Saudi Arabia Air Charter Services Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD10462

November 2024

90

About the Report

Saudi Arabia Air Charter Services Market Overview

- The Saudi Arabia Air Charter Services market is valued at USD 2.50 billion, based on a comprehensive five-year historical analysis. The market's growth is primarily driven by the surge in demand for business travel, the expansion of high-net-worth individuals (HNWIs), and the growing tourism sector. Saudi Arabias Vision 2030 plan, which emphasizes diversifying the economy and bolstering sectors like tourism and infrastructure, has been a significant driver. Additionally, the increasing corporate mobility and reliance on time-sensitive travel for executives in the Kingdom contribute to this market's development.

- Riyadh, Jeddah, and the Eastern Province are dominant regions in Saudi Arabia's air charter services market. Riyadh's prominence stems from its role as the business capital and hub for government activities, making it a crucial destination for corporate air charters. Jeddah and the Eastern Province benefit from their strategic locationsJeddah being a major point for religious tourism (due to its proximity to Mecca), while the Eastern Province supports the oil and gas industries. These cities are critical hubs for air charter services due to high demand from international businesses, government officials, and wealthy individuals.

- The Saudi General Authority of Civil Aviation (GACA) enforces strict licensing requirements for air charter operators, mandating compliance with international safety and operational standards. In 2023, GACA introduced new regulations aimed at improving the safety and efficiency of air charter services, including mandatory audits and updated certification processes for both domestic and international operators. These regulations are part of Saudi Arabias broader efforts to align its aviation sector with global standards and support the countrys growing demand for air travel.

Saudi Arabia Air Charter Services Market Segmentation

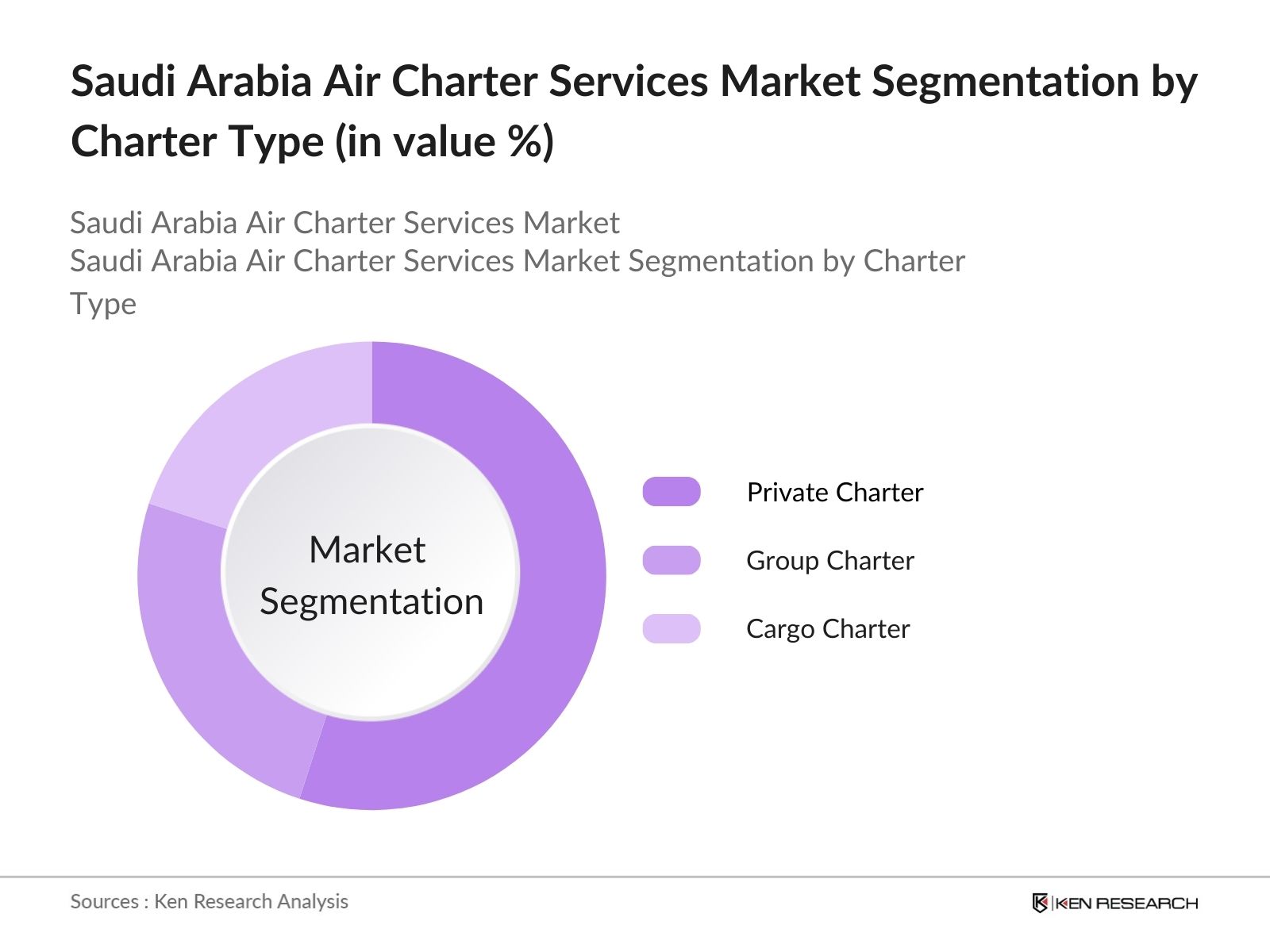

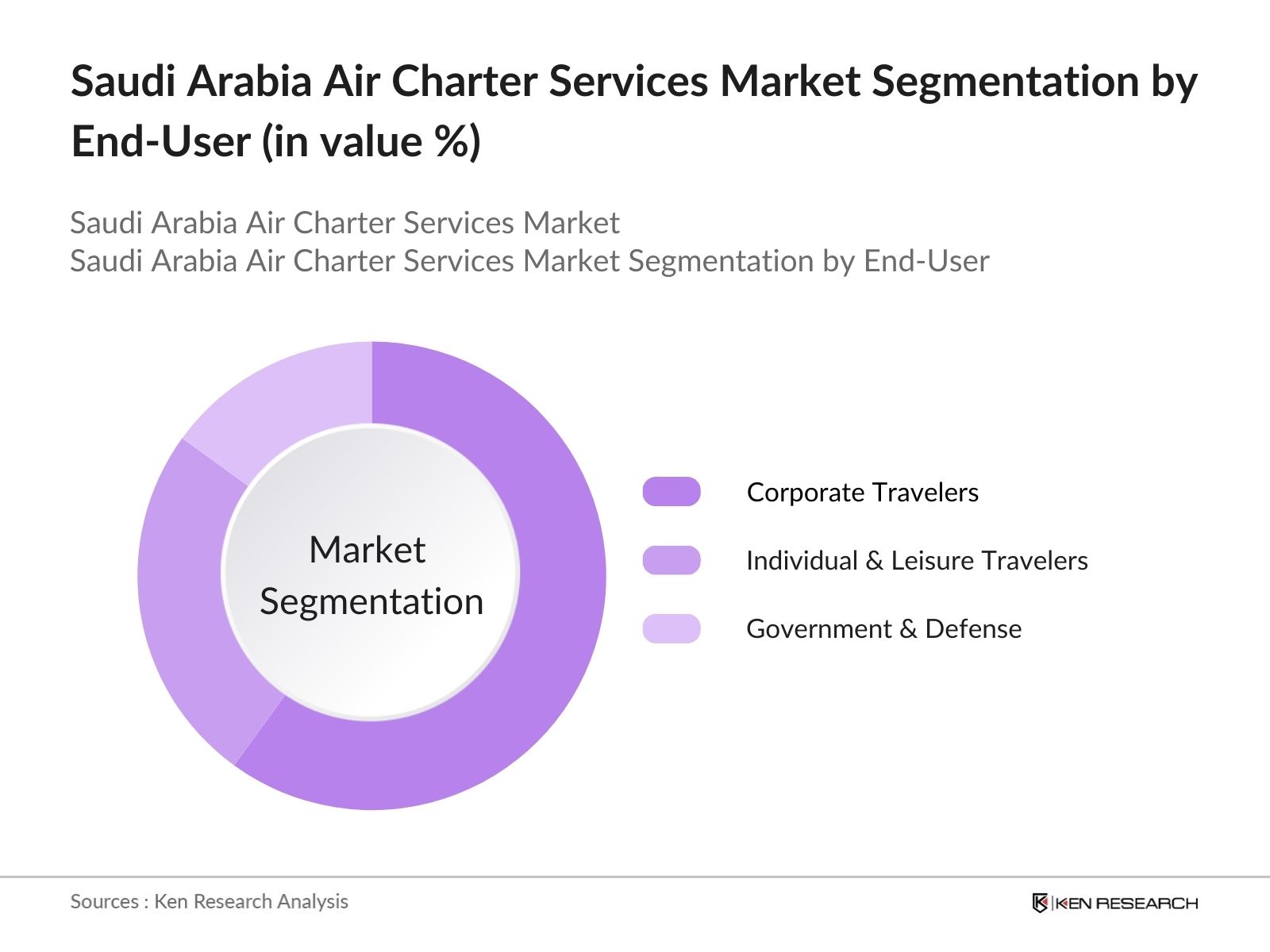

Saudi Arabia's Air Charter Services market is segmented by charter type and by end-user.

- By Charter Type: Saudi Arabia's Air Charter Services market is segmented by charter type into private charter, group charter, and cargo charter. Recently, private charters have held a dominant market share in this segmentation. This is driven by the increasing number of high-net-worth individuals, corporate travelers, and the growing demand for luxury air travel services. These private charters cater to business executives, government officials, and prominent figures, ensuring personalized, flexible, and time-efficient travel solutions.

- By End-User: The market is further segmented by end-user into corporate travelers, individual and leisure travelers, and government and defense entities. Corporate travelers dominate this segmentation, as businesses rely on air charters to meet the increasing need for efficient and secure transport solutions. The quick and flexible nature of chartered flights makes them an attractive option for companies needing to transport their executives across Saudi Arabia and internationally.

Saudi Arabia Air Charter Services Market

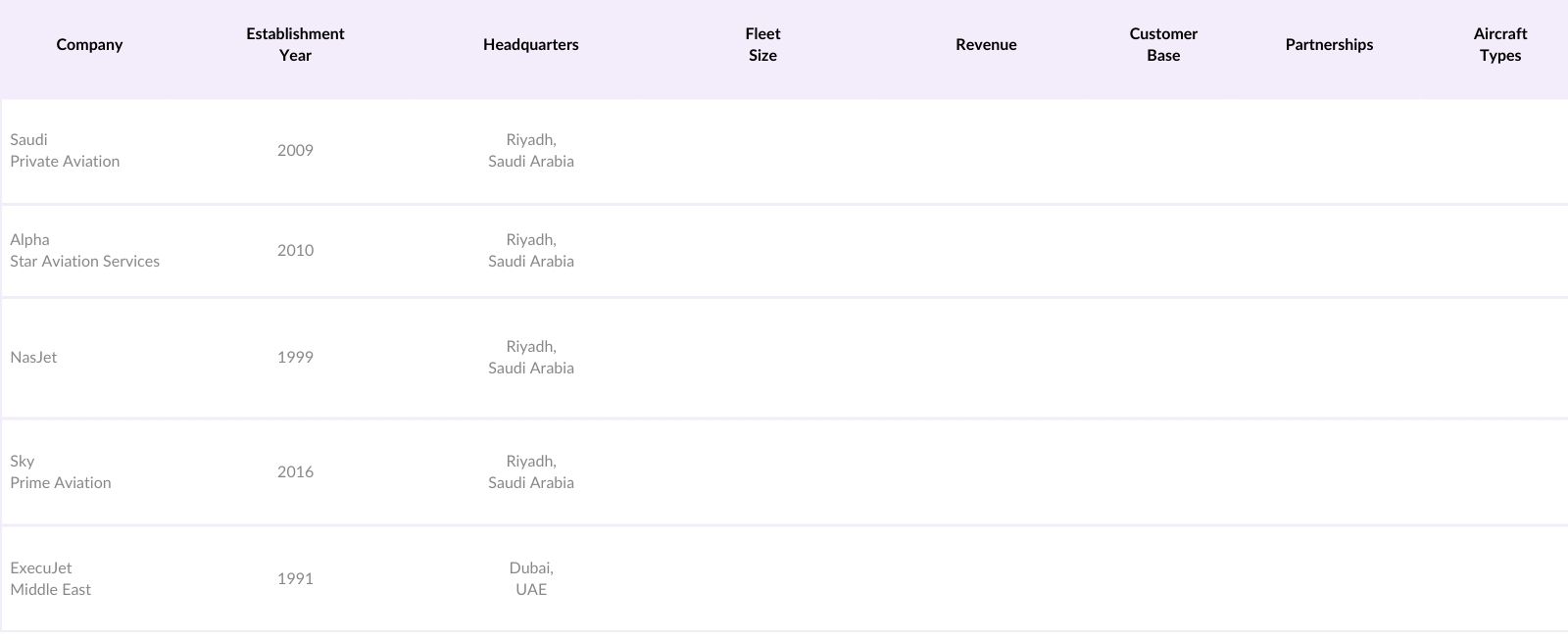

Competitive Landscape

The Saudi Arabia Air Charter Services market is dominated by key regional and international players. Consolidation in the market highlights the influence of these companies, which benefit from established networks, strategic partnerships, and a strong presence in Saudi Arabias major cities. The competitive landscape is characterized by increasing investment in fleet expansion, innovative service offerings, and the integration of new technologies, such as digital booking platforms.

Saudi Arabia Air Charter Services Market Analysis

Growth Drivers

- Demand for Business Travel [Increased Corporate Mobility]: Saudi Arabias air charter services market has seen a notable increase in demand from corporate sectors due to the rapid growth in business activities. In 2023, the country experienced a rise in foreign direct investments (FDIs), reaching $19.3 billion, largely due to initiatives within Vision 2030 aimed at economic diversification. The increase in business travel is primarily driven by sectors such as finance, energy, and construction, with significant growth in the Kingdoms special economic zones and business hubs, necessitating air charter services for fast and flexible corporate mobility.

- Government Initiatives [Vision 2030 and Economic Diversification]: The Vision 2030 initiative, launched by the Saudi government, aims to reduce the country's dependency on oil by promoting tourism, infrastructure, and diversified investments. The air charter market benefits directly from these reforms, with the Saudi aviation sector contributing $7.2 billion to the countrys GDP in 2023. The government's push towards building a robust aviation infrastructure has facilitated growth in private and business aviation, especially in regions like Riyadh and NEOM, where air charter services are being utilized to attract international investors.

- Tourism Sector Growth [Religious Tourism and Entertainment Initiatives]: Religious tourism continues to be a key driver of air charter services, with Saudi Arabia welcoming over 10 million pilgrims in 2023. This influx, combined with the governments aggressive push to attract 100 million tourists by 2030 through entertainment projects like the Red Sea Project, has significantly boosted demand for private air travel. These initiatives, alongside global events such as Formula E races and cultural festivals, have increased tourism-related charter flights to major cities like Jeddah and Medina.

Market Challenges

- High Operating Costs [Fuel Prices, Maintenance, and Crew Expenses]: Operating an air charter service in Saudi Arabia remains a costly endeavor, with fuel prices continuing to fluctuate amid global economic conditions. In 2023, the average price of jet fuel in the region was $3.14 per gallon, contributing to rising operational expenses. Additionally, maintenance costs for aircraft, coupled with the high salaries of skilled aviation crews, further strain the profitability of the air charter industry. These expenses often deter smaller operators from entering the market and challenge existing players to maintain competitive pricing.

- Regulatory Hurdles [Aviation Licensing and Compliance]: The Saudi General Authority of Civil Aviation (GACA) maintains strict regulations governing the licensing of air charter services. In 2023, new amendments were introduced to aviation laws, requiring operators to meet stringent safety and operational standards, which has increased compliance costs for companies. Additionally, foreign operators face challenges in obtaining permissions for landing rights and scheduling charter flights, often resulting in delays or denied access, which can impact service delivery and business expansion plans.

Saudi Arabia Air Charter Services Market Future Outlook

Over the next five years, the Saudi Arabia Air Charter Services market is expected to experience robust growth, driven by the Kingdom's Vision 2030 initiatives, infrastructure investments, and the rising demand for luxury and time-efficient air travel solutions. The push for economic diversification, along with a focus on tourism and entertainment, will play a pivotal role in shaping the demand for air charter services. Additionally, increased activity in the corporate and oil & gas sectors is likely to sustain the market's expansion, particularly in regions like Riyadh and the Eastern Province.

Market Opportunities

- Growth in Leisure Travel [Luxury and Adventure Tourism]: Luxury tourism in Saudi Arabia is gaining momentum, driven by projects such as the $500 billion NEOM development and the Red Sea Resort, which are expected to attract high-net-worth individuals seeking exclusive experiences. In 2023, luxury tourism represented 15% of all tourism revenue, with a significant portion of these travelers opting for private air charters. Adventure tourism in regions like Al-Ula and the Asir Mountains also presents untapped opportunities for air charter services, providing bespoke travel experiences in remote and scenic locations.

- Potential Partnerships [Government and Private Sector Collaboration]: The Saudi government has encouraged collaboration between private operators and public entities under Vision 2030, creating opportunities for air charter companies to enter strategic partnerships. In 2023, the government allocated $1.2 billion for joint aviation projects, focusing on the expansion of private aviation hubs and the development of air charter services in lesser-served regions. These partnerships aim to leverage the private sectors expertise in creating a more flexible and accessible air transport system for both domestic and international markets.

Scope of the Report

|

||

|

By End-User |

|

|

|

By Service Type |

Full-service Charter On-demand Charter Fractional Ownership |

|

|

By Aircraft Type |

Light Jets Mid-size Jets Heavy Jets Turboprops |

|

|

By Region |

North East West South |

Products

Key Target Audience

Corporate Travelers (HNWIs, Multinational Corporations)

Oil & Gas Companies

Tourism and Hospitality Industry

Government and Regulatory Bodies (Saudi General Authority of Civil Aviation)

VIP & Luxury Travel Service Providers

Defense and Security Agencies

Investors and Venture Capitalist Firms

Logistics and Supply Chain Providers

Companies

Players Mention in the Report:

Saudi Private Aviation

Alpha Star Aviation Services

NasJet

Sky Prime Aviation

ExecuJet Middle East

Gama Aviation

Jet Aviation

Qatar Executive

Air Charter Service

VistaJet

Chapman Freeborn

Empire Aviation Group

Falcon Aviation Services

Royal Jet

Wheels Up

Table of Contents

1. Saudi Arabia Air Charter Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Drivers

1.4. Market Segmentation Overview

2. Saudi Arabia Air Charter Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Air Charter Services Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Business Travel [Increased Corporate Mobility]

3.1.2. Government Initiatives [Vision 2030 and Economic Diversification]

3.1.3. Tourism Sector Growth [Religious Tourism and Entertainment Initiatives]

3.1.4. Strategic Geographical Location [Middle East Hub for Aviation]

3.2. Market Challenges

3.2.1. High Operating Costs [Fuel Prices, Maintenance, and Crew Expenses]

3.2.2. Regulatory Hurdles [Aviation Licensing and Compliance]

3.2.3. Limited Infrastructure for Private Aviation [Airport Access and Facilities]

3.3. Opportunities

3.3.1. Growth in Leisure Travel [Luxury and Adventure Tourism]

3.3.2. Potential Partnerships [Government and Private Sector Collaboration]

3.3.3. Expansion in Remote Area Accessibility [Oil & Gas and Mining Sectors]

3.4. Trends

3.4.1. Adoption of Green Aviation Technologies [Sustainable Aviation Fuel]

3.4.2. Integration of Digital Booking Platforms [Technology Adoption]

3.4.3. Rise in On-demand Charter Services [Flexibility and Convenience]

3.5. Government Regulations

3.5.1. Saudi General Authority of Civil Aviation (GACA) Regulations [Licensing and Standards]

3.5.2. Vision 2030 Policies [Economic Diversification]

3.5.3. Taxation and Subsidies [Aviation-related Tax Breaks]

3.5.4. Foreign Investment Laws [Ownership and Joint Ventures]

3.6. SWOT Analysis [Strengths, Weaknesses, Opportunities, Threats]

3.7. Stakeholder Ecosystem [Airports, Charter Operators, Regulatory Bodies]

3.8. Porters Five Forces [Competitive Dynamics in the Saudi Market]

3.9. Competition Ecosystem

4. Saudi Arabia Air Charter Services Market Segmentation

4.1. By Charter Type (In Value %)

4.1.1. Private Charter

4.1.2. Group Charter

4.1.3. Cargo Charter

4.2. By End-User (In Value %)

4.2.1. Corporate Travelers

4.2.2. Individual & Leisure Travelers

4.2.3. Government & Defense

4.3. By Service Type (In Value %)

4.3.1. Full-service Charter

4.3.2. On-demand Charter

4.3.3. Fractional Ownership

4.4. By Aircraft Type (In Value %)

4.4.1. Light Jets

4.4.2. Mid-size Jets

4.4.3. Heavy Jets

4.4.4. Turboprops

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Air Charter Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Private Aviation

5.1.2. Alpha Star Aviation Services

5.1.3. NasJet

5.1.4. Sky Prime Aviation

5.1.5. ExecuJet Middle East

5.1.6. Gama Aviation

5.1.7. Jet Aviation

5.1.8. Qatar Executive

5.1.9. Air Charter Service

5.1.10. VistaJet

5.1.11. Chapman Freeborn

5.1.12. Empire Aviation Group

5.1.13. Falcon Aviation Services

5.1.14. Royal Jet

5.1.15. Wheels Up

5.2. Cross Comparison Parameters [Fleet Size, Service Reach, Pricing Models, Certifications, Aircraft Types, Partnerships, Customer Base, Revenue]

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Air Charter Services Market Regulatory Framework

6.1. GACA Licensing Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Saudi Arabia Air Charter Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Air Charter Services Future Market Segmentation

8.1. By Charter Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Service Type (In Value %)

8.4. By Aircraft Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Air Charter Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping out all the critical players in the Saudi Arabia Air Charter Services market. This was done through extensive secondary research from proprietary databases and publicly available reports, aiming to establish a comprehensive understanding of the key stakeholders, including major corporations, regulatory bodies, and other service providers.

Step 2: Market Analysis and Construction

In this phase, historical data on fleet size, market demand, and service revenue was collected. The analysis focused on understanding service penetration and customer preferences, alongside evaluating the performance of different charter types and end-users in the Saudi market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were formed based on secondary data, and industry experts were consulted through telephone interviews. These experts, representing various air charter companies and aviation consultants, provided valuable insights into operational efficiencies, revenue generation, and key growth drivers in the market.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the gathered data, with direct consultations from charter service providers, to validate the accuracy of the estimates. The findings were consolidated to provide a reliable and comprehensive outlook on the Saudi Arabia Air Charter Services market.

Frequently Asked Questions

01. How big is the Saudi Arabia Air Charter Services Market?

The Saudi Arabia Air Charter Services market was valued at USD 2.50 billion, driven by increased demand for corporate travel, government initiatives like Vision 2030, and the rising number of high-net-worth individuals in the Kingdom.

02. What are the challenges in the Saudi Arabia Air Charter Services Market?

Key challenges include high operational costs due to fuel prices, regulatory compliance issues, and limited infrastructure for private aviation. Additionally, competition from international air charter service providers poses challenges for local companies.

03. Who are the major players in the Saudi Arabia Air Charter Services Market?

The market is dominated by major players such as Saudi Private Aviation, Alpha Star Aviation Services, NasJet, and Sky Prime Aviation. These companies have strong brand recognition, extensive fleets, and serve high-profile clients like VIPs and corporate travelers.

04. What are the growth drivers of the Saudi Arabia Air Charter Services Market?

The market is fueled by increased corporate travel, expansion of the tourism industry, particularly religious tourism, and government-driven infrastructure projects under Vision 2030. The growing demand for luxury and time-sensitive travel is also a key driver.

05. How does government regulation affect the Saudi Arabia Air Charter Services Market?

Government regulations, particularly those set by the Saudi General Authority of Civil Aviation (GACA), play a crucial role in shaping the market. Licensing standards, taxation policies, and investment incentives directly impact the operations of air charter companies in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.