Saudi Arabia Aluminium Market Outlook to 2030

Region:Middle East

Author(s):Shreya

Product Code:KROD11329

December 2024

97

About the Report

Saudi Arabia Aluminium Market Overview

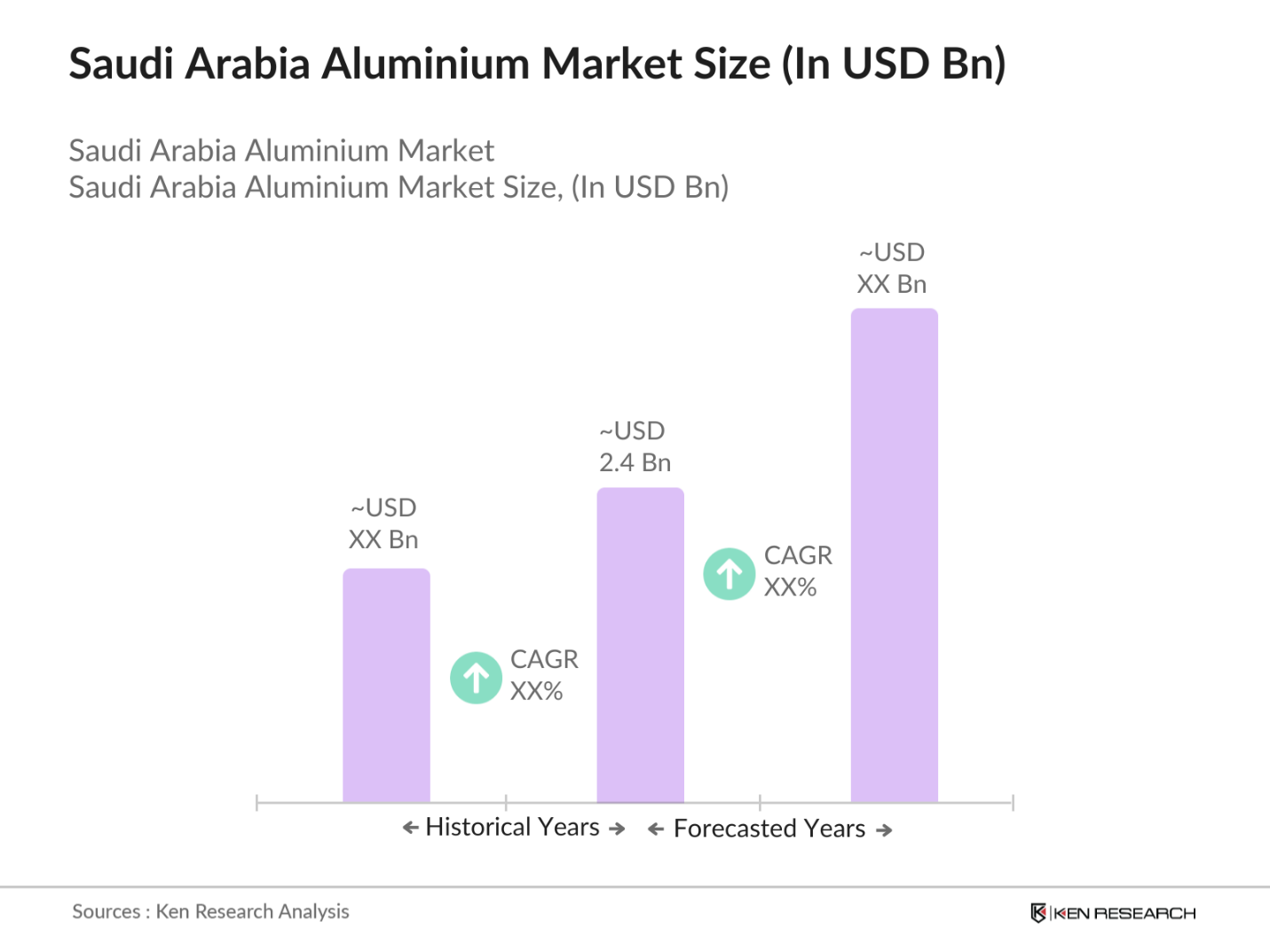

The Saudi Arabian aluminium market, valued at USD 2.4 billion, is primarily driven by the nation's strategic initiatives to diversify its economy beyond oil dependency. The government's Vision 2030 plan emphasizes industrial growth, leading to substantial investments in infrastructure and manufacturing sectors, thereby increasing the demand for aluminium products. Additionally, the automotive and construction industries are significant consumers of aluminium, further propelling market growth.

Dominant players in the Saudi Arabian aluminium market include major cities such as Riyadh, Jeddah, and Dammam. These urban centers are hubs for industrial activities, housing numerous manufacturing plants and construction projects that require extensive use of aluminium. The concentration of economic activities in these cities, coupled with supportive government policies, positions them as key contributors to the market's expansion.

Saudi Vision 2030 outlines a comprehensive plan to diversify the economy and reduce dependence on oil revenues. The aluminium industry is identified as a pivotal sector in this transformation. Initiatives under this vision include the development of industrial clusters, investment in research and development, and fostering public-private partnerships to boost aluminium production and downstream industries. These efforts aim to position Saudi Arabia as a global leader in aluminium production and export.

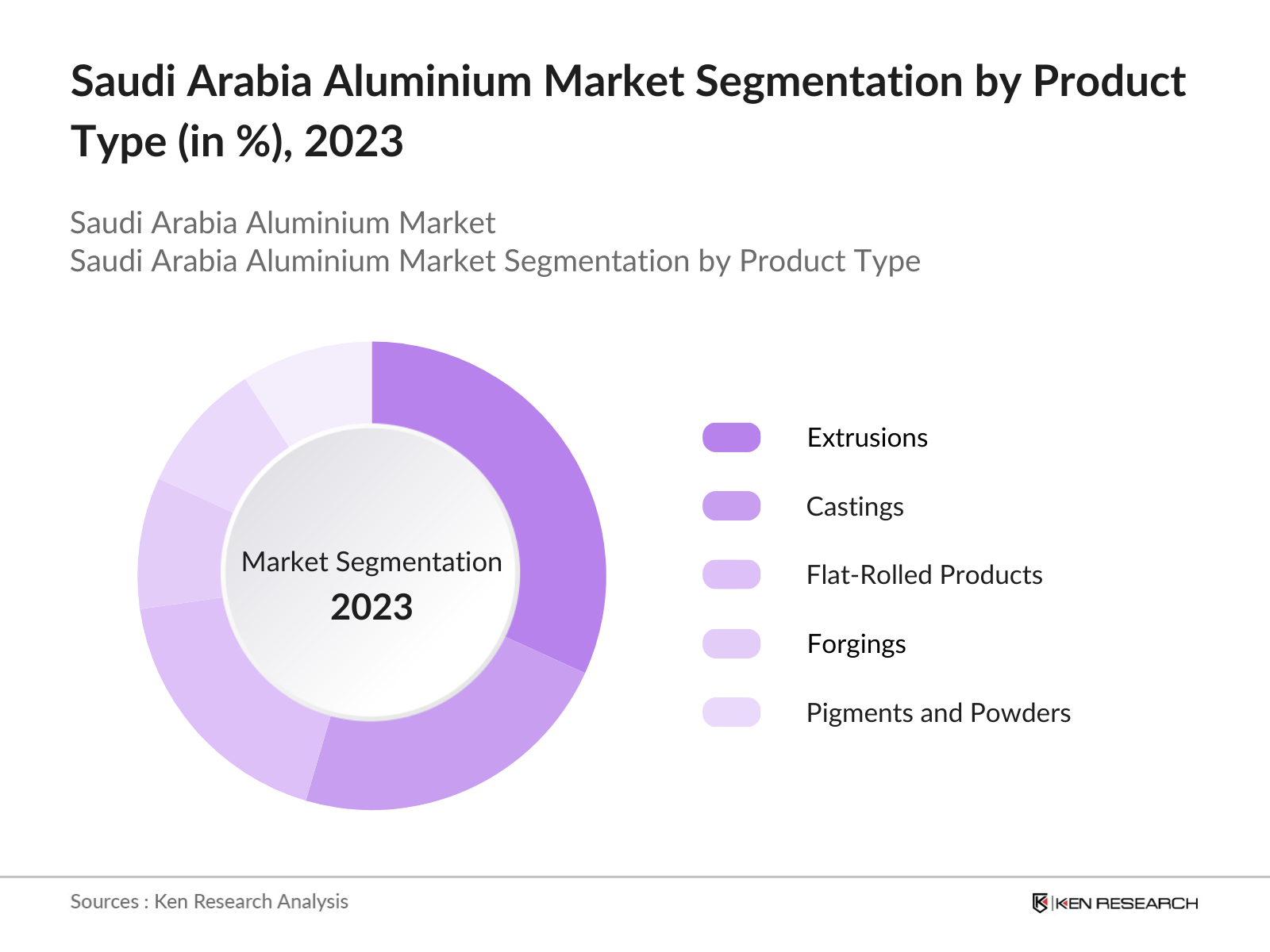

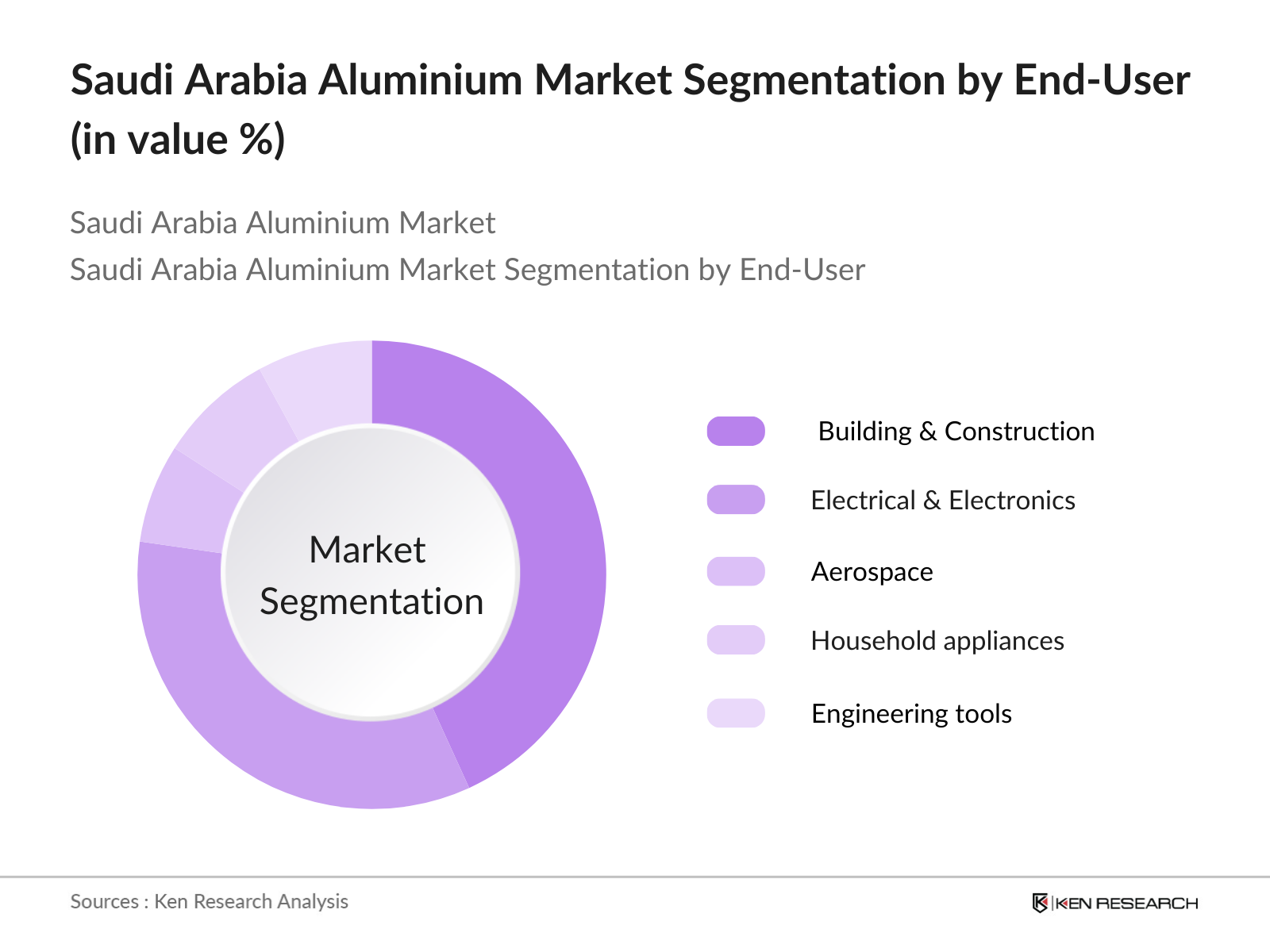

Saudi Arabia Aluminium Market Segmentation

By Product Type: The market is segmented by product type into castings, extrusions, forgings, flat-rolled products, and pigments and powders. Among these, extrusions hold a dominant market share due to their versatility and widespread application in construction and transportation sectors. The adaptability of extruded aluminium profiles in architectural designs and their structural benefits in automotive manufacturing contribute to their leading position in the market.

By End-User Industry: The market is further segmented by end-user industry into automotive, industrial, building & construction, electrical & electronics, aerospace, household appliances, engineering tools, packaging, and others. The building & construction sector dominates the market share, driven by ongoing infrastructure projects and urban development initiatives under the Vision 2030 plan. The demand for lightweight, durable, and corrosion-resistant materials in construction has led to increased utilisation of aluminium, solidifying its prominence in this segment.

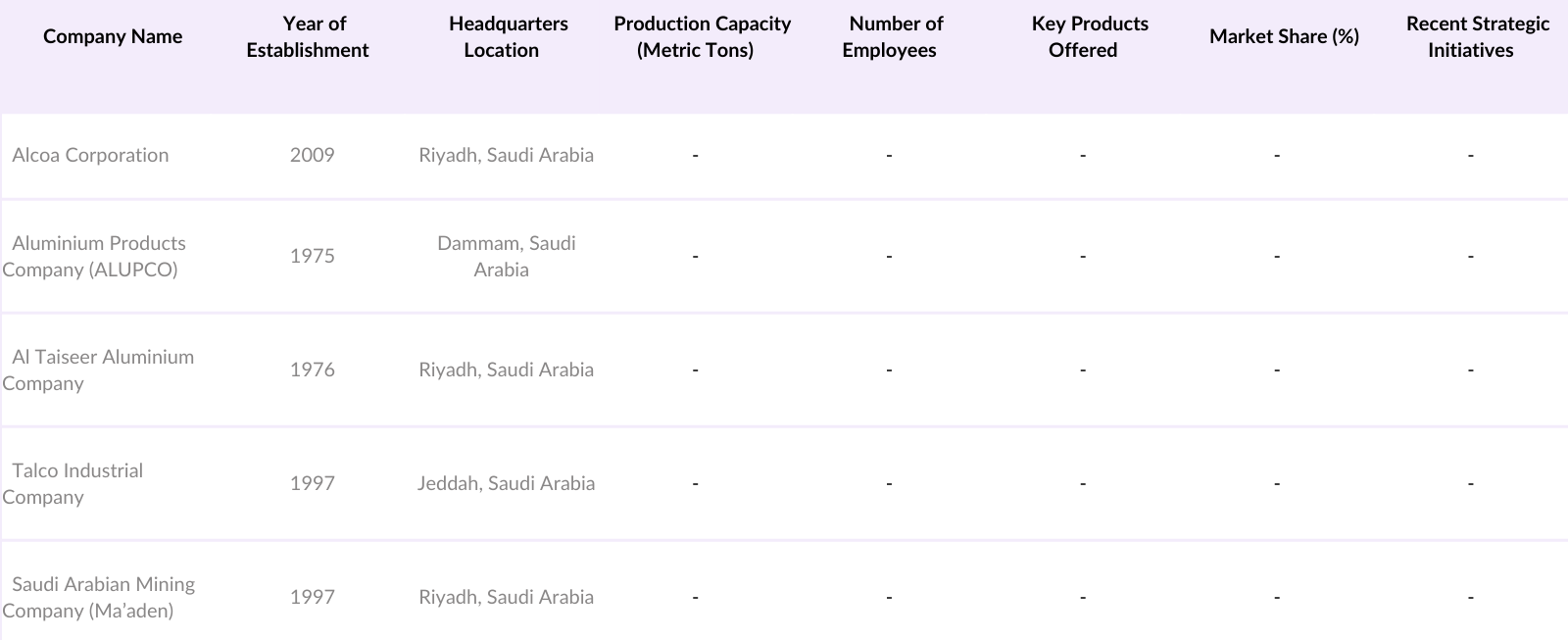

Saudi Arabia Aluminium Market Competitive Landscape

The Saudi Arabian aluminium market is characterized by the presence of several key players who contribute significantly to its growth and development. These companies are instrumental in shaping the market dynamics through their extensive product portfolios, strategic initiatives, and technological advancements.

Saudi Arabia Aluminium Industry Analysis

Growth Drivers

- Infrastructure Development Initiatives: Saudi Arabia's ambitious infrastructure projects, such as the NEOM city and the Red Sea Project, are significantly boosting the demand for aluminium. These developments require substantial quantities of aluminium for construction and related applications. The government's capital expenditure on infrastructure has been substantial, with significant allocations in recent years. For instance, the Public Investment Fund (PIF) has been investing heavily in these mega-projects, driving the need for construction materials, including aluminium.

- Expansion in Automotive Manufacturing: The Saudi Arabian automotive sector is experiencing growth, with increased production of vehicles. This expansion is leading to a higher demand for aluminium, which is favored for its lightweight properties that enhance fuel efficiency. The government's focus on diversifying the economy includes developing the automotive industry, thereby increasing the consumption of aluminium in vehicle manufacturing.

- Government Policies Promoting Industrial Diversification: Under the Vision 2030 initiative, Saudi Arabia is implementing policies to diversify its economy beyond oil dependence. This includes promoting the aluminium industry as a key sector for growth. The National Industrial Development and Logistics Program (NIDLP) aims to transform the Kingdom into a leading industrial powerhouse, with aluminium production being a significant component. These policies are fostering an environment conducive to the growth of the aluminium market.

Market Challenges

- Volatility in Raw Material Prices: The aluminium market in Saudi Arabia faces challenges due to fluctuations in the prices of raw materials like bauxite and alumina. These price volatilities can impact production costs and profit margins for manufacturers. Global market dynamics and supply chain disruptions contribute to these fluctuations, affecting the stability of the aluminium industry in the Kingdom.

- Environmental Regulations and Compliance: Saudi Arabia is strengthening its environmental regulations to promote sustainable industrial practices. The aluminium industry must comply with these regulations, which may require investments in cleaner technologies and processes. Adhering to environmental standards is essential for the industry's long-term viability but can pose challenges in terms of compliance costs and operational adjustments.

Saudi Arabia Aluminium Market Future Outlook

Over the next five years, the Saudi Arabian aluminium market is expected to experience significant growth, driven by continuous government support, advancements in aluminium processing technologies, and increasing demand from end-user industries. The implementation of Vision 2030 initiatives aims to diversify the economy, leading to substantial investments in infrastructure and industrial projects that will bolster the demand for aluminium products. Additionally, the emphasis on sustainable and lightweight materials in automotive and construction sectors is anticipated to further propel market expansion.

Future Market Opportunities

- Technological Advancements in Aluminium Processing: Advancements in aluminium processing technologies present opportunities for the Saudi Arabian market. Implementing modern techniques can enhance production efficiency, reduce costs, and improve product quality. Investing in research and development to adopt these technologies can provide a competitive edge and meet the growing domestic and international demand for high-quality aluminium products.

- Growth in Renewable Energy Sector: Saudi Arabia is investing in renewable energy projects, including solar and wind power. Aluminium is a critical component in renewable energy infrastructure, such as solar panel frames and wind turbine components. The expansion of the renewable energy sector increases the demand for aluminium, offering growth opportunities for the industry.

Scope of the Report

|

Product Type |

Castings Extrusions Forgings Flat Rolled Products Pigments and Powders |

|

Source |

Primary (Fresh Aluminium) Secondary (Recycled Aluminium) |

|

Series |

Series 1 Series 2 Series 3 Series 4 Series 5 Series 6 Series 7 Series 8 |

|

End-User Industry |

Automotive Industrial Building & Construction Electrical & Electronics Aerospace Household Appliances Engineering Tools Packaging Others |

|

Region |

West East North South |

Products

Key Target Audience

Aluminium Manufacturers

Construction and Infrastructure Companies

Automotive Manufacturers

Electrical and Electronics Manufacturers

Packaging Industry Players

Aerospace and Defense Contractors

Government and Regulatory Bodies (e.g., Ministry of Industry and Mineral Resources)

Investors and Venture Capitalist Firms

Companies

Major Players in the Market

Alcoa Corporation (Maaden)

Aluminium Products Company (ALUPCO)

Al Taiseer Aluminium Company

Talco Industrial Company

Saudi Arabian Mining Company (Maaden)

Alba (Aluminium Bahrain B.S.C.)

Emirates Global Aluminium PJSC

Al Rajhi Aluminium

Zamil Aluminium

Alfanar Aluminium

Alhamrani-Fuchs Petroleum Saudi Arabia

Arabian Extrusions Factory

Alupco

Al-Saleh Group

Aboura Metals

Table of Contents

Saudi Arabia Aluminium Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Saudi Arabia Aluminium Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Saudi Arabia Aluminium Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development Initiatives

3.1.2. Expansion in Automotive Manufacturing

3.1.3. Government Policies Promoting Industrial Diversification

3.1.4. Rising Demand in Packaging Industry

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Environmental Regulations and Compliance

3.2.3. Competition from Alternative Materials

3.3. Opportunities

3.3.1. Technological Advancements in Aluminium Processing

3.3.2. Growth in Renewable Energy Sector

3.3.3. Potential in Aerospace and Defense Industries

3.4. Trends

3.4.1. Adoption of Lightweight Materials in Transportation

3.4.2. Increase in Aluminium Recycling Practices

3.4.3. Integration of Aluminium in Smart Building Solutions

3.5. Government Regulations

3.5.1. National Industrial Development and Logistics Program (NIDLP)

3.5.2. Saudi Vision 2030 Initiatives

3.5.3. Environmental Compliance Standards

3.5.4. Import and Export Tariffs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

Saudi Arabia Aluminium Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Castings

4.1.2. Extrusions

4.1.3. Forgings

4.1.4. Flat Rolled Products

4.1.5. Pigments and Powders

4.2. By Source (In Value %)

4.2.1. Primary (Fresh Aluminium)

4.2.2. Secondary (Recycled Aluminium)

4.3. By Series (In Value %)

4.3.1. Series 1

4.3.2. Series 2

4.3.3. Series 3

4.3.4. Series 4

4.3.5. Series 5

4.3.6. Series 6

4.3.7. Series 7

4.3.8. Series 8

4.4. By End-User Industry (In Value %)

4.4.1. Automotive

4.4.2. Industrial

4.4.3. Building & Construction

4.4.4. Electrical & Electronics

4.4.5. Aerospace

4.4.6. Household Appliances

4.4.7. Engineering Tools

4.4.8. Packaging

4.4.9. Others

4.5. By Region (In Value %)

4.5.1. South

4.5.2. West

4.5.3. East

4.5.4. North

Saudi Arabia Aluminium Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Alcoa Corporation (Maaden)

5.1.2. Aluminium Products Company (ALUPCO)

5.1.3. Al Taiseer Aluminium Company

5.1.4. Talco Industrial Company

5.1.5. Saudi Arabian Mining Company (Maaden)

5.1.6. Alba (Aluminium Bahrain B.S.C.)

5.1.7. Emirates Global Aluminium PJSC

5.1.8. Al Rajhi Aluminium

5.1.9. Zamil Aluminium

5.1.10. Alfanar Aluminium

5.1.11. Alhamrani-Fuchs Petroleum Saudi Arabia

5.1.12. Arabian Extrusions Factory

5.1.13. Alupco

5.1.14. Al-Saleh Group

5.1.15. Aboura Metals

5.2. Cross Comparison Parameters (Number of Employees, Headquarters Location, Year of Establishment, Annual Revenue, Product Portfolio, Market Share, Regional Presence, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Saudi Arabia Aluminium Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

Saudi Arabia Aluminium Market Future Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Saudi Arabia Aluminium Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Series (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

Saudi Arabia Aluminium Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabian aluminium market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Saudi Arabian aluminium market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aluminium manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabian aluminium market.

Frequently Asked Questions

How big is the Saudi Arabian aluminium market?

The Saudi Arabian aluminium market is valued at USD 2.4 billion, driven by substantial investments in infrastructure and manufacturing sectors under the Vision 2030 initiative.

What are the key challenges in the Saudi Arabian aluminium market?

The Saudi Arabian aluminium market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and competition from alternative materials like steel and composite alloys. These factors impact production costs and market profitability.

Who are the major players in the Saudi Arabian aluminium market?

Major players in the Saudi Arabian aluminium market include Alcoa Corporation (Maaden), ALUPCO, Al Taiseer Aluminium Company, Talco Industrial Company, and the Saudi Arabian Mining Company (Maaden). These companies dominate due to their extensive production capabilities and alignment with Vision 2030 objectives.

What factors are driving growth in the Saudi Arabian aluminium market?

Growth in the Saudi Arabian aluminium market is driven by government initiatives promoting industrial diversification, the expansion of infrastructure projects, and rising demand for lightweight materials in construction and automotive sectors. The emphasis on sustainability further supports aluminiums popularity.

Which segments are leading in the Saudi Arabian aluminium market?

The extrusions segment leads the Saudi Arabian aluminium market in product types due to its versatility in construction and automotive applications, while the building & construction sector dominates among end-user industries due to the extensive infrastructure projects underway.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.