North America Unmanned Surface Vehicle Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1048

November 2024

83

About the Report

North America Unmanned Surface Vehicle Market Overview

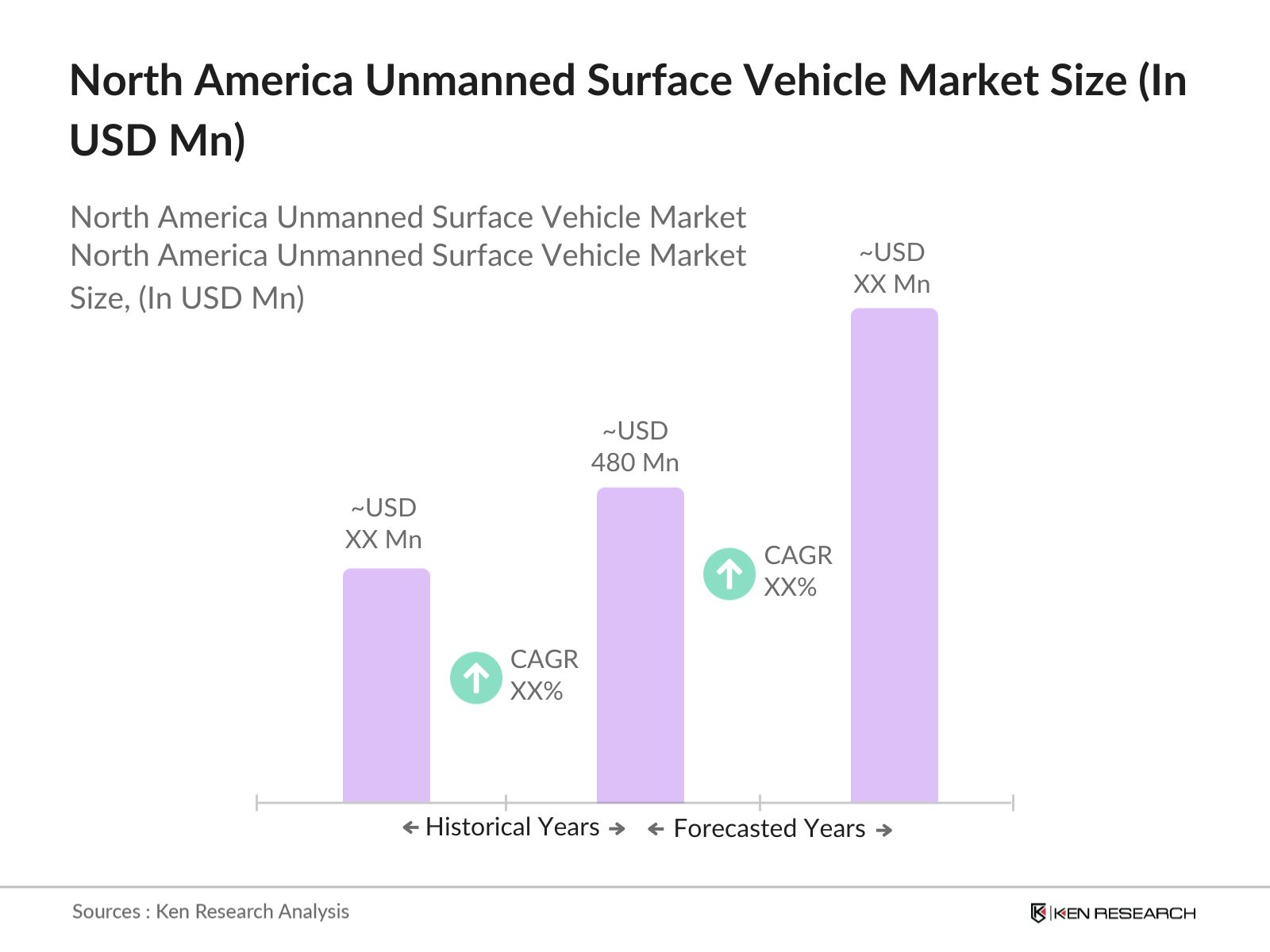

- The North America Unmanned Surface Vehicle (USV) market has experienced significant growth, with a valuation of USD 480 million. This growth is driven by increased demand for autonomous systems in military and commercial applications, advancements in artificial intelligence, and rising concerns about maritime security and environmental monitoring. Key investments by defense agencies, such as the U.S. Department of Defense, and the increased need for offshore exploration have solidified the markets expansion.

- The United States dominates the North American USV market, driven by its substantial defense budget and ongoing investments in autonomous maritime systems. The U.S. Navys focus on expanding its unmanned fleet for surveillance, reconnaissance, and defense applications has strengthened the countrys dominance. Canada follows closely, with growing interest in USV for offshore energy exploration and environmental monitoring due to its vast maritime territory.

- Federal maritime regulations play a crucial role in the USV market. The U.S. Maritime Administration (MARAD) continues to revise policies to accommodate the growing use of autonomous vessels in domestic and international waters. In 2024, MARAD introduced new guidelines aimed at ensuring the safe operation of USVs, particularly in relation to manned vessels and port operations. These regulations emphasize collision avoidance, communication protocols, and safety standards, ensuring that USVs integrate seamlessly into the broader maritime ecosystem.

North America Unmanned Surface Vehicle Market Segmentation

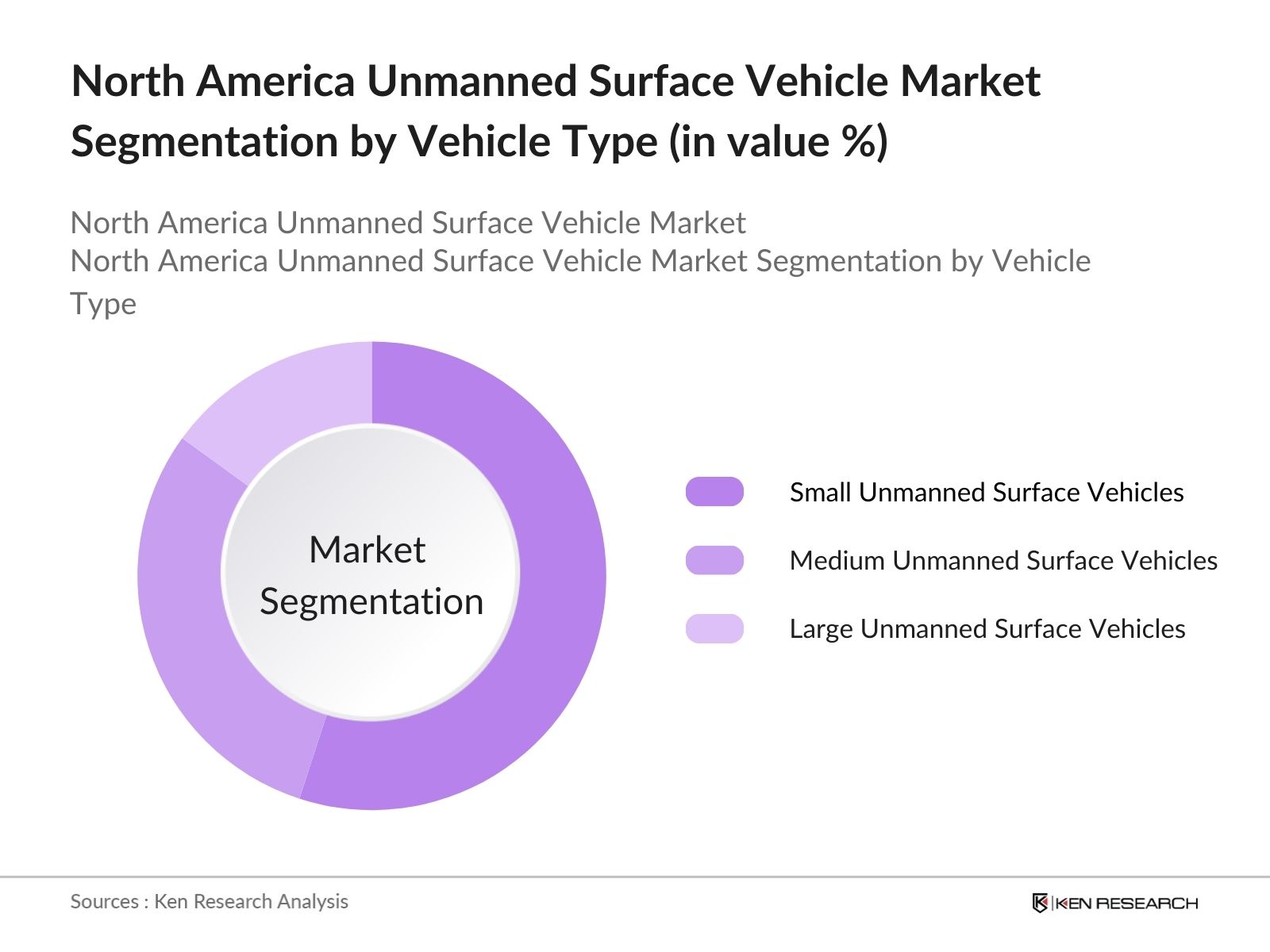

- By Vehicle Type: The market is segmented by vehicle type into small USVs, medium USVs, and large USVs. Small USVs dominate the market, primarily because of their agility, ease of deployment, and suitability for operations such as coastal surveillance, environmental monitoring, and research. These vehicles are highly versatile and cost-effective, making them ideal for a variety of commercial and scientific applications.

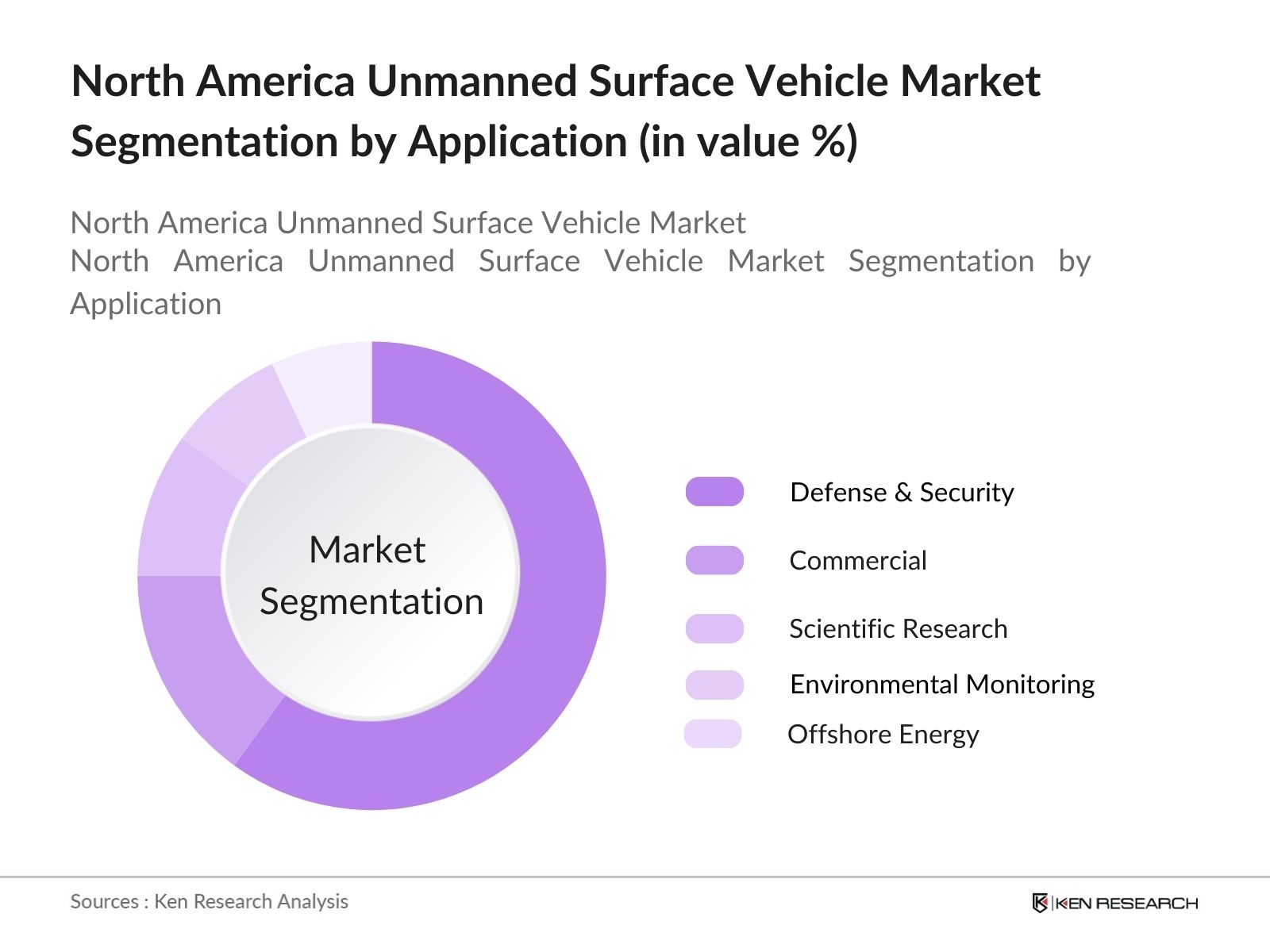

- By Application: The market is segmented by application into defense & security, commercial, scientific research, environmental monitoring, and offshore energy. Defense & security applications lead the market, largely due to the extensive use of USVs in naval operations, surveillance, and mine countermeasure tasks. The rising investment in autonomous technologies by the U.S. Navy and other defense bodies has further contributed to the dominance of this segment.

North America Unmanned Surface Vehicle Market Competitive Landscape

The North American USV market is dominated by a combination of established global defense contractors and innovative technology companies specializing in unmanned systems. These players leverage their strong R&D capabilities, government contracts, and partnerships with defense agencies to maintain their competitive edge. The market also sees strong collaboration between government bodies and private entities, particularly for research and defense projects.

|

Company |

Year Established |

Headquarters |

Fleet Size |

R&D Expenditure (USD Mn) |

Partnerships |

Technology Integration |

Major Contracts |

Product Portfolio |

Geographic Reach |

|

Textron Inc. |

1923 |

Rhode Island, USA |

|||||||

|

ASV Global (L3Harris) |

1998 |

Louisiana, USA |

|||||||

|

Teledyne Marine |

1960 |

California, USA |

|||||||

|

Kongsberg Maritime |

1814 |

Norway |

|||||||

|

Ocean Aero, Inc. |

2012 |

California, USA |

North America Unmanned Surface Vehicle Industry Analysis

Market Growth Drivers

- Military & Defense Investments: Military and defense investments in North America are propelling the unmanned surface vehicle (USV) market. In 2024, the U.S. Department of Defense allocated $842 billion to the defense budget, of which a significant portion is directed toward advanced military technologies, including USVs. These vehicles are integral to enhancing naval capabilities, with applications in mine countermeasures, reconnaissance, and anti-submarine warfare. The focus on unmanned systems is growing, with USVs playing a key role in naval fleet modernization. The U.S. Navy's Future Naval Force Study also emphasizes an increased reliance on unmanned platforms in defense strategies.

- Autonomous Systems Development: Advancements in autonomous systems technology are driving the development of USVs in North America. According to the National Science Foundation, the U.S. invested over $3 billion in 2024 for the development of autonomous and AI-driven systems. The integration of AI and machine learning into USVs allows for enhanced decision-making, navigation, and operational efficiency in maritime environments. Autonomous USVs are becoming increasingly vital in intelligence gathering and surveillance missions, with reduced human intervention, lowering operational risks in hostile environments.

- Maritime Surveillance & Security Operations: Maritime surveillance and security are critical components in driving USV adoption in North America. The U.S. Coast Guard, responsible for maintaining maritime security, is integrating USVs into its operational frameworks to monitor vast territorial waters and protect against illegal activities, such as smuggling and unauthorized fishing. With the U.S. maritime domain covering over 3.4 million square nautical miles, USVs offer cost-effective solutions for continuous monitoring and threat detection, bolstering national security measures. Enhanced operational capabilities are a priority in the 2024 U.S. maritime security budget.

Market Challenges

- High Initial Development Costs: High development costs remain a significant barrier to widespread USV adoption in North America. Building autonomous systems, including sensors, navigation, and communication technologies, involves substantial investment. According to the U.S. Department of Commerce, companies investing in maritime autonomous systems report that initial R&D expenses can reach upwards of $500 million, limiting smaller enterprises' entry into the market. These high costs necessitate significant capital expenditure, slowing down the development and deployment of USVs, especially for non-defense applications.

- Regulatory Compliance and Approval Complexities: Navigating the complex regulatory landscape is another challenge for the USV market in North America. The U.S. Maritime Administration (MARAD) and the National Oceanic and Atmospheric Administration (NOAA) have stringent regulations governing the use of unmanned systems in maritime operations. These regulations are necessary to ensure the safe integration of USVs with manned vessels. However, compliance with these standards can be costly and time-consuming, with approval processes often stretching over several years. For companies entering the market, navigating these regulations poses a significant hurdle.

North America Unmanned Surface Vehicle Market Future Outlook

Over the next five years, the North America Unmanned Surface Vehicle market is expected to experience significant growth, driven by continued investments from defense agencies, advancements in autonomous navigation technologies, and expanding applications in environmental monitoring and offshore energy. The increasing use of AI-powered systems for real-time decision-making and navigation will further accelerate market adoption. As commercial and scientific applications of USVs expand, particularly in areas such as oceanographic research and data collection, the market is set to diversify beyond military use. Key players are expected to focus on developing more versatile and energy-efficient USVs to cater to emerging market needs.

Future Market Opportunities

- Rising Demand for Autonomous Systems in Commercial Applications: There is a growing demand for USVs in commercial applications, particularly in sectors like shipping, oil exploration, and environmental monitoring. In 2024, the U.S. offshore wind energy market saw investments totaling $9 billion, creating opportunities for USVs to be used in infrastructure monitoring and environmental assessments. Autonomous USVs provide cost-effective solutions for continuous, unmanned inspections of underwater structures, offering significant operational efficiencies in the commercial sector. As industries seek more sustainable and efficient technologies, the demand for USVs in commercial applications is expected to grow.

- Technological Advancements in AI and Machine Learning: Technological advancements, particularly in AI and machine learning, present significant opportunities for the USV market. The U.S. government allocated $4 billion to AI research in 2024, focusing on enhancing autonomous decision-making in complex environments. These advancements enable USVs to autonomously interpret sensor data, optimize routes, and perform predictive maintenance. The integration of AI with USVs facilitates greater operational autonomy and improved mission success rates, particularly in defense and environmental monitoring applications.

Scope of the Report

|

||

|

By Application |

Defense & Security |

|

|

By Propulsion Type |

|

|

|

By Control Mechanism |

|

|

|

By Region |

North East West South |

Products

Key Target Audience

Defense and Security Agencies (U.S. Department of Defense, Canadian Armed Forces)

Maritime Surveillance and Environmental Agencies (NOAA, Canadian Coast Guard)

Offshore Energy Companies (Shell, ExxonMobil)

USV Manufacturers

Technology Solution Providers

Venture Capital and Investment Firms

Government and Regulatory Bodies (U.S. Coast Guard, Transport Canada)

Environmental Monitoring Agencies

Companies

Players Mention in the Report:

Textron Inc.

ASV Global (L3Harris Technologies)

Teledyne Marine

Kongsberg Maritime

Ocean Aero, Inc.

Elbit Systems Ltd.

QinetiQ North America

Saab AB

Northrop Grumman Corporation

Israel Aerospace Industries

Maritime Robotics AS

ECA Group

L3 Technologies, Inc.

General Dynamics Corporation

Autonomous Surface Vehicles (ASV)

Table of Contents

1. North America Unmanned Surface Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Unmanned Surface Vehicle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Unmanned Surface Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Military & Defense Investments

3.1.2. Autonomous Systems Development

3.1.3. Maritime Surveillance & Security Operations

3.1.4. Offshore Energy & Exploration

3.2. Market Challenges

3.2.1. High Initial Development Costs

3.2.2. Regulatory Compliance and Approval Complexities

3.2.3. Technological Barriers in Communication & Navigation Systems

3.3. Opportunities

3.3.1. Rising Demand for Autonomous Systems in Commercial Applications

3.3.2. Technological Advancements in AI and Machine Learning

3.3.3. Expansion in Environmental Monitoring & Research

3.4. Trends

3.4.1. Integration of AI-based Data Analytics

3.4.2. Increased Use of Hybrid Propulsion Systems

3.4.3. Development of Unmanned Collaborative Swarm Systems

3.5. Government Regulation

3.5.1. Federal Maritime Regulations

3.5.2. Defense Acquisition Policies

3.5.3. Environmental Impact Standards

3.5.4. Maritime Security Protocols

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape Analysis

4. North America Unmanned Surface Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Small Unmanned Surface Vehicles

4.1.2. Medium Unmanned Surface Vehicles

4.1.3. Large Unmanned Surface Vehicles

4.2. By Application (In Value %)

4.2.1. Defense & Security

4.2.2. Commercial

4.2.3. Scientific Research

4.2.4. Environmental Monitoring

4.2.5. Exploration & Offshore Energy

4.3. By Propulsion Type (In Value %)

4.3.1. Hybrid

4.3.2. Electric

4.3.3. Solar

4.3.4. Diesel-powered

4.4. By Control Mechanism (In Value %)

4.4.1. Autonomous

4.4.2. Semi-autonomous

4.4.3. Remotely Operated

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. North America Unmanned Surface Vehicle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Textron Inc.

5.1.2. ASV Global (L3Harris Technologies)

5.1.3. Sea Robotics Corporation

5.1.4. Teledyne Marine

5.1.5. Ocean Aero, Inc.

5.1.6. Elbit Systems Ltd.

5.1.7. Maritime Robotics AS

5.1.8. QinetiQ North America

5.1.9. ECA Group

5.1.10. L3 Technologies, Inc.

5.1.11. Autonomous Surface Vehicles (ASV)

5.1.12. Kongsberg Maritime

5.1.13. Northrop Grumman Corporation

5.1.14. Saab AB

5.1.15. Israel Aerospace Industries

5.2 Cross Comparison Parameters

Market Presence

Revenue

Product Portfolio

R&D Expenditure

Strategic Partnerships

Fleet Size

Geographic Reach

Technology Integration5.3 Market Share Analysis5.4 Strategic Initiatives5.5 Mergers and Acquisitions5.6 Investment Analysis5.7 Venture Capital Funding5.8 Private Equity Investments

6. North America Unmanned Surface Vehicle Market Regulatory Framework

6.1 Maritime Environmental Regulations

6.2 Defense and Security Compliance

6.3 Certification Processes for Autonomous Systems

7. North America Unmanned Surface Vehicle Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Unmanned Surface Vehicle Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Application (In Value %)

8.3 By Propulsion Type (In Value %)

8.4 By Control Mechanism (In Value %)

8.5 By Region (In Value %)

9. North America Unmanned Surface Vehicle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Entry Points for New Players

9.3 Product Innovation and Differentiation Strategies

9.4 Partnership and Collaboration Opportunities

9.5 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by mapping the ecosystem of stakeholders in the North America USV market, utilizing extensive desk research and proprietary databases. This step involved identifying critical variables such as demand drivers, technological advancements, and regulatory frameworks that impact the market.

Step 2: Market Analysis and Construction

In this phase, historical data related to USV market size, applications, and technological innovations was collected and analyzed. Key factors such as defense expenditure, commercial adoption, and environmental applications were evaluated to construct accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including representatives from leading USV manufacturers and government agencies. Their insights helped refine the research, particularly in assessing future trends and investment opportunities.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from primary and secondary research to provide a comprehensive analysis of the North America USV market. This included validation of market figures through a bottom-up approach, ensuring accurate projections.

Frequently Asked Questions

01. How big is the North America Unmanned Surface Vehicle Market?

The North America Unmanned Surface Vehicle (USV) market is valued at USD 480 million, driven by military investments, offshore energy exploration, and environmental monitoring applications.

02. What are the challenges in the North America Unmanned Surface Vehicle Market?

The North America Unmanned Surface Vehicle (USV) market faces challenges including high development costs, regulatory hurdles, and technological barriers, particularly in communication and navigation systems for autonomous operations.

03. Who are the major players in the North America Unmanned Surface Vehicle Market?

Key players in the North America Unmanned Surface Vehicle (USV) market include Textron Inc., ASV Global, Teledyne Marine, Kongsberg Maritime, and Ocean Aero. These companies dominate due to their strong R&D investments, strategic partnerships, and government contracts.

04. What are the growth drivers for the North America Unmanned Surface Vehicle Market?

Growth drivers in North America Unmanned Surface Vehicle (USV) market include increased defense expenditure, advancements in AI and autonomous systems, and expanding applications in environmental monitoring and commercial sectors.

05. What are the emerging trends in the North America Unmanned Surface Vehicle Market?

Emerging trends in North America Unmanned Surface Vehicle (USV) market include the integration of AI-powered navigation systems, hybrid propulsion technologies, and the use of USV swarms for collaborative maritime operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.