Saudi Arabia Adhesives Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD3255

November 2024

85

About the Report

Saudi Arabia Adhesives Market Overview

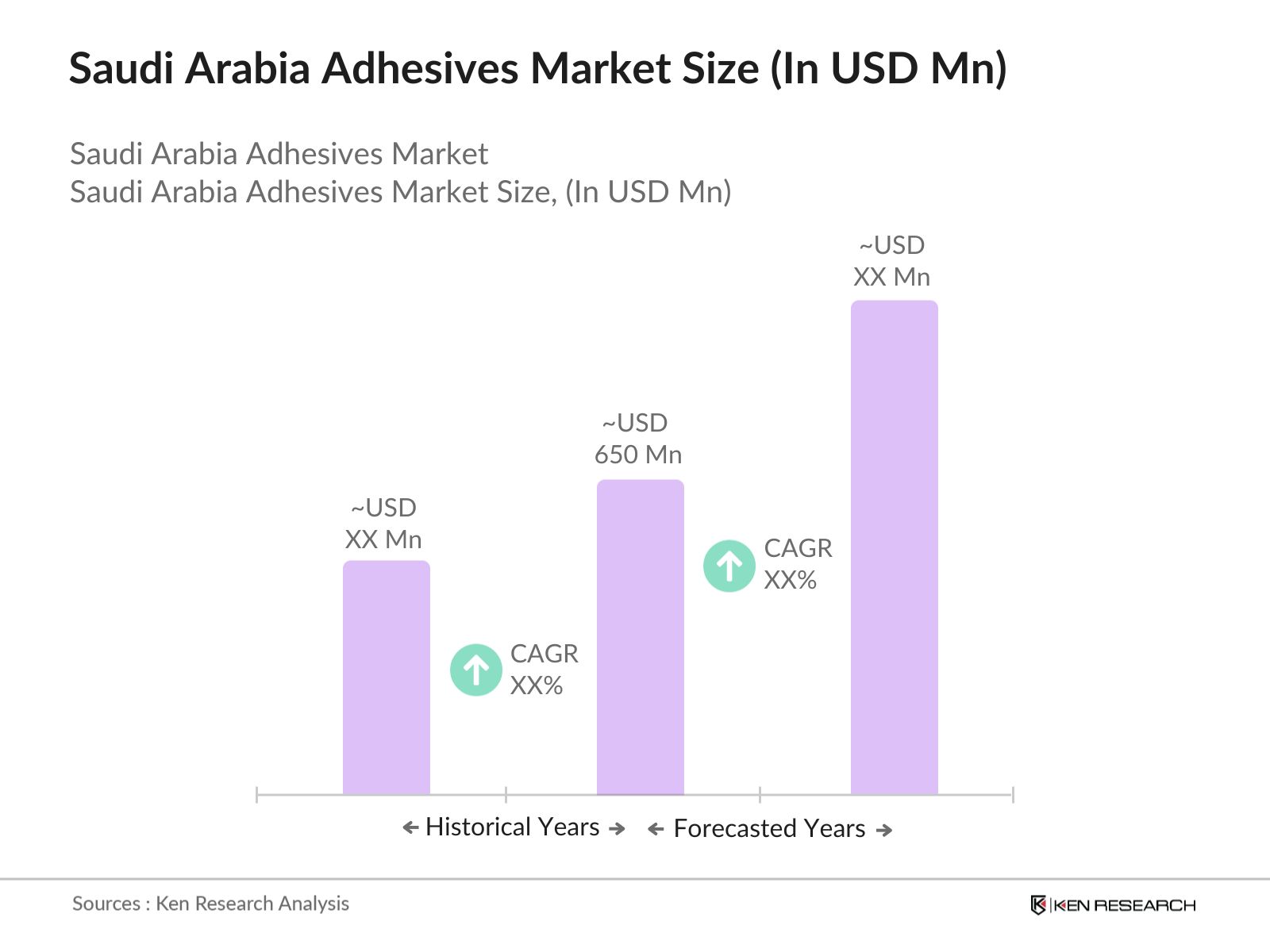

- The Saudi Arabia Adhesives Market is valued at USD 650 million, reflecting its robust expansion fueled by the nations thriving construction and packaging industries. The surge in infrastructure projects, coupled with rising demand for sustainable packaging solutions, drives this market. The automotive and healthcare sectors are emerging as significant contributors, leveraging adhesives for advanced applications in vehicle manufacturing and medical equipment assembly.

- Central and Eastern regions dominate the Saudi adhesives market due to their industrial hubs and proximity to major petrochemical suppliers. Riyadh, as the capital, hosts several infrastructure projects requiring adhesive solutions, while the Eastern region benefits from its extensive manufacturing base. This strategic positioning ensures steady supply chains and cost advantages for producers and consumers alike.

- The Saudi Standards, Metrology and Quality Organization (SASO) establishes and enforces standards for products, including adhesives, to ensure quality and safety within Saudi Arabia. These guidelines mandate that adhesives meet specific performance criteria and comply with safety standards to protect consumers and the environment. For instance, adhesives used in food packaging must adhere to regulations that prevent contamination and ensure product integrity. Manufacturers and importers are required to obtain conformity certificates for their adhesive products, demonstrating compliance with SASO standards before entering the Saudi market.

Saudi Arabia Adhesives Market Segmentation

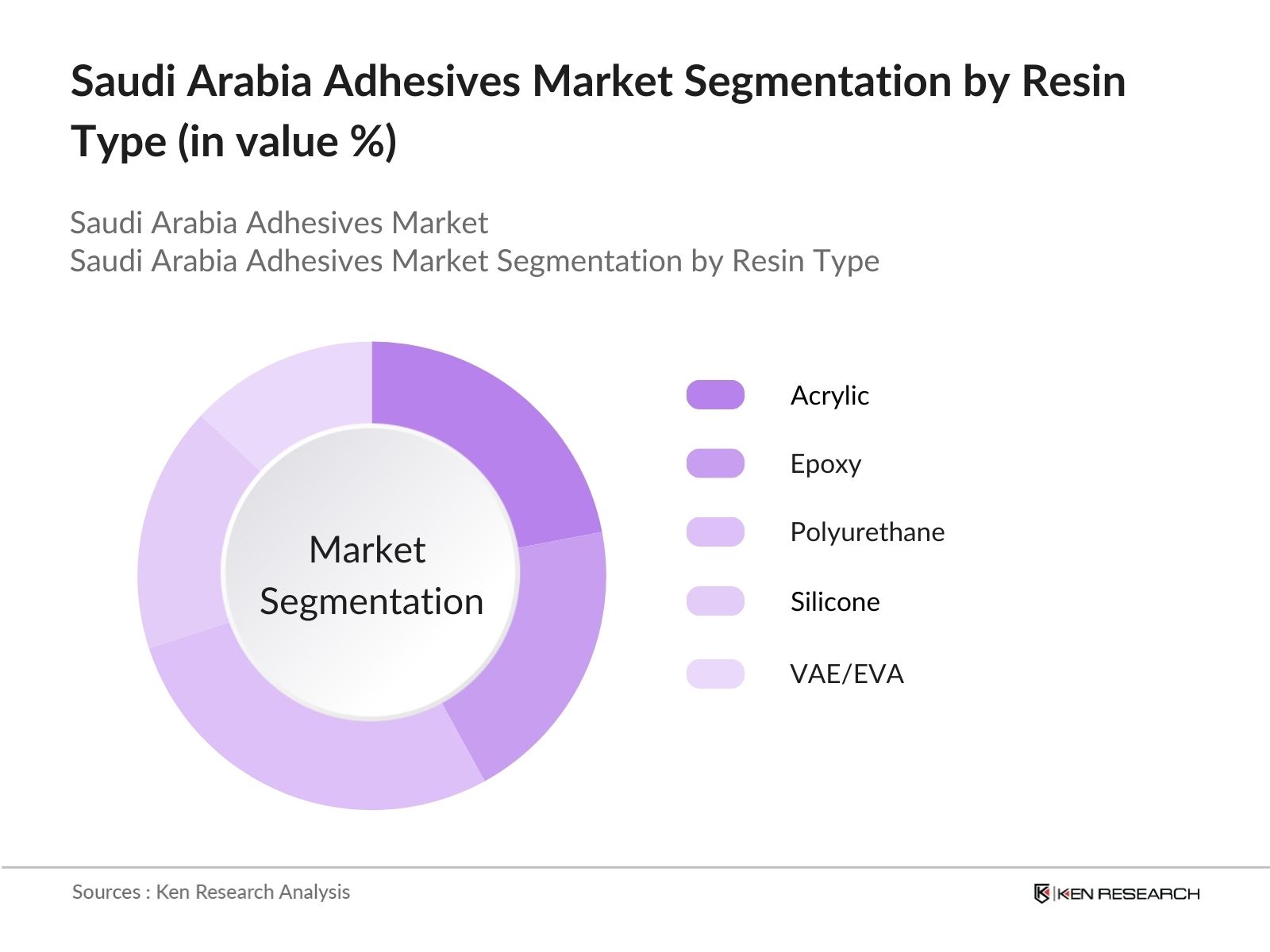

- By Resin Type: Saudi Arabia's adhesives market is segmented by resin type into acrylic, epoxy, polyurethane, silicone, VAE/EVA. Recently, polyurethane adhesives have shown dominance due to their versatility and superior bonding strength. This resin type is highly preferred in construction and automotive applications for its ability to provide durable bonds under extreme conditions, making it indispensable for high-stress environments.

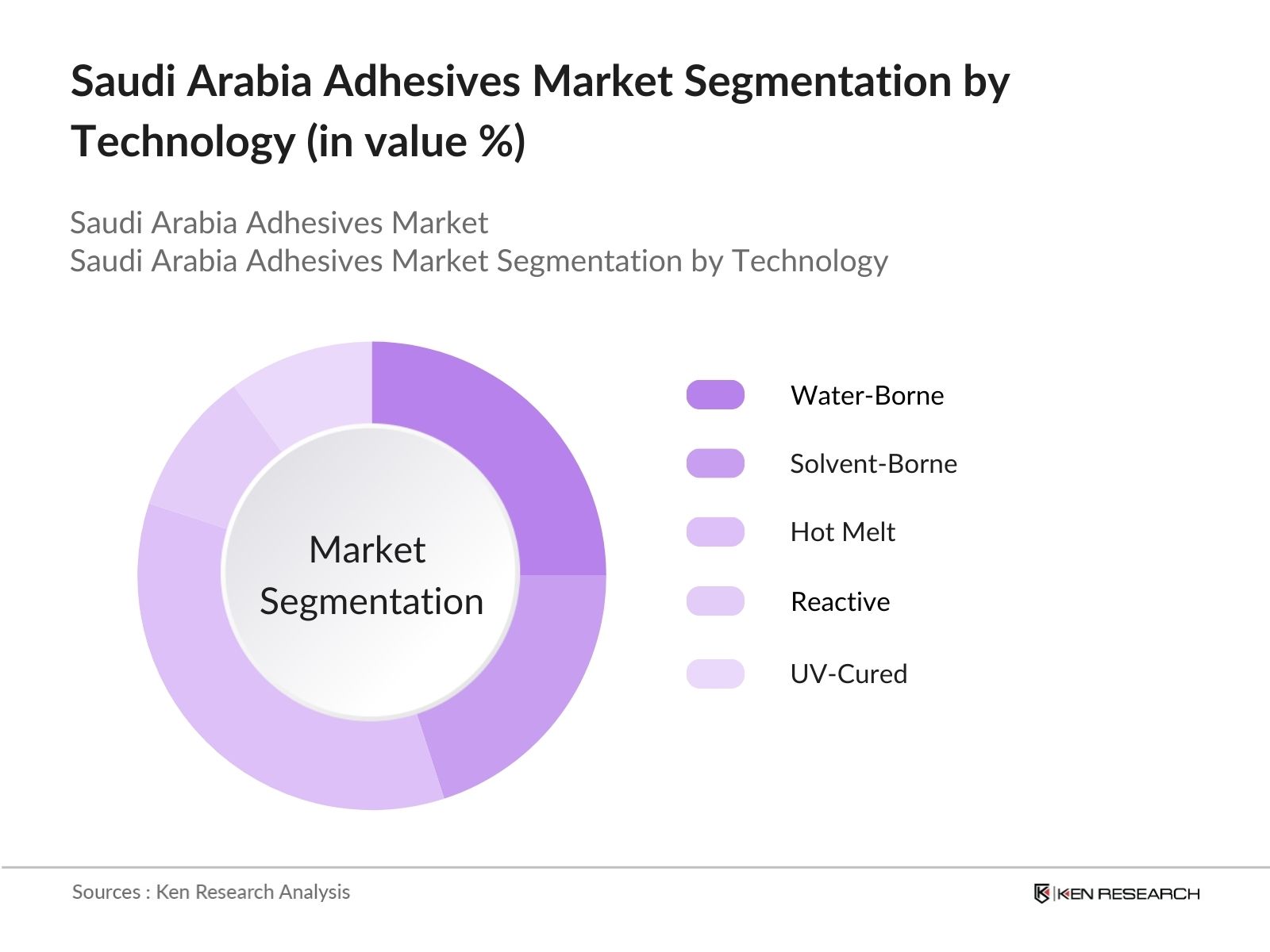

- By Technology: Technological segmentation includes water-borne, solvent-borne, hot melt, reactive, and UV-cured adhesives. Among these, hot melt adhesives dominate due to their rapid curing time and eco-friendly nature. They are extensively used in packaging applications where efficiency and sustainability are critical. The rising demand for disposable hygiene products also contributes significantly to this segment's leadership.

Saudi Arabia Adhesives Market Competitive Landscape

The Saudi Arabia adhesives market is characterized by both global and regional players, contributing to a competitive yet innovation-driven ecosystem. The market is led by established global brands like Henkel AG and local giants like Zamil Chemical. Their dominance is attributed to strong R&D investments, local manufacturing capabilities, and extensive distribution networks.

Saudi Arabia Adhesives Market Analysis

Growth Drivers

- Expansion in Construction Sector: The global construction industry has been experiencing significant growth, with the World Bank reporting a 3.5% increase in construction activities in 2023. This expansion is particularly notable in emerging economies, where urbanization and infrastructure development are accelerating. For instance, India's construction sector grew by 5.2% in 2023, driven by government initiatives like the Smart Cities Mission, which aims to develop 100 smart cities across the country. Similarly, China's Belt and Road Initiative has led to substantial investments in infrastructure projects, contributing to the demand for construction materials, including adhesives. These developments underscore the critical role of adhesives in modern construction, from bonding materials to sealing joints, thereby enhancing structural integrity and efficiency.

- Growth in Packaging Industry: The packaging industry has seen robust growth, fueled by the rise of e-commerce and increased consumer demand for packaged goods. According to the World Trade Organization, global e-commerce sales reached $26.7 trillion in 2022, reflecting a surge in online shopping. This trend has led to a higher demand for packaging materials, where adhesives play a vital role in ensuring product safety and integrity. In the United States, the packaging sector expanded by 4.1% in 2023, with adhesives being essential in applications such as carton sealing and labeling. The shift towards sustainable packaging solutions has also driven the development of eco-friendly adhesives, aligning with consumer preferences and regulatory standards.

- Advancements in Automotive Manufacturing: The automotive industry has been undergoing significant advancements, particularly in the production of electric vehicles (EVs). The International Energy Agency reported that global EV sales surpassed 10 million units in 2023, a 35% increase from the previous year. This shift has led manufacturers to adopt lightweight materials and innovative bonding techniques to improve vehicle efficiency. Adhesives have become crucial in replacing traditional welding and mechanical fasteners, contributing to weight reduction and enhanced performance. For example, the use of structural adhesives in vehicle assembly has increased by 15% in 2023, reflecting the industry's move towards more efficient manufacturing processes.

Market Challenges

- Volatility in Raw Material Prices: The adhesives industry faces challenges due to fluctuations in raw material prices, particularly petroleum-based products. In 2023, crude oil prices experienced a 20% increase, impacting the cost of synthetic polymers used in adhesive production. This volatility affects profit margins and pricing strategies for manufacturers. Additionally, supply chain disruptions, such as those caused by geopolitical tensions, have led to shortages and increased costs of essential raw materials. For instance, the price of ethylene, a key component in adhesive production, rose by 15% in 2023, adding to the industry's challenges.

- Environmental Regulations: Stringent environmental regulations have been implemented to reduce volatile organic compound (VOC) emissions from adhesives. The European Union's REACH regulation and the U.S. Environmental Protection Agency's standards have set limits on VOC content, compelling manufacturers to reformulate products. In 2023, compliance costs for adhesive producers increased by 10% due to the need for research and development of eco-friendly alternatives. Non-compliance can result in penalties and restricted market access, making adherence to these regulations both a challenge and a necessity for industry players.

Saudi Arabia Adhesives Market Future Outlook

Over the next five years, the Saudi Arabia Adhesives Market is expected to grow significantly, driven by continuous advancements in adhesive technology, increased demand for sustainable solutions, and expansion of end-use industries. Infrastructure developments aligned with Vision 2030 and a surge in eco-conscious consumer preferences will further accelerate market growth.

Marekt Opportunities

- Development of Bio-based Adhesives: The growing emphasis on sustainability has led to increased interest in bio-based adhesives derived from renewable resources. In 2023, the production of bio-based adhesives increased by 8%, reflecting a shift towards environmentally friendly products. These adhesives offer reduced environmental impact and align with global efforts to decrease reliance on fossil fuels. Research and development in this area have led to innovations such as soy-based and lignin-based adhesives, providing opportunities for manufacturers to cater to eco-conscious consumers and comply with environmental regulations.

- Technological Innovations: Advancements in adhesive technologies have opened new avenues for application and performance enhancement. In 2023, investment in research and development for adhesive technologies increased by 12%, leading to innovations such as smart adhesives with self-healing properties and temperature responsiveness. These developments have expanded the use of adhesives in high-tech industries, including electronics and aerospace, where specialized bonding solutions are required. The integration of nanotechnology has also led to adhesives with improved strength and durability, offering manufacturers opportunities to meet evolving industry demands.

Scope of the Report

|

Acrylic Epoxy Polyurethane Silicone VAE/EVA |

|

|

By Technology |

Water-Borne Solvent-Borne Hot Melt Reactive UV-Cured |

|

By End-User |

Building and Construction Packaging Automotive Healthcare Woodworking and Joinery Footwear and Leather Aerospace |

|

By Application |

Pressure Sensitive Applications Structural Adhesives Non-Structural Adhesives |

|

By Region |

North East West South |

Products

Key Target Audience

Adhesive Manufacturers

Construction and Infrastructure Companies

Automotive Manufacturers

Packaging Companies

Healthcare Equipment Manufacturers

Industrial Adhesive Suppliers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., SASO, Ministry of Industry and Mineral Resources)

Companies

Players Mention in the Report:

Henkel AG & Co. KGaA

H.B. Fuller Company

Sika AG

Arkema Group

Dow Inc.

3M Company

Avery Dennison Corporation

Zamil Chemical

Bostik SA

Huntsman Corporation

Wacker Chemie AG

RPM International Inc.

Mapei S.p.A.

Pidilite Industries Limited

Ashland Inc.

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Construction Sector

3.1.2. Growth in Packaging Industry

3.1.3. Advancements in Automotive Manufacturing

3.1.4. Rising Demand in Healthcare Applications

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Environmental Regulations

3.2.3. Competition from Alternative Bonding Technologies

3.3. Opportunities

3.3.1. Development of Bio-based Adhesives

3.3.2. Technological Innovations

3.3.3. Expansion into Emerging Applications

3.4. Trends

3.4.1. Shift Towards Sustainable Adhesives

3.4.2. Increased Use of Hot Melt Adhesives

3.4.3. Adoption of Smart Adhesive Technologies

3.5. Regulatory Landscape

3.5.1. Saudi Standards, Metrology and Quality Organization (SASO) Guidelines

3.5.2. Environmental Compliance Standards

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Market Segmentation

4.1. By Resin Type (Value %)

4.1.1. Acrylic

4.1.2. Epoxy

4.1.3. Polyurethane

4.1.4. Silicone

4.1.5. VAE/EVA

4.1.6. Others

4.2. By Technology (Value %)

4.2.1. Water-Borne

4.2.2. Solvent-Borne

4.2.3. Hot Melt

4.2.4. Reactive

4.2.5. UV-Cured

4.3. By End-Use Industry (Value %)

4.3.1. Building and Construction

4.3.2. Packaging

4.3.3. Automotive

4.3.4. Healthcare

4.3.5. Woodworking and Joinery

4.3.6. Footwear and Leather

4.3.7. Aerospace

4.3.8. Others

4.4. By Application (Value %)

4.4.1. Pressure Sensitive Applications

4.4.2. Structural Adhesives

4.4.3. Non-Structural Adhesives

4.4.4. Others

4.5. By Region (Value %)

4.5.1. South

4.5.2. West

4.5.3. East

4.5.4. North

5. Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Henkel AG & Co. KGaA

5.1.2. H.B. Fuller Company

5.1.3. Sika AG

5.1.4. Arkema Group

5.1.5. Dow Inc.

5.1.6. 3M Company

5.1.7. Avery Dennison Corporation

5.1.8. Bostik SA

5.1.9. Ashland Inc.

5.1.10. Huntsman Corporation

5.1.11. Wacker Chemie AG

5.1.12. RPM International Inc.

5.1.13. Mapei S.p.A.

5.1.14. Pidilite Industries Limited

5.1.15. The Industrial Group Ltd.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Resin Type (Value %)

8.2. By Technology (Value %)

8.3. By End-Use Industry (Value %)

8.4. By Application (Value %)

8.5. By Region (Value %)

9. Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An exhaustive study of the Saudi Arabia Adhesives Market ecosystem was conducted, identifying critical variables such as resin types, applications, and supply chain networks. The process included leveraging secondary data and proprietary databases to outline market dynamics comprehensively.

Step 2: Market Analysis and Construction

This phase involved compiling historical data and analyzing trends across resin and technology segments. Data consistency was validated through multiple sources to ensure accuracy, followed by segmentation analysis to determine key drivers of market growth.

Step 3: Hypothesis Validation and Expert Consultation

Structured interviews with industry stakeholders provided valuable insights into market dynamics. These consultations ensured data accuracy and relevance, offering a first-hand perspective on technological innovations and challenges.

Step 4: Research Synthesis and Final Output

Insights from manufacturers and end-users were integrated to produce a comprehensive report. Detailed quantitative and qualitative assessments were conducted, ensuring a holistic market analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia Adhesives Market?

The Saudi Arabia Adhesives Market is valued at USD 650 million, driven by demand in construction, packaging, and automotive industries.

02. What are the challenges in the Saudi Arabia Adhesives Market?

Saudi Arabia Adhesives Market Challenges include volatile raw material prices, stringent environmental regulations, and competition from alternative bonding technologies.

03. Who are the major players in the Saudi Arabia Adhesives Market?

Saudi Arabia Adhesives Market Key players include Henkel AG, H.B. Fuller Company, Sika AG, Zamil Chemical, and Dow Inc., supported by strong R&D and regional presence.

04. What are the growth drivers of the Saudi Arabia Adhesives Market?

Saudi Arabia Adhesives Market Growth drivers include robust construction activity, advancements in packaging solutions, and increasing adoption in healthcare and automotive sectors.

05. What are the future opportunities in the Saudi Arabia Adhesives Market?

Saudi Arabia Adhesives Market Opportunities lie in bio-based adhesive development, expansion into emerging applications, and technological innovations like smart adhesives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.