Saudi Arabia Cloud Kitchen Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9315

December 2024

92

About the Report

Saudi Arabia Cloud Kitchen Market Overview

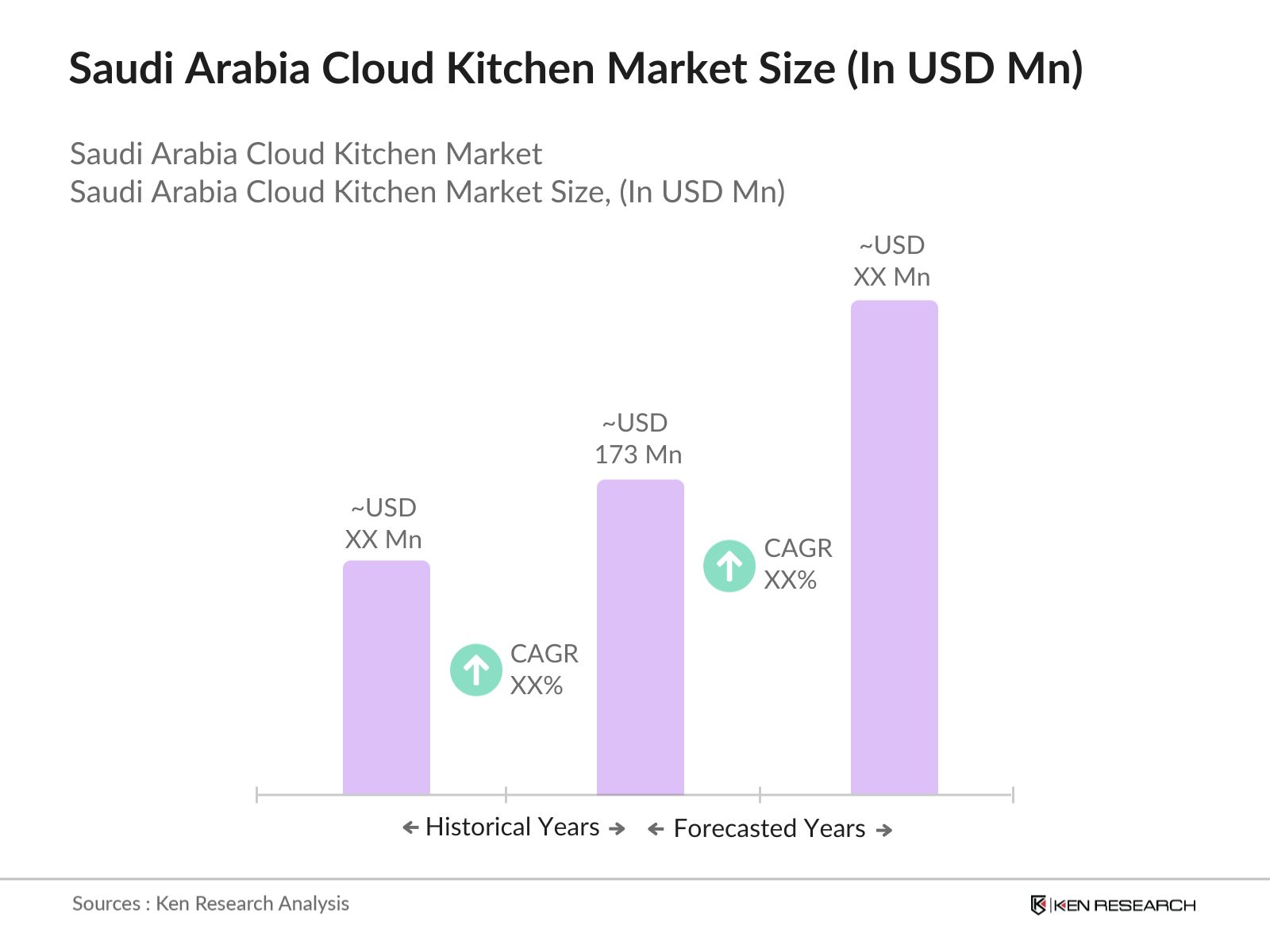

- The Saudi Arabia cloud kitchen market is valued at USD 173 million in 2023, following consistent growth from the rising demand for online food delivery. The market is primarily driven by a shift in consumer preferences toward convenience and quick service, facilitated by the widespread adoption of food delivery apps such as HungerStation and Talabat. The rapid digital transformation and the increasing penetration of smartphones in the Kingdom have further fueled the demand for cloud kitchens. Additionally, businesses are taking advantage of the lower overhead costs and flexible operational models compared to traditional brick-and-mortar restaurants.

- The market is dominated by key cities such as Riyadh, Jeddah, and Dammam due to their large, tech-savvy populations, high urbanization rates, and greater spending power. Riyadh leads the market, driven by its status as the capital city with a dense population, while Jeddah and Dammam benefit from their roles as commercial hubs. The large urban workforce and busy lifestyles in these cities create an optimal environment for cloud kitchens to thrive.

- All cloud kitchens in Saudi Arabia must comply with SFDA guidelines, which mandate strict food safety and hygiene standards. As of 2023, the SFDA has conducted over 20,000 inspections to ensure compliance with these regulations. Failure to adhere to these standards can result in hefty fines or closure of operations. This regulatory environment necessitates significant investment in maintaining safety standards, particularly for cloud kitchens operating in densely populated urban areas where demand is high.

Saudi Arabia Cloud Kitchen Market Segmentation

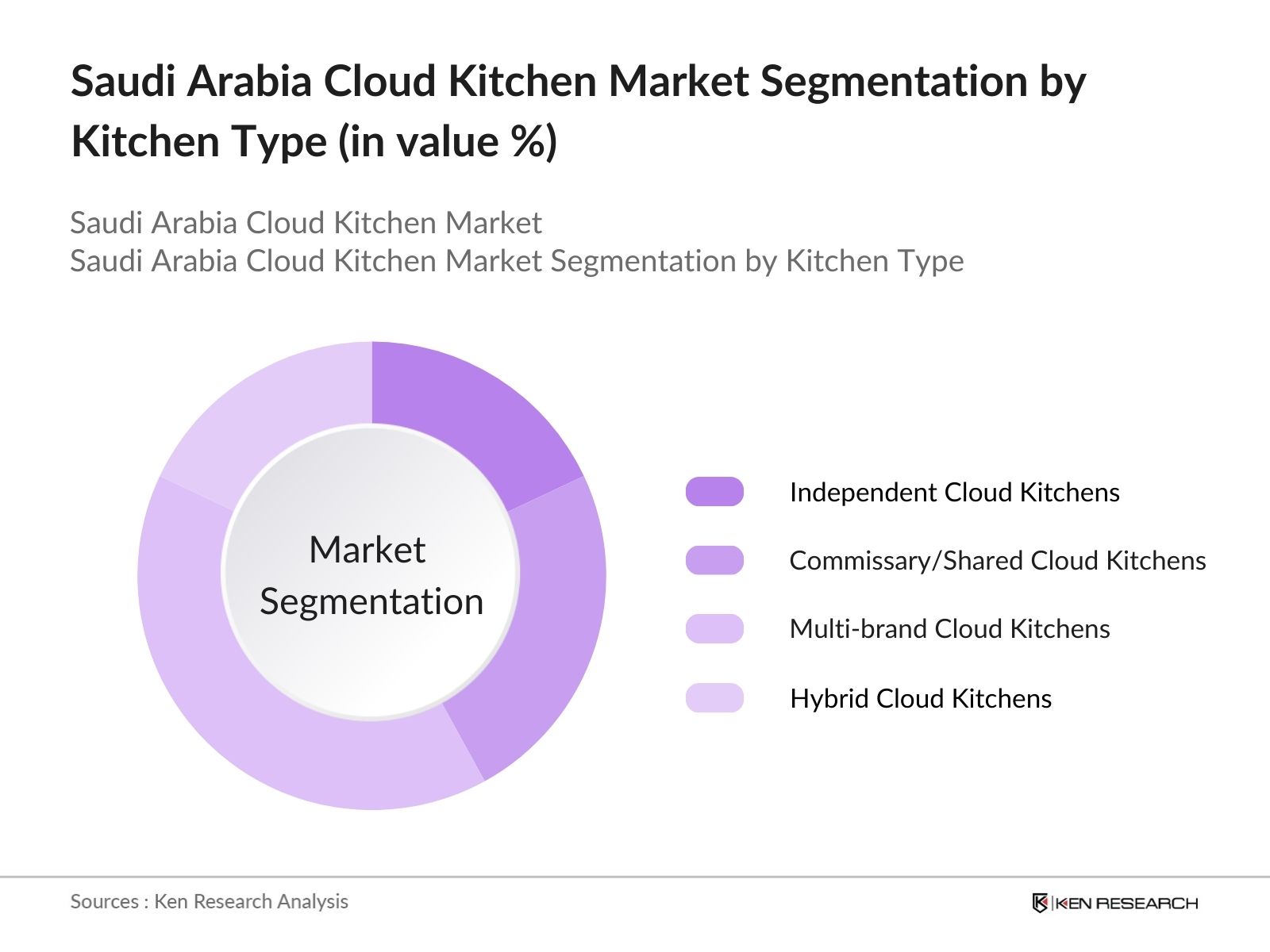

The Saudi Arabia cloud kitchen market is segmented by kitchen type and by food category.

- By Kitchen Type: The Saudi Arabia cloud kitchen market is segmented by kitchen type into independent cloud kitchens, commissary/shared cloud kitchens, multi-brand cloud kitchens, and hybrid cloud kitchens. Among these, multi-brand cloud kitchens dominate the market due to their ability to optimize operational costs while offering a diverse menu under a single roof. These kitchens benefit from economies of scale, as they serve multiple brands from the same kitchen, reducing the need for additional investments in physical locations. This model has proven especially successful in Saudi Arabia, where online food ordering is rapidly growing.

- By Food Category: The market is also segmented by food category into fast food, full-service meals, desserts and bakery, and beverages. Fast food dominates this segment due to its high demand and compatibility with the delivery-based cloud kitchen model. Saudi consumers often prefer quick meals that are easy to order and receive via delivery platforms, and fast food fits this bill perfectly. Global chains like McDonalds, KFC, and local players have been able to leverage the cloud kitchen model to reach more customers.

Saudi Arabia Cloud Kitchen Market Competitive Landscape

The Saudi Arabia cloud kitchen market is dominated by both regional and global players, each vying for a stronghold in the rapidly expanding market. The consolidation of these players highlights the significance of market leaders in shaping industry standards and driving technological adoption. Companies like Kitopi and iKcon have leveraged advanced kitchen management systems, data analytics, and strong partnerships with delivery platforms, enabling them to scale rapidly.

|

Company |

Establishment Year |

Headquarters |

No. of Outlets |

Cloud Kitchen Type |

Revenue (USD Mn) |

|

Kitopi |

2018 |

Dubai |

|||

|

iKcon |

2019 |

Dubai |

|||

|

Sweetheart Kitchen |

2017 |

Dubai |

|||

|

Kitch |

2020 |

Riyadh |

|||

|

GrubTech |

2019 |

Dubai |

Saudi Arabia Cloud Kitchen Industry Analysis

Growth Drivers

- Rising Demand for Food Delivery: In Saudi Arabia, the demand for food delivery has seen substantial growth due to the rapid proliferation of food delivery apps such as Jahez and HungerStation, with millions of monthly users. As of 2023, the number of food delivery transactions has surpassed 500 million annually, driven by the convenience of digital ordering. Riyadh and Jeddah have become central hubs for delivery services, contributing significantly to this growth. This surge in digital food delivery aligns with Saudi Arabia's urbanization trends and increasing smartphone penetration. This trend is supported by the country's 85% internet penetration rate.

- Increasing Urban Population: Saudi Arabia has seen rapid urbanization, with over 84% of its population residing in urban areas by 2023. Cities like Riyadh and Jeddah are key drivers of this trend, with Riyadh alone accounting for nearly 8 million residents. The growing urban population has increased the demand for cloud kitchens, as densely populated areas are fertile ground for food delivery services. The influx of young professionals and expatriates in these cities further drives the need for convenient, quick-service food options, which has boosted the growth of cloud kitchens.

- Shifts in Consumer Preferences: Consumer preferences in Saudi Arabia are shifting towards convenience foods, especially among the younger generation. By 2023, approximately 70% of the population is under the age of 35, with this demographic increasingly opting for food delivery over traditional dining experiences. The digital ordering market has skyrocketed, with over 60% of restaurant orders being placed online or via apps. This shift is reinforced by the cultural adaptation to fast, hassle-free dining solutions, contributing to the growing demand for cloud kitchens as a more flexible business model compared to traditional restaurants.

Saudi Arabia Cloud Kitchen Market Future Outlook

Over the next five years, the Saudi Arabia cloud kitchen market is expected to show strong growth, driven by advancements in digital ordering platforms, rising urbanization, and increasing consumer preference for convenient food solutions. The sector will likely see increased competition as global brands enter the market and local players scale up their operations. Technological innovations, such as AI-driven kitchen management systems, are expected to further optimize operations and enhance profitability. Additionally, as Saudi Arabia continues to push its Vision 2030 agenda, the diversification of the economy and the focus on technological advancement will further propel the cloud kitchen market.

Market Opportunities

- Expansion in Secondary Cities: Cloud kitchen operators are finding growth opportunities in secondary cities such as Al Khobar and Mecca, where demand for food delivery is rapidly increasing. In 2023, Meccas food delivery market saw a 20% rise in transactions, driven by the growing urban population and influx of religious tourists. These emerging cities present less saturated markets compared to Riyadh and Jeddah, offering cloud kitchen operators the chance to establish a presence and capture new customer segments. Investment in infrastructure in these areas, backed by government initiatives, is expected to further drive growth.

- Technological Integration: The adoption of AI and digital technologies is creating opportunities for cloud kitchens in Saudi Arabia. In 2023, over 15% of cloud kitchens incorporated AI-driven kitchen management systems to streamline operations, optimize supply chain management, and reduce waste. Digital ordering platforms have also seen significant integration, enabling seamless customer interaction and enhanced delivery coordination. These technologies are helping cloud kitchens reduce operational inefficiencies, enhance profitability, and offer a better customer experience, positioning them for long-term success in the market.

Scope of the Report

|

Independent Cloud Kitchens Commissary/Shared Cloud Kitchens Multi-brand Cloud Kitchens Hybrid Cloud Kitchens |

|

|

By Food Category |

Fast Food Full-service Meals Desserts and Bakery Beverages |

|

By Ordering Platform |

Proprietary Platforms Third-party Apps Social Media Channels |

|

By End-User |

Individual Consumers Corporate Clients Catering Services |

|

By Region |

North East West South |

Products

Key Target Audience

Cloud kitchen operators

Food delivery platforms

Restaurant chains exploring virtual kitchens

Investments and venture capitalist firms

Franchise owners and developers

Government and regulatory bodies (Saudi Food and Drug Authority, Ministry of Commerce and Investment)

Technology and kitchen equipment providers

Quick service restaurants (QSR)

Companies

Players Mention in the Report:

Kitopi

iKcon

Sweetheart Kitchen

Kitch

GrubTech

HungerStation

Talabat

Jahez

Mrsool

Deliveroo

Zomato

Shawarmaty

Careem Now

Burgerizzr

Kudu

Table of Contents

1. Saudi Arabia Cloud Kitchen Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Cloud Kitchen Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Cloud Kitchen Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Food Delivery (Market Driver: Growth in delivery apps and food delivery consumer culture)

3.1.2. Increasing Urban Population (Market Driver: High urbanization rate in cities like Riyadh and Jeddah)

3.1.3. Shifts in Consumer Preferences (Market Driver: Demand for convenience food and digital ordering)

3.1.4. Growth of the Restaurant Industry (Market Driver: Transition from traditional restaurants to cloud kitchens)

3.2. Market Challenges

3.2.1. High Initial Setup Costs (Market Challenge: Significant investment in infrastructure and technology)

3.2.2. Competition with Traditional Restaurants (Market Challenge: Balancing cloud kitchen efficiency with restaurant customer experience)

3.2.3. Regulatory Compliance (Market Challenge: Adhering to food safety standards and Saudi regulations)

3.3. Opportunities

3.3.1. Expansion in Secondary Cities (Opportunity: Growing demand in emerging regions like Al Khobar and Mecca)

3.3.2. Technological Integration (Opportunity: AI-driven kitchen management, digital ordering platforms)

3.3.3. Collaboration with Delivery Apps (Opportunity: Partnerships with apps like Jahez, HungerStation, and Talabat)

3.4. Trends

3.4.1. Rise of Multi-brand Cloud Kitchens (Trend: Kitchens operating multiple brands under one roof)

3.4.2. Use of Data Analytics (Trend: Data-driven decision-making to optimize kitchen operations)

3.4.3. Growth in Subscription Models (Trend: Meal kit services and recurring subscription-based food services)

3.5. Government Regulation

3.5.1. Saudi Food and Drug Authority (SFDA) Compliance (Regulation: Ensuring food safety and hygiene)

3.5.2. Licensing Requirements for Food Operations (Regulation: Securing proper business licenses)

3.5.3. Compliance with Vision 2030 (Regulation: Alignment with the national economic diversification goals)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Cloud Kitchen Network, Delivery Apps, Restaurant Owners)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Saudi Arabia Cloud Kitchen Market Segmentation

4.1. By Type of Kitchen (In Value %)

4.1.1. Independent Cloud Kitchens

4.1.2. Commissary/Shared Cloud Kitchens

4.1.3. Multi-brand Cloud Kitchens

4.1.4. Hybrid Cloud Kitchens

4.2. By Food Category (In Value %)

4.2.1. Fast Food

4.2.2. Full-service Meals

4.2.3. Desserts and Bakery

4.2.4. Beverages

4.3. By Ordering Platform (In Value %)

4.3.1. Proprietary Platforms (Restaurant-owned apps or websites)

4.3.2. Third-party Apps (e.g., HungerStation, Talabat, Jahez)

4.3.3. Social Media Channels

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Corporate Clients

4.4.3. Catering Services

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Mecca

4.5.5. Medina

5. Saudi Arabia Cloud Kitchen Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Kitopi

5.1.2. iKcon

5.1.3. GrubTech

5.1.4. Kitch

5.1.5. Sweetheart Kitchen

5.1.6. HungerStation

5.1.7. Talabat

5.1.8. Jahez

5.1.9. Mrsool

5.1.10. Deliveroo

5.1.11. Zomato

5.1.12. Shawarmaty

5.1.13. Careem Now

5.1.14. Burgerizzr

5.1.15. Kudu

5.2. Cross Comparison Parameters

5.2.1. No. of Outlets

5.2.2. Cloud Kitchen Type

5.2.3. Revenue

5.2.4. Integration with Delivery Apps

5.2.5. Geographic Reach

5.2.6. In-house or Third-party Delivery

5.2.7. Technological Capabilities

5.2.8. Brand Partnerships

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Cloud Kitchen Market Regulatory Framework

6.1. Licensing for Cloud Kitchens

6.2. Compliance with SFDA Standards

6.3. Food Safety and Hygiene Certifications

7. Saudi Arabia Cloud Kitchen Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Cloud Kitchen Future Market Segmentation

8.1. By Kitchen Type

8.2. By Food Category

8.3. By Ordering Platform

8.4. By End-User

8.5. By Region

9. Saudi Arabia Cloud Kitchen Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of stakeholders in the Saudi Arabia Cloud Kitchen Market. We collect data from industry reports, financial statements, and proprietary databases to identify the most critical factors influencing the market. This includes identifying market drivers such as smartphone penetration, food delivery apps, and urbanization rates.

Step 2: Market Analysis and Construction

In this step, historical data is analyzed to understand market dynamics and key growth factors. We gather data on the number of cloud kitchen establishments, their operational models, and revenue generation. This stage helps create an accurate picture of the current state of the market.

Step 3: Hypothesis Validation and Expert Consultation

Key industry hypotheses are validated through interviews with cloud kitchen operators, food delivery platform managers, and technology providers. These interviews help to refine our analysis and provide real-time insights into the challenges and opportunities faced by players in the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered information to create a comprehensive and accurate report. We cross-reference data from both primary and secondary sources, ensuring that our findings are validated and offer actionable insights for market participants.

Frequently Asked Questions

01. How big is the Saudi Arabia Cloud Kitchen Market?

The Saudi Arabia cloud kitchen market is valued at USD 173 million in 2023, driven by increasing urbanization, technological integration, and the rising adoption of food delivery platforms.

02. What are the challenges in the Saudi Arabia Cloud Kitchen Market?

Key challenges in Saudi Arabia cloud kitchen market include high initial setup costs, regulatory compliance, and competition from traditional restaurants. Additionally, operational efficiency and maintaining food quality in delivery services pose significant challenges.

03. Who are the major players in the Saudi Arabia Cloud Kitchen Market?

The major players in Saudi Arabia cloud kitchen market include Kitopi, iKcon, Sweetheart Kitchen, Kitch, and GrubTech. These companies have established themselves through strong technology integration and partnerships with local food delivery platforms.

04. What are the growth drivers of the Saudi Arabia Cloud Kitchen Market?

Growth drivers in Saudi Arabia cloud kitchen market include increasing demand for convenience food, the widespread adoption of food delivery apps like HungerStation and Talabat, and the rapid urbanization of key cities such as Riyadh and Jeddah.

05. What trends are emerging in the Saudi Arabia Cloud Kitchen Market?

Key trends in Saudi Arabia cloud kitchen market include the rise of multi-brand cloud kitchens, increasing use of AI and data analytics in kitchen operations, and partnerships with delivery platforms to expand reach and optimize delivery times.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.