Saudi Arabia Freight and Logistics Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD10182

November 2024

95

About the Report

Saudi Arabia Freight and Logistics Market Overview

- The Saudi Arabia Freight and Logistics market is valued at USD 24 billion, reflecting a robust growth trajectory driven by the Kingdom's Vision 2030 initiatives. The significant focus on diversifying the economy away from oil dependency has propelled growth in the non-oil sectors, including logistics. Government investments in infrastructure, such as the expansion of ports, highways, and the development of special economic zones (SEZs), have further bolstered the market. E-commerce growth, coupled with the countrys strategic position as a logistical hub, continues to drive demand for freight and logistics services.

- Riyadh and Jeddah are the dominant cities in Saudi Arabias freight and logistics market. Riyadh's central location and proximity to key industrial hubs make it a crucial point for road freight, while Jeddah, with its strategic position along the Red Sea, serves as a vital maritime gateway. The modernization of Jeddah Islamic Port and the King Abdullah Port further enhances its logistics capabilities, ensuring it remains a key player in the regional and international shipping routes.

- Saudi Arabias Logistics Efficiency and Trade Facilitation Program, launched in 2022, aims to improve customs clearance procedures and reduce delays in cargo processing. The initiative seeks to reduce the time for import/export clearance to less than two days across all Saudi ports. By automating customs processes and enhancing coordination between government agencies, the program has already cut clearance times by 18% in 2023, improving overall trade efficiency and reducing logistics costs.

Saudi Arabia Freight and Logistics Market Segmentation

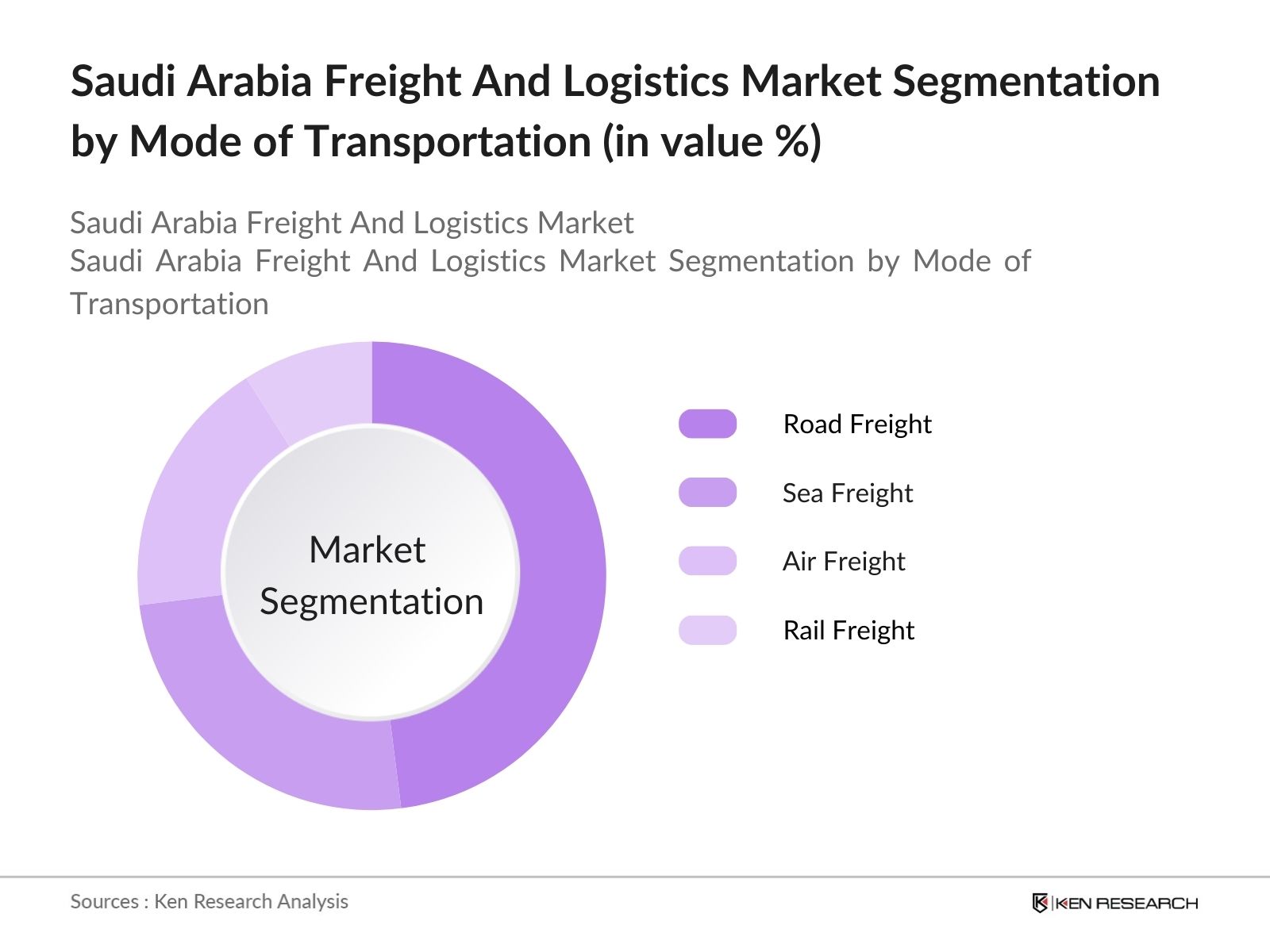

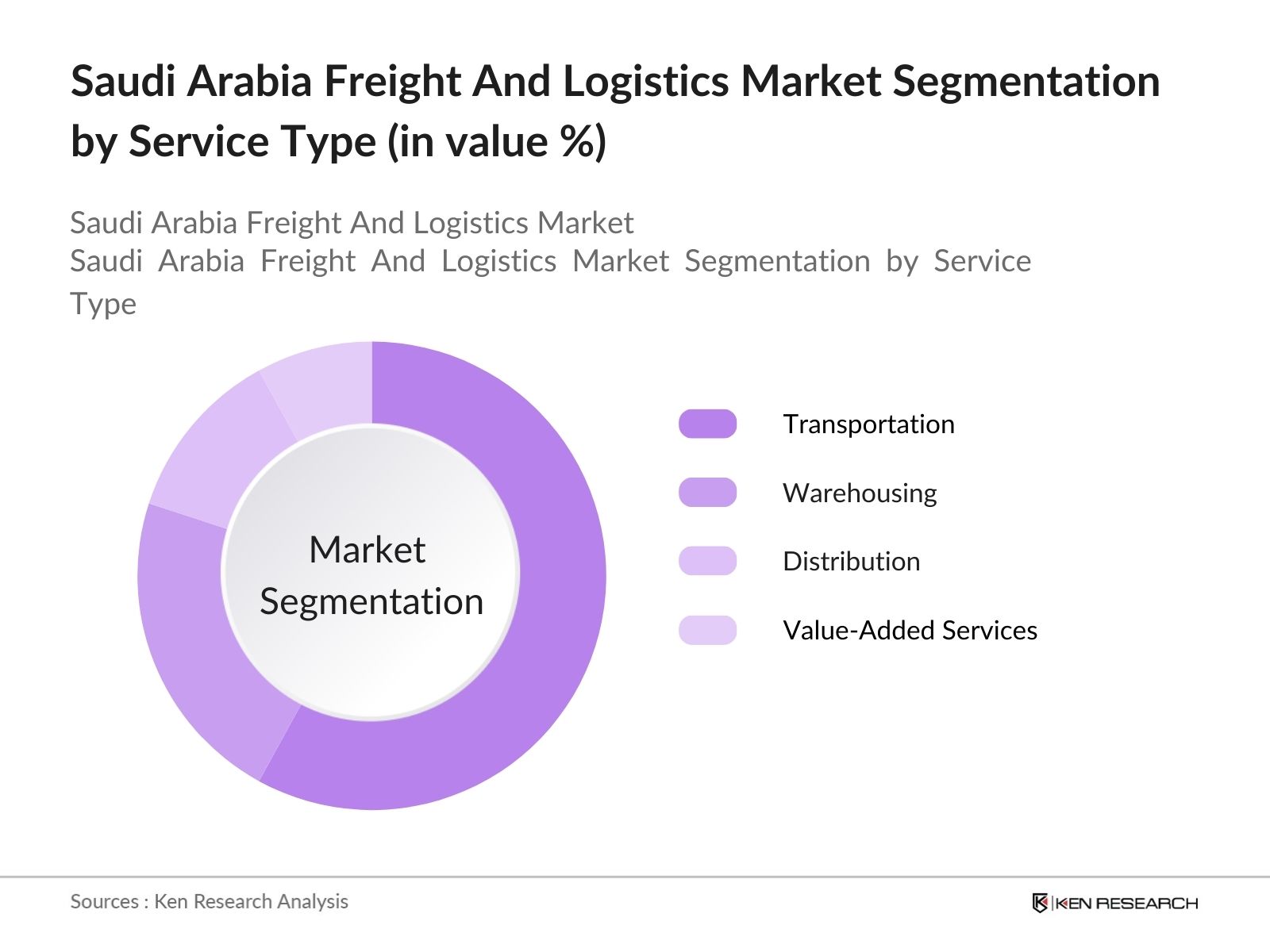

The Saudi Arabia Freight and Logistics market is segmented by mode of transportation and by service type.

- By Mode of Transportation: The Saudi Arabia Freight and Logistics market is segmented by mode of transportation into road freight, rail freight, air freight, and sea freight. Currently, road freight dominates the market, driven by Saudi Arabia's extensive network of highways that connect major industrial cities and remote areas. Road freight offers flexibility in transportation and supports the countrys growing retail and e-commerce industries, making it a preferred choice for domestic logistics. Additionally, ongoing infrastructure projects aim to further improve the efficiency and capacity of road freight transport.

- By Service Type: The Saudi Arabia Freight and Logistics market is also segmented by service type into transportation, warehousing, distribution, and value-added services. The transportation segment holds the dominant market share due to the high demand for the movement of goods across the country. The rise of e-commerce has intensified the need for efficient transportation services, particularly last-mile delivery solutions. Warehousing, on the other hand, is witnessing rapid growth as businesses expand their storage capacity to cater to the increasing volume of goods in transit, driven by both domestic demand and export activities.

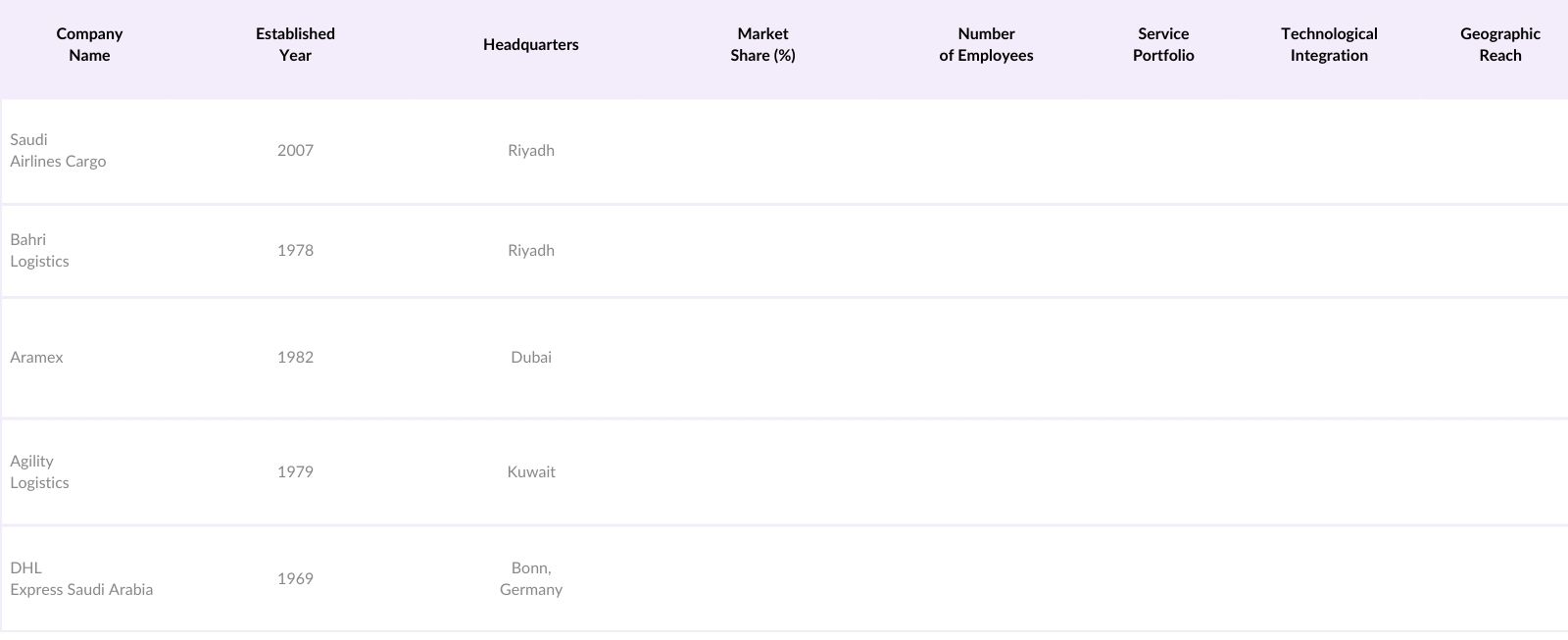

Saudi Arabia Freight and Logistics Market Competitive Landscape

The Saudi Arabia Freight and Logistics market is dominated by both local and international players. The market remains highly competitive, with several companies focusing on expanding their service offerings and investing in technology to improve operational efficiency. The consolidation of logistics firms and strategic alliances between global and local players is also a key trend. The following table outlines key competitors and their market-specific attributes. The consolidation of the market around key players, both local (Saudi Airlines Cargo, Bahri) and international (DHL, Aramex), highlights the competitive intensity. These companies are investing heavily in digital technologies to optimize their services and reduce costs, which is critical in the context of fluctuating fuel prices and customer demand for faster deliveries.

Saudi Arabia Freight and Logistics Market Analysis

Growth Drivers

- Economic Diversification (Vision 2030): Saudi Arabia's Vision 2030 is a strategic framework aimed at reducing the country's dependency on oil by diversifying its economy. As part of this plan, the non-oil sector accounted for 59.3% of the GDP by 2023, showing a clear shift towards industrialization and services, including logistics. The National Industrial Development and Logistics Program (NIDLP) has facilitated investments in transport and logistics, allocating SAR 135 billion for various projects, including enhancing freight and logistics capacity across the country. This push aligns with the goal of increasing the contribution of non-oil exports to SAR 665 billion by 2030.

- Expansion of Non-oil Sectors: The non-oil sector in Saudi Arabia has seen significant growth, with industries such as manufacturing, mining, and tourism expanding. Non-oil exports grew by SAR 43 billion in the first half of 2023 alone, driven by increased production capacity and infrastructural investments in logistics. The logistics sector, tied closely to these growing industries, has benefited from the development of specialized industrial zones and improved trade networks, positioning Saudi Arabia as a regional logistics hub. The Saudi government aims to enhance these sectors share of the economy, leveraging its strategic location to boost regional trade routes.

- Trade Agreements and Partnerships: Saudi Arabia has actively pursued bilateral and multilateral trade agreements to facilitate trade flows and boost its logistics market. The recent Comprehensive Economic Partnership Agreement (CEPA) between Saudi Arabia and key Asian countries has significantly reduced trade barriers, enabling smoother goods movement. In 2022, Saudi exports to its largest trading partner, China, reached SAR 205 billion, driven by stronger trade ties. Additionally, the Saudi-Singapore partnership on smart logistics solutions and cross-border trade facilitation is expected to enhance efficiency within the logistics sector, with the Saudi market now benefiting from more seamless global integration.

Market Challenges

- Regulatory Complexities: Despite efforts to streamline business operations, regulatory challenges in the logistics sector remain. Navigating Saudi Arabias complex customs and import procedures can significantly increase lead times for companies. A 2023 World Bank report highlighted that import clearance in Saudi Arabia averages 8-12 days, longer than in neighboring countries. While reforms under Vision 2030 are underway to reduce regulatory bottlenecks, inconsistencies in regional regulations and licensing processes remain hurdles for companies operating in the freight and logistics sector.

- Infrastructure Bottlenecks: Saudi Arabia's infrastructure, particularly in logistics, is still developing, with certain bottlenecks hindering growth. A report by the Saudi Ports Authority in 2023 revealed that 30% of the nations ports still face congestion issues, with the Jeddah Islamic Port operating at over 90% capacity. This congestion impacts delivery timelines and increases operational costs. Despite investments in port expansions, the logistics sector requires further improvements in road and rail networks to better connect ports to industrial zones, reducing transit delays.

Saudi Arabia Freight and Logistics Market Future Outlook

Over the next five years, the Saudi Arabia Freight and Logistics market is poised for significant growth, driven by continued government support, advancements in logistics technology, and rising demand from e-commerce and industrial sectors. The Kingdom's ambition to become a global logistics hub, as outlined in Vision 2030, will further stimulate infrastructure development, including modernized ports, new freight corridors, and increased capacity in warehousing and distribution networks. Companies that adapt to digital transformation, automation, and sustainable practices will be well-positioned to thrive in this evolving market.

Market Opportunities

- Government Investments in Logistics Hubs: In alignment with Vision 2030, the Saudi government has invested SAR 50 billion to develop logistics hubs across the country. This includes the expansion of King Salman Energy Park and the establishment of several logistics zones near key industrial areas. These hubs are designed to streamline the movement of goods, enhance warehousing capacities, and provide centralized processing for import and export activities. These investments will serve to position Saudi Arabia as a key logistics hub between Europe, Asia, and Africa, making it an attractive location for international logistics companies.

- Port Expansion and Modernization Projects: Saudi Arabia has prioritized the expansion and modernization of its ports as part of its efforts to become a global logistics center. By 2024, the country aims to increase the capacity of its ports to handle over 40 million containers annually, compared to the current capacity of 10 million containers. A SAR 10 billion investment into modernizing the Jeddah Islamic Port and the Dammam King Abdulaziz Port will enhance handling capabilities and reduce congestion, allowing faster goods flow through the countrys key maritime gateways.

Scope of the Report

|

||

|

By Service Type |

Transportation Warehousing Distribution Value-Added Services |

|

|

By End-User Industry |

|

|

|

By Logistics Type |

|

|

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Saudi Ports Authority, Ministry of Transport)

Investors and Venture Capitalist Firms

Logistics Service Providers

E-commerce Companies

Manufacturers (Automotive, Consumer Goods, Pharmaceuticals)

Retailers (Large-scale retail and grocery chains)

Technology Providers (IoT, automation in logistics)

Cold Chain Service Providers

Companies

Players Mention in the report:

Saudi Airlines Cargo Company

Bahri Logistics

Aramex

Agility Logistics

Almajdouie Logistics

DHL Express Saudi Arabia

United Parcel Service (UPS)

Al-Futtaim Logistics

FedEx Saudi Arabia

Kuehne + Nagel

CEVA Logistics

DB Schenker

Hellmann Worldwide Logistics

Panalpina

GAC Saudi Arabia

Table of Contents

1. Saudi Arabia Freight and Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers

1.4. Market Segmentation Overview

2. Saudi Arabia Freight and Logistics Market Size (In SAR Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Freight and Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Economic Diversification (Vision 2030)

3.1.2. Expansion of Non-oil Sectors

3.1.3. Trade Agreements and Partnerships

3.1.4. Rising E-commerce and Digital Platforms

3.2. Market Challenges

3.2.1. Regulatory Complexities

3.2.2. Infrastructure Bottlenecks

3.2.3. High Operational Costs

3.3. Opportunities

3.3.1. Government Investments in Logistics Hubs

3.3.2. Port Expansion and Modernization Projects

3.3.3. Technological Integration (Automation, IoT)

3.4. Trends

3.4.1. Shift Towards Green Logistics

3.4.2. Smart Warehousing Solutions

3.4.3. Cold Chain Logistics Demand Increase

3.5. Government Regulation

3.5.1. Logistics Efficiency and Trade Facilitation Program

3.5.2. Saudi Ports Authority Regulations

3.5.3. Vision 2030 Regulatory Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Retailers)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape and Ecosystem

4. Saudi Arabia Freight and Logistics Market Segmentation

4.1. By Mode of Transportation (In Value %)

4.1.1. Road Freight

4.1.2. Rail Freight

4.1.3. Air Freight

4.1.4. Sea Freight

4.2. By Service Type (In Value %)

4.2.1. Transportation

4.2.2. Warehousing

4.2.3. Distribution

4.2.4. Value-Added Services

4.3. By End-User Industry (In Value %)

4.3.1. Retail and FMCG

4.3.2. Oil and Gas

4.3.3. Manufacturing

4.3.4. Pharmaceuticals

4.4. By Geography (In Value %)

4.4.1. North

4.4.2. East

4.4.3. West

4.4.4. South

4.5. By Logistics Type (In Value %)

4.5.1. Third-Party Logistics (3PL)

4.5.2. Fourth-Party Logistics (4PL)

5. Saudi Arabia Freight and Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Saudi Airlines Cargo Company

5.1.2. Bahri Logistics

5.1.3. Aramex

5.1.4. Agility Logistics

5.1.5. Almajdouie Logistics

5.1.6. DHL Express Saudi Arabia

5.1.7. United Parcel Service (UPS)

5.1.8. Al-Futtaim Logistics

5.1.9. FedEx Saudi Arabia

5.1.10. Kuehne + Nagel

5.1.11. CEVA Logistics

5.1.12. DB Schenker

5.1.13. Hellmann Worldwide Logistics

5.1.14. Panalpina

5.1.15. GAC Saudi Arabia

5.2. Cross-Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue

5.2.3. Geographic Presence

5.2.4. Number of Employees

5.2.5. Service Portfolio

5.2.6. Strategic Partnerships

5.2.7. Technological Integration

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

6. Saudi Arabia Freight and Logistics Market Regulatory Framework

6.1. Trade Policies and Customs Regulations

6.2. Compliance Standards for Freight Handling

6.3. Certification and Licensing Requirements

7. Saudi Arabia Freight and Logistics Future Market Size (In SAR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Saudi Arabia Freight and Logistics Future Market Segmentation

8.1. By Mode of Transportation (In Value %)

8.2. By Service Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Geography (In Value %)

8.5. By Logistics Type (In Value %)

9. Saudi Arabia Freight and Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Target Market Entry Strategies

9.3. Investment and Expansion Recommendations

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step focuses on identifying key variables that impact the Saudi Arabia Freight and Logistics market. This is achieved through a combination of desk research and interviews with industry stakeholders, including service providers, manufacturers, and regulatory bodies.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed, including growth in freight volume, infrastructure investments, and technological advancements. This helps establish a solid foundation for forecasting market trends and revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses related to demand patterns, logistics network expansion, and competitive strategies are validated through interviews with logistics professionals. Their insights provide valuable input into the reliability of the data.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from various sources, including government publications, financial reports, and interviews. The aim is to provide an in-depth, accurate analysis of the market, which is presented in a clear, actionable format for stakeholders.

Frequently Asked Questions

01. How big is the Saudi Arabia Freight and Logistics Market?

The Saudi Arabia Freight and Logistics market is valued at USD 24 billion. It is driven by government infrastructure projects and the Kingdom's strategic location as a global logistics hub.

02. What are the challenges in the Saudi Arabia Freight and Logistics Market?

Challenges in The Saudi Arabia Freight and Logistics market include regulatory complexities, high operational costs, and infrastructure limitations in certain regions, which impact the efficiency of freight movement.

03. Who are the major players in the Saudi Arabia Freight and Logistics Market?

Key players in The Saudi Arabia Freight and Logistics market include Saudi Airlines Cargo, Bahri Logistics, Aramex, Agility Logistics, and DHL Express Saudi Arabia. These companies dominate due to their extensive service portfolios and strategic investments in technology.

04. What are the growth drivers of the Saudi Arabia Freight and Logistics Market?

Growth drivers in The Saudi Arabia Freight and Logistics market include the expansion of e-commerce, government investments in infrastructure (ports, highways), and advancements in logistics technologies such as automation and IoT.

05. What trends are shaping the Saudi Arabia Freight and Logistics Market?

Key trends in The Saudi Arabia Freight and Logistics market include the adoption of green logistics practices, the rise of smart warehousing, and increasing demand for cold chain logistics to support the pharmaceutical and food industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.