North America Weight Loss supplement Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7805

November 2024

96

About the Report

North America Weight Loss supplement Market Overview

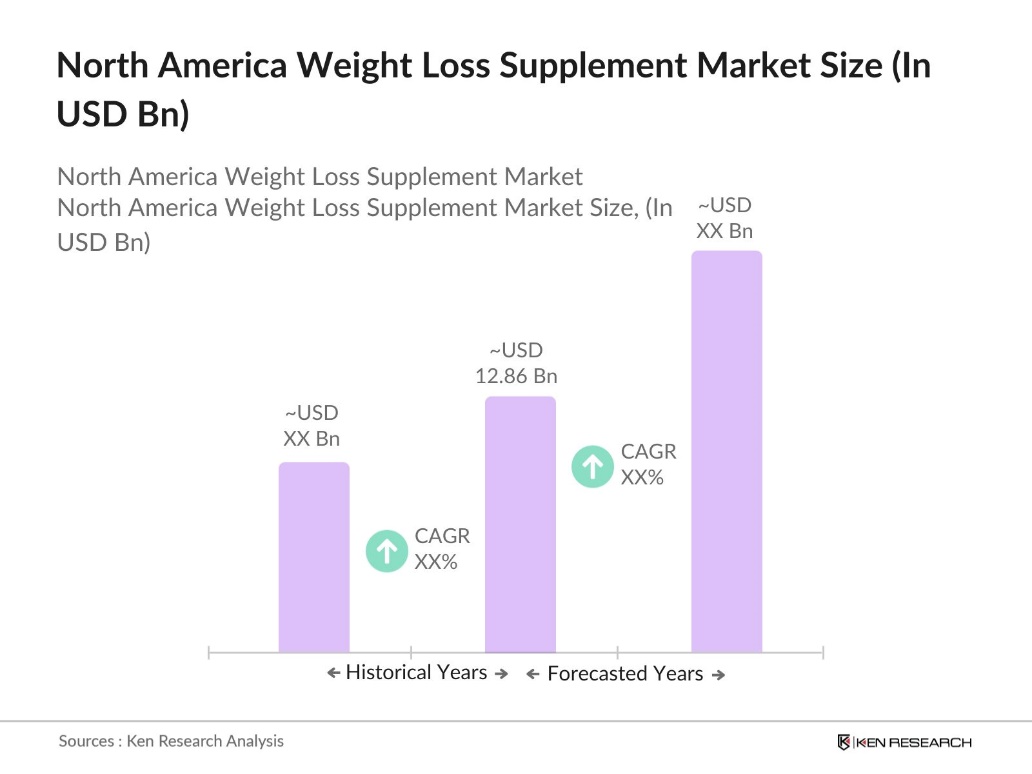

- The North America Weight Loss Supplement Market is valued at USD 12.86 billion, driven by rising consumer health consciousness, obesity-related concerns, and a growing focus on fitness and dieting trends. The market has experienced robust growth over the past five years, particularly as consumers turn to supplements as an easy-to-use, cost-effective weight management tool. Demand is bolstered by the increasing prevalence of lifestyle diseases such as diabetes, as well as the rise in awareness regarding preventive healthcare, propelling the weight loss supplement industry further.

- The market is primarily dominated by the United States and Canada due to the high levels of obesity and health-conscious consumers. The U.S. leads in product innovation and marketing, with significant support from its highly developed dietary supplement industry, regulatory environment, and fitness culture. Canada follows closely, with its population increasingly adopting health supplements in response to rising awareness of weight management and chronic diseases. The urban centers in these regions, such as New York, Los Angeles, and Toronto, drive the market due to higher disposable incomes and easy access to fitness centers and health products.

- Accurate labeling is critical in the weight loss supplement industry, as improper labeling can lead to severe penalties. In fiscal year 2023, the FDA issued a total of 180 warning letters specifically to drug and biologics manufacturers. Manufacturers are required to include detailed Supplement Facts labels, ensuring that consumers are well-informed about the ingredients, serving sizes, and potential side effects of their products, driving consumer trust and market integrity.

North America Weight Loss supplement Market Segmentation

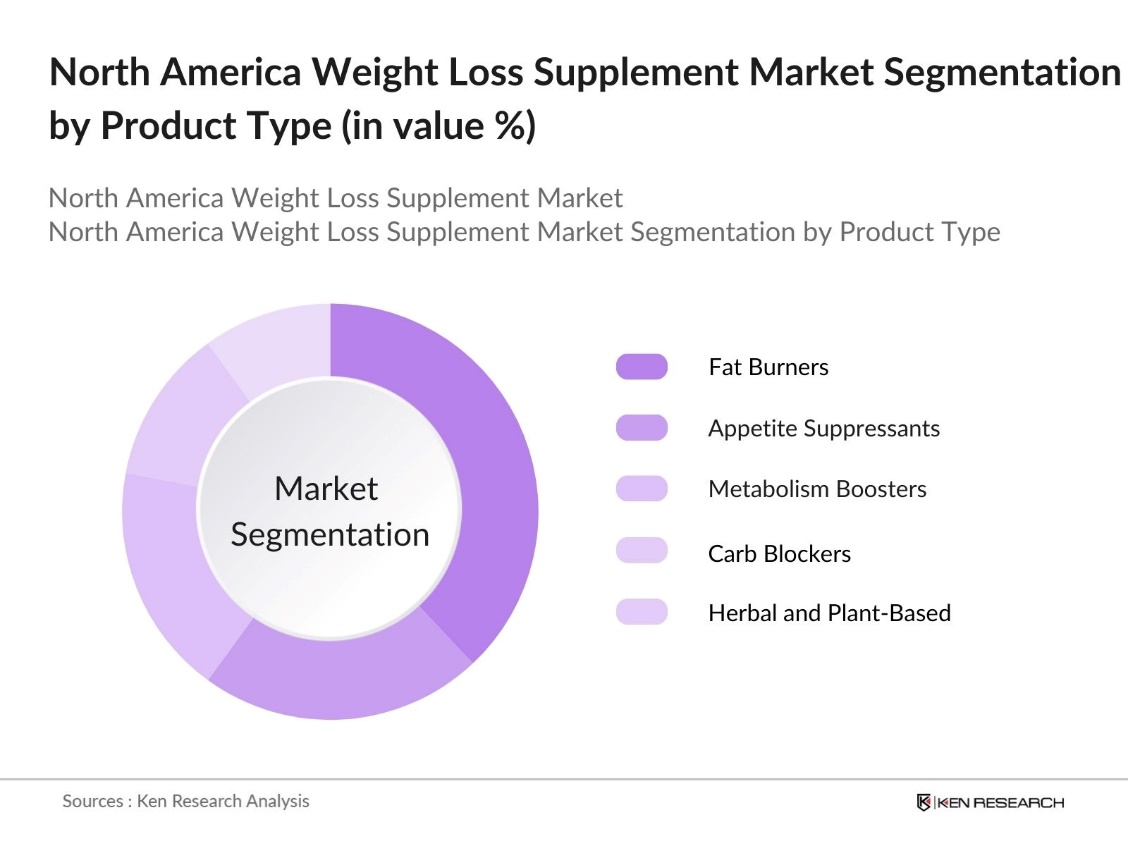

By Product Type: The North America Weight Loss Supplement market is segmented by product type into fat burners, appetite suppressants, metabolism boosters, carb blockers, and herbal and plant-based supplements. Fat burners currently hold a dominant market share. This dominance is attributed to their popularity among fitness enthusiasts and athletes for their ability to enhance energy expenditure and aid fat loss. Additionally, many fat burner products are heavily marketed with endorsements from celebrities and athletes, further boosting consumer trust and appeal.

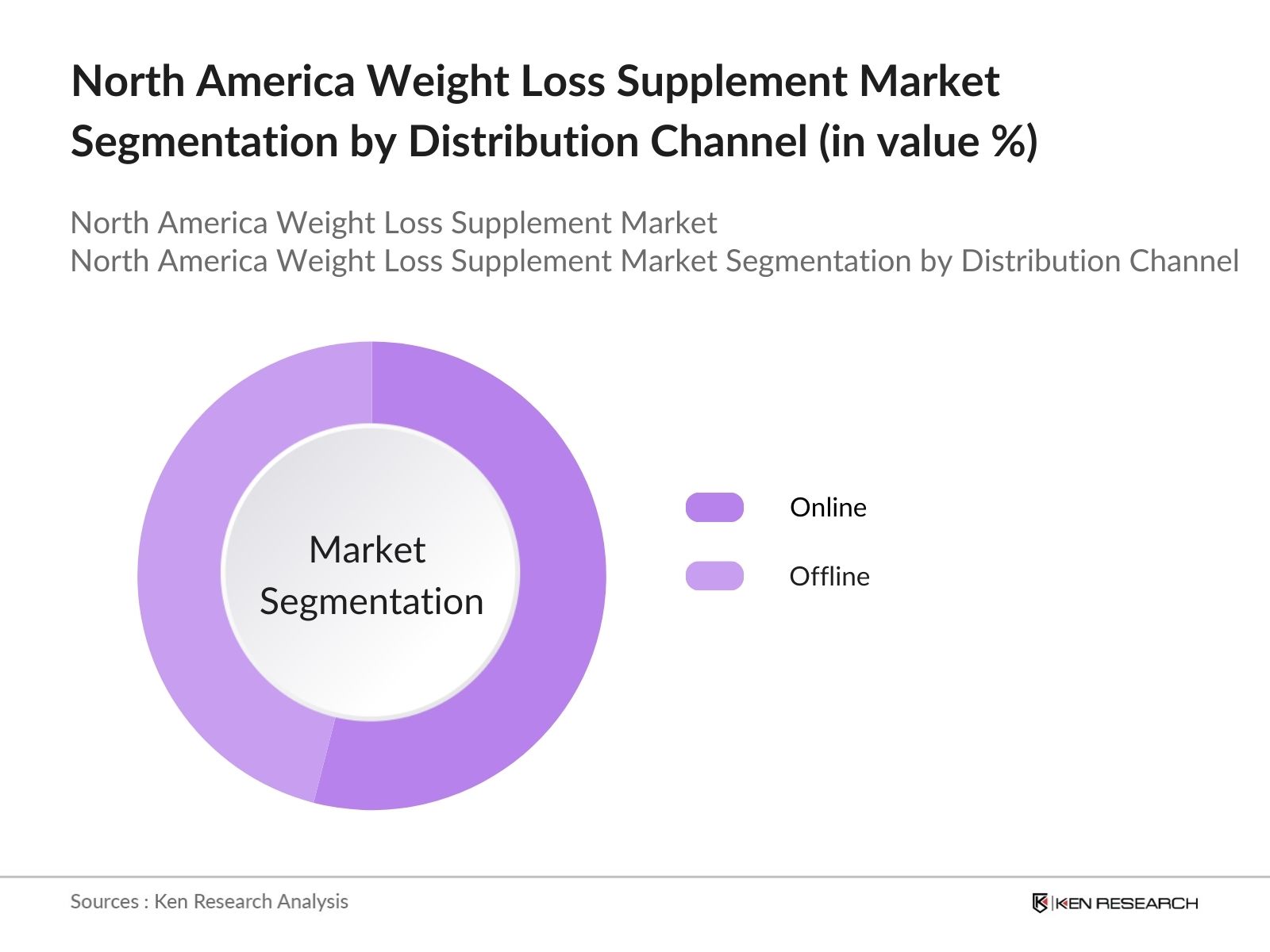

By Distribution Channel: The North America Weight Loss Supplement market is also segmented by distribution channel into offline (retail stores, pharmacies, specialty health stores) and online (e-commerce platforms, direct-to-consumer websites). Online distribution dominates the market due to the convenience of purchasing supplements from the comfort of home, coupled with the widespread adoption of e-commerce. The rise of digital marketing and influencer endorsements, along with increasing penetration of e-commerce platforms such as Amazon and Walmart, have further contributed to this trend.

North America Weight Loss supplement Market Competitive Landscape

The North America Weight Loss Supplement market is dominated by key players such as Herbalife Nutrition, GNC Holdings, and Atkins Nutritionals. These companies have established strong brand recognition through extensive product offerings, diversified distribution channels, and celebrity endorsements. Additionally, they benefit from extensive online presence and partnerships with health and wellness influencers, giving them a competitive edge over smaller players.

|

Company |

Year of Establishment |

Headquarters |

Revenue (2023) |

Number of Products |

Distribution Channels |

Product Portfolio |

Market Penetration |

Strategic Partnerships |

|

Herbalife Nutrition Ltd. |

1980 |

Los Angeles, USA |

||||||

|

Glanbia Plc |

1997 |

Kilkenny, Ireland |

||||||

|

GNC Holdings Inc. |

1935 |

Pittsburgh, USA |

||||||

|

Atkins Nutritionals, Inc. |

1989 |

Denver, USA |

||||||

|

Natures Bounty Co. |

1971 |

Ronkonkoma, USA |

North America Weight Loss supplement Industry Analysis

Growth Drivers

- Consumer Shifting Preference for Natural Products: As health consciousness continues to rise, consumers in North America are increasingly opting for natural and organic weight loss supplements. For instance, in the United States, the demand for herbal supplements has grown substantially, with products like Garcinia Cambogia and Green Tea Extract gaining popularity According to recent data, U.S. dollar sales for certified organic products approached $70 billion in 2023, marking a 3.4% increase year-over-year. This trend reflects a clear shift towards plant-based, chemical-free products that are perceived to be safer and healthier, driving growth in the weight loss supplement market.

- Increased Health-Conscious Population: North America's health-conscious population has been steadily increasing, partly driven by government-backed health campaigns. According to the CDC, approximately 46.9% of adults aged 18 and older met the Physical Activity Guidelines for aerobic exercise in recent years. The CDC also noted a notable rise in gym memberships and subscriptions to wellness apps during the same period. This increasing awareness around fitness and the desire to lead healthier lifestyles is driving demand for weight loss supplements that support these health goals.

- Influence of Fitness Trends and Dieting Fads: Fitness trends like intermittent fasting, ketogenic diets, and plant-based nutrition have spurred demand for supplements that align with these lifestyles. Consumers are increasingly seeking products that complement their diet and fitness goals. As more people adopt these popular dietary regimens, the market for specialized supplements, such as keto-friendly and plant-based options, continues to grow, driven by a focus on personalized health and weight management.

Market Challenges

- Regulatory Hurdles and FDA Approval Processes: The U.S. Food and Drug Administration (FDA) enforces strict regulatory processes for weight loss supplements, often leading to delays in product launches. These regulations focus on ensuring product safety and the accuracy of health claims, particularly regarding potential side effects. Such stringent oversight can make it challenging for new entrants to introduce products to the market, creating barriers that limit growth opportunities for smaller players.

- Increasing Scrutiny on Product Claims: Regulatory bodies are intensifying scrutiny over the claims made by weight loss supplement manufacturers. Companies must ensure their product claims are backed by credible scientific evidence to avoid legal challenges. This heightened focus on transparency has increased compliance costs, as manufacturers need to substantiate the efficacy of their products, reducing the spread of misleading information in the market.

North America Weight Loss supplement Market Future Outlook

Over the next five years, the North America Weight Loss Supplement market is expected to experience strong growth driven by the increasing awareness of obesity-related health risks and the growing adoption of health supplements as part of consumers' daily routines. Moreover, advancements in product formulations, such as personalized supplements and clean label products, are likely to attract a broader range of consumers. E-commerce will continue to be a key driver, with companies focusing on enhancing their digital presence and direct-to-consumer models.

Market Opportunities

- Growth of E-commerce and Direct-to-Consumer Sales Channels: E-commerce has become a key channel for the weight loss supplement market due to its convenience and the increasing shift towards online shopping. Direct-to-consumer brands are leveraging platforms such as Amazon and Shopify to reach health-conscious customers more easily, bypassing traditional retail challenges. This shift presents a significant opportunity for brands to expand their reach and cater to the rising demand for weight loss supplements through online channels.

- Personalized Supplements Based on DNA and Microbiome Data: The trend toward personalized supplements, tailored to an individual's genetic or microbiome data, is gaining momentum. These customized solutions offer a more targeted approach to weight loss, aligning with a persons unique health profile. As the interest in personalized health and wellness grows, brands offering such supplements are capitalizing on this trend, positioning themselves as innovators in the evolving weight loss market.

Scope of the Report

|

By Type |

Fat Burners, Appetite Suppressants Metabolism Boosters, Carb Blocker Herbal and Plant-Based Supplements |

|

By Form |

PillsPowders Liquids Gummies Teas and Detox Drinks |

|

By End-Use |

Adult Men Adult Women SeniorsAdolescents |

|

By Distribution |

Offline (Retail, Pharmacies, Specialty Stores) Online (E-commerce, Direct-to-Consumer) |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Manufacturers of Dietary Supplements

Pharmaceutical Companies

Online Retailers and E-Commerce Platforms

Nutraceutical Companies

Government and Regulatory Bodies (FDA, Health Canada)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Herbalife Nutrition Ltd.

GNC Holdings Inc.

Atkins Nutritionals, Inc.

Natures Bounty Co.

NOW Foods

Iovate Health Sciences International Inc.

Pharmavite LLC

Plexus Worldwide

SlimFast

Amway Corporation

Table of Contents

1. North America Weight Loss Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Supplements by Type, Form, End-Use, Distribution Channel)

1.3. Market Growth Rate (Market CAGR, Year-On-Year Growth)

1.4. Market Segmentation Overview

2. North America Weight Loss Supplement Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Weight Loss Supplement Market Analysis

3.1. Growth Drivers (Consumer Demand, Increased Awareness, Rising Obesity Rates)

3.1.1. Consumer Shifting Preference for Natural Products

3.1.2. Increased Health-Conscious Population

3.1.3. Influence of Fitness Trends and Dieting Fads

3.1.4. Rising Cases of Obesity and Related Health Problems

3.2. Market Challenges (Regulation, Product Efficacy, Marketing)

3.2.1. Regulatory Hurdles and FDA Approval Processes

3.2.2. Increasing Scrutiny on Product Claims

3.2.3. Intense Market Competition

3.3. Opportunities (E-commerce Growth, Personalized Supplements, Emerging Markets)

3.3.1. Growth of E-commerce and Direct-to-Consumer Sales Channels

3.3.2. Personalized Supplements Based on DNA and Microbiome Data

3.3.3. Expansion into Emerging Markets and Untapped Demographics

3.4. Trends (Plant-Based Supplements, Keto Products, Clean Labeling)

3.4.1. Surge in Plant-Based and Organic Supplements

3.4.2. Rising Popularity of Keto-Friendly and Low-Carb Supplements

3.4.3. Preference for Clean Labels and Transparency

3.5. Government Regulation (FDA, FTC, Labeling Standards, Supplement Industry Laws)

3.5.1. FDA Compliance and Dietary Supplement Health Education Act (DSHEA)

3.5.2. Regulations on Claims and Advertising

3.5.3. Labeling and Supplement Facts Requirements

3.5.4. State-Level Regulations on Sales and Distribution

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitution, Barriers to Entry)

3.9. Competition Ecosystem

4. North America Weight Loss Supplement Market Segmentation

4.1. By Type (In Value %)

4.1.1. Fat Burners

4.1.2. Appetite Suppressants

4.1.3. Metabolism Boosters

4.1.4. Carb Blockers

4.1.5. Herbal and Plant-Based Supplements

4.2. By Form (In Value %)

4.2.1. Pills

4.2.2. Powders

4.2.3. Liquids

4.2.4. Gummies

4.2.5. Teas and Detox Drinks

4.3. By End-Use (In Value %)

4.3.1. Adult Men

4.3.2. Adult Women

4.3.3. Seniors

4.3.4. Adolescents

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Retail Stores, Pharmacies, Specialty Health Stores)

4.4.2. Online (E-commerce Platforms, Direct-to-Consumer Websites)

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Weight Loss Supplement Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Herbalife Nutrition Ltd.

5.1.2. Glanbia Plc

5.1.3. GNC Holdings Inc.

5.1.4. Natures Bounty Co.

5.1.5. NOW Foods

5.1.6. Weight Watchers International, Inc.

5.1.7. Atkins Nutritionals, Inc.

5.1.8. Nutrisystem, Inc.

5.1.9. Iovate Health Sciences International Inc.

5.1.10. Pharmavite LLC

5.1.11. Plexus Worldwide

5.1.12. Amway Corporation

5.1.13. USANA Health Sciences

5.1.14. Beachbody LLC

5.1.15. SlimFast

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Reach, Market Share, Innovation, Pricing Strategy, Regional Presence, Mergers & Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Launches, Innovations)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Weight Loss Supplement Market Regulatory Framework

6.1. Dietary Supplement Regulations (FDA, DSHEA, Labeling)

6.2. Advertising and Marketing Regulations (FTC, Claims Regulations)

6.3. Certification Processes (NSF Certification, GMP)

7. North America Weight Loss Supplement Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Weight Loss Supplement Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Form (In Value %)

8.3. By End-Use (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. North America Weight Loss Supplement Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, our research team constructed a comprehensive map of the North America Weight Loss Supplement market ecosystem. This involved extensive desk research to identify key stakeholders such as manufacturers, distributors, and consumers, while gathering industry-specific data from reliable secondary and proprietary sources.

Step 2: Market Analysis and Construction

Using historical data, we analyzed the market dynamics for weight loss supplements, focusing on product penetration, consumer behavior trends, and the resulting revenue generation. Our analysis also covered the ratio of market entrants to established players to assess the competitive intensity.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were formulated and validated through consultations with industry professionals and experts using CATI interviews. These consultations helped refine our analysis and ensure accuracy, particularly in terms of product performance and market growth drivers.

Step 4: Research Synthesis and Final Output

In the final phase, detailed engagement with key market players provided insights into the competitive landscape, consumer preferences, and distribution strategies. This allowed for a validated, bottom-up approach in assessing market size and future growth potential.

Frequently Asked Questions

01 How big is the North America Weight Loss Supplement Market?

The North America Weight Loss Supplement Market was valued at USD 12.86 billion, driven by rising health consciousness, increasing obesity rates, and the adoption of dietary supplements for weight management.

02 What are the challenges in the North America Weight Loss Supplement Market?

Challenges in North America Weight Loss Supplement Market include regulatory hurdles, product efficacy concerns, and the competitive nature of the market, where numerous brands are vying for consumer attention. The market is also witnessing increased scrutiny over product claims and marketing tactics.

03 Who are the major players in the North America Weight Loss Supplement Market?

Major players in the North America Weight Loss Supplement Market include Herbalife Nutrition, GNC Holdings, Atkins Nutritionals, and NOW Foods. These companies have gained dominance due to their extensive product portfolios, strong distribution networks, and effective marketing strategies.

04 What are the growth drivers of the North America Weight Loss Supplement Market?

The North America Weight Loss Supplement Market growth drivers include increased awareness of health and fitness, rising obesity rates, and the growing demand for supplements that aid in weight management. The growth of e-commerce platforms and personalized supplements has further contributed to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.