Philippines Used Car Finance Market Outlook to 2030

Region:Asia

Author(s):Chirag, Sunaiyna, & Nishika

Product Code:KR1463

December 2024

90

About the Report

Philippines Used Car Finance Market Overview

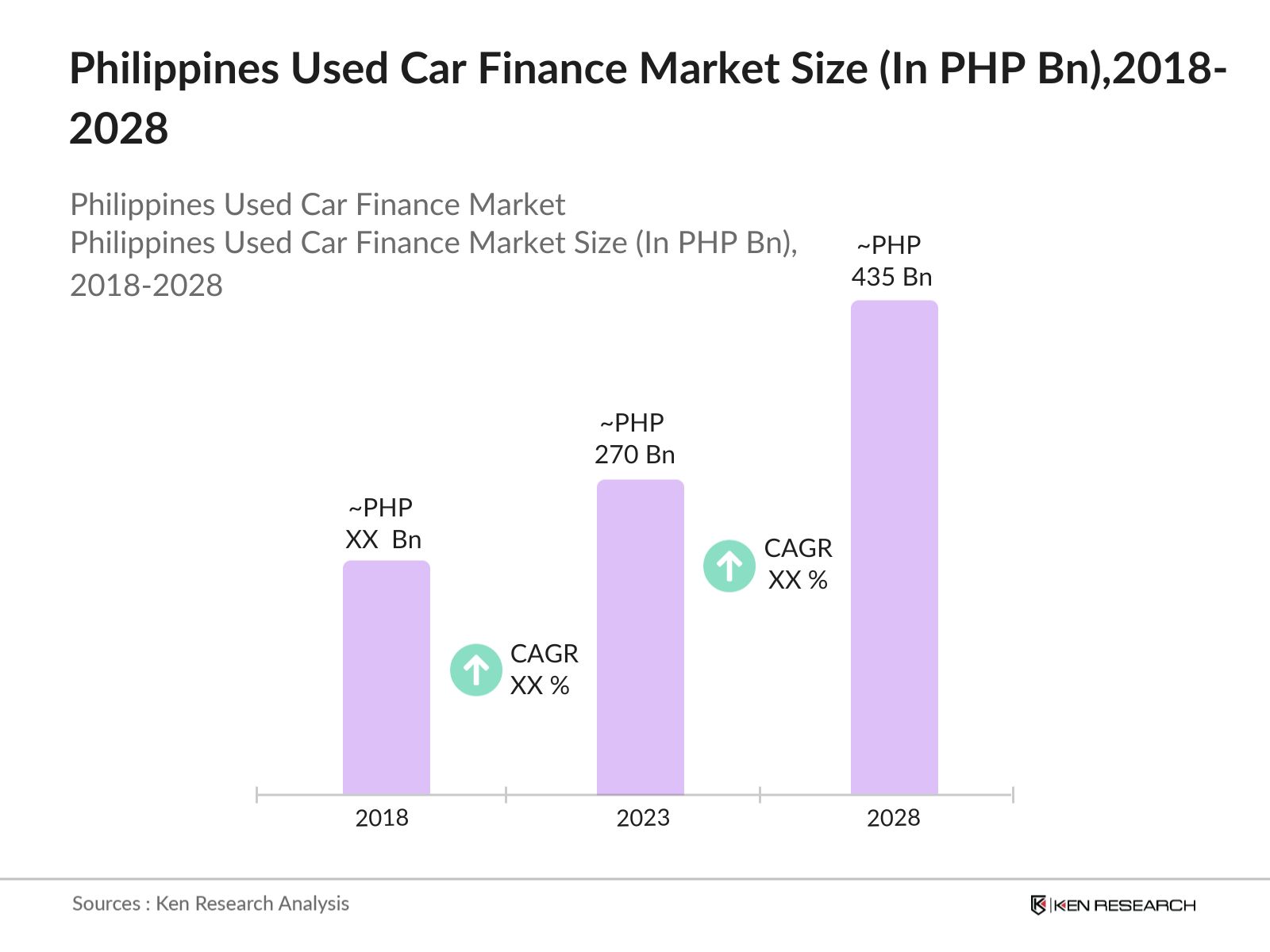

- The Philippines' used car finance market is valued at PHP 270 billion, driven by increasing demand for affordable vehicle ownership and the availability of flexible financing options. Rising urbanization, combined with a growing middle class, has fueled the demand for used cars as an economical choice over new vehicles. Financial institutions and online platforms offering competitive loan rates and simplified application processes further bolster the market.

- Metro Manila and Cebu dominate the Philippines' used car finance market due to their economic activity and high vehicle density. Metro Manila leads as the financial hub with concentrated banking services and consumer markets. Cebu, being a significant business center outside Luzon, shows robust demand due to its growing population and accessibility to organized vehicle trading channels.

- The Philippine government has implemented the National Air Quality Monitoring Program to address environmental concerns. This program involves monitoring air pollutants and enforcing regulations to reduce emissions. For the automotive sector, this means stricter emission standards for vehicles, impacting the used car market by necessitating compliance and potentially influencing consumer choices towards environmentally friendly options.

Philippines Used Car Finance Market Segmentation

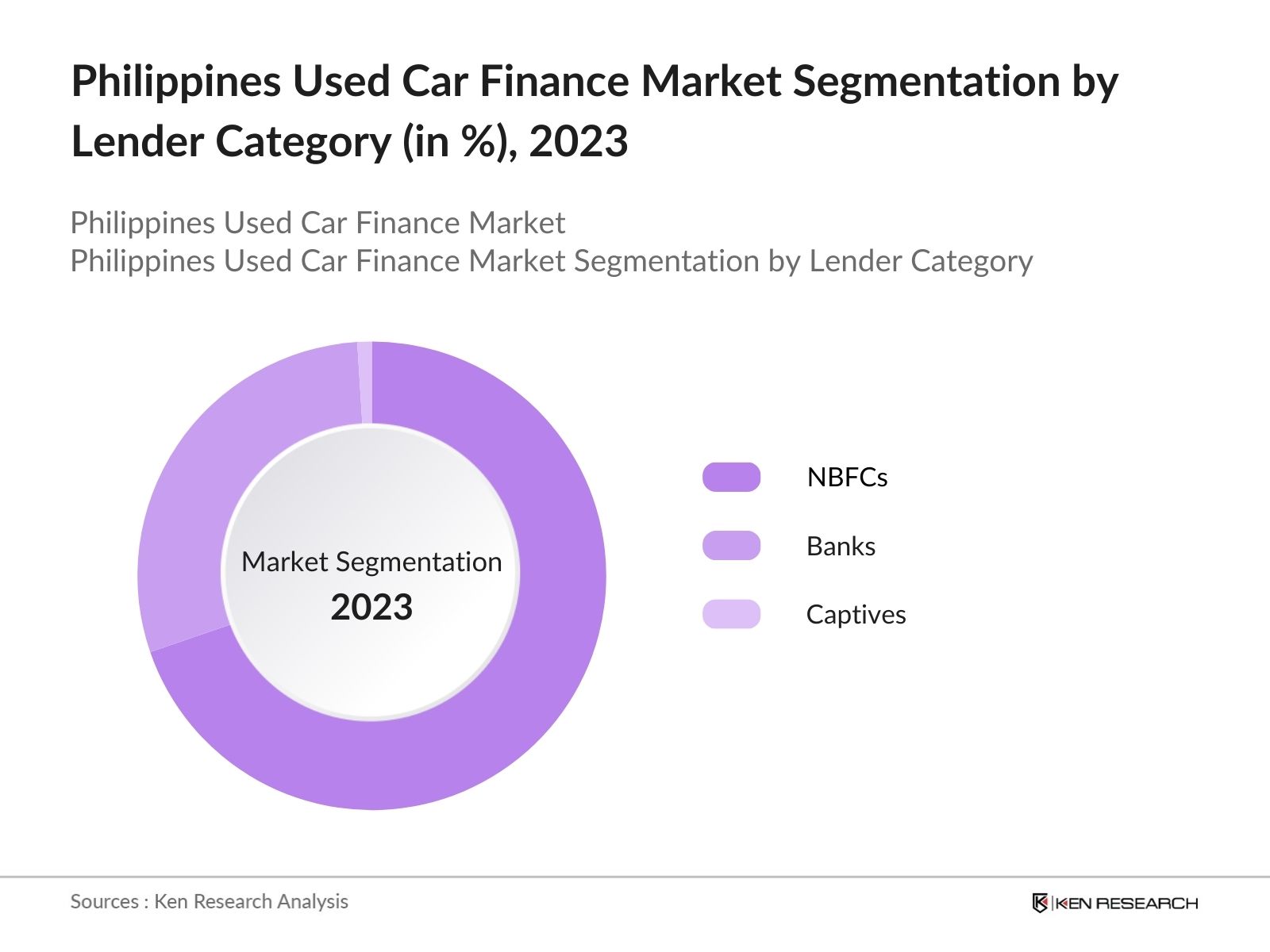

- By Lender Category: The market is segmented into NBFCs, banks, and captives. NBFCs dominate the market due to their streamlined processes, faster loan disbursement, and competitive interest rates compared to traditional banks. Their ability to cater to a broader range of borrowers, including those with limited credit history, makes them a preferred choice among consumers, particularly in semi-urban and urban areas.

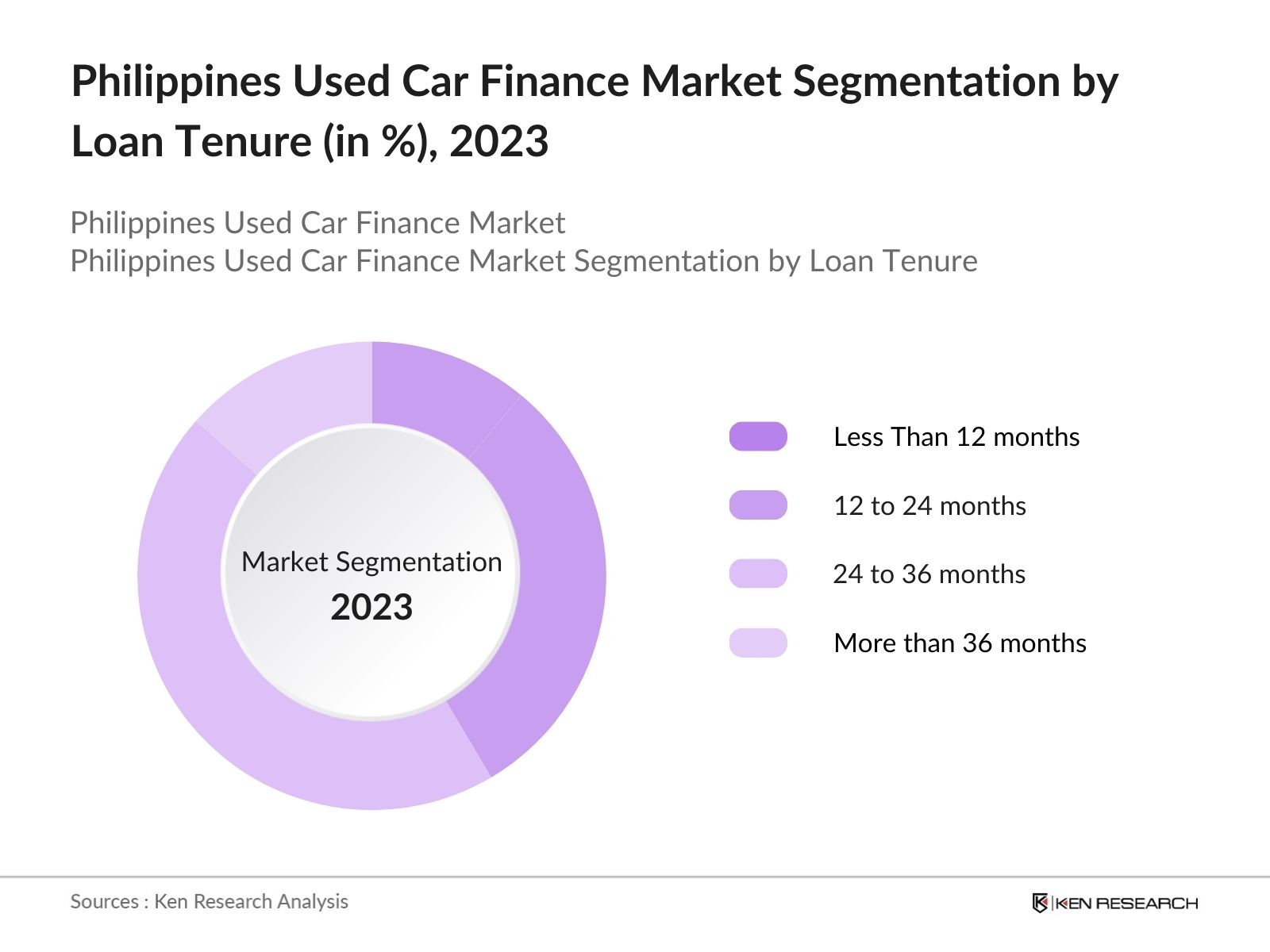

- By Loan Tenure: Loan tenure in the market is segmented into less than 12 months, 12 to 24 months, 24 to 36 months, and more than 36 months. The 24 to 36 months category dominates as it strikes a balance between affordable monthly installments and a manageable repayment period. Borrowers often prefer this tenure as it minimizes financial strain without significantly increasing the overall interest burden.

Philippines Used Car Finance Market Competitive Landscape

The Philippines used car finance market is dominated by major players offering competitive interest rates, simplified loan processes, and extensive vehicle inventories. The sector also sees increased collaboration between financial institutions and online platforms to attract tech-savvy consumers.

Philippines Used Car Finance Market Analysis

Growth Drivers

- Increasing Purchasing Power: The Philippines has experienced a notable rise in disposable incomes, contributing to higher consumer spending. In 2022, the country's Gross Domestic Product (GDP) per capita reached around USD 3,499, reflecting improved economic conditions. This economic growth has enabled more individuals to afford vehicles, thereby boosting the used car finance market. Additionally, the unemployment rate stood at 2.23% in 2023, indicating a stable labor market that supports consumer purchasing power.

- Easy Availability of Finance: The expansion of financial services in the Philippines has made vehicle financing more accessible. The auto finance market has shown robust performance, reflecting a strong recovery and growth phase for the industry since the COVID-19 pandemic in 2020. This increased availability of financing options has facilitated higher vehicle ownership rates, particularly in the used car segment. Financial institutions now offer flexible loan terms, including lower interest rates and extended repayment periods, further encouraging vehicle purchases.

- Rise in Urbanization Rates: Urbanization in the Philippines has been a significant growth driver for the used car finance market. By 2024, the urban population reached around 56.4 million, accounting for 48.5% of the total population, according to World Bank data. The shift toward urban living has increased demand for personal vehicles as public transportation struggles to meet the needs of growing urban centers. Additionally, cities like Metro Manila, Cebu, and Davao have seen higher vehicular density, with used car ownership rising as individuals seek affordable mobility options. Financial institutions have capitalized on this trend by offering tailored auto finance solutions for urban customers.

Challenges

- High Upfront Financial Barriers: Despite the availability of vehicle financing options, the upfront costs associated with acquiring a used car remain a significant obstacle for many Filipinos. Down payments and initial fees can be a financial burden, especially for individuals in lower income brackets. This limits access to vehicle ownership for a considerable segment of the population, creating challenges for market expansion and inclusivity.

- Quality Assurance and Verification Challenges: The used car market in the Philippines faces hurdles in ensuring the quality and reliability of vehicles. Limited availability of standardized inspection processes and certification systems affects consumer trust. Additionally, the lack of a centralized vehicle history database complicates verification processes, increasing risks for both buyers and financing institutions.

Philippines Used Car Finance Future Outlook

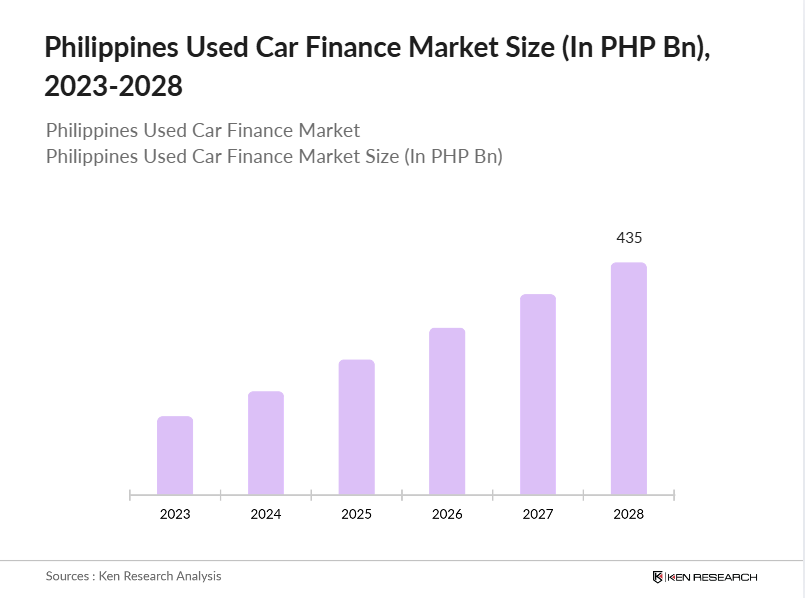

Over the next five years, the Philippines' used car finance market is expected to experience substantial growth, reaching a market size of PHP 435 Bn in 2028, driven by increasing digitalization, higher car ownership aspirations, and expanded financial inclusion efforts. The emergence of innovative fintech solutions is also anticipated to improve accessibility to loans for lower-income segments, creating new opportunities.

Future Market Opportunities

- Digital Transformation in Used Car Financing: The integration of digital platforms is reshaping the used car market in the Philippines. By 2024, the number of internet users in the country reached over 86.9 million, with a penetration rate of around 73%, according to World Bank data. This widespread digital connectivity has enabled the proliferation of online marketplaces and financing platforms, offering consumers easy access to vehicle listings and seamless loan applications.

- Unlocking Rural Market Potential: Despite urban areas like Metro Manila driving much of the vehicle demand, rural regions of the Philippines remain underpenetrated markets for used car financing. As of 2023, rural areas accounted for nearly 51.71% of the population, with infrastructure projects under the "Build, Build, Build" program improving connectivity across provinces. The government's increased investment in rural internet access has also helped bridge the digital divide, enabling more people to explore financing options online.

Scope of the Report

|

By Lender Category |

NBFCs Banks Captives |

|

By Loan Tenure |

Less Than 12 months 12 to 24 months 24 to 36 months More than 36 months |

|

By Car Type |

SUV Hatchback |

|

By Ownership |

Passenger Commercial |

|

By Age Group |

21-30 31-40 41-50 50+ |

|

By Income Level |

Low Income Group Middle Income Group High Income Group |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Land Transportation Office, Bangko Sentral ng Pilipinas)

Automotive Dealers and Manufacturers

Online Marketplace Platforms

Loan Aggregators and Brokers

Insurance Companies

Technology Solution Providers

Companies

Players Mentioned in the Report

Asialink Finance Corp.

Chailease Berjaya Finance Corp.

Global Mobility Services

Yulon Finance Philippines Corp.

JACCS Finance Philippines Corp.

RFC Car Financing Loan

League One Finance & Leasing Corp.

Global Dominion Financing Inc.

Right Choice Finance

BDO

Table of Contents

1. Executive Summary

Executive Summary of Philippines Used Car Finance Market

2. Country Overview

Philippines Country Overview, 2023 (Based on parameters such as GDP, Inflation, Major cities and more)

Overview of Financial Institutions in Philippines, 2023 (Based on parameters such as Total Number of Financial Institutes, Internet & Banking Penetration Rates, Deposits and Loans and more)

3. Philippines Automotive Sector Overview

Philippines New Car Market, 2018-2023 (New Car Sales, Major Brands, Major Countries, Car Type and Growth Drivers)

New Brands in Philippines Automotive Market ( Market Entry and Upcoming Brand)

Passenger Car Landscape in Philippines Automotive Market, 2023, ( New Passenger Car Sales, Average Age of Passenger Cars and more)

4. Philippines Used Car Market Overview

Ecosystem of Philippines Used Car Market (DDSAs, Multi- Brand, Online Auction Houses and Banks)

Business Cycle of Philippines Used Car Market

Value Chain Analysis of Philippines Used Car Market ( Sourcing, Ownership, End- users and more)

Sourcing of Used Cars For Dealers in Philippines

Lead Generation for Used Cars in Philippines

Philippines Used Car Market Business Models (B2B, B2C, C2C, C2B and B2B2C

Used Car Valuation Process

Overview of Aggregators in Philippines Used Car Market

Used Car Market Size, 2018-2023 ( Market Size in Value and Volume, B2C and C2B Sales)

Used Car Market Segmentations, 2018-2023 (By Brand, Average Replacement , and Mileage)

Market Share of Major DDSA Players in Philippines on the Basis of Sales Volume, 2023

Market Share of Major MBO Players in Philippines on the Basis of Sales Volume, 2023

Cross Comparison of DDSA Used Car Market Players

Cross Comparison of MBO Used Car Market Players

5. Philippines Used Car Finance Market Overview & Genesis

Ecosystem of Philippines Used Car Finance Market (Major Banks, NBFCs and Captives)

Philippines Used Car Finance Market Value Chain Analysis ( Vehicle Acquisition, Customer Acquisition and Loan Origination and Processing)

Business Cycle of Philippines Used Car Finance Market

Different Auto Finance Products

6. Philippines Used Car Finance Market Sizing and Segmentations

Philippines Used Car Finance Market Key Highlights

Philippines Used Car Finance Market Size, 2018-2023

Philippines Used Car Finance Market Segmentations By Lender Category, 2023

Philippines Used Car Finance Market Segmentations By Loan Tenure, 2023

Philippines Used Car Finance Market Segmentations by Car Type, 2023

Philippines Used Car Finance Market Segmentations By Ownership Type, 2023

Philippines Used Car Finance Market Segmentations By Age group and Income level, 2023

7. Industry Analysis of Philippines Used Car Finance Market

Philippines Used Car Finance Regulatory Environment ( Legislations, Implication of Regulations, Requirement, Consumer Protection laws and Potential Barriers)

Working Model of Car Repossessions by Banks

Repossessed Car Sales Channels and Strategies

Incentives in Used Car Finance Market

8. End User Analysis of Philippines Used Car Finance Market

Needs and Pain Points of Customers

Customer Profiling in Philippines Used Car Finance Market

Consumer Behavior in Philippines Used Car Market

Customer Preferences in Philippines Used Car Market

9. Competition Framework of Philippines Used Car Finance Market

Competitive Landscape of Philippines Used Car Finance Market

Market Share of Major Used Car Finance Companies in Philippines, 2023

Cross Comparison of Major Players in Philippines Used Car Finance Market

10. Future Outlook and Projections

Philippines Used Car Future Market Outlook, 2023-2028

Used Car Future Outlook, 2023-2028 (by Brand, by Average Replacement and by Mileage)

Philippines Used Car Finance Future Market Outlook, 2023-2028

Future Outlook by Ownership and by Loan Tenure on the basis of Loan Disbursed, 2028

Future Outlook by Lenders and by Car Type on the basis of Loan Disbursed, 2028

Future Outlook by Age Group and by Income Level on the basis of Loan Disbursed, 2028

Repossessed Car Sales Channels and Strategies

Incentives in Used Car Finance Market

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map of the Philippines' used car finance market was constructed, incorporating data from stakeholders, including financial institutions and dealerships. Comprehensive desk research identified crucial variables influencing the market.

Step 2: Market Analysis and Construction

Historical market data was analyzed to evaluate market penetration and key financing trends. Data reliability was ensured through triangulation with third-party verified sources.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with market experts and executives from leading companies provided critical insights, validating preliminary data and identifying emerging opportunities in the market.

Step 4: Research Synthesis and Final Output

Synthesized research findings were cross-verified with primary data to ensure a comprehensive and accurate analysis of the used car finance market.

Frequently Asked Questions

01. How big is the Philippines Used Car Finance Market?

The Philippines used car finance market is valued at PHP 270 billion, driven by increasing consumer demand for affordable vehicle ownership and flexible financing options.

02. What are the challenges in the Philippines Used Car Finance Market?

Challenges in the Philippines used car finance market include limited access to credit in rural areas, high-interest rates from unregulated lenders, and the dominance of informal vehicle trading networks.

03. Who are the major players in the Philippines Used Car Finance Market?

Major players in the Philippines used car finance market include Asialink Finance Corp., Chailease Berjaya Finance Corp., Global Mobility Services, and Yulon Finance Philippines Corp. These companies dominate through strong digital platforms and trusted financing partnerships.

04. What are the growth drivers of the Philippines Used Car Finance Market?

Growth drivers in the Philippines used car finance market include rising middle-class income, the proliferation of digital finance platforms, and increasing awareness of structured financing options over informal credit systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.