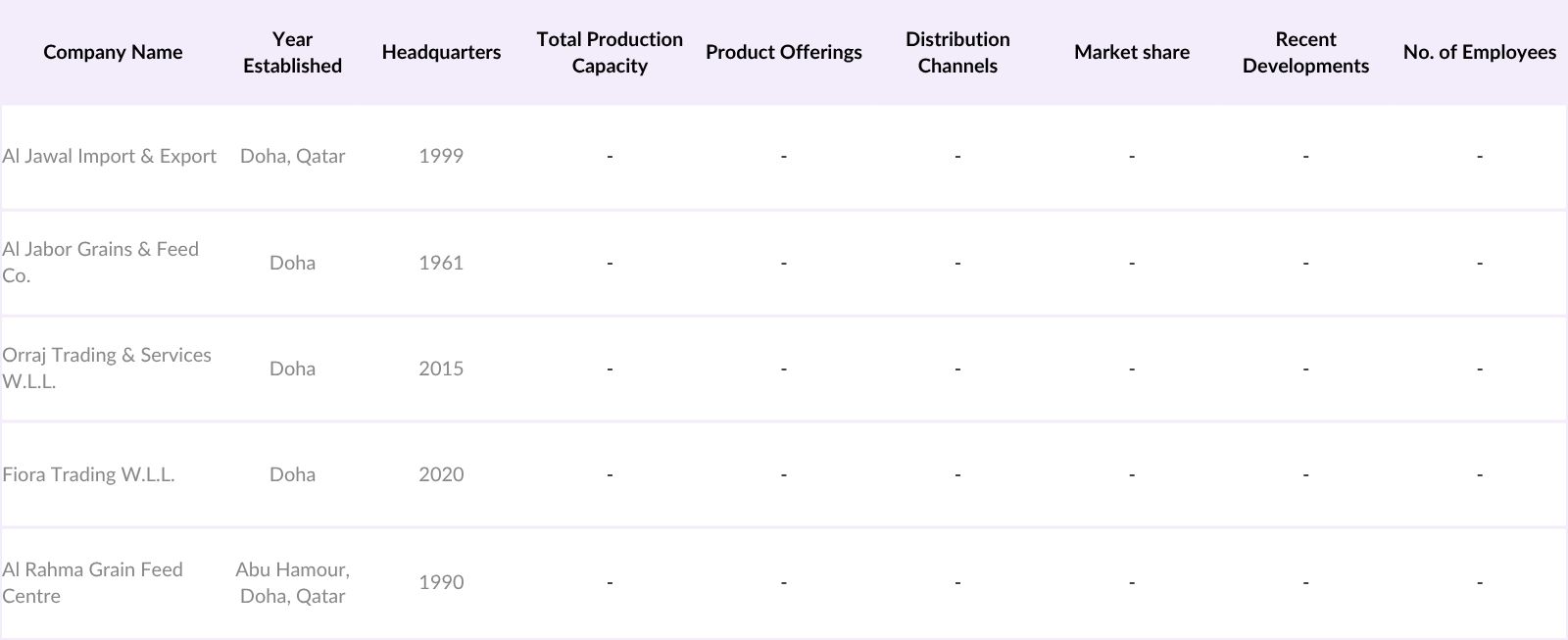

Qatar’s animal feed market is moderately consolidated, led by key players such as Al Jawal, Al Jabor Grains & Feed Co., Orraj Trading, Fiora Trading, and Al Rahma Grain Feed Centre. These companies dominate distribution and supply, operating within a tightly regulated environment and catering to both livestock and aquaculture segments.

Qatar Animal Feed Market Outlook To 2030

Region:Middle East

Author(s):Anmol

Product Code:KR1500

April 2025

80-100

About the Report

Qatar Animal Feed Market Overview

- Qatar Animal feed market is valued at USD 640 Mn, based on a five-year historical analysis. Growth in this market is largely driven by rising seafood demand, which reached a per capita seafood consumption level of 24.5 kg annually, and increased investment in Animal capacity through Qatar Strategic Food Security Projects. These initiatives have enabled a 30% increase in domestic fish production, necessitating corresponding feed imports to support the growing industry. The strong correlation between production volumes and feed requirements continues to boost feed demand across aquafarms in the country.

- Qatar dominance in the animal feed market within the Gulf region is due to a combination of policy-driven initiatives and a growing consumer shift toward seafood. The country produces 7,000 tons of marine fish and shrimp annually, creating a steady and substantial feed requirement. Urban centers such as Doha and Al Khor play a central role due to proximity to aquafarm clusters and logistics hubs, making them strategic consumption zones for imported feed and Animal development.

- Qatar enforces feed imports under Law No. 14 of 2003, which mandates all inbound feed products to be accompanied by veterinary health certificates. These must verify that feed is free from pathogens, contamination, and banned substances such as pork derivatives and radioactive materials. In 2024, customs authorities rejected over 12 shipments for non-compliance, reflecting the strict enforcement of feed safety norms to ensure biosecurity across aquafarming units.

Qatar Animal Feed Market Segmentation

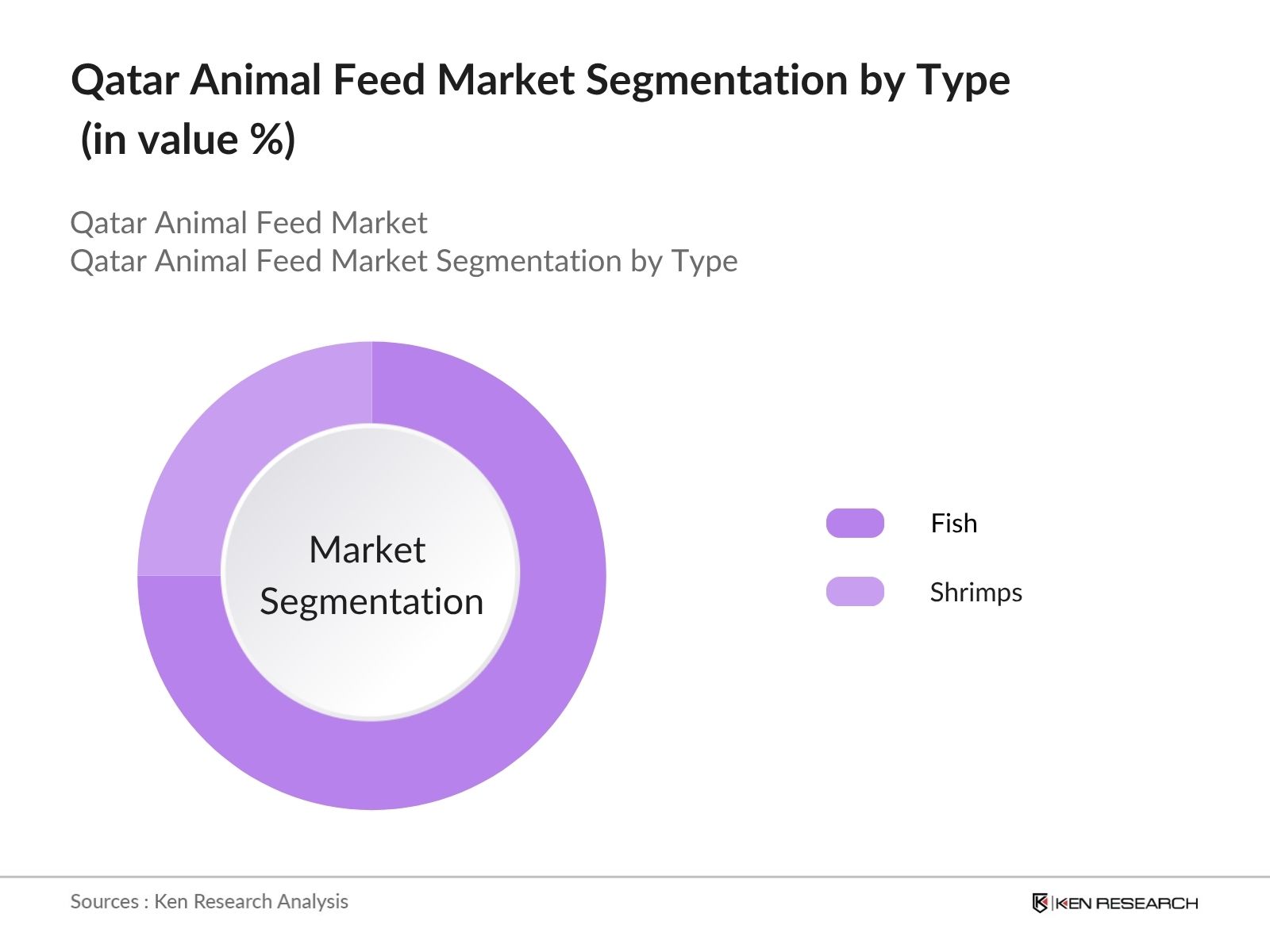

By Type: Qatar Animal Feed Market is segmented by type into fish and shrimps. Fish feed dominates due to higher tonnage and species diversity like tilapia and sea bream. These species require consistent, protein-rich diets. Additionally, government initiatives prioritize marine fish production, reinforcing demand. This makes fish feed the most essential and widely used category across Qatar aquafarming landscape.

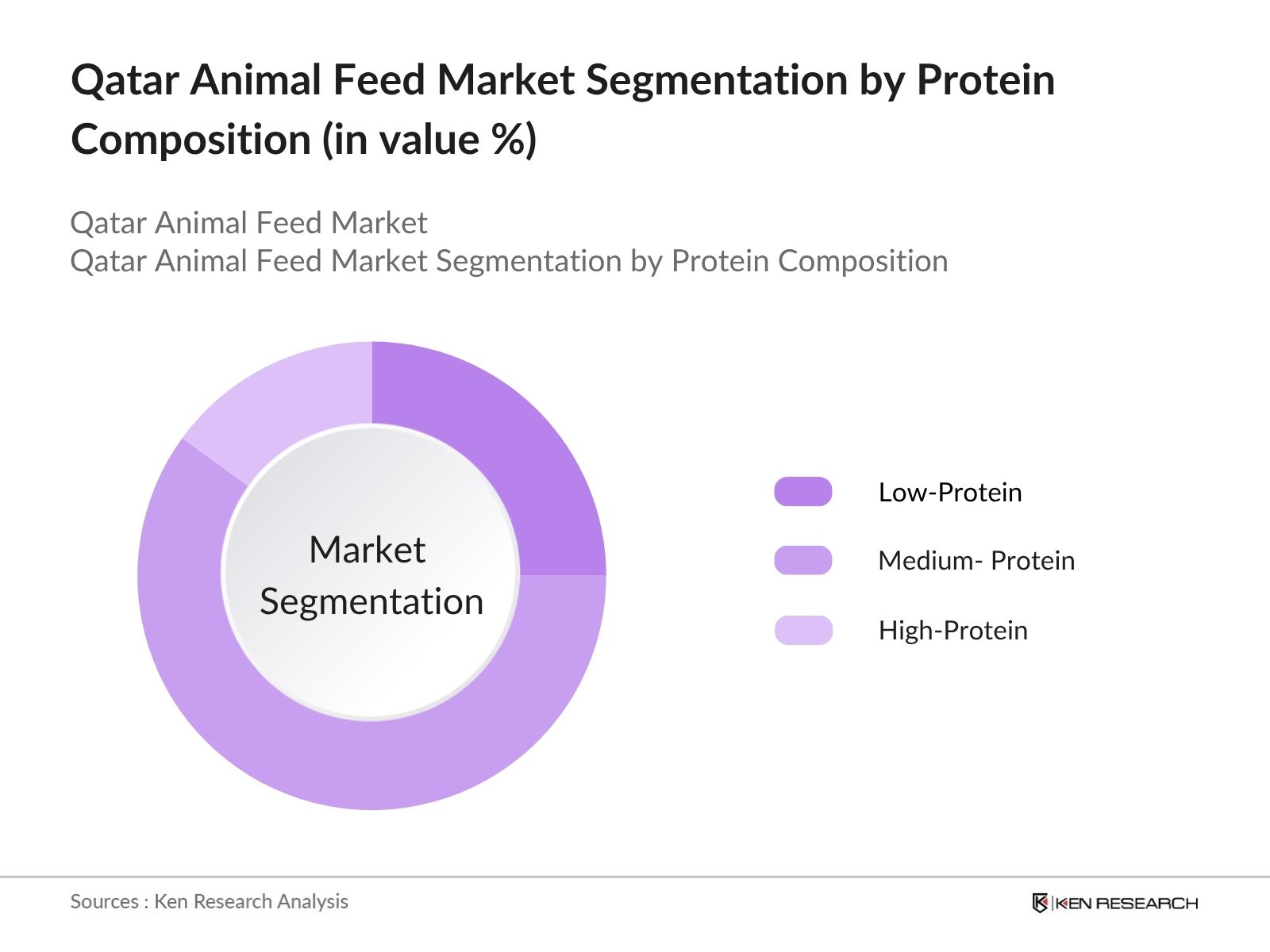

By Protein Composition: Qatar Animal Feed Market is segmented by protein composition into low-, medium-, and high-protein feed. Medium-protein feed leads due to its suitability for multiple species and balanced cost-performance ratio. Aquafarms favor protein feed to ensure effective fish growth while managing operational costs, making it the most preferred option for both small- and large-scale Animal setups.

Qatar Animal Feed Market Competitive Landscape

Qatar Animal Feed Market Analysis

Growth Drivers

Government-Backed Animal Expansion: Qatar Animal sector is witnessing expansion due to state-backed marine fish farming initiatives. As of 2024, Qatar aims to produce 7,000 tons of marine fish and shrimp annually, enhancing the need for specialized feed. With fish consumption reaching 24.5 kg per capita, demand is increasing for high-quality protein diets to meet growing seafood intake. This demandsupply linkage is accelerating feed consumption at aquafarms supported by Qatar Strategic Food Security Projects.

High Shrimp Farming Potential: Qatar climatic and coastal conditions allow ideal settings for shrimp cultivation. Currently, the country imports nearly all of its shrimp, with annual seafood imports from Southeast Asia spanning over 21 days in shipping lead time. This import dependency and high freight volatility drive Qatar to invest in domestic shrimp farming. Feed demand is rising with the proliferation of shrimp hatcheries and intensive grow-out systems now being trialed in northern and western coastal regions.

Feed-Linked Aquafarm Trials: Qatar is trialing algae-based and insect protein-based aquafeed in collaboration with state research bodies to reduce dependence on fishmeal. These innovations target feed conversion efficiency and sustainability. In 2023, over 30% of pilot aquafarms under the Ministry of Municipality tested such alternatives with a focus on tilapia and sea bass. These trials not only reduce environmental footprint but also enable cost-effective domestic feed production, driving localized feed technology adoption.

Market Challenges

Heavy Import Dependency on Feed: Qatar has no domestic fish feed production units and relies entirely on imports from Southeast Asia. All feed for Animal, including shrimp and fish variants, is imported from countries like Thailand and Vietnam. This dependency creates a supply chain risk. In 2024, feed import delays from Indonesia exceeded 3 weeks, causing farm disruptions. Limited domestic capacity continues to affect feed security and cost predictability.

Lack of Specialized Feed Manufacturers: The country lacks specialized aquafeed R&D and manufacturers, forcing it to use generic feed for multiple species. This limits nutrition optimization for species like sea bream and tilapia. For example, protein-rich feeds required in early growth cycles are often unavailable in-country, affecting yield. As per government pilot trials, feed performance drops by a major when generic products are used compared to species-specific formulations.

Qatar Animal Feed Market Future Outlook

Over the next five years, the Qatar Animal feed market is expected to continue its high-growth trajectory, backed by aggressive national food security goals, innovation in feed sources, and rising seafood consumption. Regulatory alignment with sustainability principles and trials of algae-based and insect-based protein sources could reshape procurement models. While the market will remain dependent on imports in the near term, government-backed research in microbial feed conversion may enable localized production in the long term.

Market Opportunities

Local Feed Production Shift: Qatar is actively pursuing localized feed production using food waste-to-feed technologies. In 2024, the Ministry of Municipality began funding pilot units converting food waste to microbial protein. This aligns with Qatar National Food Security Strategy to reduce dependency on imported feed. These domestic innovations will offer scalable feed alternatives, reducing exposure to external trade fluctuations and improving nutrition profiles tailored to local species.

Integrated Farm Ecosystems and Demand Surge: With fish production targets being linked to domestic farm clusters, feed manufacturers now have structured demand visibility. Government-funded farms like the Ras Matbakh facility are expanding capacity. With feed trials being integrated directly with farm setups, future demand will shift towards real-time, on-farm feed customization. This opens up significant opportunities for vendors offering flexible protein formulations and last-mile logistics support.

Scope of the Report

|

By Animal Type |

Fish |

|

By Protein Composition

|

Low-Protein Feed |

|

By Feed Type |

Crumble Feed |

|

By End User |

Government Farms |

|

By Distribution Channel |

Importers |

Products

Key Target Audience

Government and regulatory bodies (Ministry of Municipality, Qatar National Food Security Program)

Animal farm operators and commercial hatcheries

Feed importers and wholesalers

Sustainable agriculture and biotechnology startups

Logistics and cold chain service providers

Animal equipment and RAS system providers

International feed manufacturers

Investments and venture capitalist firms

Companies

Players Mentioned in the Report

- Al Jawal

Al Jabor Grains & Feed Co.

Orraj Trading

Fiora Trading

Al Rahma Grain Feed

Table of Contents

1. Qatar Animal Feed Market Overview

1.1 Definition and Scope (Fish and Shrimp Feed, Import-Dependent Categories)

1.2 Market Taxonomy (By Animal Type, Feed Type, Protein Composition, End User, Distribution Channel)

1.3 Animal Production Benchmark (Tonnage of Fish and Shrimp, Feed-to-Output Ratios)

1.4 Feed Demand Mapping (Per Capita Seafood Consumption, Feed Conversion Efficiency)

1.5 Strategic Role in National Food Security Plan (Qatar National Food Security Strategy)

2. Qatar Animal Feed Market Size (In USD Thousand)

2.1 Historical Feed Volume Demand (By Protein Composition and Animal Type)

2.2 Year-on-Year Growth Rate Analysis (Volume-Based and Value-Based)

2.3 Feed Price Benchmarking (Per Ton by Source Country and Protein Grade)

2.4 Domestic Production vs. Imports Assessment

2.5 Key Milestones (Government Import Contracts, Local Trials, Sustainability Initiatives)

3. Qatar Animal Feed Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Domestic Animal Output

3.1.2 Import Substitution Initiatives for Strategic Feed Security

3.1.3 Emergence of Insect-Based and Algae-Based Protein Trials

3.2 Restraints

3.2.1 100% Import Dependency on Feed

3.2.2 Lack of Domestic Specialized Feed Manufacturers

3.3 Opportunities

3.3.1 Development of Microbial Protein Units (Using Food Waste and Biotech)

3.3.2 Integration of Feed Supply in Government-Backed Clusters

3.4 Trends

3.4.1 Sustainable Feed Inputs (Spirulina, Palm Waste Additives)

3.4.2 Shift Toward On-Farm Custom Feed Blending Models

3.5 Government Regulation

3.5.1 Law No. 14 of 2003 (Veterinary Health Control)

3.5.2 Import Certification & Quarantine Clearance Processes

3.5.3 State-Funded Feed Innovation Trials (Ministry of Municipality)

3.6 Stakeholder Ecosystem

3.7 SWOT Analysis

3.8 Porter’s Five Forces Analysis

3.9 Competition Ecosystem and Import Logistics Network

4. Qatar Animal Feed Market Segmentation

4.1 By Animal Type (In Volume %)

4.1.1 Fish

4.1.2 Shrimps

4.2 By Feed Type (In Volume %)

4.2.1 Crumble Feed

4.2.2 Pellet Feed

4.2.3 Extruded Feed

4.3 By Protein Composition (In Volume %)

4.3.1 Low-Protein Feed

4.3.2 Medium-Protein Feed

4.3.3 High-Protein Feed

4.4 By End User (In Volume %)

4.4.1 Government Farms

4.4.2 Commercial Farms

4.5 By Distribution Channel (In Volume %)

4.5.1 Importers

4.5.2 Distributors

4.5.3 On-Farm Supply Contracts

5. Scope of the Report Qatar Animal Feed Market

5.1 By Animal Type

5.2 By Feed Type

5.3 By Protein Composition

5.4 By End User

5.5 By Distribution Channel

6. Qatar Animal Feed Market Competitive Analysis

6.1 Company Profiles of Major Players

6.1.1. Al Jawal

6.1.2. Al Jabor Grains & Feed Co.

6.1.3. Orraj Trading

6.1.4. Fiora Trading

6.1.5. Al Rahma Grain Feed

6.2 Cross Comparison Parameters (Protein Specialization, No. of Feed Variants, Regional Sourcing Base, Local Distributor Presence, Import Volume into GCC, Species-Specific Feed Capability, Feed Trial Status, Compliance Certifications)

6.3 Market Share by Import Volume (Segmented by Species and Feed Grade)

6.4 Strategic Initiatives and Local Collaborations

6.5 Mergers and Acquisitions

6.6 Private Equity and State Funding Support

6.7 Import Quota Partnerships with Government Farms

7. Qatar Animal Feed Market Regulatory Framework

7.1 Import Protocols and Veterinary Certification Rules

7.2 Approved Ingredient Lists and Prohibited Additives

7.3 Sustainability Mandates and Carbon Accountability in Feed Sourcing

7.4 Guidelines for Feed Trial and Approval in Government Farms

8. Future Market Size Qatar Animal Feed Sector

8.1 Forward-Looking Volume Forecast (Fish vs. Shrimp)

8.2 Domestic Feed Production Potential (Biotech-Based Feed Scaling)

8.3 Import Substitution Ratio Trends

8.4 Government Procurement Volume Projections

9. Future Market Segmentation Qatar Animal Feed Market

9.1 By Feed Type (Projected Volume %)

9.2 By Protein Composition (Projected Adoption)

9.3 By Animal Type (Fish vs. Shrimp Share Evolution)

9.4 By Distribution Channel (Emerging Contract Models)

9.5 By End User (Private Hatcheries vs. Public Farms Growth)

10. Analyst Strategic Recommendations

10.1 White Space Opportunity Matrix (Shrimp Feed Manufacturing in Qatar)

10.2 On-Ground Feed Innovation Clusters (Linked to Ras Matbakh and Al Khor)

10.3 Go-to-Market Strategy for New Entrants

10.4 TAM/SAM/SOM Analysis for Investor Evaluation

10.5 Regulatory Checklist for Feed Importers

Disclaimer

Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved the construction of a stakeholder map within Qatar Animal feed market. Key players including feed manufacturers, importers, government agencies, and aquafarms were identified through secondary research. The aim was to define critical market variables such as feed consumption per ton of output and import dependencies.

Step 2: Market Analysis and Construction

We analyzed historical data on feed consumption by volume, species demand trends, and pricing benchmarks. Market estimates were derived by triangulating Animal output with feed conversion ratios, validated against industry interviews. Factors such as aquafarm expansion rate and species-specific feed requirements were incorporated into the forecasting model.

Step 3: Hypothesis Validation and Expert Consultation

In-depth CATIs were conducted with Animal operators, logistic partners, and regulatory authorities. These consultations provided ground-level insights into feed purchase behaviors, import timelines, and compliance-related bottlenecks, helping us validate key assumptions in feed pricing, sourcing patterns, and volume estimates.

Step 4: Research Synthesis and Final Output

Feedback from stakeholders was merged with secondary data to develop a comprehensive analysis. Industry-leading firms and regulatory agencies were contacted to validate our segmentation models. Final output includes segmentation by protein type, animal type, volume and value share, and regulatory frameworks impacting procurement and usage.

Frequently Asked Questions

01. How big is the Qatar Animal Feed Market?

The Qatar Animal Feed Market was valued at USD 640 Mn based on a five-year historical analysis. It has grown rapidly due to strong domestic demand, government-backed aquafarming, and a complete reliance on feed imports from Southeast Asia.

02. What are the challenges in the Qatar Animal Feed Market?

Key challenges include full dependence on imported feed, which leads to high procurement costs and risks from supply chain disruptions. Additionally, there is no domestic production, exposing the industry to currency fluctuation and raw material inflation.

03. Who are the major players in the Qatar Animal Feed Market?

The market is dominated by local suppliers such as Al Jawal, Al Jabor Grains & Feed Co., Orraj Trading, Fiora Trading, and Al Rahma Grain Feed Centre. These players distribute both fish and shrimp feed across various protein grades.

04. What are the growth drivers of the Qatar Animal Feed Market?

Growth is propelled by per capita seafood consumption of 24.5 kg, Animal production of 7,000 tons annually, and policy initiatives under Qatar Strategic Food Security Projects, which aim to reduce import dependency and improve protein self-sufficiency.

05. What regulations govern the Qatar Animal Feed Market?

Qatar Animal feed imports are regulated under Law No. 14 of 2003 on Veterinary Quarantine. All imports must carry veterinary certificates, and feed must be free of pathogens, prohibited substances, and harmful microorganisms to gain clearance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.