Region:Europe

Author(s):Shubham

Product Code:KRAA0915

Pages:92

Published On:August 2025

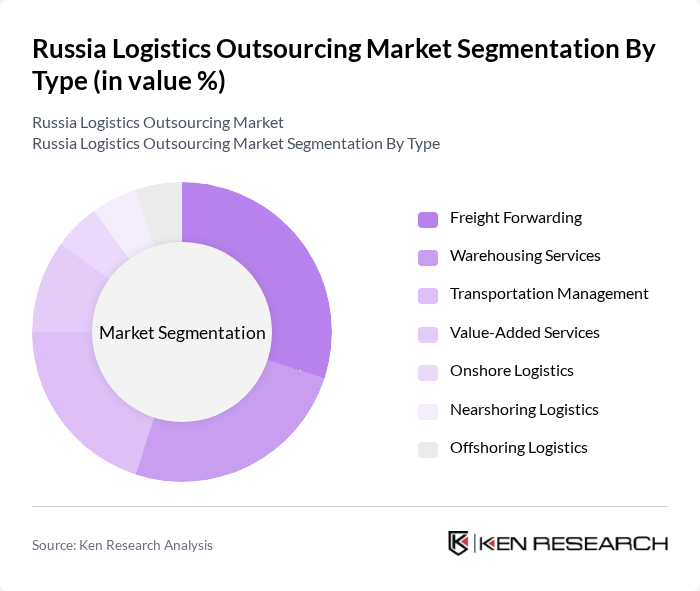

By Type:The logistics outsourcing market can be segmented into Freight Forwarding, Warehousing Services, Transportation Management, Value-Added Services, Onshore Logistics, Nearshoring Logistics, and Offshoring Logistics. Each subsegment plays a crucial role in the logistics ecosystem, supporting diverse customer needs and operational requirements. Freight Forwarding remains central due to its critical role in international trade and complex supply chain management. Warehousing Services are increasingly adopting automation and smart inventory solutions, while Transportation Management is leveraging digital platforms for real-time tracking and optimization. Value-Added Services, such as packaging and reverse logistics, continue to gain prominence as companies seek to enhance customer experience and operational flexibility .

The Freight Forwarding subsegment is currently dominating the market due to its essential role in facilitating international trade and managing the complexities of global supply chains. Companies are increasingly relying on freight forwarders to handle logistics operations, including customs clearance, documentation, and transportation. The growth of e-commerce and the pivot towards Asian trade corridors have further fueled demand for freight forwarding services, as businesses seek to optimize shipping processes and enhance customer satisfaction .

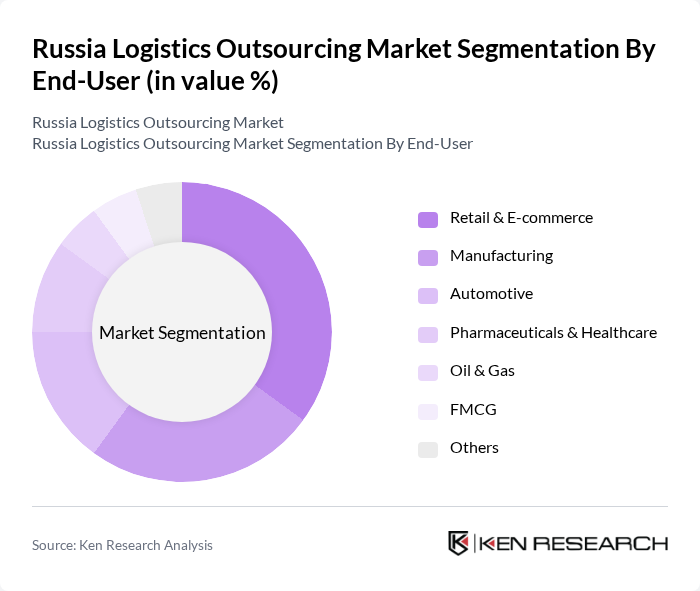

By End-User:The logistics outsourcing market is segmented by end-users, including Retail & E-commerce, Manufacturing, Automotive, Pharmaceuticals & Healthcare, Oil & Gas, FMCG, and Others. Each end-user segment has unique logistics requirements, influencing the demand for specific logistics services. Retail & E-commerce is the fastest-growing segment, driven by the surge in online shopping and the need for rapid, reliable delivery. Manufacturing and Automotive sectors are focusing on supply chain resilience and cost optimization, while Pharmaceuticals & Healthcare require specialized handling and regulatory compliance. Oil & Gas and FMCG segments continue to demand robust logistics support for large-scale, time-sensitive distribution .

The Retail & E-commerce segment is leading the market due to the rapid growth of online shopping and the increasing demand for efficient logistics solutions. Retailers are focusing on enhancing their supply chain capabilities to meet customer expectations for fast and reliable delivery. This trend has led to a surge in logistics outsourcing, as companies seek specialized providers to manage their logistics operations effectively. The sector’s growth is further supported by technological advancements and the expansion of last-mile delivery networks .

The Russia Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DPD Russia, CDEK, Kuehne + Nagel, DB Schenker, RZD Logistics, Russian Post, PEC (First Expeditionary Company), FM Logistic Russia, Major Express, Yandex Delivery, Delovye Linii, Itella Russia, TransContainer, Globaltruck, Logist.ru contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics outsourcing market in Russia appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital logistics solutions, the integration of automation and artificial intelligence is expected to streamline operations and enhance efficiency. Furthermore, the focus on sustainability will likely lead to innovative logistics practices, positioning the market for significant growth as businesses seek to reduce their environmental impact while meeting consumer demands for faster and more reliable services.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Services Transportation Management Value-Added Services Onshore Logistics Nearshoring Logistics Offshoring Logistics |

| By End-User | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Oil & Gas FMCG Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Multimodal Transport Others |

| By Service Type | Dedicated Contract Carriage Integrated Logistics Services Supply Chain Consulting Last-Mile Delivery Reverse Logistics Others |

| By Customer Type | B2B B2C Government Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Automated Logistics AI-Driven Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 60 | Logistics Directors, Supply Chain Managers |

| Manufacturing Supply Chain Management | 50 | Operations Managers, Procurement Heads |

| E-commerce Fulfillment Services | 45 | eCommerce Operations Managers, Logistics Coordinators |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Distribution Managers |

| Third-Party Logistics Providers | 55 | Business Development Managers, Client Relationship Managers |

The Russia Logistics Outsourcing Market is valued at approximately USD 71 billion, reflecting significant growth driven by increased demand for efficient supply chain solutions, digitalization, and the expansion of e-commerce activities.