Saudi Arabia Digital Media Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD4600

November 2024

90

About the Report

Saudi Arabia Digital Media Market Overview

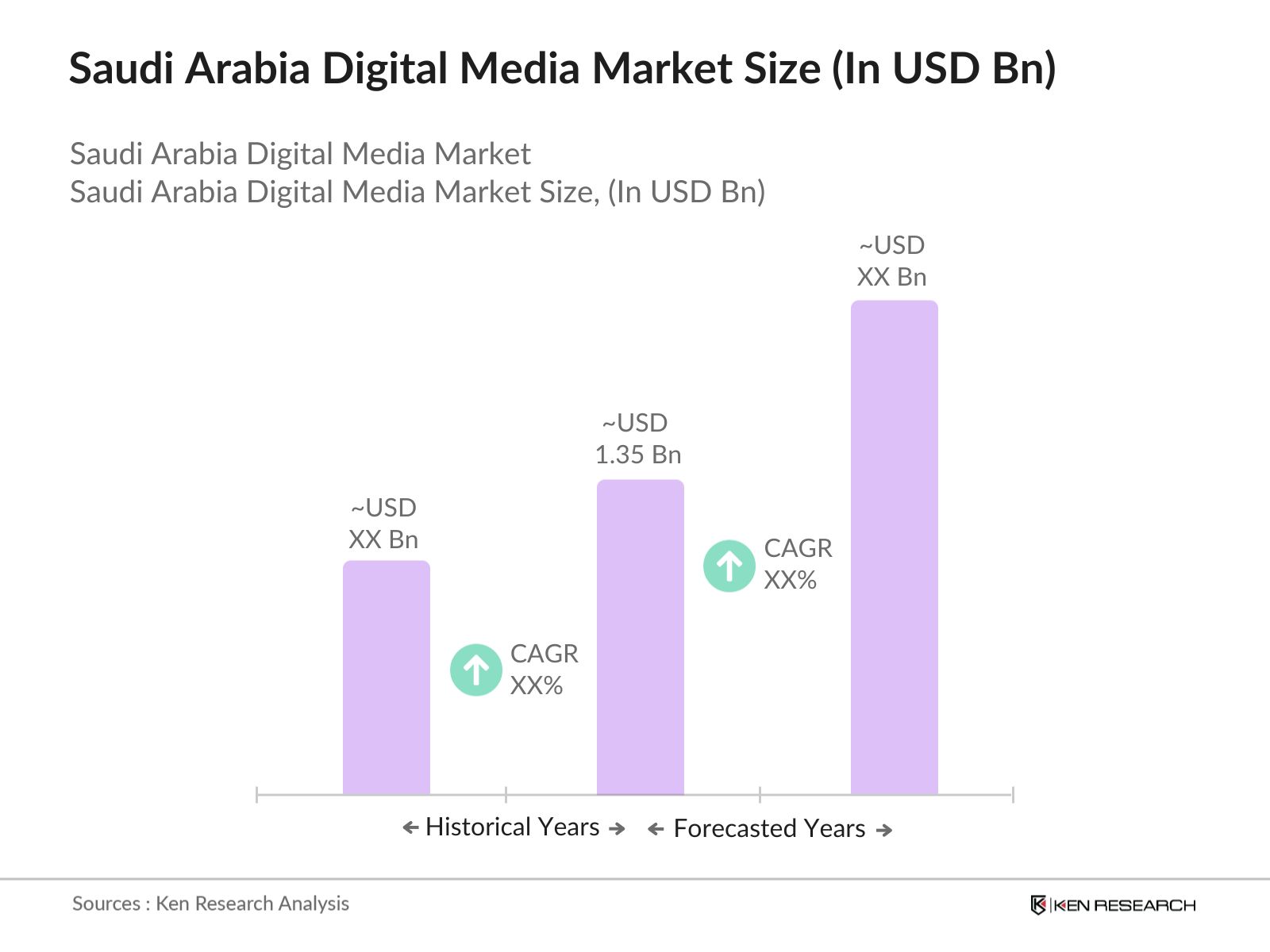

- The Saudi Arabia digital media market is valued at USD 1.35 billion, driven by an increasing adoption of digital platforms, including OTT (over-the-top) streaming services, social media, and digital advertising channels. This growth is heavily influenced by the country's high internet penetration rate, government initiatives promoting digital transformation as part of Vision 2030, and a rapidly growing youth population that consumes vast amounts of digital content. The rise in e-commerce and mobile internet usage further accelerates digital media's expansion, making Saudi Arabia one of the key digital economies in the Middle East.

- The cities of Riyadh, Jeddah, and Dammam lead the digital media market due to their advanced technological infrastructure and concentrated urban populations, which actively engage with digital content and services. Riyadh, as the capital, benefits from significant government support for digitalization and is home to many corporate headquarters. Meanwhile, Jeddah and Dammam, with their bustling commercial environments, have seen a surge in digital advertising and e-commerce activities, making them crucial hubs for the sector's growth. These cities also have a large youth demographic that fuels the demand for digital entertainment and social media.

- As part of Vision 2030, the Saudi government has introduced several digital content development programs aimed at fostering local content creation. In 2024, SAR 1 billion was allocated to support the development of local digital media, including initiatives to train local creators and provide grants for digital content production. These programs are part of a broader effort to build a sustainable digital media ecosystem that reflects Saudi culture and values.

Saudi Arabia Digital Media Market Segmentation

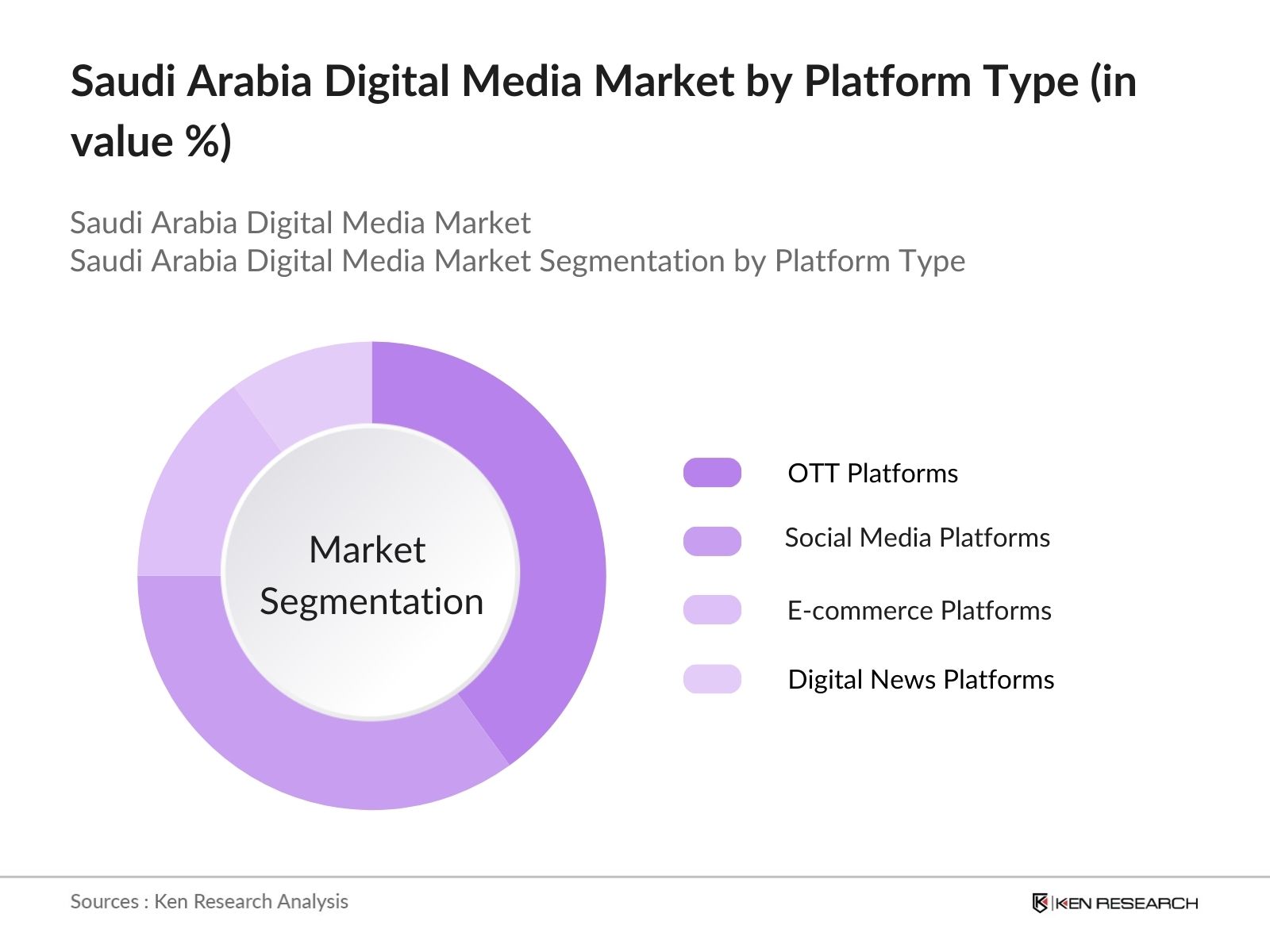

- By Platform Type: The market is segmented by platform type into over-the-top (OTT) platforms, social media platforms, e-commerce platforms, and digital news platforms. OTT Platforms dominate this segment, driven by the popularity of streaming services such as Netflix, Shahid, and YouTube. These platforms are favored by the growing youth population, who prefer on-demand content. The increasing availability of affordable data packages and high internet speed further boosts OTT platform adoption, solidifying its market dominance.

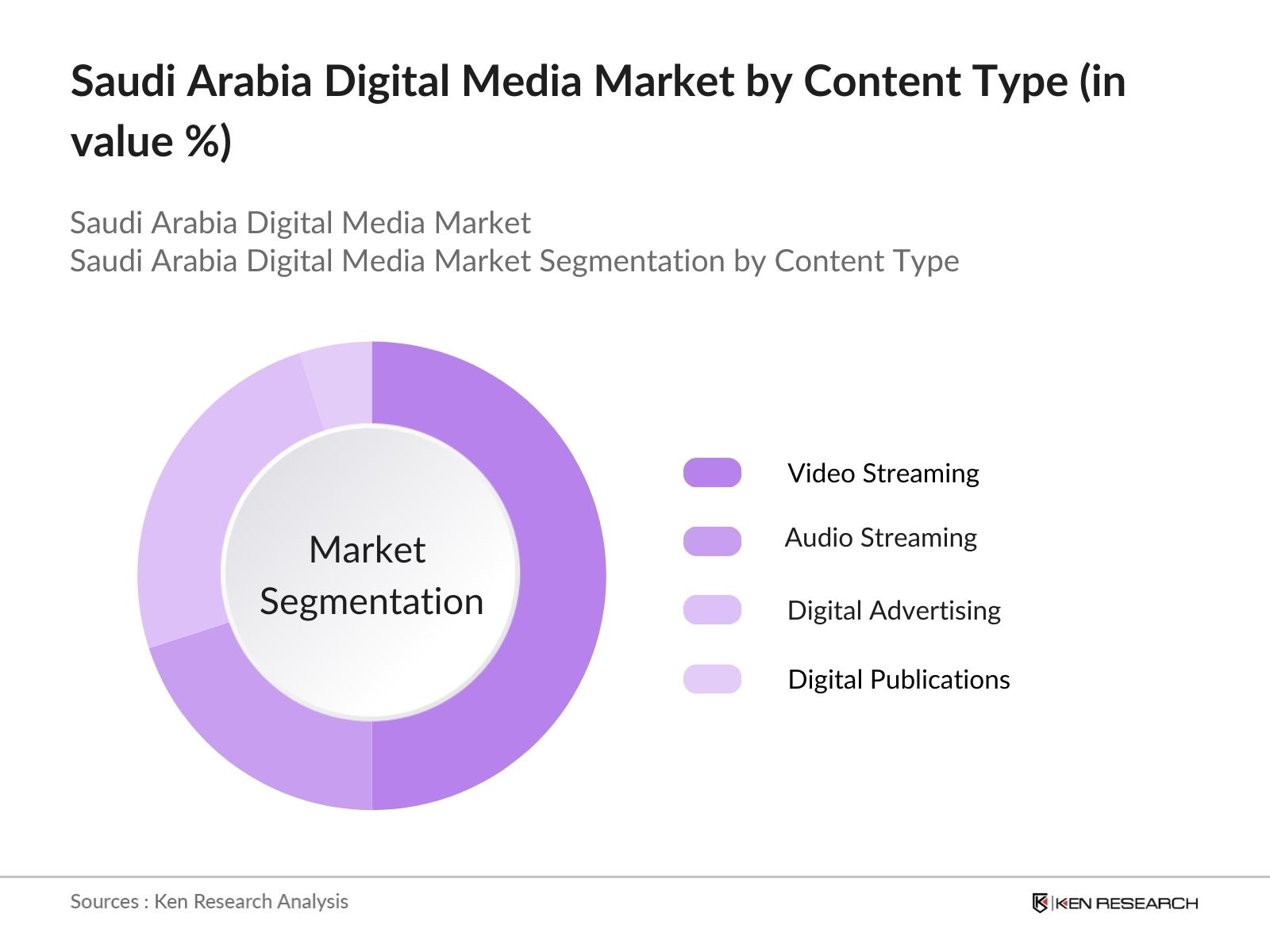

- By Content Type: The market is segmented by content type into video streaming, audio streaming, digital advertising, and digital publications. Video Streaming leads the content type segment as a result of growing demand for localized Arabic content on platforms like Shahid, alongside global offerings from Netflix and YouTube. The high consumption of video content, especially among the youth, contributes significantly to this sub-segment's dominance. The rise in video content creation for platforms such as TikTok and Instagram also enhances its influence within the market.

Saudi Arabia Digital Media Market Competitive Landscape

The Saudi Arabia digital media market is dominated by several key players that influence content creation, distribution, and digital advertising. These companies, both local and international, play a pivotal role in shaping the market landscape. Companies like Shahid (a local favorite), Netflix, YouTube, and STC Digital Media have established strong positions due to their ability to cater to local preferences, as well as their integration with global content networks.

|

Company Name |

Establishment Year |

Headquarters |

Market Reach |

Subscribers (M) |

Revenue (USD Bn) |

Local Content Ratio |

Ad Revenue (USD M) |

Partnerships |

Influence on Content Creation |

|

STC Digital Media |

1998 |

Riyadh |

|||||||

|

Netflix Saudi Arabia |

1997 |

Los Gatos, CA |

|||||||

|

Shahid (MBC Group) |

1991 |

Dubai |

|||||||

|

YouTube Saudi Arabia |

2005 |

San Bruno, CA |

|||||||

|

Twitter MENA |

2006 |

Dubai |

Saudi Arabia Digital Media Industry Analysis

Growth Drivers

- High Internet and Mobile Penetration: Saudi Arabia has experienced significant digital transformation, with over 95% of the population now connected to the internet. As of 2024, there are more than 41 million mobile connections, reflecting a high mobile penetration rate. The rise in mobile usage is directly linked to the government's Vision 2030 initiative, which aims to increase digital infrastructure across the kingdom. The high mobile and internet usage facilitates the expansion of digital media consumption, especially with a growing youth population and an increasing shift toward online platforms for content and services.

- Growth in E-commerce and OTT Platforms: E-commerce in Saudi Arabia has grown significantly, driven by the high internet penetration and digital infrastructure. In 2024, online retail sales reached SAR 45 billion, influenced by rising consumer demand for digital services. Additionally, OTT platforms have become a central part of the digital media ecosystem, with Saudi users streaming billions of hours of video content. OTT consumption is boosted by the ease of access through smartphones and tablets. This shift indicates strong demand for digital services, enhancing opportunities for digital content creators and advertisers.

- Shift Toward Digital Advertising: Digital advertising is growing rapidly in Saudi Arabia, particularly through social media platforms like Instagram, Snapchat, and YouTube, which have large user bases. In 2024, digital advertising expenditure is estimated to surpass SAR 5 billion as brands increasingly shift their budgets from traditional to digital channels. The growth is further fueled by the expanding youth population, which represents 65% of the total population and is highly engaged in online activities, driving demand for personalized, targeted digital ads.

Market Challenges

- Limited Monetization of Digital Content: Despite high internet usage, monetizing digital content in Saudi Arabia remains a challenge due to limited local payment infrastructure and digital regulations. Many content creators and platforms struggle to generate significant revenue from subscriptions or advertisements. In 2024, digital content revenue from local creators remained under SAR 1 billion, indicating underperformance in monetization strategies compared to international standards. This suggests that the local digital economy lacks robust mechanisms for financial support and revenue generation.

- Data Privacy and Cybersecurity Concerns: Saudi Arabia faces increasing concerns regarding data privacy and cybersecurity, especially with the growth of digital platforms and services. In 2024, cyberattacks in the country increased by 30% year-over-year, leading to significant financial and reputational damage for businesses in the digital media space. The Saudi government has implemented strict data privacy regulations, such as the Personal Data Protection Law (PDPL), but challenges remain in ensuring robust enforcement and creating awareness among digital platform operators.

Saudi Arabia Digital Media Market Future Outlook

Over the next five years, Saudi Arabia's digital media market is expected to experience substantial growth, driven by continuous government efforts to support digital transformation, advancements in technology like 5G, and increased consumer demand for localized digital content. With a rising youth population, higher mobile internet penetration, and the diversification of digital media platforms, this market is poised to see significant development across OTT platforms, social media, and digital advertising. The country's ongoing investment in infrastructure, such as smart cities and enhanced digital services, will further accelerate the expansion of the digital media sector.

Future Market Opportunities

- Growth in Arabic Content Creation: There is significant potential for growth in Arabic digital content creation, with the government actively encouraging local content development through various initiatives. In 2024, Arabic content comprised only 2% of global digital content, even though over 400 million people speak Arabic. This presents a major opportunity for local content creators and platforms to produce culturally relevant material, supported by government funding and incentives aimed at increasing the production and consumption of Arabic media.

- Expanding Usage of social media for Business: social media is becoming a critical tool for business operations in Saudi Arabia, particularly for small and medium enterprises (SMEs). In 2024, over 80% of Saudi businesses used social media platforms for marketing and customer engagement, reflecting the increasing importance of digital channels for commercial activities. This growing reliance on social media for business purposes offers opportunities for platform developers and digital advertisers to target this expanding market segment.

Scope of the Report

|

By Platform Type |

Over-the-Top (OTT) Platforms Social Media Platforms E-commerce Platforms Digital News Platforms |

|

By Content Type |

Video Streaming Audio Streaming Digital Advertising E-books and Digital Publications |

|

By Revenue Model |

Subscription-Based Advertisement-Based Freemium |

|

By End-User |

Individual Consumers Enterprises and SMEs Educational Institutions Government Organizations |

|

By Region |

North East West South |

Products

Key Target Audience

OTT Platform Providers

Digital Advertising Agencies

Social Media Companies

E-commerce Platforms

Banks and Financial Institutes

Government and Regulatory Bodies (Ministry of Media, CITC)

Investors and Venture Capitalist Firms

Digital Content Creators and Influencers

Telecommunications Companies

Companies

Major Players in Saudi Arabia Digital Media Market

STC Digital Media

Netflix Saudi Arabia

Shahid (MBC Group)

YouTube Saudi Arabia

Twitter MENA

Anghami

TikTok Saudi Arabia

Snap Inc. (Saudi Arabia)

Noon

Starzplay

OSN Streaming

Mobily

Souq (Amazon Saudi Arabia)

Rotana Digital Media

Saudi Research and Media Group

Table of Contents

1. Saudi Arabia Digital Media Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Digital Media Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Digital Media Market Analysis

3.1 Growth Drivers (Saudi Arabias Vision 2030, Digital Transformation, Internet Penetration, Youth Population)

3.1.1 High Internet and Mobile Penetration

3.1.2 Growth in E-commerce and OTT Platforms

3.1.3 Shift Toward Digital Advertising

3.1.4 Government Support for Digital Initiatives

3.2 Market Challenges (Low Local Content Creation, Cultural Sensitivities, Limited Data Regulation Framework)

3.2.1 Limited Monetization of Digital Content

3.2.2 Data Privacy and Cybersecurity Concerns

3.2.3 Reliance on International Content Creators

3.3 Opportunities (Content Localization, 5G Rollout, Partnerships with Global Digital Platforms)

3.3.1 Growth in Arabic Content Creation

3.3.2 Expanding Usage of Social Media for Business

3.3.3 Increased Investment in Online Learning Platforms

3.4 Trends (Rise in Influencer Marketing, Short-form Content, Growth of Podcasting)

3.4.1 Increase in Consumption of Social Video Content

3.4.2 Expansion of Digital Advertising into Emerging Sectors

3.4.3 Integration of AI and Data Analytics in Digital Media

3.5 Government Regulation (Vision 2030 Policies, Local Content Quotas, Privacy Law Implementation)

3.5.1 Introduction of Digital Content Development Programs

3.5.2 Mandatory Local Content Quota for OTT Platforms

3.5.3 Cybersecurity Laws for Digital Platforms

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Content Creators, OTT Platforms, Digital Ad Agencies, Regulatory Bodies)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Saudi Arabia Digital Media Market Segmentation

4.1 By Platform Type (In Value %)

4.1.1 Over-the-Top (OTT) Platforms

4.1.2 Social Media Platforms

4.1.3 E-commerce Platforms

4.1.4 Digital News Platforms

4.2 By Content Type (In Value %)

4.2.1 Video Streaming

4.2.2 Audio Streaming

4.2.3 Digital Advertising

4.2.4 E-books and Digital Publications

4.3 By Revenue Model (In Value %)

4.3.1 Subscription-Based

4.3.2 Advertisement-Based

4.3.3 Freemium

4.4 By End-User (In Value %)

4.4.1 Individual Consumers

4.4.2 Enterprises and SMEs

4.4.3 Educational Institutions

4.4.4 Government Organizations

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 West

4.5.4 East

5. Saudi Arabia Digital Media Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. STC Digital Media

5.1.2. Mobily

5.1.3. Shahid (MBC Group)

5.1.4. YouTube Saudi Arabia

5.1.5. Twitter MENA

5.1.6. Anghami

5.1.7. OSN Streaming

5.1.8. Starzplay

5.1.9. Noon

5.1.10. Souq (Amazon Saudi Arabia)

5.1.11. Saudi Research and Media Group

5.1.12. Rotana Digital Media

5.1.13. Snap Inc. (Saudi Arabia)

5.1.14. TikTok Saudi Arabia

5.1.15. Netflix Saudi Arabia

5.2 Cross Comparison Parameters (Revenue, Subscriber Base, Market Share, Digital Content Partnerships, Social Media Following, Localization Initiatives, Headquarter Locations, Strategic Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Digital Media Market Regulatory Framework

6.1 Digital Content Regulation

6.2 Compliance with Cultural Guidelines

6.3 Certification and Licensing for Digital Content Providers

7. Saudi Arabia Digital Media Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Digital Media Future Market Segmentation

8.1 By Platform Type (In Value %)

8.2 By Content Type (In Value %)

8.3 By Revenue Model (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Saudi Arabia Digital Media Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we map out all the key stakeholders within the Saudi Arabia digital media market ecosystem. This step involves conducting thorough desk research using secondary sources and proprietary databases to capture industry-level data. Key variables such as digital platform usage, subscriber data, and content consumption trends are identified to understand market dynamics.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data to evaluate the market's performance. Factors like content localization, platform penetration, and revenue generated from digital media are examined. Additionally, the impact of digital advertising and the consumer shift toward streaming services are evaluated for accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts. These consultations include key personnel from top digital media companies, telecommunications firms, and government bodies, ensuring that market insights are robust and accurate.

Step 4: Research Synthesis and Final Output

In the final step, we engage directly with digital media platform providers to collect detailed insights into their content strategies, user base, and revenue streams. This data is cross-referenced with our bottom-up market approach to ensure a comprehensive and validated analysis of the Saudi Arabia digital media market.

Frequently Asked Questions

01. How big is the Saudi Arabia Digital Media Market?

The Saudi Arabia digital media market is valued at USD 1.35 billion, driven by a combination of factors including high internet penetration, growing consumption of OTT content, and robust government support for digital transformation as part of Vision 2030.

02. What are the challenges in the Saudi Arabia Digital Media Market?

Challenges in the Saudi Arabia digital media market include the need for greater content localization, data privacy concerns, and the limited monetization options for digital content creators. Cultural sensitivities also play a role in shaping content strategies for international platforms.

03. Who are the major players in the Saudi Arabia Digital Media Market?

Key players in the Saudi Arabia digital media market include STC Digital Media, Shahid, YouTube Saudi Arabia, Netflix, and Twitter MENA. These companies dominate due to their strong content offerings, localized strategies, and large user bases.

04. What are the growth drivers of the Saudi Arabia Digital Media Market?

Growth is driven by increasing internet and mobile penetration, the popularity of OTT platforms, and rising investments in digital advertising in the Saudi Arabia digital media market. Government initiatives under Vision 2030 are also propelling the market forward.

05. What trends are shaping the Saudi Arabia Digital Media Market?

Key trends in the Saudi Arabia digital media market include the rise of influencer marketing, the adoption of short-form video content, and the expansion of digital advertising into new sectors such as e-commerce and education platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.