North American Soup Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD10616

November 2024

86

About the Report

North American Soup Market Overview

- The North American Soup Market, valued at USD 5.6 billion, is driven by increasing consumer demand for convenient, ready-to-eat foods. With growing awareness of health-oriented products, there is a marked shift towards soups that are high in nutrition and low in additives. Key market drivers include the growing popularity of healthy, organic options and the rising trend of plant-based diets. Soup manufacturers have responded by offering innovative products with natural and organic ingredients, significantly contributing to the market's value.

- Key cities across the United States and Canada, particularly New York, Los Angeles, and Toronto, dominate the North American Soup Market due to their high population density and demand for diverse, health-conscious food options. These cities serve as innovation hubs where product launches and branding strategies have a significant impact, especially among younger, health-conscious consumers seeking convenient food options without compromising quality.

- In the U.S., FDA mandates on food safety have become stringent, requiring clear labeling of ingredients and nutritional content, which affects soup manufacturers. Labeling accuracy is key for consumer trust, and failure to comply can lead to recalls. Canadas CFIA also enforces similar standards, with soup products subject to rigorous inspection for ingredient disclosure and allergen information.

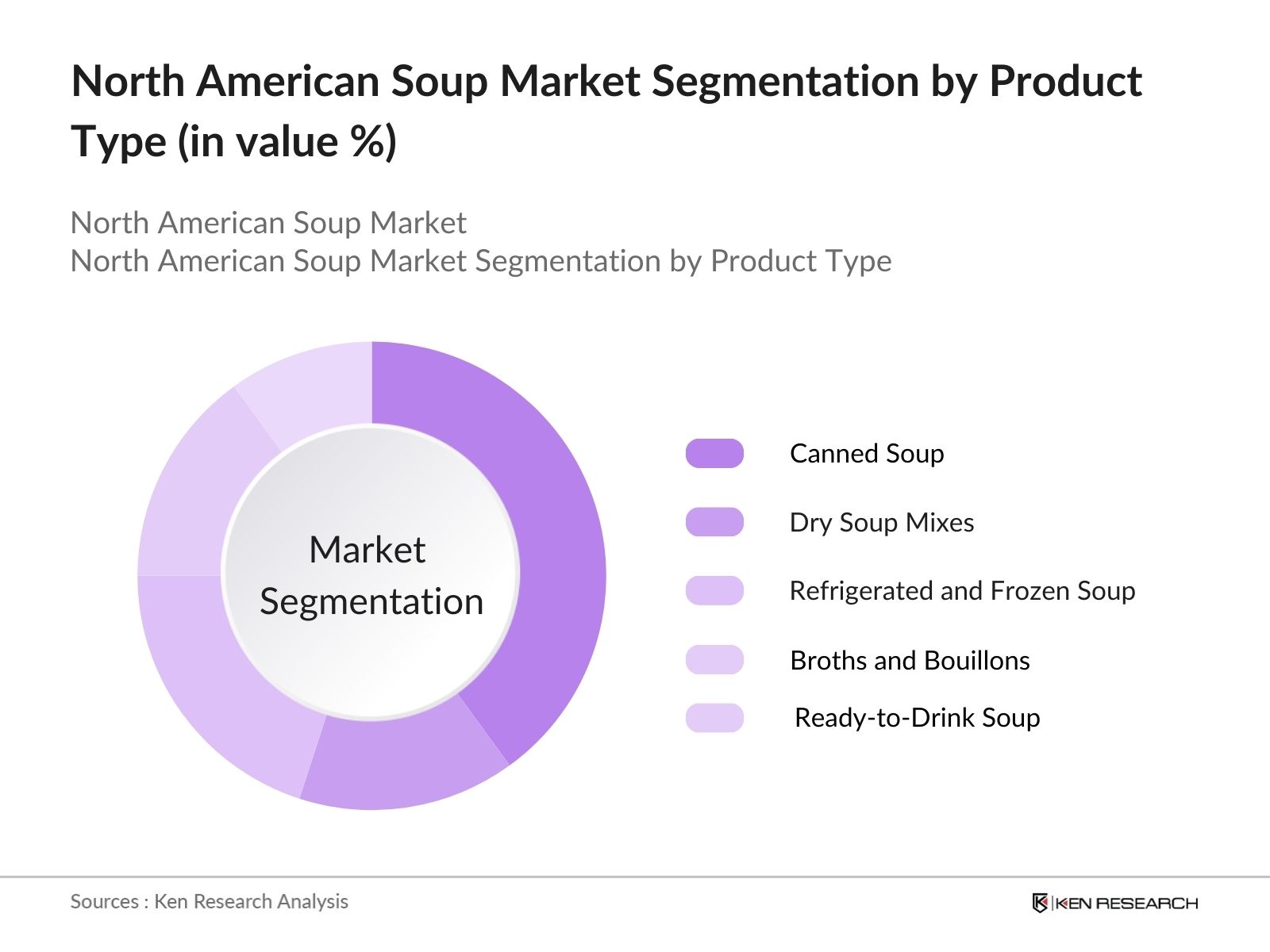

North American Soup Market Segmentation

The North American Soup Market is segmented by product type and by flavor type.

- By Product Type: The North American Soup Market is segmented by product type into canned soup, dry soup mixes, refrigerated and frozen soup, broths and bouillons, and ready-to-drink soup. Canned soup holds a dominant position in this segmentation due to its convenience, extended shelf life, and affordability. Brands like Campbells and Progresso have maintained high consumer loyalty by offering a range of flavors and maintaining a strong retail presence across North America, thereby reinforcing canned soups leading market share.

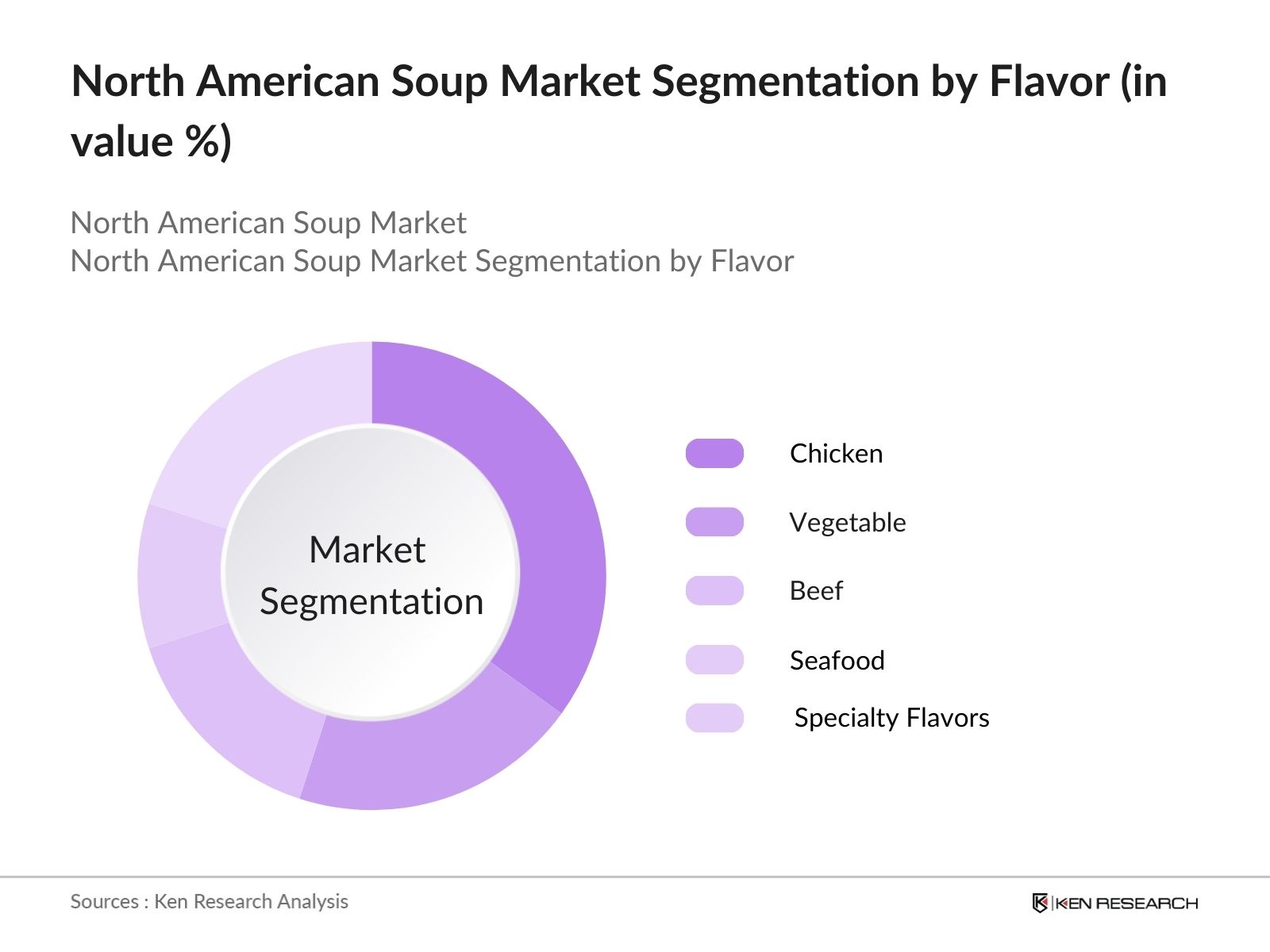

- By Flavor: The market segmentation by flavor includes chicken, vegetable, beef, seafood, and specialty flavors. Chicken-flavored soups dominate the market, thanks to their universal appeal, comforting taste, and popularity among all age groups. This flavors continued relevance is maintained by the versatile range of chicken soup products available, from traditional recipes to health-focused options that cater to various dietary preferences.

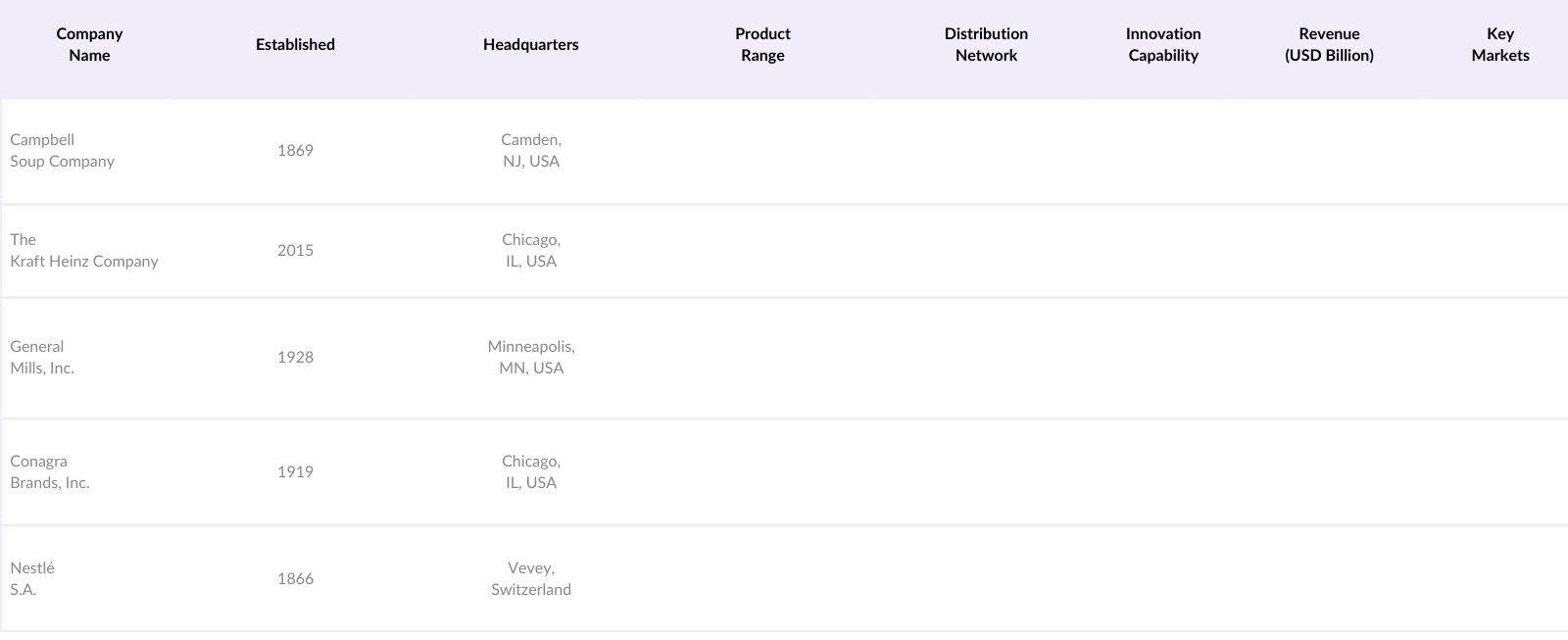

North American Soup Market Competitive Landscape

The North American Soup Market is dominated by a select number of key players, including long-established brands and a few recent entrants focusing on organic and plant-based products. Major players like Campbells, The Kraft Heinz Company, and General Mills have sustained their market influence through robust distribution networks and product innovation tailored to health-conscious consumers.

North American Soup Industry Analysis

Growth Drivers

- Rising Demand for Health-Oriented Products (Product Innovation, Health Consciousness): Growing health consciousness has driven a notable shift in North Americas food landscape, with increasing consumer demand for soups made from natural, preservative-free ingredients. According to the USDAs 2024 report on food consumption patterns, there has been a marked rise in preference for low-calorie, nutrient-rich options, with a 12% increase in purchases of health-labeled products in 2023. Additionally, the FDA has observed that sales of soups labeled high in fiber or low in sodium have grown substantially, reflecting heightened health awareness among consumers.

- Increasing Popularity of Convenience Foods (Consumer Preference)

The North American lifestyles fast pace has made ready-to-eat soups more appealing, with nearly 65% of households reportedly preferring quick meal options overelaborate preparations, according to the U.S. Census Bureaus recent findings. The Food Marketing Institute (FMI) also noted a 20% increase in canned and ready-to-heat soup purchases in 2023, largely due to growing dual-income households. This trend demonstrates how consumer preferences for convenience continue to influence demand, with ready-to-eat soups now a primary choice for time-constrained consumers. - Expanding Online and Retail Distribution Channels: Online sales for grocery items, including soups, have grown sharply, with the USDA reporting a 23% increase in online food purchases in 2023. E-commerce channels have made soup varieties more accessible, especially in remote areas, boosting product reach. Meanwhile, major grocery chains continue to expand their in-store product range, accommodating consumer demand for a wider selection of soups. These distribution trends highlight both the digital and physical markets role in the soup segment's growth

Market Challenges

- Competition from Homemade Alternatives (Home-prepared Soups): A significant challenge for the North American soup market is the popularity of home-cooked meals, with data from the Bureau of Labor Statistics showing a rise in home cooking, especially during winter months. Nearly 58% of Americans reported making soups at home at least once weekly in 2023, valuing control over ingredients. This preference for home-prepared soups limits the ready-to-eat segment's reach, as consumers perceive homemade options as healthier and more cost-effective.

- Price Sensitivity and Brand Loyalty: Consumers' brand loyalty in the North American soup market is heavily influenced by price sensitivity, as indicated by the USDA, which reports that over 40% of buyers switch brands based on price offers and discounts in 2023. Rising ingredient costs have increased the retail prices of many soup products, further influencing consumer purchasing decisions. This trend emphasizes the challenge of retaining loyal consumers in a market where price competitiveness plays a significant role.

North American Soup Market Future Outlook

The North American Soup Market is expected to experience steady growth, driven by rising consumer demand for health-oriented, convenient meal options. Increasing preference for organic and plant-based soups, coupled with product innovation focused on sustainable and minimal packaging, will likely shape the market landscape. Furthermore, the expansion of e-commerce platforms and direct-to-consumer distribution will amplify access to specialty and premium soup products, further expanding the market's reach.

Market Opportunities

- Expansion into Organic and Natural Segments: Organic soups are gaining traction, with USDA reporting a 15% increase in certified organic food production in North America. This growth aligns with consumer demand for clean-label products, particularly among younger demographics. In Canada, organic soup sales are also rising, with CFIA indicating a notable increase in consumer interest in organic certifications for packaged foods. Companies venturing into organic segments have an opportunity to tap into this growing interest.

- Growing Demand for Plant-Based and Vegan Options: With nearly 10 million Americans adopting vegan diets, as reported by the American Dietary Association (ADA), plant-based soups represent a strong growth area. The Canadian Nutrition Society also reports a surge in demand for vegan options, especially those rich in proteins like lentil or chickpea soups. This trend indicates a substantial market for plant-based soups as more consumers seek alternatives to meat-based products.

Scope of the Report

|

Canned Soup Dry Soup Mixes Refrigerated & Frozen Soup Broths & Bouillons Ready-to-Drink Soup |

|

|

By Flavor |

Chicken |

|

By Ingredients |

Supermarkets/Hypermarkets |

|

By Distribution Channel |

Online Offline |

|

By Region |

US Mexico Canada |

Products

Key Target Audience

Retail Chains (e.g., Walmart, Kroger)

Online Retailers (e.g., Amazon, Instacart)

Soup Manufacturers

Health and Wellness Brands

Distribution and Supply Chain Partners

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Packaging Solution Providers

Companies

Players Mention in the Report:

Campbell Soup Company

The Kraft Heinz Company

General Mills, Inc.

Conagra Brands, Inc.

Nestl S.A.

Amys Kitchen, Inc.

Pacific Foods of Oregon, LLC

Unilever

Progresso

Blount Fine Foods

Baxters Food Group

T. Marzetti Company

Bar Harbor Foods

Kettle Cuisine, LLC

The Hain Celestial Group

Table of Contents

1. North American Soup Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Growth Rate, Value, Volume)

1.4. Market Segmentation Overview

2. North American Soup Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North American Soup Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Health-Oriented Products (Product Innovation, Health Consciousness)

3.1.2. Increasing Popularity of Convenience Foods (Consumer Preference)

3.1.3. Influence of Seasonal and Regional Preferences

3.1.4. Expanding Online and Retail Distribution Channels

3.2. Market Challenges

3.2.1. Competition from Homemade Alternatives (Home-prepared Soups)

3.2.2. Price Sensitivity and Brand Loyalty

3.2.3. Challenges with Perishability and Shelf-life

3.3. Opportunities

3.3.1. Expansion into Organic and Natural Segments

3.3.2. Growing Demand for Plant-Based and Vegan Options

3.3.3. Product Customization and Seasonal Variants

3.4. Trends

3.4.1. Increased Demand for Low-sodium, Low-sugar Products

3.4.2. Rising Sales through E-commerce Platforms

3.4.3. Innovative Packaging Solutions (Sustainable Packaging)

3.5. Government Regulation

3.5.1. Food Safety and Labeling Requirements

3.5.2. Nutritional Standards and Health Claims

3.5.3. Import and Export Compliance for Ingredients

3.5.4. Standards for Organic and Non-GMO Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. North American Soup Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Canned Soup

4.1.2. Dry Soup Mixes

4.1.3. Refrigerated and Frozen Soup

4.1.4. Broths and Bouillons

4.1.5. Ready-to-Drink Soup

4.2. By Flavor (In Value %)

4.2.1. Chicken

4.2.2. Vegetable

4.2.3. Beef

4.2.4. Seafood

4.2.5. Specialty Flavors (Regional Variants)

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.3.5. Direct-to-Consumer Platforms

4.4. By Consumer Demographics (In Value %)

4.4.1. Online

4.4.2. Offline

4.4.5. Vegan and Plant-Based Consumers

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North American Soup Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Campbell Soup Company

5.1.2. The Kraft Heinz Company

5.1.3. Conagra Brands, Inc.

5.1.4. Nestl S.A.

5.1.5. General Mills, Inc.

5.1.6. Amys Kitchen, Inc.

5.1.7. Pacific Foods of Oregon, LLC

5.1.8. Unilever

5.1.9. Progresso

5.1.10. Blount Fine Foods

5.1.11. Baxters Food Group

5.1.12. T. Marzetti Company

5.1.13. Bar Harbor Foods

5.1.14. Kettle Cuisine, LLC

5.1.15. The Hain Celestial Group

5.2. Cross Comparison Parameters (Product Range, Production Capacity, Market Presence, Revenue, Market Strategy, Distribution Network, Brand Recognition, Innovation Capability)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North American Soup Market Regulatory Framework

6.1. Food and Drug Administration (FDA) Standards

6.2. Nutritional Labeling Regulations

6.3. Organic and Non-GMO Certification Requirements

6.4. Import/Export Compliance for Ingredients

7. North American Soup Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North American Soup Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. North American Soup Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out the ecosystem of the North American Soup Market, identifying critical stakeholders such as major soup brands, distributors, and retailers. Initial data is gathered through secondary research, utilizing established databases and proprietary resources to set the foundation for the market analysis.

Step 2: Market Analysis and Construction

Historical data is then compiled to examine revenue generation, consumer preferences, and product penetration. Data accuracy is prioritized by cross-referencing multiple reliable sources to construct a robust view of market trends, including segment-specific insights and growth areas.

Step 3: Hypothesis Validation and Expert Consultation

The gathered data and market hypotheses are validated through direct consultations with industry experts. These insights are gathered through structured interviews, offering real-time perspectives on consumer behavior, product innovation, and regional market nuances.

Step 4: Research Synthesis and Final Output

The concluding stage synthesizes all validated data into a comprehensive analysis. This stage combines the insights from all stages, producing an in-depth and accurate depiction of the North American Soup Market's dynamics.

Frequently Asked Questions

01. How big is the North American Soup Market?

The North American Soup Market was valued at USD 5.6 billion, driven by the increasing demand for convenient, healthy meal options among diverse consumer groups.

02. What are the challenges in the North American Soup Market?

The North American Soup Market faces challenges such as competition from homemade alternatives, regulatory hurdles in product labeling, and fluctuating raw material prices impacting profitability.

03. Who are the major players in the North American Soup Market?

Key players in North American Soup Market include Campbell Soup Company, The Kraft Heinz Company, General Mills, Inc., and Conagra Brands, who dominate due to strong brand presence and extensive distribution networks.

04. What drives the growth of the North American Soup Market?

North American Soup Market Growth is driven by rising health consciousness, increased demand for organic and low-sodium options, and the convenience factor appealing to fast-paced urban lifestyles.

05. What trends are shaping the North American Soup Market?

Trends in North American Soup Market include a shift towards plant-based and organic soups, the rise of e-commerce channels, and innovative, eco-friendly packaging solutions.

06. Which flavors are most popular in the North American Soup Market?

Chicken flavor is the most popular, followed by vegetable and beef, reflecting a preference for traditional, comforting flavors among North American consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.