Saudi Arabia Electric Motor Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD10077

November 2024

88

About the Report

Saudi Arabia Electric Motor Market Overview

- The Saudi Arabia electric motor market is valued at USD 78.3 billion based on a comprehensive five-year historical analysis. The market is driven by the rapid industrialization and government investments in power infrastructure projects under the initiative. Additionally, the expanding manufacturing sector and the increasing adoption of energy-efficient technologies in industrial applications have contributed to the market's steady growth. Government-backed projects aimed at boosting domestic production capabilities in the electrical sector are also fueling market expansion.

- In Saudi Arabia, dominant cities such as Riyadh and Jeddah lead the electric motor market, primarily due to the concentration of manufacturing hubs and industrial activities. These cities are home to several major infrastructure projects, including metro systems and smart city initiatives, which demand advanced electric motor solutions. Additionally, the oil and gas sector, concentrated in the Eastern Province, further drives the demand for electric motors due to the ongoing modernization of extraction and processing operations.

- The Saudi Standards, Metrology and Quality Organization (SASO) has implemented the Energy Efficiency Labeling Scheme, which mandates the use of energy-efficient motors in various industrial and commercial applications. By ensuring that motors meet specific energy performance standards, this initiative aims to reduce the overall energy consumption in sectors like manufacturing, oil and gas, and utilities. The labeling program also creates greater awareness among consumers and industries, pushing them towards more sustainable choices.

Saudi Arabia Electric Motor Market Segmentation

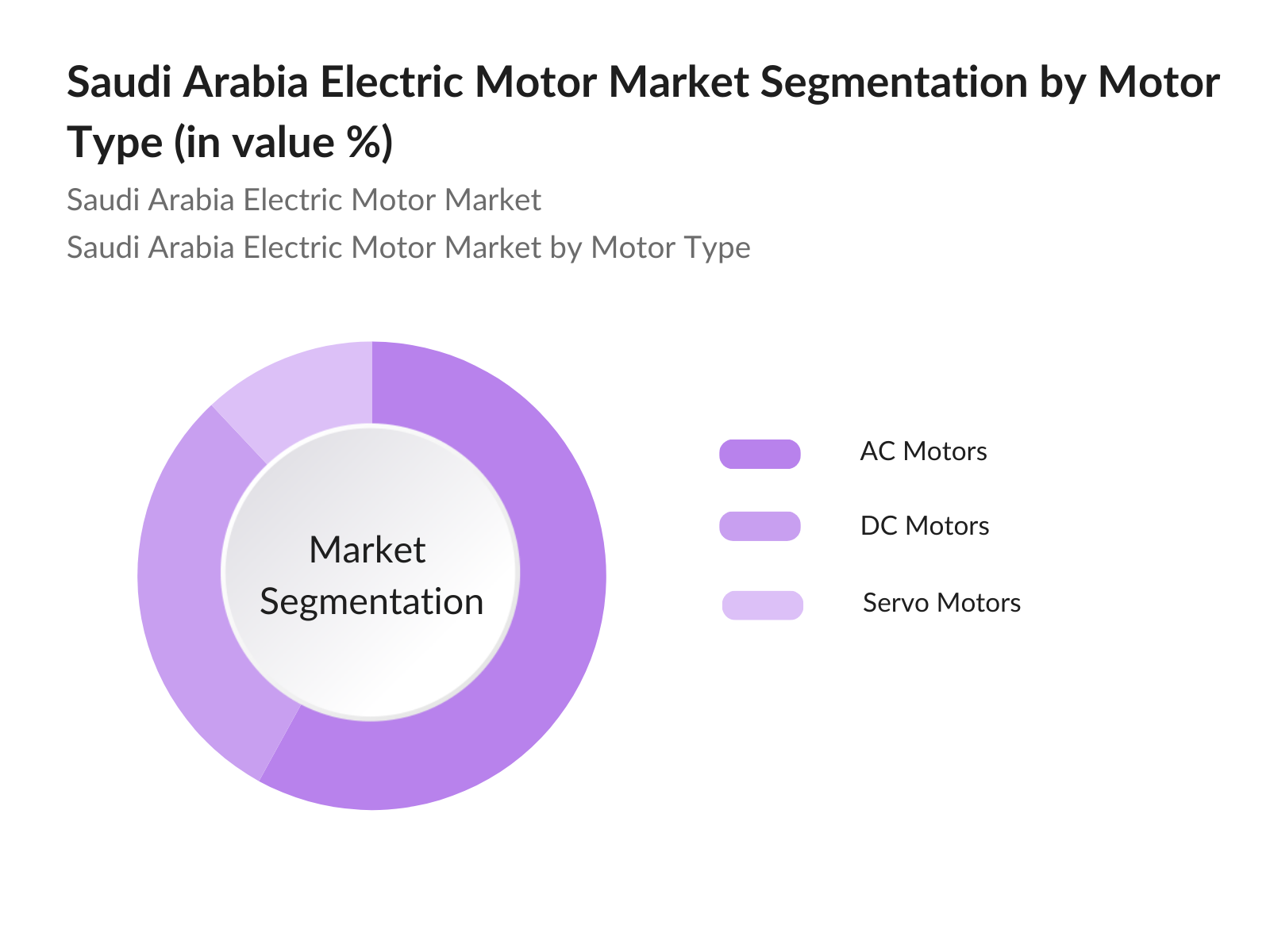

- By Motor Type: The Saudi Arabias electric motor market is segmented by motor type into AC motors, DC motors, and Servo motors. Their dominance stems from their extensive use in industrial machinery and HVAC systems. AC motors are highly reliable, durable, and efficient for heavy-duty applications, making them a preferred choice in the countrys industrial and manufacturing sectors. The availability of energy-efficient models in the AC motor category also aligns with Saudi Arabia's energy-saving goals under.

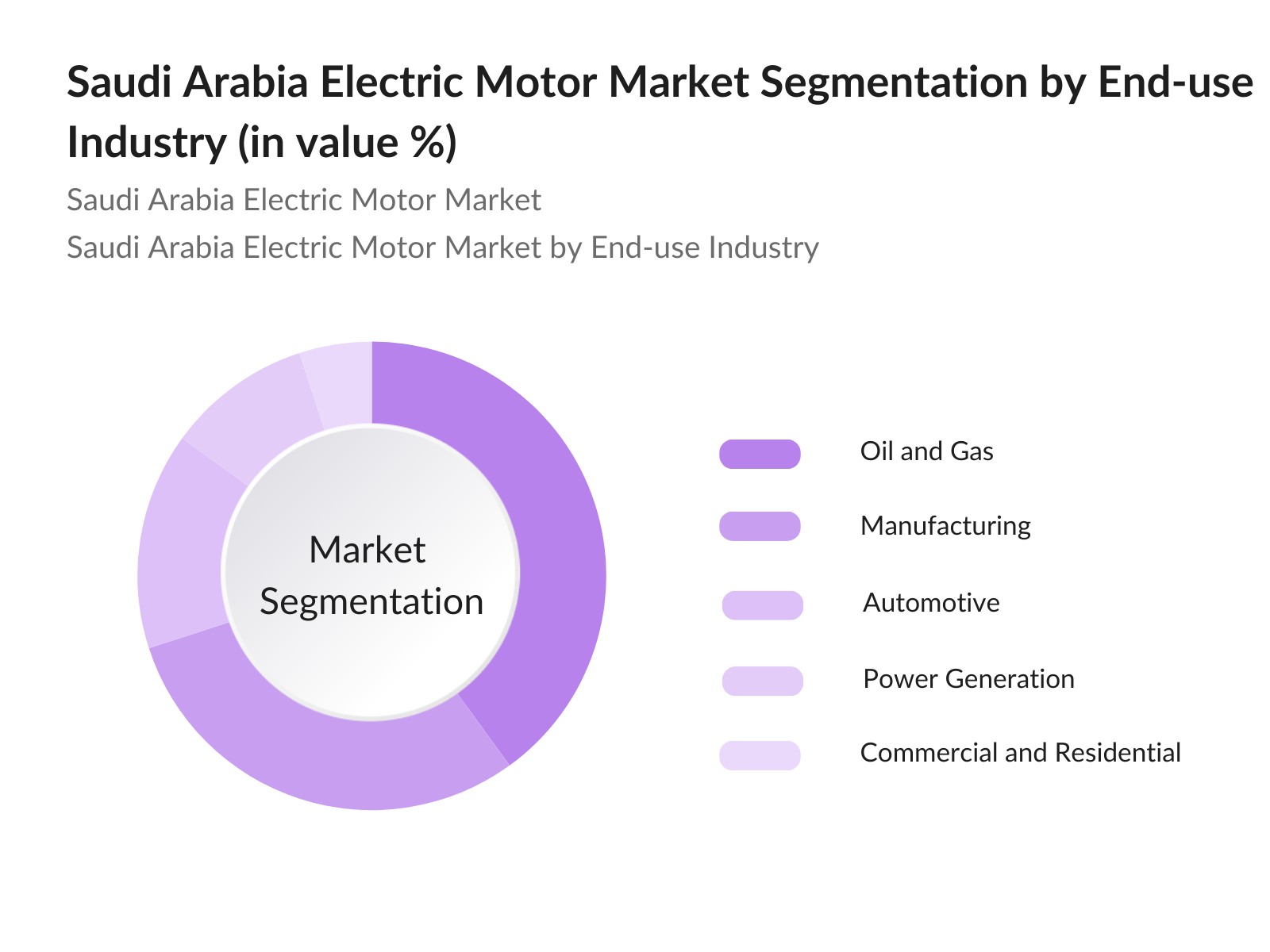

- By End-use Industry: The electric motor market is segmented by end-use industries into manufacturing, automotive, oil and gas, power generation, and commercial and residential sectors. The primarily due to Saudi Arabia's leadership in the global oil industry. The constant demand for electric motors in extraction, processing, and transportation of oil ensures a steady consumption rate. Moreover, the industrys transition to more energy-efficient technologies has further accelerated the adoption of electric motors.

Saudi Arabia Electric Motor Market Competitive Landscape

The Saudi Arabia electric motor market is dominated by major global and regional players, leading to consolidation. Companies like ABB Ltd. and Siemens AG hold strong positions in the market due to their technological prowess and extensive distribution networks. In addition, local manufacturers have started gaining traction due to government initiatives aimed at fostering domestic production.

|

Company Name |

Establishment Year |

Headquarters |

Employees |

Revenue |

Market Type |

Motor Specialization |

Regional Focus |

Key Partnerships |

Innovations |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

105,000 |

- |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Munich, Germany |

293,000 |

- |

- |

- |

- |

- |

- |

|

WEG Industries |

1961 |

Jaragu, Brazil |

33,000 |

- |

- |

- |

- |

- |

- |

|

TECO Electric & Machinery |

1956 |

Taipei, Taiwan |

13,000 |

- |

- |

- |

- |

- |

- |

|

Nidec Corporation |

1973 |

Kyoto, Japan |

110,000 |

- |

- |

- |

- |

- |

- |

Saudi Arabia Electric Motor Industry Analysis

Market Growth Drivers

- Industrial Expansion: Saudi Arabias push for industrial diversification, is driving demand for electric motors. As of 2024, the manufacturing sector plays a vital role in contributing to the nations GDP, propelled by increased industrial activity and investments in automation and energy-efficient machinery. Saudi Arabias Ministry of Industry and Mineral Resources has set a target to boost the sector's output to $320 billion, which will significantly accelerate the demand for high-performance electric motors across key industries such as petrochemicals and mining.

- Power Infrastructure Investments: Saudi Arabia's investment in power infrastructure is a key growth driver for electric motors. The country plans to increase its electricity generation capacity to 150 GW, up from its current levels. Investments totaling $15 billion are being directed toward upgrading power generation, transmission, and distribution networks. This surge in power capacity development requires efficient electric motors to power turbines, pumps, and compressors.

- Renewable Energy Projects: Saudi Arabias National Renewable Energy Program is driving the transition to green energy, which heavily relies on electric motors. Electric motors play a crucial role in operating solar inverters, wind turbines, and other equipment essential for renewable energy projects. The increasing focus on renewable energy is expected to create a growing demand for efficient and high-performance motors, contributing to the development of sustainable energy infrastructure across the country.

Market Challenges:

- Adoption of Energy-efficient Motors: The Saudi Arabian market is experiencing a notable shift towards energy-efficient electric motors, driven by stringent regulations and national energy-saving targets. As of 2024, there has been a growing adoption of energy-efficient motors across industrial applications, encouraged by government initiatives such as SASO's Energy Efficiency Labeling Scheme. These programs are accelerating the transition by mandating the use of high-efficiency motors in both public and private sector projects, which is expected to significantly enhance operational efficiency and reduce energy consumption.

- Use of IoT in Motors: The integration of IoT technology into electric motors is rapidly gaining traction in Saudi Arabia, especially within the industrial sector. By 2024, many industrial motors in key industries such as oil and gas are equipped with IoT sensors that monitor performance and predict maintenance needs. This trend is driven by the increasing need to reduce operational costs, improve motor efficiency, and minimize downtime through predictive maintenance, enhancing overall system performance and reliability in critical sectors.

Saudi Arabia Electric Motor Market Future Outlook

Over the next five years, the Saudi Arabia electric motor market is expected to grow significantly, driven by continuous industrial expansion, advancements in energy-efficient motor technologies, and increasing adoption in oil and gas, manufacturing, and automotive industries. The government's push for local manufacturing under and the transition toward renewable energy will further fuel demand for electric motors. Companies that focus on product innovation and energy-efficient solutions are poised to benefit the most in this evolving market.

Market Opportunities:

- Adoption of Energy-efficient Motors: The Saudi Arabian market is experiencing a shift towards energy-efficient electric motors, driven by regulatory measures and national energy-saving initiatives. As of 2024, the adoption of energy-efficient motors across industrial applications is increasing, supported by government programs such as SASO's Energy Efficiency Labeling Scheme. These initiatives are accelerating the trend by mandating the use of high-efficiency motors in both public and private sector projects, aiming to reduce energy consumption and improve overall operational efficiency in key industries.

- Smart Motor Solutions: Smart motor solutions, which optimize performance through advanced software controls, are becoming a key trend. In 2023, it is estimated that over 15,000 smart motors are in operation across various industries in Saudi Arabia, providing enhanced energy efficiency and real-time monitoring capabilities. These solutions are particularly important in high-demand sectors like manufacturing and energy.

Scope of the Report

|

By Motor Type |

AC Motors DC Motors Servo Motors Stepper Motors |

|

By Output Power |

Fractional Horsepower Motors Integral Horsepower Motors |

|

By Application |

Industrial Machinery HVAC Transportation Home Appliances |

|

By End-use Industry |

Manufacturing Automotive Oil and Gas Power Generation Commercial and Residential |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Power Generation Companies

Manufacturing and Industrial Plants

Oil and Gas Companies (Saudi Aramco)

Automotive Manufacturers

Construction and Infrastructure Development Companies

Energy Efficiency Solutions Providers

Companies

Players mentioned in the market

ABB Ltd.

Siemens AG

WEG Industries

TECO Electric & Machinery

Nidec Corporation

Toshiba International Corporation

Regal Rexnord Corporation

Schneider Electric

Hyundai Electric

Rockwell Automation

Leroy-Somer

Baldor Electric Company

OMEGA Engineering

General Electric

Marathon Electric

Table of Contents

1. Saudi Arabia Electric Motor Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Electric Motor Market Size (In SAR Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Electric Motor Market Analysis

3.1 Growth Drivers (Industrial Expansion, Power Infrastructure Investments, Renewable Energy Projects, Smart City Developments)

3.2 Market Challenges (High Initial Costs, Maintenance Costs, Lack of Skilled Workforce, Competition from Imports)

3.3 Opportunities (Government Initiatives for Local Manufacturing, Expanding Electrification, Rise in Electric Vehicles)

3.4 Trends (Adoption of Energy-efficient Motors, Use of IOT in Motors, Smart Motor Solutions, Integration into Smart Grids)

3.5 Government Regulation (Vision 2030, Local Content Requirements, Energy Efficiency Standards, Incentives for Electric Vehicle Manufacturing)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (OEMs, Suppliers, Distributors, End-users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Saudi Arabia Electric Motor Market Segmentation

4.1 By Motor Type (In Value %)

4.1.1 AC Motors

4.1.2 DC Motors

4.1.3 Servo Motors

4.1.4 Stepper Motors

4.2 By Output Power (In Value %)

4.2.1 Fractional Horsepower Motors

4.2.2 Integral Horsepower Motors

4.3 By Application (In Value %)

4.3.1 Industrial Machinery

4.3.2 HVAC

4.3.3 Transportation

4.3.4 Home Appliances

4.4 By End-use Industry (In Value %)

4.4.1 Manufacturing

4.4.2 Automotive

4.4.3 Oil and Gas

4.4.4 Power Generation

4.4.5 Commercial and Residential

4.5 By Region (In Value %)

4.5.1 Central Saudi Arabia

4.5.2 Eastern Saudi Arabia

4.5.3 Western Saudi Arabia

4.5.4 Northern Saudi Arabia

4.5.5 Southern Saudi Arabia

5. Saudi Arabia Electric Motor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ABB Ltd.

5.1.2 Siemens AG

5.1.3 WEG Industries

5.1.4 TECO Electric & Machinery Co. Ltd.

5.1.5 Regal Rexnord Corporation

5.1.6 Nidec Corporation

5.1.7 General Electric

5.1.8 Toshiba International Corporation

5.1.9 Schneider Electric

5.1.10 Hyundai Electric

5.1.11 Rockwell Automation

5.1.12 Leroy-Somer

5.1.13 Baldor Electric Company

5.1.14 OMEGA Engineering

5.1.15 Marathon Electric

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Motor Types Manufactured, Market Share, Regional Presence, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. Saudi Arabia Electric Motor Market Regulatory Framework

6.1 Vision 2030 Compliance

6.2 Saudi Standards, Metrology, and Quality Organization (SASO) Regulations

6.3 Energy Efficiency Labeling and Certification

6.4 Local Content Requirements

7. Saudi Arabia Electric Motor Future Market Size (In SAR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Electric Motor Future Market Segmentation

8.1 By Motor Type (In Value %)

8.2 By Output Power (In Value %)

8.3 By Application (In Value %)

8.4 By End-use Industry (In Value %)

8.5 By Region (In Value %)

9. Saudi Arabia Electric Motor Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the major stakeholders within the Saudi Arabia Electric Motor Market ecosystem. This process includes extensive desk research, utilizing government reports, company databases, and energy sector publications to identify variables impacting market growth, such as demand from oil and gas and industrial sectors.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data related to the market. This includes tracking the penetration of electric motors across different industries, evaluating industrial automation trends, and analyzing regional demand. We also evaluated the number of market entrants to ensure the accuracy of our projections.

Step 3: Hypothesis Validation and Expert Consultation

We validated our findings through interviews with industry experts and representatives from leading electric motor manufacturers. This approach ensured that we incorporated on-ground insights regarding technological advancements, regulatory impact, and market challenges.

Step 4: Research Synthesis and Final Output

In the final step, we consolidated data from multiple sources to provide a comprehensive view of the market. Direct consultations with industry experts further refined our analysis, helping us project future trends accurately while ensuring the validity of our data.

Frequently Asked Questions

01. How big is Saudi Arabia Electric Motor Market?

The Saudi Arabia electric motor market is valued at SAR 78.3 billion, driven by the industrialization efforts under and demand from oil and gas operations.

02. What are the challenges in Saudi Arabia Electric Motor Market?

Key challenges include high initial investment costs, technical complexities in motor integration, and competition from imported motors that are sometimes cheaper but lower in quality.

03. Who are the major players in Saudi Arabia Electric Motor Market?

Key players include ABB Ltd., Siemens AG, WEG Industries, TECO Electric & Machinery, and Nidec Corporation, all of which dominate due to their technological capabilities and strong presence in the region.

04. What are the growth drivers of Saudi Arabia Electric Motor Market?

Growth drivers include the expanding oil and gas industry, increasing adoption of energy-efficient motor technologies, and government incentives for local manufacturing under.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.