Saudi Arabia Fresh Fruits Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD8147

November 2024

93

About the Report

Saudi Arabia Fresh Fruits Market Overview

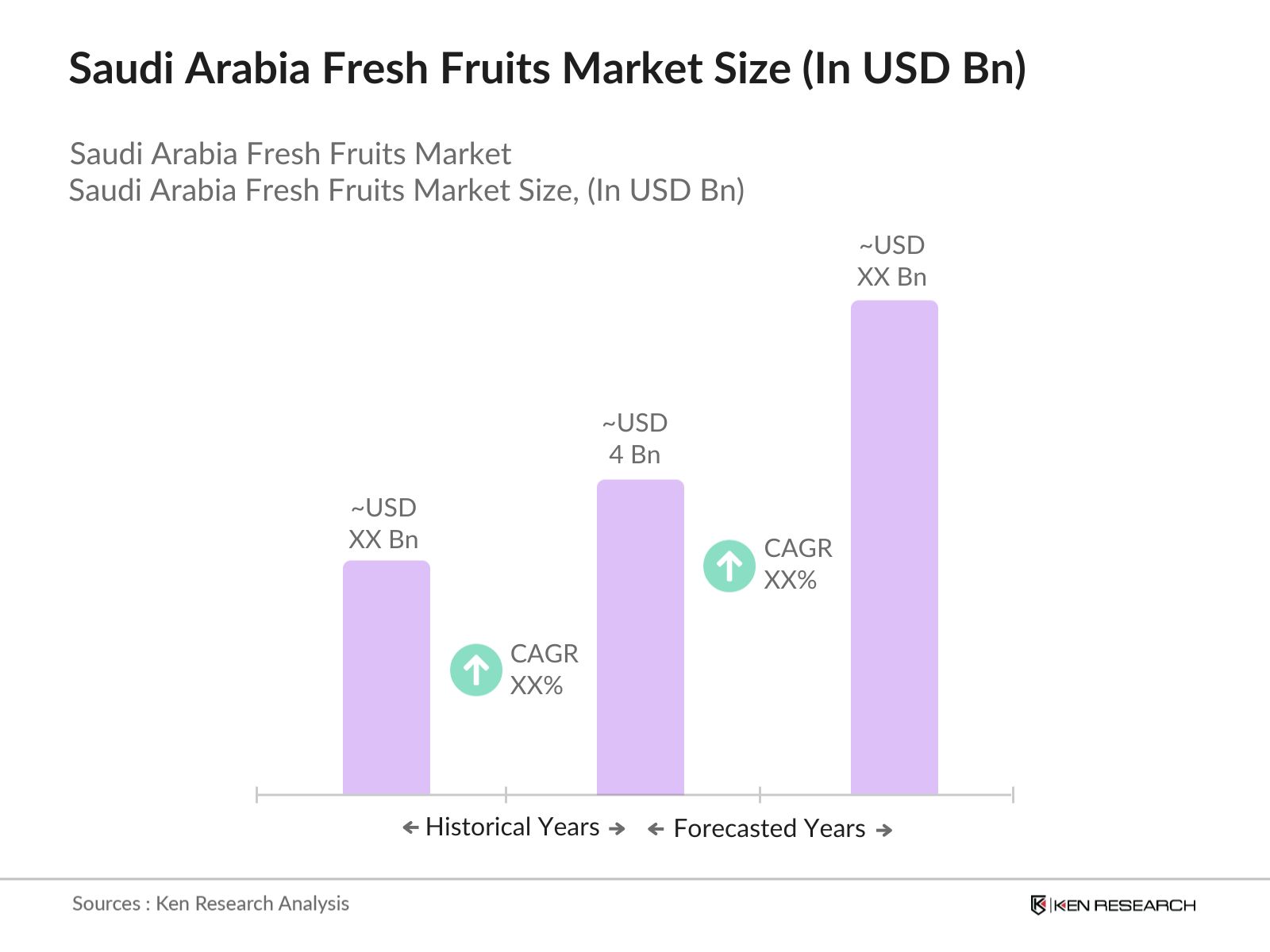

- The Saudi Arabia Fresh Fruits Market is valued at USD 4 billion, driven by rising demand for healthy, fresh produce among the growing population and an increasing awareness of the benefits of a healthy lifestyle. The demand is further bolstered by the expansion of urbanization, which has created a thriving retail sector offering fresh fruit options to consumers. This market is expected to continue benefiting from government initiatives promoting agriculture, such as investments in water-efficient farming technologies and incentives for local farmers.

- In terms of regional dominance, Riyadh and Jeddah are key cities that contribute significantly to the Saudi fresh fruits market. These cities dominate due to their large population centers, high income levels, and strong infrastructure, allowing for the smooth distribution of imported and locally grown fresh fruits. Additionally, these urban areas are home to large supermarket chains and hypermarkets that cater to a broad consumer base seeking premium fresh fruit options, making them pivotal in driving market consumption.

- Saudi Arabias agricultural development plans, under Vision 2030, aim to reduce the Kingdoms reliance on imported fruits and boost local production. In 2023, the government allocated SAR 2 billion to support the cultivation of fresh fruits through initiatives such as improved irrigation systems and technological upgrades for farmers. These efforts are part of a broader strategy to enhance food security and increase self-sufficiency in fresh fruit production.

Saudi Arabia Fresh Fruits Market Segmentation

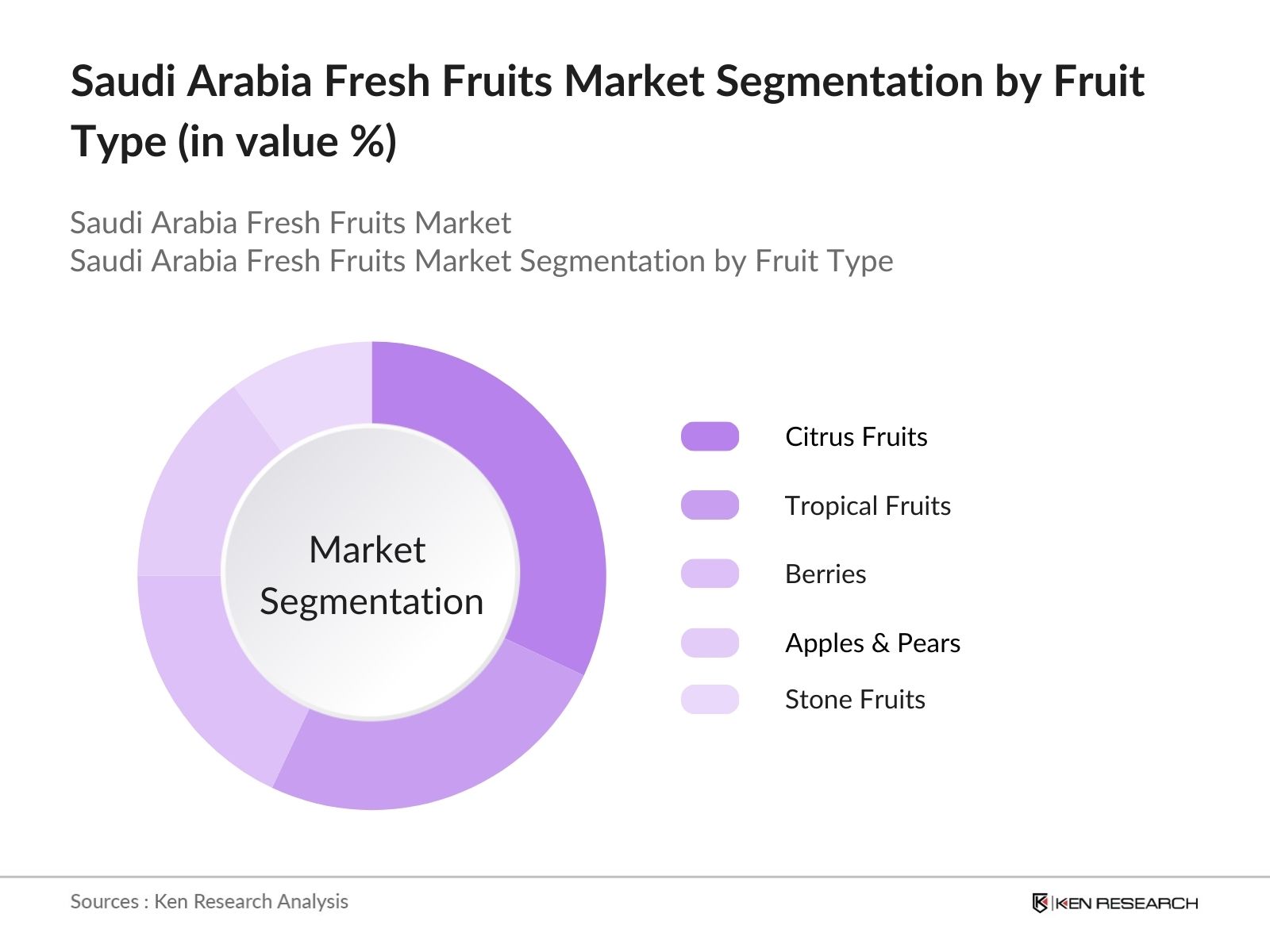

By Fruit Type: The market is segmented by fruit type into Citrus Fruits, Tropical Fruits, Berries, Apples and Pears, and Stone Fruits. Recently, Citrus Fruits have dominated the market due to their strong consumer preference for oranges, lemons, and other citrus varieties, which are rich in vitamin C and are perceived as immunity-boosting. The hot climate of Saudi Arabia makes these fruits highly desirable for their refreshing qualities, and they are widely available across retail outlets, making them a staple in many households.

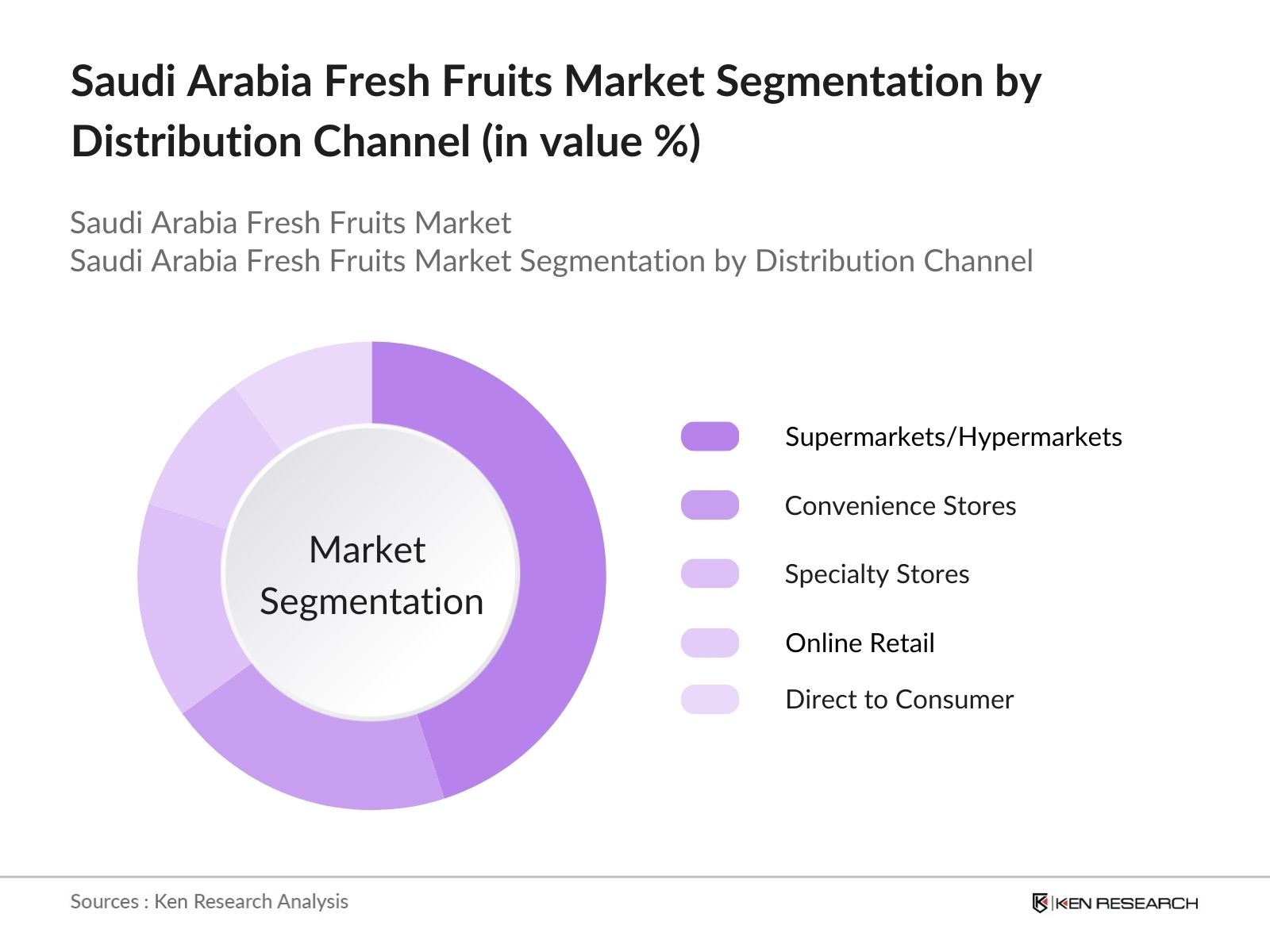

By Distribution Channel: The market is segmented by distribution channel into Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Direct to Consumer. Supermarkets/Hypermarkets hold the dominant market share, thanks to their extensive reach, convenience for shoppers, and the wide variety of fresh fruits they offer. Consumers in Saudi Arabia prefer purchasing their fruits from these retail outlets due to their consistent availability, promotional offers, and high-quality produce.

Saudi Arabia Fresh Fruits Market Competitive Landscape

The Saudi Arabia fresh fruits market is competitive, with several local and international players contributing to the supply chain. Key companies focus on expanding their distribution networks, ensuring the freshness of their produce, and offering organic and exotic fruit options to meet growing consumer demand. The competitive landscape is shaped by a few major players that dominate the market through strategic partnerships, strong brand presence, and innovative farming technologies.

|

Company |

Established |

Headquarters |

Product Range |

Revenue (2023) |

No. of Employees |

Global Reach |

Local Market Share |

Distribution Network |

|

Del Monte Foods |

1886 |

USA |

||||||

|

Almarai Co. |

1977 |

Saudi Arabia |

||||||

|

Saudi Agricultural & Livestock Investment Co. (SALIC) |

2009 |

Saudi Arabia |

||||||

|

Sunbulah Group |

1980 |

Saudi Arabia |

||||||

|

Lulu Group International |

2000 |

UAE |

Saudi Arabia Fresh Fruits Industry Analysis

Market Growth Drivers

- Rise in Health-Conscious Consumers: The rise in health-conscious consumers in Saudi Arabia has significantly boosted the fresh fruit market. As of 2024, approximately 41% of the Saudi population prioritizes healthier food options, especially fresh fruits, in their diet, driven by increasing concerns about lifestyle diseases such as diabetes and heart ailments. Fresh fruits such as apples, bananas, and citrus have become staple choices among these consumers. This trend is further supported by government initiatives encouraging healthier eating habits to combat the national obesity rate of 35.4% in 2023, emphasizing the role of fruits in promoting a balanced diet.

- Increased Demand for Organic Fresh Fruits: The demand for organic fresh fruits in Saudi Arabia has surged, driven by consumers' growing awareness of the environmental impact of farming practices and health benefits associated with organic products. The Saudi Organic Farming Policy launched in 2022, which offers subsidies to local farmers transitioning to organic practices, has resulted in a 15% increase in organic fruit production by 2024. The Kingdom's consumers are now spending more on organic apples, dates, and grapes, with imports of organic produce from countries like Egypt and the UAE also rising to meet this demand.

- Growing Disposable Income: Growing disposable income has directly contributed to increased consumption of fresh fruits in Saudi Arabia. In 2024, the average annual household income is projected to exceed SAR 148,000, up from SAR 136,000 in 2022. This rise in income, combined with urbanization, has led to higher spending on quality fresh produce, especially among middle-income families in Riyadh and Jeddah. As consumers' purchasing power grows, premium fruits like berries, avocados, and mangos have become more accessible, driving market expansion.

Market Challenges

- Climate-Dependent Yield Variations: Saudi Arabia's agricultural sector is highly vulnerable to climatic conditions, and fresh fruit yields often fluctuate due to extreme temperatures. In 2023, the average summer temperature in Riyadh exceeded 46C, leading to a 7% decline in local fruit production compared to 2022. This climatic unpredictability significantly impacts the supply of locally produced fruits like dates and citrus, increasing the dependency on imports to meet domestic demand.

- Water Resource Limitations: Water scarcity remains one of the most pressing challenges for Saudi Arabias fresh fruit market, with agriculture accounting for 84% of the Kingdom's water consumption. Due to the limited availability of renewable freshwater sources, fruit cultivation relies heavily on groundwater and desalination, which increases production costs. By 2024, groundwater extraction rates were projected to surpass 23 billion cubic meters annually, straining the agricultural sector's sustainability and limiting local fruit production capacity.

Saudi Arabia Fresh Fruits Market Future Outlook

Over the next five years, the Saudi Arabia Fresh Fruits Market is expected to witness steady growth driven by the continuous rise in consumer awareness regarding health benefits, the availability of fresh and organic fruits, and government support aimed at bolstering local agricultural production. Advancements in technology, such as water-efficient farming and precision agriculture, will also play a significant role in sustaining the domestic supply of fresh fruits while reducing import dependency. The market is likely to see increased investments in organic farming and sustainable practices as consumer preferences shift towards healthier and eco-friendly options.

Market Opportunities

- Advancements in Precision Agriculture: Technological innovations such as precision agriculture offer substantial opportunities for boosting fresh fruit yields in Saudi Arabia. As of 2024, the Kingdom has begun implementing satellite-based monitoring systems and automated irrigation to optimize water usage and improve crop health. By integrating these technologies, farms have reported a 12% increase in fruit yields, particularly for water-intensive crops like citrus and grapes. These advancements reduce dependency on imports and help local producers scale up operations.

- Rising Investments in Controlled Environment Agriculture: Controlled Environment Agriculture (CEA), including greenhouses and vertical farming, is gaining traction in Saudi Arabia to address the challenges posed by harsh climatic conditions. In 2023, the government allocated SAR 1.5 billion in subsidies and investments to CEA projects, leading to a 20% increase in local production of high-demand fruits like strawberries and tomatoes. CEA technologies allow for year-round cultivation and reduced water usage, which is critical for sustainable growth in the fresh fruit sector.

Scope of the Report

|

||

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Direct to Consumer |

|

|

By Farming Method |

Conventional Farming Organic Farming Hydroponic Farming Vertical Farming |

|

|

By Consumer Type |

Retail Consumers Institutional Buyers Exporters |

|

|

By Region |

North East West South |

Products

Key Target Audience

Retail Supermarkets/Hypermarkets

Convenience Stores Chains

Online Retailers

Wholesale Distributors

Hotels, Restaurants, and Cafes (HORECA)

Investors and Venture Capitalist Firms

Government Agencies (Ministry of Environment, Water and Agriculture)

Regulatory Bodies (Saudi Food and Drug Authority)

Banks and Financial Institutes

Companies

Saudi Arabia Fresh Fruits Market Major Players

Del Monte Foods

Almarai Co.

Saudi Agricultural & Livestock Investment Co. (SALIC)

Sunbulah Group

Lulu Group International

Nadec Group

Olam International

Panda Retail Company

Fonterra

Hassad Food

Al Watania Agriculture Co.

Savola Group

Mahaseel Agricultural Co.

Dole Food Company

Carrefour Group

Table of Contents

1. Saudi Arabia Fresh Fruits Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Fresh Fruits Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Fresh Fruits Market Analysis

3.1. Growth Drivers (Urbanization, Population Growth, Health Consciousness, Consumer Preferences)

3.1.1. Rise in Health-Conscious Consumers

3.1.2. Increased Demand for Organic Fresh Fruits

3.1.3. Growing Disposable Income

3.1.4. Expansion of Distribution Networks

3.2. Market Challenges (Water Scarcity, Climatic Conditions, Import Dependence, High Logistics Costs)

3.2.1. Climate-Dependent Yield Variations

3.2.2. Water Resource Limitations

3.2.3. High Import Dependency

3.2.4. Supply Chain and Distribution Issues

3.3. Opportunities (Technological Innovations, Investments in Agri-Tech, Government Support)

3.3.1. Advancements in Precision Agriculture

3.3.2. Rising Investments in Controlled Environment Agriculture

3.3.3. Opportunities in Fresh Fruit Exports

3.4. Trends (Organic and Exotic Fruits, Sustainable Farming Practices)

3.4.1. Increased Consumer Preference for Organic Fruits

3.4.2. Emergence of Exotic Fruits as a Premium Segment

3.4.3. Adoption of Sustainable and Water-Efficient Farming Practices

3.5. Government Regulations (Agricultural Policies, Import-Export Regulations, Subsidies for Local Farmers)

3.5.1. National Agricultural Development Plans

3.5.2. Fresh Fruit Import Quotas and Tariffs

3.5.3. Subsidies and Incentives for Domestic Producers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Saudi Arabia Fresh Fruits Market Segmentation

4.1. By Fruit Type (In Value %)

4.1.1. Citrus Fruits

4.1.2. Tropical Fruits

4.1.3. Berries

4.1.4. Apples and Pears

4.1.5. Stone Fruits

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Specialty Stores

4.2.4. Online Retail

4.2.5. Direct to Consumer

4.3. By Farming Method (In Value %)

4.3.1. Conventional Farming

4.3.2. Organic Farming

4.3.3. Hydroponic Farming

4.3.4. Vertical Farming

4.4. By Consumer Type (In Value %)

4.4.1. Retail Consumers

4.4.2. Institutional Buyers (Hotels, Restaurants, etc.)

4.4.3. Exporters

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Fresh Fruits Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Del Monte Foods

5.1.2. Saudi Agricultural and Livestock Investment Company (SALIC)

5.1.3. Almarai Co.

5.1.4. Nadec Group

5.1.5. Sunbulah Group

5.1.6. Lulu Group International

5.1.7. Al-Kabeer Group

5.1.8. Arabian Agricultural Services Company (ARASCO)

5.1.9. Panda Retail Company

5.1.10. Fonterra

5.1.11. Hassad Food

5.1.12. Al Watania Agriculture Co.

5.1.13. Savola Group

5.1.14. Mahaseel Agricultural Co.

5.1.15. Olam International

5.2. Cross Comparison Parameters (Revenue, Market Share, Geographical Presence, Product Portfolio, Certifications, Production Capacities, Sustainability Practices, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Fresh Fruits Market Regulatory Framework

6.1. Food Safety and Quality Standards

6.2. Import-Export Regulations

6.3. Certification Processes for Organic Products

7. Saudi Arabia Fresh Fruits Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Fresh Fruits Future Market Segmentation

8.1. By Fruit Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Farming Method (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Fresh Fruits Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of the Saudi Arabia Fresh Fruits Market. Comprehensive desk research is conducted to gather data on stakeholders, consumer behavior, distribution channels, and farming techniques. A combination of primary and secondary sources is used to identify key market variables affecting demand and supply.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to understand trends and market penetration levels within Saudi Arabia. Special emphasis is placed on the integration of supply chain data, logistical infrastructure, and government agricultural policies. The goal is to construct a comprehensive view of the market's performance and its economic impact.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through interviews with stakeholders, including fruit producers, retailers, and importers. These consultations offer real-time insights into consumer preferences, challenges in distribution, and trends in fresh fruit consumption.

Step 4: Research Synthesis and Final Output

In this final stage, data from all research phases is synthesized to produce a comprehensive report. The results are corroborated by direct engagement with key market players, ensuring that the final output is reliable and actionable for business professionals in the Saudi fresh fruits industry.

Frequently Asked Questions

01. How big is Saudi Arabia Fresh Fruits Market?

The Saudi Arabia fresh fruits market is valued at USD 4 billion. This is driven by increasing consumer health consciousness, government investments in agriculture, and the growing demand for organic produce.

02. What are the challenges in Saudi Arabia Fresh Fruits Market?

Challenges in this Saudi Arabia fresh fruits market include water scarcity, high logistics costs, and the heavy dependence on imports to meet local demand. Climatic conditions also play a significant role in affecting local production yields.

03. Who are the major players in the Saudi Arabia Fresh Fruits Market?

Key players in the Saudi Arabia fresh fruits market include Del Monte Foods, Almarai Co., Saudi Agricultural & Livestock Investment Co. (SALIC), Sunbulah Group, and Lulu Group International. These companies dominate through their extensive distribution networks and strong retail presence.

04. What are the growth drivers of Saudi Arabia Fresh Fruits Market?

Growth drivers in Saudi Arabia fresh fruits market include rising urbanization, increased disposable income, growing health awareness among consumers, and government initiatives to boost local agricultural production through technological innovations.

05. What are the trends in Saudi Arabia Fresh Fruits Market?

Key trends in Saudi Arabia fresh fruits market include the increasing demand for organic and exotic fruits, the adoption of sustainable farming practices, and the growing preference for fresh over processed fruits in the retail market. Additionally, advancements in water-efficient farming technologies are shaping the future of local production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.