North America UAV Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7742

November 2024

87

About the Report

North America UAV Market Overview

- The North American Unmanned Aerial Vehicle (UAV) market, valued at USD 11 billion, has experienced significant growth driven by technological advancements and expanding applications across various sectors. The integration of UAVs into industries such as agriculture, construction, and logistics has enhanced operational efficiency and data collection capabilities.

- The United States stands as the dominant force in the North American UAV market, attributed to substantial investments in defense and commercial drone technologies. The presence of leading UAV manufacturers and a supportive regulatory environment have fostered innovation and deployment across multiple industries. Canada also contributes to market growth, particularly in applications like environmental monitoring and resource management, leveraging its vast landscapes and emphasis on technological integration.

- The FAA has made strides in shaping UAV policies, as shown by its 2023 approval of over 500 waivers for commercial BVLOS operations. These policies have helped define safe operational standards while fostering industry growth, particularly for logistics and agriculture.

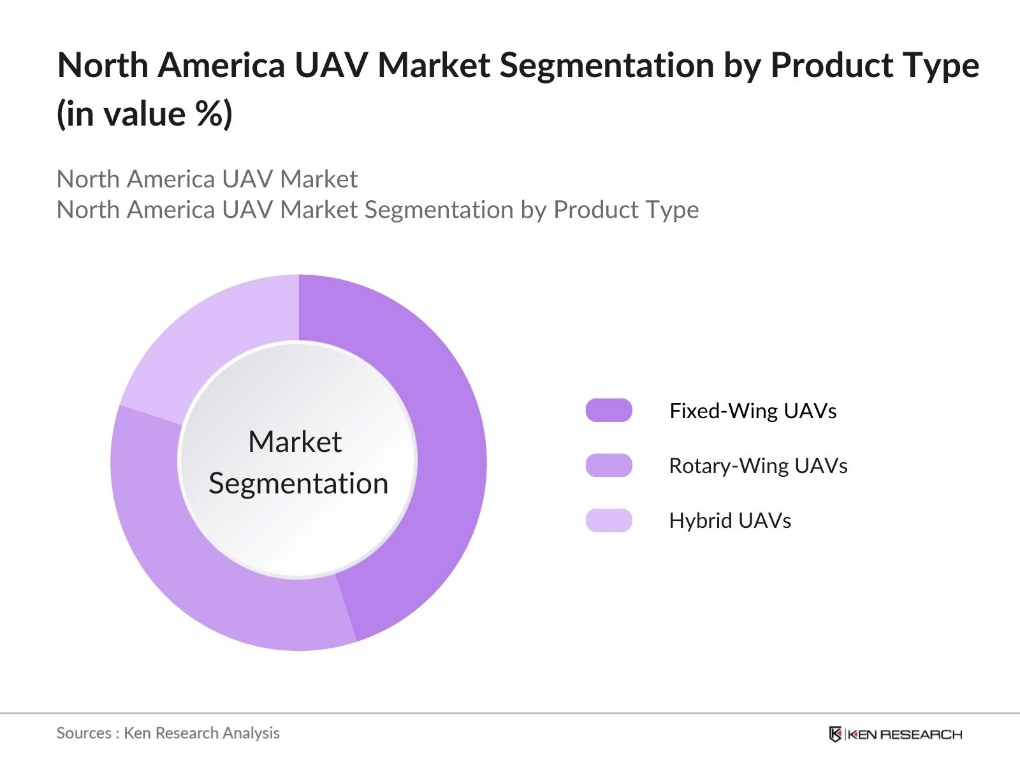

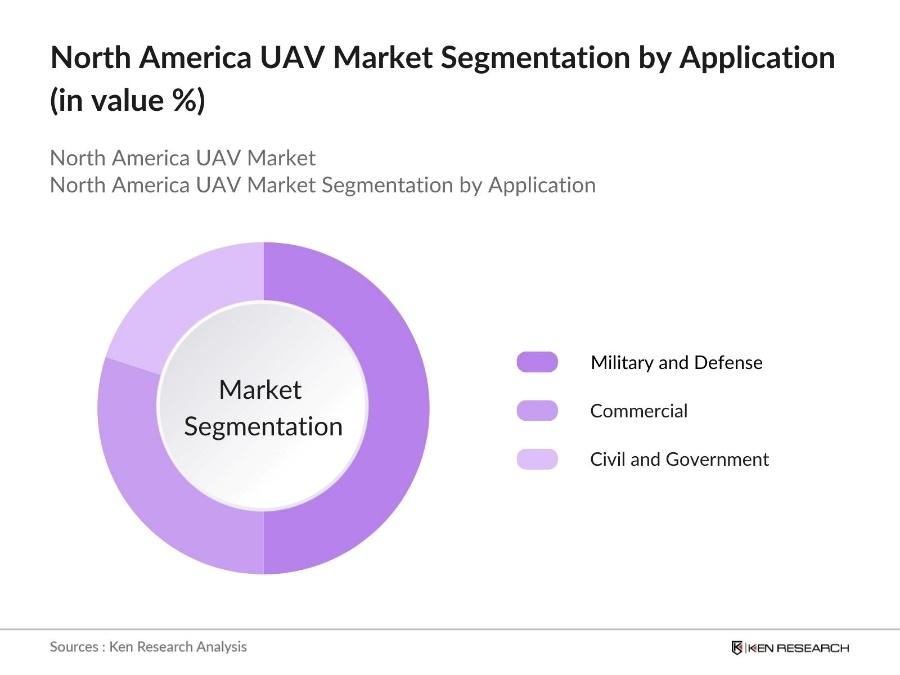

North America UAV Market Segmentation

By Product Type: The market is segmented by product type into Fixed-Wing UAVs, Rotary-Wing UAVs, and Hybrid UAVs. Fixed-Wing UAVs hold a dominant market share due to their extended flight endurance and ability to cover larger areas, making them ideal for applications such as surveillance and mapping. Their aerodynamic efficiency allows for longer flight times and higher altitudes, which are advantageous in military and commercial operations.

By Application: The market is segmented by application into Military and Defense, Commercial, and Civil and Government sectors. The Military and Defense segment leads the market, driven by the increasing utilization of UAVs for intelligence, surveillance, reconnaissance, and combat missions. The ability of UAVs to operate in high-risk environments without endangering personnel has made them indispensable tools in modern warfare and defense strategies.

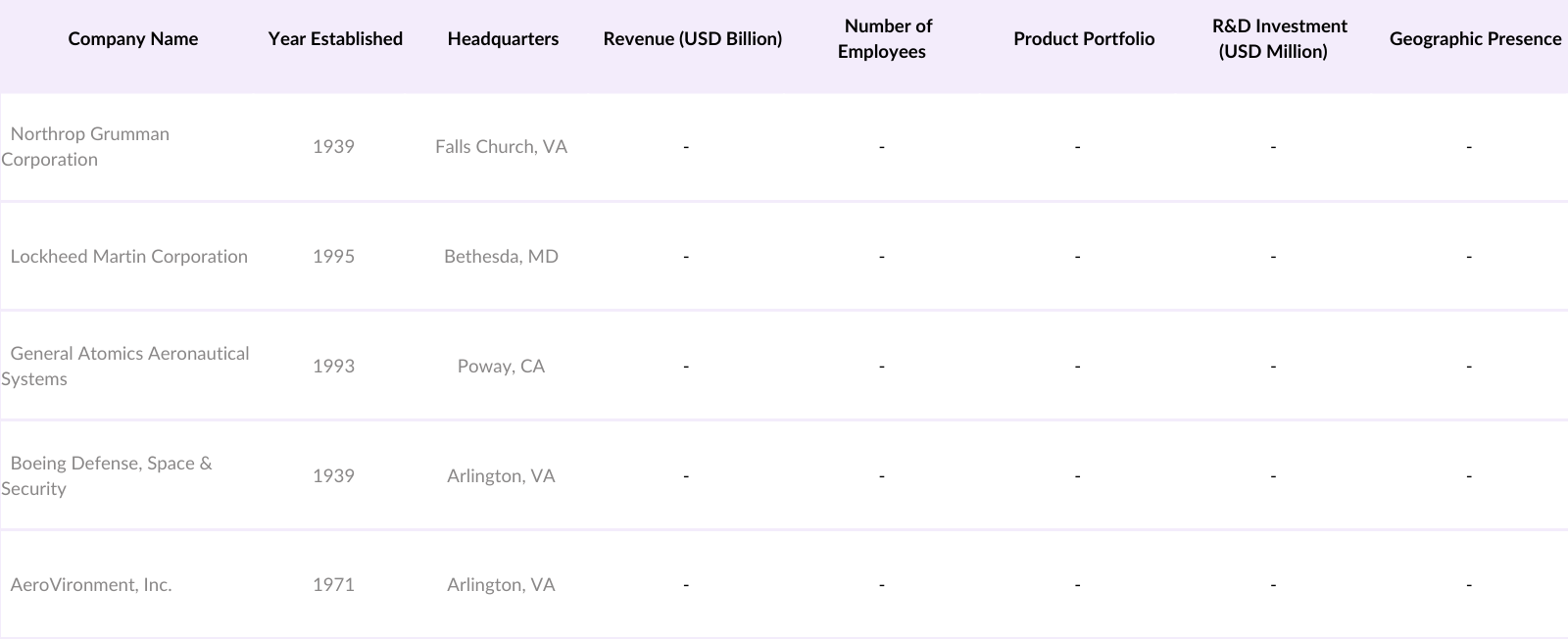

North America UAV Market Competitive Landscape

The North American UAV market is characterized by the presence of several key players who contribute to its dynamic and competitive nature. These companies are at the forefront of innovation, offering a diverse range of UAV solutions tailored to various applications.

North America UAV Industry Analysis

Growth Drivers

- Technological Advancements: The development of UAV technology in North America has accelerated, supported by increases in research and development budgets by the U.S. Department of Defense and other entities. The investments in autonomous systems, such as the $51 million awarded to support drone research and testing infrastructure in Tulsa. This funding supports innovations such as sensor miniaturization and AI integration for UAVs, which enhance their capabilities in surveillance, reconnaissance, and precision delivery applications.

- Expanding Commercial Applications: Commercial use of UAVs in industries like agriculture, logistics, and media has grown, driven by demand for data collection and efficiency improvements. The use of drones in agriculture promotes sustainable practices by enabling targeted applications of inputs, which can lead to reductions in water usage by up to 30%. This reflects a shift toward cost-effective and environmentally sustainable operations in commercial sectors.

- Increasing Defense Expenditure: The U.S. military has prioritized funding for UAV technology, emphasizing its role in intelligence, surveillance, and reconnaissance missions. This focus on drone development underscores the strategic importance of UAVs in enhancing national security capabilities. By integrating advanced autonomous systems, the defense sector aims to improve situational awareness and operational efficiency, highlighting the essential role of UAVs in modern military strategy.

Market Challenges

- Regulatory Hurdles: Despite advancements in UAV policies, operators continue to encounter regulatory obstacles, particularly with restrictions on Beyond Visual Line of Sight (BVLOS) flights. These limitations hinder the broader application of UAVs in sectors like logistics and agriculture, where extended operational range is crucial. Regulatory constraints around safety and security present challenges for achieving the full potential of UAV capabilities across commercial applications.

- Security and Privacy Concerns: UAVs pose notable challenges regarding data security and privacy, particularly as they become equipped with advanced imaging technology. Privacy concerns are especially heightened in densely populated areas, affecting public acceptance and limiting the areas where UAVs can operate. Addressing these concerns is essential to expanding UAV use while ensuring security and privacy are safeguarded in both commercial and personal spaces.

North America UAV Market Future Outlook

Over the next five years, the North American UAV market is expected to experience substantial growth, driven by continuous technological advancements, expanding commercial applications, and supportive regulatory frameworks. The integration of artificial intelligence and machine learning into UAV systems is anticipated to enhance autonomous capabilities, leading to increased adoption across industries such as agriculture, logistics, and infrastructure inspection. Additionally, the defense sector's ongoing investment in UAV technology for surveillance and combat operations will further bolster market expansion.

Market Opportunities

- Integration with AI and Machine Learning: The integration of AI and machine learning into UAV systems opens significant growth avenues by enhancing real-time data processing and decision-making capabilities. This advancement is especially beneficial for industries like agriculture, where AI-powered drones can monitor crop health, optimize resource use, and improve productivity. AI-enabled UAVs are set to transform sectors by providing intelligent, adaptive solutions that respond to dynamic environmental and operational conditions.

- Growth in Urban Air Mobility: The North American market is witnessing a rising interest in urban air mobility (UAM) solutions as demand for rapid, efficient transportation grows in metropolitan areas. Infrastructure readiness and supportive initiatives are encouraging UAM adoption, with UAVs offering innovative approaches to ease urban congestion. Investments in UAM pilot programs reflect a commitment to integrating UAVs into urban transport networks, providing sustainable alternatives to traditional transportation.

Scope of the Report

|

Product Type |

Fixed-Wing UAVs |

|

Application |

Military and Defense |

|

Technology |

Remotely Operated |

|

Endurance |

Short-Endurance UAVs |

|

Region |

United States |

Products

Key Target Audience

UAV Manufacturers

Defense Contractors

Commercial Drone Operators

Agricultural Technology Firms

Logistics and Delivery Companies

Investors and VC Firms

Government and Regulatory Bodies (e.g., Federal Aviation Administration)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Northrop Grumman Corporation

Lockheed Martin Corporation

General Atomics Aeronautical Systems

Boeing Defense, Space & Security

AeroVironment, Inc.

DJI Innovations

Parrot SA

Thales Group

Elbit Systems Ltd.

Israel Aerospace Industries Ltd.

Table of Contents

1. North America UAV Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America UAV Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America UAV Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements

3.1.2 Increasing Defense Expenditure

3.1.3 Expanding Commercial Applications

3.1.4 Favorable Regulatory Frameworks

3.2 Market Challenges

3.2.1 Regulatory Hurdles

3.2.2 Security and Privacy Concerns

3.2.3 High Initial Investment Costs

3.3 Opportunities

3.3.1 Integration with AI and Machine Learning

3.3.2 Growth in Urban Air Mobility

3.3.3 Expansion into Emerging Markets

3.4 Trends

3.4.1 Adoption of Swarm Technology

3.4.2 Development of Counter-UAV Systems

3.4.3 Increased Use in Disaster Management

3.5 Government Regulations

3.5.1 Federal Aviation Administration (FAA) Policies

3.5.2 Export Control Regulations

3.5.3 Data Protection Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. North America UAV Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Fixed-Wing UAVs

4.1.2 Rotary-Wing UAVs

4.1.3 Hybrid UAVs

4.2 By Application (Value %)

4.2.1 Military and Defense

4.2.2 Commercial

4.2.3 Civil and Government

4.3 By Technology (Value %)

4.3.1 Remotely Operated

4.3.2 Semi-Autonomous

4.3.3 Fully Autonomous

4.4 By Endurance (Value %)

4.4.1 Short-Endurance UAVs

4.4.2 Medium-Endurance UAVs

4.4.3 Long-Endurance UAVs

4.5 By Region (Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America UAV Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Northrop Grumman Corporation

5.1.2 Lockheed Martin Corporation

5.1.3 General Atomics Aeronautical Systems, Inc.

5.1.4 Boeing Defense, Space & Security

5.1.5 Textron Inc.

5.1.6 AeroVironment, Inc.

5.1.7 DJI Innovations

5.1.8 Parrot SA

5.1.9 Thales Group

5.1.10 Elbit Systems Ltd.

5.1.11 Israel Aerospace Industries Ltd.

5.1.12 BAE Systems plc

5.1.13 Saab AB

5.1.14 General Dynamics Corporation

5.1.15 Kratos Defense & Security Solutions, Inc.

5.2 Cross-Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Geographic Presence, Strategic Initiatives, Number of Employees, Year of Establishment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America UAV Market Regulatory Framework

6.1 Airspace Management Policies

6.2 Certification Processes

6.3 Compliance Requirements

7. North America UAV Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America UAV Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Application (Value %)

8.3 By Technology (Value %)

8.4 By Endurance (Value %)

8.5 By Region (Value %)

9. North America UAV Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American UAV Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American UAV Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data. These insights allow for a deeper understanding of the market dynamics and validate the projected growth patterns.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with UAV manufacturers and operators to acquire detailed insights into product segments, sales performance, customer preferences, and other pertinent factors. This step is crucial for verifying and complementing the quantitative and qualitative data derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the North American UAV market.

Frequently Asked Questions

01 How big is the North American UAV Market?

The North American UAV market is valued at USD 11 billion, driven by the integration of UAV technology across defense, commercial, and civil applications, particularly in the United States and Canada.

02 What are the main challenges in the North American UAV Market?

Key challenges in North American UAV market include stringent regulatory hurdles, security and privacy concerns, and the high initial costs associated with advanced UAV systems, which can limit accessibility for smaller enterprises.

03 Who are the major players in the North American UAV Market?

Prominent players in North American UAV market include Northrop Grumman, Lockheed Martin, General Atomics, Boeing Defense, and AeroVironment. These companies hold strong positions due to their advanced technologies, established partnerships, and government contracts.

04 What factors drive the growth of the North American UAV Market?

The North American UAV market growth is primarily driven by technological advancements, increased defense spending, and expanding applications in sectors like agriculture and logistics. The adoption of AI and machine learning further enhances UAV capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.