North America Warehouse Robot Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1566

November 2024

95

About the Report

North America Warehouse Robot Market Overview

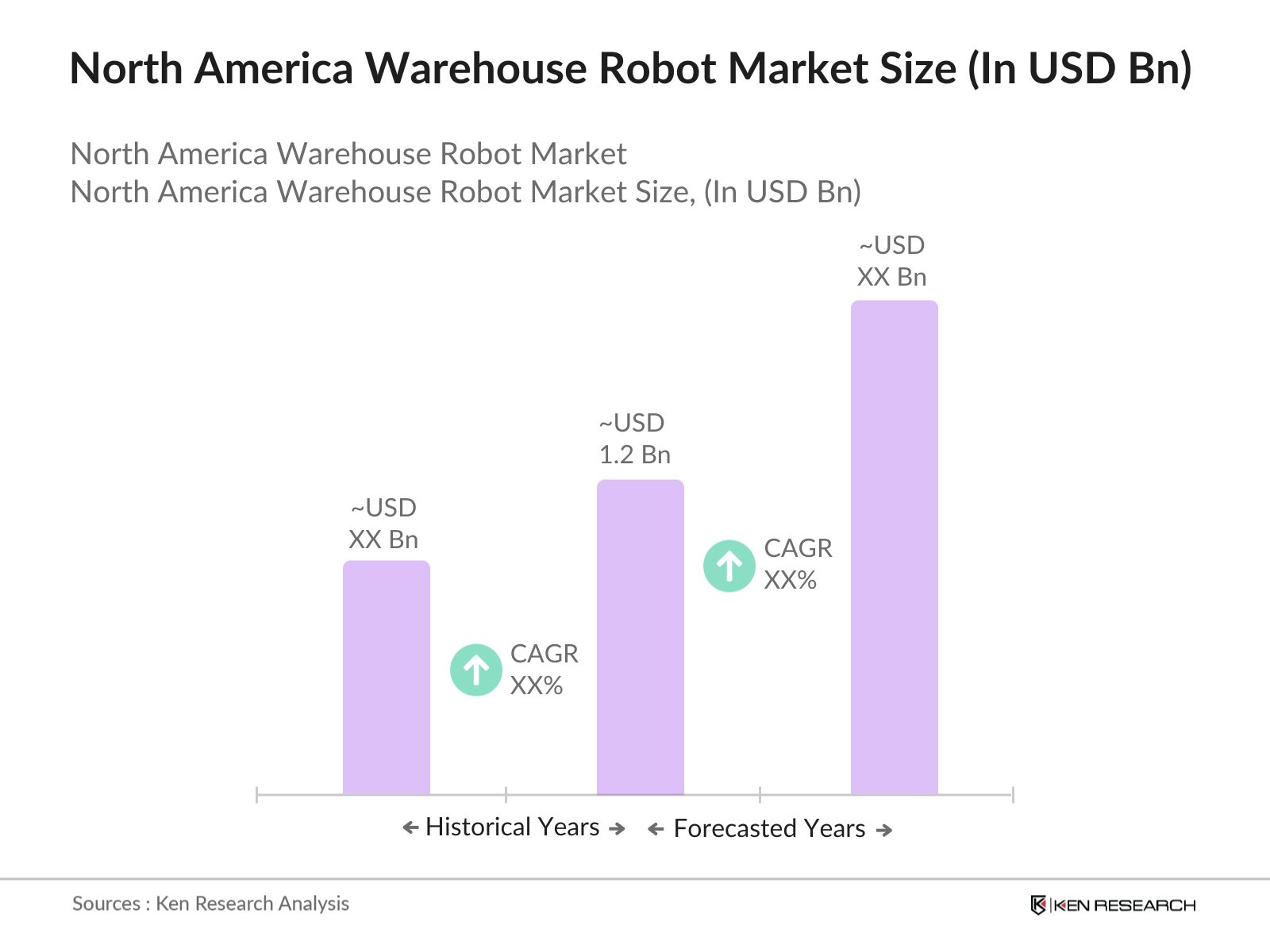

- In 2023, the North America Warehouse Robot Market was valued at USD 1.2 billion. The market's growth is driven by the increasing adoption of automation in logistics and warehousing, advancements in robotic technologies, and the rising demand for efficient and scalable warehouse operations. Warehouse robots are used to perform various tasks, such as sorting, packaging, palletizing, and transportation within warehouses.

- Major players in the North America Warehouse Robot market include Amazon Robotics, Fetch Robotics, Honeywell Intelligrated, Dematic, and Locus Robotics. These companies are recognized for their innovative technologies and comprehensive warehouse automation solutions. Amazon Robotics leads the market with its extensive use of autonomous mobile robots (AMRs) in fulfillment centers.

- Key cities in the market include Los Angeles, Chicago, and Dallas. Los Angeles stands out due to its proximity to major ports and extensive warehousing infrastructure. Chicago's position is attributed to its central location, serving as a major logistics hub in North America. Dallas is notable for its rapid growth in warehouse automation, driven by the expanding e-commerce sector.

- In 2023, Fetch Robotics launched a new line of AMRs designed to optimize material handling and improve warehouse efficiency. The company offers an integrated suite of robotic solutions, including FetchCore, a cloud-based platform for robot fleet management.

North America Warehouse Robot Market Segmentation

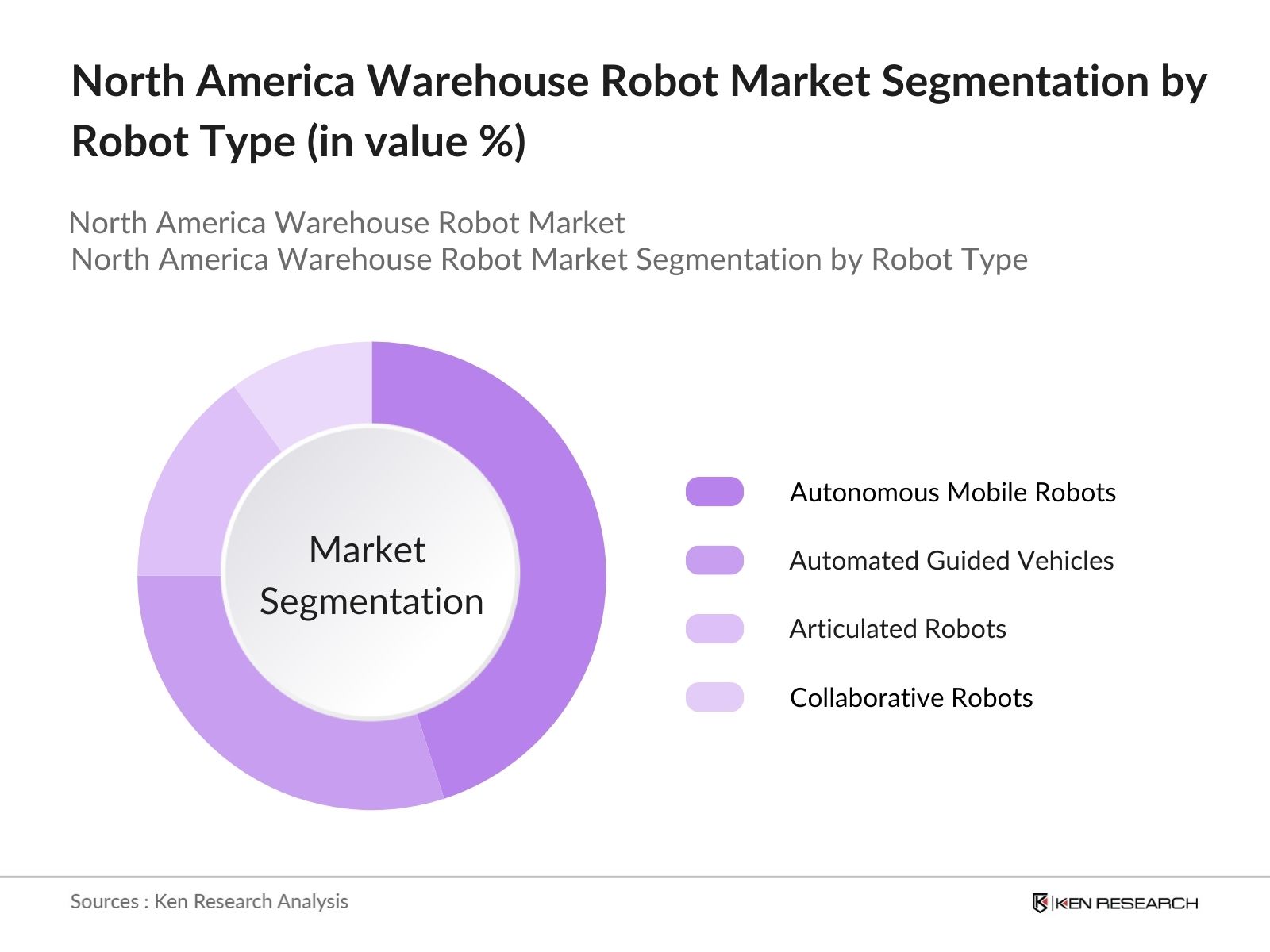

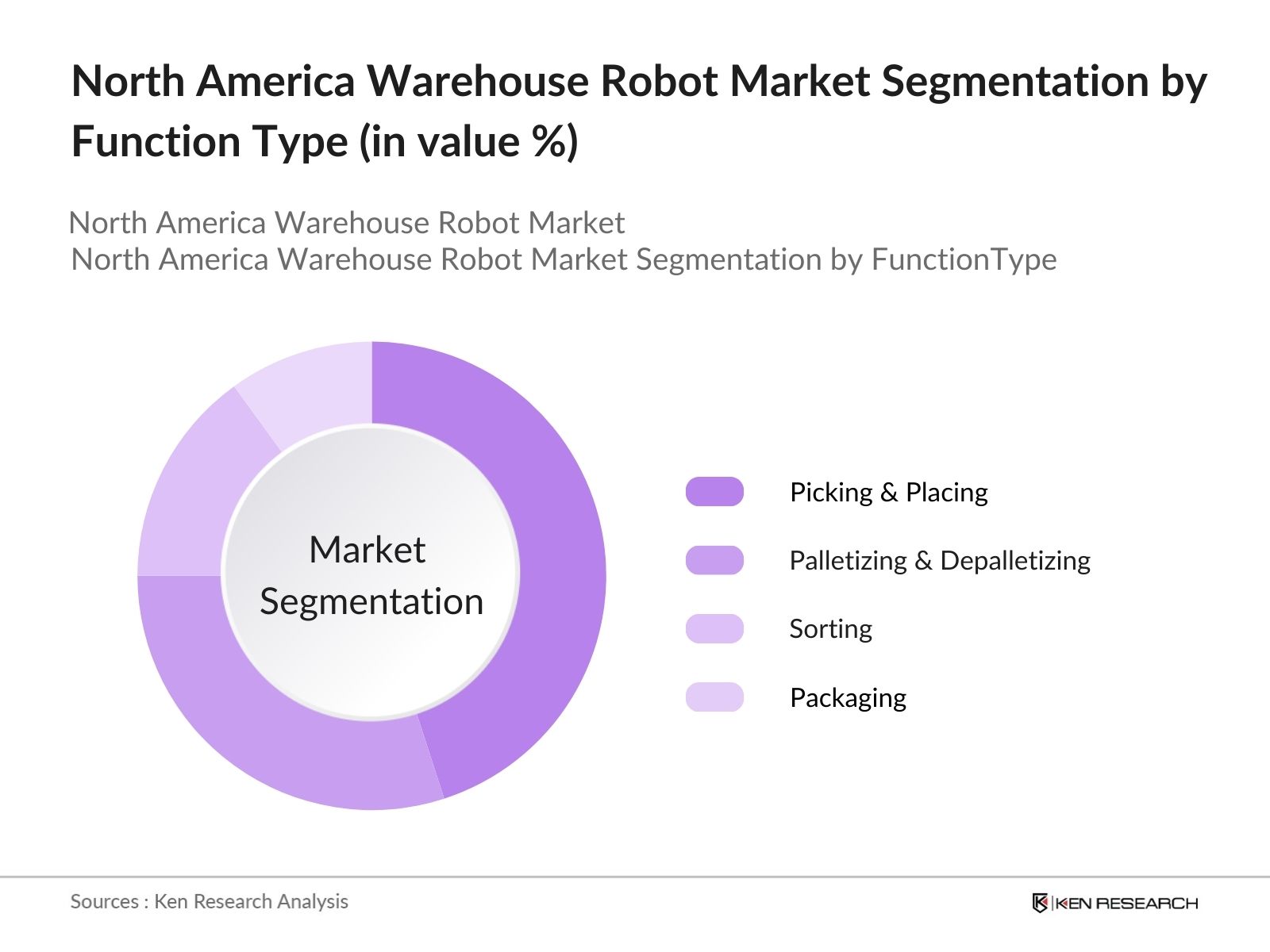

The North America Warehouse Robot market can be segmented by robot type, function, and end-user:

- By Robot Type: The North America Warehouse Robot market is segmented into Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Articulated Robots, and Collaborative Robots. In 2023, AMRs dominate the market due to their flexibility, ease of deployment, and ability to navigate dynamic warehouse environments. The increasing adoption of AMRs in e-commerce and retail warehousing is a key factor driving their market share.

- By Function: The North America Warehouse Robot market is segmented by function into Picking & Placing, Palletizing & Depalletizing, Sorting, and Packaging. In 2023, Picking & Placing functions hold the largest market share due to the high demand for automation in order fulfillment processes. The use of robots for picking and placing tasks significantly reduces labor costs and improves order accuracy.

- By End-User: The North America Warehouse Robot market is segmented by end-user type into E-commerce, Retail, Automotive, Food & Beverage, and Healthcare. In 2023, E-commerce leads the market due to the rapid growth of online shopping and the need for automated solutions to handle the high volume of orders. The increasing pressure on warehouses to process and ship orders quickly has accelerated the adoption of warehouse robots in the e-commerce sector.

North America Warehouse Robot Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Amazon Robotics |

2003 |

North Reading, USA |

|

Fetch Robotics |

2014 |

San Jose, USA |

|

Honeywell Intelligrated |

2001 |

Mason, USA |

|

Dematic |

1819 |

Atlanta, USA |

|

Locus Robotics |

2014 |

Wilmington, USA |

- Amazon Robotics: In 2024, Amazon Robotics expanded its robot fleet with the introduction of Sparrow, an advanced picking robot designed to handle a wider variety of items. This innovation is expected to enhance warehouse efficiency and reduce operational costs, further strengthening Amazon's dominance in warehouse automation.

- Fetch Robotics: In 2024, Fetch Robotics announced a strategic partnership with Zebra Technologies to integrate its AMRs with Zebra's warehouse execution systems. This collaboration aims to provide seamless automation solutions, improving operational efficiency and reducing downtime in warehouses.

North America Warehouse Robot Market Analysis

Market Growth Drivers

- Increasing Adoption of Automation in Warehousing: The rising demand for automation in warehouses is a significant growth driver for the North America Warehouse Robot Market. Companies are increasingly investing in robotic solutions to improve operational efficiency, reduce labor costs, and meet the growing demand for faster order fulfillment.

- Advancements in Robotic Technologies: Technological advancements in robotics, including AI-driven navigation and enhanced sensor capabilities, are driving market growth. These innovations enable warehouse robots to perform complex tasks with greater precision and reliability, making them indispensable in modern warehousing operations.

- Expansion of E-commerce and Retail Sectors: The rapid expansion of the e-commerce and retail sectors in North America is fueling the demand for warehouse robots. The need for efficient and scalable logistics solutions to handle the surge in online orders is driving the adoption of robotic automation in warehouses.

Market Challenges

- High Initial Investment Costs: The high initial costs associated with deploying warehouse robots pose a challenge to market growth. Small and medium-sized enterprises (SMEs) may find it difficult to invest in expensive robotic systems, limiting market penetration in this segment.

- Complexity in Integration with Existing Systems: Integrating warehouse robots with existing warehouse management systems (WMS) and IT infrastructure can be complex and time-consuming. This complexity can lead to operational disruptions and increased costs, posing a challenge to market adoption.

Government Initiatives

- Government Support for Industry 4.0: The U.S. government has been promoting the adoption of Industry 4.0 technologies, including robotics and automation, through various initiatives. In 2024, the U.S. Department of Commerce launched a grant program to support SMEs in adopting advanced manufacturing technologies, including warehouse robotics.

- Tax Incentives for Automation Investments: Several states in the U.S. offer tax incentives for businesses that invest in automation technologies, including warehouse robots. These incentives aim to encourage the adoption of advanced technologies in manufacturing and warehousing, boosting market growth.

North America Warehouse Robot Market Future Market Outlook

The North America Warehouse Robot Market is poised for significant growth, driven by advancements in robotic technologies, the expansion of e-commerce, and increasing adoption of automation in warehousing operations.

Future Market Trends

- Increased Adoption of AI and Machine Learning: Over the next five years, the integration of AI and machine learning in warehouse robots is expected to enhance their capabilities, enabling more efficient and autonomous operations. According to a report by the Robotics Industry Association, AI-driven robots will account for a significant share of the warehouse robot market by 2028.

- Expansion of Autonomous Mobile Robots (AMRs): The market is projected to see continued growth in the adoption of AMRs, driven by their flexibility and scalability. With advancements in sensor technologies and AI, AMRs are expected to become the preferred choice for warehouse automation in North America.

Scope of the Report

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Venture Capitalists

Government Agencies and Regulatory Bodies (DOC, OSHA, NIST, CBSA)

E-commerce and Retail Companies

Automotive Manufacturers

Food & Beverage Companies

Healthcare Providers

Logistics and Warehousing Companies

Technology Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Amazon Robotics

Fetch Robotics

Honeywell Intelligrated

Dematic

Locus Robotics

GreyOrange

Swisslog

IAM Robotics

Geek+

Berkshire Grey

Vecna Robotics

Kiva Systems

6 River Systems

Clearpath Robotics

Aethon

Table of Contents

1. North America Warehouse Robot Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Warehouse Robot Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Warehouse Robot Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Automation in Warehousing

3.1.2. Advancements in Robotic Technologies

3.1.3. Expansion of E-commerce and Retail Sectors

3.2. Restraints

3.2.1. High Initial Investment Costs

3.2.2. Complexity in Integration with Existing Systems

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into SME Segment

3.3.3. Growth in Regional Logistics Hubs

3.4. Trends

3.4.1. Increased Adoption of AI and Machine Learning

3.4.2. Expansion of Autonomous Mobile Robots (AMRs)

3.4.3. Enhanced Robotic Collaboration and Safety Features

3.5. Government Regulation

3.5.1. Government Support for Industry 4.0

3.5.2. Tax Incentives for Automation Investments

3.5.3. U.S. Department of Commerce Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Warehouse Robot Market Segmentation, 2023

4.1. By Robot Type (in Value %)

4.1.1. Autonomous Mobile Robots (AMRs)

4.1.2. Automated Guided Vehicles (AGVs)

4.1.3. Articulated Robots

4.1.4. Collaborative Robots

4.2. By Function (in Value %)

4.2.1. Picking & Placing

4.2.2. Palletizing & Depalletizing

4.2.3. Sorting

4.2.4. Packaging

4.3. By End-User (in Value %)

4.3.1. E-commerce

4.3.2. Retail

4.3.3. Automotive

4.3.4. Food & Beverage

4.3.5. Healthcare

4.4. By Technology (in Value %)

4.4.1. AI-driven Navigation

4.4.2. Sensor-based Automation

4.4.3. Cloud-based Fleet Management

4.4.4. Vision Systems

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Warehouse Robot Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Robotics

5.1.2. Fetch Robotics

5.1.3. Honeywell Intelligrated

5.1.4. Dematic

5.1.5. Locus Robotics

5.1.6. GreyOrange

5.1.7. Swisslog

5.1.8. IAM Robotics

5.1.9. Geek+

5.1.10. Berkshire Grey

5.1.11. Vecna Robotics

5.1.12. Kiva Systems

5.1.13. 6 River Systems

5.1.14. Clearpath Robotics

5.1.15. Aethon

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Warehouse Robot Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Warehouse Robot Market Regulatory Framework

7.1. Industry 4.0 Compliance

7.2. Automation and Safety Regulations

7.3. Tax Incentive Programs

8. North America Warehouse Robot Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Warehouse Robot Future Market Segmentation, 2028

9.1. By Robot Type (in Value %)

9.2. By Function (in Value %)

9.3. By End-User (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

10. North America Warehouse Robot Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building:

Collating statistics on the North America Warehouse Robot market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated. We will also review service quality statistics to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output:

Our team will approach multiple essential technology companies and understand the nature of product segments, sales, consumer preference, and other parameters, which will support us in validating statistics derived through a bottom-to-top approach from warehouse automation companies.

Frequently Asked Questions

01. How big is the North America Warehouse Robot Market?

In 2023, the North America Warehouse Robot Market was valued at USD 3.8 billion. This growth is driven by the increasing adoption of automation in logistics and warehousing, advancements in robotic technologies, and the rising demand for efficient and scalable warehouse operations.

02. What are the challenges in the North America Warehouse Robot Market?

Challenges in the North America Warehouse Robot Market include high initial investment costs, complexity in integration with existing systems, and potential disruptions during the transition to automated processes.

03. Who are the major players in the North America Warehouse Robot Market?

Key players in the North America Warehouse Robot Market include Amazon Robotics, Fetch Robotics, Honeywell Intelligrated, and Dematic. These companies are prominent due to their advanced technology offerings, strong market presence, and extensive global networks.

04. What are the growth drivers of the North America Warehouse Robot Market?

The North America Warehouse Robot Market is driven by increasing adoption of automation in warehousing, technological advancements in robotics, and the expansion of e-commerce and retail sectors. Additionally, supportive government initiatives and rising demand for faster order fulfillment contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.