Saudi Arabia Bariatric Surgery Devices Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9123

December 2024

87

About the Report

Saudi Arabia Bariatric Surgery Devices Market Overview

- The Saudi Arabia Bariatric Surgery Devices Market is valued at USD 150 million, with demand driven by a combination of increasing obesity rates, government support for healthcare expansion, and an uptick in minimally invasive surgery adoption. These factors reflect the country's push towards advanced healthcare solutions, aligning with the Vision 2030 objectives to reduce lifestyle-related diseases.

- Dominant regions in the market include Riyadh, Jeddah, and the Eastern Province. These areas benefit from high population density, greater healthcare infrastructure investment, and concentrated medical tourism. These cities host the leading private and public hospitals, which have the capacity to offer specialized bariatric procedures, making them hubs for bariatric surgery within Saudi Arabia.

- Saudi Arabias Vision 2030 promotes healthcare growth through partnerships with the private sector, allowing for $12 billion in investments since 2022. The strategy emphasizes enhancing healthcare services, including bariatric surgery, as part of improving quality healthcare accessibility across the kingdom. Public-private partnerships in healthcare are enabling device accessibility, supporting modern infrastructure, and advancing healthcare technologies. Vision 2030 aims to address obesity-related health challenges, creating a favorable environment for bariatric devices.

Saudi Arabia Bariatric Surgery Devices Market Segmentation

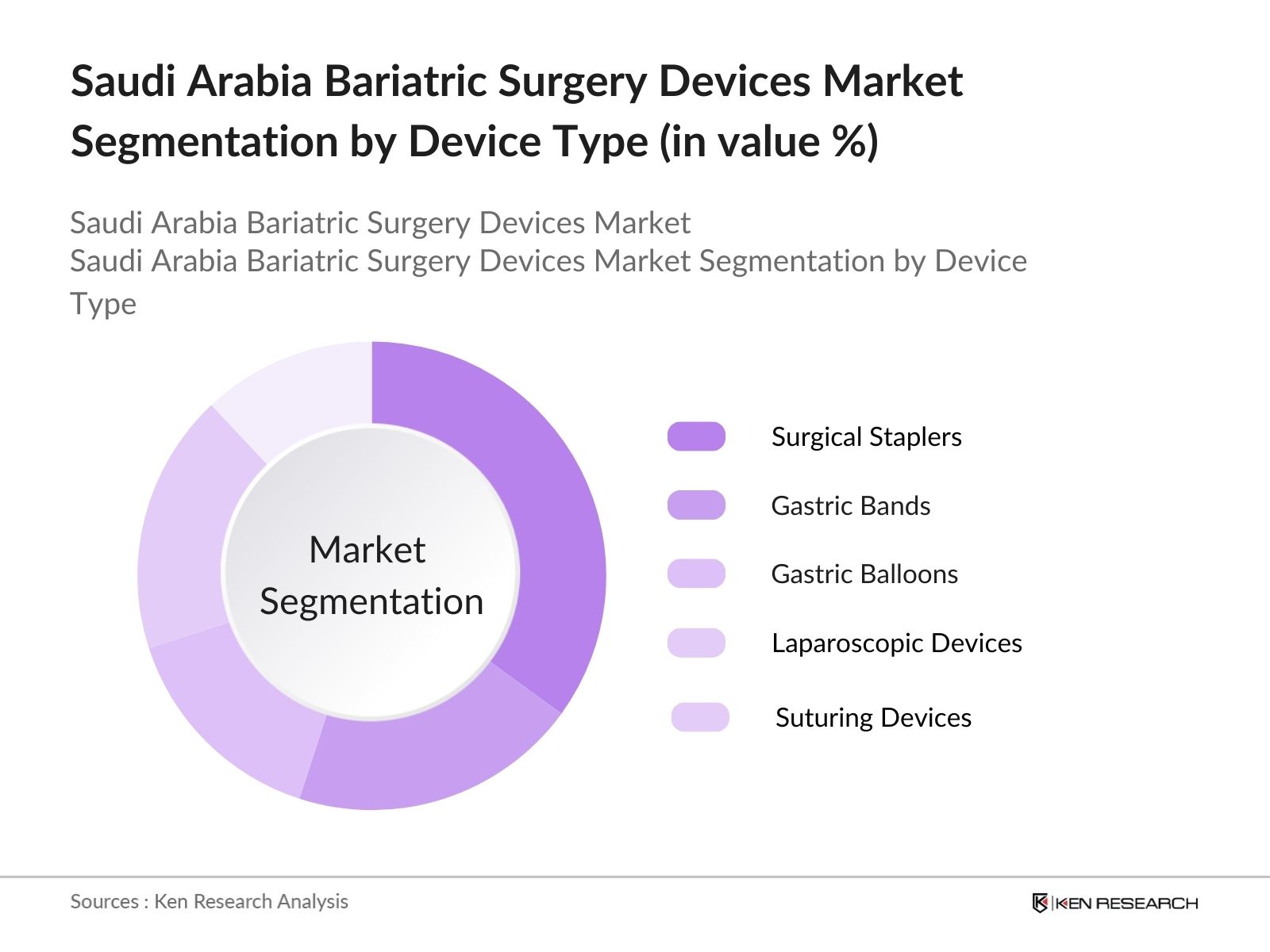

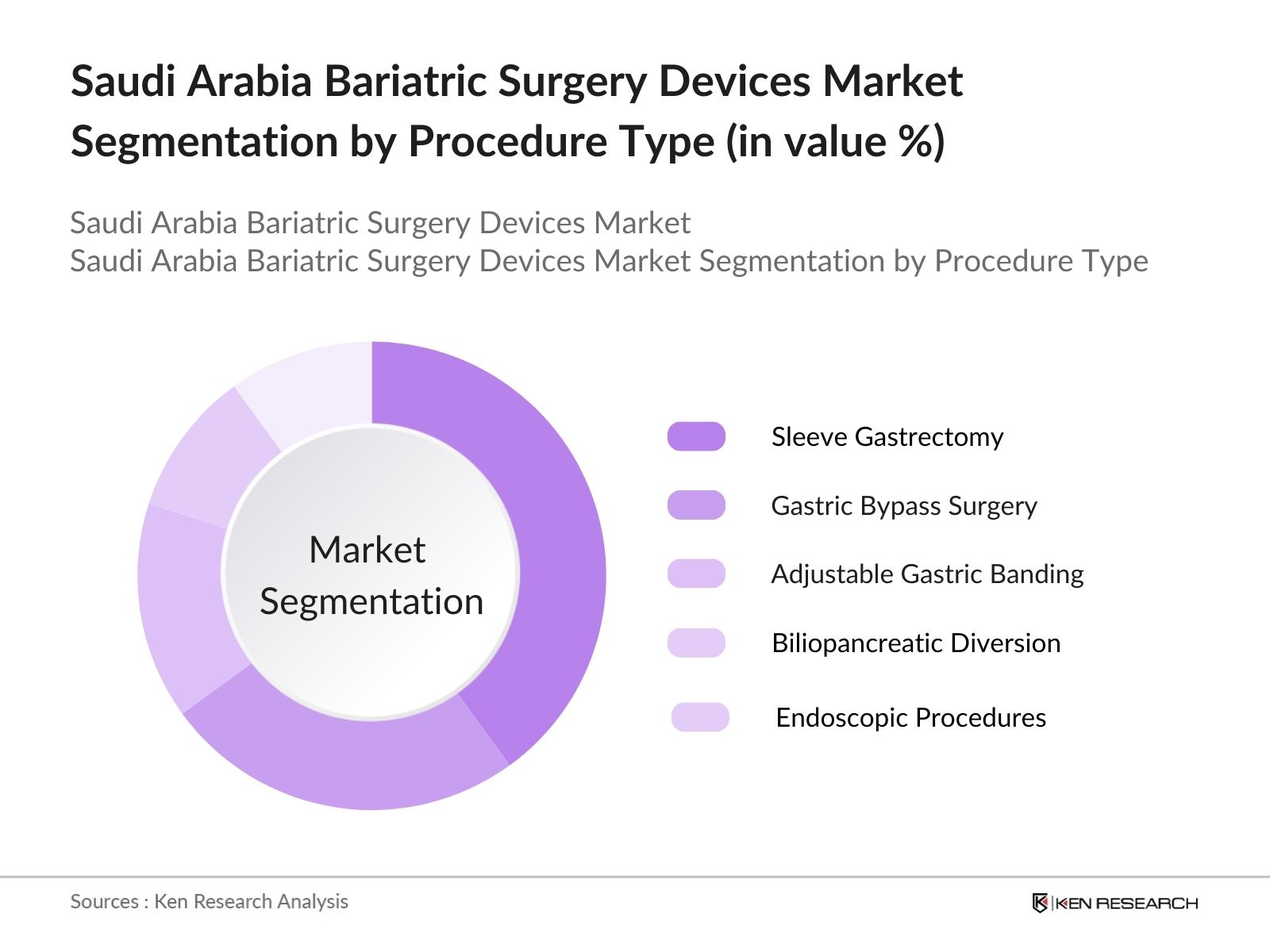

The Saudi Arabia bariatric surgery devices market is segmented by device type and by procedure type.

- By Device Type: The market is segmented by device type into surgical staplers, gastric bands, gastric balloons, laparoscopic devices, and suturing devices. Currently, surgical staplers hold a dominant market share due to their integral role in most bariatric surgeries, especially in gastric bypass and sleeve gastrectomy. Surgical staplers offer precision and efficiency, reducing operating times and post-surgical complications, which is essential for high-volume healthcare providers.

- By Procedure Type: The market is segmented by procedure type into gastric bypass surgery, sleeve gastrectomy, adjustable gastric banding, biliopancreatic diversion, and endoscopic procedures. Sleeve gastrectomy is the dominant procedure, owing to its proven effectiveness in weight reduction, relatively shorter recovery times, and lower risk of complications. It is widely favored by both surgeons and patients as it provides significant weight loss with fewer postoperative complications.

Saudi Arabia Bariatric Surgery Devices Market Competitive Landscape

The Saudi Arabia bariatric surgery devices market is dominated by leading global players known for their technological advancements, comprehensive service offerings, and substantial investment in R&D. Major players include Medtronic PLC, Johnson & Johnson (Ethicon), and Olympus Corporation, which collectively provide a significant portion of the devices used in the countrys top healthcare facilities. These companies influence in the market stems from their innovation in minimally invasive technologies and strong distribution networks.

Saudi Arabia Bariatric Surgery Devices Market Analysis

Growth Drivers

- Rising Prevalence of Obesity (Obesity Rates, Age Demographics): The prevalence of obesity in Saudi Arabia has significantly impacted healthcare needs, with nearly 7 million adults classified as obese as of 2023. This demographic is particularly prominent among individuals aged 30 to 50, accounting for nearly 65% of obesity-related health issues. Obesity rates in urban centers like Riyadh and Jeddah are notably high, with nearly 1 in 3 adults affected, contributing to a greater demand for bariatric surgeries. Data from the World Health Organization (WHO) highlights Saudi Arabias high obesity rates among the Middle Eastern countries, increasing the need for bariatric devices to address weight-related health issues.

- Increasing Adoption of Minimally Invasive Surgeries (Minimally Invasive vs. Traditional Techniques): Saudi Arabia has seen a rise in the preference for minimally invasive surgeries in bariatrics, attributed to lower post-operative recovery times and reduced scarring. By 2024, it is reported that nearly 80% of bariatric procedures in urban hospitals utilize minimally invasive techniques, showcasing a marked shift from traditional open surgeries. Minimally invasive techniques such as laparoscopic surgeries are preferred due to decreased hospitalization durations, saving an estimated 3-5 days of recovery per patient. According to Saudi Health Council data, hospitals with high volumes of minimally invasive procedures also experience improved patient outcomes and lower complication rates.

- Government Initiatives in Healthcare (Healthcare Reforms, Bariatric Surgery Awareness Programs): Saudi Arabias Vision 2030 outlines extensive healthcare reforms, including awareness programs on obesity and preventive care, increasing accessibility to bariatric treatments across the kingdom. By 2023, the Ministry of Health (MoH) launched over 500 programs nationwide to educate on obesity prevention and management, reaching approximately 3 million individuals. The governments reforms focus on enhancing access to bariatric procedures as part of larger investments of nearly $12 billion in healthcare infrastructure, creating a conducive environment for bariatric surgery devices and technologies.

Market Challenges

- High Procedure Costs (Healthcare Costs, Insurance Coverage): The cost of bariatric surgery in Saudi Arabia can reach up to $13,000 per procedure, placing financial strain on patients without comprehensive health insurance. Approximately 60% of patients seeking bariatric surgeries lack insurance coverage, leading to high out-of-pocket expenses. Limited insurance support further constrains accessibility for low- to middle-income groups, despite growing interest in surgical solutions for obesity. Government data shows that around 1.2 million citizens delay or avoid these surgeries due to financial barriers, impacting market growth and the adoption of bariatric devices.

- Post-Surgery Complications (Infection Rates, Mortality Statistics): Infection rates among bariatric surgery patients remain a significant concern, with an estimated infection incidence of 3% within Saudi hospitals offering these procedures. Infection complications in bariatric surgeries can increase hospital stays by approximately 7 days, adding to the treatment cost burden. According to Saudi Ministry of Health data, mortality rates following bariatric procedures in the country are low but still present a risk factor for patients, especially those with comorbidities. Hospitals are increasingly focusing on improving post-surgical care to manage and reduce these risks effectively.

Saudi Arabia Bariatric Surgery Devices Market Future Outlook

Over the next five years, the Saudi Arabia bariatric surgery devices market is set to experience sustained growth, driven by an increase in medical tourism, expanding healthcare infrastructure, and continued government investments in healthcare. The focus on lifestyle disease reduction under the Vision 2030 framework will further fuel demand for bariatric surgery devices, with innovations in minimally invasive technologies set to transform surgical practices. The trend towards high-precision, AI-assisted surgical devices is also expected to influence the market as healthcare providers strive for greater accuracy and safety in procedures.

Market Opportunities

- Expansion of Medical Tourism (Foreign Patient Influx, Costs vs. Global Prices): Saudi Arabias healthcare sector is attracting medical tourists due to its competitive surgical costs compared to regions like Europe, where similar procedures can cost nearly 40% more. The kingdom receives approximately 1 million medical tourists annually, with bariatric procedures ranking high in demand among international patients. This influx supports growth in bariatric surgery device markets, as hospitals are increasingly investing in high-quality surgical equipment to cater to international standards, establishing Saudi Arabia as a regional medical hub.

- Growth in Disposable Income (Per Capita Income, Middle-Class Expansion): The rise in Saudi Arabias disposable income, which reached an average of $23,000 per capita in 2023, is empowering middle-class households to afford elective surgeries, including bariatric procedures. As disposable incomes grow, demand for health-improving services rises, allowing more citizens to consider surgical options for obesity treatment. Data from Saudis General Authority for Statistics reveals a 10% growth in the middle-class demographic over the last five years, signaling increased affordability and willingness to invest in healthcare solutions like bariatric surgery.

Scope of the Report

|

Surgical Staplers Gastric Bands Gastric Balloons Laparoscopic Devices Suturing Devices |

|

|

By Procedure Type |

Gastric Bypass Surgery Sleeve Gastrectomy Adjustable Gastric Banding Biliopancreatic Diversion Endoscopic Procedures |

|

By End-User |

Hospitals Ambulatory Surgical Centers Clinics Medical Tourism Facilities |

|

By Technology |

Minimally Invasive Technology Robotic-Assisted Technology |

|

By Region |

North East West South |

Products

Key Target Audience

Hospitals and Ambulatory Surgical Centers

Healthcare Equipment Distributors

Medical Tourism Facilities

Bariatric Surgery Clinics

Surgeons and Medical Professionals

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Health)

Bariatric Surgery Device Manufacturers

Companies

Players Mention in the Report:

Medtronic PLC

Johnson & Johnson (Ethicon)

Olympus Corporation

Apollo Endosurgery

Intuitive Surgical

ReShape Lifesciences Inc.

Cousin Biotech

Aspire Bariatrics

Bariatric Solutions GmbH

Spatz FGIA Inc.

TransEnterix Inc.

USGI Medical Inc.

B. Braun Melsungen AG

ConMed Corporation

Standard Bariatrics Inc.

Table of Contents

1. Saudi Arabia Bariatric Surgery Devices Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Bariatric Surgery Devices Market Size (In SAR Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Bariatric Surgery Devices Market Analysis

3.1 Growth Drivers

3.1.1 Rising Prevalence of Obesity (Obesity Rates, Age Demographics)

3.1.2 Increasing Adoption of Minimally Invasive Surgeries (Minimally Invasive vs. Traditional Techniques)

3.1.3 Government Initiatives in Healthcare (Healthcare Reforms, Bariatric Surgery Awareness Programs)

3.1.4 Technological Advancements in Surgery Devices (Surgical Robotics, Laparoscopic Devices)

3.2 Market Challenges

3.2.1 High Procedure Costs (Healthcare Costs, Insurance Coverage)

3.2.2 Post-Surgery Complications (Infection Rates, Mortality Statistics)

3.2.3 Limited Awareness in Rural Areas (Urban vs. Rural Penetration)

3.3 Opportunities

3.3.1 Expansion of Medical Tourism (Foreign Patient Influx, Costs vs. Global Prices)

3.3.2 Growth in Disposable Income (Per Capita Income, Middle-Class Expansion)

3.3.3 Surge in Private Healthcare Providers (Private Hospital Growth, Investment Trends)

3.4 Trends

3.4.1 Integration of Artificial Intelligence in Surgery (AI Assistance in Procedures, Predictive Analysis)

3.4.2 Increasing Use of Robot-Assisted Surgeries (Adoption Rates, Success Case Studies)

3.4.3 Patient-Centric Customization of Devices (Device Innovation, Tailored Surgery Solutions)

3.5 Government Regulations

3.5.1 Saudi Vision 2030 Healthcare Strategy (Public-Private Partnerships, Healthcare Investments)

3.5.2 Bariatric Surgery Eligibility Guidelines (BMI Guidelines, Pre-Operation Protocols)

3.5.3 Medical Device Registration Requirements (Compliance Process, Regulatory Bodies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Saudi Arabia Bariatric Surgery Devices Market Segmentation

4.1 By Device Type (In Value %)

4.1.1 Surgical Staplers

4.1.2 Gastric Bands

4.1.3 Gastric Balloons

4.1.4 Laparoscopic Devices

4.1.5 Suturing Devices

4.2 By Procedure Type (In Value %)

4.2.1 Gastric Bypass Surgery

4.2.2 Sleeve Gastrectomy

4.2.3 Adjustable Gastric Banding

4.2.4 Biliopancreatic Diversion

4.2.5 Endoscopic Procedures

4.3 By End-User (In Value %)

4.3.1 Hospitals

4.3.2 Ambulatory Surgical Centers

4.3.3 Clinics

4.3.4 Medical Tourism Facilities

4.4 By Technology (In Value %)

4.4.1 Minimally Invasive Technology

4.4.2 Robotic-Assisted Technology

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. Saudi Arabia Bariatric Surgery Devices Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Medtronic PLC

5.1.2 Johnson & Johnson (Ethicon)

5.1.3 Apollo Endosurgery

5.1.4 Olympus Corporation

5.1.5 Intuitive Surgical

5.1.6 ReShape Lifesciences Inc.

5.1.7 Cousin Biotech

5.1.8 Aspire Bariatrics

5.1.9 Bariatric Solutions GmbH

5.1.10 Spatz FGIA Inc.

5.1.11 TransEnterix Inc.

5.1.12 USGI Medical Inc.

5.1.13 B. Braun Melsungen AG

5.1.14 ConMed Corporation

5.1.15 Standard Bariatrics Inc.

5.2 Cross Comparison Parameters (Revenue, Market Share, Employee Count, Product Portfolio, Headquarters, Innovations, Regulatory Approvals, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Bariatric Surgery Devices Market Regulatory Framework

6.1 Medical Device Registration Standards (Saudi Food and Drug Authority)

6.2 Healthcare Licensing Requirements (Facility Licensing, Practitioner Certification)

6.3 Reimbursement Policies (Public Insurance, Private Health Coverage)

7. Saudi Arabia Bariatric Surgery Devices Future Market Size (In SAR Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Bariatric Surgery Devices Future Market Segmentation

8.1 By Device Type (In Value %)

8.2 By Procedure Type (In Value %)

8.3 By End-User (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Saudi Arabia Bariatric Surgery Devices Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives

9.3 White Space Opportunity Analysis

9.4 Customer Cohort Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase entails developing a comprehensive ecosystem map of the Saudi Arabia Bariatric Surgery Devices Market. Extensive desk research using secondary and proprietary databases will help capture essential industry variables. The objective is to define critical elements affecting market behavior.

Step 2: Market Analysis and Construction

The market analysis phase examines historical data, focusing on procedure types, device adoption, and geographic distribution of healthcare providers. Additionally, an assessment of device usage across different hospital types will be conducted to ensure accurate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with healthcare professionals and industry stakeholders. These consultations provide critical operational insights, enabling a robust verification process of the primary data obtained.

Step 4: Research Synthesis and Final Output

In the final phase, interactions with bariatric device manufacturers will provide in-depth perspectives on product demand, surgical preferences, and customer profiles. This approach allows for a validated, comprehensive analysis of the Saudi Arabia bariatric surgery devices market.

Frequently Asked Questions

How big is the Saudi Arabia Bariatric Surgery Devices Market?

The Saudi Arabia Bariatric Surgery Devices Market is valued at USD 150 million, driven by increasing healthcare investments, rising obesity rates, and government healthcare initiatives.

01. What are the primary drivers for this market in Saudi Arabia?

Key drivers in Saudi Arabia Bariatric Surgery Devices Market include the high prevalence of obesity, the governments healthcare reforms, and the adoption of minimally invasive surgery technologies to reduce lifestyle-related health issues.

02. Who are the major players in the Saudi Arabia Bariatric Surgery Devices Market?

Major players in Saudi Arabia Bariatric Surgery Devices Market include Medtronic PLC, Johnson & Johnson (Ethicon), Olympus Corporation, Apollo Endosurgery, and Intuitive Surgical, all leading in device innovation and market presence.

03. What are the significant challenges in this market?

Challenges in Saudi Arabia Bariatric Surgery Devices Market include high costs of bariatric surgeries, limited awareness in rural areas, and potential post-operative complications that may limit patient uptake.

04. Which device type dominates the Saudi Arabia Bariatric Surgery Devices Market?

Surgical staplers dominate the Saudi Arabia Bariatric Surgery Devices Market due to their necessity in most bariatric procedures and their efficiency in minimizing surgical and recovery times.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.