Saudi Arabia Contact Lens Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD7153

October 2024

84

About the Report

Saudi Arabia Contact Lens Market Overview

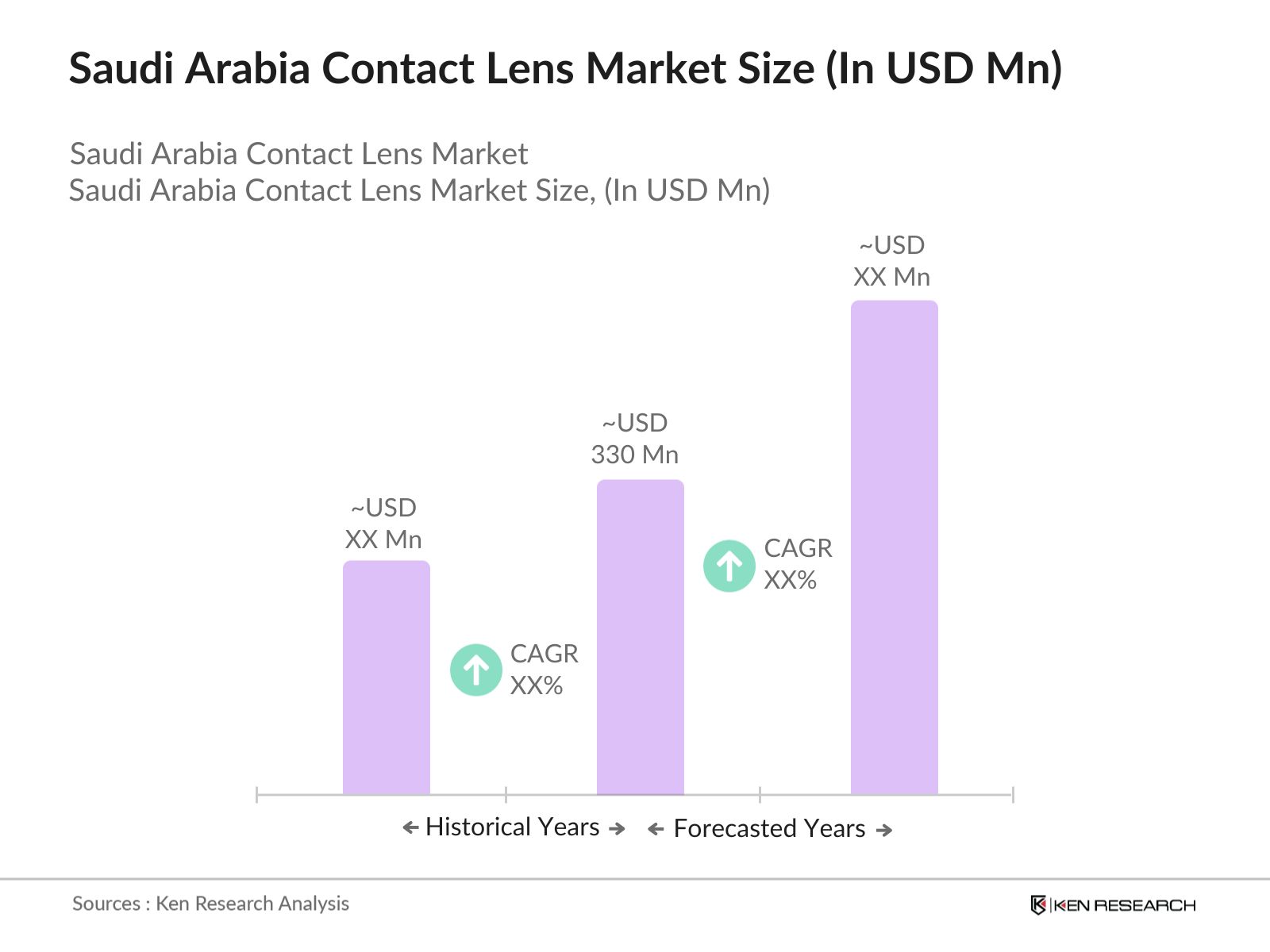

- The Saudi Arabia contact lens market is valued at USD 330 million, based on a five-year historical analysis. The market is driven by several factors, including an increasing prevalence of vision-related disorders such as myopia, hyperopia, and astigmatism. Advancements in contact lens materials, including the introduction of silicone hydrogel lenses that offer greater comfort and oxygen permeability, are also playing a significant role in driving demand. Furthermore, the growth of e-commerce platforms has made contact lenses more accessible, expanding the market size even further.

- The market is dominated by major cities such as Riyadh, Jeddah, and Dammam. These cities house a large urban population with higher disposable income, greater access to optical care services, and a heightened awareness of personal health. Additionally, Saudi Arabia's younger population, many of whom reside in these urban centers, is more inclined toward contact lens use due to lifestyle and aesthetic preferences. As a result, these cities have become the focal points of the contact lens market, pushing their dominance in the sector.

- The SFDA plays a critical role in regulating the contact lens market in Saudi Arabia. As of 2023, all imported contact lenses must comply with SFDA guidelines for medical devices, which include stringent requirements for product safety, labeling, and distribution. The SFDA conducted over 500 inspections of medical device retailers in 2023 to ensure compliance with these standards, reflecting the agencys commitment to maintaining product safety.

Saudi Arabia Contact Lens Market Segmentation

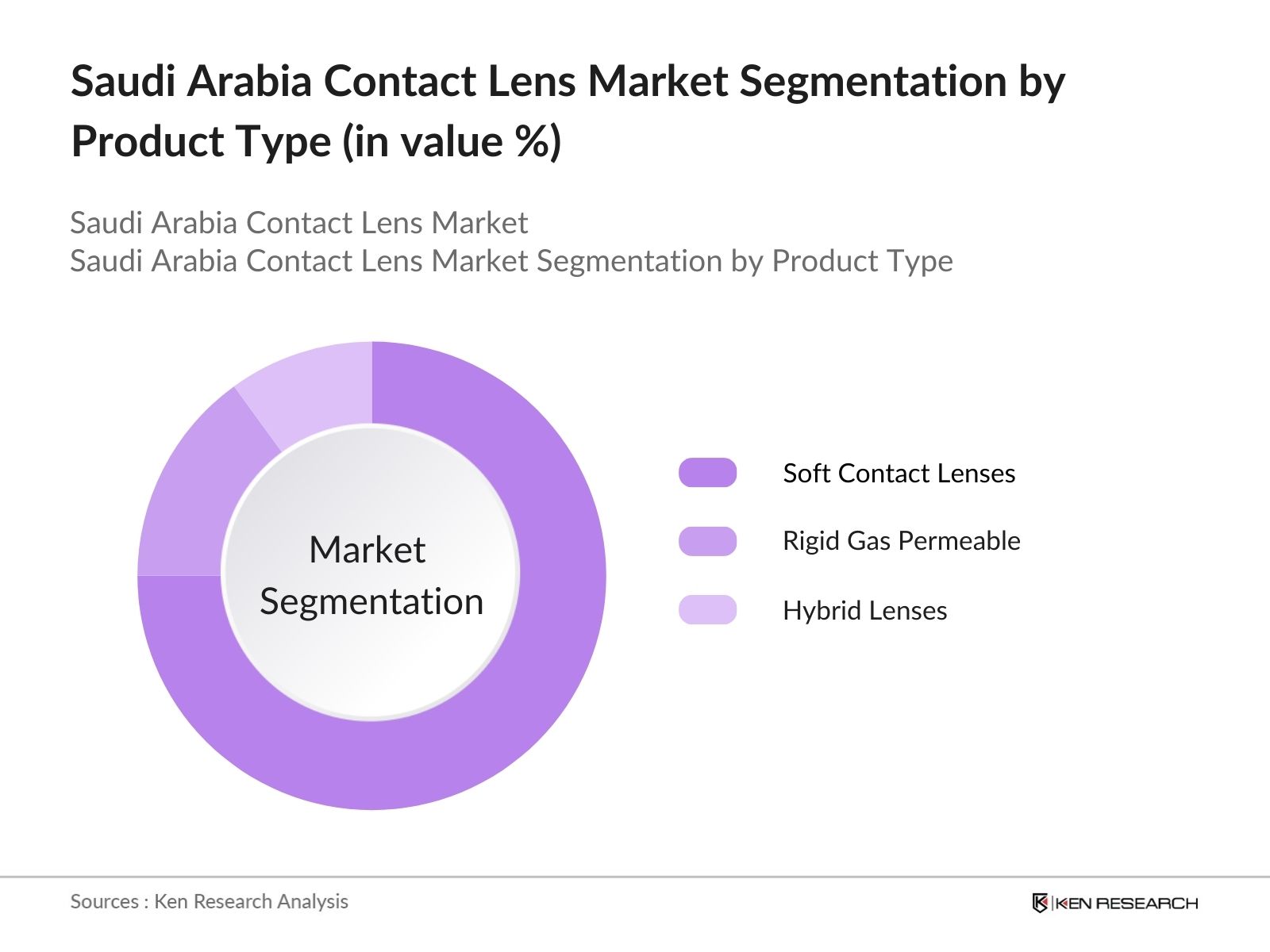

By Product Type: The market is segmented by product type into soft contact lenses, rigid gas permeable (RGP) lenses, and hybrid lenses. Soft contact lenses hold the dominant market share in the region. This dominance is primarily due to the comfort and convenience they offer for extended daily use, which suits the active lifestyle of many consumers in Saudi Arabia. Moreover, soft lenses are widely available, affordable, and increasingly recommended by optometrists, contributing to their continued dominance.

???????

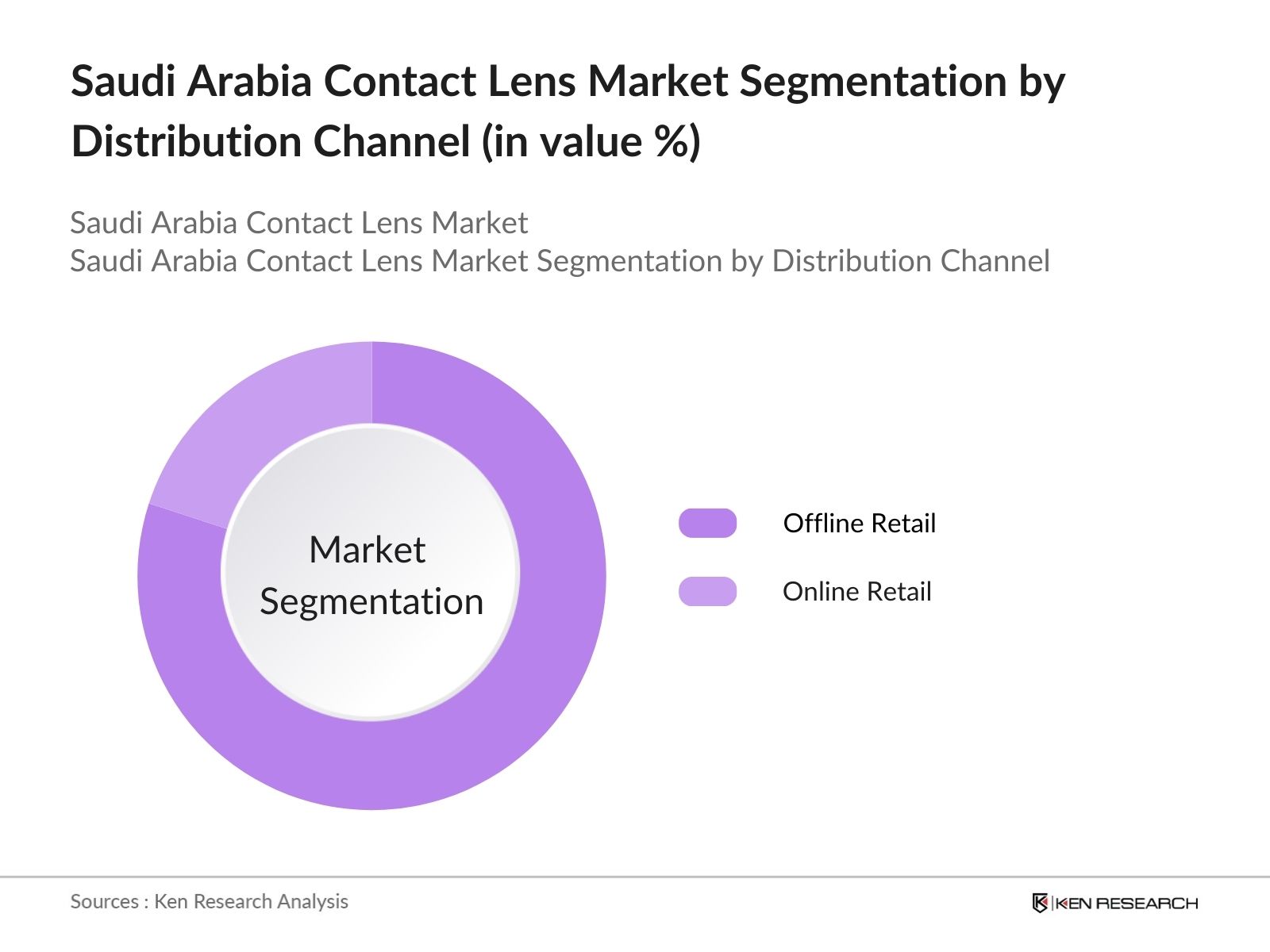

By Distribution Channel: The market is segmented by distribution channel into offline retail (optical stores, supermarkets, pharmacies) and online retail. Offline retail channels dominate the market, as optical stores and pharmacies remain the primary points of purchase for contact lenses in Saudi Arabia. This is largely because consumers trust certified optometrists for eye exams and prefer purchasing lenses from brick-and-mortar stores where they can receive personalized advice and ensure proper fittings. However, online retail is growing steadily due to the convenience it offers, particularly with the rise of e-commerce in the region.

Saudi Arabia Contact Lens Market Competitive Landscape

The Saudi Arabia contact lens market is dominated by a few major international players, including Johnson & Johnson Vision and CooperVision, along with local optical retailers. This consolidation highlights the significant influence of these key companies, as they benefit from extensive distribution networks, strong brand recognition, and product innovation. Additionally, multinational corporations like Bausch + Lomb and Alcon have strengthened their presence in the Saudi market through partnerships with local healthcare providers and opticians.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Product Portfolio |

Revenue |

R&D Investment |

Market Share |

Product Innovation |

Geographical Reach |

|

Johnson & Johnson Vision |

1959 |

New Brunswick, USA |

|||||||

|

Alcon (Novartis) |

1945 |

Geneva, Switzerland |

|||||||

|

CooperVision |

1980 |

Pleasanton, USA |

|||||||

|

Bausch + Lomb |

1853 |

Laval, Canada |

|||||||

|

Hoya Corporation |

1941 |

Tokyo, Japan |

Saudi Arabia Contact Lens Industry Analysis

Market Growth Drivers

- Increasing Prevalence of Myopia and Other Vision Disorders: In Saudi Arabia, the prevalence of myopia and other refractive errors has been rising due to increasing digital device usage. According to the Saudi Ministry of Health, as of 2023, approximately 10 million people in Saudi Arabia are diagnosed with refractive errors such as myopia. Factors such as prolonged screen time, particularly among children and young adults, are accelerating the demand for corrective contact lenses. Additionally, government health initiatives targeting vision correction further contribute to the demand for contact lenses.

- Rising Disposable Income: Saudi Arabias GDP per capita reached $28,218 in 2023, an increase driven by economic diversification under Vision 2030. Rising disposable income levels are enabling consumers to afford premium contact lenses and explore alternatives such as daily disposables. As per World Bank data, the increase in income is reflected in the consumer expenditure on health-related products, including optical goods, which saw a growth of $300 per capita in 2022-2023.

- Growing Awareness About Eye Health: Awareness campaigns conducted by the Saudi Ministry of Health, such as the National Eye Health Program, aim to reduce preventable blindness and vision impairment by promoting regular eye check-ups. As of 2024, more than 1.5 million people participated in government-backed vision health programs, leading to increased adoption of contact lenses as an alternative to eyeglasses. The demand is further supported by collaborations with local clinics to educate consumers on vision health and lens care.

Market Challenges

- High Cost of Premium Contact Lenses: The cost of premium contact lenses remains a significant challenge for middle-income households in Saudi Arabia. While the average disposable income has increased, the cost of premium lenses, which can range from $50 to $150 per pack, often exceeds the affordability range for many consumers. A report by the General Authority for Statistics in 2023 indicates that 40% of individuals in rural areas still opt for lower-cost alternatives or eyeglasses due to high contact lens prices.

- Lack of Awareness in Rural Areas: While urban areas see growing adoption of contact lenses, rural areas lag in awareness. In 2023, only 30% of individuals in rural areas had access to vision care services, as reported by the Saudi Ministry of Health. The absence of eye care clinics and limited accessibility to vision correction products contribute to this challenge, reducing potential market penetration in less-developed regions.

Saudi Arabia Contact Lens Market Future Outlook

Over the next five years, the Saudi Arabia contact lens market is expected to show significant growth driven by technological advancements in lens materials, rising disposable incomes, and the increasing demand for cosmetic and therapeutic lenses. Additionally, the expansion of e-commerce platforms and the growing awareness of eye health among the younger population will fuel this growth. Furthermore, regulatory support from government bodies in ensuring product safety and quality standards is anticipated to facilitate smoother market penetration.

Market Opportunities

- Expansion into Untapped Rural Markets: With only 30% of rural populations having access to adequate vision care services, there is significant potential for contact lens manufacturers to expand into these areas. The Saudi government is investing in rural healthcare infrastructure, and as of 2023, $5 billion has been allocated towards improving medical services in underdeveloped regions. This creates an opportunity for companies to establish distribution networks and provide affordable contact lenses, addressing the unmet demand.

- Increasing Demand for Cosmetic Lenses: Cosmetic lenses, particularly colored lenses, have gained popularity in Saudi Arabia, driven by aesthetic preferences and cultural trends. As of 2024, the Saudi Cosmetic Product Usage Survey reported that 40% of women aged 18-35 have used cosmetic lenses at least once. This growing trend, coupled with the rising influence of social media influencers promoting aesthetic products, offers substantial market opportunities for companies offering cosmetic lens variants.

Scope of the Report

|

Soft Contact Lenses, Rigid Gas Permeable (RGP) Lenses, Hybrid Lenses |

|

|

By Usage Type |

Corrective Lenses, Cosmetic Lenses, Therapeutic Lenses |

|

By Material Type |

Hydrogel, Silicone Hydrogel, PMMA |

|

By Distribution Channel |

Offline Retail (Optical Stores, Supermarkets, Pharmacies), Online Retail |

|

By Region |

North East West South |

Products

Key Target Audience

Contact Lens Manufacturers

Optical Retail Chains

Eye Care Clinics and Hospitals

Distributors and Wholesalers

E-commerce Platforms

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Investment and Venture Capitalist Firms

Healthcare Providers and Professionals

Companies

Players Mention in the Report:

- Johnson & Johnson Vision

- Alcon (Novartis)

- CooperVision

- Bausch + Lomb

- Hoya Corporation

- SEED Co., Ltd.

- Menicon Co., Ltd.

- Carl Zeiss AG

- EssilorLuxottica

- UltraVision CLPL

- Clearlab

- Safilens

- Avizor International

- Bright Optical

- Visioneering Technologies, Inc.

Table of Contents

Saudi Arabia Contact Lens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Saudi Arabia Contact Lens Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Saudi Arabia Contact Lens Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Myopia and Other Vision Disorders

3.1.2. Rising Disposable Income

3.1.3. Growing Awareness About Eye Health

3.1.4. Advancements in Lens Materials and Technologies

3.2. Market Challenges

3.2.1. High Cost of Premium Contact Lenses

3.2.2. Lack of Awareness in Rural Areas

3.2.3. Stringent Regulatory Standards

3.3. Opportunities

3.3.1. Expansion into Untapped Rural Markets

3.3.2. Increasing Demand for Cosmetic Lenses

3.3.3. Growth in E-commerce Channels for Distribution

3.4. Trends

3.4.1. Growing Popularity of Daily Disposable Lenses

3.4.2. Rising Demand for Silicone Hydrogel Lenses

3.4.3. Increasing Focus on Environmentally Sustainable Lenses

3.5. Regulatory Landscape

3.5.1. Saudi Food and Drug Authority (SFDA) Standards

3.5.2. Compliance Requirements for Medical Devices

3.5.3. Certifications for Imported Contact Lenses

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

Saudi Arabia Contact Lens Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Soft Contact Lenses

4.1.2. Rigid Gas Permeable (RGP) Lenses

4.1.3. Hybrid Lenses

4.2. By Usage Type (In Value %)

4.2.1. Corrective Lenses

4.2.2. Cosmetic Lenses

4.2.3. Therapeutic Lenses

4.3. By Material Type (In Value %)

4.3.1. Hydrogel

4.3.2. Silicone Hydrogel

4.3.3. PMMA (Polymethyl Methacrylate)

4.4. By Distribution Channel (In Value %)

4.4.1. Offline Retail (Optical Stores, Supermarkets, Pharmacies)

4.4.2. Online Retail

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. South

Saudi Arabia Contact Lens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson Vision

5.1.2. Alcon (Novartis)

5.1.3. CooperVision

5.1.4. Bausch + Lomb

5.1.5. Hoya Corporation

5.1.6. Menicon Co., Ltd.

5.1.7. SEED Co., Ltd.

5.1.8. Carl Zeiss AG

5.1.9. EssilorLuxottica

5.1.10. Mark'ennovy

5.1.11. UltraVision CLPL

5.1.12. Clearlab

5.1.13. Safilens

5.1.14. Avizor International

5.1.15. Bright Optical

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Market Share, Revenue, Product Portfolio, Innovation Focus, Market Presence, Supply Chain)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers and Acquisitions, Partnerships, Product Launches)

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Private Equity Investments

Saudi Arabia Contact Lens Market Regulatory Framework

6.1. SFDA Compliance Standards for Contact Lenses

6.2. Import Regulations for Medical Devices

6.3. Labeling and Certification Requirements

6.4. Environmental and Health Safety Regulations

Saudi Arabia Contact Lens Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Saudi Arabia Contact Lens Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Usage Type (In Value %)

8.3. By Material Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

Saudi Arabia Contact Lens Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Distribution Strategy Recommendations

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia contact lens market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Saudi Arabia contact lens market. This includes assessing market penetration, the ratio of product types to distribution channels, and revenue generation. Additionally, an evaluation of product performance metrics is conducted to ensure the reliability and accuracy of market share estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through structured interviews with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple contact lens manufacturers and distributors to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia contact lens market.

Frequently Asked Questions

-

How big is the Saudi Arabia Contact Lens Market?

The Saudi Arabia contact lens market is valued at USD 330 million, driven by the increasing prevalence of vision disorders, rising disposable income, and growing demand for aesthetic and therapeutic lenses. -

What are the challenges in the Saudi Arabia Contact Lens Market?

Challenges in Saudi Arabia contact lens market include the high cost of premium contact lenses, stringent regulatory standards, and the lack of awareness about eye health in rural areas, which limits market penetration. -

Who are the major players in the Saudi Arabia Contact Lens Market?

Major players in Saudi Arabia contact lens market include Johnson & Johnson Vision, Alcon, CooperVision, Bausch + Lomb, and Hoya Corporation, which dominate the market due to their extensive distribution networks and product innovation. -

What are the growth drivers of the Saudi Arabia Contact Lens Market?

Key growth drivers in Saudi Arabia contact lens market include the rising prevalence of myopia, advancements in lens materials, and the increasing accessibility of contact lenses through both offline and online retail channels. -

What trends are shaping the Saudi Arabia Contact Lens Market?

Trends in Saudi Arabia contact lens market include the growing popularity of daily disposable lenses, the increasing demand for silicone hydrogel lenses, and a heightened focus on environmentally sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.