Saudi Arabia Entertainment and Amusement Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD8077

December 2024

95

About the Report

Saudi Arabia Entertainment and Amusement Market Overview

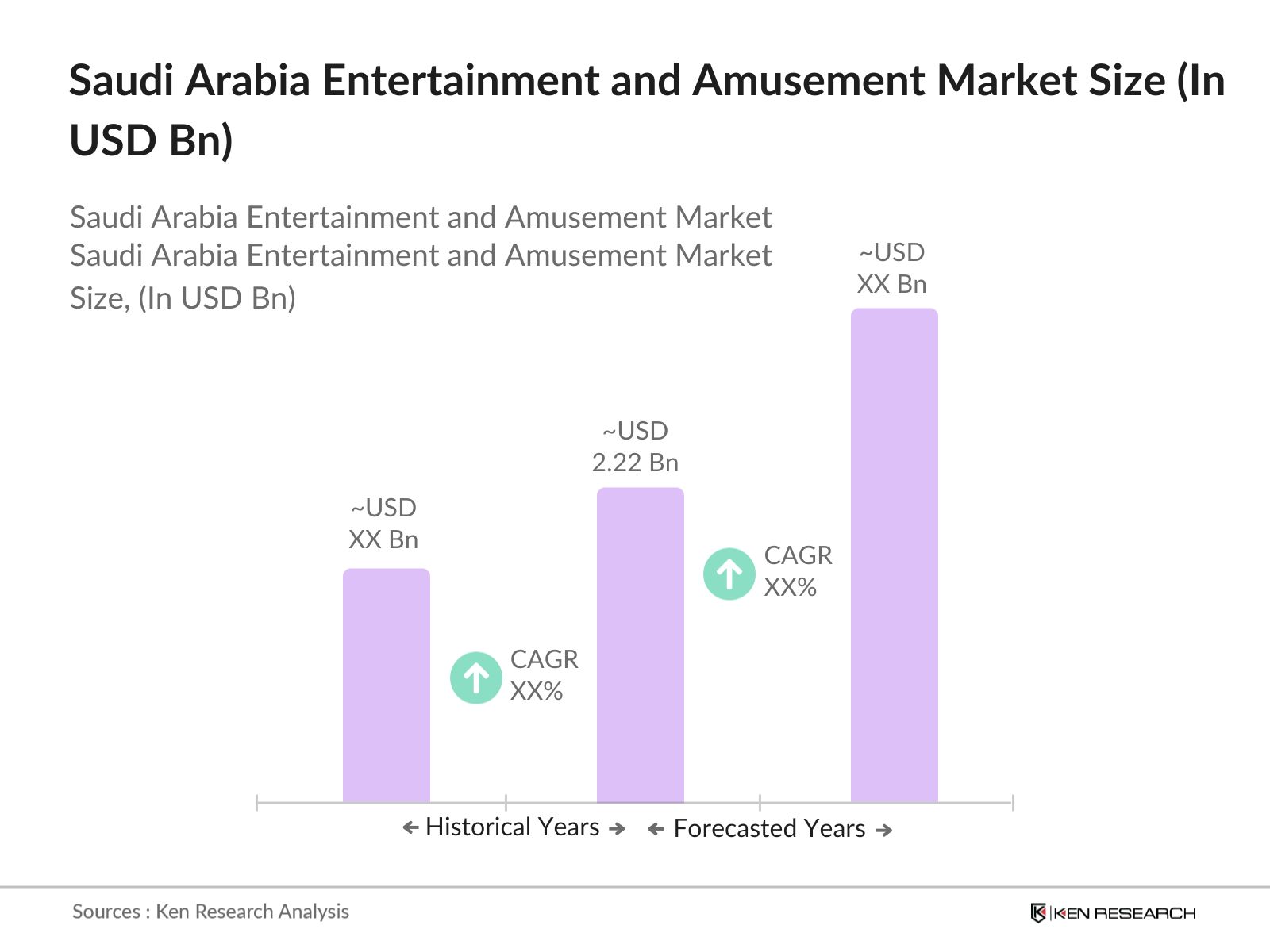

- The Saudi Arabia Entertainment and Amusement Market is valued at USD 2.22 billion, reflecting the significant push from Vision 2030 to diversify the economy and reduce reliance on oil revenues. This market is driven by substantial government investments, particularly in mega-projects like NEOM and Qiddiya, aimed at establishing Saudi Arabia as a regional entertainment hub. These developments include amusement parks, cinemas, and live entertainment venues, which have become popular among both residents and tourists, driving market growth.

- The market's dominance is led by cities like Riyadh and Jeddah, which serve as the countrys cultural and economic centers. Riyadh, in particular, has seen rapid growth due to its large population and status as the capital city, attracting both local and international entertainment investments. Jeddahs location on the Red Sea also makes it a key tourist destination, with numerous entertainment projects targeted at the influx of visitors.

- Vision 2030 has prioritized the entertainment sector as a key component of its diversification strategy. In 2022, the Saudi government allocated SAR 50 billion to the General Entertainment Authority to support new projects and initiatives aimed at expanding the sector. These initiatives include the creation of 20 new entertainment zones across the kingdom by 2025, aiming to double the number of jobs in the sector to 100,000. The government's efforts are aimed at making Saudi Arabia a regional entertainment hub.

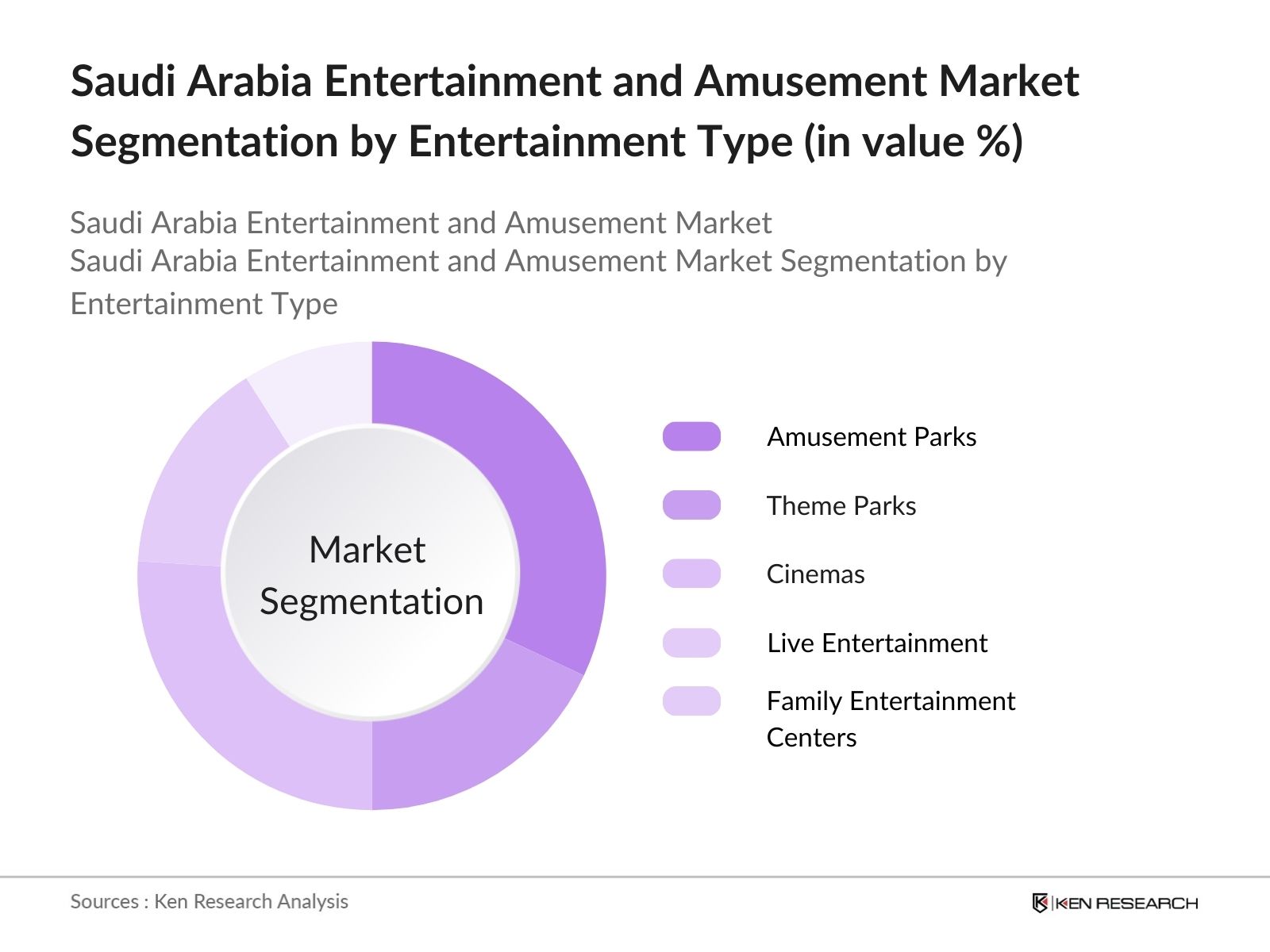

Saudi Arabia Entertainment and Amusement Market Segmentation

Saudi Arabia's entertainment market is segmented by entertainment type and by revenue streams.

- By Entertainment Type: Saudi Arabia's entertainment market is segmented into amusement parks, theme parks, cinemas, live entertainment (concerts, festivals, theatre), and family entertainment centers. Recently, amusement parks hold a dominant market share due to significant investments in infrastructure and the introduction of international entertainment brands. Mega-projects like Six Flags Qiddiya are spearheading the rise of this sub-segment, with increasing footfall driven by both local consumers and international tourists. Cinemas have also rapidly grown following the 2018 lifting of the cinema ban, with major chains like AMC and VOX Cinemas contributing to the segments expansion.

- By Revenue Stream: Revenue streams for the Saudi entertainment market include ticket sales, sponsorships, food and beverages, and merchandise. Ticket sales dominate this segmentation, accounting for a large portion of revenue, driven by high attendance at major events and attractions. The sponsorship segment is also seeing significant growth, with brands eager to associate themselves with entertainment projects, especially as the government continues to invest heavily in promoting entertainment as a key pillar of the economy.

Saudi Arabia Entertainment and Amusement Market Competitive Landscape

The Saudi Arabia entertainment market is dominated by a mix of local and international players. Local entities, particularly government-backed ventures, play a significant role in the industrys growth. The market consolidation is evident, with companies benefiting from large-scale projects and strategic partnerships. The consolidation of these players highlights their influence on the market, with partnerships between international and local firms driving significant investment into entertainment infrastructure.

Saudi Arabia Entertainment and Amusement Industry Analysis

Growth Drivers

- Government Investment through Vision 2030: The Saudi government has been channeling substantial funds into the entertainment sector under its Vision 2030 initiative. In 2022, the Saudi Entertainment Ventures Company (SEVEN) announced investments of approximately $3 billion in entertainment projects aimed at constructing theme parks, cinemas, and concert venues. These investments are part of broader efforts to diversify the economy and reduce oil dependency. As of 2024, public funds are expected to facilitate the creation of 100+ entertainment destinations across the kingdom, promoting local tourism and cultural engagement.

- Rise in Disposable Income: Between 2022 and 2024, Saudi Arabia's average household disposable income has seen a noticeable increase, with the General Authority for Statistics reporting an average household income of SAR 16,600 in 2023, up from SAR 15,200 in 2022. This rise in income has bolstered consumer spending on leisure and entertainment, resulting in a 20% higher allocation of household expenditure toward entertainment activities. This economic improvement is also facilitated by government reforms and subsidies aimed at raising living standards, driving more participation in local entertainment.

- Increasing Inbound Tourism: The Ministry of Tourism reported that Saudi Arabia welcomed over 16.5 million international visitors in 2023, compared to 14 million in 2022. The easing of visa regulations and the introduction of tourist e-visas have contributed to this rise. These visitors, particularly from Europe and Asia, are increasingly participating in leisure activities, including cultural festivals, amusement parks, and live events, driving demand for more entertainment infrastructure. Tourism is also supported by massive investments in hospitality, with over 10,000 new hotel rooms expected to be added by 2025.

Market Challenges

- Regulatory Constraints (Permit Acquisitions, Licensing Issues): The regulatory framework in Saudi Arabia presents significant challenges for new entrants in the entertainment sector. Acquiring permits for large-scale events, theme parks, and cinema operations remains a slow process, with the Saudi Ministry of Commerce reporting that it takes an average of 6-9 months to receive all necessary approvals. Furthermore, foreign companies face additional hurdles due to the strict licensing requirements, which include maintaining a 51% Saudi ownership in joint ventures, as mandated by government policies. This lengthy process limits the markets growth pace.

- High Operational Costs (Cost of Entertainment Infrastructure Development): The development of entertainment infrastructure, including theme parks, cinemas, and concert venues, faces high operational costs. For example, the cost of building a large-scale theme park such as SEVEN's project in Riyadh exceeds SAR 10 billion. Additionally, maintaining and staffing these facilities remains a challenge due to high labor costs and imported technologies, leading to elevated overhead expenses. These financial burdens can deter potential investors and slow the overall pace of infrastructure development, despite government efforts to incentivize investment.

Saudi Arabia Entertainment and Amusement Market Future Outlook

Over the next few years, the Saudi Arabia Entertainment and Amusement market is expected to experience continued growth driven by the government's commitment to Vision 2030. This includes ongoing infrastructure developments, increased tourism, and the growing demand for diverse entertainment options. The sectors expansion will also be fueled by advancements in technology, including virtual and augmented reality applications in theme parks and cinemas, further enhancing consumer experiences.

Market Opportunities

- Untapped Regions (Eastern Province, Northern Regions): Significant opportunities exist in the untapped regions of Saudi Arabia, particularly in the Eastern Province and Northern Regions, which have been relatively underserved by the entertainment industry. As of 2024, these regions host only 15% of the kingdom's entertainment infrastructure. The government has announced plans to invest SAR 1.5 billion in these areas to develop cinemas, cultural centers, and amusement parks, targeting a population of over 10 million residents. This regional development is expected to create thousands of jobs and attract more investment in the coming years.

- Growing Demand for Local and Cultural Entertainment: As of 2024, local demand for cultural entertainment has surged, particularly in cities like Jeddah and Riyadh, where local festivals and historical events attract large crowds. For example, the Diriyah Season 2023 saw over 2 million visitors, highlighting the growing interest in Saudi cultural heritage and historical tourism. This demand has encouraged local entrepreneurs to create culturally focused entertainment options, such as Saudi-themed restaurants and art exhibitions, which cater to both domestic and international audiences.

Scope of the Report

|

Amusement Parks Theme Parks Cinemas Live Entertainment Family Entertainment Centers |

|

|

By Age Group |

Children (0-12 Years) Teens (13-19 Years) Adults (20-45 Years) Senior Citizens (45+ Years) |

|

By Mode of Operation |

Indoor Entertainment Outdoor Entertainment |

|

By Revenue Stream |

Ticket Sales Sponsorships Food and Beverages Merchandise |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Saudi Ministry of Tourism, General Entertainment Authority)

Entertainment and Amusement Park Operators

Cinemas and Film Distribution Companies

International Entertainment Brands and Franchises

Real Estate Developers

Local Investors and Venture Capitalist Firms

Event Management and Promotion Companies

Technology Providers for VR/AR Amusement Solutions

Companies

Major Players in the Market

Saudi Entertainment Ventures (SEVEN)

AMC Entertainment

Majid Al Futtaim (VOX Cinemas)

Al Hokair Group

Cirque du Soleil

Six Flags (Qiddiya)

Wild Wadi

Dubai Parks and Resorts

KidZania Riyadh

Cinepolis

Meraas

Dubai Holding Entertainment

Tihama Advertising and Public Relations

Rotana Group

The Red Sea Development Company

Table of Contents

1. Saudi Arabia Entertainment and Amusement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Year-on-Year % Growth)

1.4. Market Segmentation Overview (Revenue Share by Key Segments)

2. Saudi Arabia Entertainment and Amusement Market Size (In USD Bn)

2.1. Historical Market Size (Analysis of Pre-Vision 2030 and Post-Vision 2030 Impact)

2.2. Year-on-Year Growth Analysis (Growth Rates by Sector: Amusement Parks, Cinemas, Theme Parks, Live Events)

2.3. Key Market Developments and Milestones (New Projects, Infrastructure Investment, Vision 2030 Initiatives)

3. Saudi Arabia Entertainment and Amusement Market Analysis

3.1. Growth Drivers

3.1.1. Government Investment through Vision 2030

3.1.2. Rise in Disposable Income

3.1.3. Increasing Inbound Tourism

3.1.4. Growing Interest in Leisure and Cultural Activities

3.2. Market Challenges

3.2.1. Regulatory Constraints (Permit Acquisitions, Licensing Issues)

3.2.2. High Operational Costs (Cost of Entertainment Infrastructure Development)

3.2.3. Lack of Skilled Workforce in Amusement Technologies

3.3. Opportunities

3.3.1. Untapped Regions (Eastern Province, Northern Regions)

3.3.2. Growing Demand for Local and Cultural Entertainment

3.3.3. International Collaborations (Partnerships with Global Entertainment Brands)

3.4. Trends

3.4.1. Development of Mega Entertainment Projects (NEOM, Qiddiya)

3.4.2. Integration of Technology in Entertainment (VR, AR, AI-based Amusement Solutions)

3.4.3. Growing Popularity of Live Entertainment and Music Festivals

3.5. Government Regulations

3.5.1. Vision 2030 Initiatives in Entertainment

3.5.2. Public-Private Partnerships (PPP) and Incentives

3.5.3. Regulations for Foreign Investments in Entertainment

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Public and Private Sector, International Collaborators)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Threat of Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Competitive Landscape, Key Players, and Market Share Analysis)

4. Saudi Arabia Entertainment and Amusement Market Segmentation

4.1. By Entertainment Type (Revenue Contribution)

4.1.1. Amusement Parks

4.1.2. Theme Parks

4.1.3. Cinemas

4.1.4. Live Entertainment (Concerts, Festivals, Theatre)

4.1.5. Family Entertainment Centers

4.2. By Age Group (In Value %)

4.2.1. Children (0-12 Years)

4.2.2. Teens (13-19 Years)

4.2.3. Adults (20-45 Years)

4.2.4. Senior Citizens (45+ Years)

4.3. By Mode of Operation (In Value %)

4.3.1. Indoor Entertainment

4.3.2. Outdoor Entertainment

4.4. By Revenue Stream (In Value %)

4.4.1. Ticket Sales

4.4.2. Sponsorships and Partnerships

4.4.3. Food and Beverages

4.4.4. Merchandise

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Makkah

4.5.5. Medina

5. Saudi Arabia Entertainment and Amusement Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (Business Strategy, Revenue, Key Projects)

5.1.1. Saudi Entertainment Ventures (SEVEN)

5.1.2. AMC Entertainment

5.1.3. Majid Al Futtaim

5.1.4. Cirque du Soleil

5.1.5. Al Hokair Group

5.1.6. Meraas

5.1.7. Dubai Parks and Resorts

5.1.8. Cinescape

5.1.9. Dubai Holding Entertainment

5.1.10. Wild Wadi

5.1.11. Six Flags (Qiddiya)

5.1.12. The Red Sea Project (TRSDC)

5.1.13. KidZania Riyadh

5.1.14. Cinepolis

5.1.15. Vox Cinemas

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Number of Entertainment Projects, Market Share, Technology Utilization, Partnerships)

5.3. Market Share Analysis (Revenue Contribution by Key Players)

5.4. Strategic Initiatives (New Investments, Diversification, Geographic Expansion)

5.5. Mergers and Acquisitions (Key Deals and Impact on Market)

5.6. Investment Analysis (Private Investment, Public-Private Partnerships)

5.7. Venture Capital Funding (Key Deals in Entertainment Startups)

5.8. Government Grants (Subsidies, Incentives for Local Players)

5.9. Private Equity Investments (Analysis of Major PE Investments)

6. Saudi Arabia Entertainment and Amusement Market Regulatory Framework

6.1. Entertainment Licensing Requirements

6.2. Tax Incentives for Foreign Entertainment Investment

6.3. Public Safety Standards (Security, Health, and Safety Regulations for Entertainment Venues)

7. Saudi Arabia Entertainment and Amusement Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Vision 2030, Infrastructure Development, Technology Integration)

8. Saudi Arabia Entertainment and Amusement Future Market Segmentation

8.1. By Entertainment Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Mode of Operation (In Value %)

8.4. By Revenue Stream (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Entertainment and Amusement Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Targeted Marketing Strategies, Social Media, Influencers)

9.4. White Space Opportunity Analysis (Untapped Market Regions and Segments)

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

This stage involves mapping out all the significant stakeholders in the Saudi Arabia Entertainment and Amusement Market. Desk research was conducted, leveraging secondary sources such as government reports and proprietary industry databases, to identify the variables influencing market dynamics, such as government policies, tourism trends, and consumer behavior.

Step 2: Market Analysis and Construction

Historical data was analyzed to assess the markets growth, taking into account the introduction of major projects like NEOM and the opening of cinemas. This phase also involved evaluating service quality statistics and customer satisfaction levels in amusement parks and cinemas, to estimate the market's revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through direct consultation with industry stakeholders via interviews. Input from experts at entertainment companies such as SEVEN, AMC, and VOX Cinemas was crucial in understanding the market's performance and growth trajectory.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all collected data and inputs from industry leaders, combining it with a bottom-up approach to produce the final market report. Direct feedback from local entertainment providers was incorporated to ensure the accuracy of data.

Frequently Asked Questions

01. How big is the Saudi Arabia Entertainment and Amusement Market?

The Saudi Arabia Entertainment and Amusement Market is valued at USD 2.22 billion, driven by large-scale government initiatives under Vision 2030 and increasing consumer demand for entertainment options.

02. What are the challenges in the Saudi Arabia Entertainment and Amusement Market?

Challenges in Saudi Arabia Entertainment and Amusement Market include regulatory hurdles, such as licensing and permit acquisition for entertainment ventures, high operational costs, and the scarcity of a skilled workforce trained in advanced entertainment technologies like virtual and augmented reality.

03. Who are the major players in the Saudi Arabia Entertainment and Amusement Market?

Key players in Saudi Arabia Entertainment and Amusement Market include Saudi Entertainment Ventures (SEVEN), AMC Entertainment, Majid Al Futtaim, Al Hokair Group, and Cirque du Soleil. These companies dominate the market due to their strong partnerships, government backing, and large-scale projects.

04. What are the growth drivers for the Saudi Arabia Entertainment and Amusement Market?

The Saudi Arabia Entertainment and Amusement Market is propelled by government investments through Vision 2030, increasing disposable incomes, a rising influx of tourists, and mega-projects like Qiddiya and NEOM, which are set to position Saudi Arabia as a global entertainment hub.

05. What are the key trends in the Saudi Arabia Entertainment and Amusement Market?

Key trends in Saudi Arabia Entertainment and Amusement Market include the development of mega-projects such as Qiddiya, the integration of virtual and augmented reality in amusement parks and cinemas, and a growing demand for live entertainment events like music festivals and cultural performances.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.