North America Wheat Protein Ingredients Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1398

November 2024

100

About the Report

North America Wheat Protein Ingredients Market Overview

- The North America Wheat Protein Ingredients Market is valued at USD 1 billion, driven by a growing demand for plant-based protein sources among health-conscious consumers. This demand is boosted by increasing vegan and vegetarian diets and the expanding sports nutrition sector, which incorporates wheat protein due to its high nutritional profile. The rise of functional foods and clean label trends further propels the wheat protein market, as manufacturers seek high-protein ingredients with minimal additives.

- The United States and Canada are dominant in the North America Wheat Protein Ingredients Market. The U.S. leads due to its extensive food processing industry and high consumer awareness of dietary supplements and plant-based alternatives. Canadas market strength lies in its robust agricultural sector, which supports raw material supply, and an increasing preference for sustainable protein sources. These factors consolidate both countries positions as market leaders in wheat protein ingredients.

- The FDA Food Safety Modernization Act (FSMA) mandates stringent safety standards, affecting wheat protein processing standards in North America. This legislation requires producers to implement rigorous preventive controls, ensuring consumer safety. FDA records indicate a 15% increase in wheat protein manufacturers seeking FSMA compliance, reflecting the industry's commitment to meeting high safety standards.

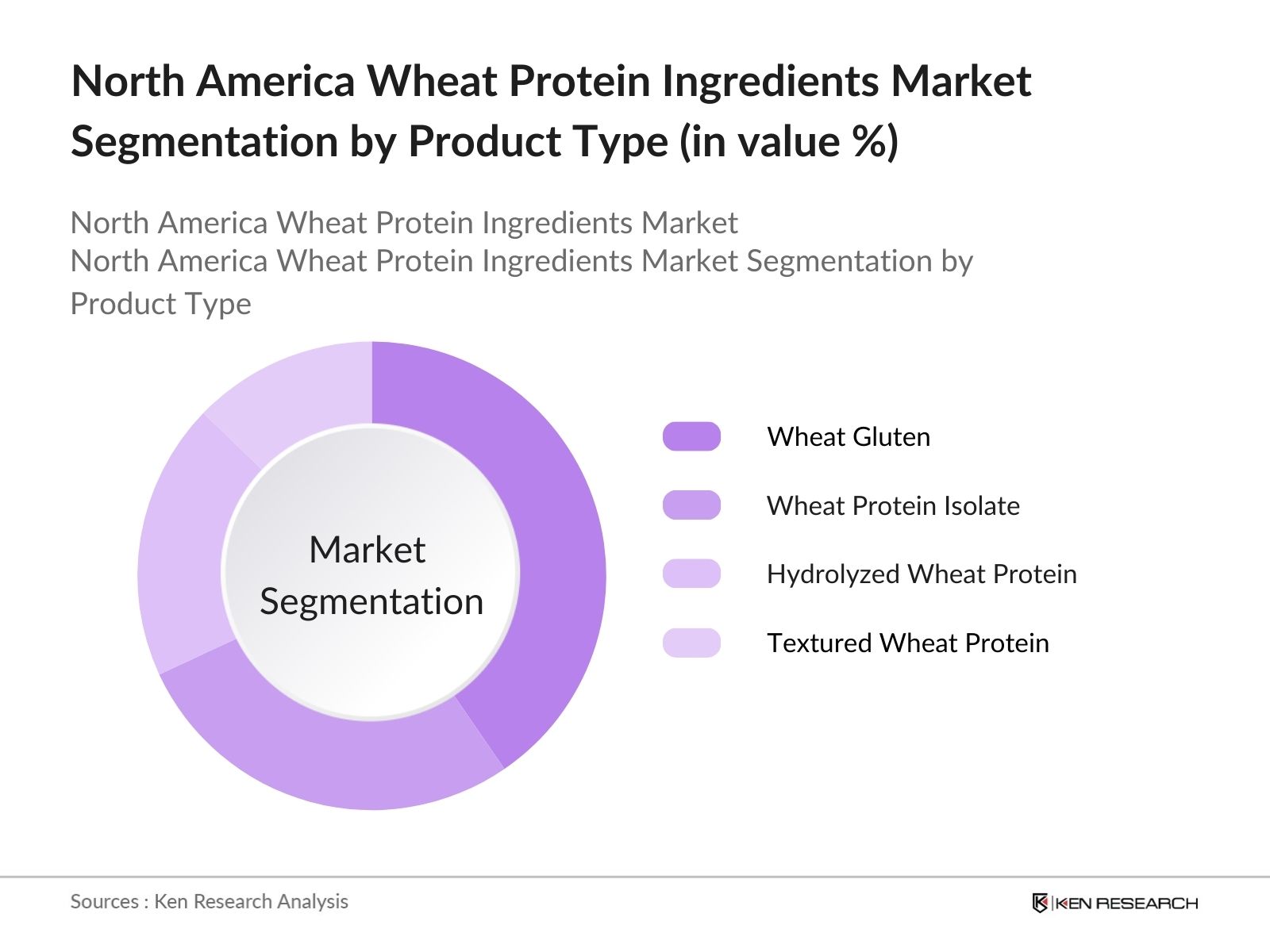

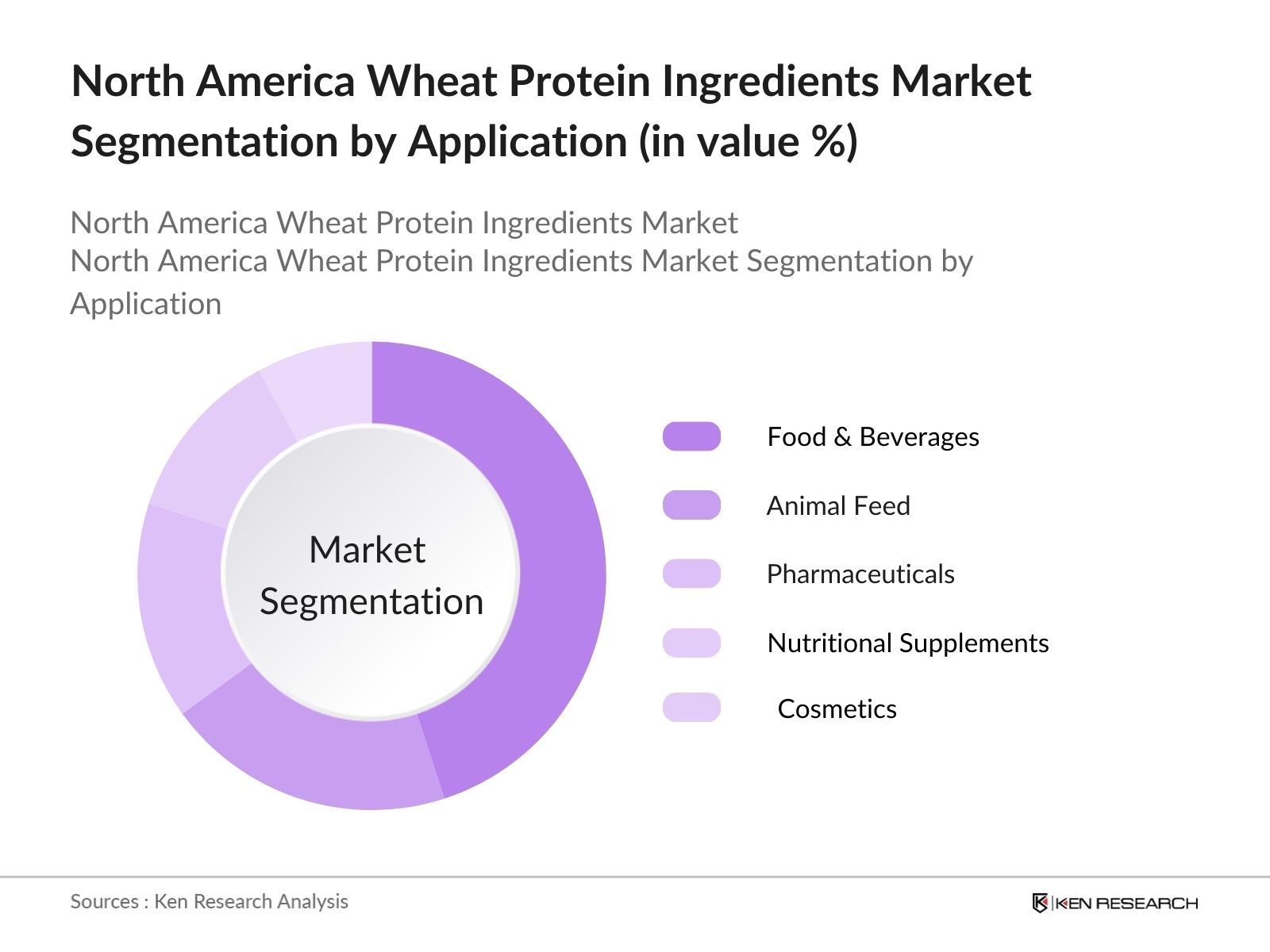

North America Wheat Protein Ingredients Market Segmentation

The North America Wheat Protein Ingredients market is segmented by product type and by application.

- By Product Type: The market is segmented by product type into wheat gluten, wheat protein isolate, hydrolyzed wheat protein, textured wheat protein, and others. Currently, wheat gluten holds a dominant market share due to its high protein concentration and its application across bakery and meat substitute products. Wheat glutens affordability and ease of processing make it a preferred choice among food manufacturers. Additionally, wheat protein isolate is rapidly gaining popularity in the sports nutrition industry for its high protein content and clean label appeal.

- By Application: The market is also segmented by application, including food & beverages, animal feed, pharmaceuticals, nutritional supplements, and cosmetics. The food & beverages segment commands the largest share, driven by the growing use of wheat protein in bakery, confectionery, and meat analog products. Rising awareness of plant-based diets and clean-label products has also contributed to this segment's growth. In the animal feed sector, wheat protein is increasingly favored due to its digestibility and nutritional content.

North America Wheat Protein Ingredients Market Competitive Landscape

The North America Wheat Protein Ingredients Market is characterized by a mix of domestic and international players, with key companies focusing on expanding their production capacities and launching specialized protein ingredients. Established industry leaders maintain their dominance by leveraging vast distribution networks and high R&D investment.

North America Wheat Protein Ingredients Market Analysis

Growth Drivers

- Rising Demand in Nutraceuticals: Wheat protein ingredients are becoming essential in nutraceuticals due to their high-quality amino acid profile, which enhances immune and muscle functions, attracting health-conscious consumers. The nutraceutical sector in North America is booming, with a substantial increase in health supplements consumption in 2024. The U.S. Food and Drug Administration (FDA) reported a 10% rise in demand for dietary supplements, indicating growing interest in functional ingredients like wheat protein to support health. The aging population, comprising around 60 million adults over 65, increasingly drives nutraceutical purchases in the region.

- Increasing Vegan Population: The rise in veganism has heightened the demand for plant-based proteins like wheat protein, which offers a viable protein source without animal derivatives. As of 2024, nearly 10 million people in North America identify as vegan or vegetarian, and plant-based food sales grew by 15%, showing a preference shift from animal to plant-based proteins. Such trends drive wheat proteins growth in food applications, supporting consumer choices for cruelty-free, sustainable diets.

- Health and Wellness Trends: Health and wellness trends have intensified in recent years, with a 12% increase in health-related product sales across North America as of 2024. Wheat protein, known for its benefits in weight management and muscle recovery, aligns with these trends. According to the CDC, almost 40% of adults in North America engage in regular exercise, further driving demand for wheat protein in recovery products. The protein supports the wellness markets goals of balanced diets and muscle maintenance among health-focused consumers.

Market Challenges

- High Production Costs: Wheat protein production requires extensive resources, leading to elevated costs that hinder widespread adoption. The USDA reported an 18% rise in wheat prices in 2023, increasing raw material costs for wheat protein manufacturers. Additionally, energy and processing expenses have surged by 5-7%, further impacting production budgets. These costs present a challenge for manufacturers trying to maintain competitive prices in the market while ensuring product quality.

- Supply Chain Disruptions: The wheat protein industry has faced significant supply chain challenges due to global events impacting agricultural production and transportation. According to the North American Grain Export Association, logistical disruptions led to a 6% delay in wheat supply schedules in early 2024, complicating inventory management for protein ingredient producers. Delays in transportation, compounded by climate-related production impacts, highlight the vulnerability of wheat protein supply chains to external shocks.

North America Wheat Protein Ingredients Market Future Outlook

Over the coming years, the North America Wheat Protein Ingredients Market is anticipated to witness sustained growth driven by increasing demand for sustainable, plant-based protein sources. Consumer inclination towards healthier food choices, along with advancements in wheat protein processing technologies, will continue to shape the markets trajectory. This trend is expected to foster innovation, leading to new product applications and expansion into untapped markets within the region.

Market Opportunities

- Technological Advancements in Processing: Innovative processing technologies are enhancing the quality and efficiency of wheat protein production, opening new growth avenues. A 2024 USDA report highlights increased government funding for food processing technology, which has led to a 10% improvement in production efficiency in North American facilities. These advancements make wheat protein production more feasible and contribute to higher purity levels and improved functional properties, expanding its applicability in various sectors, including bakery and sports nutrition.

- Growing Demand in Sports Nutrition: Sports nutritions growth in North America, with an estimated 50 million active gym-goers, presents an opportunity for wheat protein as a plant-based recovery protein. The FDA reported a 20% rise in protein supplement usage, underscoring the demand for non-animal-based proteins among athletes. Wheat protein, high in glutamine, aligns with sports nutritions goals for muscle recovery and endurance, securing its relevance in this rapidly expanding market.

Scope of the Report

|

||||

|

By Application |

Food & Beverages |

|||

|

By Function |

Emulsification |

|||

|

By Form |

Dry |

|||

|

By Region |

US Mexico Canada Rest |

Products

Key Target Audience

Food & Beverage Manufacturers

Dietary Supplement Companies

Pharmaceutical Companies

Animal Feed Producers

Cosmetic Product Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Sports and Fitness Companies

Companies

Players Mention in the Report:

Archer Daniels Midland

Cargill, Incorporated

Roquette Frres

Tereos

Manildra Group USA

MGP Ingredients, Inc.

Glico Nutrition Co., Ltd.

CropEnergies AG

Crespel & Deiters GmbH & Co. KG

Kerry Group

Krner-Strke GmbH

Royal Ingredients Group

Tereos Syral

Agridient Inc.

BENEO GmbH

Table of Contents

1. North America Wheat Protein Ingredients Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR in the Wheat Protein Sector)

1.4 Market Segmentation Overview

2. North America Wheat Protein Ingredients Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (M&A, Product Launches)

3. North America Wheat Protein Ingredients Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand in Nutraceuticals

3.1.2 Increasing Vegan Population

3.1.3 Health and Wellness Trends

3.1.4 Expansion of Plant-Based Protein Market

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Supply Chain Disruptions

3.2.3 Competition with Alternative Proteins

3.3 Opportunities

3.3.1 Technological Advancements in Processing

3.3.2 Growing Demand in Sports Nutrition

3.3.3 Government Support for Plant Proteins

3.4 Trends

3.4.1 Clean Label and Transparency Demand

3.4.2 Increased Usage in Infant Nutrition

3.4.3 Shift Toward Functional Foods

3.5 Regulatory Landscape

3.5.1 FDA Food Safety Modernization Act Compliance

3.5.2 Labeling Standards

3.5.3 Organic and Non-GMO Certifications

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Producers, Distributors, End Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Wheat Protein Ingredients Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Wheat Gluten

4.1.2 Wheat Protein Isolate

4.1.3 Hydrolyzed Wheat Protein

4.1.4 Textured Wheat Protein

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Food & Beverages

4.2.2 Animal Feed

4.2.3 Pharmaceuticals

4.2.4 Nutritional Supplements

4.2.5 Cosmetics

4.3 By Function (In Value %)

4.3.1 Emulsification

4.3.2 Texturizing

4.3.3 Binding

4.3.4 Film Formation

4.3.5 Others

4.4 By Form (In Value %)

4.4.1 Dry

4.4.2 Liquid

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

4.5.4 Rest of North America

5. North America Wheat Protein Ingredients Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Archer Daniels Midland Company

5.1.2 Cargill, Incorporated

5.1.3 Roquette Frres

5.1.4 Tereos

5.1.5 Manildra Group USA

5.1.6 MGP Ingredients, Inc.

5.1.7 Glico Nutrition Co., Ltd.

5.1.8 CropEnergies AG

5.1.9 Crespel & Deiters GmbH & Co. KG

5.1.10 Kerry Group

5.1.11 Krner-Strke GmbH

5.1.12 Royal Ingredients Group

5.1.13 Tereos Syral

5.1.14 Agridient Inc.

5.1.15 BENEO GmbH

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Reach, Production Capacity, Certifications, R&D Investment, Sustainability Initiatives, Client Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Development, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity & Venture Capital Funding

6. North America Wheat Protein Ingredients Market Regulatory Framework

6.1 Protein Content Labeling Regulations

6.2 Compliance with Allergen Labeling

6.3 Non-GMO and Organic Certifications

6.4 Health and Safety Regulations

7. North America Wheat Protein Ingredients Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Wheat Protein Ingredients Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Function (In Value %)

8.4 By Form (In Value %)

8.5 By Region (In Value %)

9. North America Wheat Protein Ingredients Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Targeted Marketing Strategies

9.3 Market Penetration Insights

9.4 Product Portfolio Diversification Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involves constructing a comprehensive ecosystem map that includes all primary stakeholders within the North America Wheat Protein Ingredients Market. Extensive desk research and a combination of secondary databases are utilized to identify critical variables shaping market dynamics.

Step 2: Market Analysis and Construction

We compile and analyze historical data related to the market, focusing on product penetration, consumption rates across applications, and revenue generation. This stage ensures accurate estimation of the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts and practitioners. This consultation offers valuable insights into operational and financial factors influencing the market, which is essential for refining and corroborating our data.

Step 4: Research Synthesis and Final Output

The final stage involves interaction with key manufacturers to gain insights into specific product segments, sales trends, and consumer preferences. This synthesis process guarantees that our analysis is comprehensive, data-driven, and accurately represents the North America Wheat Protein Ingredients Market.

Frequently Asked Questions

01. How big is the North America Wheat Protein Ingredients Market?

The North America Wheat Protein Ingredients Market was valued at USD 1 billion, fueled by the demand for plant-based proteins across various applications, including food, beverages, and animal feed.

02. What are the main challenges in the North America Wheat Protein Ingredients Market?

Key challenges in North America Wheat Protein Ingredients Market include high production costs, which impact pricing competitiveness, and competition from alternative protein sources such as soy and pea proteins, which are increasingly popular among consumers.

03. Who are the major players in the North America Wheat Protein Ingredients Market?

Leading companies in the North America Wheat Protein Ingredients Market include Archer Daniels Midland, Cargill, Roquette Frres, Tereos, and Manildra Group USA, known for their extensive product portfolios, strong supply networks, and significant market influence.

04. What are the growth drivers of the North America Wheat Protein Ingredients Market?

The North America Wheat Protein Ingredients Market is driven by an increasing preference for plant-based diets, rising demand for sustainable protein ingredients, and a surge in functional foods and sports nutrition products that utilize wheat protein.

05. How does regulation impact the North America Wheat Protein Ingredients Market?

Regulatory standards, such as FDA labeling requirements and certification processes for organic and non-GMO products, significantly influence the market by shaping consumer confidence and product development trends.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.