Saudi Arabia In-Vitro Diagnostics Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD8567

December 2024

83

About the Report

Saudi Arabia In-Vitro Diagnostics Market Overview

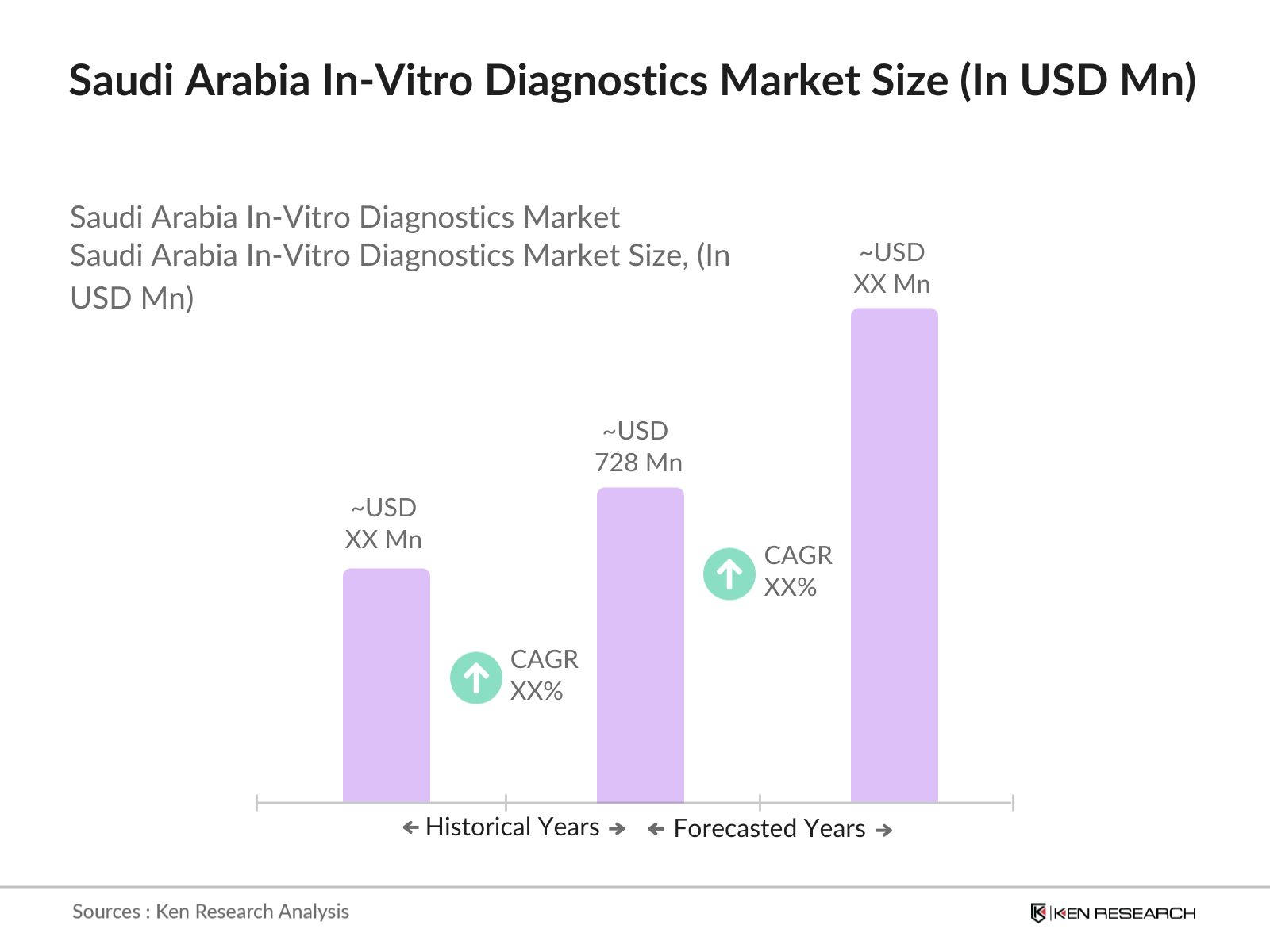

- The Saudi Arabia In-Vitro Diagnostics (IVD) market is valued at USD 728 million, supported by the Kingdoms focus on healthcare infrastructure, a rise in chronic disease prevalence, and increased diagnostic awareness. This growing healthcare landscape is largely driven by the Vision 2030 framework, which prioritizes advanced diagnostic services and increased healthcare accessibility.

- Key regions, including Riyadh and Jeddah, dominate the IVD market due to well-established healthcare facilities, a high population density, and investments in advanced diagnostic technology. These cities also serve as central hubs for healthcare services, attracting leading diagnostic service providers and fostering innovation in medical diagnostics.

- The SFDA enforces rigorous standards for IVD products, mandating compliance with quality and safety benchmarks. In 2024, the SFDA streamlined its diagnostic product approval process, enabling faster market entry while maintaining stringent regulatory standards. These regulations aim to ensure diagnostic safety and efficacy, establishing Saudi Arabia as a reliable market for IVD providers committed to quality.

Saudi Arabia In-Vitro Diagnostics Market Segmentation

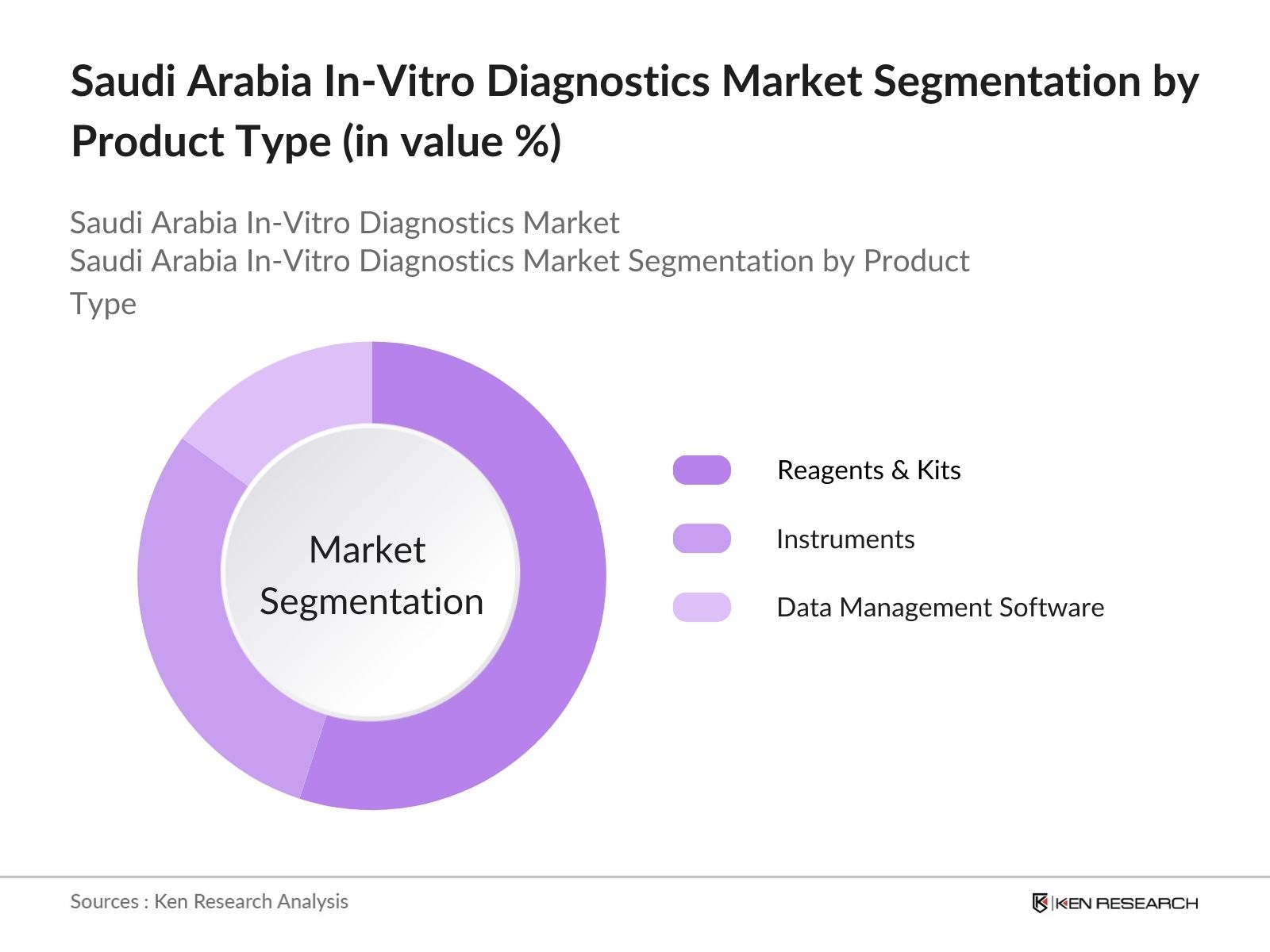

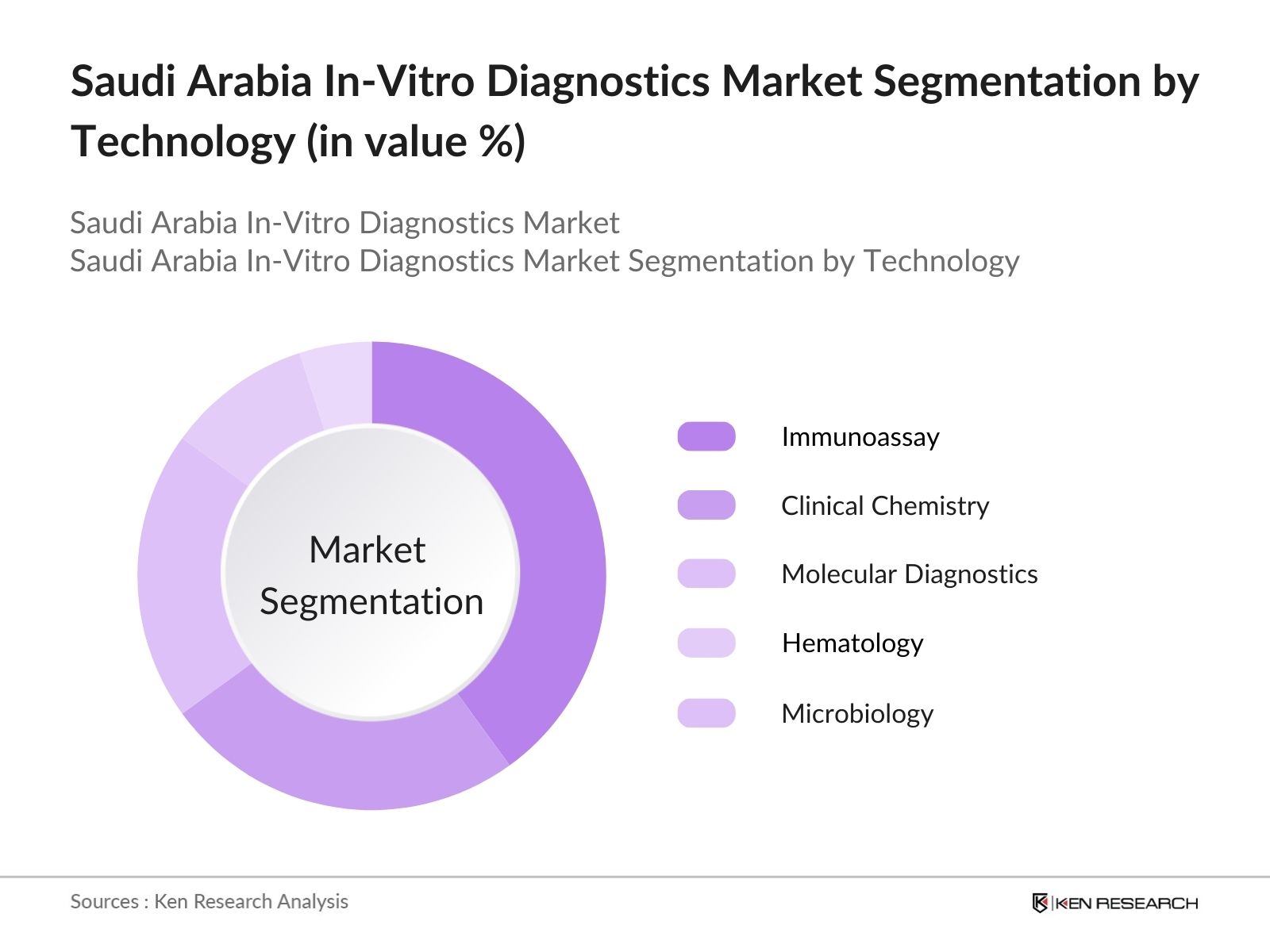

The Saudi Arabia IVD market is segmented by product type and by technology.

- By Product Type: The Saudi Arabia IVD market is segmented by product type into reagents & kits, instruments, and data management software. Reagents & kits hold a dominant market share due to their indispensable role in diagnostic testing across labs and hospitals. This segments continued relevance stems from its widespread applications in various diagnostic tests, making it essential for accurate and efficient diagnostics.

- By Technology: The IVD market is segmented by technology into immunoassay, clinical chemistry, molecular diagnostics, hematology, and microbiology. Immunoassay technology dominates due to its widespread application in detecting various diseases, supported by advancements in testing sensitivity and specificity, making it a preferred choice for accurate diagnostics in Saudi Arabia.

???????

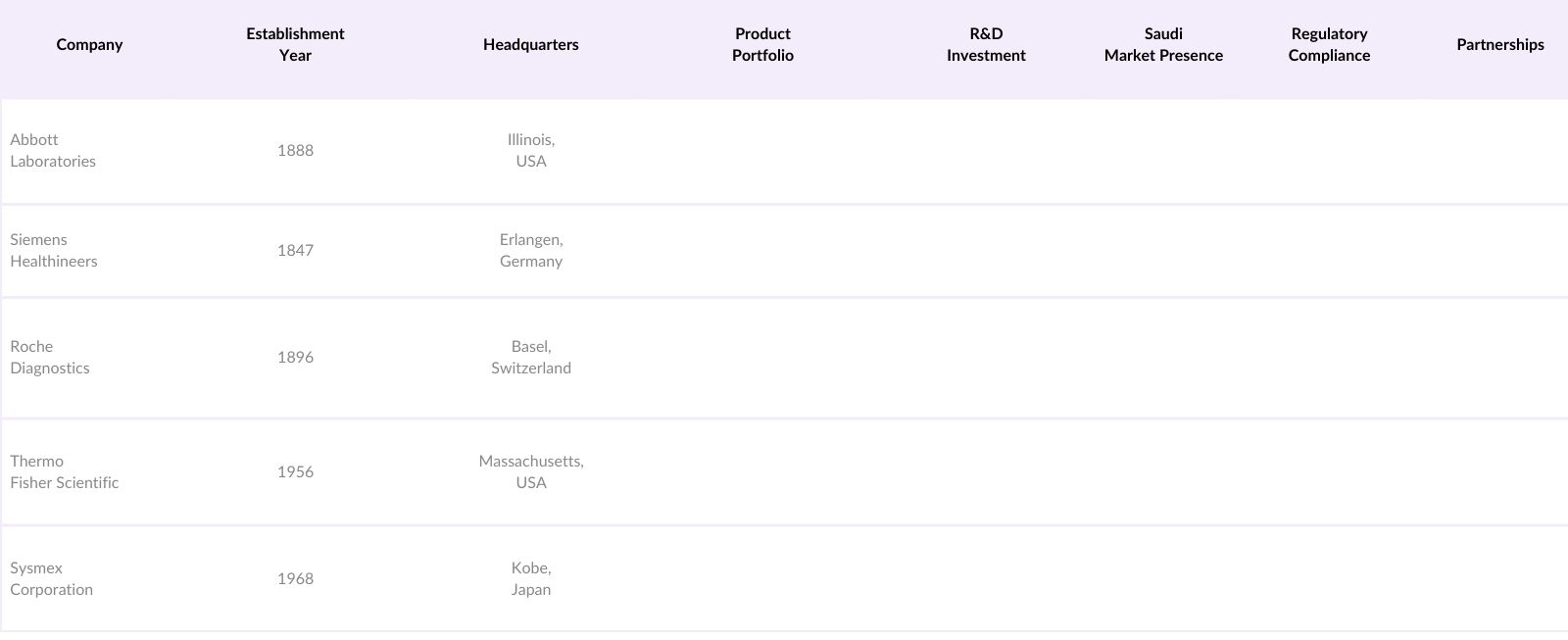

Saudi Arabia In-Vitro Diagnostics Market Competitive Landscape

The Saudi Arabia IVD market is characterized by a few dominant global and regional players who are well-established and recognized for their technological advancements and market reach. This consolidation showcases the impact of these major players within the diagnostic landscape.

Saudi Arabia In-Vitro Diagnostics Market Analysis

Growth Drivers

- Increased Prevalence of Chronic Diseases: The prevalence of chronic diseases in Saudi Arabia has risen significantly, with the Ministry of Health (MoH) reporting nearly 4 million diabetes cases and over 50,000 new cancer diagnoses annually in recent years. Heart diseases are among the primary causes of mortality, impacting the healthcare systems demand for advanced diagnostics. The MoHs healthcare expenditure has increased to support the management of these chronic conditions, amounting to USD 35 billion in 2024. This increase highlights a direct need for in-vitro diagnostics (IVD) to support disease management and timely intervention.

- Growing Demand for Early Diagnostics: The demand for early diagnostics in Saudi Arabia is accelerating, spurred by government health screenings under Vision 2030, aiming for early detection of non-communicable diseases. In 2024, an estimated 1.5 million people accessed early diagnostic services through government programs. Increased MoH allocations for diagnostics have strengthened accessibility, with more than USD 3 billion invested in preventive healthcare initiatives. This funding boost is driving demand for IVD tools, particularly in imaging and pathology, necessary for proactive healthcare delivery.

- Advancements in Diagnostic Technologies: Saudi Arabias diagnostic technology sector has experienced advancements in molecular and digital diagnostics, fueled by partnerships with global tech firms. The MoH reports an 18% increase in diagnostic centers equipped with digital pathology and AI-based molecular tools by 2024. These improvements align with Saudi Vision 2030, emphasizing tech-enabled healthcare. The Saudi Digital Health Initiative has further allocated USD 1.2 billion toward diagnostics technology adoption, significantly enhancing the accuracy and accessibility of diagnostics.

Market Challenges

- High Cost of Diagnostic Devices: Saudi Arabias dependency on imported diagnostic devices poses a significant challenge, with high procurement costs for IVD equipment. MoH data indicates that IVD device imports constitute approximately 70% of the markets total supply, adding financial strain. In 2024, the cost of imported diagnostic devices increased by 12%, impacting accessibility in smaller clinics. The Saudi governments efforts to establish local manufacturing have been limited, affecting the pricing structure of IVDs across healthcare facilities.

- Regulatory Constraints: The Saudi Food and Drug Authority (SFDA) enforces stringent regulations on imported IVD products, necessitating comprehensive clinical evidence and product registration, which often delays market entry. In 2024, SFDA processing times for diagnostic approvals averaged 6-9 months. These regulatory requirements impact foreign companies entering the Saudi market and add time and costs for local healthcare providers, slowing the adoption of the latest IVD innovations.

Saudi Arabia In-Vitro Diagnostics Market Future Outlook

Over the next five years, the Saudi Arabia IVD market is expected to experience strong growth propelled by factors such as rising demand for personalized diagnostics, expanding healthcare infrastructure, and continued investments in advanced diagnostic technology. Additionally, the ongoing efforts under the Vision 2030 framework are expected to bolster this sector by enhancing local manufacturing and diagnostic capabilities.

Market Opportunities

- Expansion of Private Healthcare Sector: Private healthcare is rapidly expanding in Saudi Arabia, with nearly 60 new hospitals opened by private entities since 2022, driven by USD 8 billion in investments. This growth boosts demand for high-quality IVD tools in private hospitals and clinics, complementing public sector efforts. Private sector expansion aligns with Vision 2030s goal to increase private healthcares contribution to overall healthcare services, fostering a market for advanced diagnostics and IVD technology adoption.

- Rise in Personalized Medicine: The MoH has been investing in personalized medicine, integrating genetic diagnostics within treatment plans. In 2024, Saudi Arabia reported 7,000 personalized treatment cases supported by advanced genetic diagnostics. The National Genome Program, backed by USD 1 billion, aims to enhance personalized medicine by developing genetic diagnostic capabilities, providing a key opportunity for specialized IVD providers to address specific patient needs.

Scope of the Report

|

Reagents & Kits Instruments Data Management Software |

|

|

By Technology |

Immunoassay Clinical Chemistry Molecular Diagnostics Hematology Microbiology |

|

By Application |

Infectious Diseases Diabetes Oncology Cardiology Nephrology |

|

By End-User |

Hospitals Laboratories Point-of-Care Testing Centers Research Institutes |

|

By Region |

North East West South |

Products

Key Target Audience

Healthcare providers and diagnostic centers

Hospitals and clinics with diagnostic services

Pharmaceuticals involved in diagnostic solutions

Biotechnology firms

Research institutes and laboratories

Investors and venture capitalist firms

Government and regulatory bodies (e.g., SFDA, Ministry of Health)

Private healthcare investors

Companies

Major Players in Saudi Arabia In-Vitro Diagnostics Market

Abbott Laboratories

Siemens Healthineers

Roche Diagnostics

Thermo Fisher Scientific

Sysmex Corporation

Bio-Rad Laboratories

Becton, Dickinson and Company

Danaher Corporation

Hologic, Inc.

Qiagen N.V.

Cepheid

Grifols, S.A.

Ortho Clinical Diagnostics

PerkinElmer Inc.

Agilent Technologies

Table of Contents

Saudi Arabia In-Vitro Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Saudi Arabia In-Vitro Diagnostics Market Size (In SAR Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Saudi Arabia In-Vitro Diagnostics Market Analysis

3.1. Growth Drivers

- 3.1.1. Increased Prevalence of Chronic Diseases

- 3.1.2. Growing Demand for Early Diagnostics

- 3.1.3. Advancements in Diagnostic Technologies

- 3.1.4. Favorable Government Initiatives

3.2. Market Challenges

- 3.2.1. High Cost of Diagnostic Devices

- 3.2.2. Regulatory Constraints

- 3.2.3. Lack of Skilled Workforce

3.3. Opportunities

- 3.3.1. Expansion of Private Healthcare Sector

- 3.3.2. Rise in Personalized Medicine

- 3.3.3. Growing Adoption of Digital Pathology

3.4. Trends

- 3.4.1. Point-of-Care Testing (POCT) Integration

- 3.4.2. Shift towards Molecular Diagnostics

- 3.4.3. Adoption of AI in Diagnostics

3.5. Government Regulation

- 3.5.1. Saudi Food and Drug Authority (SFDA) Standards

- 3.5.2. Import Regulations

- 3.5.3. Healthcare Transformation Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Landscape

Saudi Arabia In-Vitro Diagnostics Market Segmentation

4.1. By Product Type (In Value %)

- 4.1.1. Reagents & Kits

- 4.1.2. Instruments

- 4.1.3. Data Management Software

4.2. By Technology (In Value %)

- 4.2.1. Immunoassay

- 4.2.2. Clinical Chemistry

- 4.2.3. Molecular Diagnostics

- 4.2.4. Hematology

- 4.2.5. Microbiology

4.3. By Application (In Value %)

- 4.3.1. Infectious Diseases

- 4.3.2. Diabetes

- 4.3.3. Oncology

- 4.3.4. Cardiology

- 4.3.5. Nephrology

4.4. By End-User (In Value %)

- 4.4.1. Hospitals

- 4.4.2. Laboratories

- 4.4.3. Point-of-Care Testing Centers

- 4.4.4. Research Institutes

4.5. By Region (In Value %)

- 4.5.1. North

- 4.5.2. East

- 4.5.3. West

- 4.5.4. South

Saudi Arabia In-Vitro Diagnostics Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

- 5.1.1. Abbott Laboratories

- 5.1.2. Siemens Healthineers

- 5.1.3. Roche Diagnostics

- 5.1.4. Bio-Rad Laboratories

- 5.1.5. Becton, Dickinson and Company

- 5.1.6. Danaher Corporation

- 5.1.7. Thermo Fisher Scientific

- 5.1.8. Sysmex Corporation

- 5.1.9. PerkinElmer Inc.

- 5.1.10. Agilent Technologies

- 5.1.11. Hologic, Inc.

- 5.1.12. Ortho Clinical Diagnostics

- 5.1.13. Cepheid

- 5.1.14. Qiagen N.V.

- 5.1.15. Grifols, S.A.

5.2. Cross Comparison Parameters (Annual Revenue, Employee Count, Headquarters, R&D Investment, Product Range, Regional Presence, Regulatory Approvals, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Trends

5.7. Government and Private Funding

5.8. Emerging Startups

Saudi Arabia In-Vitro Diagnostics Market Regulatory Framework

6.1. SFDA Compliance Standards

6.2. Clinical Trial Approval Process

6.3. Import and Export Regulations

6.4. ISO Certification Requirements

Saudi Arabia In-Vitro Diagnostics Future Market Size (In SAR Million)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

Saudi Arabia In-Vitro Diagnostics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

Saudi Arabia In-Vitro Diagnostics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Penetration Strategies

9.3. Product Portfolio Optimization

9.4. Emerging White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping out key stakeholders, from healthcare providers to diagnostic technology developers. Extensive desk research and proprietary databases are used to gather in-depth industry insights, focusing on identifying factors influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data analysis is performed to evaluate IVD market growth drivers and challenges. This includes assessing the demand for diagnostic tests, regional segmentation, and advancements in diagnostic technologies to estimate market revenues accurately.

Step 3: Hypothesis Validation and Expert Consultation

Through direct interviews and surveys with industry experts, we validate assumptions and obtain insights on trends and strategic approaches. This consultation phase ensures our findings align with the current industry climate and stakeholders' views.

Step 4: Research Synthesis and Final Output

Data synthesis involves combining qualitative and quantitative insights to generate a holistic view of the Saudi Arabia IVD market. This phase includes preparing detailed insights and projections based on cross-verification with industry players.

Frequently Asked Questions

How big is the Saudi Arabia In-Vitro Diagnostics Market?

The Saudi Arabia In-Vitro Diagnostics Market is valued at USD 728 million, driven by a strong healthcare infrastructure and increased demand for diagnostic services.

What are the main challenges in the Saudi Arabia In-Vitro Diagnostics Market?

Challenges in Saudi Arabia In-Vitro Diagnostics Market include high costs associated with advanced diagnostic equipment, stringent regulatory compliance, and the need for skilled professionals to handle sophisticated technologies.

Who are the major players in the Saudi Arabia In-Vitro Diagnostics Market?

Key players in Saudi Arabia In-Vitro Diagnostics Market include Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Thermo Fisher Scientific, and Sysmex Corporation, known for their extensive product portfolios and market presence.

What factors are driving the Saudi Arabia In-Vitro Diagnostics Market?

Key drivers in Saudi Arabia In-Vitro Diagnostics Market include the rising prevalence of chronic diseases, increased government spending on healthcare, and the Vision 2030 initiative, which supports healthcare innovation.

What technologies are most popular in the Saudi Arabia In-Vitro Diagnostics Market?

Immunoassay and molecular diagnostics are widely popular due to their applications in detecting infectious diseases, chronic conditions, and the precision they offer.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.