Saudi Arabia Ice Cream Market Outlook to 2030

Region:Middle East

Author(s):Paribhasha Tiwari

Product Code:KROD4407

December 2024

90

About the Report

Saudi Arabia Ice Cream Market Overview

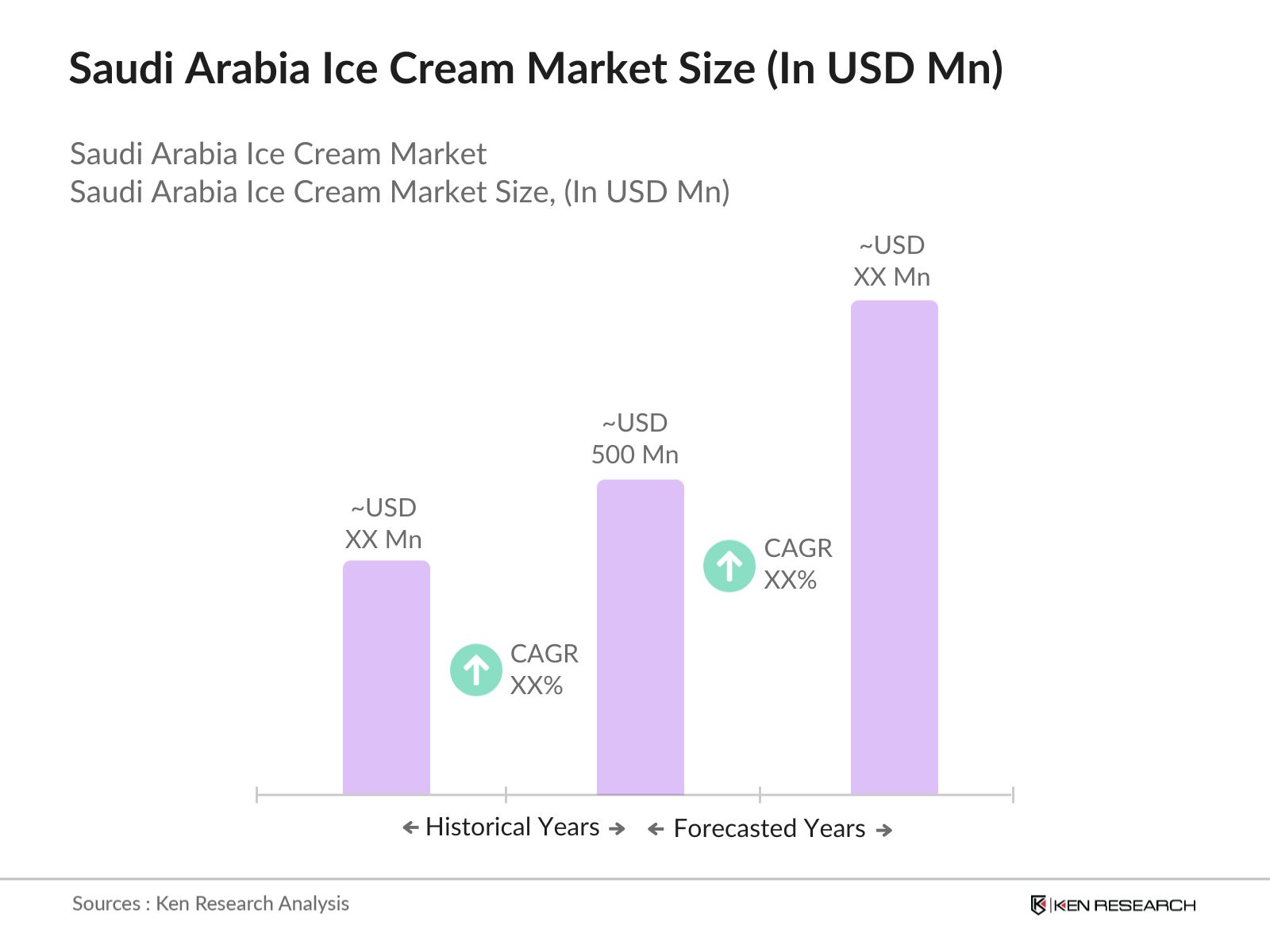

- The Saudi Arabia ice cream market is valued at USD 500 million based on a five-year historical analysis. This growth has been driven primarily by the increasing demand for premium ice cream and healthier alternatives, such as low-fat and sugar-free options, spurred by rising health consciousness. Additionally, the country's growing disposable income and expanding young population have also contributed to the increased demand for a diverse range of ice cream flavors and brands. According to reports from government bodies and the GCCs dairy market studies, this trend is expected to continue with sustained consumer interest in premium products.

- Cities like Riyadh and Jeddah dominate the ice cream market in Saudi Arabia due to their larger populations, higher per capita incomes, and vibrant retail landscapes. Riyadh, being the capital city, has a thriving urban population with greater access to premium ice cream outlets and imported brands. Jeddah, with its coastal tourism, also sees high demand, particularly during the warmer months. These cities benefit from better logistics and supply chain infrastructure, making it easier for ice cream producers and distributors to maintain a stable product flow.

- Saudi Arabias Vision 2030 framework has prioritized the expansion of the retail and foodservice sectors. In 2024, the government allocated SAR 12 billion to improve infrastructure, logistics, and distribution networks, indirectly supporting the growth of the ice cream industry by improving market access for frozen foods. This initiative will help brands overcome the logistical challenges of cold chain distribution in the coming years.

Saudi Arabia Ice Cream Market Segmentation

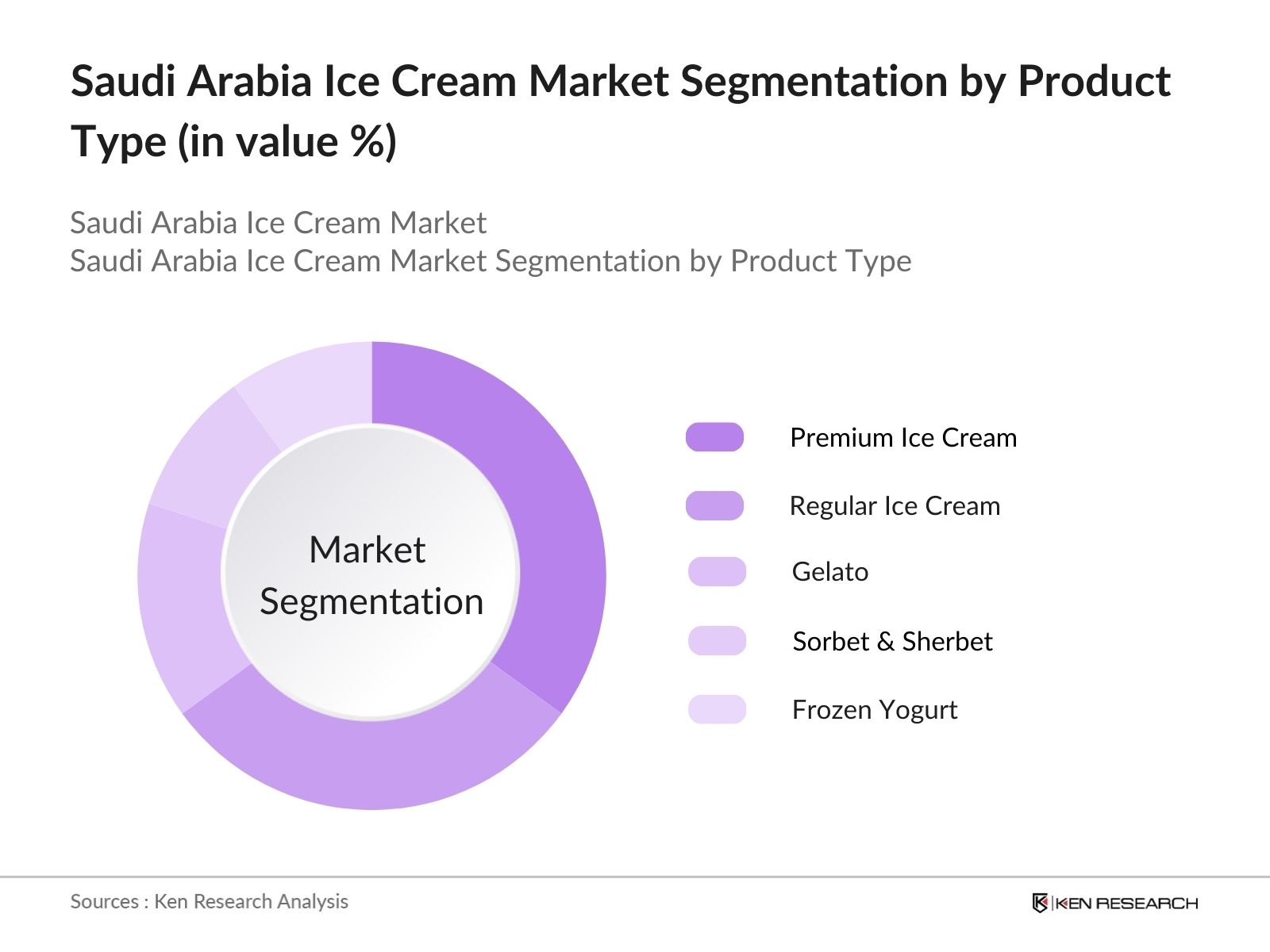

By Product Type: The Saudi Arabia ice cream market is segmented by product type into premium ice cream, regular ice cream, gelato, sorbet & sherbet, and frozen yogurt. Recently, premium ice cream holds a dominant market share due to the rising disposable income and the growing influence of Western lifestyles. Consumers are increasingly seeking out higher-quality ingredients and unique flavors, which has contributed to the success of premium brands. The growing demand for organic and natural products has further driven the market in this segment.

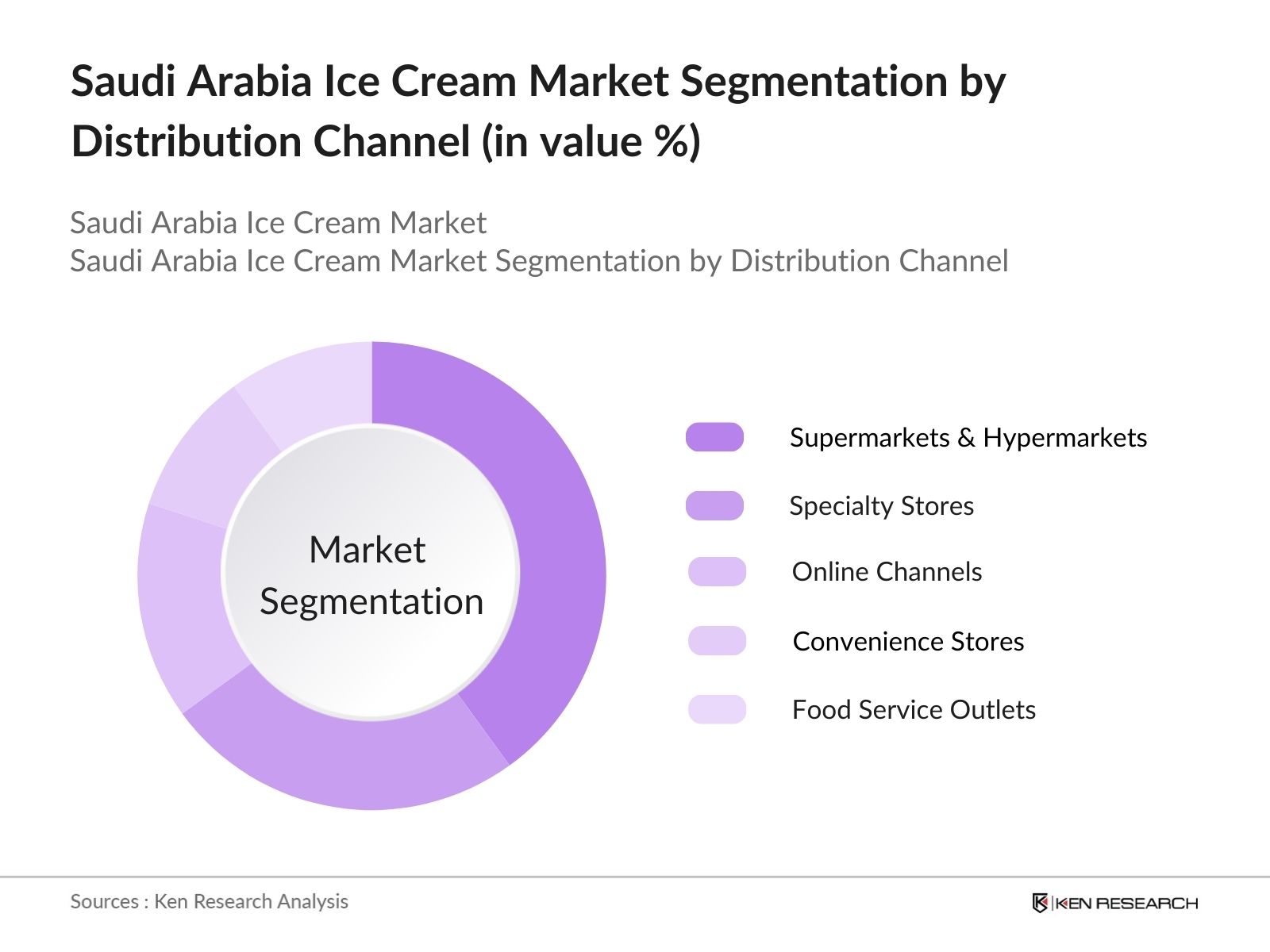

By Distribution Channel: The market is also segmented by distribution channels, including supermarkets & hypermarkets, specialty stores, online channels, convenience stores, and food service outlets. Supermarkets and hypermarkets lead the distribution channel segment, primarily because of their wide product variety and aggressive promotional strategies. Supermarkets offer customers the convenience of purchasing a range of brands and types of ice creams in bulk, often at discounted rates, which makes them the preferred choice for families and large buyers.

Saudi Arabia Ice Cream Market Competitive Landscape

The Saudi Arabia ice cream market is dominated by several key players, including both local and international brands. These companies leverage their established presence, product innovation, and strategic partnerships to maintain a competitive edge.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Market Penetration |

Retail Presence |

Local Manufacturing |

Distribution Network |

Sustainability Initiatives |

|

Almarai |

1977 |

Riyadh, KSA |

- | - | - | - | - | - |

|

SADAFCO |

1976 |

Jeddah, KSA |

- | - | - | - | - | - |

|

Baskin Robbins KSA |

1945 |

Canton, MA, USA |

- | - | - | - | - | - |

|

Mars GCC |

1911 |

McLean, VA, USA |

- | - | - | - | - | - |

|

Nestl KSA |

1867 |

Vevey, Switzerland |

- | - | - | - | - | - |

Saudi Arabia Ice Cream Market Analysis

Growth Drivers

- Shift Toward Premium Ice Creams: The demand for premium ice creams in Saudi Arabia has surged, driven by changing consumer preferences and increased focus on indulgent experiences. In 2024, with disposable incomes increasing and consumers willing to pay for higher-quality products, sales of premium ice cream products such as artisanal and organic variants have seen substantial growth. The premium segment is expanding primarily in urban centers like Riyadh and Jeddah, where high-income households are driving consumption. Government data shows that premium products made up a significant portion of the ice cream category sales, reflecting a more affluent consumer base.

- Increased Demand for Healthier Variants: mHealth-conscious consumers in Saudi Arabia are showing a strong preference for ice cream products with lower sugar content and natural ingredients. According to industry reports, in 2024, the market for better-for-you ice creams saw strong sales, with manufacturers introducing options such as dairy-free, gluten-free, and probiotic-infused variants. This shift aligns with the countrys broader health trends as government initiatives promote healthier eating habits. The healthier ice cream segment has rapidly grown, particularly among millennials who are more conscious of the health implications of traditional desserts.

- Rising Disposable Income: The growth of the Saudi economy, fueled by Vision 2030, has led to an increase in disposable income levels. In 2024, the average household income has risen, leading to a higher expenditure on leisure products such as ice cream. Households with an income above SAR 200,000 have notably increased their spending on frozen desserts, including ice creams, leading to robust growth in this category. This growing purchasing power allows consumers to explore more diverse ice cream options, from gourmet to imported international brands, supporting overall market expansion.

Market Challenges

- Price Sensitivity Among Consumers: Despite the demand for premium products, a significant portion of Saudi Arabias population remains price-sensitive, especially in lower-income groups. This has posed a challenge for premium ice cream brands looking to expand their reach in 2024. The average price per unit for ice creams in Saudi Arabia has risen, leading to fluctuations in demand among middle-income consumers, who are more likely to opt for local, affordable brands. Addressing this price sensitivity while maintaining product quality remains a challenge for many brands.

- Seasonal Demand Fluctuations: Ice cream consumption in Saudi Arabia is highly seasonal, with peak sales during the summer months. The extreme heat during this period drives sales, but during cooler months, demand often plummets. In 2024, data shows that over 60% of ice cream sales occurred during the summer, leaving a large off-season gap for manufacturers to manage. Companies struggle to maintain consistent cash flow and profitability during the cooler months, impacting their operational efficiency.

Saudi Arabia Ice Cream Market Future Outlook

Over the next five years, the Saudi Arabia ice cream market is expected to experience significant growth driven by several key factors. The expanding young population, combined with an increasing preference for premium and healthier ice cream options, will fuel market expansion. Additionally, technological advancements in refrigeration and supply chain efficiency will ensure wider product availability across regions. The governments initiatives to support local production will likely encourage more domestic players to enter the market, enhancing competition.

Market Opportunities

- Expansion in Vegan and Low-Calorie Ice Cream Segments: There has been growing consumer interest in plant-based and low-calorie ice cream products in Saudi Arabia. In 2024, vegan ice cream sales grew by approximately 15 million units due to the rising popularity of plant-based diets among younger consumers. The increasing awareness of health benefits associated with vegan products provides a lucrative opportunity for companies to innovate and capture this growing market segment.

- Growth of E-Commerce Channels: With the rapid growth of e-commerce platforms like Noon and Amazon in Saudi Arabia, ice cream companies have started leveraging online channels to expand their customer base. In 2024, online grocery sales surged by SAR 500 million, reflecting increased consumer trust in digital platforms. This shift opens up opportunities for brands to offer home-delivered, premium ice creams that cater to the growing demand for convenience among busy urban professionals.

Scope of the Report

|

By Product Type |

Premium Ice Cream Regular Ice Cream Gelato Sorbet & Sherbet Frozen Yogurt |

|

By Flavor Type |

Vanilla, Chocolate Fruit-Based Nut-Based Others (Caramel, Cookies & Cream) |

|

By Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Online Channels Convenience Stores Food Service Channels |

|

By Ingredient Type |

Dairy-Based Non-Dairy Based Organic Ingredients Plant-Based |

|

By Region |

Riyadh Jeddah Eastern Province Mecca Province Others (Al-Madinah, Al-Qassim, etc.) |

Products

Key Target Audience

Ice Cream Manufacturers

Retailers and Distributors

Supermarkets and Hypermarkets

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Packaging Companies

Supply Chain and Logistics Providers

Flavor and Ingredient Suppliers

Investors and Venture Capital Firms

Companies

Players Mentioned in the Report:

Almarai

SADAFCO (Saudi Dairy and Foodstuff Company)

Baskin Robbins KSA

Mars GCC

Nestl KSA

Hagen-Dazs Saudi Arabia

Unilever (Walls)

Gulf West Company

Americana Group

Magnum

Table of Contents

1. Saudi Arabia Ice Cream Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Saudi Arabia Ice Cream Consumption Patterns

1.5. Market Segmentation Overview

2. Saudi Arabia Ice Cream Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Ice Cream Market Analysis

3.1. Growth Drivers (Consumer Preferences, Disposable Income)

3.1.1. Shift Toward Premium Ice Creams

3.1.2. Increased Demand for Healthier Variants

3.1.3. Rising Disposable Income

3.1.4. Expanding Retail Sector

3.2. Market Challenges (Operational Barriers, Regulatory Hurdles)

3.2.1. Price Sensitivity Among Consumers

3.2.2. Seasonal Demand Fluctuations

3.2.3. Regulatory Compliance for Food Safety Standards

3.2.4. High Supply Chain Costs

3.3. Opportunities (Product Innovation, Expanding Consumer Base)

3.3.1. Expansion in Vegan and Low-Calorie Ice Cream Segments

3.3.2. Growth of E-Commerce Channels

3.3.3. Introduction of Novel Flavors

3.3.4. Opportunities for Expansion in Secondary Cities

3.4. Trends (Consumer Preferences, Industry Initiatives)

3.4.1. Rise of Private Label Ice Creams

3.4.2. Increase in Demand for Single-Serve and On-the-Go Formats

3.4.3. Collaborations with Restaurants and Cafs

3.4.4. Growth in Customizable Ice Cream Products

3.5. Government Regulation (Food Quality, Health Standards)

3.5.1. Saudi Food and Drug Authority (SFDA) Guidelines

3.5.2. Import Regulations and Tariffs on Dairy Products

3.5.3. Local Production Regulations

3.5.4. Standards for Natural and Artificial Ingredients

3.6. SWOT Analysis

3.7. Competitive Landscape

3.8. Porters Five Forces Analysis

3.9. Consumer Behavior and Purchasing Patterns

4. Saudi Arabia Ice Cream Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Premium Ice Cream

4.1.2. Regular Ice Cream

4.1.3. Gelato

4.1.4. Sorbet & Sherbet

4.1.5. Frozen Yogurt

4.2. By Flavor Type (In Value %) 4.2.1. Vanilla

4.2.2. Chocolate

4.2.3. Fruit-Based Flavors

4.2.4. Nut-Based Flavors

4.2.5. Others (Caramel, Cookies & Cream, etc.)

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Channels

4.3.4. Convenience Stores

4.3.5. Food Service Channels

4.4. By Ingredient Type (In Value %)

4.4.1. Dairy-Based

4.4.2. Non-Dairy Based

4.4.3. Organic Ingredients

4.4.4. Plant-Based

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Mecca Province

4.5.5. Others (Al-Madinah, Al-Qassim, etc.)

5. Saudi Arabia Ice Cream Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almarai

5.1.2. SADAFCO (Saudi Dairy and Foodstuff Company)

5.1.3. Baskin Robbins KSA

5.1.4. Mars GCC

5.1.5. Nestl KSA

5.1.6. Unilever (Walls)

5.1.7. Haagen-Dazs

5.1.8. Gulf West Company

5.1.9. Americana Group

5.1.10. Hagen-Dazs Saudi Arabia

5.1.11. Ice Cap

5.1.12. Frostys

5.1.13. Ice Land Factory

5.1.14. Kwality Walls

5.1.15. Magnum

5.2. Cross Comparison Parameters (Market Share, Distribution Network, Product Range, Local Manufacturing Presence, Innovation Capabilities, Pricing Strategy, Consumer Preference Alignment, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Expansion Initiatives

5.7. Venture Capital and Funding

5.8. Government Incentives for Local Production

6. Saudi Arabia Ice Cream Market Regulatory Framework

6.1. SFDA Food Safety Standards

6.2. Compliance and Labeling Requirements

6.3. Import Regulations on Dairy Products

6.4. Organic Certification and Health Labeling

7. Saudi Arabia Ice Cream Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Ice Cream Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Ice Cream Market Analysts Recommendations

9.1. Market Entry Strategies

9.2. Consumer Targeting Initiatives

9.3. White Space Analysis

9.4. Innovation and R&D Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involved identifying key variables that influence the Saudi Arabia Ice Cream Market. This was achieved by conducting comprehensive desk research, reviewing secondary data from government reports, market studies, and proprietary databases.

Step 2: Market Analysis and Construction

To validate our market findings, consultations were conducted with industry experts through computer-assisted telephone interviews (CATIs). These discussions helped refine the market hypotheses and offered deeper insights into the operational and financial aspects of the ice cream market.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market findings, consultations were conducted with industry experts through computer-assisted telephone interviews (CATIs). These discussions helped refine the market hypotheses and offered deeper insights into the operational and financial aspects of the ice cream market.

Step 4: Research Synthesis and Final Output

In the final phase, detailed discussions were held with ice cream manufacturers and distributors to cross-verify the data obtained through the bottom-up approach. The final report was synthesized to provide an accurate, comprehensive analysis of the Saudi Arabia Ice Cream Market.

Frequently Asked Questions

1. How big is the Saudi Arabia Ice Cream Market?

The Saudi Arabia ice cream market is valued at USD 500 million, driven by rising disposable incomes, a growing young population, and increasing demand for premium ice cream products.

2. What are the challenges in the Saudi Arabia Ice Cream Market?

Challenges in the Saudi ice cream market include seasonal demand fluctuations, price sensitivity among consumers, and high supply chain costs. Moreover, stringent regulatory compliance for food safety standards presents operational barriers for manufacturers.

3. Who are the major players in the Saudi Arabia Ice Cream Market?

Key players in the Saudi Arabia ice cream market include Almarai, SADAFCO, Baskin Robbins KSA, Mars GCC, and Nestlé KSA, which dominate due to their strong brand presence and extensive distribution networks.

4. What are the growth drivers of the Saudi Arabia Ice Cream Market?

The Saudi Arabia ice cream market is primarily driven by rising disposable income, increasing health consciousness, and the growing demand for premium ice cream products. Additionally, innovations in flavor and packaging have contributed to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.