North America Travel Trailer Market Outlook to 2030

Region:North America

Author(s):Ananya Singh

Product Code:KROD8600

November 2024

88

About the Report

North America Travel Trailer Market Overview

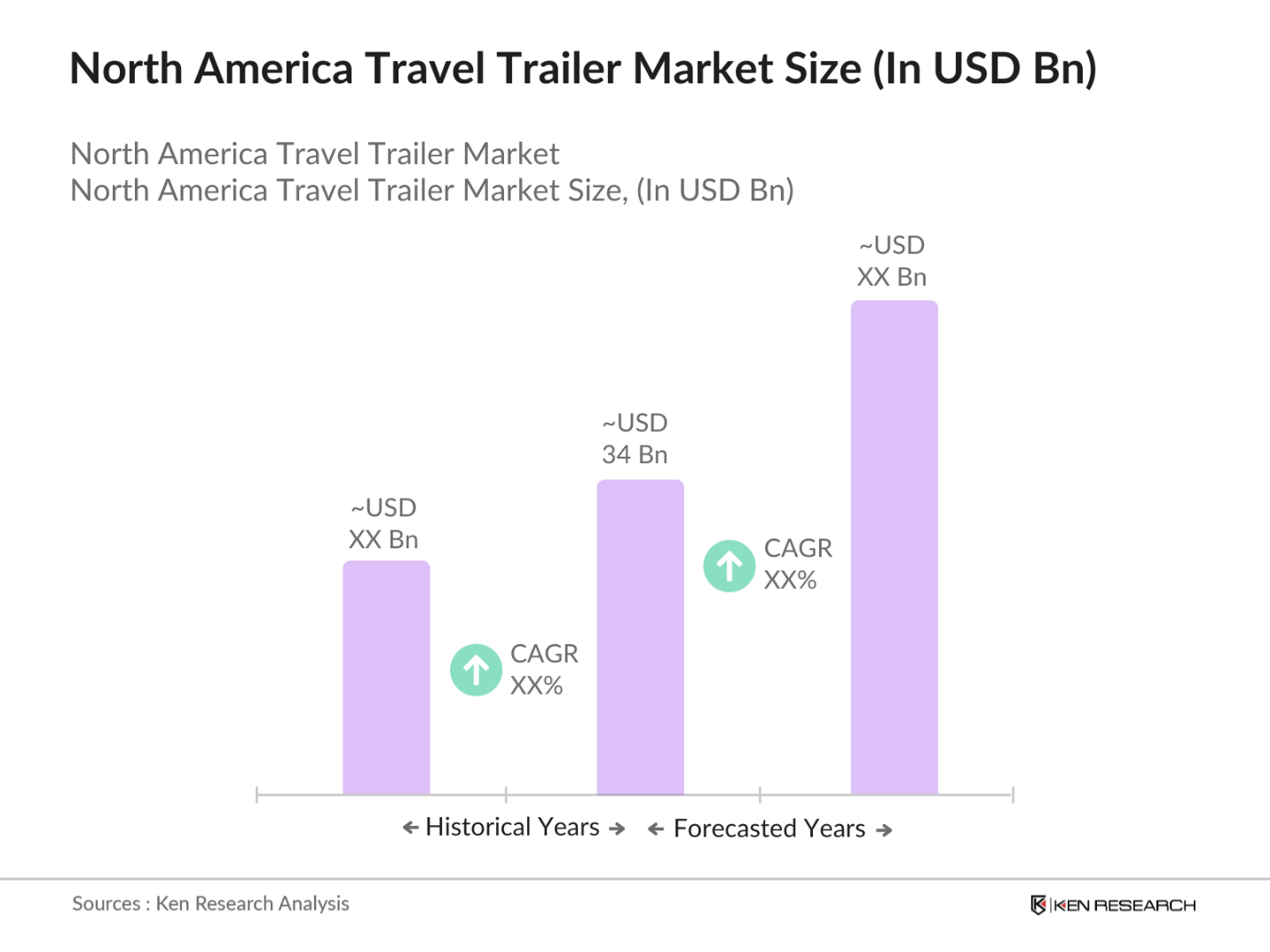

- The North America Travel Trailer Market, based on a detailed analysis, has reached a valuation of USD 34 billion, driven by strong demand for recreational travel and leisure vehicles in the U.S. and Canada. The rising interest in travel trailers is attributed to the growing preference for affordable travel options that allow users to experience nature while maintaining the comfort of home-like amenities. This growth is further fueled by advancements in trailer design and technology, which provide enhanced features at accessible price points, appealing to a broader consumer base.

- In North America, the U.S. is the dominant market for travel trailers, closely followed by Canada. The U.S. leads due to its widespread culture of road trips and camping, a robust RV infrastructure, and diverse landscapes ideal for recreational vehicle travel. The favorable economic conditions in Canada, along with government-backed tourism initiatives, have also spurred demand, making it a strong market. Both countries benefit from a high disposable income and a growing demographic that favors outdoor activities, driving the growth of the travel trailer segment.

- Several states in the U.S., such as California and Colorado, have allocated funds to develop public RV parks and camping facilities, responding to increased demand from travel trailer users. In 2024, California invested $20 million in upgrading RV parks, enhancing accessibility and amenities. Such initiatives increase the appeal of travel trailer vacations, supporting market growth by providing well-equipped, accessible destinations for travel trailer owners.

North America Travel Trailer Market Segmentation

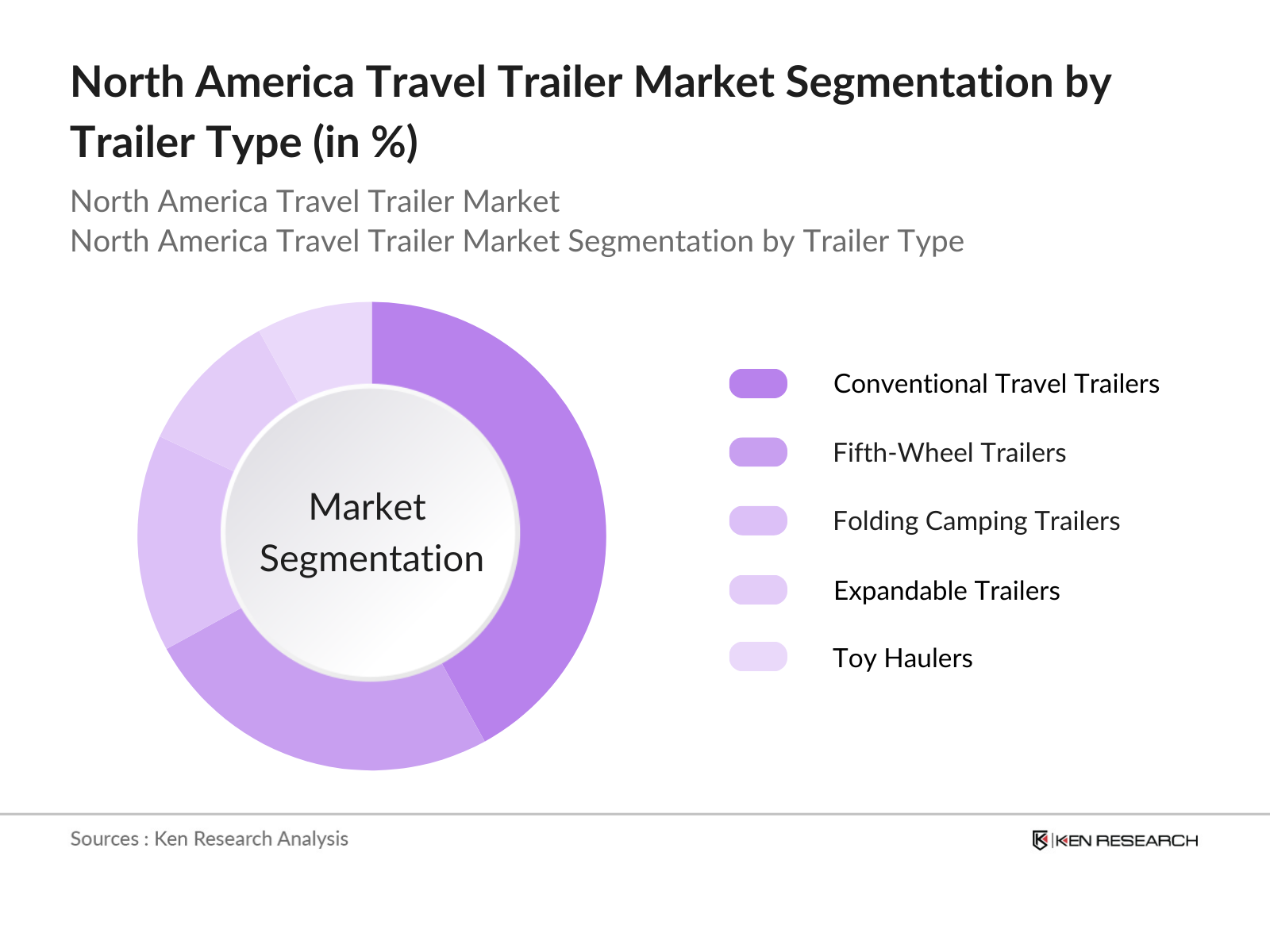

By Trailer Type: The North America Travel Trailer market is segmented by trailer type into conventional travel trailers, fifth-wheel trailers, folding camping trailers, expandable trailers, and toy haulers. Conventional travel trailers hold a dominant share in the market due to their affordability, ease of use, and widespread availability, making them a popular choice for both first-time buyers and seasoned RV enthusiasts. These trailers offer a range of customizable features, catering to different needs and budgets, and are suited for various camping environments, from basic to luxury.

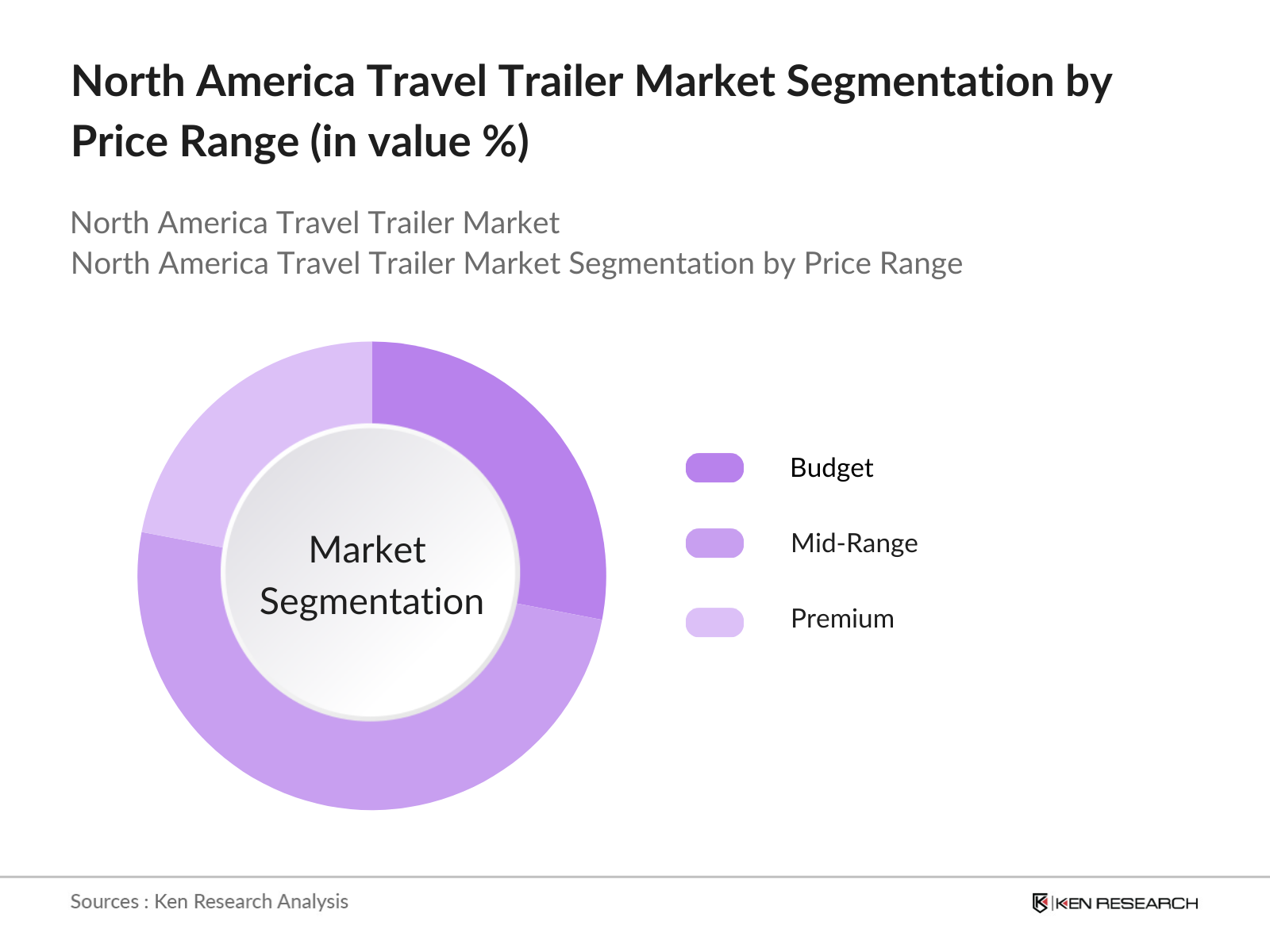

By Price Range: The North America Travel Trailer market is further segmented by price range into budget, mid-range, and premium travel trailers. The mid-range segment currently dominates the market due to its balance between cost and features, appealing to a wide demographic that seeks a comfortable experience without the high cost associated with premium models. Mid-range trailers often include modern amenities like bathrooms, kitchens, and entertainment setups, making them attractive to families and groups looking for a complete travel experience.

North America Travel Trailer Market Competitive Landscape

The North America Travel Trailer Market is led by several major players, with a blend of well-established companies and new entrants bringing innovations. Key players include Thor Industries, Winnebago Industries, and Forest River, Inc., which dominate due to their extensive product portfolios, strong dealer networks, and brand reputation.

North America Travel Trailer Market Analysis

Growth Drivers

- Increasing Demand for Domestic Travel Solutions: The North American travel trailer market has seen significant growth driven by consumers' increased preference for domestic travel. In the U.S. alone, over 85 million Americans plan road trips annually, creating sustained demand for travel trailers. This trend aligns with a substantial rise in domestic tourism, with over 700 million domestic trips recorded in 2024, as families and individuals seek affordable travel options within the country. Travel trailers meet this demand by offering flexibility and cost-effective travel, positioning them as a viable choice for budget-conscious consumers seeking personalized travel experiences.

- Rise of Remote Work and Digital Nomadism: The shift to remote work has influenced consumer behavior, leading to increased interest in mobile living options like travel trailers. In 2024, around 50 million Americans reported remote work capabilities, creating a significant market for travel trailers tailored to work-from-anywhere lifestyles. This demand is particularly strong among younger consumers who value the freedom to work remotely. Travel trailers with connectivity features and workspaces are increasingly popular, allowing remote workers to travel while maintaining productivity. This trend highlights a shift in consumer priorities, with travel trailers offering an attractive balance between mobility and convenience.

- Affordable Alternative to Traditional Vacation Options: With rising hotel prices and airfare costs, travel trailers have emerged as an affordable vacation alternative. According to recent reports, average hotel room rates in major North American cities have increased to $150 per night, making extended stays expensive for families. In contrast, the cost of renting a travel trailer averages around $100 per night, offering considerable savings. This cost efficiency makes travel trailers an appealing choice for families and budget travelers, particularly for trips to national parks, which attract over 300 million visitors annually in North America. As consumers seek cost-effective ways to explore, the demand for travel trailers continues to grow.

Market Challenges

- High Initial Purchase and Maintenance Costs: The cost of purchasing a travel trailer is significant, with both initial purchase prices and ongoing maintenance expenses posing barriers for some consumers. These costs can deter potential buyers, particularly those considering travel trailers for occasional use. The high investment required may limit market accessibility, especially for younger consumers or those with limited budgets.

- Seasonal Demand Variations Impacting Consistent Sales: Demand for travel trailers is notably seasonal, with peak sales typically occurring during warmer months. This creates challenges for manufacturers and dealers who must manage fluctuating demand. Seasonal variability impacts inventory management and cash flow, requiring businesses to adapt to low sales volumes during off-peak periods. This challenge highlights the need for effective seasonal strategies to maintain profitability and manage resources throughout the year.

North America Travel Trailer Market Future Outlook

Over the next five years, the North America Travel Trailer Values Market is expected to witness steady growth, driven by rising consumer demand for sustainable and affordable travel options. Increased interest in recreational vehicle travel post-pandemic, combined with advancements in trailer design and connectivity, will fuel market expansion. Key players are likely to capitalize on this trend by introducing eco-friendly models with modern amenities, catering to the evolving preferences of a younger, more mobile generation of travelers.

Market Opportunities

- Increased Demand for Electric and Hybrid Travel Trailers: The demand for electric and hybrid travel trailers is expected to surge over the next five years, driven by rising fuel costs and environmental awareness. As governments across North America invest in sustainable technologies, manufacturers are projected to introduce more eco-friendly options, addressing consumer preferences for reduced emissions and fuel savings.

- Expansion of Mobile Workspaces within Trailers: With the sustained prevalence of remote work, manufacturers are likely to develop trailers with dedicated workspaces and enhanced connectivity. These designs will cater to digital nomads and remote workers seeking a flexible work environment on the road, making mobile workspaces a prominent feature in future models.

Scope of the Report

|

By Trailer Type |

Conventional Travel Trailers Fifth-Wheel Trailers Folding Camping Trailers Expandable Trailers Toy Haulers |

|

By Price Range |

Budget Mid-Range Premium |

|

By End-User |

Individual Buyers Commercial Fleet Owners |

|

By Distribution Channel |

OEM Dealerships Online Sales Specialty Retailers |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Travel and Tourism Agencies

Government and Regulatory Bodies (U.S. Department of Transportation, Canadian Ministry of Transport)

RV Dealerships and Distributors

Component Manufacturers (e.g., HVAC systems, electrical systems)

OEMs (Original Equipment Manufacturers)

Investment and Venture Capitalist Firms

Private RV Park Owners and Operators

Outdoor Recreation and Camping Associations

Companies

Players Mentioned in the Report

Thor Industries

Winnebago Industries

Forest River, Inc.

Jayco, Inc.

Airstream

Grand Design RV

Coachmen RV

Dutchmen Manufacturing

Keystone RV

Lance Camper Manufacturing

Table of Contents

1. North America Travel Trailer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Valuation Trends (Value Analysis)

1.4. Overview of Key Segments

2. North America Travel Trailer Market Size (USD Mn)

2.1. Historical Market Size Analysis

2.2. Year-On-Year Growth Trends

2.3. Major Market Milestones

2.4. Forecasted Growth Trends

3. North America Travel Trailer Market Dynamics

3.1. Key Market Drivers

3.1.1. Rising RV Popularity and Outdoor Recreation

3.1.2. Economic Conditions Impacting Disposable Income

3.1.3. Technological Innovations in Travel Trailer Design

3.1.4. Government Support for Domestic Tourism

3.2. Market Restraints

3.2.1. High Initial and Maintenance Costs

3.2.2. Impact of Seasonal Demand Variation

3.2.3. Market Saturation in Key Regions

3.3. Market Opportunities

3.3.1. Expansion of Luxury Travel Trailers

3.3.2. Development of Eco-Friendly Models

3.3.3. Growth in Mobile Infrastructure for Work-from-Anywhere Models

3.4. Emerging Market Trends

3.4.1. Integration of Smart Technologies (IoT)

3.4.2. Modular and Customizable Travel Trailer Options

3.4.3. Popularity of Towable Travel Trailers

3.5. Regulatory Analysis

3.5.1. Regional Emission Standards

3.5.2. State-Level Certification Requirements

3.5.3. Safety Compliance Standards

4. North America Travel Trailer Market Segmentation

4.1. By Trailer Type (In Value %)

4.1.1. Conventional Travel Trailers

4.1.2. Fifth-Wheel Trailers

4.1.3. Folding Camping Trailers

4.1.4. Expandable Trailers

4.1.5. Toy Haulers

4.2. By Price Range (In Value %)

4.2.1. Budget

4.2.2. Mid-Range

4.2.3. Premium

4.3. By End-User (In Value %)

4.3.1. Individual Buyers

4.3.2. Commercial Fleet Owners

4.4. By Distribution Channel (In Value %)

4.4.1. OEM Dealerships

4.4.2. Online Sales

4.4.3. Specialty Retailers

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Travel Trailer Competitive Landscape

5.1. Detailed Profiles of Major Competitors

5.1.1. Thor Industries

5.1.2. Winnebago Industries

5.1.3. Forest River, Inc.

5.1.4. Jayco Inc.

5.1.5. Airstream

5.1.6. Grand Design RV

5.1.7. Coachmen RV

5.1.8. Dutchmen Manufacturing

5.1.9. Keystone RV

5.1.10. Lance Camper Manufacturing

5.1.11. Heartland RV

5.1.12. Highland Ridge RV

5.1.13. Starcraft RV

5.1.14. Northwood Manufacturing

5.1.15. Oliver Travel Trailers

5.2. Cross Comparison Parameters (Product Offerings, Warranty, Dealer Network, Production Facilities, Customization Options)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Innovations

5.5. Mergers and Acquisitions

5.6. Investment and Funding Landscape

5.7. Venture Capital Funding and Investor Interest

5.8. Private Equity Investments

6. North America Travel Trailer Regulatory Landscape

6.1. Emission and Environmental Standards

6.2. Certification Processes

6.3. Compliance Regulations

7. North America Travel Trailer Future Market Size (USD Mn)

7.1. Projected Market Growth

7.2. Key Growth Drivers for Future Demand

8. North America Travel Trailer Future Market Segmentation

8.1. By Trailer Type (In Value %)

8.2. By Price Range (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Market Analysts Recommendations for North America Travel Trailer Market

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Insights

9.3. Product Positioning Strategy

9.4. White Space and Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map was developed to include all significant stakeholders within the North America Travel Trailer Market. The process involved extensive desk research across both secondary and proprietary databases to gather a robust dataset, helping to identify and define essential variables affecting market trends and dynamics.

Step 2: Market Analysis and Construction

This step involved compiling and analyzing historical data related to the North America Travel Trailer Market. This encompassed a detailed review of market penetration rates, growth in regional demand, and the revenue generated from different trailer segments, ensuring a comprehensive understanding of the revenue landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and subsequently validated through consultations with industry experts via CATI (Computer-Assisted Telephone Interviews). These expert consultations provided valuable insights on market dynamics, operational trends, and financial metrics, thereby enhancing the accuracy and reliability of the analysis.

Step 4: Research Synthesis and Final Output

The final phase included engaging directly with key travel trailer manufacturers to obtain detailed insights into product segments, sales performance, and consumer behavior. This step helped refine and verify data collected through a bottom-up approach, resulting in a validated and comprehensive analysis of the North America Travel Trailer Market.

Frequently Asked Questions

01. How big is the North America Travel Trailer Market?

The North America Travel Trailer Market is valued at USD 34 billion, driven by increasing consumer interest in affordable and versatile recreational travel options that allow for exploration while retaining comfort.

02. What are the challenges in the North America Travel Trailer Values Market?

Challenges in the North America Travel Trailer Market include high initial and maintenance costs, seasonal demand fluctuations, and stringent safety regulations, which can affect both manufacturing and usage.

03. Who are the major players in the North America Travel Trailer Values Market?

The North America Travel Trailer Market features key players like Thor Industries, Winnebago Industries, and Forest River, Inc., which hold significant influence due to their extensive product lines, dealer networks, and brand loyalty among consumers.

04. What are the growth drivers of the North America Travel Trailer Values Market?

The North America Travel Trailer Market is driven by rising interest in outdoor activities, affordability of travel trailers compared to other recreational vehicles, and the availability of new, technologically advanced models.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.