Philippines Dialysis Centre Market Outlook to 2030

Philippines Dialysis Centre Market: Growth Drivers, Trends & Future Outlook to 2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1529

August 2025

90

About the Report

Philippines Dialysis Centre Market Overview

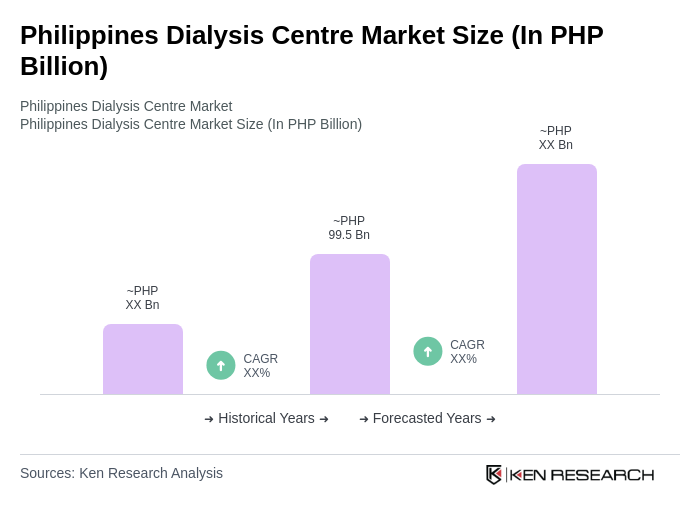

- The Philippines Dialysis Centre Market is valued at PHP 99.5 billion, based on a five-year historical analysis. This is supported by rising dialysis utilization driven by increasing chronic kidney disease prevalence and aging demographics, alongside private-sector expansion and government funding for sessions through the national insurer. The market has also seen supply-side strengthening via exclusive distribution agreements and network expansion among leading providers.

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Dialysis Centre Market. Metro Manila leads due to the density of tertiary hospitals and specialty centers (e.g., NKTI, large private hospital chains), while Cebu and Davao anchor Visayas and Mindanao, respectively, with growing private dialysis chains and hospital-affiliated centers expanding coverage.

- In 2023, the Philippine government implemented key Universal Health Care Act provisions through PhilHealth policy updates expanding dialysis coverage, which reduced out-of-pocket burden and supported capacity growth among providers under the National Health Insurance Program.

Philippines Dialysis Centre Market Segmentation

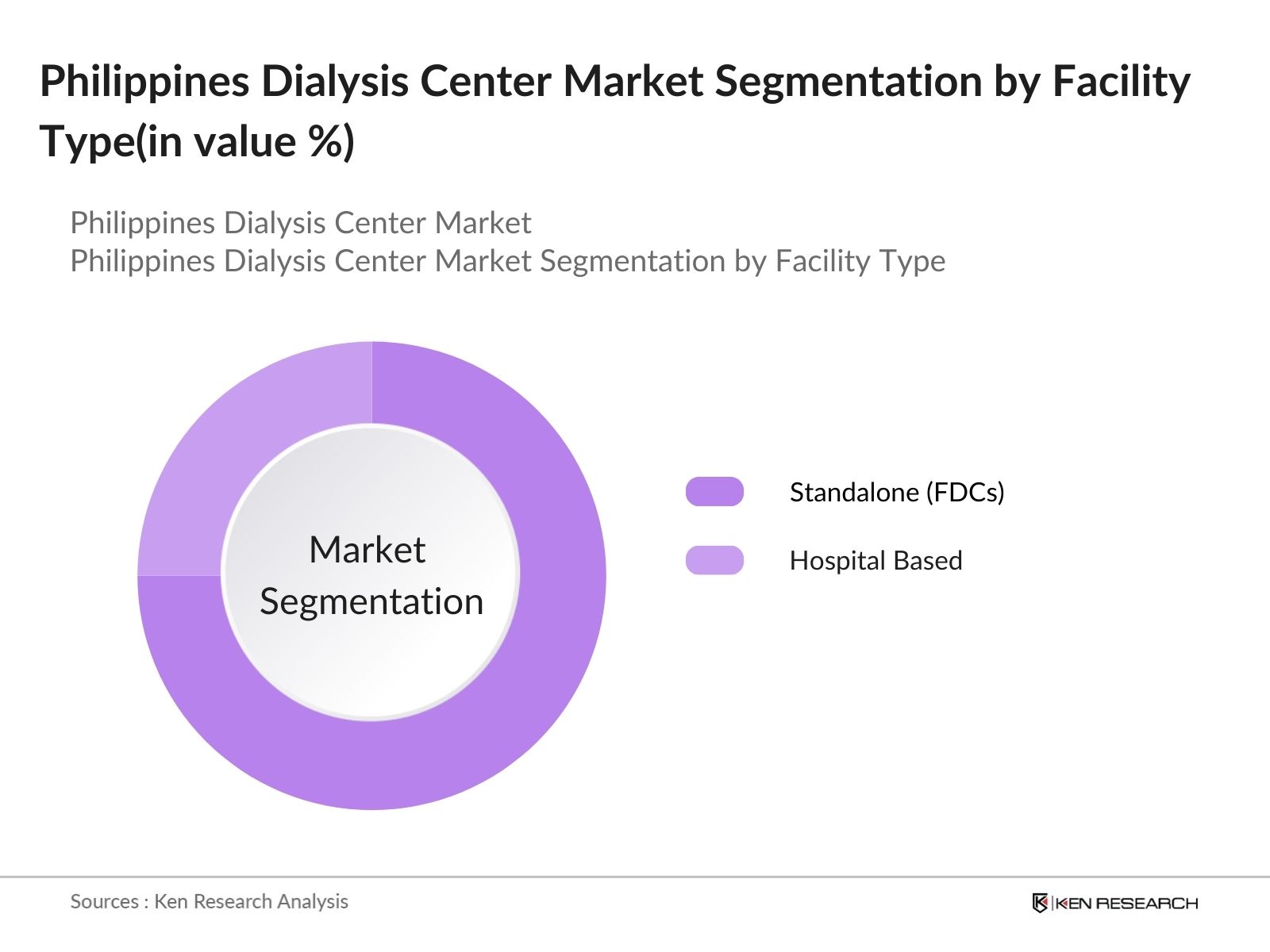

By Facility Type: The Philippines dialysis center market is segmented into Standalone Facilities (FDCs) and Hospital-Based Centers. Standalone centers hold the majority share, driven by their faster rollout, greater access to capital, and operational flexibility compared to hospital setups. Hospital-based centers, while still significant, are expected to see a gradual decline in share as standalone models continue to expand at a faster pace and dominate market growth.

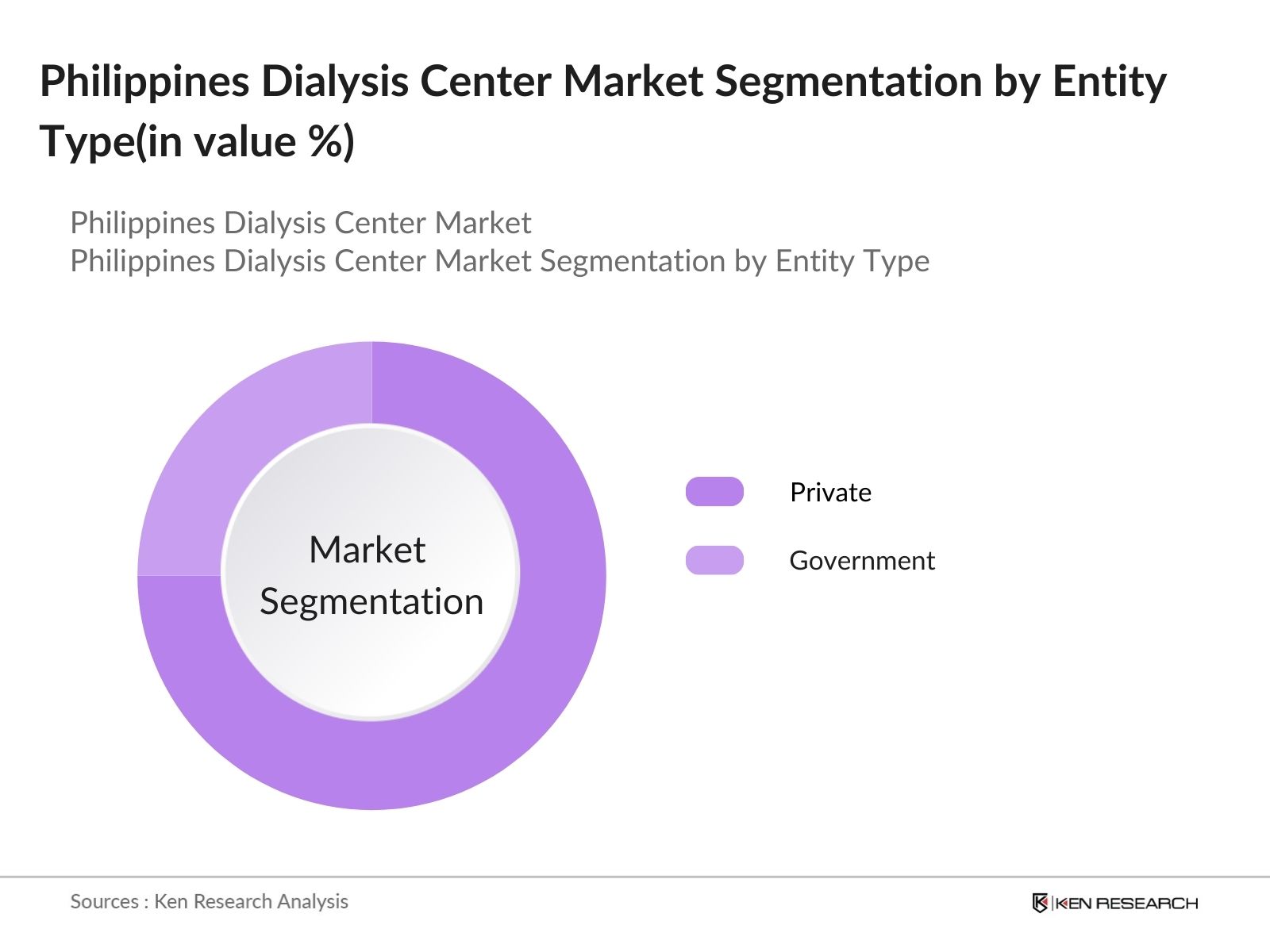

By Entity Type: The Philippines dialysis center market is segmented into Private Operators and Government-Operated Centers. Private operators account for the dominant share, supported by stronger financing, faster rollout capabilities, and regulatory ease, enabling rapid expansion across the country. Government-operated centers continue to play a critical role in ensuring access for underserved areas and providing essential safety-net services, though their overall share is gradually declining as private sector presence strengthens.

Philippines Dialysis Centre Market Competitive Landscape

The Philippines Dialysis Centre Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nephro Group Dialysis Center, NephroPlus, B. Braun Avitum Philippines, Inc., Fresenius Kidney Care, and Hemotek Renal Center contribute to innovation, geographic expansion, and service delivery in this space.

| Nephro Group Dialysis Center | 1995 | Philippines | – | – | – | – | – | – |

| NephroPlus | 2020 | India | – | – | – | – | – | – |

| B. Braun Avitum Philippines, Inc. | 1989 | Germany | – | – | – | – | – | – |

| Fresenius Kidney Care | 2011 | Germany | – | – | – | – | – | – |

| Hemotek Renal Center | 2008 | Philippines | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Installed stations/chairs | Number of dialysis centers (nationwide footprint) | Annual treatments/patient-days | Revenue growth rate (YoY) | Market share by treatments | Average treatment tariff (PhilHealth vs private pay) |

|---|

Philippines Dialysis Centre Market Industry Analysis

Growth Drivers

- Rising CKD Prevalence and Lifestyle-Linked Risk Factors: The Philippines has approximately 7 million people living with chronic kidney disease (CKD), with a national prevalence rate of 35.94%—significantly higher than the global average. This rising trend is largely attributed to high rates of diabetes, obesity (27%), and hypertension. Each year, an estimated 120 Filipinos per million progress to end-stage renal disease (ESRD), creating sustained demand for dialysis services, especially in urban and semi-urban areas.

- Aging Population Accelerating Dialysis Demand: The population aged 60 and above reached 10.3 million in 2024, accounting for 9% of the country’s total population. As age is a primary risk factor for CKD and related complications, this demographic shift is significantly increasing the burden on dialysis centers. With higher disease incidence among the elderly, dialysis facilities must scale operations to meet growing treatment needs and ensure access in both urban and provincial regions.

- PhilHealth Expansion and Investment-Backed Ecosystem: Under the Universal Health Care Law, PhilHealth now reimburses PHP 6,350 per HD session and PHP 1.2M per patient annually—boosting affordability and access. As a result, PhilHealth HD session claims grew at a 15.5% CAGR, reaching 5.1 million by 2024. Coupled with PPPs, NGO assistance, and rising private investment from players like NephroPlus and Fresenius, the market is witnessing strong infrastructure expansion and long-term viability.

Market Challenges

- Financial Barriers to Sustained Dialysis Access: Out-of-pocket costs and limited insurance coverage continue to restrict dialysis access across the Philippines. While government health programs subsidize a portion of treatment, many patients—especially the elderly—struggle to afford the recommended number of sessions per week. Additional expenses such as lab work, medications, and transport further increase the burden. These financial gaps often force patients to reduce or discontinue treatment, underlining the urgent need for expanded financial protection and reimbursement frameworks.

- Limited Rural Penetration and Home-Based Adoption: Dialysis services remain largely concentrated in urban regions, leaving rural areas underserved. Although home-based dialysis options like PD and HHD could ease facility congestion and improve access, they are still underutilized due to low patient awareness, limited physician training, and infrastructure gaps. A strong preference for in-center treatment continues to dominate care delivery, restricting the scalability of decentralized dialysis models. This imbalance hinders equitable access and slows service expansion in provincial and remote locations.

Philippines Dialysis Centre Market Future Outlook

The future of the dialysis market in the Philippines appears promising, driven by increasing healthcare investments and a focus on improving patient care. The government is expected to enhance healthcare infrastructure, particularly in underserved areas, while technological advancements will continue to improve treatment options. Additionally, the integration of telehealth services is likely to facilitate better patient management and follow-up care, ultimately leading to improved health outcomes and increased patient satisfaction in the dialysis sector.

Market Opportunities

- Expansion of Franchise and Chain-Based Dialysis Models: The Philippines dialysis sector is undergoing rapid growth through franchise-led and corporate expansion. Players like NephroPlus have scaled to over 35 centers, tapping into underserved Tier 2 and 3 regions via low-CAPEX franchise formats. This model boosts patient reach, ensures standardized care protocols, and allows new entrants to penetrate high-demand provinces with reduced operational risk.

- Underserved Potential in Home Dialysis Solutions: Home dialysis adoption in the Philippines remains below 2%, signaling a significant whitespace compared to 13–30% in Australia and the U.S. Providers can leverage this gap to reduce facility strain, offer flexible care, and align with PhilHealth’s decentralization goals. Strategic rollouts in Visayas and Mindanao, coupled with training and patient education, can unlock long-term value and system-wide efficiency.

Scope of the Report

| By Facility Type |

Standalone (FDCs) Hospital Based |

| By Entity Type |

Private Government |

| By Payment Source |

Phil Health Out of Pocket Others |

| By Patient Profile |

Hypertensive Nephrosclerosis Diabetic Nephropathy Chronic Glomerulonephritis Others |

| By Location |

National Capital Region (Metro Manila) Luzon Visayas Mindanao Others |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Health, Food and Drug Administration)

Healthcare Providers and Hospital Administrators

Medical Equipment Suppliers

Pharmaceutical Companies

Health Insurance Companies

Industry Associations (e.g., Philippine Society of Nephrology)

Non-Governmental Organizations (NGOs) focused on healthcare

Companies

Players Mentioned in the Report:

Nephro Group Dialysis Center

NephroPlus

B. Braun Avitum Philippines, Inc.

Fresenius Kidney Care

Hemotek Renal Center

Philippine Kidney Dialysis Foundation (PKDF)

National Kidney and Transplant Institute (NKTI)

DaVita Kidney Care (DaVita Philippines)

St. Lukes Medical Center

The Medical City

Table of Contents

1. Executive Summary

1.1 Executive Summary: Philippines Dialysis Center Market

2. Market Overview of the Philippines Dialysis Center Market

2.1 Market Ecosystem Basis: Facility Types

2.2 Market Overview based on Different Ownership Models

2.3 Market Overview based on Reimbursement Models

3. Market Size and Segmentation of the Philippines Dialysis Center Market

3.1 Market Size of Philippines Dialysis Market by Value, CY’2020–CY’2025P–CY’2030F

3.2 Market Size of Philippines Dialysis Market by Patient Count, CY’2020–CY’2025P–CY’2030F

3.3 Market Size of Philippines Dialysis Market by Dialysis Session, CY’2020–CY’2025P–CY’2030F

3.4 Market Size of Philippines Dialysis Market by Spend per Dialysis Session, CY’2020–CY’2025P–CY’2030F

3.5 Market Size of Philippines Dialysis Market by Dialysis Centers, CY’2020–CY’2025P–CY’2030F

3.6 Market Size Analysis of Philippines Dialysis Market, CY’2025P–CY’2030F

3.7 By Type of Facility and By Type of Ownership in Philippines Dialysis Market, CY’2025P–CY’2030F

3.8 By Type of Payment Source and By Patient Profile in Philippines Dialysis Market, CY’2025P–CY’2030F

3.9 By Geography in Philippines Dialysis Market, CY’2025P–CY’2030F

3.10 Dialysis Treatment Growth Tailwinds and Drivers

4. Industry Analysis of the Philippines Dialysis Center Market

4.1 Demand Drivers for the Philippines Dialysis Center Market

4.2 Challenges for the Philippines Dialysis Center Market

4.3 Trends for the Philippines Dialysis Center Market

5. Demand Side Analysis

5.1 Target Persona Demographic Profile for Philippines Dialysis Center Market

5.2 Target Persona Preference Profile for Philippines Dialysis Center Market

5.3 Target Persona Decision-Making Drivers for the Philippines Dialysis Center Market

5.4 Target Persona Financial Profile for Philippines Dialysis Center Market

6. Competitive Landscape

6.1 Competition Landscape of the Philippines Dialysis Market

6.2 Market Share Analysis of Key Players in the Dialysis Service Market

6.3 Competition Analysis of the Philippines Dialysis Center Market

7. Analyst Recommendation

7.1 Analyst Recommendation: TAM, SAM & SOM Analysis

7.2 Analyst Recommendation: Whitespace Opportunities

8. Research Methodology

Research Methodology

Phase 1: Approach

Desk Research

- Analysis of government health statistics and reports on dialysis prevalence in the Philippines

- Review of industry publications and market reports on healthcare infrastructure and dialysis services

- Examination of academic journals and studies focusing on renal care and dialysis treatment trends

Primary Research

- Interviews with nephrologists and healthcare professionals specializing in dialysis

- Surveys with dialysis center administrators to gather insights on operational challenges and patient demographics

- Focus group discussions with patients undergoing dialysis to understand their experiences and needs

Validation & Triangulation

- Cross-validation of findings through multiple data sources, including government health data and industry reports

- Triangulation of qualitative insights from interviews with quantitative data from surveys

- Sanity checks through expert panel reviews comprising healthcare economists and industry veterans

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of the total addressable market based on national healthcare expenditure and dialysis service allocation

- Segmentation of the market by type of dialysis (hemodialysis vs. peritoneal dialysis) and patient demographics

- Incorporation of government health initiatives aimed at increasing access to dialysis services

Bottom-up Modeling

- Collection of data on the number of dialysis centers and their average patient capacity

- Operational cost analysis based on service pricing and reimbursement rates from health insurance providers

- Volume x cost calculations to derive revenue estimates for the dialysis market

Forecasting & Scenario Analysis

- Multi-factor regression analysis incorporating population growth, aging demographics, and chronic kidney disease prevalence

- Scenario modeling based on potential changes in healthcare policy and insurance coverage for dialysis

- Baseline, optimistic, and pessimistic projections for market growth through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dialysis Center Administrators | 100 | Center Managers, Operations Directors |

| Nephrologists and Healthcare Providers | 80 | Renal Specialists, General Practitioners |

| Patients Undergoing Dialysis | 120 | Dialysis Patients, Caregivers |

| Health Insurance Representatives | 60 | Claims Managers, Policy Analysts |

| Healthcare Policy Makers | 50 | Government Officials, Health Program Directors |

Frequently Asked Questions

What is the current value of the Philippines Dialysis Centre Market?

The Philippines Dialysis Centre Market is valued at approximately PHP 99.5 billion, driven by increasing chronic kidney disease prevalence, an aging population, and government funding for dialysis sessions through the national insurer, PhilHealth.

Which regions dominate the Philippines Dialysis Centre Market?

Metro Manila, Cebu, and Davao are the leading regions in the Philippines Dialysis Centre Market. Metro Manila has the highest concentration of tertiary hospitals and specialty centers, while Cebu and Davao are expanding their private dialysis chains and hospital-affiliated centers.

How has the Universal Health Care Act impacted dialysis coverage in the Philippines?

In 2023, the Philippine government implemented provisions of the Universal Health Care Act, expanding dialysis coverage under PhilHealth. This initiative has reduced out-of-pocket expenses for patients and supported the growth of dialysis capacity among healthcare providers.

What types of dialysis treatments are available in the Philippines?

The Philippines offers various types of dialysis treatments, including hemodialysis (in-center), home hemodialysis, and peritoneal dialysis. Hemodialysis is the most common method, while home modalities are gaining popularity due to patient autonomy and convenience.

What are the main end-user categories in the dialysis market?

The dialysis market is segmented into hospital-based dialysis units, independent/free-standing clinics, home-based patients, and government-operated centers. Hospital-based units dominate due to comprehensive care, while independent clinics are rapidly expanding across the country.

What are the key growth drivers for the dialysis market in the Philippines?

Key growth drivers include the increasing prevalence of chronic kidney diseases, a rising aging population, and advancements in dialysis technology. These factors contribute to a growing demand for dialysis services and facilities across the country.

What challenges does the Philippines Dialysis Centre Market face?

The market faces challenges such as the high cost of dialysis treatment, limited access in rural areas, and a shortage of trained healthcare professionals. These issues hinder patient access to necessary treatments and limit market growth potential.

What opportunities exist for the dialysis market in the Philippines?

Opportunities include the expansion of private dialysis centers and the introduction of home dialysis solutions. With increasing demand for quality healthcare, private facilities can offer advanced treatment options, while home solutions enhance patient convenience and reduce facility burdens.

How is the aging population affecting the dialysis market?

The aging population in the Philippines is a significant factor driving the dialysis market. As the number of individuals aged 60 and above increases, so does the demand for dialysis treatments, necessitating the expansion of dialysis centers to meet their needs.

What role does technology play in the dialysis market?

Technological advancements in dialysis treatment, such as portable machines and improved filtration systems, enhance patient outcomes and operational efficiency. The adoption of these technologies is increasing, attracting more patients to dialysis centers and driving market growth.

What is the average cost of a dialysis session in the Philippines?

The average cost of a single dialysis session in the Philippines is approximately PHP 2,500. This cost can be prohibitive for many patients, especially those without insurance, highlighting the financial burden associated with dialysis treatment.

How does PhilHealth support dialysis patients in the Philippines?

PhilHealth provides financial support for dialysis patients through reimbursements under the National Health Insurance Program. This initiative helps reduce the out-of-pocket burden for patients, making dialysis treatments more accessible and affordable.

What is the future outlook for the dialysis market in the Philippines?

The future of the dialysis market in the Philippines looks promising, with expected growth driven by increased healthcare investments, technological advancements, and government initiatives aimed at improving healthcare infrastructure, particularly in underserved areas.

Which companies are key players in the Philippines Dialysis Centre Market?

Key players in the Philippines Dialysis Centre Market include Fresenius Medical Care Philippines, B. Braun Avitum Philippines, Nephro Group, Philippine Kidney Dialysis Foundation, and the National Kidney and Transplant Institute, among others, contributing to innovation and service delivery.

What is the significance of home dialysis solutions in the market?

Home dialysis solutions are becoming increasingly significant as they offer patients greater autonomy and convenience. Approximately 20% of patients express interest in home-based options, which can alleviate the burden on healthcare facilities and improve patient satisfaction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.