Saudi Arabia Animal Feed Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD6944

December 2024

82

About the Report

Saudi Arabia Animal Feed Market Overview

- The Saudi Arabia animal feed market is valued at USD 2.63 billion, based on a five-year historical analysis. This market's growth is primarily driven by increasing livestock production and government initiatives to boost the agriculture and food security sectors. The Saudi government has heavily invested in modernizing the agriculture sector, aiming to reduce dependency on feed imports by supporting local feed production facilities. Furthermore, rising demand for high-quality protein products such as poultry and dairy is pushing the demand for nutrient-rich animal feed.

- Riyadh and the Eastern Province are dominant regions in the animal feed market due to the high concentration of large-scale livestock farming operations and food processing plants. Riyadh, as the economic hub, houses most of the leading feed producers and distributors, benefiting from established distribution networks. The Eastern Province is also pivotal due to its proximity to key ports, making it a strategic location for feed ingredient imports, which is essential in maintaining a stable feed supply chain in the kingdom.

- In 2024, the Saudi Food and Drug Authority (SFDA) tightened its regulations on feed safety, focusing on ensuring that all animal feed products meet stringent safety and quality standards. The SFDA's Feed Safety Regulation mandates regular inspections and testing for contaminants, along with strict adherence to nutritional standards. Compliance with these regulations has become more demanding for feed producers, requiring significant investments in testing and certification processes. These regulations are essential to ensuring the safety of animal products consumed within the country.

Saudi Arabia Animal Feed Market Segmentation

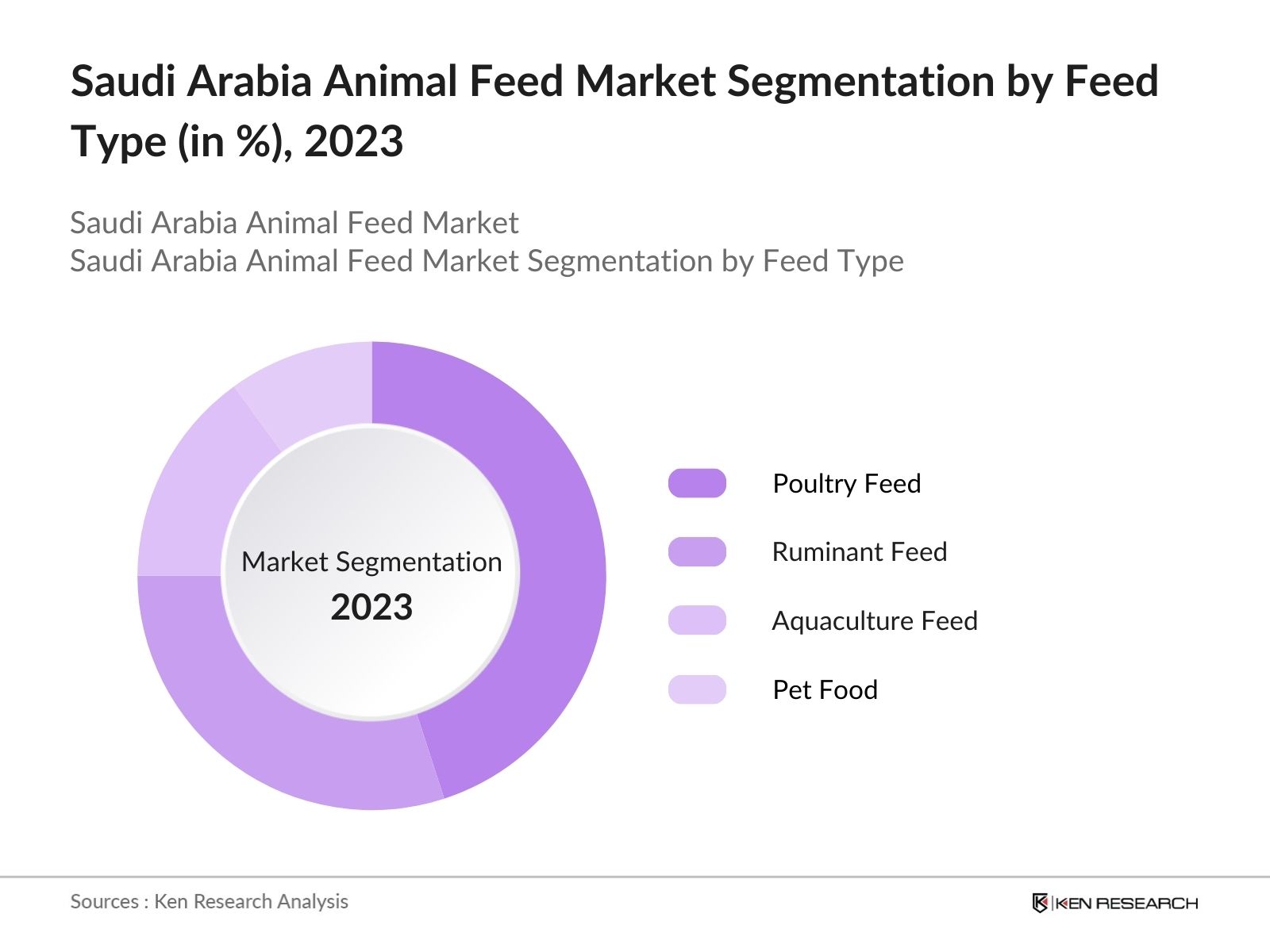

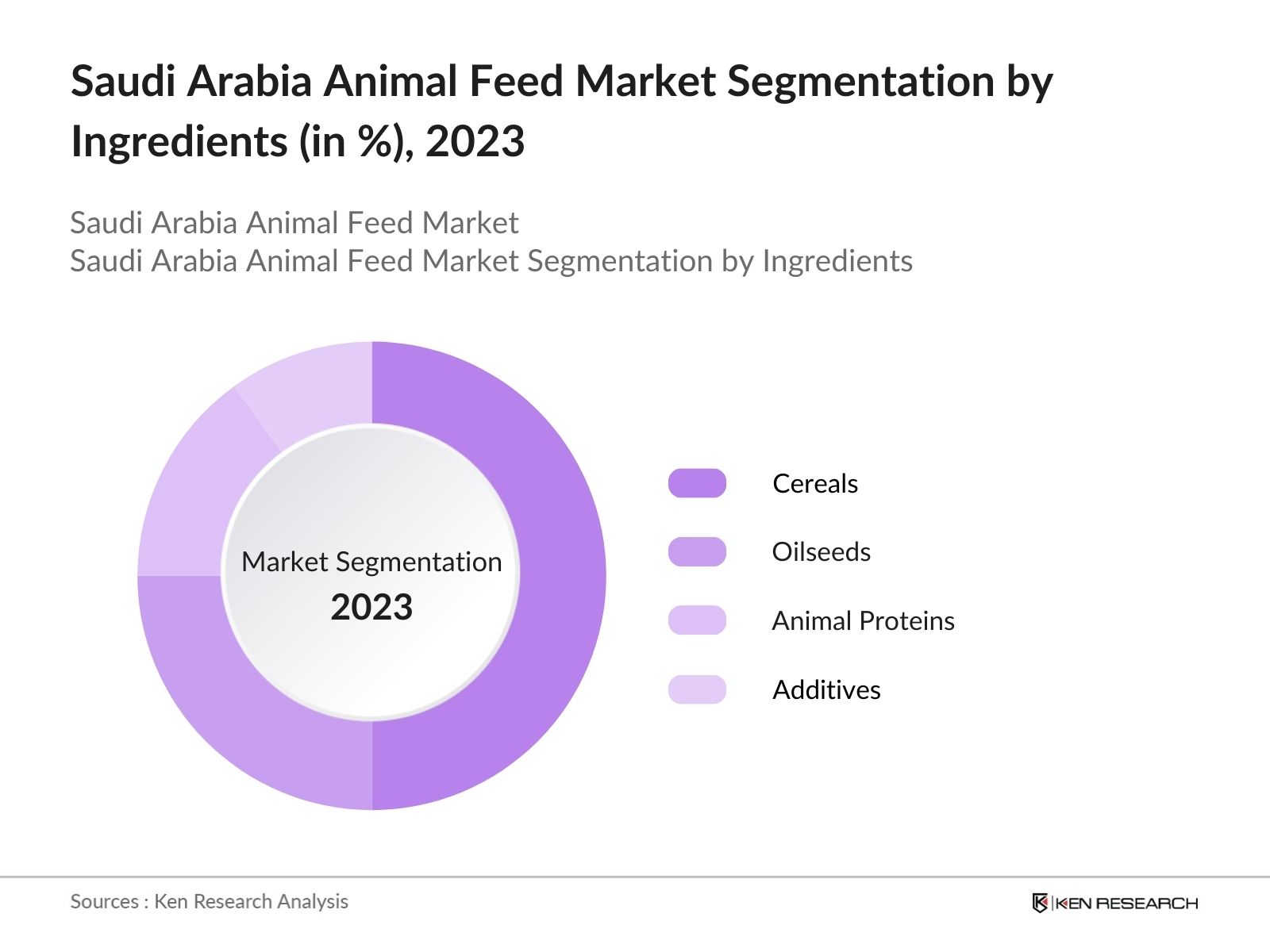

Saudi Arabia's animal feed market is segmented by feed type and by feed ingredients.

- By Feed Type: The market is segmented by feed type into poultry feed, ruminant feed, aquaculture feed, and pet food. Poultry feed holds a dominant share in the feed type segmentation, largely due to the high consumption of poultry products in the country. The Saudi population consumes vast amounts of poultry meat, leading to a surge in demand for poultry feed. Poultry farms are extensively spread across the country, and the government's focus on self-sufficiency in poultry production further boosts the demand for poultry feed.

- By Ingredients: The market is also segmented by feed ingredients, such as cereals, oilseeds, animal proteins, and additives. Cereals, particularly corn and barley, dominate this segment, contributing to about 50% of the total feed production. Corn is a primary energy source for most livestock, while barley is favored in ruminant feed formulations. Saudi Arabia imports most of its corn, but there is a significant push towards boosting domestic barley production to meet the rising demand.

Saudi Arabia Animal Feed Market Competitive Landscape

The Saudi animal feed market is dominated by a few major players, including local companies like Almarai and multinational corporations like Cargill. These companies have integrated supply chains that span from raw material sourcing to feed production, allowing them to leverage economies of scale and ensure a consistent supply of feed. Almarai, for example, plays a significant role due to its large-scale dairy and poultry operations, positioning it as a leading feed consumer and producer. Other key players in the market focus on specific livestock segments, such as aquaculture or pet food, further consolidating their presence in the market.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Production Capacity |

No. of Employees |

|

Almarai Company |

1977 |

Riyadh |

|||

|

National Feed Company (Feedco) |

1995 |

Dammam |

|||

|

Cargill |

1865 |

Minneapolis |

|||

|

Zad Holding Company |

1969 |

Doha |

|||

|

Arasco |

1983 |

Riyadh |

Saudi Arabia Animal Feed Industry Analysis

Market Growth Drivers

- Increasing Livestock Population: The livestock sector in Saudi Arabia has been experiencing consistent growth, driven by government-backed initiatives and private sector investment. As of 2024, the country's livestock population reached 14 million sheep, 2 million cattle, and 3 million goats, supported by the Ministry of Environment, Water, and Agriculture's focus on self-sufficiency in food production. This increase in livestock populations is also closely tied to the demand for high-quality feed, with the growing livestock industry consuming over 12 million metric tons of feed annually.

- Government Agricultural Initiatives: The Saudi governments agricultural initiatives, such as the National Agriculture Strategy, aim to enhance local food production, directly boosting demand for animal feed. The government allocated $1.9 billion in 2024 to improve livestock and feedstock production under the Agricultural Development Fund. These subsidies help local farmers access affordable, high-quality feed, further promoting livestock growth. Additionally, in line with Vision 2030, Saudi Arabia is focusing on sustainable agricultural practices, making domestic feed production a priority to reduce reliance on feed imports.

- Rising Demand for High-Quality Feed: There is increasing demand for high-quality, nutritionally balanced animal feed in Saudi Arabia, largely due to the rising consumption of animal products. In 2024, Saudi Arabia saw a significant shift towards feed that complies with international nutrition standards, with local feed manufacturers producing over 6 million metric tons of premium feed annually. Quality certifications such as ISO 22000 and the implementation of global feed safety protocols are driving the need for enhanced feed quality. This trend ensures that animal nutrition is prioritized, improving the overall health and productivity of livestock.

Market Challenges

- High Costs of Raw Materials: The high cost of essential raw materials like corn and soybean continues to be a challenge for the animal feed market in Saudi Arabia. In 2024, corn prices reached $280 per ton, and soybean imports were priced at $450 per ton due to global supply chain disruptions. Furthermore, import tariffs on key feed ingredients, including grains, increased operational costs for local feed producers, leading to higher feed prices for livestock farmers. This situation has created significant pressure on profit margins for local producers who rely heavily on imported raw materials.

- Volatility in Feed Ingredient Availability: Saudi Arabia faces significant challenges in ensuring a stable supply of feed ingredients due to local agricultural limitations and heavy reliance on imports. In 2024, the country imported over 90% of its feed ingredients, with supply chain disruptions exacerbated by geopolitical factors and fluctuating global commodity prices. Local crop production, particularly barley and wheat, remains insufficient to meet domestic demand, creating volatility in feed ingredient availability. This situation results in inconsistent feed supplies and price hikes, affecting the cost structure for livestock producers.

Saudi Arabia Animal Feed Market Future Outlook

Over the next five years, the Saudi animal feed market is expected to see substantial growth driven by the governments focus on food security and local agricultural production. This is supported by initiatives aimed at boosting local feed production capacity, reducing dependence on imported feed ingredients, and encouraging technological innovations in feed manufacturing processes. Additionally, the expanding livestock and poultry industries will further fuel demand for high-quality, nutrient-dense feed, presenting opportunities for both local and international feed producers to capture more market share.

Future Market Opportunities

- Growth in Aquaculture Sector: Aquaculture is emerging as a growth area in Saudi Arabia's animal feed market, with government investments exceeding $530 million in 2024 to develop the sector. The Ministry of Environment, Water, and Agriculture aims to increase aquaculture production to 500,000 tons by 2025, driving demand for specialized feed products. Aquafeed production in Saudi Arabia rose to over 200,000 tons in 2024, catering to the expanding fish farming industry, which has become a critical component of the countrys food security strategy.

- Expansion of Organic Feed Products: The demand for organic poultry and dairy products has fueled the growth of organic feed production in Saudi Arabia. In 2024, organic feed production reached 120,000 tons, driven by consumer preferences for sustainably farmed animal products. Government regulations promoting organic agriculture and livestock farming are expected to continue supporting this trend. The Saudi government, through its Vision 2030 framework, is also promoting environmentally sustainable farming practices, encouraging the expansion of organic feed production to meet the increasing demand for organic animal products.

Scope of the Report

|

By Feed Type |

Poultry Feed Ruminant Feed Swine Feed Aquaculture Feed Pet Food |

|

By Ingredients |

Cereals (Corn, Barley, Wheat) Oilseeds (Soybean, Sunflower, Rapeseed) Animal Proteins (Fishmeal, Bone Meal) Additives (Amino Acids, Vitamins, Enzymes) |

|

By Form |

Pellets Crumbles Mash |

|

By Livestock |

Poultry (Broilers, Layers, Turkey) Cattle (Dairy, Beef) Swine Aquaculture (Tilapia, Shrimp) |

|

By Region |

North East West South |

Products

Key Target Audience

Livestock Farmers and Poultry Farms

Feed Producers and Manufacturers

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Agriculture)

Investment and Venture Capital Firms

Feed Ingredient Suppliers

Banks and Financial Institutes

Animal Nutritionists and Veterinarians

Agricultural Cooperatives and Associations

Large-Scale Dairy and Meat Processing Companies

Companies

Major Players in Saudi Arabia Animal Feed Market

Almarai Company

National Feed Company (Feedco)

Arasco

Zad Holding Company

Cargill

Al-Watania Poultry

Saudi Dairy & Foodstuff Company (SADAFCO)

Middle East Feedmill

National Aquaculture Group (NAQUA)

Gulf Feed Mills Co.

United Feed Company

Arab Company for Livestock Development (ACOLID)

Saudi Feed Company

Abdullah A. Barrak & Sons Co.

Al-Kabeer Group

Table of Contents

1. Saudi Arabia Animal Feed Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Animal Feed Market Size (In SAR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Animal Feed Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Livestock Population (Livestock Growth Rate, Animal Husbandry Trends)

3.1.2. Government Agricultural Initiatives (Government Subsidies, National Agriculture Strategy)

3.1.3. Rising Demand for High-Quality Feed (Quality Certifications, Animal Nutrition Trends)

3.1.4. Expansion of Poultry and Dairy Sectors (Industry Contribution to GDP, Poultry Production Growth)

3.2. Market Challenges

3.2.1. High Costs of Raw Materials (Corn, Soybean Prices, Import Tariffs)

3.2.2. Volatility in Feed Ingredient Availability (Local Crop Production Variability, Import Dependencies)

3.2.3. Strict Regulatory Framework (Feed Safety Standards, Compliance Costs)

3.3. Opportunities

3.3.1. Growth in Aquaculture Sector (Aquaculture Feed Demand, Government Investments)

3.3.2. Expansion of Organic Feed Products (Demand for Organic Poultry and Dairy, Consumer Preferences)

3.3.3. Technological Advancements in Feed Production (Automation, Smart Farming, AI Adoption)

3.4. Trends

3.4.1. Adoption of Feed Additives (Probiotics, Enzymes, Feed Supplements)

3.4.2. Shift to Sustainable Feed Production (Environmentally Friendly Feed, Carbon Footprint Reduction)

3.4.3. Increasing Preference for Non-GMO Feed (Consumer Demand, Government Policies)

3.5. Government Regulations

3.5.1. Saudi Food and Drug Authority (SFDA) Feed Regulations (Safety Standards, Compliance)

3.5.2. Import Restrictions and Trade Tariffs (Impact on Feed Ingredients, Supply Chain Disruptions)

3.5.3. National Biosecurity Programs (Animal Health, Disease Prevention)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Farmers, Feed Manufacturers, Distributors, Regulators)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Saudi Arabia Animal Feed Market Segmentation

4.1. By Feed Type (In Value %)

4.1.1. Poultry Feed

4.1.2. Ruminant Feed

4.1.3. Swine Feed

4.1.4. Aquaculture Feed

4.1.5. Pet Food

4.2. By Ingredients (In Value %)

4.2.1. Cereals (Corn, Barley, Wheat)

4.2.2. Oilseeds (Soybean, Sunflower, Rapeseed)

4.2.3. Animal Proteins (Fishmeal, Bone Meal)

4.2.4. Additives (Amino Acids, Vitamins, Enzymes)

4.3. By Form (In Value %)

4.3.1. Pellets

4.3.2. Crumbles

4.3.3. Mash

4.3.4. Others (Cakes, Blocks)

4.4. By Livestock (In Value %)

4.4.1. Poultry (Broilers, Layers, Turkey)

4.4.2. Cattle (Dairy, Beef)

4.4.3. Swine

4.4.4. Aquaculture (Tilapia, Shrimp)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. Southern Region

5. Saudi Arabia Animal Feed Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almarai Company

5.1.2. National Feed Company (Feedco)

5.1.3. Arasco

5.1.4. Al-Kabeer Group

5.1.5. Zad Holding Company

5.1.6. Al-Watania Poultry

5.1.7. Middle East Feedmill

5.1.8. Arab Company for Livestock Development (ACOLID)

5.1.9. United Feed Company

5.1.10. National Aquaculture Group (NAQUA)

5.1.11. Abdullah A. Barrak & Sons Co.

5.1.12. Saudi Feed Company

5.1.13. Gulf Feed Mills Co.

5.1.14. Saudi Dairy & Foodstuff Company (SADAFCO)

5.1.15. National Agricultural Development Company (NADEC)

5.2. Cross Comparison Parameters (Market Share, No. of Employees, Headquarters, Revenue, Product Portfolio, Regional Presence, Production Capacity, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Animal Feed Market Regulatory Framework

6.1. Feed Safety Standards

6.2. Import Regulations

6.3. Certification Processes

6.4. Compliance Requirements

7. Saudi Arabia Animal Feed Future Market Size (In SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Animal Feed Future Market Segmentation

8.1. By Feed Type (In Value %)

8.2. By Ingredients (In Value %)

8.3. By Form (In Value %)

8.4. By Livestock (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Animal Feed Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia Animal Feed Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Saudi animal feed market. This includes assessing market penetration, feed demand across livestock sectors, and the revenue generated by key players. Furthermore, an evaluation of feed quality and availability statistics will be conducted to ensure the reliability and accuracy of market size and growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through in-depth interviews with industry experts representing a diverse array of feed manufacturers, livestock producers, and government bodies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple feed manufacturers and livestock farmers to acquire detailed insights into feed production trends, sales performance, livestock feeding practices, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia Animal Feed Market.

Frequently Asked Questions

01. How big is the Saudi Arabia Animal Feed Market?

The Saudi Arabia animal feed market is valued at USD 2.63 billion, driven by increasing demand for livestock products such as poultry and dairy, along with government support for local feed production.

02. What are the challenges in the Saudi Arabia Animal Feed Market?

Challenges in the Saudi Arabia animal feed market include high dependency on imported feed ingredients like corn and soybean, volatile raw material prices, and stringent government regulations concerning feed safety and quality.

03. Who are the major players in the Saudi Arabia Animal Feed Market?

Key players in the Saudi Arabia animal feed market include Almarai Company, National Feed Company (Feedco), Cargill, Arasco, and Zad Holding Company. These companies dominate due to their extensive distribution networks and large production capacities.

04. What are the growth drivers of the Saudi Arabia Animal Feed Market?

Growth drivers in the Saudi Arabia animal feed market include the rising demand for high-quality animal protein, government initiatives to boost local feed production, and advancements in feed manufacturing technologies that improve feed quality and efficiency.

05. What is the outlook for the Saudi Arabia Animal Feed Market?

The Saudi Arabia animal feed market is expected to experience significant growth in the coming years, driven by increased livestock farming, poultry production, and the development of local feed production capacities to reduce reliance on imports.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.