Saudi Arabia Home Healthcare Services Market Outlook to 2030

Region:Middle East

Author(s):Paribhasha Tiwari

Product Code:KROD11135

December 2024

99

About the Report

Saudi Arabia Home Healthcare Services Market Overview

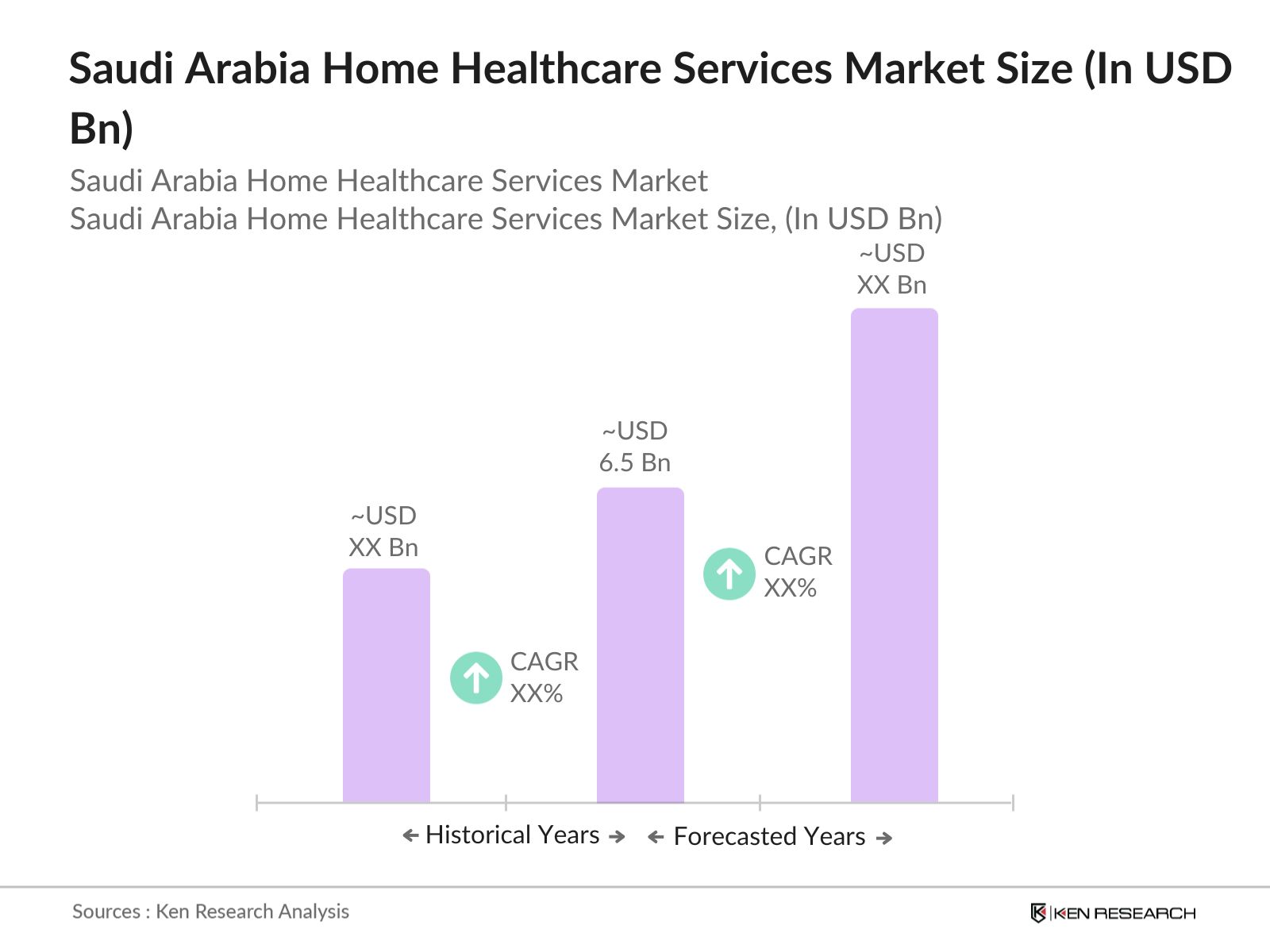

- The Saudi Arabia Home Healthcare Services Market is valued at USD 6.5 billion, based on a comprehensive analysis of recent market trends and growth indicators. The markets expansion is largely driven by the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, among an aging population. Additionally, the governments Vision 2030, which prioritizes healthcare development, has encouraged significant investments in the home healthcare sector, supporting greater accessibility to in-home care and advanced medical equipment.

- Within Saudi Arabia, Riyadh and Jeddah are the primary markets for home healthcare services due to high urbanization levels, an increasing number of elderly residents, and the availability of specialized healthcare providers. Riyadh, in particular, benefits from the presence of leading healthcare institutions and government support, which fuels further growth in home healthcare infrastructure. The Eastern Province also shows potential growth due to investments in healthcare by private players and a high population density, which supports service scalability.

- The Saudi Arabia Government has increased investment and regulatory support aiming at enhancing the sector. The Saudi Ministry of Health has established a Health Sector Transformation Program as part of its Vision 2030 initiative, which focuses on improving healthcare services and expanding infrastructure. This program includes plans to invest over USD 65 billion in healthcare infrastructure by 2030, with a specific emphasis on increasing private sector participation from 40% to 65%.

Saudi Arabia Home Healthcare Services Market Segmentation

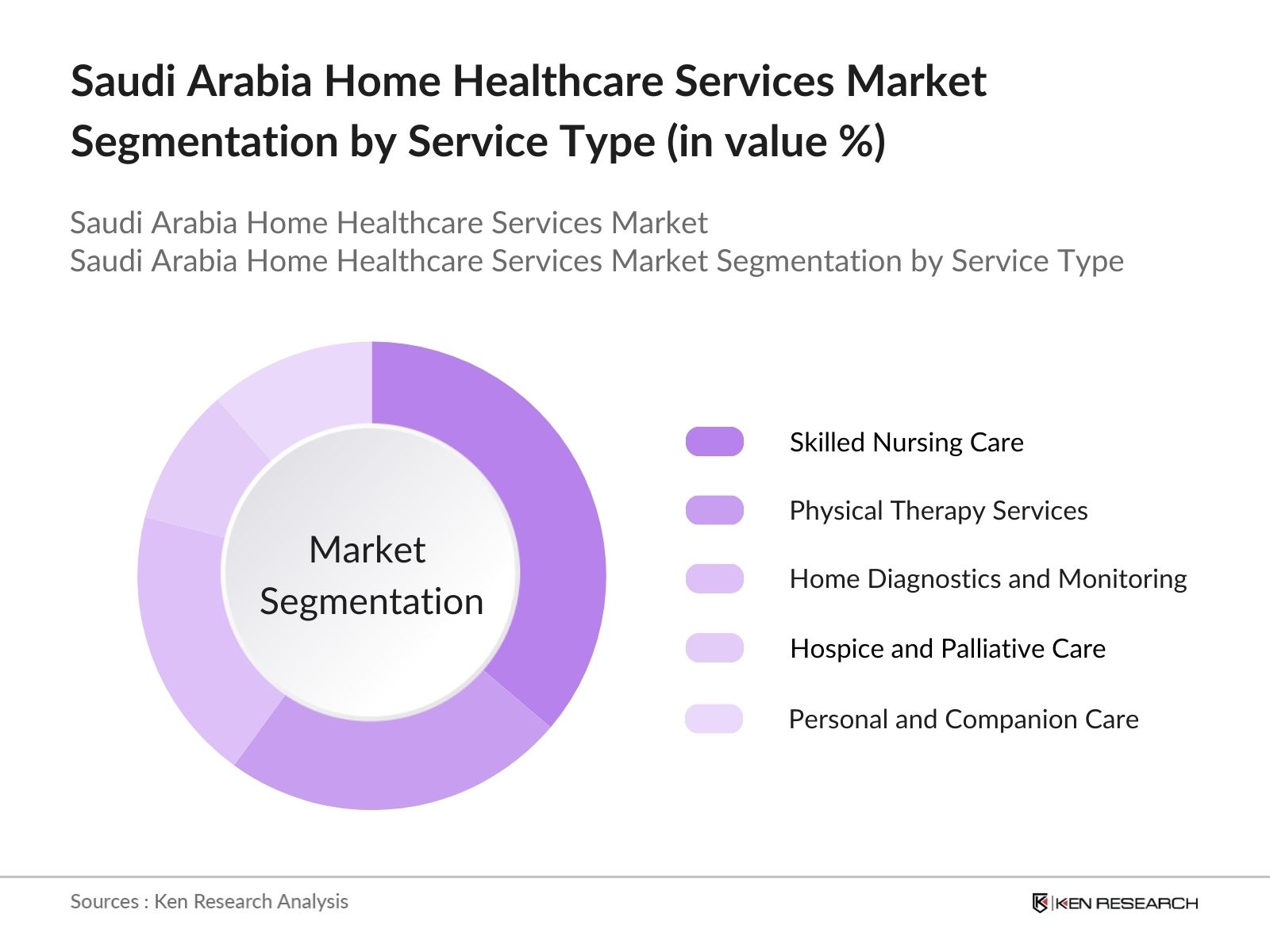

By Service Type: The Saudi Arabia Home Healthcare Services Market is segmented by service type into skilled nursing care, physical therapy services, hospice and palliative care, home diagnostics and monitoring, and personal and companion care. Skilled nursing care holds a dominant market share within the service type segment due to the high demand for complex, around-the-clock medical care provided by certified professionals. This service is particularly crucial for elderly patients and those with chronic health conditions requiring regular monitoring and administration of medications by licensed nurses.

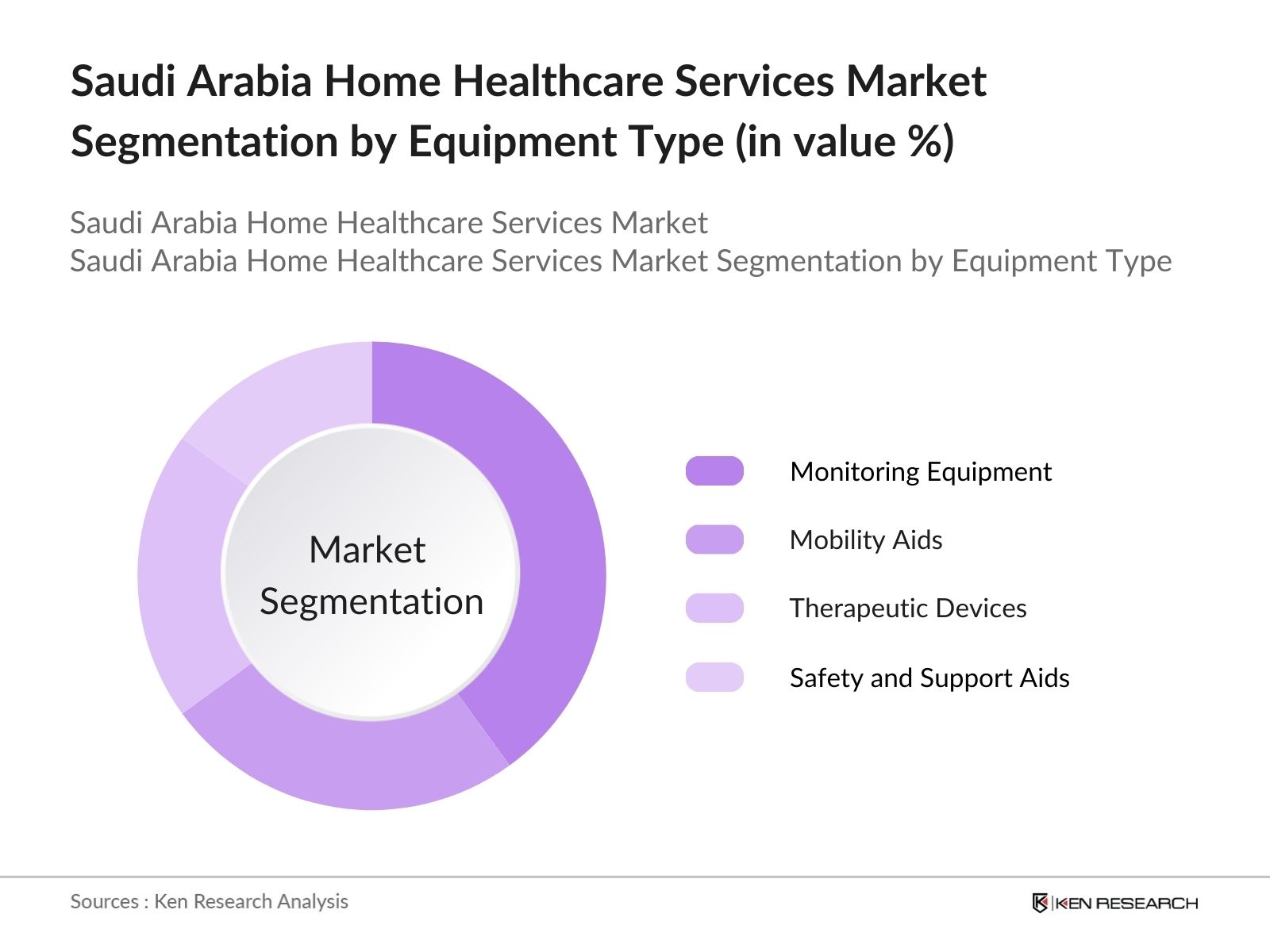

By Equipment Type: This market is further segmented by equipment type into mobility aids, monitoring equipment, therapeutic devices, and safety and support aids. Monitoring equipment has the largest market share due to the increasing need for remote patient monitoring devices, which enable healthcare providers to monitor patients' vital signs, glucose levels, and blood pressure in real-time. This growth aligns with the rising prevalence of chronic diseases and the shift toward preventative care, which emphasizes continuous health monitoring.

Saudi Arabia Home Healthcare Services Market Competitive Landscape

Saudi Arabia Home Healthcare Services Market Competitive Landscape

The Saudi Arabia Home Healthcare Services Market is dominated by a few major players, including prominent domestic providers and international companies. This competitive landscape underscores the importance of strategic alliances, innovation in home-based diagnostic devices, and expansion into underpenetrated regions.

Saudi Arabia Home Healthcare Services Market Analysis

Growth Drivers

- Aging Population and Prevalence of Chronic Diseases: The Saudi population aged 65 and older has surpassed 1.5 million, with a significant portion requiring continuous healthcare services, highlighting a growing demand for home-based care solutions. Chronic conditions like diabetes and cardiovascular diseases affect more than 4 million adults in the country, increasing the need for ongoing monitoring and support within the home healthcare sector. This rising demographic demands accessible healthcare, reinforcing the need for home healthcare services to improve patient outcomes.

- Government Support for Health Infrastructure (Vision 2030, Healthcare Transformation): Saudi Arabia's Vision 2030 prioritizes healthcare quality, with a projected investment in home healthcare exceeding SAR 12 billion to transform the sectors accessibility and quality standards. Vision 2030 aims to allocate substantial resources toward healthcare, with home healthcare services positioned as a critical component, creating incentives and subsidies for service providers. This policy has encouraged local and international companies to expand operations in the Kingdom, addressing both service gaps and regulatory frameworks to improve sector integration.

- Advancements in Remote Monitoring and Diagnostic Technology: With 1.2 million Saudi homes now equipped with smart devices, digital health solutions have surged. The Ministry of Health (MOH) has also committed over SAR 5 billion to enhance telemedicine infrastructure, fostering advancements in remote monitoring technologies. The implementation of AI-supported patient monitoring systems and diagnostic tools aligns with this strategy, making healthcare access more efficient and expanding the scope of home-based services.

Market Challenges

- Shortage of Skilled Healthcare Workforce: The shortage of trained healthcare personnel remains a pressing issue, with Saudi Arabia requiring an additional 15,000 skilled home healthcare professionals to meet current demand levels. This gap is intensified by limitations in specialized training facilities, which can hinder service quality. The governments efforts to introduce healthcare-focused training programs have only partially met workforce demands, resulting in overstrained existing staff.

- High Initial Setup and Operational Costs: Operational costs, averaging SAR 2 million annually for large-scale home healthcare providers, create a financial barrier for new entrants. Expenses related to equipment, staffing, and logistics, compounded by the high cost of establishing a robust digital health infrastructure, add to the challenges. This financial hurdle discourages small and medium enterprises from entering the market and restricts the sector's growth potential.

Saudi Arabia Home Healthcare Services Market Future Outlook

Over the next five years, the Saudi Arabia Home Healthcare Services Market is expected to grow significantly, driven by the increasing incidence of chronic illnesses, government support for healthcare infrastructure, and rising awareness about home healthcare options. The integration of advanced technologies, such as AI in diagnostics and IoT-enabled monitoring devices, will further propel market growth by enhancing the efficiency of care delivery and enabling remote patient monitoring, especially in urbanized areas.

Market Opportunities

- Expansion of Telehealth Services and Virtual Care: With over 8 million Saudi citizens gaining access to virtual health consultations through government-supported initiatives, the potential for telehealth services is substantial. Telemedicine programs have facilitated over 300,000 consultations within a year, highlighting the demand for remote healthcare solutions that supplement traditional home healthcare services, especially in rural and underserved regions.

- Integration of AI and IoT in Patient Monitoring: The integration of AI and IoT in patient monitoring is a promising avenue, with the Saudi market adopting around 200,000 IoT-enabled devices specifically designed for healthcare use. These technologies enable real-time monitoring of patient vitals and predictive health analytics, improving early diagnosis and reducing the frequency of hospital visits, which supports home-based treatment efficacy.

Scope of the Report

|

By Service Type |

Skilled Nursing Care |

|

By Application |

Chronic Disease Management |

|

By Equipment Type |

Mobility Aids (Wheelchairs, Walkers) |

|

By Mode of Payment |

Self-Pay |

|

By Region |

Riyadh |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Saudi Food and Drug Authority)

Home Healthcare Providers

Private and Public Healthcare Institutions

Technology and Medical Device Manufacturers

Insurance Companies

Telehealth and Remote Monitoring Service Providers

Rehabilitation and Palliative Care Providers

Companies

Players Mentioned in the Report:

Dr. Sulaiman Al-Habib Medical Group

Seha Home Health

Careem Healthcare Services

Lifecare Home Health Services

Advanced Healthcare Company (AHC)

Saudi German Hospital Group

Al Borg Laboratories

King Faisal Specialist Hospital

Abdul Latif Jameel Health

Health & Wellness Solutions

Table of Contents

1. Saudi Arabia Home Healthcare Services Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Home Healthcare Services Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Home Healthcare Services Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population and Chronic Diseases

3.1.2 Government Support for Health Infrastructure (Vision 2030, Healthcare Transformation)

3.1.3 Technological Advancements in Remote Monitoring and Diagnostics

3.1.4 Increasing Awareness and Demand for Home-Based Care

3.2 Market Challenges

3.2.1 Shortage of Skilled Healthcare Workforce

3.2.2 High Initial Setup and Operational Costs

3.2.3 Limited Insurance Coverage for Home Healthcare Services

3.3 Opportunities

3.3.1 Expansion of Telehealth Services and Virtual Care

3.3.2 Integration of AI and IoT in Patient Monitoring

3.3.3 Strategic Partnerships with Hospitals and Pharmacies

3.4 Trends

3.4.1 Growing Demand for Rehabilitation and Palliative Care

3.4.2 Adoption of Mobile Health Units for Remote Regions

3.4.3 Customization of Services for Lifestyle-Related Health Issues

3.5 Government Regulation

3.5.1 National Healthcare Regulations for Home Care Licensing

3.5.2 Insurance Policy Revisions and Coverage Expansion

3.5.3 Quality Standards and Accreditation Requirements

3.6 SWOT Analysis

3.7 Stake Ecosystem (Health Ministry, Providers, Insurers, Patients)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Saudi Arabia Home Healthcare Services Market Segmentation

4.1 By Service Type (in Value %)

4.1.1 Skilled Nursing Care

4.1.2 Physical Therapy Services

4.1.3 Hospice and Palliative Care

4.1.4 Home Diagnostics and Monitoring

4.1.5 Personal and Companion Care

4.2 By Application (in Value %)

4.2.1 Chronic Disease Management

4.2.2 Post-Surgery Care

4.2.3 Long-Term Care for the Elderly

4.2.4 Pediatric and Neonatal Care

4.2.5 End-of-Life Care

4.3 By Equipment Type (in Value %)

4.3.1 Mobility Aids (Wheelchairs, Walkers)

4.3.2 Monitoring Equipment (BP Monitors, Glucose Monitors)

4.3.3 Therapeutic Devices (Ventilators, Oxygen Equipment)

4.4 By Mode of Payment (in Value %)

4.4.1 Self-Pay

4.4.2 Insurance Reimbursement

4.4.3 Government Funding

4.5 By Region (in Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Eastern Province

4.5.4 Makkah

4.5.5 Madinah

5. Saudi Arabia Home Healthcare Services Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Dr. Sulaiman Al-Habib Medical Group

5.1.2 Seha Home Health

5.1.3 Careem Healthcare Services

5.1.4 Saudi German Hospital Group

5.1.5 Dr. Erfan & Bagedo General Hospital

5.1.6 Lifecare Home Health Services

5.1.7 Advanced Healthcare Company (AHC)

5.1.8 King Faisal Specialist Hospital

5.1.9 Al Borg Laboratories

5.1.10 King Fahad Medical City (KFMC)

5.1.11 Abeer Medical Group

5.1.12 Bupa Arabia

5.1.13 Fakeeh Home Health

5.1.14 Abdul Latif Jameel Health

5.1.15 Health & Wellness Solutions

5.2 Cross Comparison Parameters (Revenue, Patient Footprint, Specialized Services, Technology Integration, Workforce Size, Presence in Rural Areas, Strategic Partnerships, Quality Accreditations)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Home Healthcare Services Market Regulatory Framework

6.1 National Health Regulations for Service Providers

6.2 Compliance with Safety and Quality Standards

6.3 Certification and Accreditation Processes

7. Saudi Arabia Home Healthcare Services Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Home Healthcare Services Future Market Segmentation

8.1 By Service Type (in Value %)

8.2 By Application (in Value %)

8.3 By Equipment Type (in Value %)

8.4 By Mode of Payment (in Value %)

8.5 By Region (in Value %)

9. Saudi Arabia Home Healthcare Services Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives and Outreach Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping major stakeholders within the Saudi Arabia Home Healthcare Services Market. This is accomplished through comprehensive desk research, leveraging both secondary and proprietary databases to collate extensive industry-level insights, defining critical variables affecting market growth.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered and analyzed, covering market penetration, regional service availability, and resultant revenue trends. Additionally, an evaluation of service standards is conducted to ensure accuracy in revenue forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are constructed and validated via interviews with industry experts across various companies. These consultations yield insights into operational and financial aspects, aiding in refining and validating the market data.

Step 4: Research Synthesis and Final Output

The final stage entails direct engagement with key home healthcare providers to gather specific data on product segments, service performance, and consumer preferences. This process is designed to validate data derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the Saudi Arabia Home Healthcare Services Market.

Frequently Asked Questions

01. How big is the Saudi Arabia Home Healthcare Services Market?

The Saudi Arabia Home Healthcare Services Market is valued at USD 6.5 billion, supported by increasing demand for home-based care and chronic disease management services.

02. What are the main drivers of the Saudi Arabia Home Healthcare Services Market?

Key growth drivers in the Saudi Arabia Home Healthcare Services Market include a rising aging population, government initiatives under Vision 2030, and technological advancements in home monitoring and diagnostics.

03. Which cities dominate the Saudi Arabia Home Healthcare Services Market?

In the Saudi Arabia Home Healthcare Services Market, Riyadh and Jeddah lead due to urbanization, a higher proportion of elderly residents, and significant investments in healthcare infrastructure.

04. Who are the major players in the Saudi Arabia Home Healthcare Services Market?

Leading companies in the Saudi Arabia Home Healthcare Services Market include Dr. Sulaiman Al-Habib Medical Group, Seha Home Health, and Careem Healthcare Services, known for their comprehensive service offerings and technological integration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.