North America Urban Air Mobility Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD2140

December 2024

99

About the Report

North America Urban Air Mobility Market Overview

- The North American Urban Air Mobility (UAM) market is experiencing significant growth, driven by rapid urbanization and technological advancements. The market was valued at USD 1.5 billion, reflecting a strong demand for efficient transportation solutions in congested urban areas. This growth is propelled by the increasing adoption of electric Vertical Take-Off and Landing (eVTOL) aircraft and substantial investments from both private and public sectors.

- The United States leads the North American UAM market, primarily due to its advanced technological infrastructure and supportive regulatory environment. Major cities like Los Angeles and Dallas are at the forefront, hosting numerous pilot projects and partnerships aimed at integrating UAM solutions into existing transportation networks. Canada is also emerging as a significant player, with cities like Toronto exploring UAM to alleviate traffic congestion and enhance urban mobility.

- The FAA has taken proactive steps in establishing guidelines for eVTOL certification and operational standards. In 2024, it introduced new regulations for Advanced Air Mobility (AAM), emphasizing strict safety and performance criteria for eVTOLs operating in urban airspace. The FAAs guidelines set forth requirements for airworthiness, pilot training, and operational limits, providing a regulatory framework for the safe deployment of UAM.

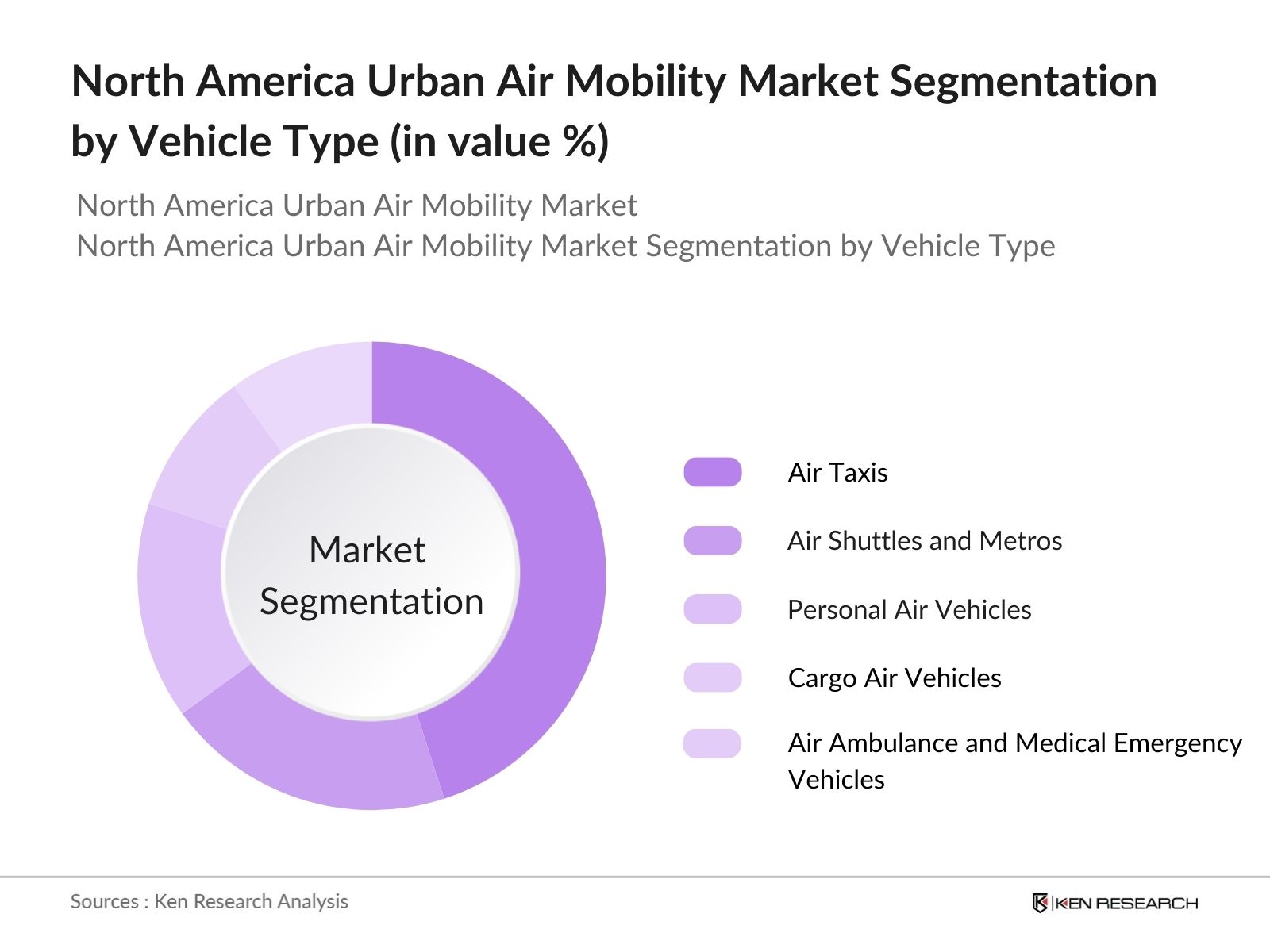

North America Urban Air Mobility Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into air taxis, air shuttles and metros, personal air vehicles, cargo air vehicles, and air ambulance and medical emergency vehicles. Air taxis currently dominate this segment, driven by the increasing demand for efficient and time-saving transportation options in urban areas. Companies like Joby Aviation and Archer Aviation are leading the development of air taxi services, focusing on providing affordable and sustainable urban air travel solutions.

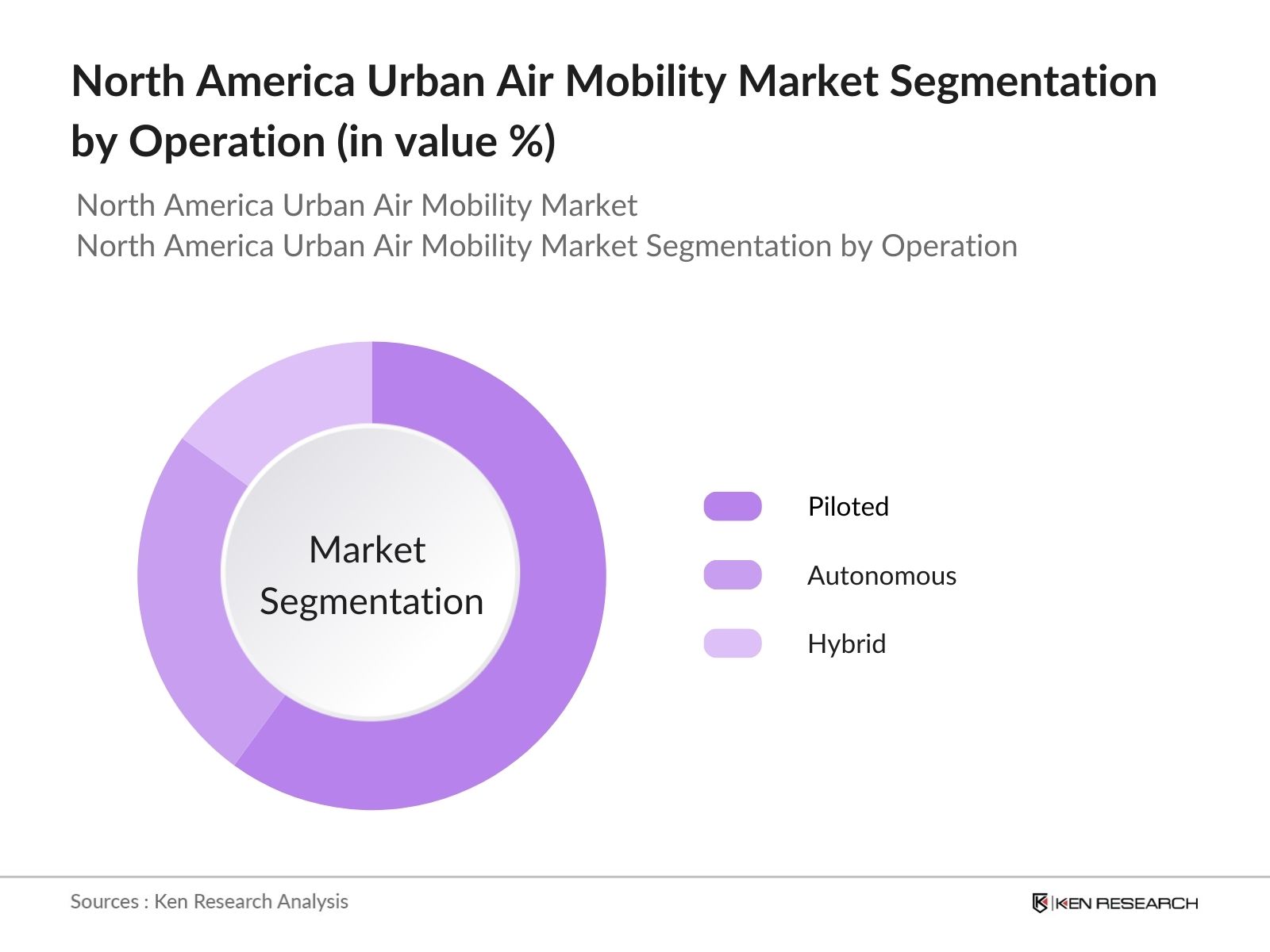

By Operation: The market is also segmented by operation into piloted, autonomous, and hybrid operations. Piloted operations hold the largest market share, as regulatory bodies currently favor human-operated flights for safety and certification reasons. However, there is a growing interest in autonomous operations, with companies investing in advanced technologies to enable self-flying capabilities in the future.

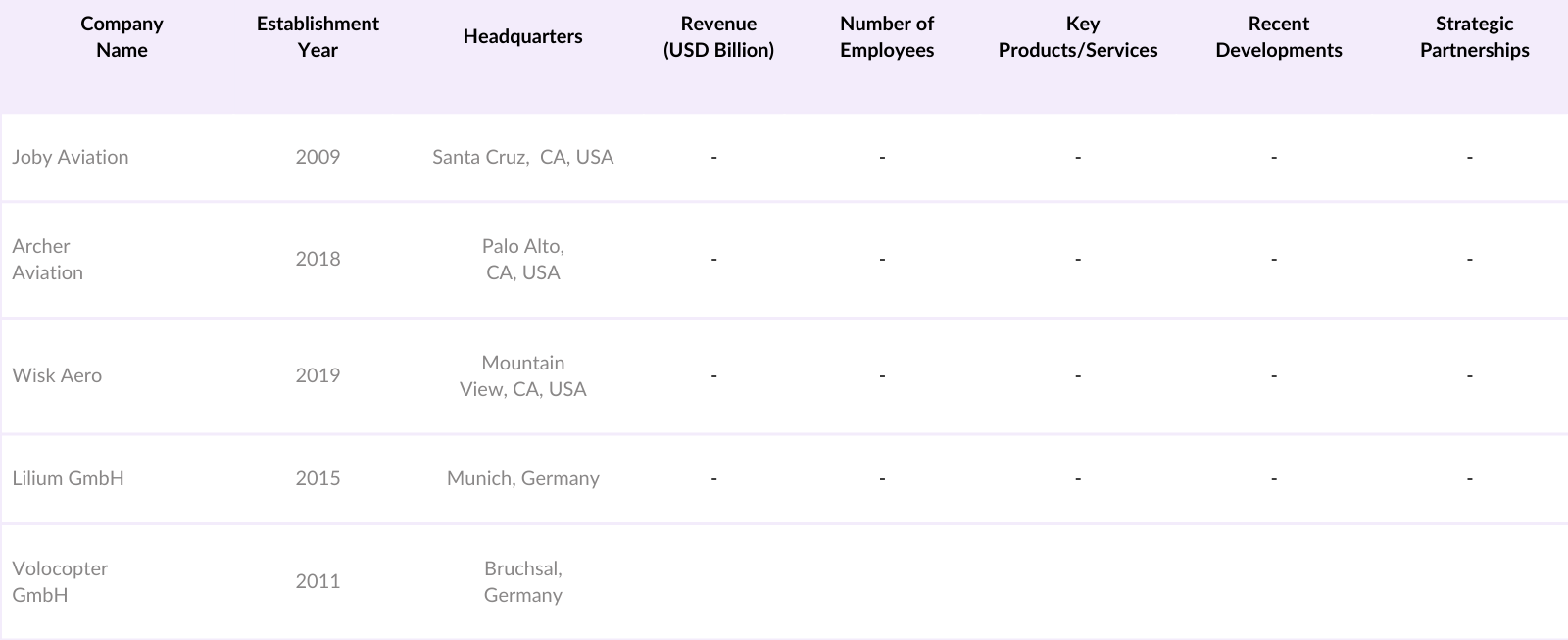

North America Urban Air Mobility Market Competitive Landscape

The North American UAM market is characterized by the presence of several key players, each contributing to the market's growth through innovation and strategic partnerships.

North America Urban Air Mobility Industry Analysis

Growth Drivers

- Urbanization and Traffic Congestion: As of 2024, urban areas are experiencing unprecedented growth, with the global urban population reaching approximately 4.4 billion people. This rapid urbanization has led to significant traffic congestion, particularly in major cities. For instance, in 2023, Paris recorded an average Traffic Congestion Index (TCI) of 41.04, while Mexico City had a TCI of 39.24, indicating severe congestion levels. Such congestion not only hampers mobility but also results in economic losses and environmental degradation, underscoring the need for innovative transportation solutions like Urban Air Mobility (UAM) to alleviate these challenges.

- Technological Advancements in eVTOL Aircraft: The development of electric Vertical Take-Off and Landing (eVTOL) aircraft has accelerated, with significant milestones achieved in 2024. Companies like Supernal unveiled the S-A2 eVTOL concept, designed to cruise at 120 miles per hour at an altitude of 1,500 feet, targeting urban operations between 25 to 40 miles. Additionally, advancements in battery technology and autonomous flight systems have enhanced the feasibility and safety of eVTOLs, positioning them as viable alternatives to traditional ground transportation in congested urban environments.

- Investment and Funding in UAM Projects: The Urban Air Mobility sector has attracted substantial investment in recent years. In 2023, global investments in UAM projects exceeded $5 billion, reflecting strong confidence in the industry's potential. Notably, companies like Joby Aviation and Archer Aviation have secured significant funding to advance their eVTOL development and commercialization efforts. This influx of capital is driving innovation and accelerating the timeline for bringing UAM solutions to market.

Market Challenges

- Infrastructure Development and Integration: The successful implementation of UAM requires the development of supporting infrastructure, such as vertiports and charging stations. As of 2024, there are limited vertiports operational worldwide, with major cities like Los Angeles and Singapore planning to establish UAM infrastructure in the coming years. Integrating eVTOL operations with existing transportation networks and urban planning frameworks poses logistical challenges that need to be addressed to facilitate seamless UAM services.

- Public Acceptance and Safety Concerns: Public perception and acceptance are critical for the adoption of UAM. Surveys conducted in 2023 indicate that while there is interest in eVTOL services, concerns about safety, noise, and privacy persist among potential users. Addressing these concerns through transparent communication, rigorous safety testing, and community engagement is vital to build trust and encourage widespread acceptance of UAM solutions.

North America Urban Air Mobility Market Future Outlook

Over the next five years, the North American UAM market is expected to witness substantial growth, driven by continuous technological advancements, favorable regulatory frameworks, and increasing consumer demand for efficient urban transportation solutions. The integration of UAM into existing transportation networks, coupled with the development of supporting infrastructure like vertiports, will play a crucial role in shaping the market's future. Additionally, advancements in battery technology and autonomous flight systems are anticipated to enhance the operational efficiency and safety of UAM services.

Future Market Opportunities

- Expansion of Air Taxi Services: The demand for efficient urban transportation solutions is driving the expansion of air taxi services. In 2024, several companies, including Joby Aviation and Archer Aviation, announced plans to launch commercial eVTOL services in major cities. These services aim to reduce travel times and alleviate ground traffic congestion, offering a convenient alternative for urban commuters. The scalability of air taxi operations presents a significant growth opportunity within the UAM market.

- Integration with Smart City Initiatives: Urban Air Mobility aligns with smart city initiatives aimed at enhancing urban living through technology. Cities like Dubai and Singapore are incorporating UAM into their urban planning strategies to improve connectivity and reduce congestion. The integration of eVTOL services with smart city infrastructure, such as IoT-enabled traffic management systems, can optimize urban transportation networks and contribute to sustainable urban development.

Scope of the Report

|

Vehicle Type |

Air Taxis |

|

Range |

Intercity |

|

Operation |

Piloted |

|

End User |

Ridesharing Companies |

|

Region |

United States |

Products

Key Target Audience

Urban Transportation Authorities (e.g., Metropolitan Transportation Authority)

Aerospace Manufacturers

Technology Providers

Infrastructure Developers

Logistics and Delivery Companies

Emergency Medical Services

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Aviation Administration)

Companies

Major Players

Joby Aviation

Archer Aviation

Wisk Aero

Lilium GmbH

Volocopter GmbH

EHang Holdings Ltd.

Bell Textron Inc.

EmbraerX (Eve Air Mobility)

Hyundai Urban Air Mobility (Supernal)

Boeing NeXt

Airbus Urban Mobility

Kitty Hawk Corporation

Uber Elevate (Acquired by Joby Aviation)

Vertical Aerospace

Pipistrel Aircraft

Table of Contents

North America Urban Air Mobility Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

North America Urban Air Mobility Market Size (USD Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

North America Urban Air Mobility Market Analysis

Growth Drivers

Urbanization and Traffic Congestion

Technological Advancements in eVTOL Aircraft

Environmental Concerns and Sustainability Initiatives

Investment and Funding in UAM Projects

Market Challenges

Regulatory and Certification Hurdles

Infrastructure Development and Integration

Public Acceptance and Safety Concerns

High Initial Capital Expenditure

Opportunities

Expansion of Air Taxi Services

Integration with Smart City Initiatives

Development of Cargo and Logistics Solutions

Advancements in Autonomous Flight Technologies

Trends

Collaboration Between Aerospace and Automotive Industries

Adoption of Hybrid and Electric Propulsion Systems

Emergence of Vertiports and Supporting Infrastructure

Increased Focus on Noise Reduction Technologies

Government Regulations

Federal Aviation Administration (FAA) Guidelines

Environmental Protection Agency (EPA) Standards

State and Municipal Regulations

Public-Private Partnerships and Funding Programs

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Landscape

North America Urban Air Mobility Market Segmentation

By Vehicle Type (Value %)

Air Taxis

Air Shuttles and Metros

Personal Air Vehicles

Cargo Air Vehicles

Air Ambulance and Medical Emergency Vehicles

By Range (Value %)

Intercity

Intracity

By Operation (Value %)

Piloted

Autonomous

Hybrid

By End User (Value %)

Ridesharing Companies

Scheduled Operators

E-commerce Companies

Hospitals and Medical Agencies

Private Operators

By Region (Value %)

United States

Canada

Mexico

North America Urban Air Mobility Market Competitive Analysis

Detailed Profiles of Major Companies

Joby Aviation

Archer Aviation

Wisk Aero

Lilium GmbH

Volocopter GmbH

EHang Holdings Ltd.

Bell Textron Inc.

EmbraerX (Eve Air Mobility)

Hyundai Urban Air Mobility (Supernal)

Boeing NeXt

Airbus Urban Mobility

Kitty Hawk Corporation

Uber Elevate (Acquired by Joby Aviation)

Vertical Aerospace

Pipistrel Aircraft

Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Number of Employees, Product Portfolio, Technological Capabilities, Strategic Partnerships, Market Presence)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

North America Urban Air Mobility Market Regulatory Framework

Airworthiness Certification Processes

Pilot and Operator Licensing Requirements

Air Traffic Management and Integration

Noise and Environmental Impact Standards

North America Urban Air Mobility Future Market Size (USD Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

Future Market Segmentation

By Vehicle Type (Value %)

By Range (Value %)

By Operation (Value %)

By End User (Value %)

By Region (Value %)

North America Urban Air Mobility Market Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American Urban Air Mobility Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American Urban Air Mobility Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple urban air mobility manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the North American Urban Air Mobility Market.

Frequently Asked Questions

01 How big is the North American Urban Air Mobility Market?

The North American Urban Air Mobility Market was valued at USD 1.5 billion, driven by the demand for efficient urban transportation solutions and increased investment in eVTOL technologies.

02 What are the key drivers of the North American Urban Air Mobility Market?

Key drivers in the North American Urban Air Mobility Market include rapid urbanization, advancements in electric propulsion and autonomous technology, and supportive regulatory frameworks that encourage the integration of UAM solutions into urban infrastructure.

03 Which cities are leading the North American Urban Air Mobility Market?

Cities like Los Angeles, Dallas, and Toronto lead the North American Urban Air Mobility Market, driven by their established infrastructure, government support, and the need to alleviate urban traffic congestion through innovative transportation solutions.

04 What challenges does the North American Urban Air Mobility Market face?

The North American Urban Air Mobility Market faces challenges including regulatory hurdles, infrastructure development, public acceptance of UAM solutions, and the high initial costs of eVTOL technology deployment.

05 Who are the major players in the North American Urban Air Mobility Market?

Major players in the North American Urban Air Mobility Market include Joby Aviation, Archer Aviation, Wisk Aero, Lilium GmbH, and Volocopter GmbH, each contributing to the market through innovations in technology and strategic partnerships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.