North America Waste Management Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4141

December 2024

92

About the Report

North America Waste Management Market Overview

- The North America waste management market is valued at USD 215 billion, based on a five-year historical analysis. This market is driven by increasing urbanization and industrialization, which generate substantial volumes of waste. The rising consumer awareness around environmental sustainability, along with government regulations aimed at reducing landfill waste and promoting recycling, have further bolstered the demand for efficient waste management services. With the emergence of smart waste technologies and waste-to-energy initiatives, the market continues to see robust growth across North America.

- The United States and Canada are dominant in this market due to their high waste generation rates and stringent environmental regulations. Both countries have made significant investments in waste infrastructure, particularly in cities like New York, Los Angeles, Toronto, and Vancouver. These cities have well-established recycling and waste treatment systems, as well as strong public-private partnerships aimed at achieving sustainability goals. Mexico is also showing signs of growth due to industrial expansion and the increasing focus on urban waste management.

- The U.S. Environmental Protection Agency launched the National Recycling Strategy in 2021, focusing on improving the recycling infrastructure and reducing contamination in recycled materials. This initiative is pushing for improvements in waste sorting and recycling technology, aiming to recycle 50 million tons of waste annually by 2025. In 2023, the EPA invested over $400 million into grants for local governments to improve recycling operations and waste collection efficiency.

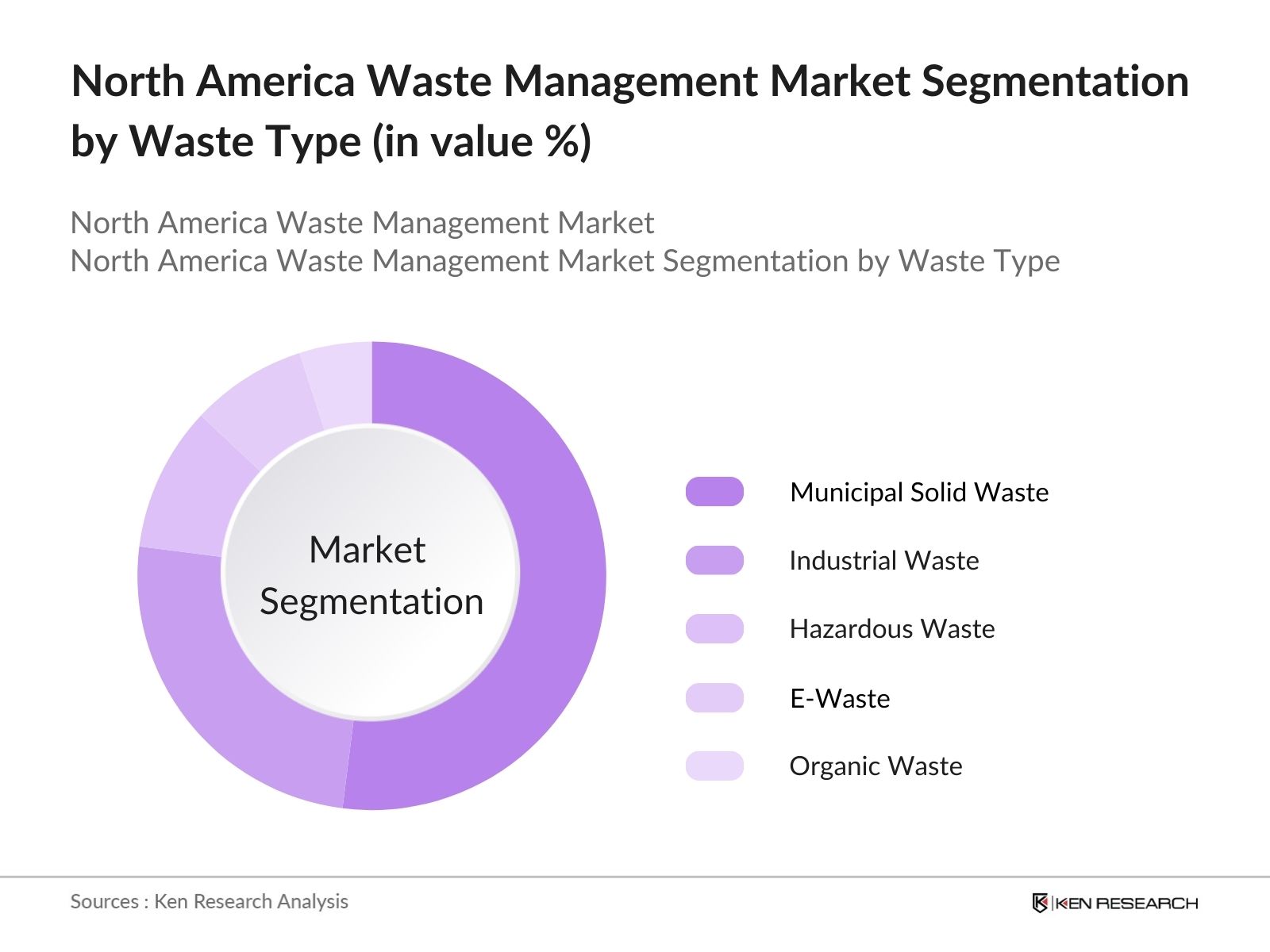

North America Waste Management Market Segmentation

By Waste Type: The North America waste management market is segmented by waste type into municipal solid waste, industrial waste, hazardous waste, e-waste, and organic waste. Recently, municipal solid waste has held a dominant market share under this segmentation, primarily driven by the rapid urbanization in major cities, leading to high levels of residential waste generation. The emphasis on improving municipal waste collection systems and implementing recycling programs across urban areas in the U.S. and Canada has contributed to the strong growth of this segment.

By Disposal Methods: The market is also segmented by disposal methods, including landfill, recycling, composting, and waste-to-energy. Landfill remains the dominant method of waste disposal due to the large volumes of waste generated in urban areas. Despite growing efforts to reduce landfill dependency, a significant portion of North American waste still ends up in landfills, particularly in regions where recycling infrastructure is not fully developed. However, the recycling and waste-to-energy segments are rapidly growing as environmental concerns push governments and private organizations to invest in more sustainable alternatives.

North America Waste Management Market Competitive Landscape

The North America waste management market is dominated by several key players, both domestic and international, who compete based on service range, geographic reach, technological advancements, and strategic partnerships. Many of these companies are focusing on expanding their recycling capabilities and investing in new technologies like smart waste collection and waste-to-energy systems.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Service Range |

Geographic Reach |

Mergers & Acquisitions |

Sustainability Initiatives |

Technology Adoption |

|

Waste Management, Inc. |

1968 |

Houston, Texas, U.S. |

- | - | - | - | - | - | - |

|

Republic Services, Inc. |

1998 |

Phoenix, Arizona, U.S. |

- | - | - | - | - | - | - |

|

GFL Environmental Inc. |

2007 |

Vaughan, Ontario, Canada |

- | - | - | - | - | - | - |

|

Clean Harbors, Inc. |

1980 |

Norwell, Massachusetts |

- | - | - | - | - | - | - |

|

Veolia North America |

2000 |

Boston, Massachusetts |

- | - | - | - | - | - | - |

North America Waste Management Market Analysis

Growth Drivers

- Rising Urbanization (Waste Generation Growth): Rapid urbanization in North America has resulted in a significant increase in waste generation. The U.S. and Canada are seeing a surge in urban populations, with over 82.7% of the U.S. population now living in urban areas, which is expected to drive more solid waste production. Waste generated by urban populations reached 270 million metric tons in the U.S. in 2023, according to the World Bank. This rise in urban waste is placing immense pressure on waste management systems to scale up infrastructure and services.

- Stringent Government Regulations (EPA Regulations, Zero Waste Initiatives): Environmental regulations play a crucial role in shaping the North American waste management market. The U.S. Environmental Protection Agency (EPA) enforces stringent rules on waste disposal and recycling, aiming to reduce landfilling and promote zero-waste policies. The U.S. governments Resource Conservation and Recovery Act mandates proper waste disposal, influencing both public and private entities to adopt sustainable waste management practices. Zero-waste initiatives are gaining traction, especially in large cities like San Francisco, where they target diverting 100% of waste from landfills by 2025.

- Industrialization (Increased Commercial Waste): Industrial growth across North America is leading to a rise in commercial and industrial waste. With the U.S. industrial sector contributing over $3.7 trillion to the economy in 2024, industrial waste is a major contributor to overall waste volumes. This waste includes manufacturing by-products, hazardous materials, and e-waste. The increased commercial activity in sectors like construction, retail, and manufacturing demands better waste management services and systems to handle large-scale waste outputs.

Market Challenges

- High Infrastructure Costs: The development of waste treatment facilities and recycling plants requires substantial financial investment, which poses a challenge to the waste management industry. Building modern recycling facilities costs approximately $20 million to $50 million, depending on their size and capacity. Additionally, the operational costs for waste treatment plants are substantial, with advanced waste-to-energy facilities costing upwards of $100 million. These high infrastructure costs limit expansion efforts, especially in underfunded regions and smaller municipalities.

- Lack of Public Awareness: Public participation in waste segregation and recycling remains low in many parts of North America. Despite efforts to promote recycling, approximately 60 million tons of recyclable waste still ends up in landfills in the U.S. annually, according to government reports. A lack of proper awareness and knowledge about waste sorting contributes to the failure of recycling programs. The absence of consistent national policies on waste segregation adds to the complexity, making it difficult to educate and engage the public effectively.

North America Waste Management Market Future Outlook

Over the next five years, the North America waste management market is expected to exhibit significant growth driven by increased urbanization, environmental awareness, and governmental regulations that favor sustainable waste solutions. Investment in recycling infrastructure, coupled with advancements in waste-to-energy technology, is anticipated to reduce reliance on landfills. Additionally, the integration of smart waste management systems, which use IoT and AI for efficient waste collection and sorting, will play a pivotal role in reshaping the market. The focus will increasingly shift toward reducing waste at the source and promoting circular economy models.

Market Opportunities

- Technological Advancements: Technological advancements in waste management are presenting significant growth opportunities. Waste-to-energy (WTE) technologies are being implemented to convert waste into energy, reducing landfill dependency and generating power. In the U.S., there are more than 70 waste-to-energy plants currently in operation, processing over 29 million tons of waste annually. Moreover, smart waste management solutions, including IoT-enabled sensors in waste bins, are enhancing waste collection efficiency by monitoring fill levels and optimizing collection routes, reducing costs and emissions.

- Public-Private Partnerships: Collaboration between private waste management companies and local governments is increasingly viewed as a viable solution to address waste management challenges. Several North American cities have launched successful public-private partnerships (PPP) to enhance waste treatment and recycling services. For example, Torontos Green Bin program, implemented through a PPP, processes over 180,000 tons of organic waste annually. Such partnerships are expected to expand, providing a framework for sustainable waste management initiatives across the region.

Scope of the Report

|

By Waste Type |

Municipal Solid Waste Industrial Waste Hazardous Waste E-Waste Organic Waste |

|

By Disposal Methods |

Landfill Recycling Composting Waste-to-Energy |

|

By Service Type |

Collection Services Transportation Services Treatment Services |

|

By End-User |

Residential Commercial Industrial |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Municipalities and Local Governments

Environmental Protection Agencies (EPA, Canada Environment and Climate Change)

Private Waste Management Companies

Recycling Equipment Manufacturers

Industrial Waste Generators (Automotive, Manufacturing)

Retail Chains and Large Commercial Establishments

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Energy, Canadian Council of Ministers of the Environment)

Companies

Players Mentioned in the Report:

Waste Management, Inc.

Republic Services, Inc.

Clean Harbors, Inc.

Veolia North America

GFL Environmental Inc.

Covanta Holding Corporation

Waste Connections, Inc.

Stericycle, Inc.

Recology

Suez North America

Table of Contents

1. North America Waste Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Waste Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Waste Management Market Analysis

3.1. Growth Drivers

3.1.1. Rising Urbanization (Waste Generation Growth)

3.1.2. Stringent Government Regulations (EPA Regulations, Zero Waste Initiatives)

3.1.3. Industrialization (Increased Commercial Waste)

3.1.4. Circular Economy (Focus on Recycling and Reuse)

3.2. Market Challenges

3.2.1. High Infrastructure Costs (Waste Treatment Facilities, Recycling Plants)

3.2.2. Lack of Public Awareness (Waste Segregation and Recycling Challenges)

3.2.3. Environmental Regulations (Permitting and Compliance Issues)

3.3. Opportunities

3.3.1. Technological Advancements (Waste-to-Energy, Smart Waste Management)

3.3.2. Public-Private Partnerships (Collaboration with Local Governments)

3.3.3. Growing Recycling Market (Increasing Recycling Capacities)

3.4. Trends

3.4.1. Adoption of Smart Waste Collection Systems

3.4.2. Shift Toward Zero Waste Cities

3.4.3. Increasing Focus on Organic Waste Management

3.5. Government Regulations

3.5.1. Environmental Protection Agency (EPA) Standards (Solid Waste Management Rules)

3.5.2. Recycling Mandates (Federal and State-Level Initiatives)

3.5.3. Landfill Restrictions (Reduction in Landfill Waste)

3.5.4. Waste Disposal Permits

3.6. SWOT Analysis (Market-Specific Strengths, Weaknesses, Opportunities, Threats)

3.7. Stake Ecosystem (Municipalities, Waste Collectors, Recyclers, Government Agencies)

3.8. Porters Five Forces (Competitive Rivalry, Supplier Power, Buyer Power, Substitution, New Entrants)

3.9. Competition Ecosystem (Waste Management Players and Their Services)

4. North America Waste Management Market Segmentation

4.1. By Waste Type (In Value %)

4.1.1. Municipal Solid Waste

4.1.2. Industrial Waste

4.1.3. Hazardous Waste

4.1.4. E-Waste

4.1.5. Organic Waste

4.2. By Disposal Methods (In Value %)

4.2.1. Landfill

4.2.2. Recycling

4.2.3. Composting

4.2.4. Waste-to-Energy

4.3. By Service Type (In Value %)

4.3.1. Collection Services

4.3.2. Transportation Services

4.3.3. Treatment Services

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Waste Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Waste Management Inc.

5.1.2. Republic Services, Inc.

5.1.3. Stericycle, Inc.

5.1.4. Clean Harbors, Inc.

5.1.5. Covanta Holding Corporation

5.1.6. Waste Connections, Inc.

5.1.7. GFL Environmental Inc.

5.1.8. Advanced Disposal Services, Inc.

5.1.9. Veolia North America

5.1.10. Recology

5.1.11. Biffa Waste Services Ltd.

5.1.12. Suez North America

5.1.13. Cleanaway Waste Management Ltd.

5.1.14. Rubicon Global Holdings LLC

5.1.15. Casella Waste Systems, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Service Range, Geographic Reach, Mergers & Acquisitions, Sustainability Initiatives)

5.3. Market Share Analysis (Market Leaders, Regional Players, Niche Players)

5.4. Strategic Initiatives (New Service Launches, Geographic Expansions, Partnerships)

5.5. Mergers And Acquisitions (Key Deals, Impact on Market Dynamics)

5.6. Investment Analysis (Infrastructure Investments, Technology Adoption)

5.7. Venture Capital Funding (Key Funding Rounds, Market Impact)

5.8. Government Grants (Incentives for Recycling, Landfill Alternatives)

5.9. Private Equity Investments (Top Investors, Market Impact)

6. North America Waste Management Regulatory Framework

6.1. Environmental Standards (EPA Waste Management Guidelines, Local Regulations)

6.2. Compliance Requirements (Permitting, Waste Disposal Approvals)

6.3. Certification Processes (ISO Certifications for Waste Management)

7. North America Waste Management Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Waste Management Future Market Segmentation

8.1. By Waste Type (In Value %)

8.2. By Disposal Methods (In Value %)

8.3. By Service Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Waste Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing an ecosystem map of stakeholders in the North America Waste Management Market. This includes waste generators, collectors, recyclers, and regulatory agencies. A combination of secondary and proprietary research databases is used to gather extensive industry-level data.

Step 2: Market Analysis and Construction

Historical market data is analyzed to assess waste generation rates, recycling penetration, and disposal methods. Additionally, market revenue is calculated using service providers revenue data, which helps determine the size and structure of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts. This includes executives from leading waste management companies and representatives from regulatory bodies, providing insights into market trends, challenges, and growth drivers.

Step 4: Research Synthesis and Final Output

A comprehensive synthesis of the research is conducted, focusing on segment-specific growth, market share distribution, and future outlook. The bottom-up approach is employed to validate market size and forecast data, ensuring a reliable final analysis.

Frequently Asked Questions

01. How big is the North America Waste Management Market?

The North America waste management market is valued at USD 215 billion, driven by rapid urbanization and increasing environmental awareness.

02. What are the challenges in the North America Waste Management Market?

Challenges in the North America waste management market include high infrastructure costs, public resistance to waste management fees, and the need for better waste segregation systems.

03. Who are the major players in the North America Waste Management Market?

Key players in the North America waste management market include Waste Management, Inc., Republic Services, Inc., GFL Environmental Inc., Veolia North America, and Clean Harbors, Inc.

04. What are the growth drivers of the North America Waste Management Market?

Growth drivers in the North America waste management market include stringent government regulations on waste disposal, increasing recycling initiatives, and the rise of waste-to-energy technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.