Philippines Car Rental Market Outlook to 2027

Driven by the increase in tourism and business activities along with deeper internet penetration and adoption of digital services

Region:Asia

Author(s):Navya Dalakoti and Mahika Heda

Product Code:KR1345

July 2023

166

About the Report

The report provides a comprehensive analysis of the potential of the Car Rental industry in Philippines. The report covers an overview and genesis of the industry, and market size in terms of revenue and fleet size.

we are covering five markets in this report – Car Rental, Car Leasing, Ride Sharing, Ride Hailing and Self Drive markets; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

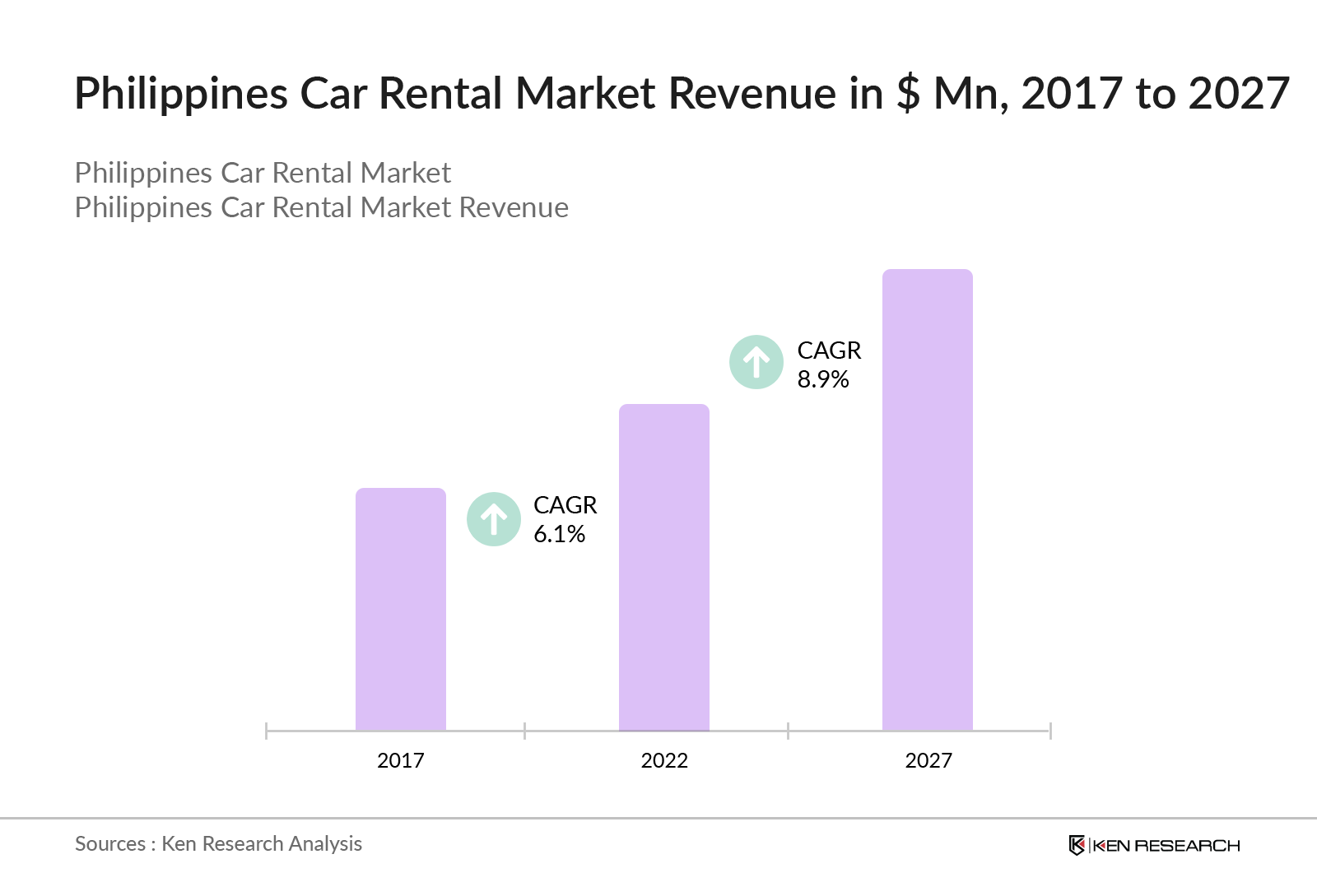

According to Ken Research estimates, the Car Rental Market – which is at $~293.0 Mn in 2022 – is forecasted to grow further into a $ ~ 448.7 Mn by 2027, owing to the expansion of the tourism industry, the increase in internet penetration and adoption of smart phones in the country.

- Leisure travel is estimated to continue being the highest revenue generating segment with the increase in tourism across the country.

- Tourists and Corporate Clients are majority of the customers of the market.

- Players are looking to expand their fleet size to premium cars to offer comfort and luxury to customers.

Key Trends by Market Segment:

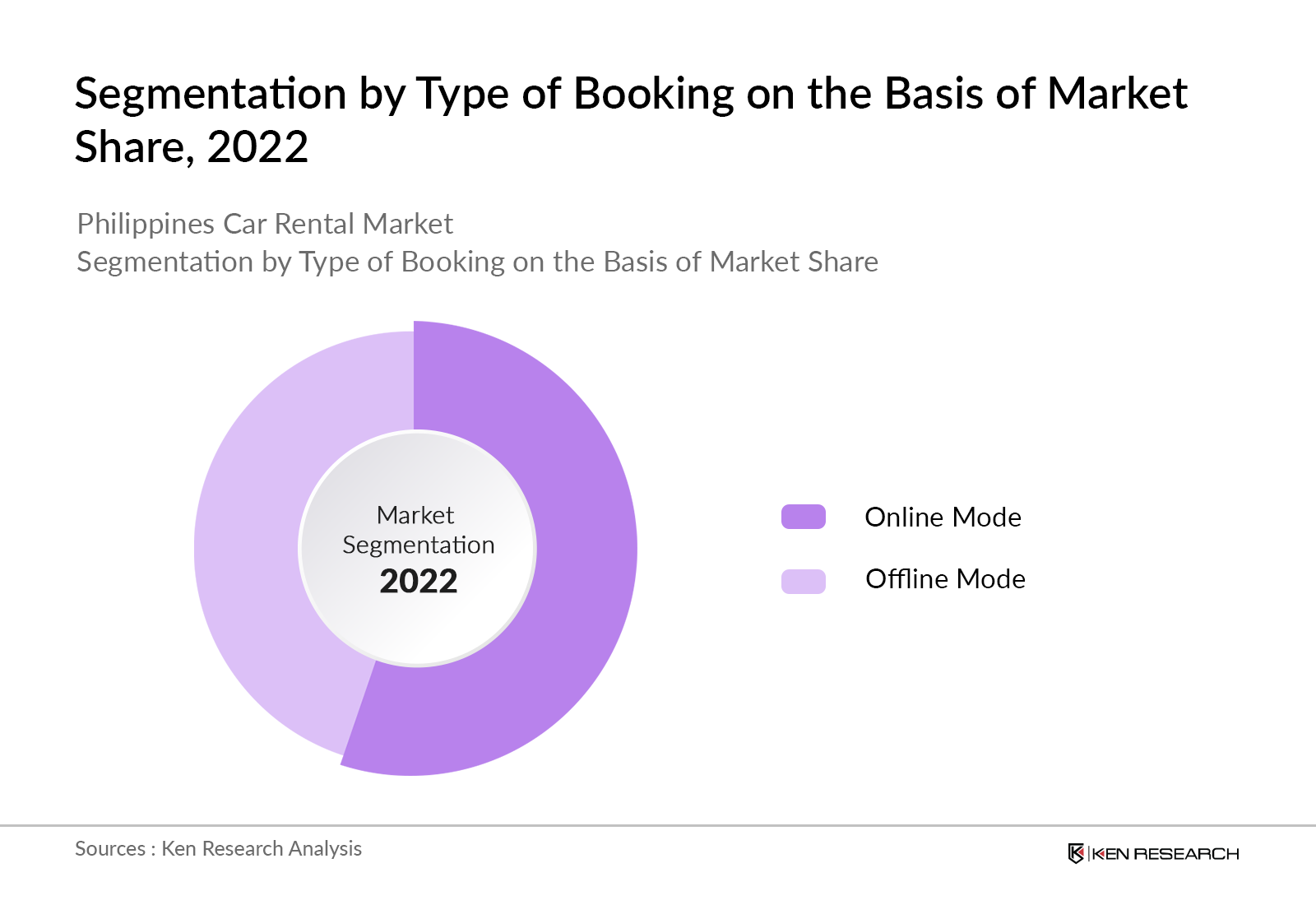

By Type of Booking: In the last few years, the mode of booking for car rental services has shifted to online platforms with 60% bookings being made online. This can be attributed to the increasing internet penetration and familiarity of online bookings across the country.

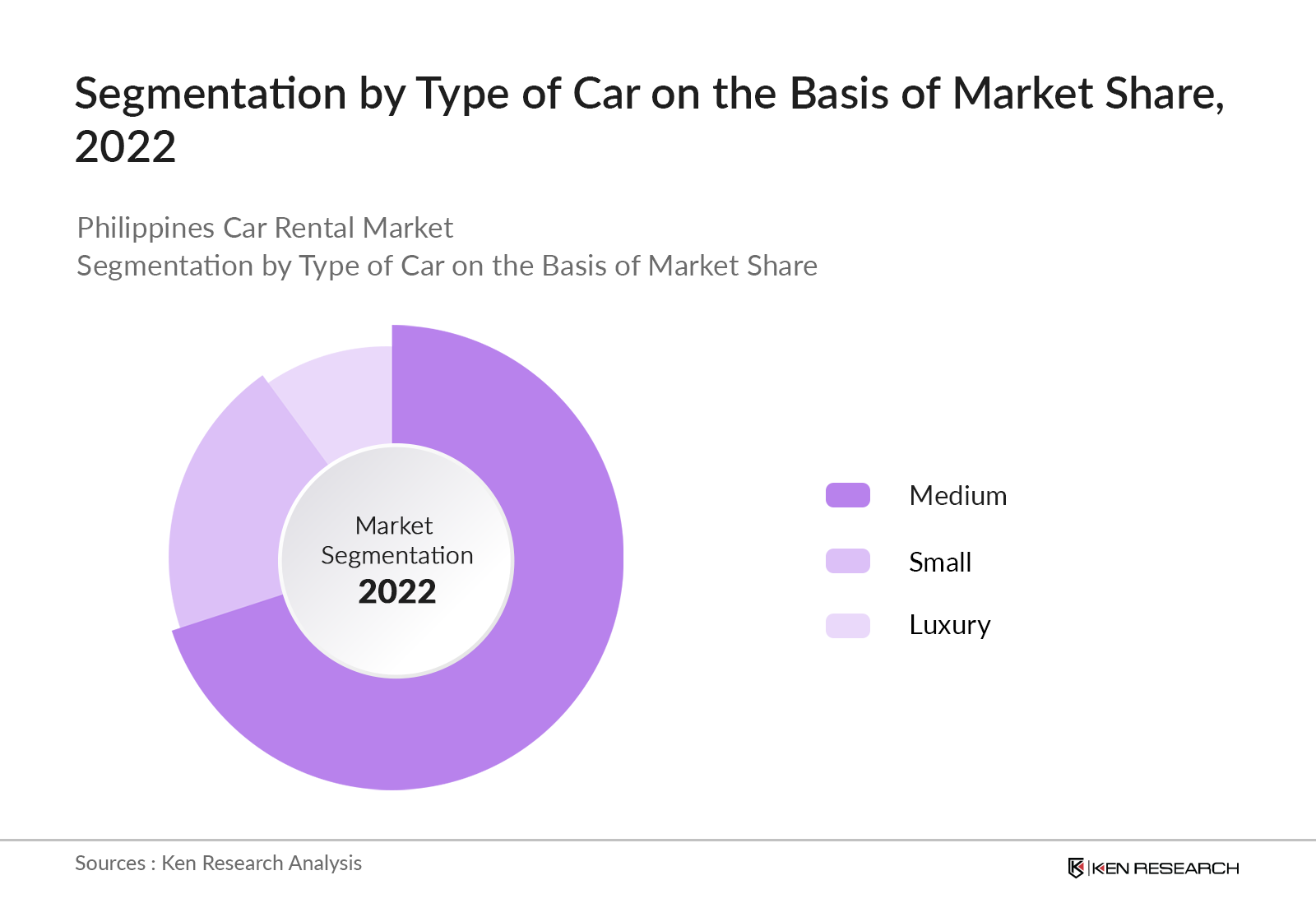

By Type of Car: Medium sized cars are the most preferable type of cars by people as it is comfortable and affordable. It is also convenient for tourists as they have luggage to carry as well.

Competitive Landscape

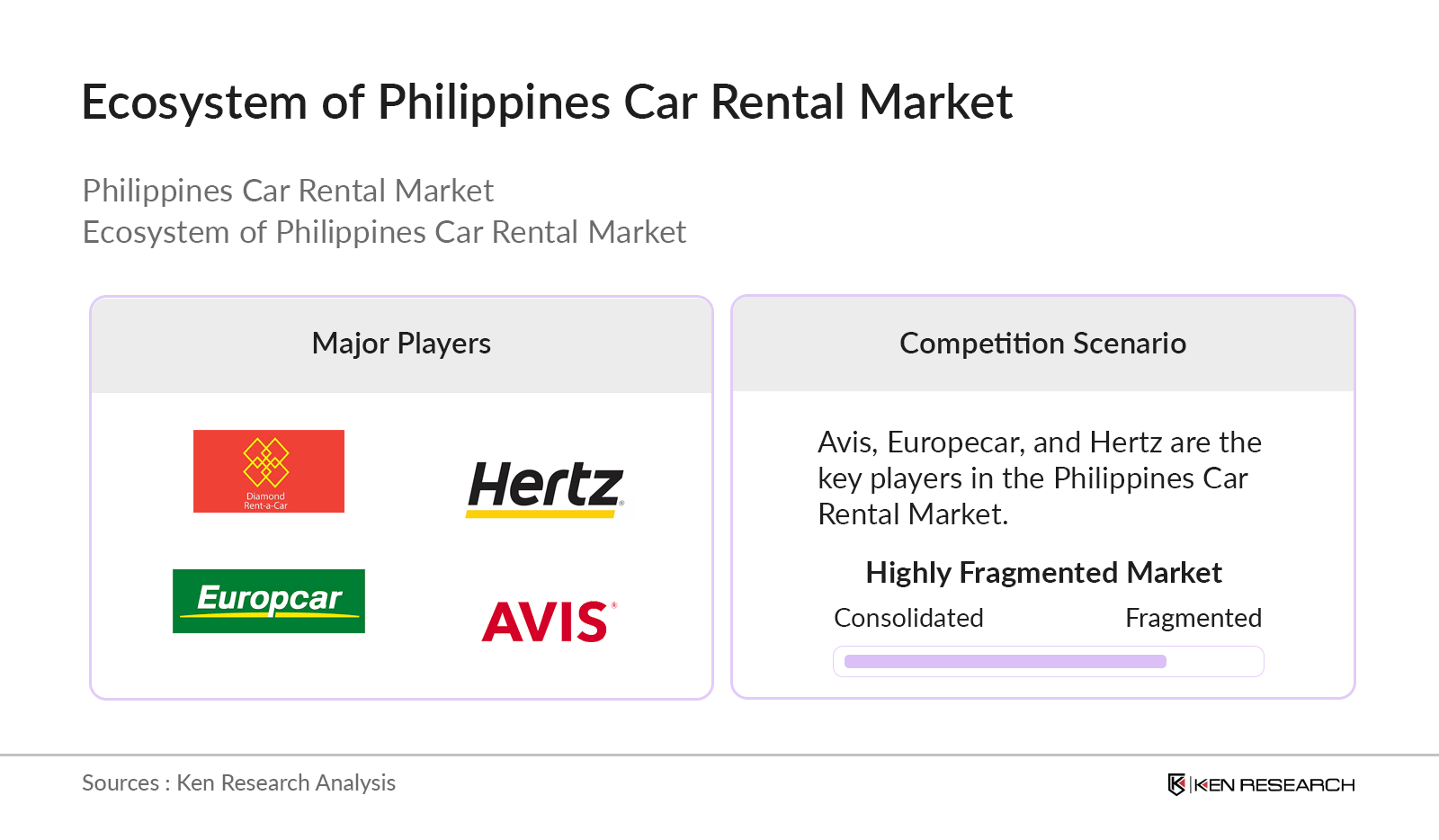

The Philippines Market is highly fragmented with multiple players competing on the basis of fleet size, rental fee charged and quality of vehicles among others. Avis, one of the oldest companies in this market, has managed to remain the market leader with the highest market share of 4.60%.

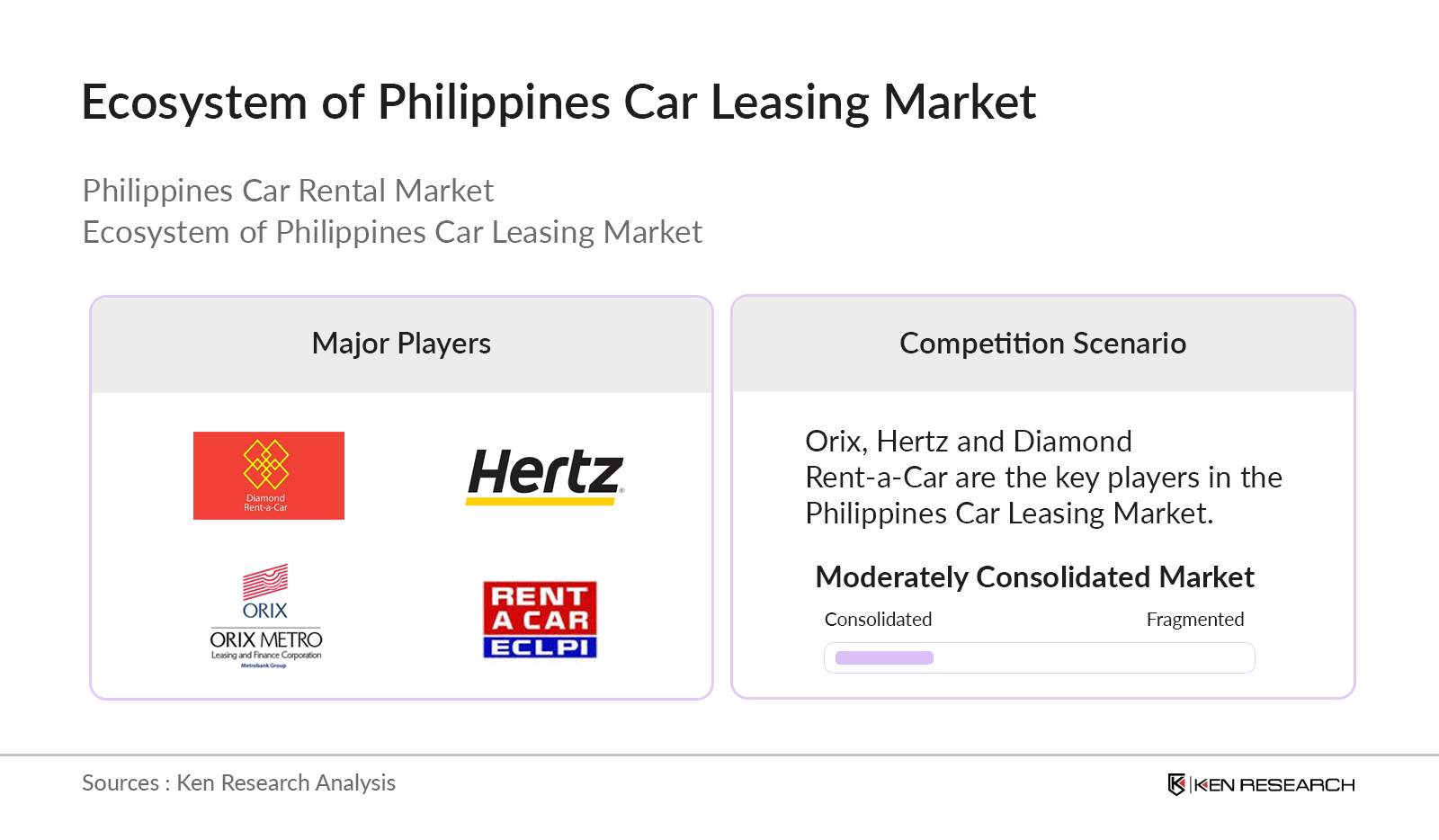

Philippines Car Leasing Market is consolidated with Orix capturing 75% of the leasing market in Philippines. Other players include Hertz, Diamond Rent-a-Car and ECLPI among others.

Philippines Ride Hailing Market is highly consolidated with Grab capturing 93% of the hailing market in Philippines. With the acquisition of Uber by Grab in Philippines in 2018, Grab has captured the ride hailing market, leaving very less for the remaining players. Other players include Joyride app and others.

Scope of the Report

|

Philippines Car Rental Market |

|

|

By Type of Car |

Small Cars(PHP 3500-7500 / Per trip) Medium(PHP 3500-7500 / Per trip) Luxury(PHP 7500+) |

|

By Type of Booking |

Online Offline |

|

By Purpose |

Leisure Business |

|

Philippines Car Leasing Market |

|

|

By Type of Region |

Manila Luzon Visayas Mindanao |

|

By Time Duration |

1 year 2 year 3 year 4 or more year |

|

By Vehicle Price Range |

Economical (PHP 20000-35000 Mid-Range (PHP 35000-50000) Premium (PHP 50000+) |

|

By Type of End User |

Corporate Retail Individuals |

|

Philippines Ride Hailing Market |

|

|

By Type of Region |

Metropolitan Non Metropolitan |

|

Philippines Ride Sharing Market |

|

|

By Point of Service |

Rest Area At Airport |

|

By Type of Car |

Sedan SUV |

|

By Type of Distance |

Short distance Long distance |

|

Philippines Self-Drive Car Rental Market |

|

|

By Type of Region |

Metro cities Non metro cities |

|

By Type of Booking Channel |

Online Offline |

|

By Usage |

Intercity Intracity |

|

By Time Period |

1-2 days A week A month |

|

By Type of Car |

Standard(PHP 1000-4000/24hours) Luxury(PHP 1500+ / per hour) |

|

By Type of Booking Period |

Weekend Weekdays |

|

By Segment of Car |

Standard luxury |

|

By Status of Ownership |

Owned Leased |

|

By Point of Service |

At Airport Rest area |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Car Rental Service Providers

Car Rental Companies aiming to establish in Philippines

Philippines’s automotive industries

Government Bodies & Regulating Authorities

Venture Capitalist targeting the car rental market

Automotive industry association

Car Manufacturers

Existing Car Rental Companies

OEM Dealerships

New Market Entrants

Investors

Car Rental Associations

Time Period Captured in the Report

Historical Period: 2017-2022

Base Period: 2022

Forecast Period: 2022P-2027

Companies

Major Players Mentioned in the Report

Car Rental

Diamond Rent-a-Car

Luxicar

Voyg

Rent a Car ECLPI

Avis

Hertz

SafeRide

Self-Drive

Europcar

Thrifty

Juzzr Car Rental

Hertz

Voyg

SafeRide

VPI

Ride Hailing

Grab

JoyRide

Hirna

Maxim

Ride Sharing

Grab

Hirna

Car Leasing

Orix

Avis

Diamond Rent-a-Car

Europcar

Herts

ECLPI Rent a Car

Table of Contents

1. Executive Summary

1.1 Executive Summary: Philippines Car Rental Market

1.2 Executive Summary: Philippines Car Leasing Market

1.3 Executive Summary: Philippines Ride Hailing Market

1.4 Executive Summary: Philippines Ride Sharing Market

1.5 Executive Summary: Philippines Self-Drive Car Rental Market

2. Country Overview of Philippines

2.1 Socio-Demographic Outlook of Philippines

2.2 Economic Landscape and Internet Penetration of Philippines

3. Philippines Overall Car Rental Market Overview

3.1 Ecosystem of Philippines Car Rental Market

4. Philippines Overall Car Rental Market Industry Analysis Overview

4.1 Trends and Developments

4.2 SWOT Analysis

4.3 Regulatory Landscape

5. Philippines Car Rental Market

5.1 Market Size on the basis of Revenue and Volume of Fleet Size, 2017-2022

5.2 Market Segmentation by Type of Booking

5.3 Market Segmentation by Type of Car

5.4 Market Segmentation by Purpose

5.5 Industry Analysis: Issues and Challenges

5.6 Industry Analysis: Impact of Covid’19

5.7 Competitive Landscape: Market Share of Companies

5.8 Competitive Landscape: Gartner’s Magic

5.9 Competitive Landscape: Cross Comparison

5.10 Competitive Landscape: Strength and Weakness of Major Players

5.11 Future Outlook: Market Size by Revenue and Volume of Fleet Size, 2022-2027

5.12 Future Outlook: Market Segmentation by Type of Car

5.13 Future Outlook: Market Segmentation by Purpose

5.14 Future Outlook: Market Segmentation by Type of Booking

6. Philippines Car Leasing Market

6.1 Market Segmentation by Type of Time Duration

6.2 Market Segmentation by Type of Car

6.3 Market Segmentation by Type of End User

6.4 Competitive Landscape: Market Share of Companies

6.5 Competitive Landscape: Gartner’s Magic

6.6 Competitive Landscape: Cross Comparison

6.7 Competitive Landscape: Strength and Weakness of Major Players

6.8 Future Outlook: Market Size by Revenue and Volume of Fleet Size, 2022-2027

6.9 Future Outlook: Market Segmentation by Type of Region

6.10 Future Outlook: Market Segmentation by Time Duration

6.11 Future Outlook: Market Segmentation by Type Car

6.12 Future Outlook: Market Segmentation by Type of End-User

7. Philippines Ride Hailing Market

7.1 Market Segmentation by Type of Region

7.2 Industry Analysis: Growth Drivers

7.3 Industry Analysis: Issues and Challenges

7.4 Industry Analysis: Regulatory Landscape

7.5 Competitive Landscape: Market Share of Companies

7.6 Competitive Landscape: Cross Comparison

7.7 Competitive Landscape: Strength and Weakness of Major Players

7.8 Future Outlook: Market Size by Revenue and Volume of Fleet Size, 2022-2027

7.9 Future Outlook: Market Segmentation by Type of Region

8. Philippines Ride Sharing Market

8.1 Market Segmentation by Point of Service

8.2 Market Segmentation by Type of Car

8.3 Market Segmentation by Type of Distance

8.4 Industry Analysis: Growth Drivers

8.5 Industry Analysis: Issues and Challenges

8.6 Industry Analysis: Regulatory Landscape

8.7 Industry Analysis: Impact of Covid’19

8.8 Competitive Landscape: Market Share of Companies

8.9 Competitive Landscape: Cross Comparison

8.10 Future Outlook: Market Size by Revenue and Volume of Fleet Size, 2022-2027

8.11 Future Outlook: Market Segmentation by Point of Service

8.12 Future Outlook: Market Segmentation by Type of Distance

8.13 Future Outlook: Market Segmentation by Type of Car

9. Philippines Self-Drive Car Rental Market

9.1 Market Segmentation by Type of Region

9.2 Market Segmentation by Type of Booking Channel

9.3 Market Segmentation by Type of Usage

9.4 Market Segmentation by Time Period

9.5 Market Segmentation by Type of Car

9.6 Market Segmentation by Type of Booking Period

9.7 Market Segmentation by Type of Car Segmentation

9.8 Market Segmentation by Status Ownership

9.9 Market Segmentation by Point of Service

9.10 Industry Analysis: Issues and Challenges

9.11 Industry Analysis: Impact of Covid’19

9.12 Competitive Landscape: Market Share of Companies

9.13 Competitive Landscape: Gartner’s Magic

9.14 Competitive Landscape: Cross Comparison

9.15 Future Outlook: Market Size by Revenue and Volume of Fleet Size, 2022-2027

9.16 Future Outlook: Market Segmentation by Type of Region

9.17 Future Outlook: Market Segmentation by Type of Booking Channel

9.18 Future Outlook: Market Segmentation by Type of Usage

9.19 Future Outlook: Market Segmentation by Time Period

9.20 Future Outlook: Market Segmentation by Type of Car

9.21 Future Outlook: Market Segmentation by Type of Booking Period

9.22 Future Outlook: Market Segmentation by Type of Car Segmentation

9.23 Future Outlook: Market Segmentation by Status Ownership

9.24 Future Outlook: Market Segmentation by Point of Service

10. Case Study

10.1 Case Study of Zoomcar

11. Analyst Recommendations

12. Industry speaks

12.1 Interview with Senior Fleet Sales Specialist, Toyota Mobility Solutions

12.2 Interview with Ex Transport Operations Consultant, Grab

12.3 Interview with APAC Regional Sales Manager of a leading car rental company

13. Research Methodology

Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Our team will initially create an ecosystem for all the major entities in the Car Rental Market that are providing car rental, car leasing, ride sharing, ride hailing and self-drive services in Philippines Market.

Step: 2 Market Building:

In the next step, we will refer to multiple secondary and proprietary databases to perform deck research around the market and collate industry-level information such as type of market structure, consumption in terms of value, and fleet size other areas to create an initial level hypothesis. We will also explore company-level info by referring press releases, annual reports, financial statements, and other documents to understand basic information about the companies and market level.

Step: 3 Validating and Finalizing:

Later our team will conduct a series of Interviews with multiple C-Level Executive and other stakeholders belonging to different companies to confirm the market hypothesis, validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Furthermore, to validate this data our team will pitch each company as a potential customer through a mystery shopping exercise and will confirm the operational and financial performance of Philippines Car Rental Market Entities which have been shared by company executives and available on secondary databases. We will be conducting another set of CATIs with the respective entities to understand customer behavior, channel preference, and other factors. We will also assess customer analysis in terms of their preferences and pain points.

Frequently Asked Questions

01 What is the market size of Phillipines Car Rental Market?

The market size of Phillipines Car Rental market was at $293 million in 2022.

02 How did the car rental industry developed in the Phillipines?

Increasing costs of owning a car & vast number of Internet connections across the world led to growth of car rentals in Phillipines.

03 Who are the key players in Phillipines Car Rental Market?

Phillipines car rental market is led by Avis, Diamond Rent a Car, Hertz, SafeRide etc. among other players.

04 What is the future outlook for Phillipines Car Rental market?

Phillipines Car Rental Market is expected to reach $448 million by 2027.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.