Saudi Arabia Heavy-Duty Trucks Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD7028

December 2024

98

About the Report

Saudi Arabia Heavy-Duty Trucks Market Overview

- The Saudi Arabia heavy-duty trucks market is valued at USD 3.1 billion, driven by the growing need for freight transportation and the continuous expansion of infrastructure projects. Major development initiatives, such as the Saudi Vision 2030, have increased the demand for heavy-duty trucks, especially within sectors like construction, mining, and oil & gas. The logistics industry has also seen strong demand due to increased activity in both domestic and international trade, creating a need for durable, high-capacity trucks that can support long-distance haulage and heavy loads.

- Major cities such as Riyadh, Jeddah, and Dammam dominate the heavy-duty trucks market due to their strategic locations and industrial significance. Riyadh, as the political and economic hub, has the highest concentration of infrastructure projects and corporate activities, fueling demand for construction trucks and logistics services. Jeddah and Dammam, being key port cities, are crucial centers for import/export operations, making them major contributors to the demand for heavy-duty trucks, particularly in logistics and transport.

- The Saudi Transport General Authority (TGA) enforces regulations governing the operation of heavy-duty trucks. In 2024, the TGA introduced stricter safety and operational guidelines to improve road safety. These include requirements for vehicle maintenance, driver training, and compliance with weight limits. Compliance with these regulations is essential for companies operating heavy-duty trucks, as violations can result in fines and vehicle impoundment.

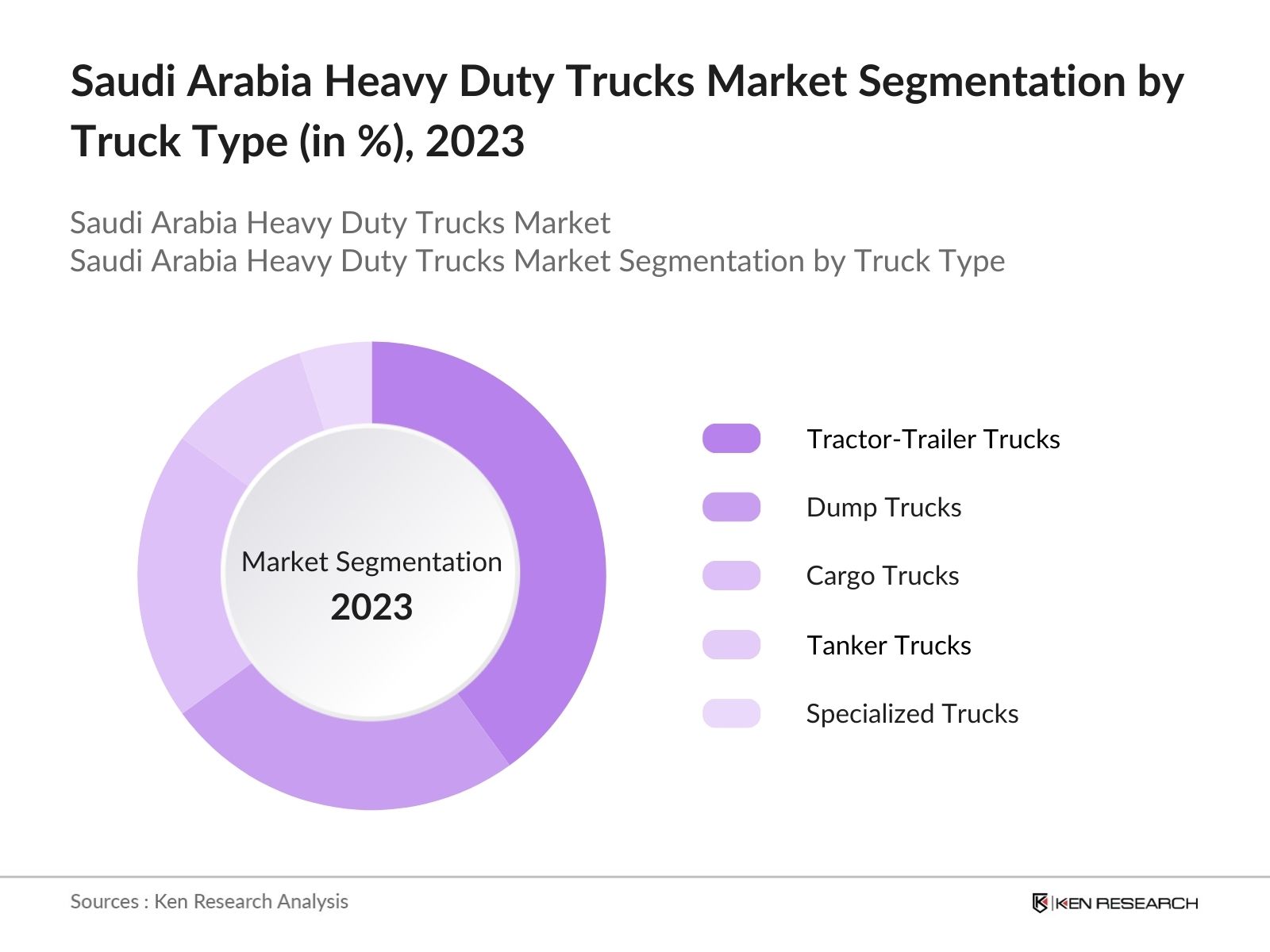

Saudi Arabia Heavy-Duty Trucks Market Segmentation

By Truck Type: The market is segmented by truck type into dump trucks, cargo trucks, tractor-trailer trucks, tanker trucks, and specialized trucks. Among these, tractor-trailer trucks hold a dominant market share. This dominance is due to the high demand for these trucks in long-distance transportation, especially in the logistics sector, which handles the majority of the country's freight movement. Tractor-trailer trucks are also highly flexible in terms of load capacity and trailer attachments, which makes them ideal for various industries, including oil & gas and construction.

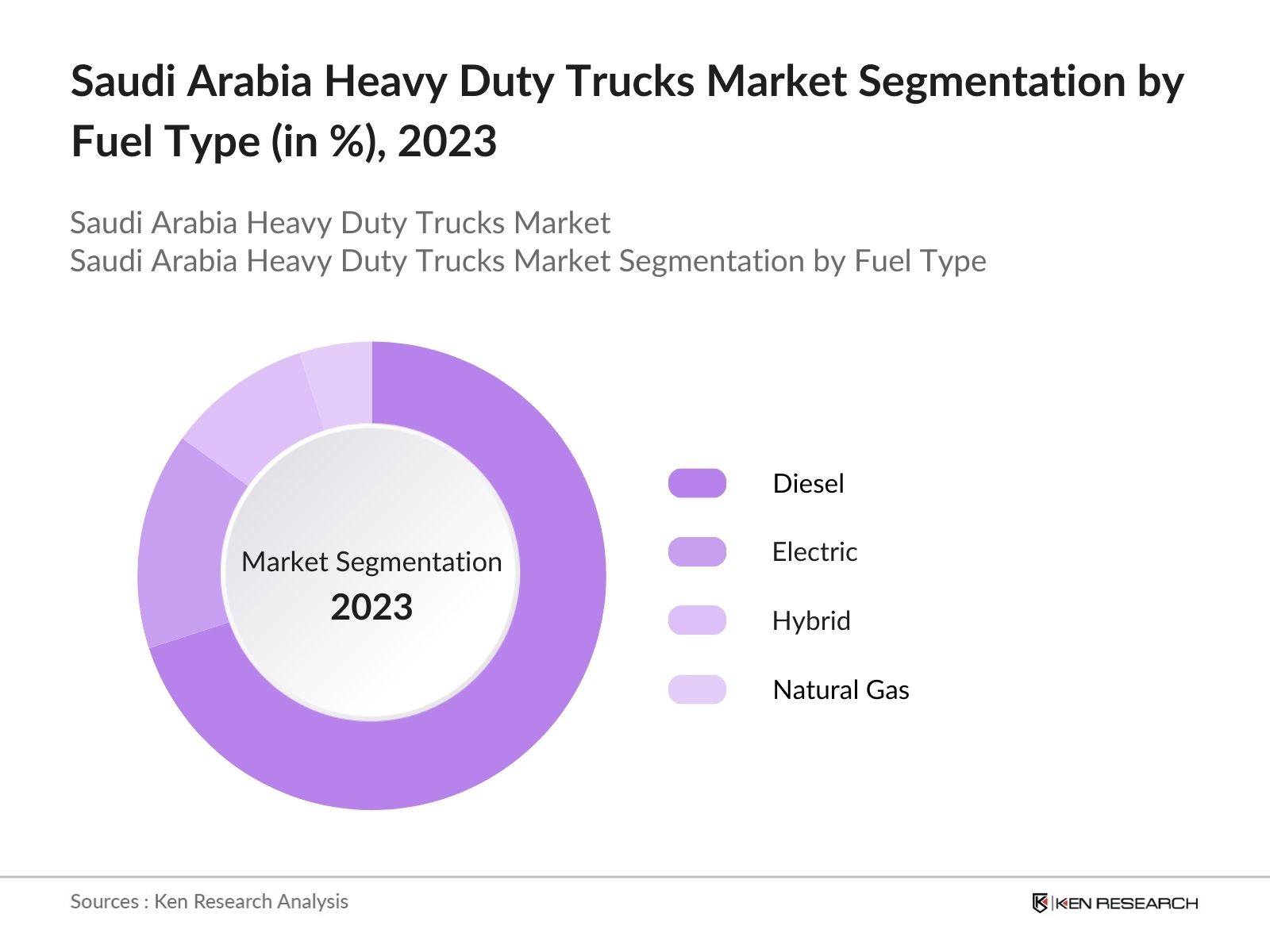

By Fuel Type: The market in Saudi Arabia is also segmented by fuel type into diesel, electric, hybrid, and natural gas trucks. Diesel trucks have historically dominated the market due to their robust performance, availability, and the widespread presence of fueling infrastructure across the country. However, the growing focus on sustainability and reducing carbon emissions has led to increasing interest in electric and hybrid trucks, especially for urban use. Nonetheless, the high initial cost of electric trucks and the current limitations in charging infrastructure keep diesel trucks as the leading segment in 2023.

Saudi Arabia Heavy-Duty Trucks Market Competitive Landscape

The Saudi Arabia heavy-duty trucks market is dominated by both global and local players, with manufacturers focusing on technological innovation and fleet expansion to capture the growing demand for trucks in industrial sectors. The market is highly competitive, with established companies like Daimler AG and Volvo Trucks leading in terms of product innovation and large-scale distribution networks. Additionally, government regulations favoring local manufacturing are encouraging partnerships between international firms and local assemblers.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Technological Integration |

Customer Support |

Dealer Network |

Manufacturing Facilities |

Market Presence |

Sustainability Initiatives |

|

Daimler AG |

1926 |

Stuttgart, Germany |

|||||||

|

Volvo Trucks |

1927 |

Gothenburg, Sweden |

|||||||

|

Scania AB |

1911 |

Sdertlje, Sweden |

|||||||

|

MAN Truck & Bus |

1915 |

Munich, Germany |

|||||||

|

PACCAR Inc. (DAF Trucks) |

1905 |

Washington, USA |

Saudi Arabia Heavy-Duty Trucks Industry Analysis

Growth Drivers

- Infrastructure Development (Construction Industry, Transport Projects): The construction industry in Saudi Arabia is experiencing a boom, driven by large-scale projects like NEOM and the Red Sea Project. The Saudi government has allocated $1.3 trillion for infrastructure projects, which necessitates a rise in heavy-duty trucks for transporting materials and machinery. Additionally, the expansion of transportation infrastructure like new roads and railway projects (such as the Saudi Landbridge) further fuels demand for heavy-duty trucks.

- Industrial Expansion (Mining, Oil & Gas): Saudi Arabia's mining and oil & gas sectors are critical contributors to its economy, with the mining industry alone expected to increase in prominence as part of the Vision 2030 objectives. Saudi Arabia produced approximately 10 million barrels of oil per day in 2023, maintaining heavy reliance on transporting oilfield equipment. The mining sector extracted 30 million tons of raw materials in 2022. Both industries rely on heavy-duty trucks to transport materials and equipment, which enhances demand for these vehicles.

- Vision 2030 (Diversification Initiatives, Investment in Non-Oil Sectors): Saudi Arabia's Vision 2030 aims to reduce dependence on oil by diversifying into sectors such as construction, tourism, and logistics. As of 2024, $500 billion has been directed toward non-oil sectors. This push requires increased transportation capacity for large-scale projects, fostering demand for heavy-duty trucks. Investment in renewable energy, construction, and industrial sectors directly contributes to the demand for advanced logistics infrastructure, including heavy-duty trucks.

Market Challenges

- High Initial Costs of Heavy-Duty Trucks: The acquisition of heavy-duty trucks represents a significant capital expenditure, with prices ranging from $150,000 to $250,000 per unit in Saudi Arabia. These high upfront costs deter small and medium enterprises (SMEs) from entering the market or expanding their fleets. Even larger companies must carefully consider operational efficiency and returns before making such purchases. Financing options are often limited, further exacerbating this challenge for many businesses involved in logistics and construction.

- Fluctuating Fuel Prices: Saudi Arabia's dependence on fuel means that fluctuations in global oil prices directly affect operational costs in the heavy-duty truck market. In 2024, global oil prices ranged between $85 and $90 per barrel, causing unpredictable costs for logistics companies. The volatility of fuel prices remains a concern for businesses managing large fleets of trucks, as fuel accounts for nearly 40% of total operating expenses.

Saudi Arabia Heavy-Duty Trucks Market Future Outlook

The Saudi Arabia heavy-duty trucks market is expected to continue its upward trajectory due to government support for infrastructure development and the growing industrial and logistics sectors. The ongoing push for sustainable transport solutions, coupled with advancements in truck technologies like autonomous driving, electric drivetrains, and telematics, will drive the market's evolution. Investment in the expansion of electric truck infrastructure and an increased focus on fleet management optimization will shape the market's landscape over the coming years.

Future Market Opportunities

- Increasing Urbanization (Road Network Expansion): Saudi Arabias urban population reached over 36 million in 2023, fueling the need for expanded road networks and logistics infrastructure. The government plans to invest $36 billion into improving its road networks by 2025, opening up opportunities for heavy-duty truck manufacturers. Increased urbanization requires more efficient transport services for goods and construction materials, directly driving demand for these trucks.

- Technological Advancements (Telematics, Autonomous Trucks): The adoption of telematics and autonomous driving technology is gaining momentum in Saudi Arabia. In 2024, several major logistics companies have already integrated GPS-based fleet management systems, improving efficiency and safety. Autonomous trucks are also being tested on key transportation routes. Companies utilizing advanced telematics reduce fuel costs by 20% and improve logistics planning, creating further demand for modern heavy-duty trucks with integrated technology.

Scope of the Report

|

By Truck Type |

Dump Trucks Cargo Trucks Tractor-Trailer Trucks Tanker Trucks Specialized Trucks |

|

By Fuel Type |

Diesel Electric Hybrid Natural Gas |

|

By Application |

Construction Logistics, Mining Oil & Gas Agriculture |

|

By Technology |

Telematics Enabled Autonomous Capabilities ADAS Predictive Maintenance Technology |

|

By Region |

North East West South |

Products

Key Target Audience

Heavy-Duty Truck Manufacturers

Fleet Management Companies

Logistics and Transport Firms

Oil & Gas Industry Players

Construction Companies

Government and Regulatory Bodies (Saudi Transport General Authority, Ministry of Transport)

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Automotive Parts Suppliers

Companies

Saudi Arabia Heavy-Duty Trucks Market Major Players

Daimler AG

Volvo Trucks

Scania AB

MAN Truck & Bus

PACCAR Inc. (DAF Trucks)

Tata Motors

Hyundai Heavy Duty Trucks

Ashok Leyland

Isuzu Motors

Hino Motors

UD Trucks

Sinotruk

Iveco

BYD Heavy Trucks

Mercedes-Benz Trucks

Table of Contents

1. Saudi Arabia Heavy Duty Trucks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Heavy Duty Trucks Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Heavy Duty Trucks Market Analysis

3.1. Growth Drivers

- 3.1.1. Infrastructure Development (Construction Industry, Transport Projects)

- 3.1.2. Rising Demand in Logistics (Freight Transportation, E-commerce)

- 3.1.3. Industrial Expansion (Mining, Oil & Gas)

- 3.1.4. Government Vision 2030 (Diversification Initiatives, Investment in Non-Oil Sectors)

3.2. Market Challenges

- 3.2.1. High Initial Costs of Heavy-Duty Trucks

- 3.2.2. Fluctuating Fuel Prices

- 3.2.3. Maintenance and Operational Costs

- 3.2.4. Skilled Labor Shortage for Truck Maintenance and Operation

3.3. Opportunities

- 3.3.1. Increasing Urbanization (Road Network Expansion)

- 3.3.2. Technological Advancements (Telematics, Autonomous Trucks)

- 3.3.3. Government Subsidies for Green Initiatives (Electric and Hybrid Trucks)

- 3.3.4. Foreign Direct Investments in Transportation Infrastructure

3.4. Trends

- 3.4.1. Shift Toward Electric Heavy-Duty Trucks

- 3.4.2. Integration of Advanced Safety Features (ADAS, Collision Prevention)

- 3.4.3. Digitalization in Fleet Management (GPS, IoT, Telematics)

- 3.4.4. Growth of Leasing and Rental Services for Heavy-Duty Trucks

3.5. Government Regulations

- 3.5.1. Saudi Transport General Authority Regulations

- 3.5.2. Emission Standards (Euro 6 Standards Implementation)

- 3.5.3. Road Safety and Weight Compliance Regulations

- 3.5.4. Policies to Encourage Local Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

- 3.8.1. Bargaining Power of Suppliers

- 3.8.2. Bargaining Power of Buyers

- 3.8.3. Threat of New Entrants

- 3.8.4. Threat of Substitutes

- 3.8.5. Industry Rivalry

3.9. Competitive Landscape

- 3.9.1. Key Players Overview

- 3.9.2. Market Share Analysis

- 3.9.3. Strategic Initiatives (Product Launches, Partnerships, Acquisitions)

- 3.9.4. Technological Developments (Automation, Electrification)

4. Saudi Arabia Heavy Duty Trucks Market Segmentation

4.1. By Truck Type (In Value %)

- 4.1.1. Dump Trucks

- 4.1.2. Cargo Trucks

- 4.1.3. Tractor-Trailer Trucks

- 4.1.4. Tanker Trucks

- 4.1.5. Specialized Trucks

4.2. By Fuel Type (In Value %)

- 4.2.1. Diesel

- 4.2.2. Electric

- 4.2.3. Hybrid

- 4.2.4. Natural Gas

4.3. By Application (In Value %)

- 4.3.1. Construction

- 4.3.2. Logistics

- 4.3.3. Mining

- 4.3.4. Oil & Gas

- 4.3.5. Agriculture

4.4. By Region (In Value %)

- 4.4.1. North

- 4.4.2. East

- 4.4.3. West

- 4.4.4. South

4.5. By Technology (In Value %)

- 4.5.1. Telematics Enabled

- 4.5.2. Autonomous Capabilities

- 4.5.3. Advanced Driver Assistance Systems (ADAS)

- 4.5.4. Predictive Maintenance Technology

5. Saudi Arabia Heavy Duty Trucks Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

- 5.1.1. Daimler AG

- 5.1.2. Volvo Trucks

- 5.1.3. Scania AB

- 5.1.4. MAN Truck & Bus

- 5.1.5. PACCAR Inc. (DAF Trucks)

- 5.1.6. Iveco

- 5.1.7. Hino Motors

- 5.1.8. Tata Motors

- 5.1.9. Ashok Leyland

- 5.1.10. Hyundai Heavy Duty Trucks

- 5.1.11. Isuzu Motors

- 5.1.12. UD Trucks

- 5.1.13. Sinotruk

- 5.1.14. BYD Heavy Trucks

- 5.1.15. Mercedes-Benz Trucks

5.2. Cross Comparison Parameters (Truck Load Capacity, Fuel Efficiency, Emission Standards Compliance, Technology Integration, Customer Support Network, Manufacturing Facilities, Price Range, Customization Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers and Acquisitions, Partnerships, Technological Collaborations)

5.5. Investment Analysis (Private Equity, Government Grants, Venture Capital)

6. Saudi Arabia Heavy Duty Trucks Market Regulatory Framework

6.1. Road Safety and Trucking Regulations

6.2. Compliance Requirements for Emissions and Noise

6.3. Import Tariffs and Trade Regulations

6.4. Certification and Safety Standards

7. Saudi Arabia Heavy Duty Trucks Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Heavy Duty Trucks Future Market Segmentation

8.1. By Truck Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Heavy Duty Trucks Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Strategy Recommendations

9.3. Strategic Roadmap for Market Entry/Expansion

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping the heavy-duty truck ecosystem in Saudi Arabia, including all key stakeholders such as manufacturers, suppliers, and end-users. Secondary research was conducted through reliable government databases, industry reports, and corporate filings to define the critical market variables affecting growth, such as infrastructure investment and logistics demand.

Step 2: Market Analysis and Construction

Historical data from credible sources was analyzed to assess trends and performance in the heavy-duty trucks market. This included evaluating key sectors like construction, oil & gas, and logistics, and their impact on the demand for heavy-duty trucks. The data also covered truck production, sales, and operating metrics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the initial data collected. These were validated through in-depth interviews with industry experts and professionals from key companies operating in the Saudi Arabian heavy-duty truck sector. Insights on emerging technologies, market dynamics, and future growth potential were collected.

Step 4: Research Synthesis and Final Output

The final research output included both top-down and bottom-up approaches, incorporating feedback from stakeholders across the supply chain. This ensured that the report is comprehensive, covering market performance, growth drivers, and challenges from all relevant angles, with particular attention to future trends like electrification and autonomous driving.

Frequently Asked Questions

How big is Saudi Arabia's Heavy-Duty Trucks Market?

The Saudi Arabia heavy-duty trucks market is valued at USD 3.1 billion, driven by growing industrial activities, especially in the construction and logistics sectors.

What are the challenges in Saudi Arabias Heavy-Duty Trucks Market?

The Saudi Arabia heavy-duty trucks markets key challenges include high fuel costs, stringent emissions regulations, and the high initial cost of heavy-duty trucks. Additionally, the slow adoption of electric trucks due to infrastructure constraints remains a barrier.

Who are the major players in Saudi Arabia's Heavy-Duty Trucks Market?

The Saudi Arabia heavy-duty trucks market is dominated by global players such as Daimler AG, Volvo Trucks, and Scania AB, alongside local manufacturers like Tata Motors and Ashok Leyland.

What are the growth drivers of Saudi Arabias Heavy-Duty Trucks Market?

The Saudi Arabia heavy-duty trucks market is propelled by the governments Vision 2030 initiative, increased infrastructure investments, and the expanding logistics and construction sectors.

What are the technological advancements in Saudi Arabias Heavy-Duty Trucks Market?

Technological advancements include the adoption of telematics, autonomous driving capabilities, and the increasing use of electric and hybrid trucks in the logistics and transportation sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.