Saudi Arabia Agriculture Equipment Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD3359

November 2024

94

About the Report

Saudi Arabia Agriculture Equipment Market Overview

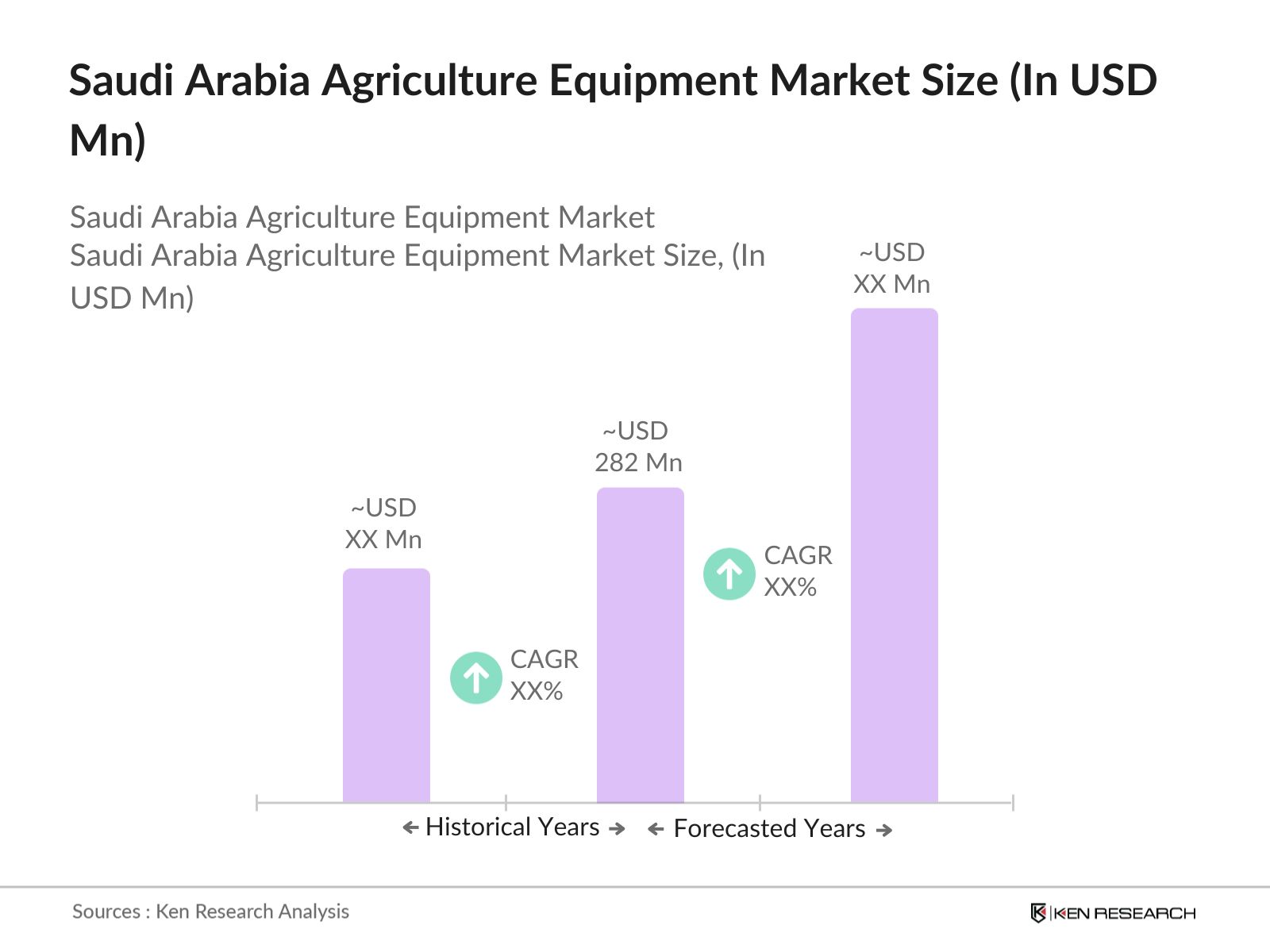

- The Saudi Arabia Agriculture Equipment Market is valued at USD 282 million, reflecting a strong foundation fueled by government subsidies, technological advancements in agriculture, and a shift toward sustainable farming practices. This market expansion aligns with national goals to diversify the economy, including initiatives under Saudi Vision 2030 that encourage local production and self-sufficiency in food supply. In addition, modern farming technologies and precision agriculture solutions contribute significantly to market growth, promoting efficiency and reducing environmental impact.

- Riyadh and the Eastern Province lead the agriculture equipment market in Saudi Arabia, primarily due to their extensive farming areas and supportive infrastructure. Riyadhs dominance stems from its central location and access to key distribution networks, while the Eastern Province benefits from advanced irrigation systems supporting large-scale agricultural operations. These areas also receive substantial government investment in agricultural technology and infrastructure, making them pivotal to the country's agricultural output.

- Subsidy programs for agricultural machinery are a major support pillar for Saudi farmers, with SAR 3.1 billion allocated to equipment subsidies in 2024 by the Agricultural Development Fund. These programs provide financial relief for small farmers, promoting access to advanced machinery. The subsidies aim to improve productivity and sustainability, making agriculture more resilient to economic and environmental challenges.

Saudi Arabia Agriculture Equipment Market Segmentation

The Saudi Arabia Agriculture Equipment market is segmented by product type and by power source.

- By Product Type: The Saudi Arabia Agriculture Equipment market is segmented by product type into tractors, harvesters, irrigation systems, plows and cultivators, and seed drills and planters. Currently, tractors hold a dominant market share within the product type segment, driven by their versatility across various farming tasks. Tractors enable efficient soil preparation, transportation of goods, and mechanized plowing, which is essential for larger farms in Saudi Arabia. Major global brands, alongside local players, provide a range of tractor options that address the specific needs of Saudi farmers, from small-scale operations to industrial farming setups.

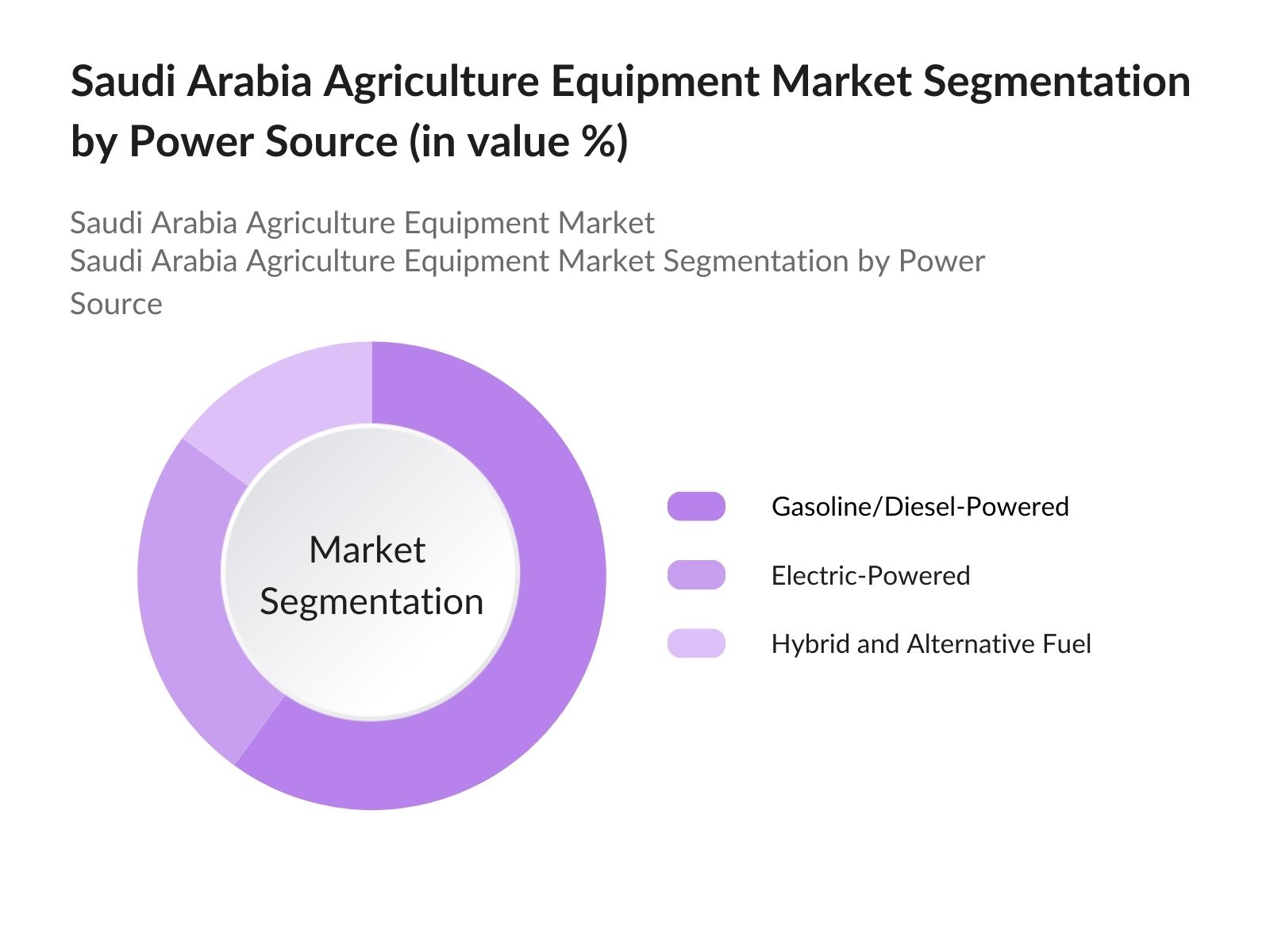

- By Power Source: The market is also segmented by power source, including gasoline/diesel-powered, electric-powered, and hybrid and alternative fuel options. Gasoline/diesel-powered equipment dominates the power source segment due to their high performance, durability, and suitability for Saudi Arabias large-scale farming. Although electric-powered equipment is gaining interest, diesel-powered options remain essential for prolonged, heavy-duty operations, especially in regions where electrical infrastructure may be underdeveloped. However, the demand for sustainable solutions continues to grow, setting the stage for future growth in electric and hybrid options.

Saudi Arabia Agriculture Equipment Market Competitive Landscape

The Saudi Arabia Agriculture Equipment market is dominated by several key players, each contributing to a competitive landscape marked by innovation and strategic partnerships. Local companies benefit from government incentives, while international players leverage advanced technology to strengthen their presence.

Saudi Arabia Agriculture Equipment Market Analysis

Growth Drivers

- Government Subsidies and Incentives: The Saudi government has been active in promoting agricultural modernization, providing substantial subsidies and incentives for the procurement of advanced agricultural equipment. In 2024, the Saudi Ministry of Environment, Water, and Agriculture allocated SAR 3.5 billion to various subsidy programs, benefiting farmers and equipment manufacturers alike. These initiatives have improved access to high-efficiency machinery, reducing operational costs for farmers and enhancing productivity. For instance, under the Kingdoms Vision 2030, direct financial assistance has been extended to small and medium-sized farmers, with SAR 600 million specifically earmarked for sustainable machinery subsidies.

- Technological Advancements in Machinery: The integration of advanced technologies such as GPS, automation, and sensors in agricultural machinery is transforming the industry. In Saudi Arabia, approximately 3,200 units of GPS-enabled tractors were imported in 2023, a marked increase from prior years, driven by demand for precision agriculture. The Ministry of Investment reported that investments worth SAR 5 billion were allocated to technological advancements in farming equipment in 2024, highlighting a trend toward smart, high-tech solutions that improve operational efficiency and crop yields.

- Increasing Demand for Efficient Farming Solutions: Given the arid climate and limited arable land, the demand for efficient farming equipment is substantial. In 2023, Saudi Arabias cultivated land covered approximately 1.5 million hectares, requiring efficient machinery to maximize output. Over SAR 2 billion was spent on machinery upgrades in 2024 to enhance water efficiency and reduce input costs. High-efficiency equipment such as low-emission tractors and solar-powered irrigation systems has seen increased adoption to address resource scarcity and improve farm productivity.

Market Challenges

High Cost of Modern Equipment: The initial investment required for advanced agricultural equipment is high, creating barriers for small and medium-scale farmers. For example, the cost of a basic mechanized plow ranges between SAR 150,000 and SAR 250,000 in 2024, according to the Saudi Agricultural Fund, posing a financial burden. Although subsidies are available, the capital-intensive nature of modern equipment discourages widespread adoption. The Saudi government has recognized this gap, yet the high costs continue to affect the markets expansion.

Limited Access to Skilled Labor: Operating advanced machinery requires skilled labor, which is limited in Saudi Arabias agricultural sector. In 2024, only 16% of the countrys 150,000 agricultural workforce received formal training in machinery operation, according to the Saudi Human Resources Development Fund. This shortage of trained personnel slows the adoption of technologically advanced equipment and impacts operational efficiency, creating a barrier to the broader use of high-tech solutions in farming.

Saudi Arabia Agriculture Equipment Market Future Outlook

Over the next five years, the Saudi Arabia Agriculture Equipment Market is projected to experience substantial growth, driven by increased government investment, a transition toward precision agriculture, and advancements in renewable energy-powered equipment. The governments commitment to achieving food security and promoting sustainable farming practices aligns with national priorities, fostering innovation in agriculture equipment and expanding the adoption of efficient machinery. Additionally, increased focus on desert farming and smart agriculture solutions is expected to attract further investment and technological advancements in the market.

Market Opportunities

- Expansion in Desert Farming Techniques: Saudi Arabia is advancing desert farming techniques, utilizing specialized equipment suited for arid environments. In 2024, SAR 1.2 billion was invested in desert farming initiatives, focusing on machinery capable of efficient water utilization. With the Ministry of Environment, Water, and Agriculture supporting desert farming, manufacturers have the opportunity to innovate and supply equipment suited for harsh conditions. This demand for specialized machinery is anticipated to drive industry growth, providing substantial opportunities for new product developments.

- Investment in Smart Agriculture: Saudi Arabia is witnessing a surge in smart agriculture investments, aiming to increase productivity and efficiency. In 2024, SAR 2.5 billion was allocated to digital agriculture initiatives, including IoT-enabled equipment and data-driven farming solutions. The Smart Agriculture Program, backed by the Ministry of Communications and Information Technology, facilitates the integration of IoT and AI in farming equipment, providing a fertile ground for market expansion in smart machinery. This shift offers ample growth potential for companies focusing on advanced, connected equipment.

Scope of the Report

|

||

|

By Flavor |

Crop Farming Livestock Management Aquaculture Horticulture |

|

|

By Ingredients |

Gasoline/Diesel-Powered Electric-Powered Hybrid and Alternative Fuel |

|

|

By Distribution Channel |

Direct Sales Online Retail Dealerships Third-Party Distributors |

|

|

By Region |

North East West South |

Products

Key Target Audience

Agriculture Equipment Manufacturers

Farming Cooperatives

Commercial Farming Enterprises

Government and Regulatory Bodies (Ministry of Environment, Water, and Agriculture)

Distributors and Retailers

Technological Solution Providers

Investors and Venture Capitalist Firms

Banks and Financial institutes

Sustainable Farming Initiatives and NGOs

Companies

Players Mention in the Report:

Al-Jazirah Engineers & Consultants

Zamil Industrial

Gulf Agriculture

Saudi Equipment Rental Company

Alkhorayef Group

Al Mutlaq Establishment

Saudi Aramco (Agricultural Equipment Division)

Al Ruqee Group

Delmon Co. Ltd.

Mahindra & Mahindra Saudi Arabia

John Deere Saudi Arabia

CNH Industrial N.V.

Kubota Corporation

AGCO Corporation

CLAAS KSA

Table of Contents

1. Saudi Arabia Agriculture Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Agriculture Equipment Market Size (In SAR Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Agriculture Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Government Subsidies and Incentives

3.1.2 Technological Advancements in Machinery

3.1.3 Increasing Demand for Efficient Farming Solutions

3.1.4 Favorable Agricultural Policies

3.2 Market Challenges

3.2.1 High Cost of Modern Equipment

3.2.2 Limited Access to Skilled Labor

3.2.3 Environmental Impact and Sustainability Issues

3.3 Opportunities

3.3.1 Expansion in Desert Farming Techniques

3.3.2 Investment in Smart Agriculture

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Rise in Use of AI and IoT in Equipment

3.4.2 Adoption of Precision Agriculture

3.4.3 Demand for Renewable-Powered Machinery

3.5 Government Regulation

3.5.1 Subsidy Programs for Agricultural Equipment

3.5.2 Compliance Standards and Certification

3.5.3 Import Regulations and Duties on Equipment

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Saudi Arabia Agriculture Equipment Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Tractors

4.1.2 Harvesters

4.1.3 Irrigation Systems

4.1.4 Plows and Cultivators

4.1.5 Seed Drills and Planters

4.2 By Application (In Value %)

4.2.1 Crop Farming

4.2.2 Livestock Management

4.2.3 Aquaculture

4.2.4 Horticulture

4.3 By Power Source (In Value %)

4.3.1 Gasoline/Diesel-Powered

4.3.2 Electric-Powered

4.3.3 Hybrid and Alternative Fuel

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Online Retail

4.4.3 Dealerships

4.4.4 Third-Party Distributors

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

5. Saudi Arabia Agriculture Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Al-Jazirah Engineers & Consultants

5.1.2 Zamil Industrial

5.1.3 Gulf Agriculture

5.1.4 Saudi Equipment Rental Company

5.1.5 Alkhorayef Group

5.1.6 Al Mutlaq Establishment

5.1.7 Saudi Aramco (Agricultural Equipment Division)

5.1.8 Al Ruqee Group

5.1.9 Delmon Co. Ltd.

5.1.10 Mahindra & Mahindra Saudi Arabia

5.1.11 John Deere Saudi Arabia

5.1.12 CNH Industrial N.V.

5.1.13 Kubota Corporation

5.1.14 AGCO Corporation

5.1.15 CLAAS KSA

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Technology Adoption Level, Product Diversification, Regional Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Agriculture Equipment Market Regulatory Framework

6.1 Environmental Standards and Guidelines

6.2 Compliance Requirements for Equipment Imports

6.3 Certification and Licensing Processes

6.4 Safety Standards and Regulations

7. Saudi Arabia Agriculture Equipment Future Market Size (In SAR Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Agriculture Equipment Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Power Source (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Saudi Arabia Agriculture Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the ecosystem and identifying all stakeholders within the Saudi Arabia Agriculture Equipment Market. Comprehensive desk research is undertaken to gather baseline data, focusing on critical variables impacting market trends, such as government policies, technological advancements, and distribution channels.

Step 2: Market Analysis and Data Compilation

Historical data on market dynamics, including equipment adoption rates, sales trends, and supply chain analysis, are compiled. This process ensures a detailed understanding of revenue flow, product availability, and technological adoption rates, essential for an accurate market assessment.

Step 3: Expert Consultation and Hypothesis Validation

Engagement with industry experts through structured interviews provides firsthand insights into market challenges, growth opportunities, and the competitive landscape. Expert input refines data accuracy and helps validate key trends and drivers in the Saudi Arabia Agriculture Equipment Market.

Step 4: Data Synthesis and Final Analysis

All gathered data undergoes a synthesis process, ensuring cohesive analysis and integration into the final report. Interactions with equipment manufacturers provide supplementary insights, reinforcing the reliability of market segmentation and growth projections.

Frequently Asked Questions

How big is the Saudi Arabia Agriculture Equipment Market?

The Saudi Arabia Agriculture Equipment Market is valued at USD 282 million, driven by government incentives, advancements in farming technology, and a focus on sustainability.

What are the challenges in the Saudi Arabia Agriculture Equipment Market?

Key challenges include the high cost of advanced machinery, limited access to skilled labor for equipment maintenance, and climate-related constraints that affect farming.

Who are the major players in the Saudi Arabia Agriculture Equipment Market?

Major players include Al-Jazirah Engineers & Consultants, Zamil Industrial, Gulf Agriculture, and Alkhorayef Group, each contributing to the competitive landscape with diverse product offerings.

What are the growth drivers of the Saudi Arabia Agriculture Equipment Market?

Growth drivers encompass government subsidies, the push for food security, and technological integration such as IoT and AI, which enhance farming efficiency and sustainability.

What is the impact of government regulations on the Saudi Arabia Agriculture Equipment Market?

Government regulations support the adoption of sustainable farming practices, with subsidies and import regulations favoring modern, environmentally friendly machinery.

Which regions dominate the Saudi Arabia Agriculture Equipment Market?

Riyadh and the Eastern Province dominate due to their robust farming infrastructure, government investments, and access to essential distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.