Philippines Confectionery Market Outlook to 2030

Region:Asia

Author(s):Aashi and Manan

Product Code:KR1517

July 2025

80

About the Report

Philippines Confectionery Market Overview

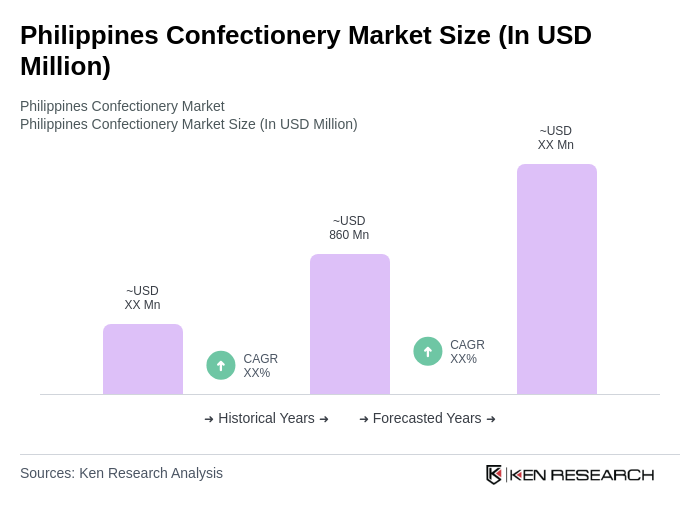

- The Philippines Confectionery Market is valued at USD 860 million, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, rapid urbanization, and a growing preference for indulgent snacks among younger consumers. The expansion of modern retail channels, such as supermarkets and convenience stores, has further increased product accessibility. Additionally, the introduction of innovative flavors and healthier alternatives is attracting new consumer segments and supporting market growth .

- Metro Manila, Cebu, and Davao remain the dominant cities in the Philippines Confectionery Market. Metro Manila, as the capital, features a high concentration of retail outlets and a diverse consumer base. Cebu and Davao benefit from their strategic locations and expanding urban populations, making these cities influential in shaping national consumer trends and preferences .

- In 2023, the Philippine government continued to enforce Sugar Regulatory Administration (SRA) guidelines to regulate sugar production and pricing. These measures are designed to stabilize the sugar market, ensure fair pricing for both producers and consumers, and promote local sugar production to reduce reliance on imports, thereby supporting the domestic confectionery industry .

Philippines Confectionery Market Segmentation

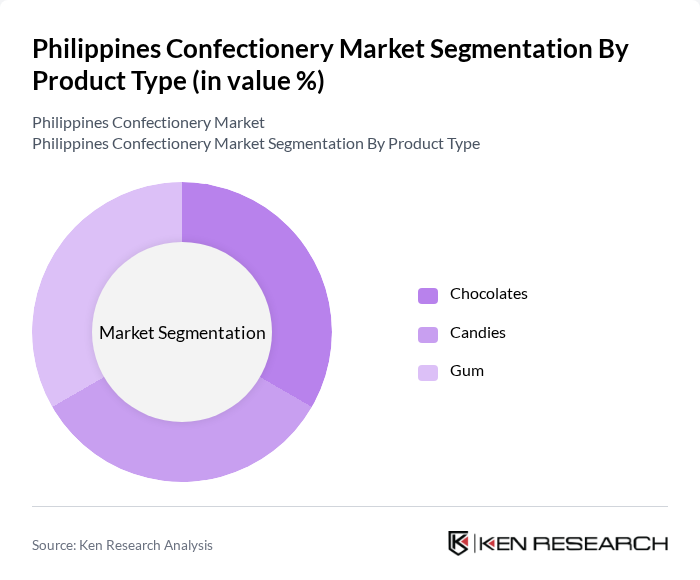

By Product Type: The confectionery market is segmented into chocolates, sugar confectionery (candies), and gums. Chocolates maintain the largest share, driven by their popularity for gifting and everyday consumption. The rise of premium and artisanal chocolate brands, along with increased demand for healthier and innovative chocolate products, has further solidified chocolates' leading position in the market. Sugar confectionery, including hard candies and chewy sweets, appeals to a broad demographic, while gum remains popular among younger consumers seeking novelty and functional benefits .

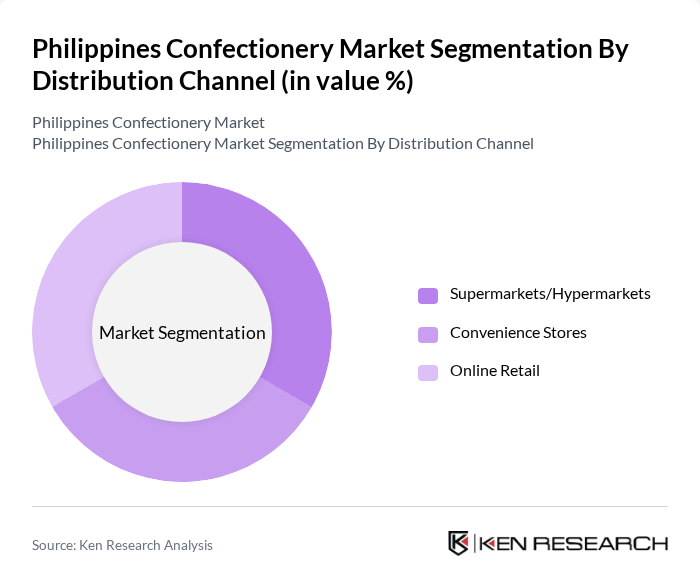

By Distribution Channel: The market is segmented into supermarkets/hypermarkets, convenience stores, online retail, and others. Supermarkets and hypermarkets are the leading distribution channels, offering a wide product range and the convenience of one-stop shopping. Convenience stores are also significant, particularly in urban areas with high foot traffic. Online retail is gaining traction, especially among younger, digitally savvy consumers who value convenience and access to a broader assortment of products .

Philippines Confectionery Market Competitive Landscape

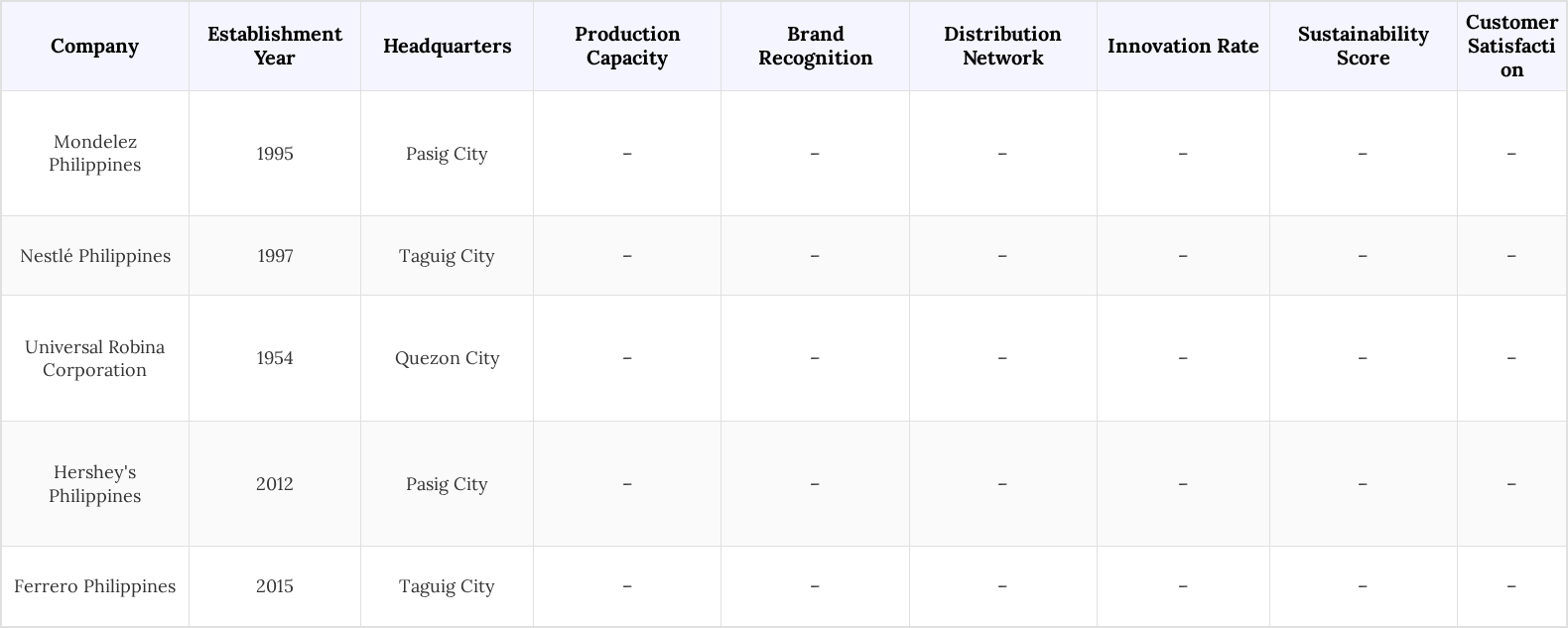

The Philippines Confectionery Market is characterized by a competitive landscape with several key players, including multinational corporations and local manufacturers. Major companies such as Mondelez Philippines, Nestlé Philippines, and Universal Robina Corporation are prominent in this market, leveraging their extensive distribution networks and strong brand recognition to capture consumer attention. The market is moderately concentrated, with these companies continuously innovating to meet changing consumer preferences .

Philippines Confectionery Market Industry Analysis

Growth Drivers

- Increasing Disposable Income: The Philippines has seen a steady rise in disposable income, with an average increase of 6.0% annually over the past five years. In future, the average household income is projected to reach approximately PHP 350,000, enabling consumers to spend more on discretionary items like confectionery. This increase in purchasing power is driving demand for both everyday and premium confectionery products, as consumers are more willing to indulge in higher-quality options.

- Rising Demand for Premium Confectionery Products: The premium segment of the confectionery market is experiencing significant growth, with sales expected to reach PHP 25 billion in future. This trend is fueled by changing consumer preferences towards high-quality, artisanal products. As consumers become more health-conscious, they are increasingly seeking out premium options that offer unique flavors and natural ingredients, further driving the growth of this segment in the Philippines.

- Expansion of E-commerce Platforms: E-commerce in the Philippines is projected to grow rapidly, with estimates showing a compound annual growth rate (CAGR) of around 14% from 2025 to 2033. This growth is driven by increasing internet and smartphone penetration, rising consumer trust in digital payments, and active social commerce on platforms like Facebook, TikTok, and Instagram. Over 70 million Filipinos are expected to shop online by 2025, boosted by mobile-first commerce and government support for digital infrastructure, benefiting both established brands and new entrants.

Market Challenges

- Intense Competition Among Local and International Brands: The Philippine confectionery market is highly competitive, with numerous local and international brands vying for market share. This intense competition results in price wars and aggressive marketing strategies, which can erode profit margins. The entry of new players is expected to further intensify the competitive landscape, making it increasingly challenging for existing brands to retain their market position.

- Fluctuating Raw Material Prices: The confectionery industry is heavily dependent on raw materials such as sugar, cocoa, and dairy, which are subject to global price volatility. Disruptions in the supply chain and changing demand patterns can significantly impact production costs. Manufacturers may be forced to absorb these rising costs or pass them on to consumers, which could affect overall sales and profitability.

Philippines Confectionery Market Future Outlook

The Philippines confectionery market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, consumers are expected to increasingly favor premium and artisanal products. Additionally, the shift towards online shopping will continue to reshape the retail landscape, providing brands with new avenues for reaching consumers. Companies that innovate and adapt to these trends will likely thrive, while those that fail to respond may struggle to maintain relevance in this competitive market.

Market Opportunities

- Growing Trend of Healthier Confectionery Options: There is a rising consumer interest in healthier confectionery alternatives, with the market for sugar-free and organic products expected to grow by 25% in future. This trend presents an opportunity for brands to innovate and cater to health-conscious consumers, potentially capturing a significant share of the market.

- Expansion into Untapped Rural Markets: Approximately 51% of the Philippine population resides in rural areas, presenting a significant opportunity for confectionery brands. By expanding distribution networks and targeting these underserved markets, companies can tap into a growing consumer base that is increasingly seeking affordable indulgences, potentially increasing overall sales by 15% in the coming years.

Scope of the Report

| By Type |

Chocolate Candies Gum Others |

| By End-User |

Children Teenagers Adults Seniors Others |

| By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Others |

| By Occasion |

Festivals Birthdays Holidays Everyday Consumption Others |

| By Packaging Type |

Rigid Packaging Flexible Packaging Bulk Packaging Others |

| By Flavor |

Chocolate Fruit Mint Spicy Others |

| By Price Range |

Premium Mid-range Economy Others |

| By Health Attribute |

Sugar-free Organic Gluten-free Functional Others |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Trade and Industry, Food and Drug Administration)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., Philippine Confectionery Association)

Financial Institutions

Market Analysts and Industry Experts

Companies

Players Mentioned in the Report:

Mondelez Philippines

Nestlé Philippines

Universal Robina Corporation

Hershey's Philippines

Ferrero Philippines

Sweet Haven Confections

Pinoy Treats Co.

Tropical Delights Confectionery

Manila Sweets & Snacks

Sugar Rush Philippines

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. Philippines Confectionery Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 Philippines Confectionery Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. Philippines Confectionery Market Analysis

3.1 Growth Drivers

3.1.1 Increasing disposable income

3.1.2 Rising demand for premium confectionery products

3.1.3 Growth of the retail sector

3.1.4 Expansion of e-commerce platforms

3.2 Market Challenges

3.2.1 Intense competition among local and international brands

3.2.2 Fluctuating raw material prices

3.2.3 Health concerns related to sugar consumption

3.2.4 Regulatory hurdles and compliance issues

3.3 Market Opportunities

3.3.1 Growing trend of healthier confectionery options

3.3.2 Expansion into untapped rural markets

3.3.3 Innovation in product offerings

3.3.4 Collaborations with local artisans and brands

3.4 Market Trends

3.4.1 Increasing popularity of artisanal and handmade products

3.4.2 Shift towards sustainable and eco-friendly packaging

3.4.3 Rise of online shopping and direct-to-consumer sales

3.4.4 Growing interest in local flavors and ingredients

3.5 Government Regulation

3.5.1 Sugar tax implementation

3.5.2 Food safety regulations

3.5.3 Labeling requirements for nutritional information

3.5.4 Import/export regulations for confectionery products

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. Philippines Confectionery Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. Philippines Confectionery Market Segmentation

8.1 By Type

8.1.1 Chocolate

8.1.2 Candies

8.1.3 Gum

8.1.4 Others

8.2 By End-User

8.2.1 Children

8.2.2 Teenagers

8.2.3 Adults

8.2.4 Seniors

8.2.5 Others

8.3 By Distribution Channel

8.3.1 Supermarkets/Hypermarkets

8.3.2 Convenience Stores

8.3.3 Online Retail

8.3.4 Others

8.4 By Occasion

8.4.1 Festivals

8.4.2 Birthdays

8.4.3 Holidays

8.4.4 Everyday Consumption

8.4.5 Others

8.5 By Packaging Type

8.5.1 Rigid Packaging

8.5.2 Flexible Packaging

8.5.3 Bulk Packaging

8.5.4 Others

8.6 By Flavor

8.6.1 Chocolate

8.6.2 Fruit

8.6.3 Mint

8.6.4 Spicy

8.6.5 Others

8.7 By Price Range

8.7.1 Premium

8.7.2 Mid-range

8.7.3 Economy

8.7.4 Others

8.8 By Health Attribute

8.8.1 Sugar-free

8.8.2 Organic

8.8.3 Gluten-free

8.8.4 Functional

8.8.5 Others

9. Philippines Confectionery Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Revenue Growth Rate

9.2.2 Market Penetration

9.2.3 Product Diversification

9.2.4 Customer Satisfaction Ratings

9.2.5 Brand Recognition

9.2.6 Distribution Network Strength

9.2.7 Innovation Rate

9.2.8 Pricing Strategy

9.2.9 Sustainability Practices

9.2.10 Market Responsiveness

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 Mondelez Philippines

9.5.2 Nestlé Philippines

9.5.3 Mars Philippines

9.5.4 Universal Robina Corporation

9.5.5 Del Monte Philippines

9.5.6 HBC, Inc.

9.5.7 Liwayway Marketing Corporation

9.5.8 RFM Corporation

9.5.9 CDO Foodsphere, Inc.

9.5.10 Jack 'n Jill

9.5.11 Purefoods Hormel Company

9.5.12 San Miguel Foods

9.5.13 Tasty Treat

9.5.14 M&M's Philippines

9.5.15 Chocovron

10. Philippines Confectionery Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Budget allocation for confectionery products

10.1.2 Preference for local vs. imported products

10.1.3 Evaluation criteria for procurement

10.1.4 Frequency of procurement cycles

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in production facilities

10.2.2 Spending on marketing and branding

10.2.3 Budget for R&D in product innovation

10.2.4 Expenditure on sustainability initiatives

10.3 Pain Point Analysis by End-User Category

10.3.1 Quality concerns

10.3.2 Price sensitivity

10.3.3 Availability of products

10.3.4 Health-related issues

10.4 User Readiness for Adoption

10.4.1 Awareness of new products

10.4.2 Willingness to try premium products

10.4.3 Feedback mechanisms

10.4.4 Trends in consumer preferences

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Metrics for success evaluation

10.5.2 Opportunities for product line expansion

10.5.3 Customer retention strategies

10.5.4 Long-term partnerships with suppliers

11. Philippines Confectionery Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Identification of market gaps

1.2 Business model options

1.3 Value proposition development

1.4 Revenue streams analysis

1.5 Cost structure evaluation

2. Marketing and Positioning Recommendations

2.1 Branding strategies

2.2 Product USPs

2.3 Target audience segmentation

2.4 Communication channels

2.5 Promotional tactics

3. Distribution Plan

3.1 Urban retail strategies

3.2 Rural NGO tie-ups

3.3 E-commerce integration

3.4 Logistics and supply chain management

3.5 Distribution partnerships

4. Channel & Pricing Gaps

4.1 Underserved routes

4.2 Pricing bands analysis

4.3 Competitor pricing strategies

4.4 Consumer price sensitivity

4.5 Recommendations for pricing adjustments

5. Unmet Demand & Latent Needs

5.1 Category gaps identification

5.2 Consumer segments analysis

5.3 Product development opportunities

5.4 Market entry strategies

5.5 Feedback collection mechanisms

6. Customer Relationship

6.1 Loyalty programs design

6.2 After-sales service strategies

6.3 Customer engagement initiatives

6.4 Feedback and improvement loops

6.5 Community building efforts

7. Value Proposition

7.1 Sustainability initiatives

7.2 Integrated supply chains

7.3 Unique selling points

7.4 Customer-centric approaches

7.5 Competitive advantages

8. Key Activities

8.1 Regulatory compliance measures

8.2 Branding efforts

8.3 Distribution setup processes

8.4 Marketing campaigns

8.5 Performance monitoring

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product mix considerations

9.1.2 Pricing band strategies

9.1.3 Packaging innovations

9.2 Export Entry Strategy

9.2.1 Target countries analysis

9.2.2 Compliance roadmap development

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield investments

10.3 Mergers & Acquisitions

10.4 Distributor Model evaluation

11. Capital and Timeline Estimation

11.1 Capital requirements analysis

11.2 Timelines for market entry

11.3 Resource allocation strategies

11.4 Risk assessment

12. Control vs Risk Trade-Off

12.1 Ownership considerations

12.2 Partnerships evaluation

12.3 Risk management strategies

13. Profitability Outlook

13.1 Breakeven analysis

13.2 Long-term sustainability strategies

13.3 Financial projections

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Timeline for key activities

15.2.2 Milestone tracking

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines Confectionery Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Philippines Confectionery Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Philippines Confectionery Market.

Frequently Asked Questions

What is the current value of the Philippines Confectionery Market?

The Philippines Confectionery Market is valued at approximately USD 860 million, reflecting a five-year historical analysis. This growth is attributed to rising disposable incomes, urbanization, and a preference for indulgent snacks among younger consumers.

Which cities dominate the Philippines Confectionery Market?

Metro Manila, Cebu, and Davao are the leading cities in the Philippines Confectionery Market. Metro Manila, as the capital, has a high concentration of retail outlets, while Cebu and Davao benefit from expanding urban populations and strategic locations.

What are the main product types in the Philippines Confectionery Market?

The market is segmented into chocolates, sugar confectionery (candies), and gums. Chocolates hold the largest market share, driven by gifting and everyday consumption, while sugar confectionery appeals to a broad demographic, and gum is popular among younger consumers.

How is the Philippines Confectionery Market regulated?

The Philippine government enforces Sugar Regulatory Administration (SRA) guidelines to regulate sugar production and pricing. These measures aim to stabilize the sugar market, ensure fair pricing, and promote local sugar production, supporting the domestic confectionery industry.

What factors are driving growth in the Philippines Confectionery Market?

Key growth drivers include increasing disposable incomes, rising demand for premium confectionery products, and the expansion of e-commerce platforms. These factors enable consumers to spend more on indulgent and high-quality confectionery items.

What challenges does the Philippines Confectionery Market face?

The market faces challenges such as intense competition among over 200 local and international brands, fluctuating raw material prices, and health concerns related to sugar consumption. These factors can impact profit margins and market stability.

What opportunities exist in the Philippines Confectionery Market?

Opportunities include the growing trend for healthier confectionery options, expansion into untapped rural markets, and innovation in product offerings. Brands can capture market share by catering to health-conscious consumers and reaching underserved populations.

How is the distribution channel structured in the Philippines Confectionery Market?

The market is primarily segmented into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets and hypermarkets lead in distribution, while online retail is gaining traction among younger, digitally savvy consumers.

What is the future outlook for the Philippines Confectionery Market?

The market is expected to experience dynamic growth, driven by rising disposable incomes and evolving consumer preferences. The shift towards online shopping and premium products will reshape the retail landscape, benefiting innovative brands.

Who are the major players in the Philippines Confectionery Market?

Key players include Mondelez Philippines, Nestlé Philippines, Universal Robina Corporation, Hershey's Philippines, and Ferrero Philippines. These companies leverage extensive distribution networks and strong brand recognition to capture consumer attention in the competitive market.

What trends are shaping the Philippines Confectionery Market?

Trends include the increasing popularity of artisanal and handmade products, a shift towards sustainable packaging, and a growing interest in local flavors. These trends reflect changing consumer preferences and a demand for unique, high-quality offerings.

What is the impact of e-commerce on the Philippines Confectionery Market?

E-commerce is projected to grow significantly, facilitating easier access to a wide range of confectionery products. The convenience of online shopping, combined with social media marketing, boosts sales for both established brands and new entrants.

How do health trends affect the Philippines Confectionery Market?

There is a rising consumer interest in healthier confectionery options, such as sugar-free and organic products. This trend is expected to grow, presenting opportunities for brands to innovate and cater to health-conscious consumers.

What are the packaging types used in the Philippines Confectionery Market?

Packaging types in the market include rigid packaging, flexible packaging, and bulk packaging. These options cater to various consumer preferences and product types, ensuring convenience and appeal in retail settings.

What is the significance of the Sugar Regulatory Administration (SRA) in the market?

The SRA plays a crucial role in regulating sugar production and pricing in the Philippines. Its guidelines aim to stabilize the sugar market, promote local production, and ensure fair pricing for both producers and consumers in the confectionery industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.