Saudi Arabia Frozen and Retail Bakery Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD2580

December 2024

94

About the Report

Saudi Arabia Frozen and Retail Bakery Market Overview

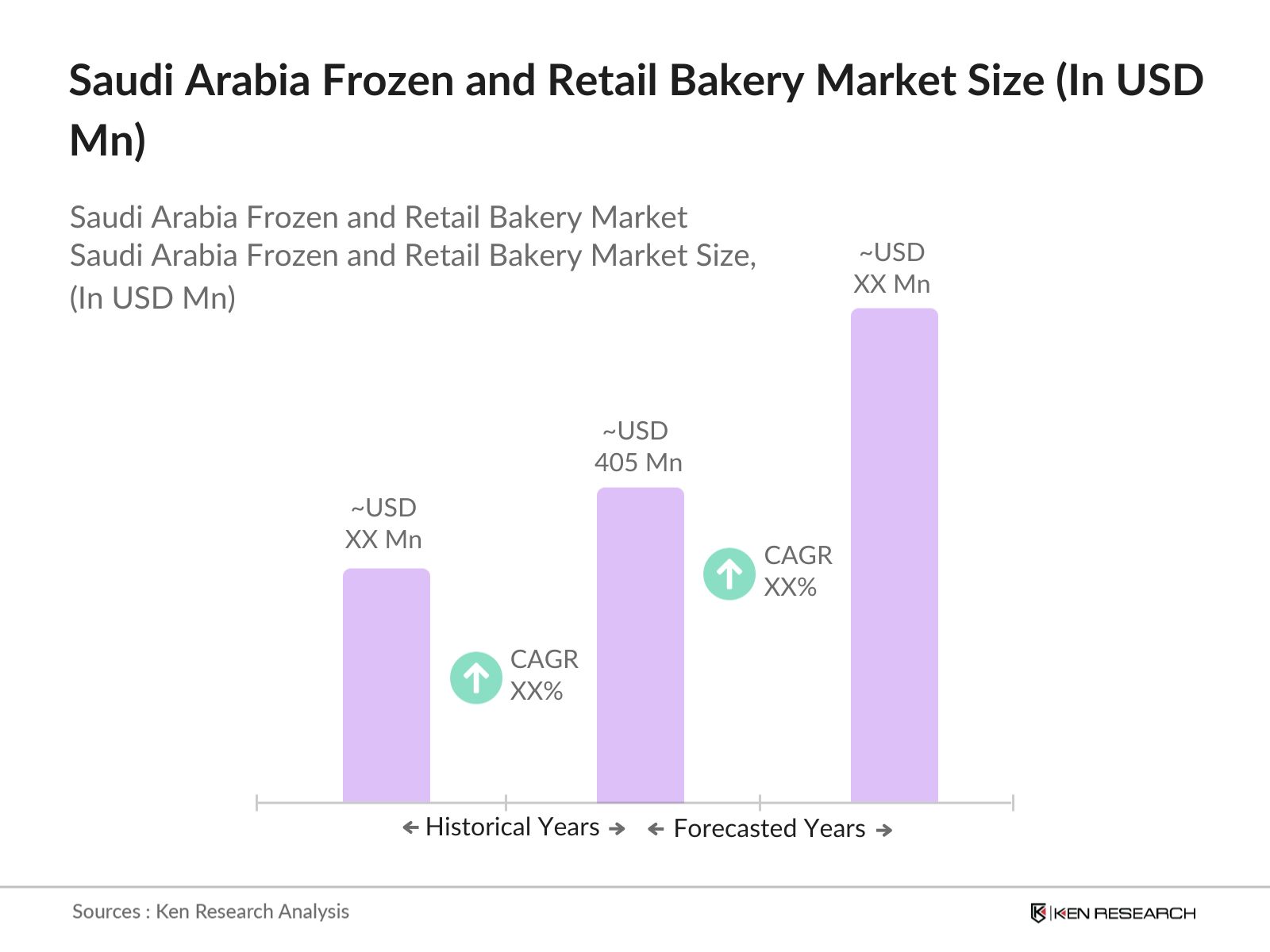

- The Saudi Arabia frozen and retail bakery market is valued at USD 405 million, driven by an increasing demand for convenient food options and a growing number of health-conscious consumers preferring ready-to-eat bakery products. The rise in disposable income, coupled with expanding urbanization, has also fueled market growth, as more consumers seek affordable yet high-quality baked goods in both frozen and fresh categories. The markets development is supported by the modernization of retail infrastructure and technological advancements in food storage, enabling extended shelf life without compromising quality.

- Riyadh and Jeddah are dominant in the Saudi bakery market, largely due to their high population density and extensive retail networks that cater to both domestic consumers and the thriving tourism sector. These cities benefit from well-established supply chains and a wide array of distribution channels, including supermarkets, specialty stores, and bakeries that provide a comprehensive range of bakery items. The demand in these urban centers is also propelled by a diverse expatriate population with a high consumption of bakery products, thus driving overall market expansion.

- The Saudi Standards, Metrology, and Quality Organization (SASO) enforces strict food safety standards across all bakery products sold in Saudi Arabia. In 2024, SASO introduced enhanced inspection protocols to ensure compliance, impacting bakery production timelines and import approvals. These regulations prioritize consumer safety, requiring bakery producers to maintain high standards, which influences production processes and costs within the market.

Saudi Arabia Frozen and Retail Bakery Market Segmentation

The Saudi bakery market is segmented by product type and by distribution channel.

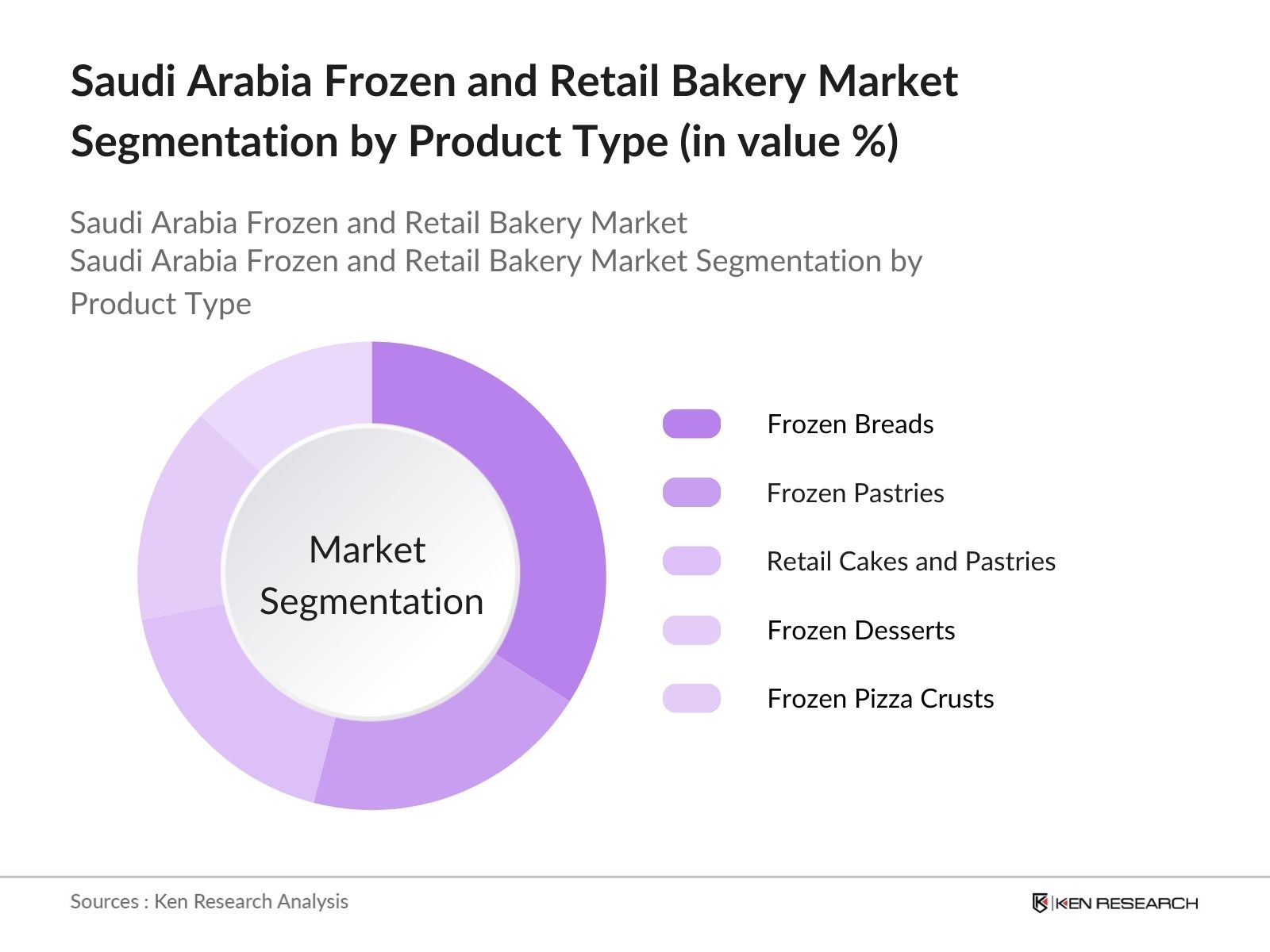

- By Product Type: The Saudi bakery market is segmented by product type into frozen breads, frozen pastries, retail cakes and pastries, frozen desserts, and frozen pizza crusts. Recently, frozen breads have held a dominant market share in the product type category due to their convenience and long shelf life, appealing to both households and food service industries. With the rising trend of quick meals, frozen breads offer an efficient solution, allowing consumers to enjoy freshly baked quality without the preparation time. Key players in this segment have developed innovative packaging solutions to enhance product freshness, further solidifying this segments position.

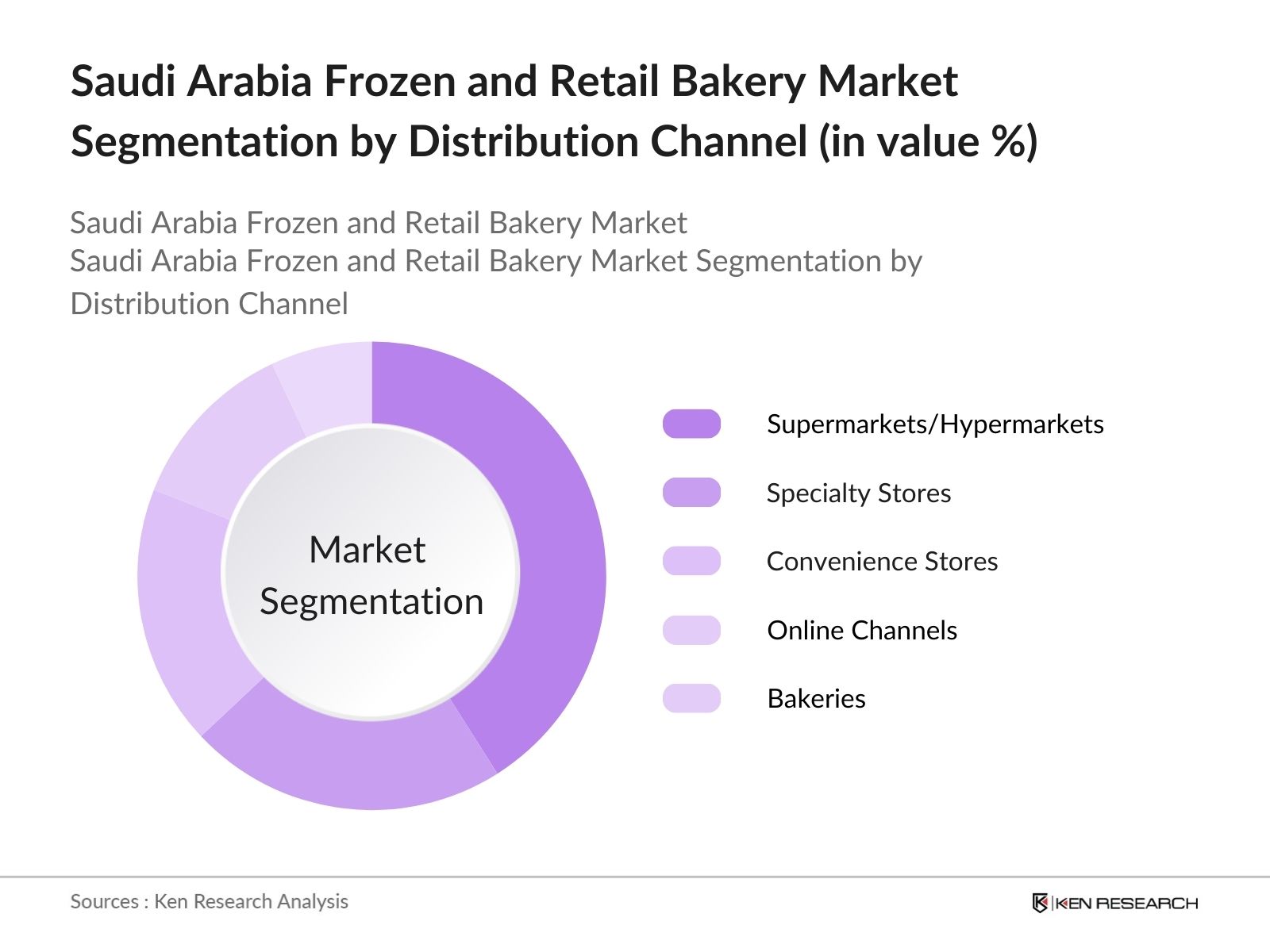

- By Distribution Channel: The market segmentation by distribution channel includes supermarkets/hypermarkets, specialty stores, convenience stores, online channels, and bakeries. Supermarkets and hypermarkets dominate this category due to their extensive presence across Saudi Arabia and the convenience they offer to consumers. With large, well-organized displays, supermarkets provide a one-stop shopping experience where consumers can find various bakery products, catering to different tastes and preferences. Additionally, hypermarkets have implemented promotions and discounts, further driven customer loyalty and solidifying their dominance in the distribution channel segment.

Saudi Arabia Frozen and Retail Bakery Market Competitive Landscape

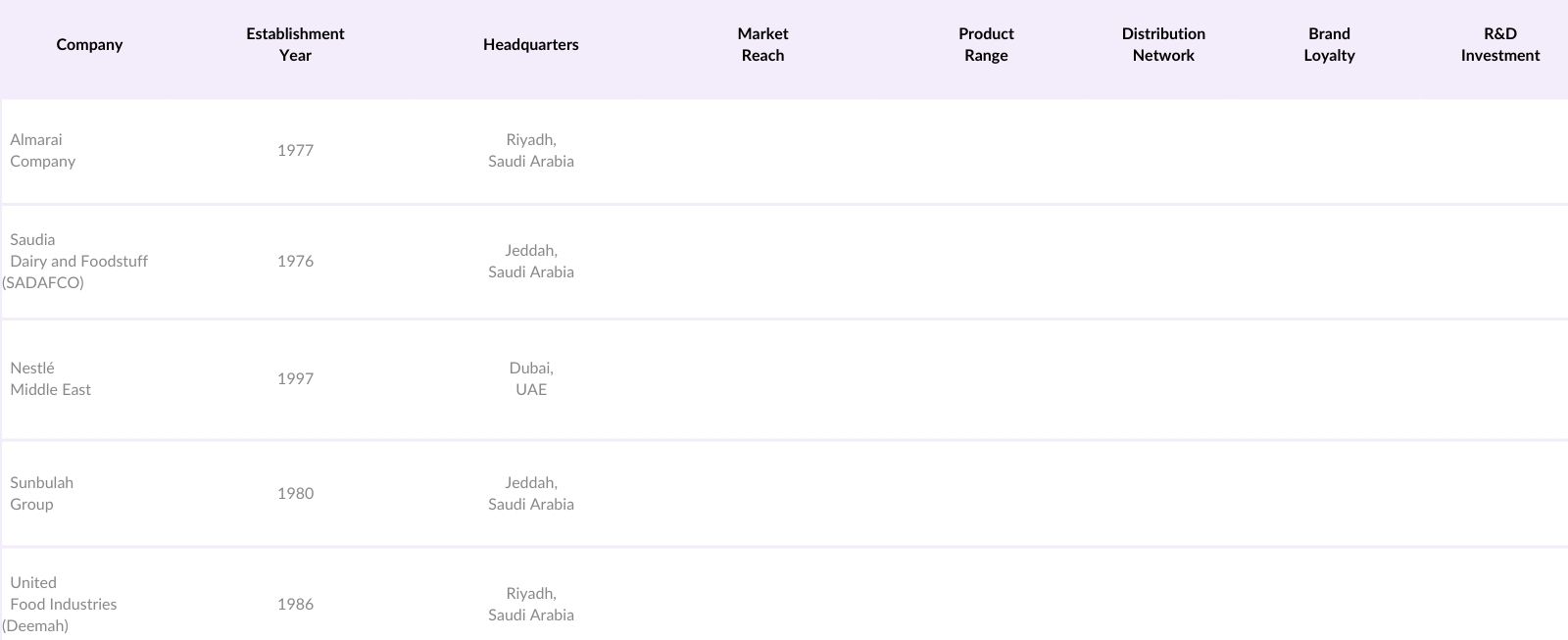

The Saudi Arabia frozen and retail bakery market is characterized by a mix of local and international companies, each aiming to capture a significant market share through innovative product offerings and strategic distribution channels. Major players, such as Almarai and SADAFCO, lead the market due to their extensive distribution networks and robust brand recognition. The presence of both established domestic brands and multinational corporations highlights the competitive nature of the market, with players investing heavily in marketing and product innovation to retain customer loyalty.

Saudi Arabia Frozen and Retail Bakery Market Analysis

Growth Drivers

- Increased Urbanization (Population Density Impact): Saudi Arabias urban population has been steadily rising, with urban centers like Riyadh and Jeddah experiencing population densities above 1,200 people per square kilometer as of 2024. This urban concentration directly impacts food preferences, increasing demand for quick and convenient bakery products as city dwellers seek accessible food options. World Bank data shows that Saudi Arabia's total urban population reached 33 million in 2024, driven by significant growth in urban infrastructure and migration from rural areas. This urban expansion fuels demand for bakery items across frozen and retail segments, catering to on-the-go and convenience-seeking consumers.

- Changing Consumer Preferences (Convenience Foods Demand): With a 2024 population estimate of over 35 million, the Saudi market has witnessed a notable shift towards convenience foods, aligning with changing consumer lifestyles and increasing work-related time constraints. IMF reports indicate an uptick in the consumer index for convenience foods by around 15% from 2022 to 2024, reflecting higher consumption of ready-to-eat bakery products IMF. This preference shift is expected to continue, making convenience-oriented frozen and retail bakery products a staple in urban Saudi households, particularly among younger demographics and working professionals.

- Rise in Disposable Income (Income Bracket Distribution): Saudi Arabias per capita income has shown steady growth, with disposable income increasing significantly among middle and upper-income brackets, as reported by the IMF in 2024. The increase in disposable incomereaching approximately $23,000 per capita as of 2024has encouraged consumers to explore a wider range of bakery options, including premium and health-focused products. This income growth has enabled a larger portion of the population to access diverse bakery products, catering to both every day and specialized dietary needs.

Market Challenges

- Regulatory Standards (Halal Certification Compliance): In Saudi Arabia, stringent halal certification regulations enforced by the Saudi Food and Drug Authority (SFDA) apply to all food products, including frozen and retail bakery items. Compliance with halal standards, which include sourcing, handling, and ingredient regulations, increases operational requirements for bakery producers. As of 2024, SFDA reports indicate that over 90% of bakery imports adhere to halal standards, yet achieving compliance adds logistical costs and impacts product timelines. Strict regulatory oversight presents a compliance challenge for bakery manufacturers aiming to enter or expand within the market.

- High Production Costs (Supply Chain Inflation): The Saudi bakery market faces rising production costs, partly due to supply chain inflation affecting raw ingredients like wheat and sugar. Government data indicates a 20% increase in food import costs in 2023, impacting bakery manufacturers reliant on imported ingredients. Rising energy and logistics costs further inflate production expenses, posing a significant cost challenge for local bakeries and imported products alike. This cost inflation in production and logistics is a primary barrier for bakery market growth, as it affects product pricing and availability.

Saudi Arabia Frozen and Retail Bakery Market Future Outlook

The Saudi Arabia frozen and retail bakery market is expected to expand steadily over the coming years, driven by a continuous rise in consumer demand for convenient, ready-to-eat food options and a broader range of innovative product offerings. As the retail sector modernizes and consumer preferences shift towards health-conscious and diverse products, opportunities for premium and organic bakery items are anticipated to grow. Furthermore, advancements in food processing and storage technologies are likely to support this trend, ensuring product quality and availability for a wider audience.

Market Opportunities

- Demand for Health-Focused Products (Gluten-Free, Organic Products): Health-conscious consumer trends are rising in Saudi Arabia, with a focus on gluten-free, organic, and low-sugar options. The Saudi Ministry of Health reports a 12% increase in demand for organic products from 2022 to 2024, indicating a consumer shift towards healthier food options. This trend offers an opportunity for bakery brands to expand their product lines with health-focused options, catering to a growing market of health-conscious consumers seeking nutritious alternatives in frozen and retail bakery products.

- Technological Advancements (Automated Production Equipment): Saudi Arabias bakery sector is adopting advanced automation to enhance production efficiency and product quality. As of 2024, approximately 40% of bakeries in major urban areas utilize automated machinery, reducing labor costs and enhancing production capabilities. The Ministry of Industry and Mineral Resources promotes technological advancements through grants and incentives for automated equipment adoption, aligning with Vision 2030 industrial development goals. Automation in production supports efficient scaling of bakery operations, opening avenues for increased product variety and market reach.

Scope of the Report

|

Frozen Breads Frozen Pastries Retail Cakes and Pastries Frozen Desserts Frozen Pizza Crusts |

|

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Convenience Stores Online Channels Bakeries |

|

By Customer Segment |

Household Consumers Food Service Industry Institutional Buyers |

|

By Category |

Conventional Bakery Products Premium and Artisanal Products Health-Oriented Bakery Products |

|

By Region |

North East West South |

Products

Key Target Audience

Retail Chains and Supermarkets

Frozen Food Manufacturers

Bakeries and Confectioners

Food Service Industry Players

Government and Regulatory Bodies (Saudi Food and Drug Authority, SASO)

Health and Nutrition Advocacy Groups

Packaging Solution Providers

Investment and Venture Capital Firms

Companies

Players Mention in the Report:

Almarai Company

Saudia Dairy and Foodstuff Company (SADAFCO)

Americana Group

Nestl Middle East

Sunbulah Group

United Food Industries Corporation (Deemah)

Al Kabeer Group ME

Aryzta AG

Fonterra Brands Arabia

International Foodstuffs Company (IFFCO)

Switz Group

Ulker Biskvi Sanayi AS

Olayan Group

Agthia Group

Yamama Biscuit Company

Table of Contents

Saudi Arabia Frozen and Retail Bakery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Saudi Arabia Frozen and Retail Bakery Market Size (in SAR Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Saudi Arabia Frozen and Retail Bakery Market Analysis

3.1 Growth Drivers

3.1.1 Increased Urbanization (Population Density Impact)

3.1.2 Changing Consumer Preferences (Convenience Foods Demand)

3.1.3 Rise in Disposable Income (Income Bracket Distribution)

3.1.4 Tourism Sector Expansion (Visitor Spending Influence)

3.2 Market Challenges

3.2.1 Regulatory Standards (Halal Certification Compliance)

3.2.2 High Production Costs (Supply Chain Inflation)

3.2.3 Limited Cold Storage Facilities (Infrastructure Constraints)

3.3 Opportunities

3.3.1 Demand for Health-Focused Products (Gluten-Free, Organic Products)

3.3.2 Technological Advancements (Automated Production Equipment)

3.3.3 Expansion in Online Distribution Channels (E-commerce Growth)

3.4 Trends

3.4.1 Rising Popularity of Frozen Bakery Items (Consumer Preference Shift)

3.4.2 Introduction of Premium and Gourmet Products (Product Innovation)

3.4.3 Increasing Demand for Single-Serve Packaging (Convenience Factor)

3.5 Government Regulation

3.5.1 Food Safety Standards (SASO Compliance)

3.5.2 Halal Product Certification (Saudi Food and Drug Authority)

3.5.3 Taxation Policies on Frozen Goods (VAT and Import Tariffs)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

Saudi Arabia Frozen and Retail Bakery Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Frozen Breads

4.1.2 Frozen Pastries

4.1.3 Retail Cakes and Pastries

4.1.4 Frozen Desserts

4.1.5 Frozen Pizza Crusts

4.2 By Distribution Channel (in Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Specialty Stores

4.2.3 Convenience Stores

4.2.4 Online Channels

4.2.5 Bakeries

4.3 By Customer Segment (in Value %)

4.3.1 Household Consumers

4.3.2 Food Service Industry

4.3.3 Institutional Buyers

4.4 By Category (in Value %)

4.4.1 Conventional Bakery Products

4.4.2 Premium and Artisanal Products

4.4.3 Health-Oriented Bakery Products

4.5 By Region (in Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

Saudi Arabia Frozen and Retail Bakery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Almarai Company

5.1.2 Al-Othaim Markets

5.1.3 Saudia Dairy and Foodstuff Company (SADAFCO)

5.1.4 Americana Group

5.1.5 Nestl Middle East

5.1.6 Sunbulah Group

5.1.7 United Food Industries Corporation (Deemah)

5.1.8 Al Kabeer Group ME

5.1.9 Aryzta AG

5.1.10 Dossary Farms

5.1.11 Fonterra Brands Arabia

5.1.12 International Foodstuffs Company (IFFCO)

5.1.13 Switz Group

5.1.14 Ulker Biskvi Sanayi AS

5.1.15 Olayan Group

5.2 Cross Comparison Parameters (Production Capacity, Employee Count, Regional Presence, Revenue, Market Share, Product Portfolio, R&D Investment, and Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Development, Mergers and Acquisitions, and Expansion Plans)

5.5 Investment Analysis (Private Equity Funding and Government Grants)

5.6 Joint Ventures and Collaborations

5.7 Technological Partnerships

5.8 Market Entry Strategies

Saudi Arabia Frozen and Retail Bakery Market Regulatory Framework

6.1 Food Safety and Quality Standards

6.2 Labeling and Packaging Regulations

6.3 Import and Export Regulations

6.4 Halal Certification Process

6.5 Environmental Compliance and Waste Management

Saudi Arabia Frozen and Retail Bakery Future Market Size (in SAR Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Saudi Arabia Frozen and Retail Bakery Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Distribution Channel (in Value %)

8.3 By Customer Segment (in Value %)

8.4 By Category (in Value %)

8.5 By Region (in Value %)

Saudi Arabia Frozen and Retail Bakery Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Penetration Strategies

9.3 Product Innovation Recommendations

9.4 Market Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the frozen and retail bakery ecosystem in Saudi Arabia, including all prominent stakeholders. Secondary research sources, such as industry publications and government databases, were utilized to define the key factors influencing market growth.

Step 2: Market Analysis and Construction

Historical data on market dynamics, distribution channels, and consumer preferences were compiled and analyzed. This included evaluating the revenue contributions of various segments, allowing for an accurate projection of market trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market drivers, challenges, and consumer behavior were developed and validated through expert interviews. These consultations provided insights into the operational and strategic focus areas for leading players.

Step 4: Research Synthesis and Final Output

This final stage involved synthesizing data collected from various sources and cross-verifying with leading bakery manufacturers in Saudi Arabia. The objective was to ensure a comprehensive and accurate analysis aligned with market realities.

Frequently Asked Questions

01. How big is the Saudi Arabia Frozen and Retail Bakery Market?

The Saudi Arabia frozen and retail bakery market was valued at USD 405 million, primarily driven by an increasing demand for convenient, ready-to-eat food options and a rising focus on health-conscious product offerings.

02. What are the main challenges in the Saudi Arabia Frozen and Retail Bakery Market?

Key challenges include regulatory compliance with food safety standards, high production costs, and limited cold storage infrastructure, all of which affect operational efficiency and profitability.

03. Who are the major players in the Saudi Arabia Frozen and Retail Bakery Market?

Major players include Almarai Company, SADAFCO, Sunbulah Group, Nestl Middle East, and Americana Group, with strong brand recognition and extensive distribution networks.

04. What factors are driving growth in the Saudi Arabia Frozen and Retail Bakery Market?

Growth is driven by increased urbanization, rising disposable income, and the expanding tourism sector, which enhances the demand for convenient and high-quality bakery products across various consumer segments.

05. Which product type holds the largest share in the Saudi Arabia Frozen and Retail Bakery Market?

Frozen breads dominate the product type segment, benefiting from their convenience, extended shelf life, and appeal to both household and food service sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.