Saudi Arabia ATM Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD8707

December 2024

87

About the Report

Saudi Arabia ATM Market Overview

- The Saudi Arabia ATM market is currently valued at USD 2.62 billion, driven by a combination of factors including the expansion of the banking sector, a high demand for cash transactions, and continued consumer reliance on cash despite the growing digital payment infrastructure. The governments push towards financial inclusion, alongside the growing e-commerce sector, has also contributed to the increased installation of ATMs across the country. Additionally, the Saudi Arabian Monetary Authoritys (SAMA) regulatory guidelines ensure security and efficiency in ATM transactions, fostering consumer trust.

- Riyadh, Jeddah, and Dammam dominate the Saudi ATM market due to their dense population, robust commercial activity, and a highly developed financial infrastructure. Riyadh, being the capital and a central economic hub, houses numerous financial institutions that drive the demand for ATMs. Jeddah, as a major port city, sees heavy cash flow and transactions in its commercial districts, while Dammams strategic location near oil fields contributes to a high concentration of ATMs serving workers and businesses in the region.

- The Saudi Arabian Monetary Authority (SAMA) has introduced stringent guidelines for ATM operations to ensure safety and efficiency. As of 2023, all ATMs in Saudi Arabia must comply with the latest security protocols, including end-to-end encryption and biometric authentication. SAMA also mandates regular maintenance checks and software updates to protect against cyber threats. Failure to adhere to these regulations results in heavy penalties, with fines ranging up to SAR 1 million per violation. These guidelines ensure that ATM networks remain secure and reliable across the kingdom.

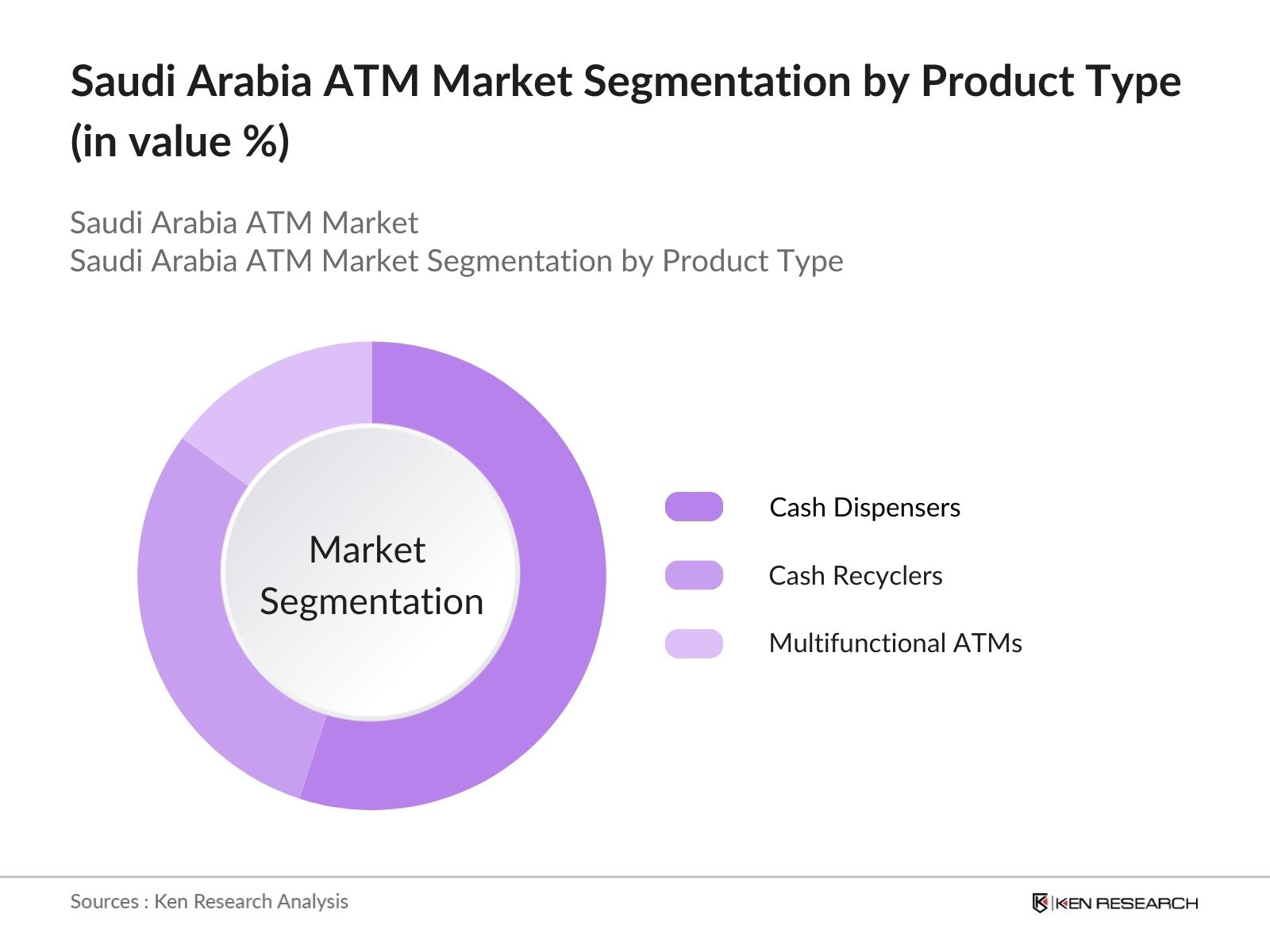

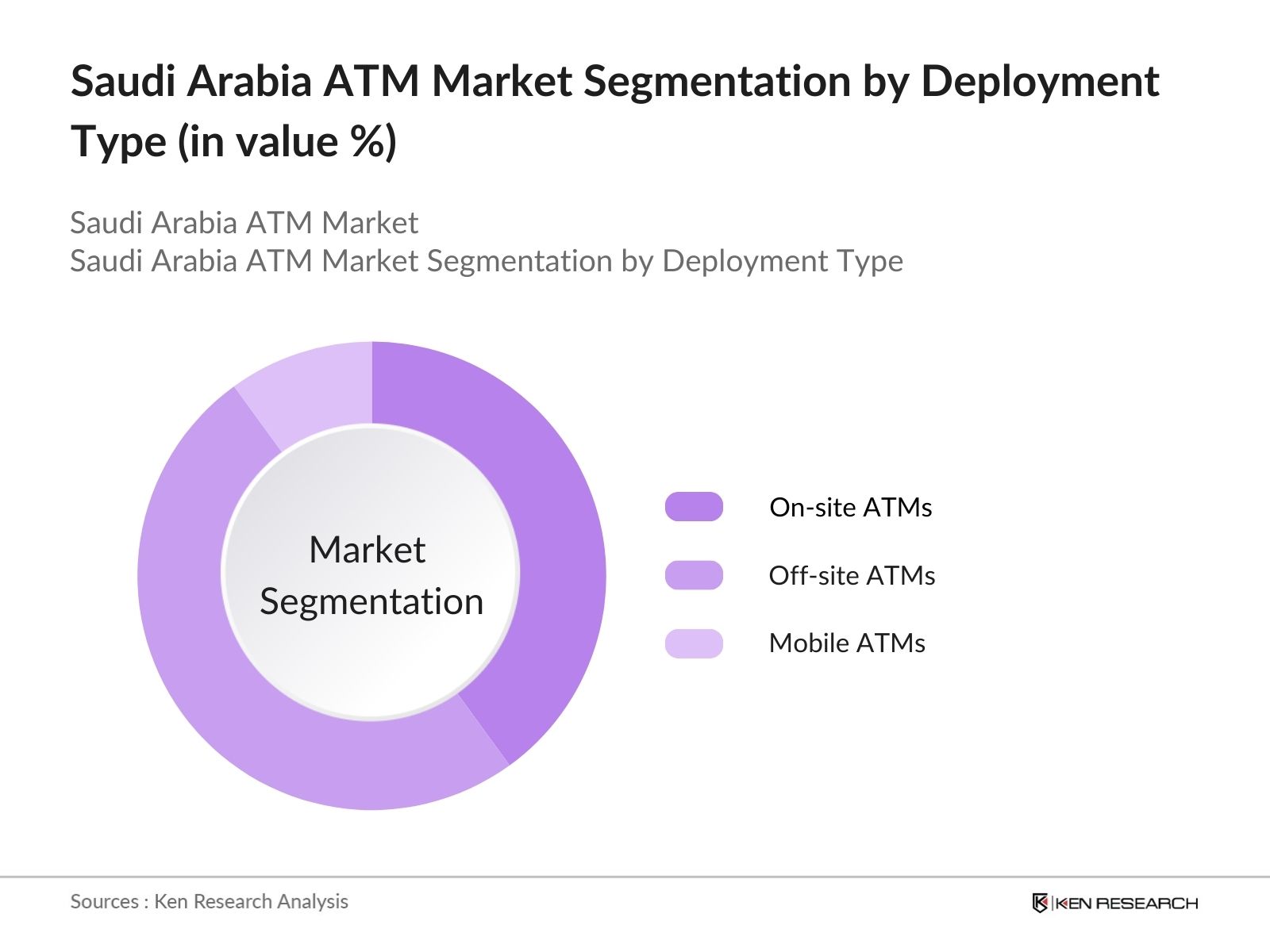

Saudi Arabia ATM Market Segmentation

- By Product Type: The market is segmented by product type into cash dispensers, cash recyclers, and multifunctional ATMs. Cash dispensers are the dominant segment due to their widespread usage for straightforward cash withdrawals, especially in retail and commercial hubs where quick access to cash remains essential for both businesses and consumers. The relatively low maintenance cost and simplicity of cash dispensers make them the preferred choice for banks and financial institutions aiming for high ATM deployment rates across the country.

- By Deployment Type: The market is further segmented by deployment type into on-site ATMs, off-site ATMs, and mobile ATMs. Off-site ATMs hold a dominant position as they cater to a broader customer base in high-traffic areas such as malls, airports, and hospitals, providing convenience for consumers. The strategic placement of these off-site ATMs in commercial and urban areas ensures maximum footfall, making them a lucrative option for banks looking to expand their customer outreach and service offerings.

Saudi Arabia ATM Market Competitive Landscape

The Saudi Arabia ATM market is dominated by both local and international players, with significant influence from global technology providers that offer innovative ATM solutions. Companies like NCR Corporation and Diebold Nixdorf lead in terms of technology integration, while local financial institutions such as Saudi Hollandi Bank play a key role in the deployment of ATM networks across urban and rural areas. This market consolidation highlights the dominance of these major players, especially in offering advanced ATM services like biometric authentication and AI-powered functionalities.

|

Company |

Establishment Year |

Headquarters |

No. of ATMs Deployed |

Revenue (SAR) |

Market Share (%) |

|

NCR Corporation |

1884 |

Atlanta, USA |

|||

|

Diebold Nixdorf |

1859 |

Ohio, USA |

|||

|

Hyosung TNS |

1979 |

Seoul, South Korea |

|||

|

Saudi Hollandi Bank |

1926 |

Riyadh, Saudi Arabia |

|||

|

GRG Banking |

1999 |

Guangzhou, China |

Saudi Arabia ATM Industry Analysis

Market Growth Drivers

- Rise in E-commerce and Digital Payments: The rise of e-commerce platforms in Saudi Arabia has accelerated digital payment adoption, pushing the need for more ATMs. In 2022, digital payment transactions in Saudi Arabia reached over 1.5 billion, as reported by the Saudi Central Bank (SAMA). This increase has driven ATM usage, primarily for cash withdrawals to complement online purchases. Additionally, as cash remains integral in specific sectors, the demand for ATMs to balance digital payments and cash remains strong. Data from SAMA highlights a 12% rise in card transactions, contributing to increased cash withdrawals in 2024.

- Expansion of Banking Network: Saudi Arabia has been expanding its banking network, with over 5,000 new bank branches introduced between 2022 and 2024. The Saudi Central Bank (SAMA) has noted that this expansion has facilitated the installation of ATMs across urban and rural areas. Increased accessibility to banking services has promoted financial inclusion, especially for unbanked populations. With the opening of 100 new ATMs every quarter in 2023, ATM penetration continues to grow in line with government and financial institution goals. This growth supports enhanced financial services throughout the kingdom.

- Government Initiatives for Cashless Economy: The Saudi Vision 2030 initiative aims to reduce the countrys dependence on cash and promote a cashless economy. However, as of 2024, cash remains a dominant transaction method, accounting for 35% of all retail payments, as per SAMA's reports. The Saudi government has implemented policies encouraging the use of digital wallets and cards, leading to a demand for more ATMs to handle increased cash withdrawals during this transition period. To support cash transactions during the cashless economy initiative, banks have continued to increase ATM deployment.

Market Challenges

- Growing Cases of ATM Fraud: Cybersecurity threats are a growing concern for the Saudi ATM market. In 2023, SAMA reported 1,200 cases of ATM-related fraud, a 20% increase from 2022. These incidents included skimming and unauthorized withdrawals, leading to a loss of SAR 100 million. Despite advancements in ATM security, the persistence of these crimes presents a challenge to banks and customers. The Saudi government has responded by strengthening security standards, but the cost of mitigating these risks remains high. This financial burden is a challenge for maintaining a secure ATM network.

- High Installation and Operational Costs: ATM installation and maintenance costs have surged, with each new machine costing approximately SAR 200,000 to install in urban areas, according to a 2023 SAMA report. Additionally, operational costs, including security, electricity, and software updates, add an extra SAR 50,000 annually. This has posed a significant challenge, especially for small banks with limited budgets. Furthermore, remote areas face higher costs due to transportation and network installation, contributing to disparities in ATM availability across regions. These costs deter some banks from expanding ATM networks, despite growing demand.

Future Market Opportunities

- Increasing Adoption of AI-powered ATMs: AI-powered ATMs have begun to see adoption in Saudi Arabia as banks look to automate services. As of 2024, 500 AI-powered ATMs are in operation, offering features such as facial recognition, voice commands, and predictive analytics to enhance customer experience. SAMA has endorsed the adoption of AI in banking to streamline operations and reduce manual errors. These machines are expected to reduce wait times and increase transaction accuracy, offering opportunities for further market growth in the upcoming years. The move toward AI integration is aligned with Saudi Arabias digital transformation strategy.

- Blockchain Technology for Secure Transactions: Blockchain technology is emerging as a solution for enhancing the security of ATM transactions in Saudi Arabia. In 2023, several pilot projects were launched by major banks to test blockchain integration, allowing for more transparent and secure transaction records. This technology has proven effective in mitigating the risks associated with ATM fraud, as it provides tamper-proof transaction logs. According to SAMA, the use of blockchain in ATMs could reduce fraud-related losses by SAR 50 million annually. This innovation presents a significant opportunity to strengthen the security framework of Saudi ATMs.

Scope of the Report

|

By Product Type |

Cash Dispensers Cash Recyclers Multifunctional ATMs |

|

By Deployment Type |

On-site ATMs Off-site ATMs Mobile ATMs |

|

By Functionality |

Cash Transactions Bill Payments Funds Transfer |

|

By End User |

Banks Independent ATM Deployers Financial Institutions |

|

By Region |

North East West South |

Products

Key Target Audience

Banks and Financial Institutions

ATM Manufacturers and Suppliers

Independent ATM Deployers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Arabian Monetary Authority - SAMA)

Banks and Financial Institutes

ATM Security Solution Providers

Financial Technology (Fintech) Companies

Payment Service Providers

Companies

Saudi Arabia ATM Market Major Players

NCR Corporation

Diebold Nixdorf

Hyosung TNS

Saudi Hollandi Bank

GRG Banking

Hitachi-Omron Terminal Solutions

Fujitsu

OKI Electric Industry

Euronet Worldwide

Cardtronics

Wincor Nixdorf

KAL ATM Software

Systech Corp

Samba Financial Group

Banque Saudi Fransi

Table of Contents

1. Saudi Arabia ATM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia ATM Market Size (In SAR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia ATM Market Analysis

3.1. Growth Drivers (Increased Digitalization, Financial Inclusion, Cash Transactions)

3.1.1. Rise in E-commerce and Digital Payments

3.1.2. Expansion of Banking Network

3.1.3. Government Initiatives for Cashless Economy

3.2. Market Challenges (Cybersecurity Threats, High Maintenance Costs)

3.2.1. Growing Cases of ATM Fraud

3.2.2. High Installation and Operational Costs

3.2.3. Limited Access in Remote Areas

3.3. Opportunities (Integration of AI, Blockchain in ATMs)

3.3.1. Increasing Adoption of AI-powered ATMs

3.3.2. Blockchain Technology for Secure Transactions

3.3.3. ATM-as-a-Service Models

3.4. Trends (Contactless ATM Solutions, Mobile Integration)

3.4.1. Biometric Authentication for ATMs

3.4.2. Cardless Cash Withdrawals via Mobile Apps

3.4.3. Rising Demand for Cash Recycling ATMs

3.5. Government Regulations

3.5.1. Saudi Arabian Monetary Authority (SAMA) Guidelines

3.5.2. Regulatory Standards for ATM Security

3.5.3. Compliance with Anti-Money Laundering (AML) Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Banking Dependency, Supplier Power)

3.9. Competition Ecosystem (ATM Manufacturers, Banking Providers)

4. Saudi Arabia ATM Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cash Dispensers

4.1.2. Cash Recyclers

4.1.3. Multifunctional ATMs

4.2. By Deployment Type (In Value %)

4.2.1. On-site ATMs

4.2.2. Off-site ATMs

4.2.3. Mobile ATMs

4.3. By Functionality (In Value %)

4.3.1. Cash Transactions

4.3.2. Bill Payments

4.3.3. Funds Transfer

4.4. By End User (In Value %)

4.4.1. Banks

4.4.2. Independent ATM Deployers

4.4.3. Financial Institutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Saudi Arabia ATM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NCR Corporation

5.1.2. Diebold Nixdorf

5.1.3. Hyosung TNS

5.1.4. GRG Banking

5.1.5. Fujitsu

5.1.6. Hitachi-Omron Terminal Solutions

5.1.7. OKI Electric Industry

5.1.8. Euronet Worldwide

5.1.9. Cardtronics

5.1.10. Wincor Nixdorf

5.1.11. KAL ATM Software

5.1.12. Systech Corp

5.1.13. Saudi Hollandi Bank

5.1.14. Samba Financial Group

5.1.15. Banque Saudi Fransi

5.2. Cross Comparison Parameters (No. of ATMs Deployed, Headquarters, Inception Year, Revenue, Market Share, Technology Innovation, Service Network, ATM Security Solutions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia ATM Market Regulatory Framework

6.1. Regulations by Saudi Arabian Monetary Authority (SAMA)

6.2. Compliance with International ATM Standards

6.3. Security Certification Requirements

6.4. Technological Integration Regulations

7. Saudi Arabia ATM Market Future Size (In SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia ATM Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Functionality (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia ATM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, the research process focuses on identifying key variables that influence the Saudi Arabia ATM market, such as cash transaction volumes, financial inclusion programs, and technological advancements in ATM machines. This is achieved through extensive desk research and a review of proprietary databases.

Step 2: Market Analysis and Construction

During this phase, historical data regarding ATM deployment, customer usage patterns, and financial penetration rates are analyzed. This includes assessing ATM usage in both urban and rural settings, focusing on revenue generation and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses related to growth drivers, technological advancements, and regulatory impacts are validated through interviews with industry experts, including ATM manufacturers and bank representatives. Their insights provide detailed operational data that help refine the market model.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data collected from primary and secondary sources to ensure a comprehensive analysis of the Saudi Arabia ATM market. Detailed insights on product segments, consumer preferences, and technology adoption are included in the final report.

Frequently Asked Questions

01. How big is the Saudi Arabia ATM Market?

The Saudi Arabia ATM market is valued at SAR 2.62 billion, driven by strong demand for cash transactions and the expansion of the countrys banking network.

02. What are the key challenges in the Saudi Arabia ATM Market?

Challenges in the market include cybersecurity threats, high operational costs for ATM maintenance, and increasing ATM fraud incidents, particularly in off-site locations.

03. Who are the major players in the Saudi Arabia ATM Market?

Key players in the market include NCR Corporation, Diebold Nixdorf, Hyosung TNS, Saudi Hollandi Bank, and GRG Banking, who dominate due to their advanced ATM technologies and strong service networks.

04. What are the growth drivers of the Saudi Arabia ATM Market?

The market is propelled by increasing consumer demand for cash transactions, the expansion of the banking sector, and government initiatives aimed at improving financial inclusion across both urban and rural areas.

05. What are the trends shaping the Saudi Arabia ATM Market?

Trends include the integration of biometric authentication, the rise of cardless ATMs, and the increasing adoption of AI-powered ATMs for enhanced user experience and security.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.