Saudi Arabia Fruits and Vegetables Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD5656

November 2024

99

About the Report

Saudi Arabia Fruits and Vegetables Market Overview

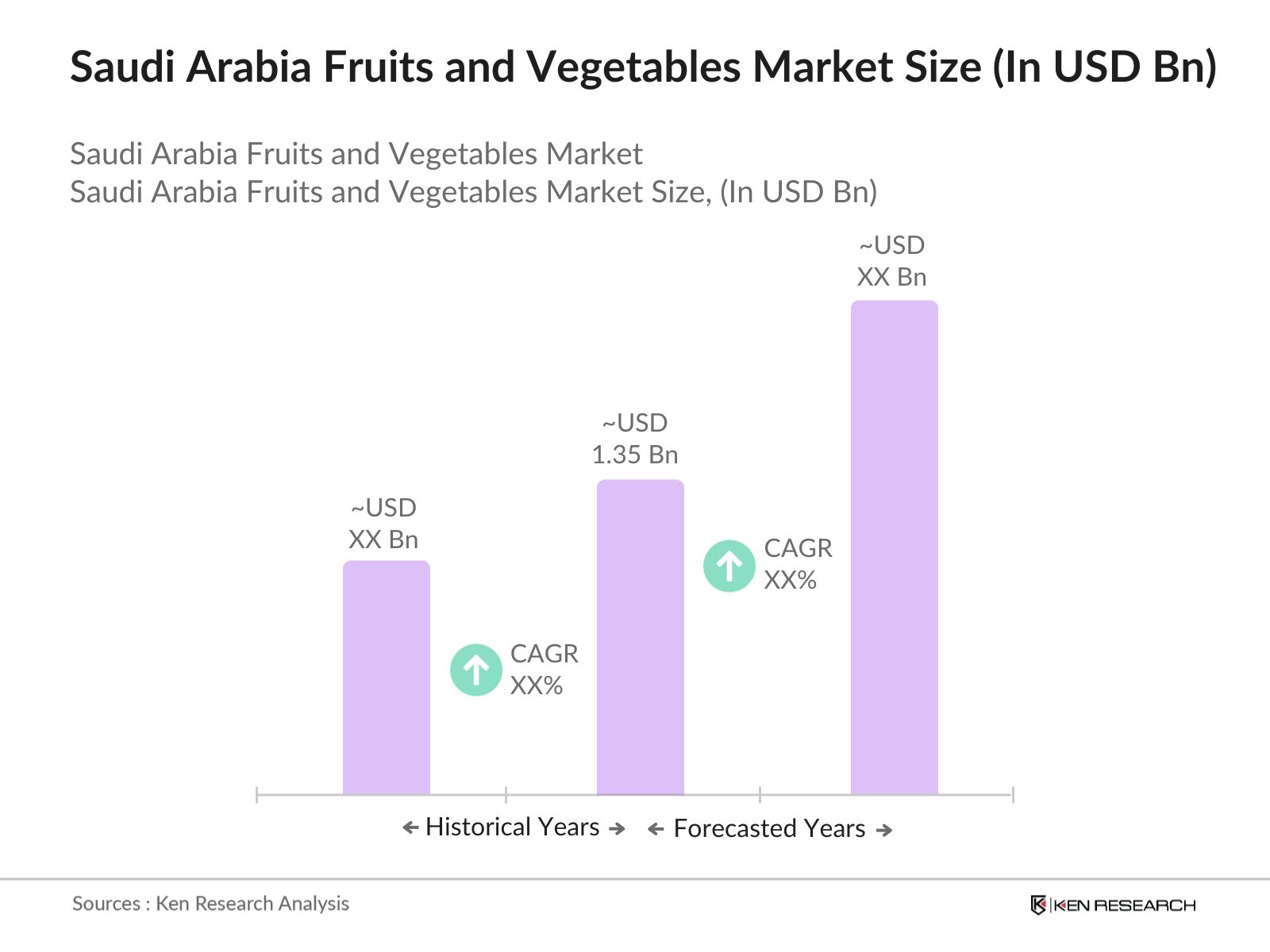

- The Saudi Arabia fruits and vegetables market is valued at USD 1.35 billion, driven by increasing domestic demand and government support for agricultural sustainability. Over the past five years, government initiatives such as the Vision 2030 and the National Agricultural Development Plan have pushed for food security and reduced dependency on imports. This growth is also fueled by rising awareness of the health benefits associated with fresh produce consumption and the expansion of agricultural technologies like hydroponics and vertical farming.

- Key regions such as Riyadh and Jeddah dominate the market due to their large urban populations and high per capita consumption of fresh produce. These cities have more access to advanced farming techniques and better supply chain infrastructure, which allows for the consistent supply of fruits and vegetables. The focus on local production to ensure food security and the availability of cold storage facilities further strengthens their dominance.

- To address water scarcity, the Saudi government has introduced subsidies for water-saving technologies, including drip irrigation and hydroponics. In 2023, over SAR 500 million was allocated to farmers adopting these technologies, helping to reduce agricultural water consumption by 20%. These subsidies aim to support sustainable farming practices and ensure long-term agricultural viability.

Saudi Arabia Fruits and Vegetables Market Segmentation

- By Product Type: The market is segmented into dates, citrus fruit, tropical fruits and tomatoes. Recently, dates have dominated the fruits segment due to their cultural and economic significance in Saudi Arabia. Dates are not only a staple food but are also increasingly exported, driving their market share. Similarly, tomatoes dominate the vegetable segment because of their versatile use in local cuisine and their high demand in both fresh and processed forms.

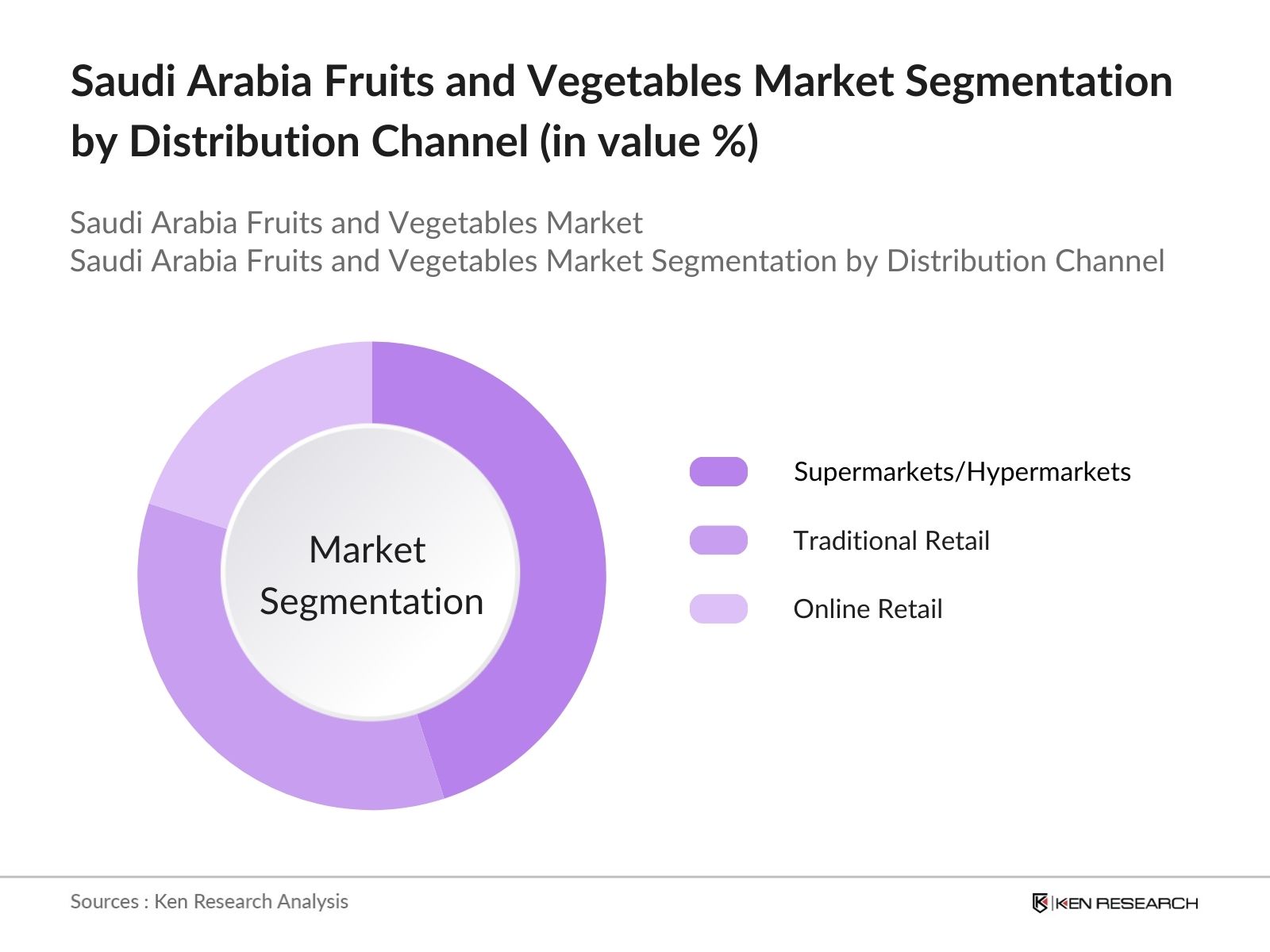

- By Distribution Channel: The market is also segmented by distribution channel into supermarkets/hypermarkets, traditional retail, and online retail. Supermarkets/Hypermarkets: These have a dominant share due to their extensive reach, ease of access, and ability to offer fresh produce at competitive prices. Traditional Retail: Still in rural areas and small towns, traditional markets play a crucial role in offering locally grown produce. Online Retail: This segment is growing due to the increasing adoption of e-commerce platforms and the rising demand for home delivery of fresh fruits and vegetables.

Saudi Arabia Fruits and Vegetables Market Competitive Landscape

The Saudi Arabia fruits and vegetables market is highly competitive, with both local and international players contributing to its growth. Large domestic companies have a presence due to their control over supply chains and close alignment with government initiatives. The market is dominated by local players such as Almarai and Al Watania Agriculture, alongside global firms like Del Monte and Dole. This consolidation highlights the importance of advanced farming technologies and cold chain logistics in maintaining market leadership. Companies with better access to cold storage and transportation are able to offer fresher produce, ensuring their competitiveness in a market where freshness is a key demand driver.

|

Company |

Established |

Headquarters |

Product Range |

Revenue (2023) |

No. of Employees |

Global Reach |

Local Market Share |

Distribution Network |

|

Almarai Company |

1977 |

Riyadh, Saudi Arabia |

||||||

|

Al Watania Agriculture |

1982 |

Al Jouf, Saudi Arabia |

||||||

|

Del Monte Saudi Arabia |

1886 |

Khobar, Saudi Arabia |

||||||

|

Pure Harvest Smart Farms |

2017 |

Abu Dhabi, UAE |

||||||

|

NADEC |

1981 |

Riyadh, Saudi Arabia |

Saudi Arabia Fruits and Vegetables Industry Analysis

Market Growth Drivers

- Increased Consumption of Organic Produce: Saudi Arabia has seen a rising demand for organic produce, fueled by increased awareness of health benefits and food safety. Organic food consumption has surged, with domestic production reaching over 30,000 metric tons of organic fruits and vegetables in 2023, as per the Saudi Organic Farming Association. Organic farming initiatives are also on the rise due to government support under the Saudi Vision 2030 framework. This reflects a growing trend towards locally sourced, chemical-free produce, contributing to healthier dietary habits and a diversified agricultural sector.

- Government Initiatives (Saudi Vision 2030, National Agricultural Development Plan): The Saudi Vision 2030 has allocated SAR 6 billion for agricultural reforms aimed at self-sufficiency in fruits and vegetables. One key pillar is the National Agricultural Development Plan (NADP), which encourages modern farming techniques to meet growing domestic demand. As of 2023, agriculture contributes 3% to Saudi Arabias GDP, with fruits and vegetables accounting for a large share. These initiatives promote sustainable practices and enhance local food production.

- Advancements in Agriculture Technology (Hydroponics, Vertical Farming): Advancements in hydroponics and vertical farming are transforming Saudi Arabia's agricultural landscape. By 2024, Saudi Arabia has over 300 hydroponic farms, producing 20% more yield per hectare compared to traditional farming. The governments support for agri-tech innovations, including SAR 1 billion invested in controlled-environment agriculture, has been instrumental in overcoming water scarcity issues. This approach enhances crop efficiency and optimizes water use, addressing Saudi Arabias agricultural sustainability challenges.

Market Challenges

- Water Scarcity and Agricultural Sustainability: Saudi Arabia is one of the worlds most water-scarce nations, with renewable water resources at just 500 cubic meters per capita. In 2023, agricultural irrigation accounts for 84% of the countrys total water consumption. The need for efficient water management systems, such as drip irrigation, is critical. The government has introduced initiatives like water-saving subsidies to reduce water consumption, but the challenge of balancing food production and water use remains.

- Import Dependency for Fruits: Saudi Arabia imports over 70% of its fruit requirements due to limited domestic production capacity. In 2023, the country imported 3.2 million tons of fruits, particularly from countries like India, Egypt, and South Africa. This dependency exposes the market to risks from global trade fluctuations, such as higher transportation costs and supply chain disruptions, which can affect availability and pricing.

Saudi Arabia Fruits and Vegetables Market Future Outlook

Over the next five years, the Saudi Arabia fruits and vegetables market is expected to grow due to continued government support for agricultural innovation, improvements in farming technologies such as hydroponics, and efforts to reduce reliance on imports. The adoption of controlled-environment agriculture and increased investments in local farming infrastructure will also play pivotal roles in driving future growth. The rise in health-conscious consumers and the growing trend towards organic farming are anticipated to boost demand for fruits and vegetables. Moreover, the expansion of e-commerce and improved cold storage solutions will further solidify the market's growth trajectory, particularly in urban areas.

Future Market Opportunities

- Growth in Organic Farming Initiatives: The Saudi government is actively promoting organic farming to reduce import dependency. In 2023, organic farming initiatives covered 45,000 hectares, and the government plans to increase this by 20% over the next five years through incentives such as subsidies for organic fertilizers. With the growing demand for organic produce, this sector presents an opportunity for expansion, enhancing both local production and export potential.

- Expansion in Agri-Tech Investments: In 2024, the Saudi government allocated SAR 2.5 billion to develop agricultural technology, particularly in precision agriculture and automation. These investments are geared towards increasing crop yield efficiency and water management, addressing the core issue of water scarcity. The expansion of these technologies can improve the productivity of Saudi Arabias fruits and vegetables sector, creating opportunities for growth in high-tech farming operations.

Scope of the Report

|

Dates Citrus fruit Tropical fruits tomatoes |

|

|

By Distribution Channel |

Supermarkets/Hypermarkets Traditional Retail Online Retail |

|

By Farming Technique |

Organic Farming Conventional Farming Hydroponic Farming |

|

By End-Use |

Retail Consumers HoReCa (Hotel/Restaurant/Catering) Food Processing Industry |

|

By Region |

North East West South |

Products

Key Target Audience

Agricultural Investors

Venture Capital Firms

Government and Regulatory Bodies (Ministry of Environment, Water, and Agriculture)

Banks and Financial Institutes

Agribusiness Companies

Cold Chain Logistics Providers

Supermarkets and Retail Chains

Organic Food Retailers

Food Processing Companies

Companies

Saudi Arabia Fruits and Vegetables Market Major Players

Almarai Company

Al Watania Agriculture

Del Monte Saudi Arabia

Pure Harvest Smart Farms

NADEC

Dole Saudi Arabia

Desert Farms

Saudi Vegetable Oil Company

Tamimi Markets

Lulu Hypermarket

Al Bakrawe Farm

Fresh Del Monte Produce Inc.

Al Kabeer Group

Saudi Agricultural Development Company

Al Jazira Poultry Farm

Table of Contents

1. Saudi Arabia Fruits and Vegetables Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Fruits and Vegetables Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Fruits and Vegetables Market Analysis

3.1 Growth Drivers

3.1.1 Increased Consumption of Organic Produce

3.1.2 Government Initiatives (Saudi Vision 2030, National Agricultural Development Plan)

3.1.3 Advancements in Agriculture Technology (Hydroponics, Vertical Farming)

3.1.4 Rise in Health-Conscious Consumers

3.2 Market Challenges

3.2.1 Water Scarcity and Agricultural Sustainability

3.2.2 High Import Dependency for Fruits

3.2.3 Fluctuations in Climate Conditions

3.3 Opportunities

3.3.1 Growth in Organic Farming Initiatives

3.3.2 Expansion in Agri-Tech Investments

3.3.3 Improved Cold Storage Infrastructure

3.4 Trends

3.4.1 Adoption of Controlled-Environment Agriculture

3.4.2 Increased Use of Drip Irrigation

3.4.3 Growing Preference for Locally Grown Products

3.5 Government Regulation

3.5.1 Subsidies for Water-Saving Technologies

3.5.2 Import Tariff Changes

3.5.3 Support for Domestic Agriculture through Vision 2030

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Saudi Arabia Fruits and Vegetables Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fruits

4.1.1.1 Citrus Fruits

4.1.1.2 Dates

4.1.1.3 Tropical Fruits (Bananas, Mangoes)

4.1.1.4 Berries

4.1.2 Vegetables

4.1.2.1 Leafy Vegetables

4.1.2.2 Root Vegetables

4.1.2.3 Tomatoes

4.1.2.4 Cucumbers

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Traditional Retail

4.2.3 Online Retail

4.3 By Farming Technique (In Value %)

4.3.1 Organic Farming

4.3.2 Conventional Farming

4.3.3 Hydroponic Farming

4.4 By End-Use (In Value %)

4.4.1 Retail Consumers

4.4.2 HoReCa (Hotel/Restaurant/Catering)

4.4.3 Food Processing Industry

4.5 By Region (In Value %)

4.5.1 Norht

4.5.2 West

4.5.3 East

4.5.4 South

5. Saudi Arabia Fruits and Vegetables Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Almarai Company

5.1.2 Al Watania Agriculture

5.1.3 Del Monte Saudi Arabia

5.1.4 Dole Saudi Arabia

5.1.5 Desert Farms

5.1.6 Pure Harvest Smart Farms

5.1.7 NADEC (National Agricultural Development Company)

5.1.8 Saudi Vegetable Oil Company

5.1.9 Tamimi Markets

5.1.10 Lulu Hypermarket

5.1.11 Al Bakrawe Farm

5.1.12 Fresh Del Monte Produce Inc.

5.1.13 Almarai

5.1.14 Saudi Agricultural Development Company

5.1.15 Al Kabeer Group

5.2 Cross Comparison Parameters (Production Capacity, Farming Technique, Revenue, Number of Employees)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Fruits and Vegetables Market Regulatory Framework

6.1 Agricultural Certification Requirements

6.2 Water Use Regulations

6.3 Import and Export Compliance

6.4 Environmental Standards

7. Saudi Arabia Fruits and Vegetables Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Fruits and Vegetables Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Farming Technique (In Value %)

8.4 By End-Use (In Value %)

8.5 By Region (In Value %)

9. Saudi Arabia Fruits and Vegetables Market Analyst's Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we mapped the major stakeholders of the Saudi Arabia fruits and vegetables market. We utilized secondary research tools, including industry databases and reports, to gather data on key market dynamics and stakeholders. The primary goal was to identify the variables driving market trends and influencing consumer demand.

Step 2: Market Analysis and Construction

We analyzed historical data on fruit and vegetable consumption, production rates, and import-export balances to build a detailed picture of the market. We also assessed supply chain infrastructure and advancements in agricultural technology.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with leading agricultural experts and farmers, we validated key market assumptions regarding production costs, the impact of new technologies, and consumer preferences for locally grown produce.

Step 4: Research Synthesis and Final Output

The final phase involved engaging directly with local farming companies and Agri-Tech firms to validate sales data, production capabilities, and market expansion strategies. This synthesis ensured the accuracy of our market forecasts and segmentation.

Frequently Asked Questions

01. How big is the Saudi Arabia Fruits and Vegetables Market?

The Saudi Arabia fruits and vegetables market is valued at USD 1.35 billion, with steady growth driven by increasing domestic demand and government support for agricultural development.

02. What are the challenges in the Saudi Arabia Fruits and Vegetables Market?

Challenges in Saudi Arabia fruits and vegetables market include water scarcity, dependency on imported fruits, and climate change, all of which affect local production capacity. Additionally, supply chain inefficiencies and high production costs pose risks to market stability.

03. Who are the major players in the Saudi Arabia Fruits and Vegetables Market?

Key players in Saudi Arabia fruits and vegetables market include Almarai, Al Watania Agriculture, Del Monte Saudi Arabia, Pure Harvest Smart Farms, and NADEC, dominating through strong supply chains and government-backed agricultural programs.

04. What are the growth drivers of the Saudi Arabia Fruits and Vegetables Market?

Saudi Arabia fruits and vegetables market Growth is propelled by increased investment in agri-tech, government initiatives to reduce food import dependency, and growing consumer demand for fresh, organic produce.

05. What role does technology play in the Saudi Arabia Fruits and Vegetables Market?

Technologies like hydroponics, vertical farming, and drip irrigation systems are major technologies in Saudi Arabia fruits and vegetables market that are transforming local agriculture, improving efficiency, and reducing the environmental impact of farming.

This detailed report provides an in-depth analysis of the Saudi Arabia fruits and vegetables market, covering key market drivers, segmentation, competitive landscape, and future outlook.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.