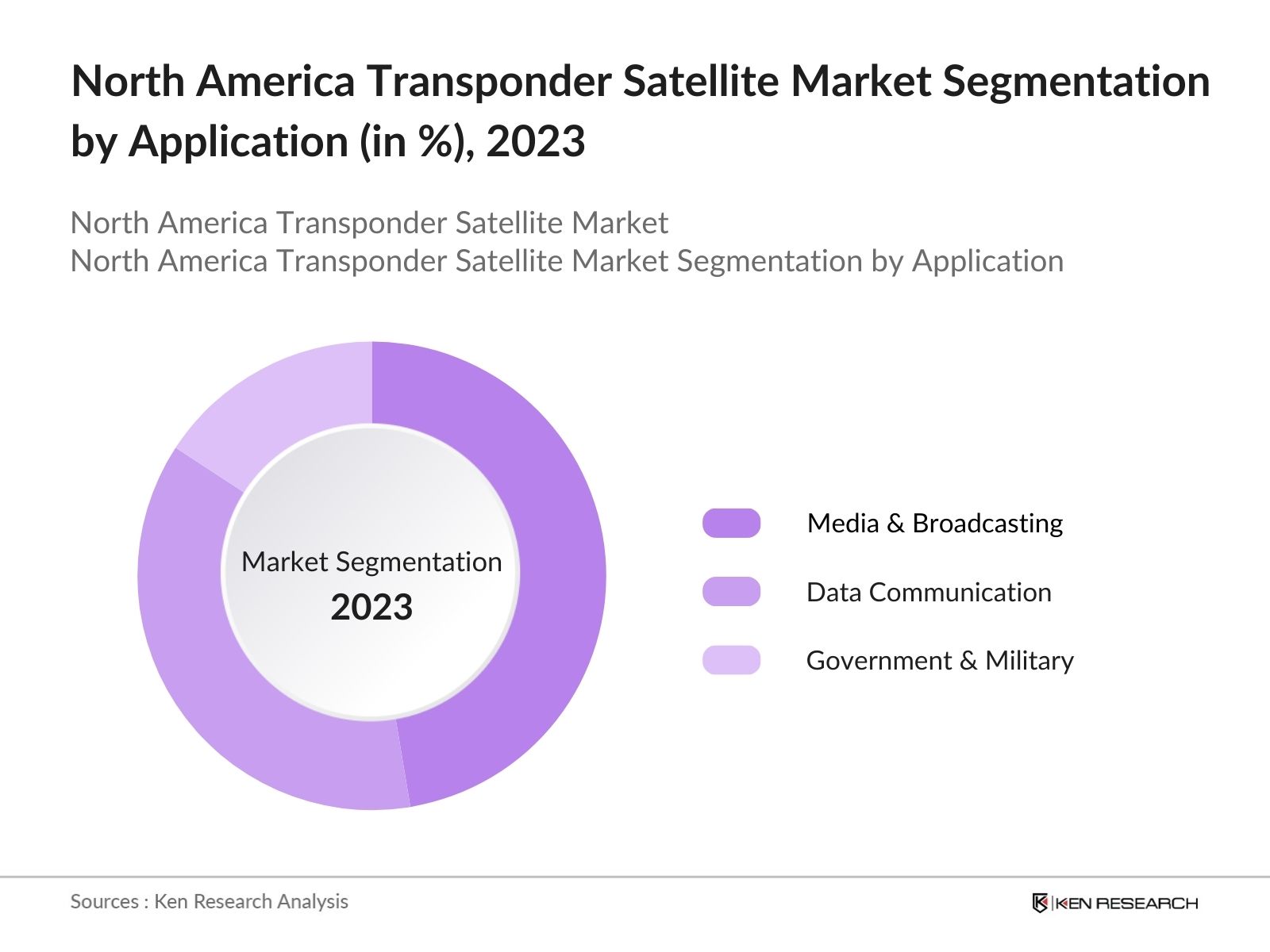

By Application: The North America Satellite Transponder Market is segmented by application into media & broadcasting, data communication, and government & military. In 2023, media & broadcasting dominated this segment due to the continuous demand for television broadcasting and live event coverage, which require reliable satellite transponder services. The sector's reliance on high-definition content and global broadcasting capabilities further strengthens its position.

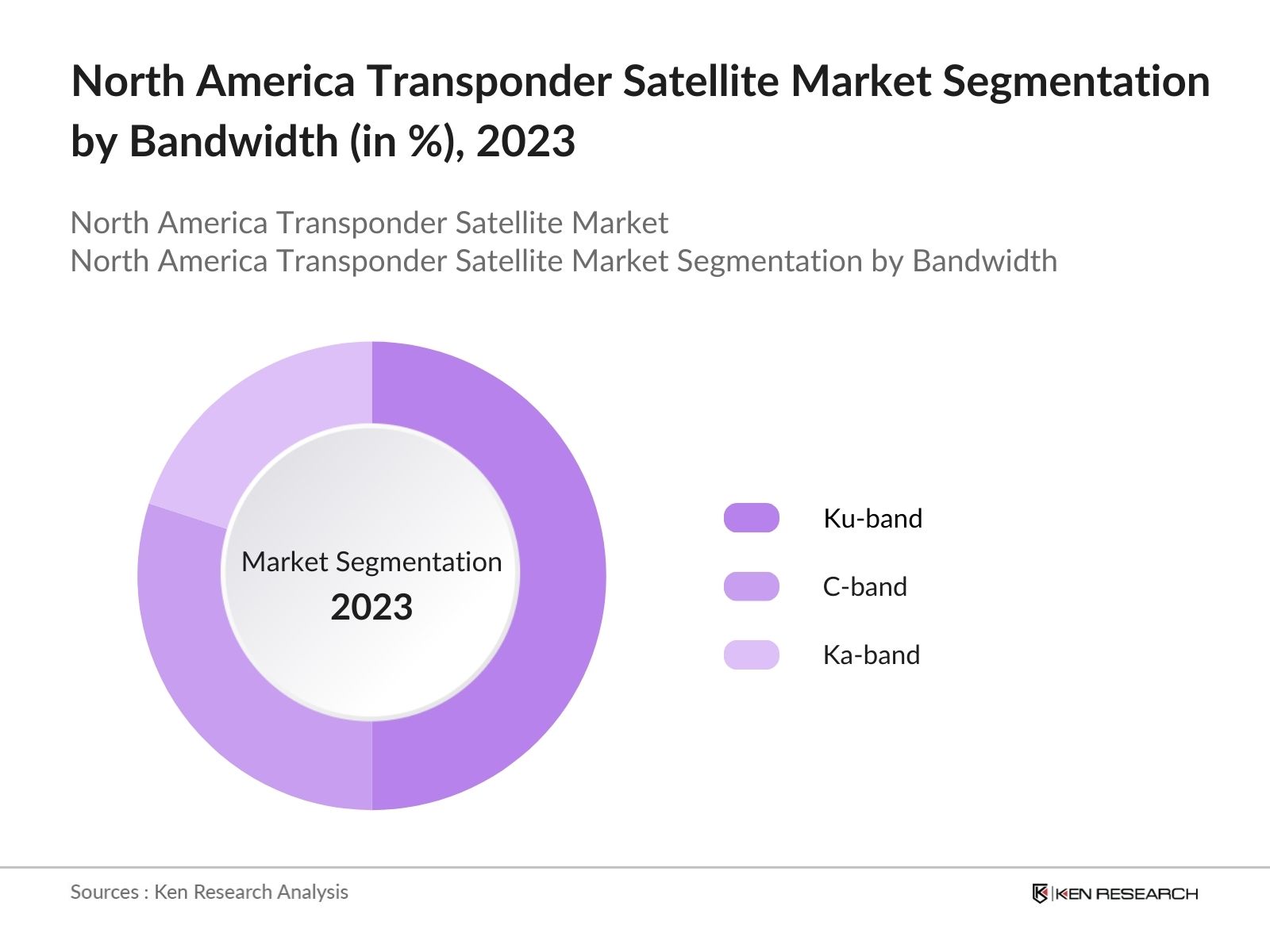

By Bandwidth: The market is segmented by bandwidth into C-band, Ku-band, and Ka-band transponders. In 2023, Ku-band transponders dominated this segment due to their widespread use in direct-to-home (DTH) television services and data communication. Ku-band is preferred for its balance between coverage and capacity, making it ideal for broadcasting and communication purposes across North America.

By Region: The North America Satellite Transponder Market is segmented regionally into the USA and Canada. In 2023, the USA dominated the market, driven by its advanced satellite infrastructure, significant investments in technology, and the presence of major satellite operators and broadcasting companies. The countrys leadership in media, telecommunications, and defense sectors, which heavily rely on satellite transponder services, also contributed to its dominance

North America Transponder Satellite Market Competitive Landscape

|

Company Name |

Year Established |

Headquarters |

|

SES S.A. |

1985 |

Betzdorf, Luxembourg |

|

Intelsat |

1964 |

McLean, Virginia, USA |

|

Eutelsat Communications |

1977 |

Paris, France |

|

Telesat Canada |

1969 |

Ottawa, Canada |

|

EchoStar Corporation |

1980 |

Englewood, Colorado, USA |

- Eutelsat Communications: In 2024, Intelsat announced a significant expansion of its partnership with Eutelsat Group, focusing on the latter's OneWeb Low Earth Orbit (LEO) satellite constellation. This expanded agreement is valued at $250 million over the first six years, with an option for an additional $250 million, potentially bringing the total to $500 million over seven years.

- Intelsat: In 2022, Intelsat successfully launched its Galaxy 35 and Galaxy 36 satellites aboard an Ariane 5 rocket. These satellites, built by Maxar, will replace aging satellites in Intelsat's Galaxy fleet and provide critical capacity for live sports, entertainment, and news coverage in North America.

North America Transponder Satellite Industry Analysis

Growth Drivers

- Rising Demand for High-Definition Broadcasting: The North American pay TV market captured a revenue share of over 40% in 2023, with more than 124 million households in the U.S. having a television. This substantial household penetration underscores the strong demand for HD and UHD content & highlights the ongoing importance of delivering high-quality content to meet the expectations of a well-established and tech-savvy consumer base.

- Expansion of Satellite-Based Internet Services: Satellite internet services are available across all 50 states in the U.S., reaching millions of customers, particularly in underserved regions. By the end of 2023, satellite providers offered data speeds ranging from 25 Mbps to 220 Mbps. Adoption of satellite internet services is expected to continue driving demand for satellite transponders. The increasing reliance on satellite internet for remote work and education further fuels the demand for reliable and high-capacity satellite transponders.

- Government Investments in Satellite Infrastructure: Government initiatives such as the U.S. Space Forces National Security Space Launch (NSSL) program have been key drivers in the satellite transponder market. For fiscal year 2024, the Space Force plans to increase its launches from 12 in 2023 to 21 missions. These aim to enhance the nation's satellite communication capabilities for defense and security purposes.

Market Challenges

- Spectrum Allocation and Regulatory Challenges: The Federal Communications Commission (FCC) has been cautious in allocating new frequency bands for satellite communications, especially with the increasing demand for 5G networks. This reallocation has forced satellite operators to invest in new technologies to adapt to the changing spectrum landscape.

- High Capital Expenditure and Maintenance Costs: The satellite transponder market is capital-intensive, with high costs associated with satellite manufacturing, launch, and maintenance Moreover, the long operational life of satellites, typically 15 years, necessitates ongoing maintenance and potential mid-life upgrades, adding to the financial burden on satellite operators.

North America Transponder Satellite Market Government Initiatives

- Enhanced Satellite Communication Program: Enhanced Satellite Communication Project Polar (ESCP-P) was announced in 2023 as part of Canada's efforts to improve satellite communications capabilities, particularly for the Canadian Armed Forces in the Arctic region. With a funding greater than $5 billion, this initiative is aimed at providing essential communication services in remote areas lacking terrestrial infrastructure.

- National Telecommunications and Information Administration Reauthorization Act: National Telecommunications and Information Administration Reauthorization Act was most recently introduced in the 118th Congress (2023-2024) as H.R. 4510. This act aims to reauthorize the National Telecommunications and Information Administration (NTIA) for the first time in nearly 30 years. It aims to bolster the transponder satellite market by ensuring updated regulatory frameworks and improved oversight, which can enhance satellite spectrum management and facilitate industry growth.

North America Transponder Satellite Future Market Outlook

By 2028, North America Satellite Transponder Market is poised for steady growth over the next five years, driven by increasing demand for high-quality satellite-based communication services.

Future Trends

- Shift Towards Ka-Band and Higher Frequency Transponders: The future of the North America Satellite Transponder Market will see a shift towards the adoption of Ka-band and higher frequency transponders, which offer greater bandwidth and faster data transmission rates. This trend will be driven by the increasing demand for high-speed internet and data services, particularly in remote and underserved regions.

- Integration of Satellite and Terrestrial Networks: Over the next five years, the integration of satellite and terrestrial networks will become a prominent trend in the North American market. This hybrid approach will leverage the strengths of both satellite and terrestrial infrastructures to provide seamless connectivity, particularly for enterprise and government applications.

Scope of the Report

|

By Application |

Media & Broadcasting Data Communication Government & Military |

|

By Bandwidth |

C-band Ku-band Ka-band |

|

By Service |

Leasing Maintenance and Support Others |

|

By Amplifier Type |

Solid-State Power Amplifiers (SSPA) Traveling Wave Tube Amplifiers (TWTA) |

|

By Region |

USA |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Satellite Communication Service Providers

Broadcasting Companies

Telecommunication Companies

Aerospace and Defense Companies

Satellite Manufacturers

Energy and Utility Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, Canadian Radio-television and Telecommunications Commission)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Major Players Mentioned in the Report:

SES S.A.

Intelsat

Eutelsat Communications

Telesat Canada

EchoStar Corporation

ViaSat Inc.

L3Harris Technologies

Boeing Space and Launch

Northrop Grumman Corporation

Lockheed Martin Corporation

Globalstar Inc.

Iridium Communications Inc.

Anik Satellites

SpaceX

Hughes Network Systems

Table of Contents

1. North America Transponder Satellite Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. North America Transponder Satellite Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Transponder Satellite Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for High-Definition Broadcasting

3.1.2. Expansion of Satellite-Based Internet Services

3.1.3. Government Investments in Satellite Infrastructure

3.1.4. Expansion of DTH (Direct-to-Home) Services

3.2. Restraints

3.2.1. High Capital and Operational Costs

3.2.2. Spectrum Allocation and Regulatory Challenges

3.2.3. Limited Frequency Spectrum Availability

3.3. Opportunities

3.3.1. Growth in HTS (High Throughput Satellite) Technology

3.3.2. Emerging Applications in IoT

3.3.3. Satellite-Based Internet Services Expansion

3.4. Trends

3.4.1. Integration with 5G Technology

3.4.2. Growth of CubeSats and Small Satellites

3.4.3. Collaboration Between Satellite Operators and Telecom Providers

3.5. Government Regulation

3.5.1. Enhanced Satellite Communication Program

3.5.2. National Telecommunications and Information Administration Reauthorization Act

3.5.3. National Space Policy

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Transponder Satellite Market Segmentation, 2023

4.1. By Bandwidth (in Value %)

4.1.1. C-band

4.1.2. Ku-band

4.1.3. Ka-band

4.2. By Application (in Value %)

4.2.1 Media & Broadcasting

4.2.2 Data Communication

4.2.3 Government & Military

4.3. By Service Type (in Value %)

4.3.1 Leasing

4.3.2 Maintenance and Support

4.3.3 Others

4.4. By Amplifier Type

4.4.1 Solid-State Power Amplifiers (SSPA)

4.4.2 Traveling Wave Tube Amplifiers (TWTA)

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

4.5.4. Rest of North America

5. North America Transponder Satellite Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. SES S.A.

5.1.2 Intelsat

5.1.3 Eutelsat Communications

5.1.4 Telesat Canada

5.1.5 EchoStar Corporation

5.1.6 ViaSat Inc.

5.1.7 L3Harris Technologies

5.1.8 Boeing Space and Launch

5.1.9 Northrop Grumman Corporation

5.1.10 Lockheed Martin Corporation

5.1.11 Globalstar Inc.

5.1.12 Iridium Communications Inc.

5.1.13 Anik Satellites

5.1.14 SpaceX

5.1.15 Hughes Network Systems

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Transponder Satellite Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Transponder Satellite Market Regulatory Framework

7.1. Satellite Licensing Procedures

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Transponder Satellite Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Transponder Satellite Market Future Segmentation, 2030

9.1. By Bandwidth (in Value %)

9.2. By Application (in Value %)

9.3. By Service Type (in Value %)

9.4 By Amplifier Type (in Value %)

9.5. By Region (in Value %)

10. North America Transponder Satellite Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on North America Transponder Satellite Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Transponder Satellite Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3:Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple transponder satellite companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from transponder satellite companies.

Frequently Asked Questions

01 How big is North America Transponder Satellite Market?

North America Transponder Satellite Market was valued at USD 415 billion in 2023, driven by increasing demand for controlled release and targeted delivery in various industries. The market's growth is propelled by advancements in pharmaceuticals, food and beverages, and agrochemicals sectors

02 What are the challenges in the North America Transponder Satellite Market?

Challenges of North America Transponder Satellite Market include spectrum allocation issues, high capital expenditure and maintenance costs, and growing competition from Low Earth Orbit (LEO) satellite networks. These factors create uncertainty and financial pressures for operators in the market.

03 What are the growth drivers of North America Transponder Satellite Market?

North America Transponder Satellite Market is propelled by the rising demand for high-definition broadcasting, expansion of satellite-based internet services in rural areas, and significant government investments in satellite infrastructure, particularly for defense and remote communication needs.

04 Who are the major players in the North America Transponder Satellite Market?

Key players in North America Transponder Satellite Market include SES S.A., Intelsat, Eutelsat Communications, Telesat Canada, and EchoStar Corporation. These companies lead the market due to their extensive satellite fleets, advanced technology, and strong industry partnerships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.