Saudi Arabia Baby Care Products Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD11130

November 2024

88

About the Report

Saudi Arabia Baby Care Products Market Overview

- The Saudi Arabia baby care products market is valued at USD 3.66 billion, reflecting robust growth due to rising awareness of infant hygiene and increased disposable income among Saudi families. Key product categories like skincare, toiletries, and baby food have experienced consistent demand, driven by health-conscious parents and premium product availability. Factors such as growing birth rates and a trend toward branded baby products contribute to this market's expansion.

- Riyadh and Jeddah are the primary hubs driving the baby care products market in Saudi Arabia, attributed to high-income levels, urban population density, and well-established retail networks in these cities. These regions have witnessed a steady influx of both local and international brands, further solidifying their positions as the primary markets for baby care products.

- The SFDA requires that baby care products meet detailed safety guidelines, especially for chemical composition. Non-compliance can lead to product recalls or fines. In 2023, the SFDA recorded multiple recalls due to safety violations, reinforcing the need for compliant, regulated products that adhere to government standards.

Saudi Arabia Baby Care Products Market Segmentation

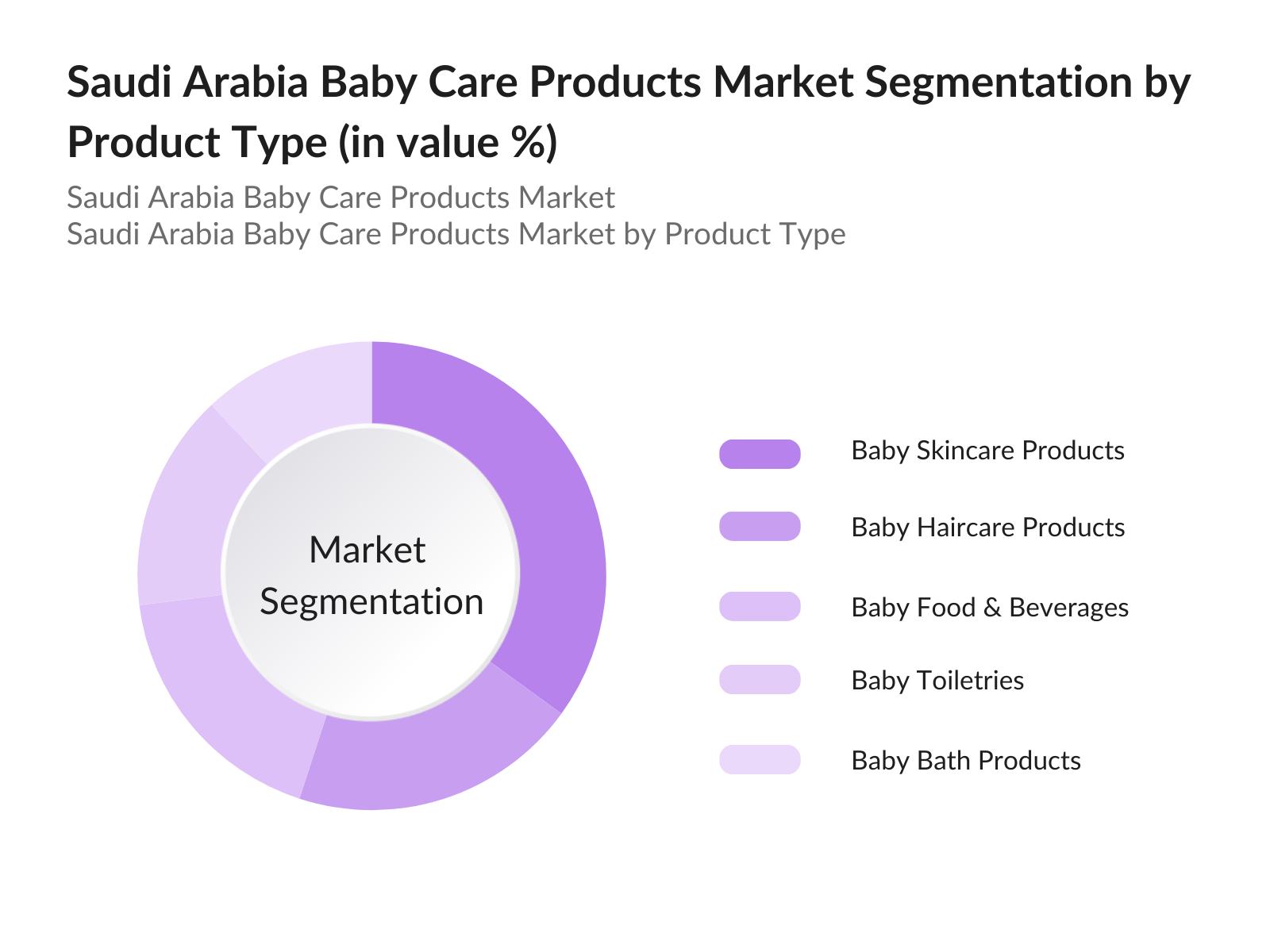

- By Product Type: The Saudi Arabia baby care products market is segmented by product type into Baby Skincare Products, Baby Haircare Products, Baby Toiletries, Baby Food & Beverages, and Baby Bath Products. Baby Skincare Products lead the product type segmentation due to their wide usage among consumers, focusing on products like creams and lotions to cater to the sensitive skin of infants. With a strong presence of brands like Johnson & Johnson, these products remain a consumer favorite due to their established reputation for quality and safety.

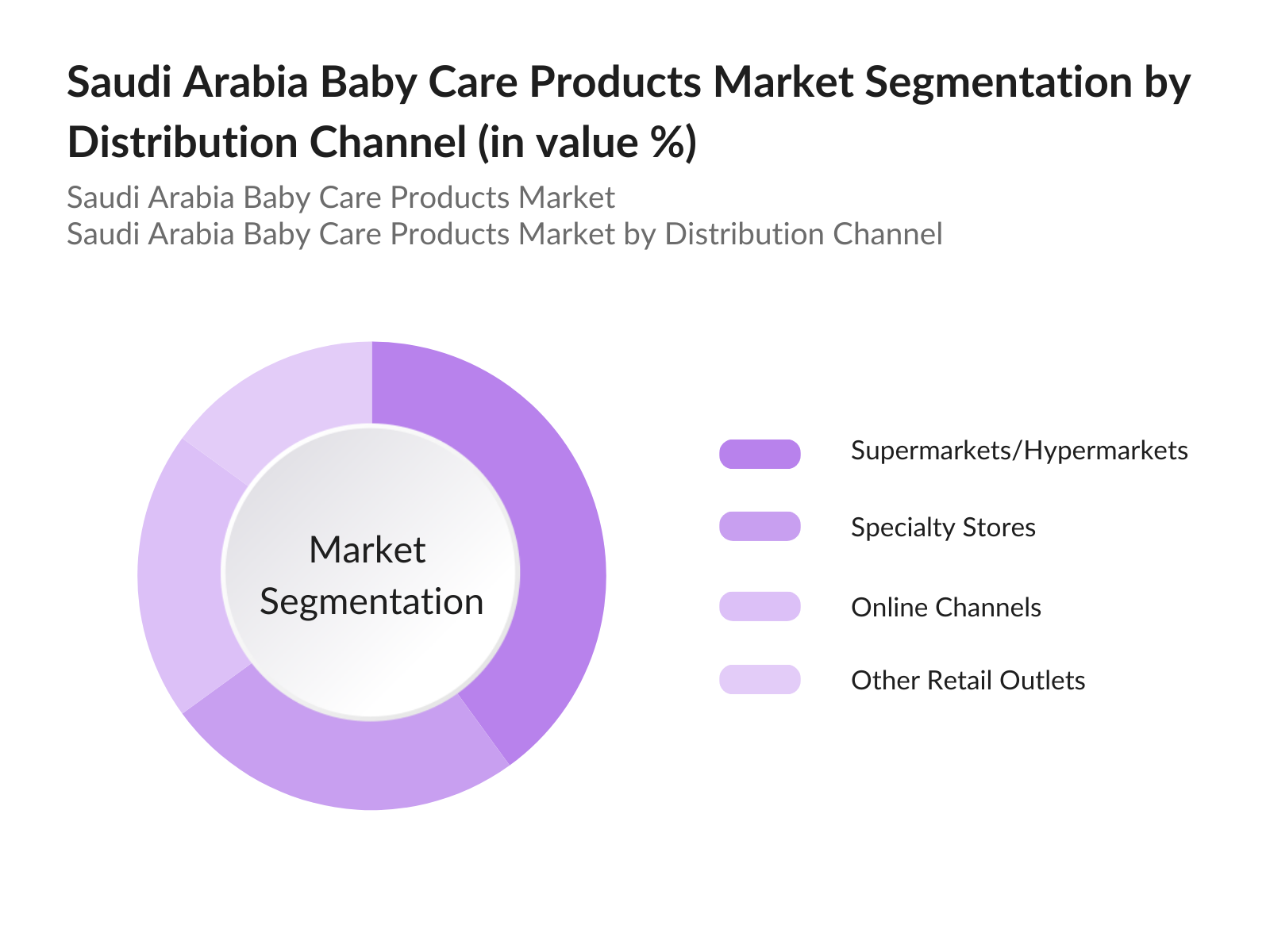

- By Distribution Channel: Distribution channels for baby care products in Saudi Arabia include Supermarkets/Hypermarkets, Specialty Stores, Online Channels, and Other Retail Outlets. Supermarkets and hypermarkets are predominant due to their ability to stock a wide variety of brands, ensuring competitive pricing and convenience for consumers. Furthermore, these stores offer promotions that attract a significant customer base, especially for bulk purchases.

Saudi Arabia Baby Care Products Market Competitive Landscape

The Saudi Arabia baby care products market is dominated by a mix of multinational corporations and local players, making for a competitive market landscape. Leading companies leverage extensive distribution networks and strong brand reputations to maintain their market positions.

|

Company |

Establishment Year |

Headquarters |

Distribution Network |

Key Product Range |

Brand Loyalty |

Innovation Rate |

Revenue (USD Billion) |

Market Position |

|

Johnson & Johnson |

1886 |

New Jersey, USA |

High |

- |

- |

- |

- |

- |

|

Procter & Gamble |

1837 |

Cincinnati, USA |

Extensive |

- |

- |

- |

- |

- |

|

Nestl S.A. |

1866 |

Vevey, Switzerland |

Global |

- |

- |

- |

- |

- |

|

Unilever |

1929 |

London, UK |

High |

- |

- |

- |

- |

- |

|

Kimberly-Clark |

1872 |

Texas, USA |

Extensive |

- |

- |

- |

- |

- |

Saudi Arabia Baby Care Products Industry Analysis

Market Growth Drivers

- Rising Birth Rates: Saudi Arabia has a relatively high birth rate compared to many countries, with approximately 18.3 births per 1,000 people in 2023. This figure underscores a consistent demand for baby care products. As of 2024, the population under 5 years old has reached 3.1 million, according to Saudi Arabias General Authority for Statistics. With population growth expected to maintain this demand, the need for diverse baby care products, including hygiene and food, is substantial.

- Western Trends in Baby Care: Saudi Arabias exposure to Western lifestyles is reshaping consumer behavior in baby care. Products such as baby lotions, powders, and specialized skincare have become increasingly popular, with premium categories showing significant growth, particularly among urban, affluent families. Saudi household expenditure on childcare products has increased by 10 billion SAR annually, highlighting a market that favors branded, high-quality products.

- Preference for Branded Products: Brand preference is a strong driver, with many Saudi families investing in well-known international brands due to perceived quality and safety. Trusted brands from Western markets often dominate, contributing to higher market penetration. Saudi Arabias annual import of baby care products valued in billions reflects this preference, as the market for baby products shifts toward international standards.

Market Challenges:

- High Costs of Premium Products: Premium baby care products imported into Saudi Arabia often carry high tariffs, impacting consumer affordability. Average annual expenditure on premium baby care products by a Saudi family has been calculated at around 5,000 SAR. High prices restrict access for many consumers, especially those in lower-income brackets. Economic shifts and currency fluctuations further influence affordability, limiting widespread adoption.

- Economic Fluctuations: Saudi Arabias reliance on oil means that economic fluctuations can impact consumer purchasing power, directly affecting the baby care products market. During periods of lower oil revenues, household spending contracts, impacting sectors like baby care. With projected government spending decreases, discretionary spending may face constraints, which could affect premium and non-essential baby product sales.

Saudi Arabia Baby Care Products Market Future Outlook

Over the next five years, the Saudi Arabia baby care products market is expected to witness substantial growth. Factors like increased consumer spending, the expansion of e-commerce platforms, and the rise in demand for organic products will be pivotal in shaping this growth trajectory. Major players are anticipated to invest in innovative products with eco-friendly and natural ingredients to meet evolving consumer preferences and regulatory standards.

Market Opportunities:

- Demand for Organic and Eco-Friendly Products: Growing awareness of organic and eco-friendly options has surged among Saudi consumers. Saudi Arabia imported organic products worth over 15 billion SAR in 2023, highlighting the shifting consumer focus. With a young and informed consumer base, eco-conscious families increasingly demand non-toxic, eco-friendly baby care items, which represent a major growth opportunity for new and existing brands.

- Eco-Friendly Baby Care: Innovation in eco-friendly baby care products is rising, with demand for products using plant-based materials and biodegradable packaging. Saudi Arabia imported biodegradable packaging worth over 2 billion SAR in 2023, showing a trend aligned with sustainable practices. Additionally, innovations such as baby wipes with fewer synthetic additives have grown popular, appealing to health-conscious parents.

Scope of the Report

|

By Product Type |

Baby Skincare Haircare Bath Products Toiletries Food & Beverages |

|

By Distribution Channel |

Specialty Stores Supermarkets/Hypermarkets Online Channels Others |

|

By Age Group |

Newborn (0-6 months) Infant (6-12 months) Toddler (1-3 years) |

|

By Packaging Type |

Bottles Tubs Pouches Jars Tubes |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Baby Care Product Manufacturers

Retail Chains and Supermarkets

Specialty Baby Product Stores

Online Retailers

Investments and Venture Capitalist Firms

Healthcare Providers and Pediatricians

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Research and Development Organizations

Companies

Players mentioned in the market

Johnson & Johnson

Procter & Gamble

Nestl S.A.

Unilever

Kimberly-Clark Corporation

Beiersdorf AG

Chicco

Babyshop

Danone S.A.

Pigeon Corporation

Mustela (Laboratoires Expanscience)

Himalaya Herbals

Nuby

Nunu Baby Care Products (Batterjee Factory)

B for Baby KSA

Table of Contents

1. Saudi Arabia Baby Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (e.g., Baby Skincare, Haircare, Bath Products, Toiletries, Food & Beverages)

1.3. Market Growth Rate and Key Trends

1.4. Market Segmentation Overview (By Product Type, Distribution Channel)

2. Saudi Arabia Baby Care Products Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Developments and Milestones

3. Saudi Arabia Baby Care Products Market Analysis

3.1. Market Dynamics

3.1.1. Growth Drivers (Rising Birth Rates, Western Trends in Baby Care, Preference for Branded Products)

3.1.2. Restraints (High Costs of Premium Products, Economic Fluctuations)

3.1.3. Opportunities (Demand for Organic and Eco-Friendly Products)

3.1.4. Challenges (Counterfeit Product Concerns, Regulatory Compliance)

3.2. Technology and Product Innovation Trends (e.g., Eco-Friendly Baby Care, New Ingredients)

3.3. Regulatory Framework (Import Standards, Product Safety Compliance)

3.4. Impact of COVID-19 on Baby Care Products Market

3.5. Porters Five Forces Analysis

4. Saudi Arabia Baby Care Products Market Segmentation

4.1. By Product Type

4.1.1. Baby Skincare Products

4.1.2. Baby Haircare Products

4.1.3. Baby Bath Products

4.1.4. Baby Toiletries

4.1.5. Baby Food & Beverages

4.2. By Distribution Channel

4.2.1. Specialty Stores

4.2.2. Supermarkets/Hypermarkets

4.2.3. Online Channels

4.2.4. Other Retail Outlets

5. Saudi Arabia Baby Care Products Competitive Landscape

5.1. Profiles of Key Companies (e.g., Johnson & Johnson, Procter & Gamble, Nestl, Kimberly-Clark, Unilever)

5.2. Cross Comparison Parameters (Market Share, Product Range, Revenue, Innovation Rate, Customer Base, Distribution Network, Geographical Presence, Product Pricing)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships)

5.5. Key Competitive Developments

6. Saudi Arabia Baby Care Products Future Market Size (USD Billion)

6.1. Future Market Size Projections

6.2. Growth Drivers for Future Market Expansion

7. Saudi Arabia Baby Care Products Future Market Segmentation

7.1. By Product Type

7.2. By Distribution Channel

8. Saudi Arabia Baby Care Products Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Segmentation Analysis

8.3. White Space Opportunity Identification

8.4. Recommended Marketing Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with identifying key market variables, including consumer preferences, product innovation trends, and regional demand variances. This is supported by comprehensive secondary research using industry databases to understand market dynamics.

Step 2: Market Analysis and Construction

This stage involves compiling historical and current market data for the Saudi Arabia baby care products market. Analysis includes segmentation, revenue generation, and brand positioning based on product penetration.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses are validated through consultations with industry experts, leveraging primary research methods such as interviews. Insights from these experts refine our understanding of market trends and operational challenges.

Step 4: Research Synthesis and Final Output

In the final phase, data is synthesized to produce an in-depth report. This stage includes validating our data with major players in the baby care products industry to ensure an accurate, credible, and actionable market analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia Baby Care Products Market?

The Saudi Arabia baby care products market is valued at USD 3.66 billion, with demand driven by increasing consumer awareness regarding infant care, hygiene, and premium product availability.

02. What are the challenges in the Saudi Arabia Baby Care Products Market?

Challenges include economic fluctuations affecting consumer spending, high costs associated with premium products, and the presence of counterfeit products impacting brand trust.

03. Who are the major players in the Saudi Arabia Baby Care Products Market?

Key players include Johnson & Johnson, Procter & Gamble, Nestl, Unilever, and Kimberly-Clark Corporation. These companies lead due to their extensive distribution networks and diverse product ranges.

04. What are the growth drivers of the Saudi Arabia Baby Care Products Market?

Growth is fueled by rising birth rates, increased disposable income, and the trend toward organic and eco-friendly baby care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.