Oman E-commerce Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD925

July 2024

92

About the Report

Oman E-commerce Market Overview

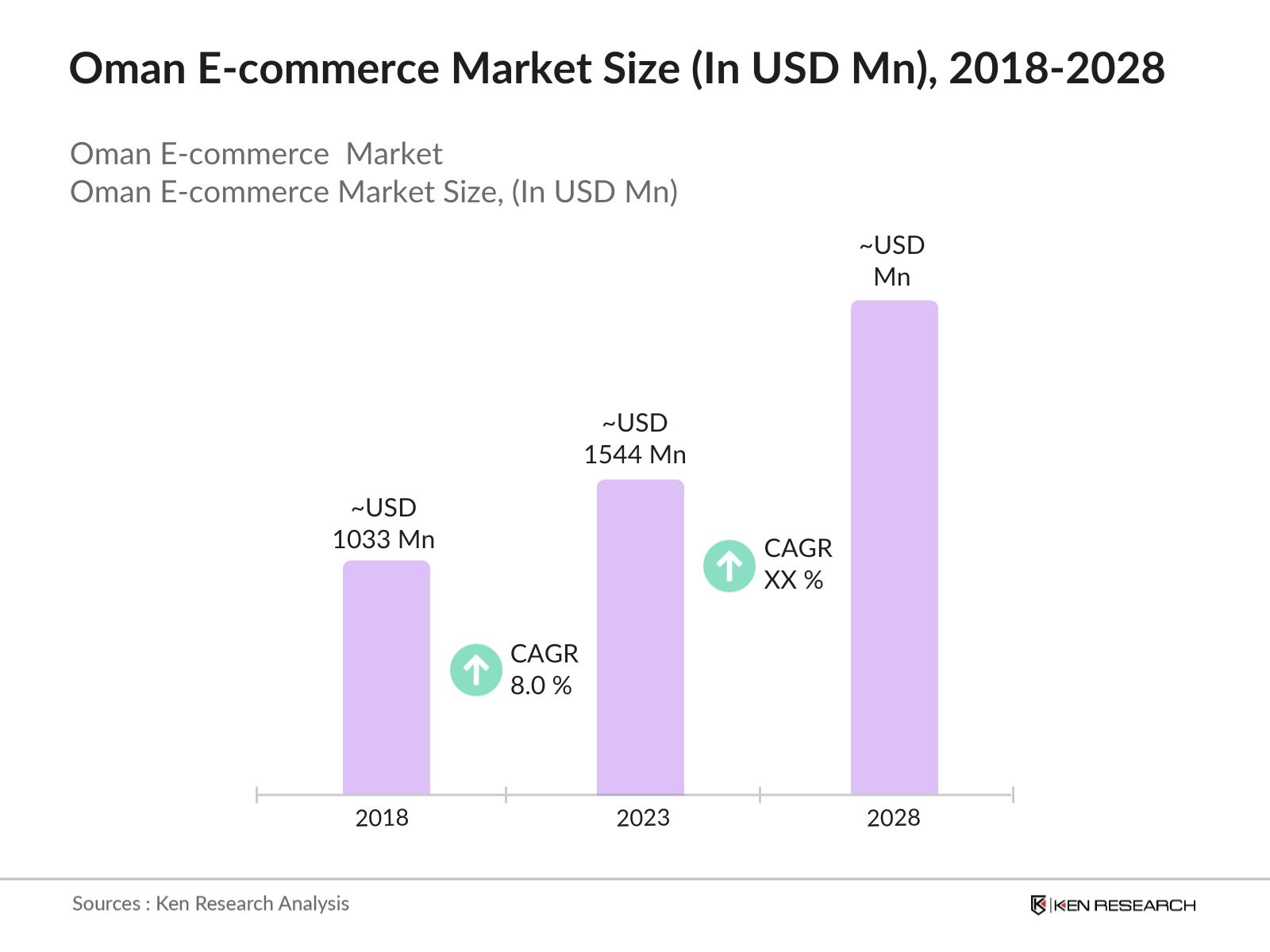

- The e-commerce market in Oman is valued USD 1544 million in 2023. This growth is primarily driven by increased internet penetration, rising smartphone usage, and a shift in consumer behaviour towards online shopping. Government initiatives promoting digital transformation and the development of online payment systems have also played significant roles in expanding the market.

- In 2018, the Omani e-commerce market was valued at USD 1033 million. The market has experienced significant growth due to advancements in logistics, improved digital infrastructure, and the growing middle-class population.

- The market is moderately fragmented with several key players in the market include Souq.com (now Amazon), eBay, Namshi, Noon, and local platforms like Akeed and Talabat. These companies dominate due to their wide product ranges, efficient delivery services, and strong brand recognition.

- A significant development in Oman’s logistics sector in 2023, it involved the inauguration of a new logistics facility at Muscat International Airport. This facility aims to enhance logistical capabilities in the region, improve delivery efficiency, and create new job opportunities, contributing to economic growth and community development in Oman.

Oman E-Commerce Market Analysis

- As of 2023, Oman boasts over 4.8 million internet users and approximately 4 million smartphone users, significantly boosting access to online shopping platforms. This widespread connectivity is further supported by substantial investments in high-speed internet and advanced mobile networks, driving the growth of e-commerce and digital services in the country. These developments facilitate a more connected and tech-savvy population.

- The growth of e-commerce in Oman has led to the proliferation of new businesses, job creation, and the evolution of traditional retail models. It has also driven demand for improved logistics and supply chain management, fostering partnerships between local and international players.

- The Muscat Governorate is the dominant region in the Omani e-commerce market, accounting for over half of the total market share. This dominance is attributed to its higher population density, better internet infrastructure, and higher income levels compared to other regions.

Oman E-commerce Market Segmentation

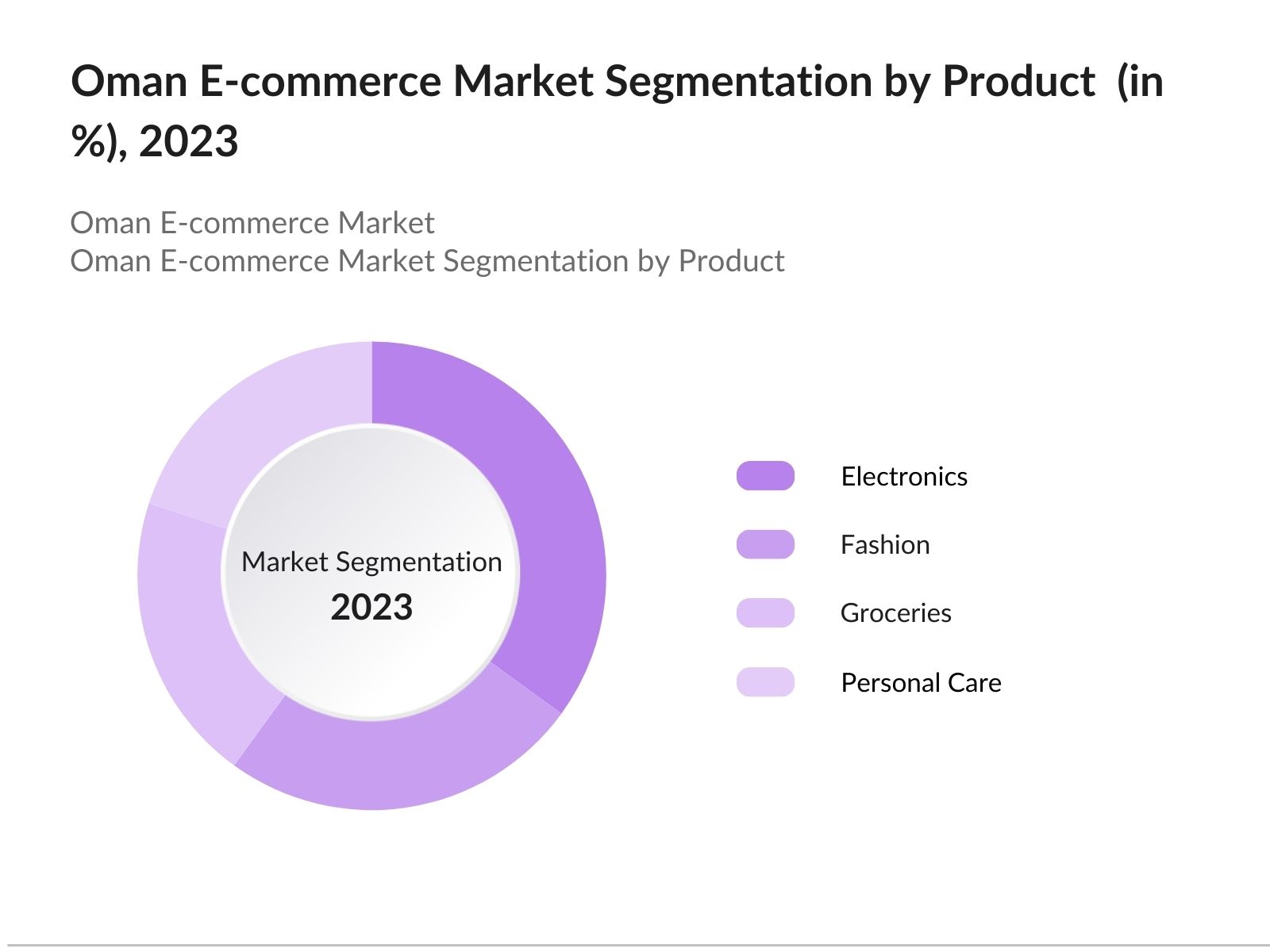

By Product Category: Oman E-commerce market is segmented by product category market into electronics, fashion, Groceries and Personal care. In 2023, Electronics is the dominant segment in Oman E-commerce market. Electronics dominate due to the high demand for gadgets, smartphones, and home appliances. Frequent upgrades and innovations drive this segment.

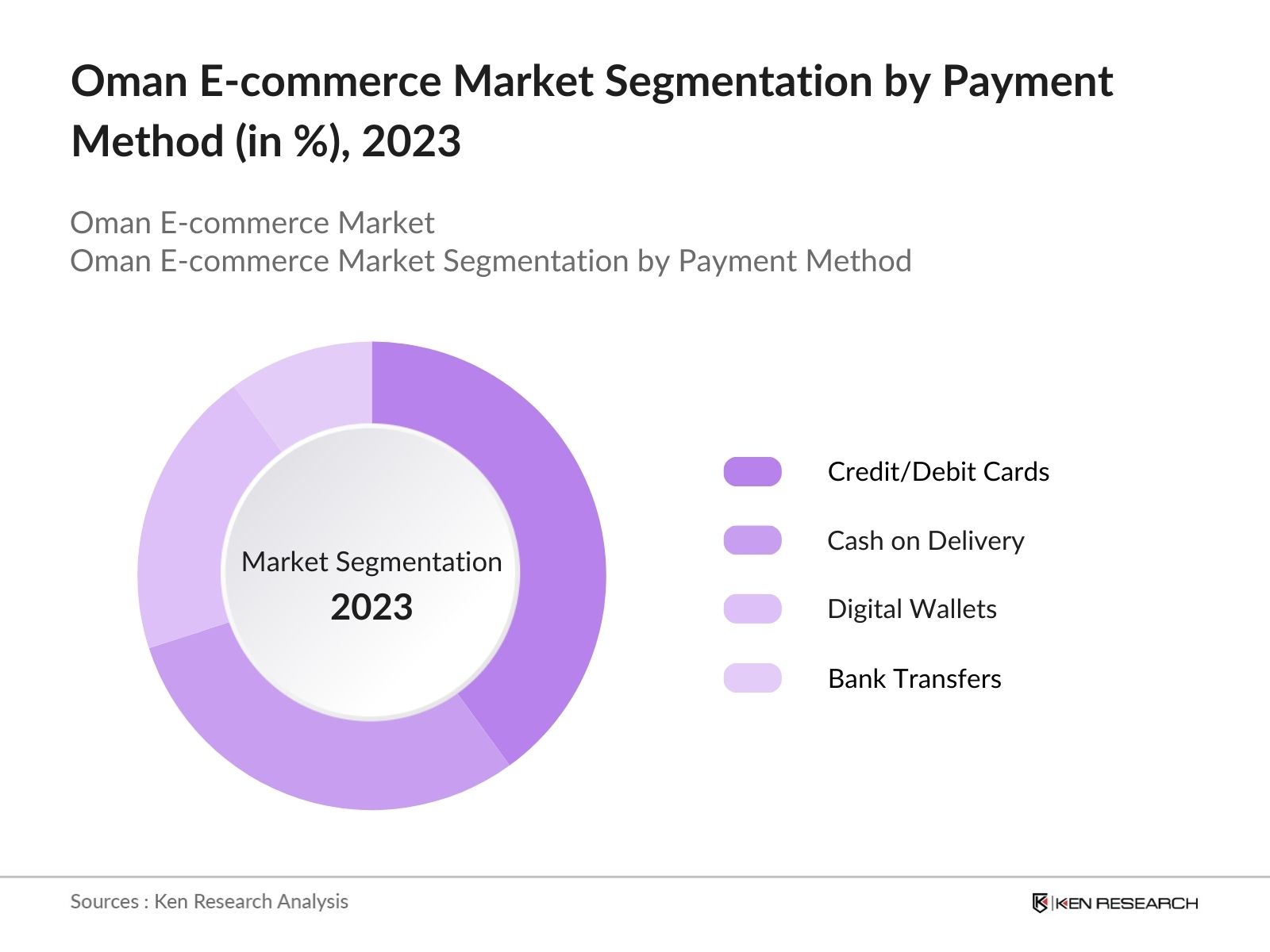

By Payment Method: Oman E-commerce market is segmented by payment method into Credit/Debit Cards, Cash on Delivery, Digital Wallets and Bank Transfers. In 2023, Credit/Debit Cards is the dominant segment in Oman E-commerce market. It is dominant as they are Preferred for security and convenience. Most online platforms support major credit and debit cards.

In Region: The Oman e-commerce market is segmented by region into north, south, west, and east. In 2023, the Northern region is the dominant market due to its higher population density, economic activity, and urbanization, particularly around Muscat, the capital city. This region benefits from better infrastructure, higher income levels, and greater access to technology, which collectively drive the growth of online shopping.

Oman E-commerce Market Competitive Landscape

- Jumia's Partnership with Local Retailers 2022: Jumia has entered into various strategic partnerships with local retailers to expand its product offerings and boost market penetration. For example, Jumia partnered with Coca-Cola in 2022 to provide online shopping for consumers in Africa, significantly increasing the assortment available on the platform

- AI Chatbots for Customer Service 2022: Many e-commerce platforms in Oman introduced AI-powered chatbots in 2022 to enhance customer service. These chatbots provide instant support, answer queries, and assist with transactions, improving the overall customer experience.

- Talabat Partners with Carrefour for Same-Day Grocery Delivery (2024): Talabat, a leading online food and grocery delivery platform in the Middle East, announced a strategic partnership with Carrefour to offer same-day grocery delivery services. This collaboration leverages Carrefour's extensive network of over 250 stores across the region, significantly expanding Talabat's grocery delivery reach and product selection, enhancing convenience for customers.

Oman E-commerce Industry Analysis

Oman E-commerce Market Growth Drivers

- Digital Transformation Initiatives: The Omani government’s Vision 2040 aims to transform the nation into a digital society by heavily investing in digital infrastructure. These investments include expanding high-speed internet coverage and enhancing mobile networks, which have resulted in over 4.8 million people having internet access by 2023.

- Rising Technological-Savvy Youth Population: Oman has a young and tech-savvy population, with approximately 2 million individuals aged 18-30 as of 2023. This demographic is highly engaged in digital platforms and prefers online shopping due to convenience and access to a wider range of products.

- Advancements in Payment Systems: The introduction and adoption of secure online payment systems have boosted consumer confidence in e-commerce. In 2022, the Central Bank of Oman reported a 30% increase in the use of digital payment methods, including credit/debit cards and mobile wallets.

Oman E-commerce Market Challenges

- Logistics and Delivery Issues: Oman’s geographic and infrastructural challenges pose significant hurdles to efficient logistics and delivery services. The country’s vast desert regions and underdeveloped road networks in some areas lead to higher transportation costs and longer delivery times.

- Regulatory Barriers: Stringent regulations on online transactions and imports can impede the growth of the e-commerce market. For instance, the 2021 introduction of new customs duties and import regulations has increased the cost and complexity of importing goods for online retailers. These regulatory barriers can limit the availability of international products and increase operational costs for e-commerce businesses.

- Cybersecurity Concerns: With the rise in online transactions, cybersecurity has become a critical concern. Oman has witnessed a 25% increase in reported cyberattacks targeting e-commerce platforms between 2020 and 2023. These security threats can undermine consumer trust and deter them from engaging in online shopping.

Oman E-commerce Government Initiatives

- E-Payment Regulations 2021: In 2021, the Central Bank of Oman introduced new e-payment regulations to streamline and secure online payments. These regulations have facilitated the adoption of digital payment methods, ensuring safer and more efficient transactions.

- SME Development Programs 2022: In 2022, the Omani government introduced several pivotal programs to bolster SMEs within the e-commerce sector. One of these initiatives, the "E-commerce Support Program," focuses on providing financial aid, training, and essential resources to SMEs aiming to establish and expand their online footprint. This initiative is complemented by the "Digital Transformation Fund," which supports SMEs in adopting digital technologies crucial for enhancing their competitiveness in Oman's evolving e-commerce landscape.

Oman E-commerce Market Future Outlook

The Oman e-commerce market is projected to continue its robust growth, driven by technological advancements, increased internet penetration, and favorable government policies. Innovations in logistics and payment systems will further propel market expansion.

Future Market Trends

-

- Rise of E-Commerce: With over 4 million people using smartphones in 2023, the penetration of these devices is set to further revolutionize mobile commerce (m-commerce). As mobile technology advances and more mobile-friendly e-commerce platforms are developed, consumers will be increasingly relying on mobile devices to browse and purchase products online.

- Enhanced Sustainability Focus: By 2028, consumer demand for eco-friendly products and sustainable business practices will drive e-commerce platforms to adopt comprehensive green initiatives, such as zero-waste packaging, renewable energy usage, and carbon-neutral delivery options. Approximately 70% of online retailers in Oman are expected to implement robust sustainability practices.

- Continued Expansion of Product Categories: The variety of product categories available online will continue to grow, encompassing an even broader range of goods and services. By 2028, the Omani e-commerce market will see a significant increase in the availability of niche products, including organic foods, specialty pharmaceuticals, and personalized home services.

Scope of the Report

|

By Product Category |

Electronics Fashion Groceries Personal Care |

|

By Payment Method |

Credit/Debit Cards Cash on Delivery Digital Wallets Bank Transfers |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Logistics companies

E-commerce Agencies

Digital Marketers

Brand Managers

Advertising Technology Providers

Banks and Financial Institutions

Government and Regulatory Authorities (Public Authority for Consumer Protection (PACP), Oman Chamber of Commerce and Industry (OCCI) and others)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report: Â

Amazon (Souq.com)

Noon

Namshi

eBay

Akeed

Talabat

Aliexpress

Alibaba

Kenzz

Jumia

Mumzworld

Carrefour

Lulu Hypermarket

Jarir Bookstore

Awok

Sprii

Wadi

Elabelz

Fordeal

Ounass

Table of Contents

1. Oman E-commerce Market Overview

1.1 Oman E-commerce Market Taxonomy

2. Oman E-commerce Market Size (in USD Bn), 2018-2023

3. Oman E-commerce Market Analysis

3.1 Oman E-commerce Market Growth Drivers

3.2 Oman E-commerce Market Challenges and Issues

3.3 Oman E-commerce Market Trends and Development

3.4 Oman E-commerce Market Government Regulation

3.5 Oman E-commerce Market SWOT Analysis

3.6 Oman E-commerce Market Stake Ecosystem

3.7 Oman E-commerce Market Competition Ecosystem

4. Oman E-commerce Market Segmentation, 2023

4.1 Oman E-commerce Market Segmentation by Product Category (in %), 2023

4.2 Oman E-commerce Market Segmentation by Payment Method (in %), 2023

4.3 Oman E-commerce Market Segmentation by Region (in %), 2023

5. Oman E-commerce Market Competition Benchmarking

5.1 Oman E-commerce Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Oman E-commerce Market Future Market Size (in USD Bn), 2023-2028

7. Oman E-commerce Market Future Market Segmentation, 2028

7.1 Oman E-commerce Market Segmentation by Product Category (in %), 2028

7.2 Oman E-commerce Market Segmentation by Payment Method (in %), 2028

7.3 Oman E-commerce Market Segmentation by Region (in %), 2028

8. Oman E-commerce Market Analysts’ Recommendations

8.1 Oman E-commerce Market TAM/SAM/SOM Analysis

8.2 Oman E-commerce Market Customer Cohort Analysis

8.3 Oman E-commerce Market Marketing Initiatives

8.4 Oman E-commerce Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 01: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 02: Market Building:

Collating statistics on Oman E-commerce Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Oman E-commerce Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 03: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 04: Research output:

Our team will approach multiple retail companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from E-commerce companies.Â

Frequently Asked Questions

01 How big is e-commerce market in Oman?

The e-commerce market in Oman was valued at USD 1033 billion in 2018 and in 2023 the market was reached a value of USD 1544 million.

02 Who are the major players in the Omani e-commerce market?

Major players in Oman E-commerce market include Amazon (Souq.com), Noon, Namshi, eBay, Akeed, Talabat, and Carrefour.

03 Which segment dominates the Omani e-commerce market?

In Oman E-commerce market, the product category is the dominant segment which include electronics, fashion, groceries, and personal care products.

04 What are drivers of the e-commerce market in Oman?

Key growth drivers in Oman E-commerce market include increased internet and smartphone penetration, government initiatives, and changing consumer preferences towards online shopping.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.