Saudi Arabia Image Sensor Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD10602

November 2024

95

About the Report

Saudi Arabia Image Sensor Market Overview

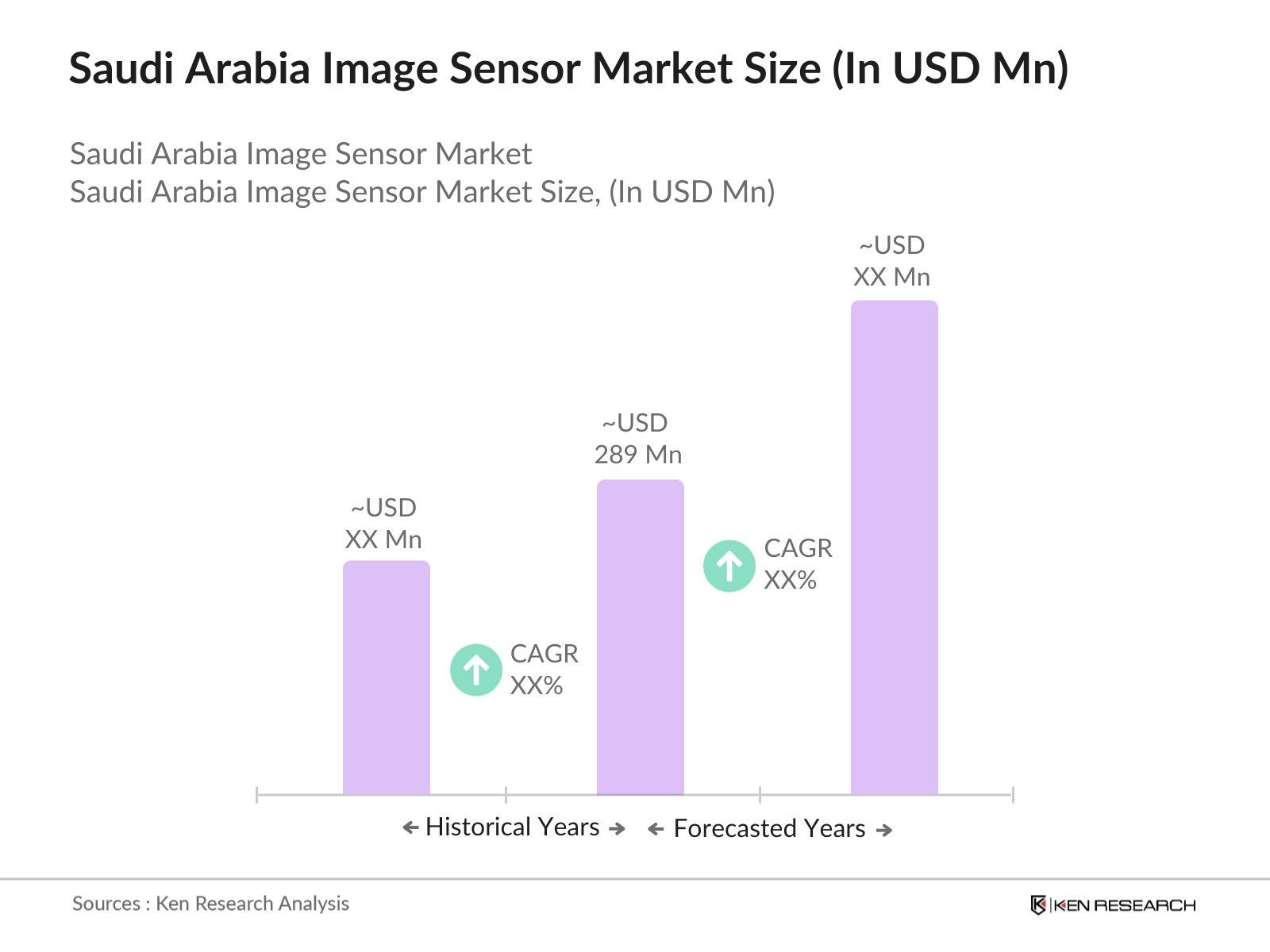

- The Saudi Arabia image sensor market is valued at USD 289 million, driven primarily by the increasing demand for consumer electronics, automotive safety features, and advanced medical imaging technologies. The market's growth trajectory is influenced by government initiatives supporting technological innovation in the region, such as the Saudi Vision 2030, which emphasizes industrial diversification and digital transformation. Additionally, the rising adoption of AI and IoT-based applications in various sectors has significantly boosted demand for high-performance image sensors.

- Riyadh and Jeddah dominate the market, primarily due to their high concentration of tech-driven industries and government-supported initiatives in smart cities and infrastructure development. Riyadh, in particular, has become a hub for technological innovation, while Jeddah leads in automotive advancements and industrial applications. These cities' strategic locations and advanced infrastructure contribute to their dominance in the image sensor market.

- The Saudi government has implemented stringent data privacy regulations for image processing systems used in surveillance and consumer devices. As of 2024, the countrys cybersecurity laws mandate strict controls over how image data is collected, stored, and processed. This regulatory framework has compelled manufacturers to ensure compliance with local privacy standards, especially for public security and AI-powered surveillance systems.

Saudi Arabia Image Sensor Market Segmentation

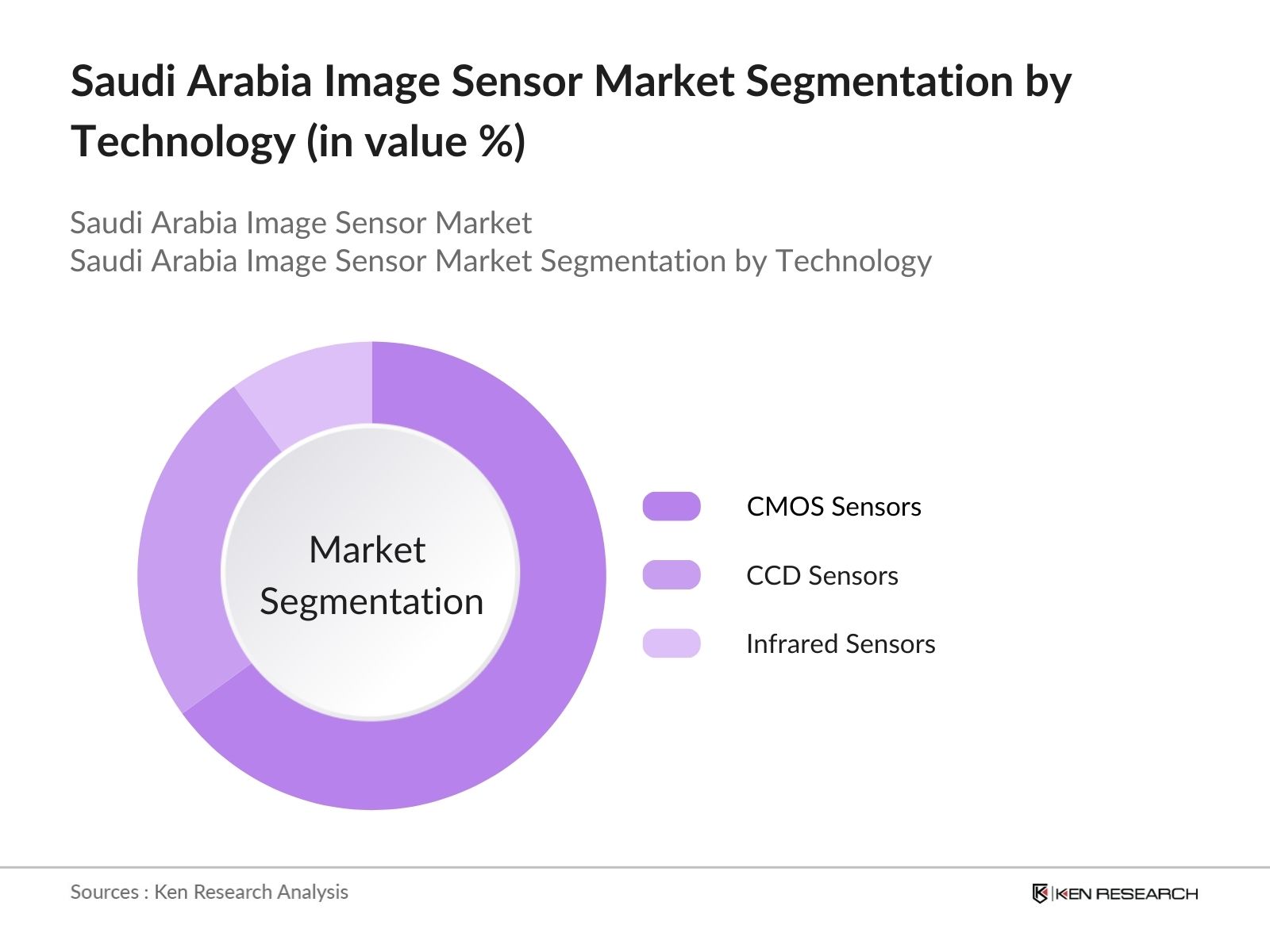

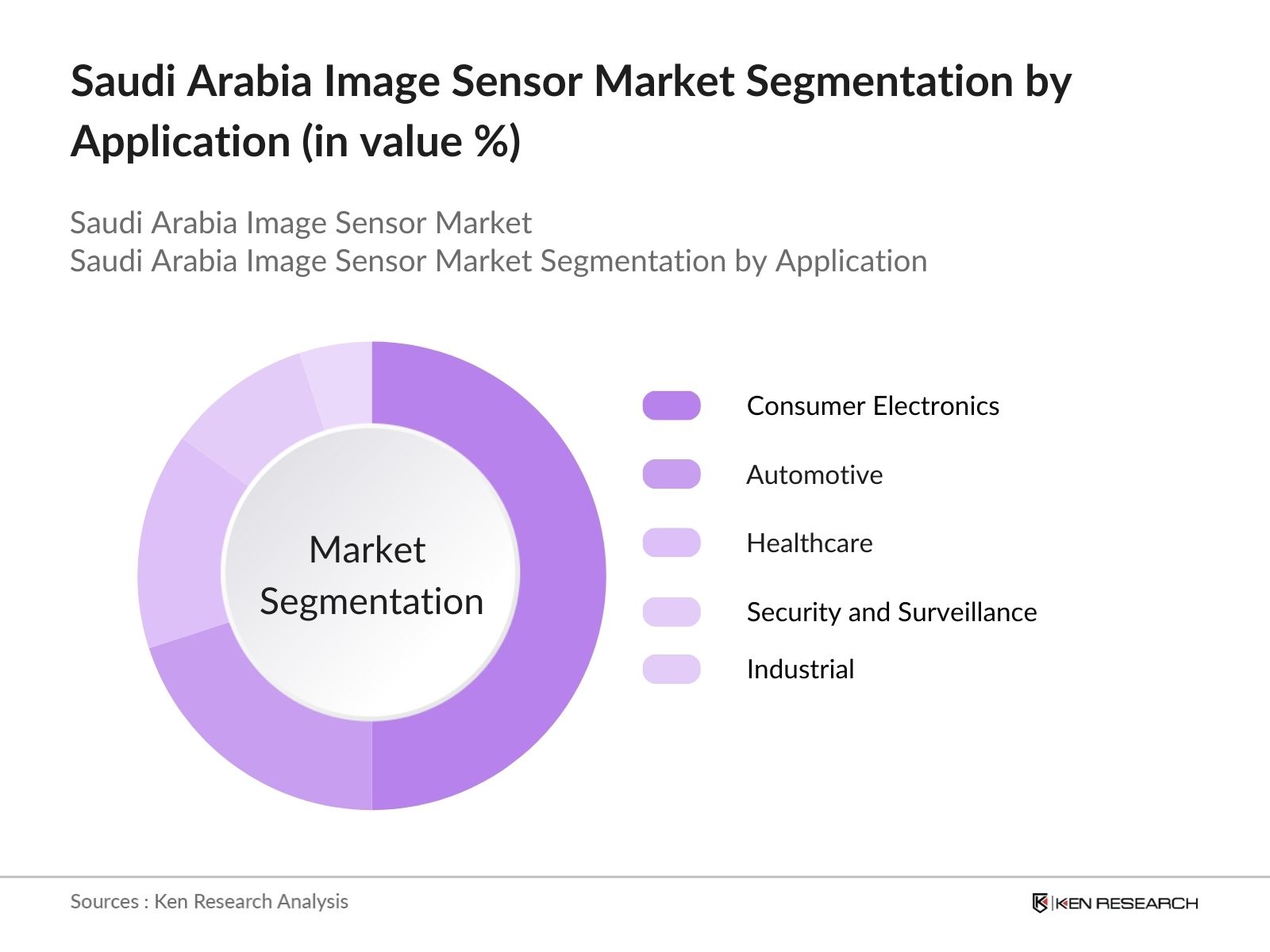

The Saudi Arabia image sensor market is segmented by technology and by application.

- By Technology: The market is segmented by technology into CMOS sensors, CCD sensors, and infrared sensors. CMOS sensors have a dominant market share due to their lower power consumption, faster readout speeds, and better integration with modern electronics. In the consumer electronics sector, CMOS sensors are favored for their compact size and superior performance in smartphones, cameras, and other handheld devices. Furthermore, their integration into automotive safety systems, such as advanced driver assistance systems (ADAS), has solidified their position in the market.

- By Application: The market is segmented by application into consumer electronics, automotive, healthcare, security and surveillance, and industrial sectors. The consumer electronics segment holds a dominant market share due to the growing demand for smartphones, tablets, and cameras equipped with high-resolution image sensors. In addition to consumer devices, this segment is also driven by the increasing use of image sensors in wearable devices, home automation systems, and IoT devices, making it the leading contributor to market growth.

Saudi Arabia Image Sensor Market Competitive Landscape

The Saudi Arabia image sensor market is dominated by global players with established positions in the sensor manufacturing space. These companies have built strong footholds due to their extensive R&D efforts, innovative product portfolios, and strategic partnerships in the region. The major players in the Saudi Arabian market benefit from the region's growing demand for technology-driven solutions, particularly in consumer electronics, automotive, and security sectors. The market exhibits high competition among these key players, with each company vying for market share through technological innovations, partnerships, and regional expansion strategies.

|

Company |

Establishment Year |

Headquarters |

Market Presence |

R&D Expenditure |

Technology Portfolio |

Partnerships |

Revenue |

Geographic Reach |

|

Sony Corporation |

1946 |

Tokyo, Japan |

||||||

|

Samsung Electronics Co., Ltd. |

1938 |

Suwon, South Korea |

||||||

|

OmniVision Technologies, Inc. |

1995 |

California, USA |

||||||

|

ON Semiconductor Corporation |

1999 |

Arizona, USA |

||||||

|

STMicroelectronics N.V. |

1987 |

Geneva, Switzerland |

Saudi Arabia Image Sensor Industry Analysis

Growth Drivers

- Increasing Adoption of Cameras in Consumer Electronics: The rise in consumer electronics adoption, particularly smartphones and tablets, has fueled the demand for image sensors in Saudi Arabia. In 2024, smartphone penetration in Saudi Arabia reached approximately 43 million users, a significant driver for integrated camera sensorsnally, the countrys focus on tech-driven economic growth has led to an increase in the import of advanced image sensors used in consumer electronics. This shift has been further encouraged by government policies that aim to boost digital technology use as part of Vision 2030.

- Automotive Safety Regulations (ADAS Integration, Dash Cameras): Saudi Arabia has witnessed a growing emphasis on automotive safety, primarily driven by government regulations encouraging the use of Advanced Driver Assistance Systems (ADAS). As of 2024, the automotive industry has seen a 20% rise in the adoption of dash cameras and ADAS, especially due to regulations on safety features for new vehicles. These development ushed demand for image sensors in the automotive sector, with ADAS technologies becoming a mandatory feature in most new cars sold within the country.

- Growing Security and Surveillance (Smart Cities Initiatives, Public Security Systems): In alignment with the Saudi government's Smart Cities Initiative, cities like Riyadh and Neom are investing in public security infrastructure, significantly boosting the demand for surveillance systems with advanced image sensors. The government has allocated $500 billion to smart city developments, which includes security infrastructure using high-resolution image sensors. The Ministry of Interior's growing of public security cameras, integrated with smart sensors, further emphasizes this trend.

Market Challenges

- High Manufacturing Advanced Technologies: One of the major challenges faced by the Saudi image sensor market is the high cost of producing advanced sensors, particularly for cutting-edge technologies like backside-illuminated sensors and 3D sensing technologies. Manufacturers face challenges in lowering costs while maintaining performance. The Saudi government has introduced some incentives to support local manufacturing, but the industry remains heavily reliant on imports from global suppliers.

- Power Consumption Issues in Mobile and Wearable Devices: sing power consumption of image sensors in mobile phones and wearable devices presents another challenge. The average power consumption for mobile camera modules in high-end smartphones now exceeds 1.5W, leading to overheating issues and shorter battery life. This is particularly concerning in the Saudi market, where the demand for power mobile devices is growing. Consumers prioritize devices that offer longer battery life, pushing manufacturers to focus on energy-efficient sensor solutions.

Saudi Arabia Image Sensor Market Future Outlook

Over the next five years, the Saudi Arabia image sensor market is expected to witness substantial growth driven by continuous advancements in sensor technology, increasing demand for high-resolution sensors in consumer electronics, and the rise of autonomous driving in the automotive sector. Government-led initiatives such as Vision 2030 are expected to further fuel the adoption of image sensors across various sectors, including healthcare, smart cities, and industrial automation.

Future Market Opportunities

- Artificial Intelligence Integration for Image Processing: AI-powered image sensors are finding significant opportunities in Saudi Arabia, particularly in the realms of automotive safety and public surveillance. The integration of AI into image processing systems for faster, real-time analysis is already being adopted in smart city projects like Neom. This development creates opportunities for advanced AI-enabled sensors, which can process high-resolution images with enhanced accuracy and speed. The rise in AI-based applications is expected to significantly boost the demand for smarter sensors across industries.

- Growth of Edge Computing in Imaging Applications: Edge computing is becoming an essential part of imaging applications in Saudi Arabia, especially in automotive, healthcare, and security systems. With the countrys heavy investment in 5G infrastructure, real-time data processing through edge devices has seen rapid growth. Image sensors integrated with edge computing enable faster image processing and reduce the need for cloud dependency, which is crucial for time-sensitive applications like ADAS and smart surveillance.

Scope of the Report

|

||

|

By Application |

Consumer Electronics Automotive Healthcare Security and Surveillance Industrial |

|

|

By Spectrum |

|

|

|

By Processing Type |

2D Image Sensors 3D Image Sensors |

|

|

By Region |

North East West South |

Products

Saudi Arabia Image Sensor Market Key Target Audience

Consumer Electronics Manufacturers

Automotive OEMs and Suppliers

Healthcare Device Manufacturers

Security and Surveillance Solutions Providers

Industrial Automation Firms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Communications and Information Technology Commission, Saudi Standards, Metrology and Quality Organization)

Semiconductor Manufacturers and Suppliers

Companies

Saudi Arabia Image Sensor Market Major Players

Sony Corporation

Samsung Electronics Co., Ltd.

OmniVision Technologies, Inc.

ON Semiconductor Corporation

STMicroelectronics N.V.

Teledyne Technologies Incorporated

Panasonic Corporation

Canon Inc.

Hamamatsu Photonics K.K.

Sharp Corporation

Pixelplus Co., Ltd.

Himax Technologies, Inc.

GalaxyCore Inc.

Smartsens Technology (Shenzhen) Co., Ltd.

ams-OSRAM AG

Table of Contents

1. Saudi Arabia Image Sensor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Image Sensor Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Image Sensor Market Analysis

3.1. Growth Drivers (Technological Advancements, Consumer Electronics Demand, Automotive Applications)

3.1.1. Increasing Adoption of Cameras in Consumer Electronics

3.1.2. Surge in Automotive Safety Regulations (ADAS integration, Dash Cameras)

3.1.3. Growing Demand for Security and Surveillance (Smart Cities Initiatives, Public Security Systems)

3.1.4. Expanding Healthcare Sector (Medical Imaging, Endoscopy Devices)

3.2. Market Challenges (Pricing, Sensor Noise, Low-Light Performance)

3.2.1. High Manufacturing Costs for Advanced Technologies

3.2.2. Power Consumption Issues in Mobile and Wearable Devices

3.2.3. Sensitivity to Environmental Factors (Temperature, Humidity)

3.3. Opportunities (AI Integration, Edge Computing, 3D Sensing)

3.3.1. Artificial Intelligence Integration for Image Processing

3.3.2. Growth of Edge Computing in Imaging Applications

3.3.3. Rise of 3D Imaging for Augmented Reality and Facial Recognition

3.4. Trends (CMOS vs. CCD Adoption, Miniaturization, Backside-Illuminated Sensors)

3.4.1. CMOS Dominance over CCD in Consumer Devices

3.4.2. Trend towards Miniaturized and Ultra-Compact Sensors

3.4.3. Increasing Use of Backside-Illuminated Sensors for Low-Light Applications

3.5. Government Regulations (Data Privacy, Security Standards for Public Use)

3.5.1. Cybersecurity and Privacy Standards for Image Processing

3.5.2. Regulatory Framework for Automotive Sensors

3.5.3. Licensing and Certifications for Industrial Image Sensors

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Semiconductor Manufacturers, Government Agencies)

3.8. Porters Five Forces Analysis (Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, Threat of New Entrants)

3.9. Competitive Ecosystem

4. Saudi Arabia Image Sensor Market Segmentation

4.1. By Technology (In Value %)

4.1.1. CMOS Sensors

4.1.2. CCD Sensors

4.1.3. Infrared Sensors

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Healthcare

4.2.4. Security and Surveillance

4.2.5. Industrial

4.3. By Spectrum (In Value %)

4.3.1. Visible Spectrum

4.3.2. Infrared Spectrum

4.3.3. Ultraviolet Spectrum

4.4. By Processing Type (In Value %)

4.4.1. 2D Image Sensors

4.4.2. 3D Image Sensors

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Image Sensor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sony Corporation

5.1.2. Samsung Electronics Co., Ltd.

5.1.3. OmniVision Technologies, Inc.

5.1.4. ON Semiconductor Corporation

5.1.5. Panasonic Corporation

5.1.6. Canon Inc.

5.1.7. STMicroelectronics N.V.

5.1.8. Teledyne Technologies Incorporated

5.1.9. Hamamatsu Photonics K.K.

5.1.10. Sharp Corporation

5.1.11. Pixelplus Co., Ltd.

5.1.12. Himax Technologies, Inc.

5.1.13. GalaxyCore Inc.

5.1.14. Smartsens Technology (Shenzhen) Co., Ltd.

5.1.15. ams-OSRAM AG

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Expenditure, Technology Partnerships, Manufacturing Capabilities, Innovation Index, Market Share, Geographic Footprint)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Image Sensor Market Regulatory Framework

6.1. Data Privacy and Security Regulations

6.2. Compliance Requirements for Image Sensors in Automotive

6.3. Certification Processes for Medical Image Sensors

7. Saudi Arabia Image Sensor Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Image Sensor Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Spectrum (In Value %)

8.4. By Processing Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Image Sensor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a comprehensive market ecosystem by identifying the major stakeholders in the Saudi Arabia image sensor market. This is done through extensive desk research, analyzing industry reports, databases, and academic studies. The goal is to outline critical variables such as technology adoption, market drivers, and challenges that will influence market growth.

Step 2: Market Analysis and Construction

In this phase, historical data related to the image sensor market in Saudi Arabia is compiled and analyzed. This involves evaluating the penetration of sensors in different applications, such as automotive, consumer electronics, and security, along with revenue generation metrics. Historical market trends and patterns are analyzed to project the future growth of the market.

Step 3: Hypothesis Validation and Expert Consultation

A market hypothesis is developed based on the data gathered from the previous steps. This hypothesis is then validated through expert interviews conducted via CATIs with industry professionals from key market segments. These interviews help refine the market outlook and validate critical assumptions about sensor demand and usage across sectors.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the gathered information, creating a robust market report that is both comprehensive and actionable. The report includes a bottom-up analysis of various image sensor applications and their impact on the market, providing an accurate and validated picture of the current market landscape.

Frequently Asked Questions

1. How big is the Saudi Arabia Image Sensor Market?

The Saudi Arabia image sensor market is valued at USD 289 million, driven by high demand in consumer electronics, automotive safety systems, and security and surveillance applications.

2. What are the challenges in the Saudi Arabia Image Sensor Market?

Challenges in Saudi Arabia image sensor market include high manufacturing costs for advanced sensor technologies and technical issues such as power consumption and sensor noise in mobile devices. Additionally, the sensitivity of sensors to environmental factors like temperature and humidity poses a problem in industrial applications.

3. Who are the major players in the Saudi Arabia Image Sensor Market?

Key players in Saudi Arabia image sensor market include Sony Corporation, Samsung Electronics Co., Ltd., OmniVision Technologies, Inc., ON Semiconductor Corporation, and STMicroelectronics N.V., all of which dominate the market due to their technological advancements and extensive product portfolios.

4. What are the growth drivers of the Saudi Arabia Image Sensor Market?

The Saudi Arabia image sensor market is propelled by increasing adoption in consumer electronics, growing demand for automotive safety features, and expanding use in healthcare imaging technologies. Government initiatives under Saudi Vision 2030 also play a crucial role in driving market growth.

5. What are the trends in the Saudi Arabia Image Sensor Market?

Key trends in Saudi Arabia image sensor market include the dominance of CMOS sensors over CCD sensors, the growing demand for 3D sensing technologies in AR and VR applications, and the integration of AI-based image processing solutions across sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.