Saudi Arabia Cannabidiol Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD3528

November 2024

95

About the Report

Saudi Arabia Cannabidiol Market Overview

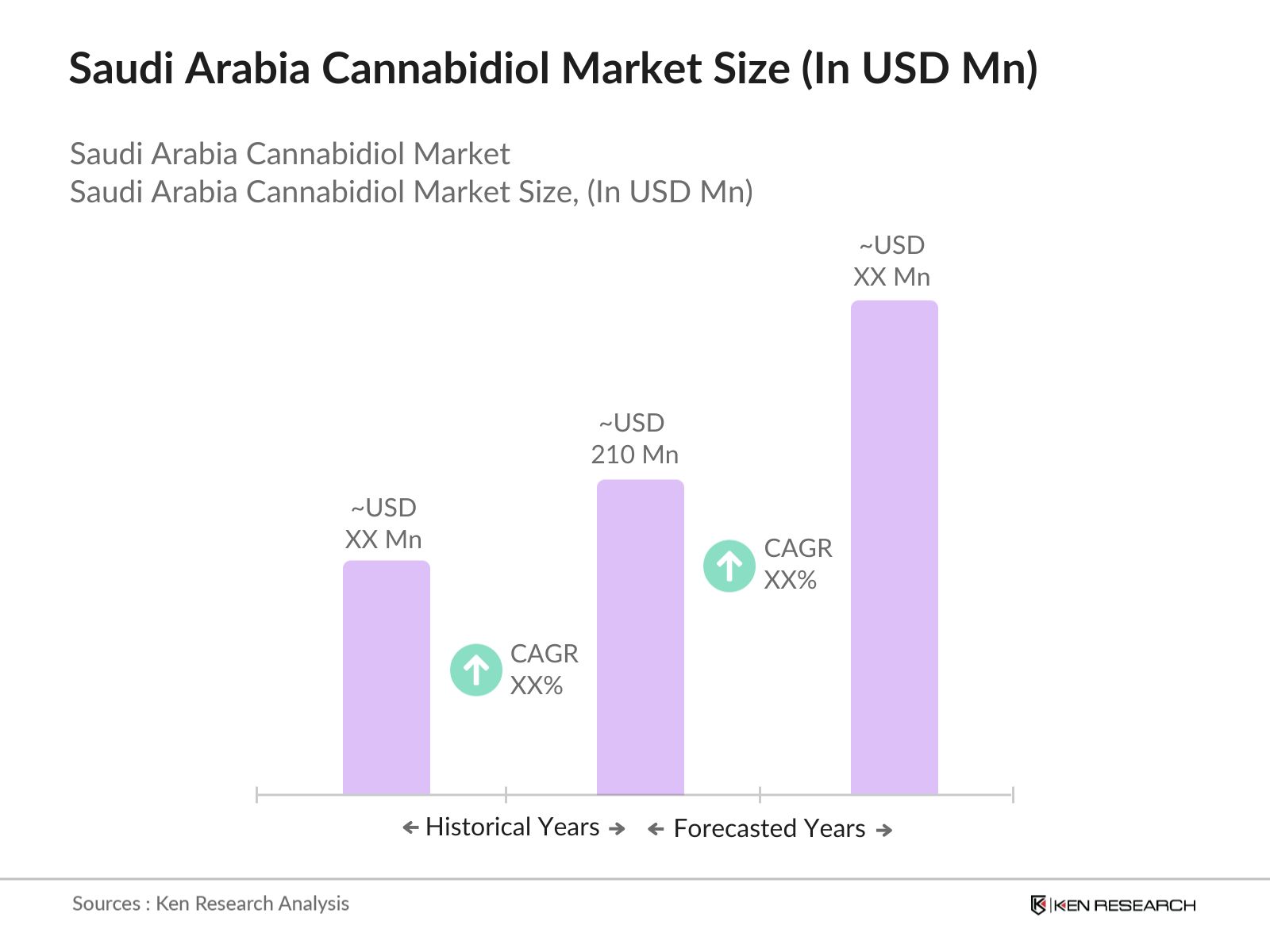

- The Saudi Arabia Cannabidiol (CBD) market is valued at USD 210 million, primarily driven by the growing consumer awareness of the health benefits of CBD products, especially in wellness and medical sectors. The increasing acceptance of CBD in pharmaceuticals, cosmetics, and dietary supplements has led to a surge in demand across the country. Government initiatives to regulate CBD use and ensure product quality are also playing a vital role in driving market growth. This expansion is supported by growing R&D investments and product development by local and international players.

- Riyadh and Jeddah dominate the CBD market in Saudi Arabia, largely due to their advanced healthcare infrastructure and high consumer spending on wellness products. Riyadh, being the capital, hosts several healthcare institutions that are pioneering research into CBDs medical applications. Jeddah, with its thriving retail sector, sees a robust demand for personal care and cosmetics infused with CBD, making it another key market in the kingdom. The strategic geographic positioning of these cities also enhances their dominance in terms of distribution.

- The Saudi Food and Drug Authority (SFDA) has implemented stringent guidelines for the approval of CBD products. As of 2024, only a limited number of CBD products have been approved for medical use, primarily for patients with conditions like epilepsy. The SFDA continues to assess international data on CBD efficacy and safety, and any future approvals will be tied to strict clinical evidence requirements and controlled distribution.

Saudi Arabia Cannabidiol Market Segmentation

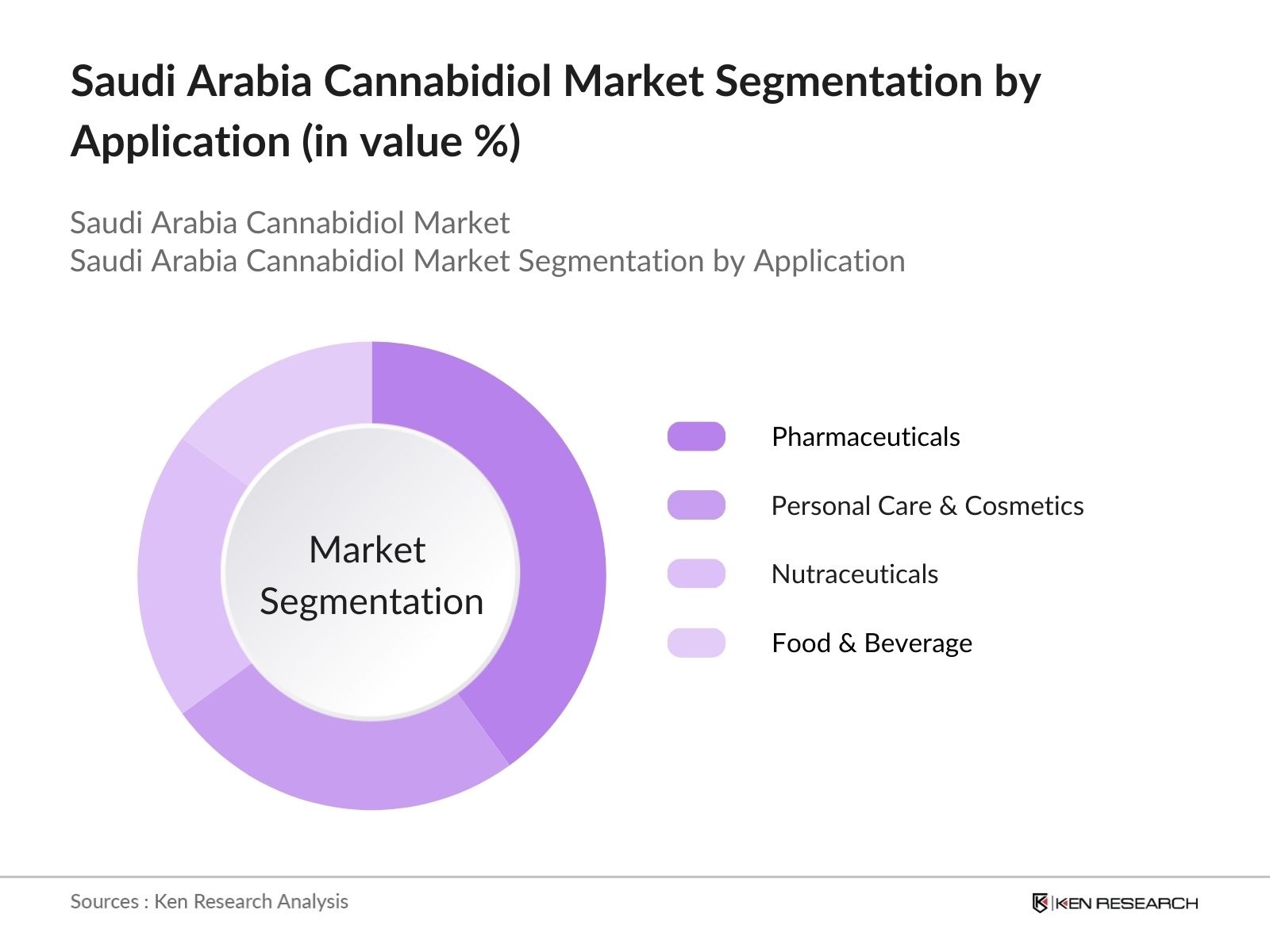

Saudi Arabias CBD market can be segmented by product type and by application.

- By Product Type: The market is segmented by product type into CBD oils, CBD capsules, CBD creams & lotions, CBD edibles, and CBD tinctures. CBD oils hold a dominant market share due to their versatility and growing acceptance in both medical and wellness applications. The ease of use, ability to manage dosages, and diverse health benefits make CBD oils the preferred choice among consumers. The growing focus on natural remedies and the perceived therapeutic benefits have made CBD oils the top-selling product type.

- By Application: The market is also segmented by application into pharmaceuticals, personal care & cosmetics, nutraceuticals, and food & beverage. The pharmaceutical segment dominates due to CBD's growing recognition for treating conditions like epilepsy, chronic pain, and anxiety. The increased medical research supporting the efficacy of CBD in healthcare is boosting the adoption of CBD-infused pharmaceuticals in Saudi Arabia. Moreover, the Saudi Food and Drug Authority (SFDA) plays a crucial role in regulating CBD products, further increasing consumer confidence.

Saudi Arabia Cannabidiol Market Competitive Landscape

The Saudi Arabian CBD market is characterized by a few key players, both domestic and international. These companies dominate the market through extensive R&D, product innovation, and strategic partnerships. The regulatory landscape has allowed some early movers to capture market share, while newer entrants are investing heavily in product quality and certification to gain consumer trust.

The competitive landscape is led by companies like Elixinol Global, Charlottes Web, and Medterra CBD, which have leveraged their strong international presence to make inroads into the Saudi market. Local players are also emerging, focusing on culturally adapted products.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Certifications |

R&D Investment |

Market Presence |

Sustainability Practices |

Revenue (SAR Million) |

|

Elixinol Global |

2014 |

|||||||

|

Charlottes Web |

2013 |

|||||||

|

Medterra CBD |

2017 |

|||||||

|

Purekana |

2015 |

|||||||

|

NuLeaf Naturals |

2014 |

Saudi Arabia Cannabidiol Industry Analysis

Market Growth Drivers

- Regulatory Easing: The Saudi Arabian government has shown a growing openness to the CBD market, with regulatory reforms under Vision 2030 that focus on diversification and promoting innovation in healthcare. The Saudi Food and Drug Authority (SFDA) has recently been reviewing policies to allow medical products that contain CBD for specific treatments, such as epilepsy and pain management. In 2024, the Ministry of Health allocated an additional USD 18 billion to healthcare reform, including a focus on alternative medicines. These reforms present potential pathways for controlled CBD integration into Saudi Arabia's medical framework.

- Medical Research Advancements: Advancements in medical research globally are prompting a re-evaluation of CBDs health benefits in Saudi Arabia. Saudi researchers are partnering with global universities to investigate the effectiveness of CBD in treating conditions like chronic pain and anxiety disorders. In 2024, Saudi Arabia increased its healthcare research budget by 15%, which includes studies on alternative treatments. Collaborations with international medical institutes have led to increased consumer awareness and government interest in incorporating CBD into therapeutic practices.

- Increasing Consumer Awareness: There has been an increasing shift in consumer awareness of CBDs potential health benefits, driven largely by global trends and social media. A recent survey by the Saudi Ministry of Health found that nearly 40% of respondents in urban areas expressed curiosity about CBD as an alternative treatment for various ailments. This shift is indicative of growing demand and greater acceptance, which aligns with the government's Vision 2030 initiative to modernize healthcare and expand alternative treatments.

Market Challenges

- Regulatory Uncertainty: Despite recent regulatory discussions, the legal landscape for CBD remains complex and uncertain in Saudi Arabia. In 2023, the SFDA only granted limited approval for CBD-based medications in specific cases, such as epilepsy, leaving a broad array of applications still unregulated. These gray areas deter businesses from entering the market due to the fear of heavy fines or shutdowns. Additionally, the Ministry of Interiors ongoing prohibition on cannabis-based products poses challenges for wider adoption.

- Cultural Sensitivity: Cultural and religious norms continue to present barriers to CBD acceptance in Saudi Arabia. The use of cannabis-derived products is still a highly sensitive topic, with public opinion largely influenced by conservative Islamic values. A 2023 study by the Saudi Research and Development Council indicated that only 12% of Saudis felt comfortable with the idea of cannabis-based medical treatments, reflecting deep-seated cultural hesitations. This resistance complicates efforts to expand awareness and promote CBD products in the local market.

Saudi Arabia Cannabidiol Market Future Outlook

Over the next five years, the Saudi Arabia CBD market is expected to witness substantial growth, driven by continuous regulatory reforms, rising consumer awareness, and an increasing focus on research and development. The expanding applications of CBD in pharmaceuticals, personal care, and nutraceuticals will provide significant opportunities for market players. The governments focus on diversifying the economy away from oil and investing in health and wellness sectors is also expected to accelerate market growth.

As the regulatory environment continues to evolve, international companies are likely to increase their presence in the Saudi market, partnering with local firms to cater to the growing demand. The wellness trend and the shift toward natural and organic products will further enhance the adoption of CBD-based products in Saudi Arabia.

Market Opportunities

- Expansion in Healthcare: The Saudi governments investment in healthcare, particularly in alternative treatments, creates a significant opportunity for CBD products. In 2024, the Ministry of Health announced plans to allocate USD 15 billion toward modernizing healthcare facilities and integrating alternative medicines, including those based on CBD. This investment signals a shift in healthcare policy, opening doors for CBD to be utilized for chronic pain management and mental health therapies.

- Cosmetics and Wellness Industry: The cosmetics and wellness industries in Saudi Arabia are rapidly expanding, creating a promising market for CBD-infused products. In 2024, the Saudi General Authority for Statistics reported that the beauty and wellness market was valued at approximately USD 3 billion. CBDs properties, such as anti-inflammatory effects, make it an attractive addition to skincare and wellness products. Additionally, Saudi womens increasing interest in organic and natural products makes the country a key target for CBD product expansion.

Scope of the Report

|

CBD Oils CBD Capsules CBD Creams & Lotions CBD Edibles CBD Tinctures |

|

|

By Application |

Pharmaceuticals Personal Care & Cosmetics Nutraceuticals Food & Beverage |

|

By Distribution Channel |

Online Retail Offline Retail (Pharmacies, Specialty Stores) Hospital Pharmacies |

|

By Source |

Hemp-Derived CBD Marijuana-Derived CBD |

|

By Region |

North East West South |

Products

Key Target Audience

Pharmaceuticals Manufacturers

Personal Care & Cosmetics Manufacturers

Nutraceutical Companies

Food & Beverage Producers

Hospitals and Healthcare Institutions

Retail Pharmacies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Health)

Companies

Players Mention in the Report:

Elixinol Global

Charlottes Web

Medterra CBD

Purekana

NuLeaf Naturals

Endoca

CV Sciences, Inc.

HempMeds

Green Roads

PharmaHemp

Aurora Cannabis

Canopy Growth Corporation

Tilray

Medical Marijuana Inc.

CV Sciences, Inc.

Table of Contents

1. Saudi Arabia CBD Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia CBD Market Size (In SAR Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia CBD Market Analysis

3.1. Growth Drivers (Regulatory Easing, Medical Research Advancements, Increasing Consumer Awareness)

3.2. Market Challenges (Regulatory Uncertainty, Cultural Sensitivity, Limited Consumer Awareness)

3.3. Opportunities (Expansion in Healthcare, Cosmetics and Wellness Industry, International Trade)

3.4. Trends (Organic CBD Products, CBD in Pharmaceuticals, Sustainable Sourcing)

3.5. Government Regulations (SFDA Approval Processes, Import Restrictions, Product Labeling Requirements)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Competition Intensity, Threat of New Entrants, Threat of Substitutes)

3.9. Competition Ecosystem

4. Saudi Arabia CBD Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. CBD Oils

4.1.2. CBD Capsules

4.1.3. CBD Creams & Lotions

4.1.4. CBD Edibles

4.1.5. CBD Tinctures

4.2. By Application (In Value %)

4.2.1. Pharmaceuticals

4.2.2. Personal Care & Cosmetics

4.2.3. Nutraceuticals

4.2.4. Food & Beverage

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail (Pharmacies, Specialty Stores)

4.3.3. Hospital Pharmacies

4.4. By Source (In Value %)

4.4.1. Hemp-Derived CBD

4.4.2. Marijuana-Derived CBD

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia CBD Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Elixinol Global

5.1.2. Charlottes Web

5.1.3. Medterra CBD

5.1.4. Purekana

5.1.5. NuLeaf Naturals

5.1.6. Endoca

5.1.7. CV Sciences, Inc.

5.1.8. HempMeds

5.1.9. Green Roads

5.1.10. PharmaHemp

5.1.11. Aurora Cannabis

5.1.12. Canopy Growth Corporation

5.1.13. Tilray

5.1.14. Medical Marijuana Inc.

5.1.15. CV Sciences, Inc.

5.2. Cross Comparison Parameters (Product Range, Market Penetration, Sales Volume, Customer Base, Innovation, Certifications, Sustainability Practices, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia CBD Market Regulatory Framework

6.1. SFDA Regulations for Cannabidiol Products

6.2. Licensing and Certification Requirements

6.3. Import and Export Guidelines

6.4. Legalization Landscape (Medical and Recreational)

6.5. Compliance and Quality Standards

7. Saudi Arabia CBD Future Market Size (In SAR Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia CBD Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia CBD Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map of all major stakeholders within the Saudi Arabia CBD Market. Extensive desk research, utilizing a combination of secondary and proprietary databases, is conducted to gather essential information. The primary goal is to identify the key variables affecting market dynamics.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data related to the Saudi Arabia CBD Market. Factors such as market penetration, revenue generation, and consumer adoption rates are assessed. Service quality statistics are also evaluated to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through in-depth interviews with industry experts from various companies. These consultations provide valuable operational and financial insights directly from the industry, ensuring the accuracy of the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings through direct engagement with CBD manufacturers, retailers, and healthcare professionals. This process validates the statistics derived from the bottom-up approach and ensures a comprehensive analysis of the Saudi Arabia CBD market.

Frequently Asked Questions

01. How big is the Saudi Arabia CBD Market?

The Saudi Arabia CBD market is valued at USD 210 million, driven by consumer interest in wellness and the rising demand for medical CBD products.

02. What are the challenges in the Saudi Arabia CBD Market?

Challenges in Saudi Arabia CBD market include strict regulations, cultural barriers, and limited consumer awareness. The regulatory framework is evolving, but compliance remains complex for new market entrants.

03. Who are the major players in the Saudi Arabia CBD Market?

Key players in Saudi Arabia CBD market include Elixinol Global, Charlottes Web, Medterra CBD, and NuLeaf Naturals, dominating the market with their extensive product portfolios and strong international presence.

04. What are the growth drivers of the Saudi Arabia CBD Market?

The Saudi Arabia CBD market is driven by rising consumer awareness, increased research on CBD benefits, and government initiatives to regulate and promote the use of CBD in healthcare and wellness products.

05. What trends are shaping the Saudi Arabia CBD Market?

Trends in Saudi Arabia CBD market include the increasing popularity of organic CBD products, the use of CBD in personal care and cosmetics, and a focus on sustainable production practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.