Saudi Arabia LED Lighting Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD11438

November 2024

86

About the Report

Saudi Arabia LED Lighting Market Overview

- The Saudi Arabia LED lighting market is valued at USD 72 billion, driven by the nation's ongoing urban development projects and a focus on energy-efficient solutions. The rise in demand is closely linked to government initiatives promoting sustainable infrastructure. LED lighting, known for its cost-effectiveness and longevity, has become essential in both public and private sectors, including commercial and residential applications.

- Major cities such as Riyadh and Jeddah are leading the adoption of LED technology, primarily due to their rapid urbanization and smart city initiatives. These cities are investing heavily in smart infrastructure and lighting solutions, further supported by the governments green energy push and the high rate of construction projects. Additionally, the commercial sector in these cities has shown an increasing preference for energy-efficient lighting.

- The Saudi government has introduced several incentive programs to encourage the adoption of green technologies, including LED lighting. The National Renewable Energy Program (NREP) offers rebates and tax incentives for businesses and households that switch to energy-efficient lighting solutions. As of 2023, the government had provided over $2 billion in subsidies for green energy initiatives, including lighting upgrades in public infrastructure. This push toward green technologies is expected to further accelerate the transition to LED lighting systems across the country.

Saudi Arabia LED Lighting Market Segmentation

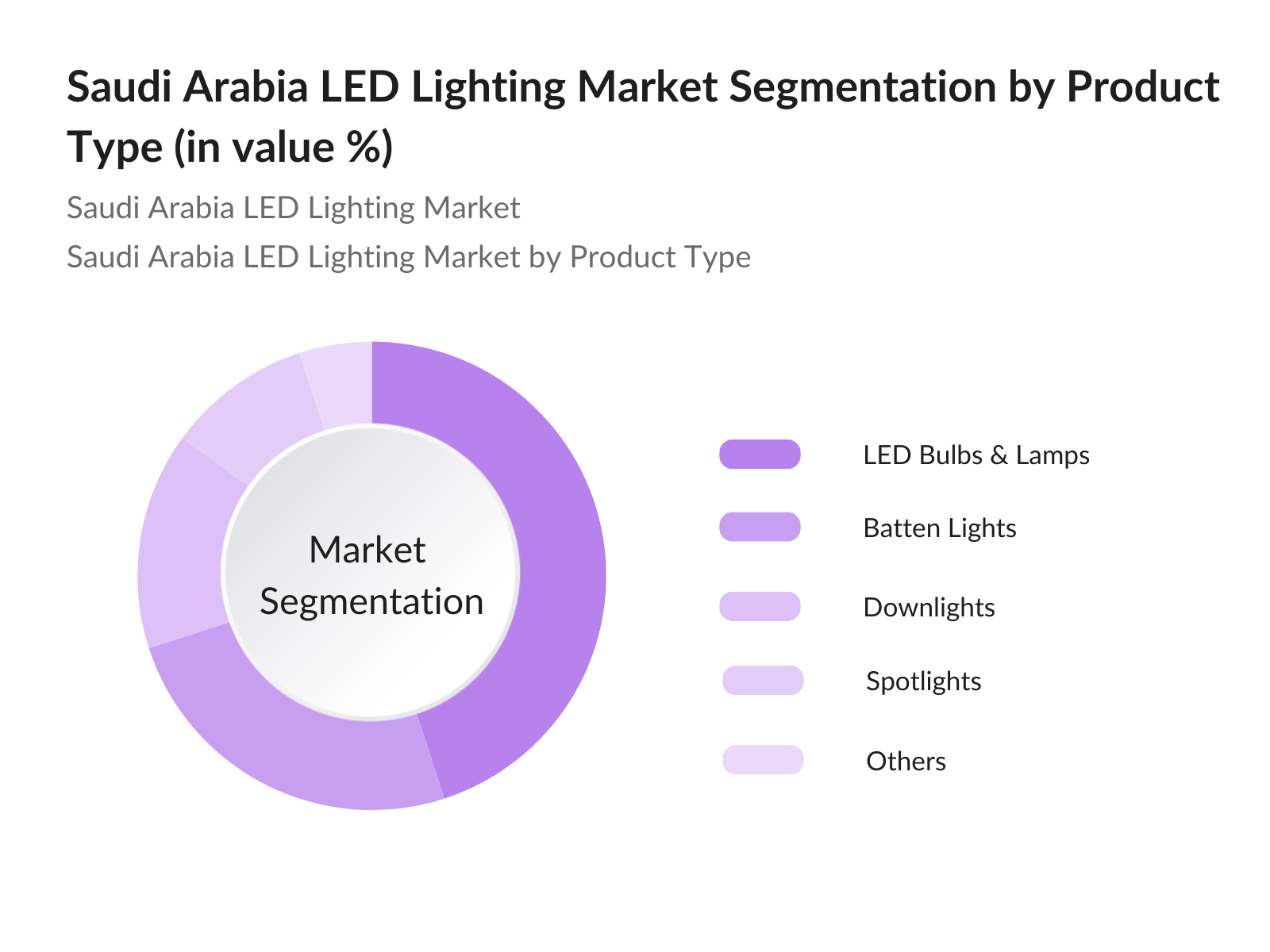

By Product Type: Saudi Arabias LED lighting market is segmented by product type into LED bulbs & lamps, batten lights, downlights, spotlights, and others. LED bulbs & lamps hold the dominant share in the product type segmentation. This is due to their widespread application across various settings, from household lighting to commercial and industrial sectors. Their relatively low cost and energy efficiency make them the preferred choice for large-scale installations across the nation.

By Application: The market is segmented by application into outdoor lighting and indoor lighting. Indoor lighting dominates this segmentation due to its use in residential, commercial, and industrial spaces, where energy efficiency and longer product lifecycles offer significant benefits. Particularly in commercial spaces, the adoption of smart lighting solutions, which integrate LED technology with IoT, has surged, making it the leading application segment.

Saudi Arabia LED Lighting Market Competitive Landscape

The Saudi Arabia LED lighting market is marked by intense competition, with both local and international players. The dominant players leverage their extensive distribution networks and innovative product offerings, making them market leaders. Al Nasser Group, for example, excels due to its robust domestic distribution and government contracts. Meanwhile, LEDVANCE GmbH and Zumtobel Group are known for their high-end, technologically advanced LED solutions that cater to both industrial and commercial clients.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Certifications |

Revenue (2023) |

Regional Presence |

R&D Investment |

|

Al Nasser Group |

1978 |

Riyadh, Saudi Arabia |

Wide (Domestic) |

- |

- |

- |

- |

|

LEDVANCE GmbH |

2016 |

Munich, Germany |

Advanced LED Solutions |

- |

- |

- |

- |

|

Alfanar Group |

1976 |

Riyadh, Saudi Arabia |

Integrated Solutions |

- |

- |

- |

- |

|

NVC International Holdings |

2008 |

Hong Kong, China |

Smart Lighting |

- |

- |

- |

- |

|

Zumtobel Group |

1950 |

Dornbirn, Austria |

High-End Commercial |

- |

- |

- |

- |

Saudi Arabia LED Lighting Market Analysis

Market Growth Drivers

- Energy Efficiency Focus (Government Initiatives): Saudi Arabia is focused on reducing its domestic energy consumption through energy-efficient technologies like LED lighting. The National Energy Efficiency Program (NEEP) has supported this shift by promoting the adoption of energy-saving technologies in various sectors. The government has allocated over $3 billion toward green technologies and energy efficiency. As a result, many new constructions are mandated to implement energy-efficient LED lighting solutions, with significant retrofitting projects underway in urban areas. By 2025, an estimated 2 million homes are expected to adopt energy-efficient systems, driving demand for advanced LED technologies.

- Technological Advancements (Li-Fi, IoT Integration): Technological advancements like Li-Fi and IoT-enabled LED lighting systems are enhancing energy management and data communication within the Saudi market. IoT integration is expected to connect more than 50 million devices in Saudi Arabia by 2025. Furthermore, pilot projects using Li-Fi for high-speed data communication through LED lights are underway. NEOM is expected to pioneer these technologies within its infrastructure, driving demand for intelligent lighting systems that contribute to overall smart city energy savings.

- Adoption of Smart Lighting Systems (Residential, Commercial, Industrial): Saudi Arabias adoption of smart lighting systems is growing rapidly across sectors. By 2023, commercial buildings in major cities like Riyadh and Jeddah had increasingly installed smart lighting systems, featuring motion sensors and adaptive lighting technologies. The residential sector, supported by government subsidies for energy-efficient appliances, has seen a rise in smart bulb installations, with over 1 million smart bulbs sold in 2023. In the industrial sector, smart lighting is being used to enhance operational efficiency and reduce electricity costs, making it a key area of investment.

Market Challenges:

- High Initial Costs for Advanced LED Technologies: While LED technology offers long-term energy savings, the initial cost remains a barrier for widespread adoption. High-quality LED systems, especially those integrated with IoT capabilities, are significantly more expensive than traditional lighting systems. This has slowed adoption rates in sectors with limited budgets, such as small-to-medium enterprises. In rural areas, where affordability remains a concern, the government has allocated $1.5 billion to subsidize energy-efficient technology. However, the high upfront costs of advanced LED systems continue to be a major deterrent for many potential adopters.

- Limited Skilled Workforce for Smart Systems: The implementation of IoT-enabled lighting systems requires a skilled workforce, which remains a challenge in Saudi Arabia. The countrys vocational training programs have only recently begun focusing on the skills needed for smart system integration, with fewer than 10,000 certified professionals in this field as of 2023. To address this gap, the government has committed $500 million toward training initiatives over the next five years, aiming to certify an additional 50,000 workers in smart technology sectors by 2025.

Saudi Arabia LED Lighting Market Future Outlook

Over the next five years, the Saudi Arabia LED lighting market is expected to see substantial growth. The growing adoption of smart city projects, and the increasing awareness of energy-efficient solutions. As the government continues to encourage sustainability and green energy solutions, LED lighting will remain a critical element in urban development and residential projects.

Market Opportunities:

- Increasing Demand for Lighting-as-a-Service (LaaS): Lighting-as-a-Service (LaaS) is gaining momentum in Saudi Arabia, particularly among businesses looking to reduce upfront costs and shift to a subscription-based model for lighting. By 2023, around 300 commercial buildings had already adopted LaaS contracts, with the market for LaaS services expected to grow as more companies prioritize operational efficiency. The shift toward service-based lighting models aligns with the country's broader energy efficiency goals and creates new revenue streams for LED manufacturers and service providers.

- Expansion of IoT-Enabled Smart Homes: IoT-enabled smart homes are a rising trend in Saudi Arabia, with over 200,000 smart homes projected to be completed by 2025, primarily driven by government-backed housing programs. These homes integrate smart lighting systems that can be controlled remotely via mobile devices, reducing energy consumption. As of 2023, IoT-enabled home automation systems were installed in over 150,000 households. This growth in smart homes is expected to drive the demand for advanced LED lighting systems integrated with smart home solutions.

Scope of the Report

|

By Type |

LED Bulbs & Lamps Batten Lights Downlights Spotlights Others |

|

By Application |

Outdoor Lighting Indoor Lighting |

|

By End-User Sector |

Residential Commercial Industrial Public Sector |

|

By End-User |

Smart LED Systems Traditional LED Systems Li-Fi-Enabled Lighting Energy-Efficient Lighting Solar-Powered LED Systems |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Government and Regulatory Bodies (Saudi Energy Efficiency Center, SASO)

LED Manufacturers and Distributors

Electrical Contractors and Installers

Real Estate Developers

Municipal Authorities

Industrial and Commercial Enterprises

Investments and Venture Capital Firms

Renewable Energy Solution Providers

Companies

Players Mentioned in the market

Al Nasser Group

LEDVANCE GmbH

Alfanar Group

NVC International Holdings Limited

OPPLE Lighting Co. Ltd.

CINMAR Lighting Systems

Huda Lighting

Al AbdulKarim Holding

Zumtobel Group AG

Signify N.V.

Cooper Lighting

Acuity Brands

Philips Lighting

Cree Lighting

Fagerhult Group

Table of Contents

1. Saudi Arabia LED Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia LED Lighting Market Size (In USD Million)

2.1. Historical Market Size

2.2. Key Market Milestones

2.3. Year-On-Year Growth Analysis

2.4. Key Market Developments and Trends

3. Saudi Arabia LED Lighting Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Smart City Projects (Vision 2030)

3.1.2. Energy Efficiency Focus (Government Initiatives)

3.1.3. Technological Advancements (Li-Fi, IoT Integration)

3.1.4. Adoption of Smart Lighting Systems (Residential, Commercial, Industrial)

3.2. Market Challenges

3.2.1. High Initial Costs for Advanced LED Technologies

3.2.2. Competition from Traditional Lighting Technologies

3.2.3. Limited Skilled Workforce for Smart Systems

3.3. Opportunities

3.3.1. Increasing Demand for Lighting-as-a-Service (LaaS)

3.3.2. Expansion of IoT-Enabled Smart Homes

3.3.3. Government Incentives for Green Technologies

3.4. Trends

3.4.1. Growing Use of Smart Bulbs and LED Dimmers

3.4.2. Li-Fi for Enhanced Data Communication in LED Lighting

3.4.3. Modular and Dynamic Lighting Systems

3.5. Market Regulation and Environmental Compliance

3.5.1. National Renewable Energy Program (NREP)

3.5.2. Saudi Standards, Metrology, and Quality Organization (SASO)

3.5.3. ECRA Regulations for Energy Efficiency

4. Saudi Arabia LED Lighting Market Segmentation

4.1. By Type (In Value %):

4.1.1. LED Bulbs & Lamps

4.1.2. Batten Lights

4.1.3. Downlights

4.1.4. Spotlights

4.1.5. Others

4.2. By Application (In Value %):

4.2.1. Outdoor Lighting

4.2.2. Indoor Lighting

4.3. By End-User Sector (In Value %):

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Public Sector

4.4. By Region (In Value %):

4.4.1. Central

4.4.2. Western

4.4.3. Eastern

4.4.4. Southern

4.4.5. Northern

5. Saudi Arabia LED Lighting Competitive Landscape

5.1. Company Profiles (By Market Share and Strategy)

5.1.1. Al Nasser Group

5.1.2. LEDVANCE GmbH

5.1.3. Alfanar Group

5.1.4. NVC International Holdings Limited

5.1.5. OPPLE Lighting Co. Ltd.

5.1.6. CINMAR Lighting Systems

5.1.7. Huda Lighting

5.1.8. Al AbdulKarim Holding

5.1.9. Zumtobel Group AG

5.1.10. Signify N.V.

5.1.11. Cooper Lighting

5.1.12. Acuity Brands

5.1.13. Philips Lighting

5.1.14. Cree Lighting

5.1.15. Fagerhult Group

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Product Range, Certifications, Inception Year, Regional Focus, Innovation Score, Market Penetration)

5.3. Market Share Analysis (Major Players by Application and Region)

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. Saudi Arabia LED Lighting Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance and Certification (SASO, ECRA)

6.3. Government Incentives for Green Lighting Solutions

7. Saudi Arabia LED Lighting Market Future Size (In USD Million)

7.1. Market Size Projections

7.2. Key Factors Driving Future Growth

8. Saudi Arabia LED Lighting Market Analyst Recommendations

8.1. White Space Opportunity Analysis

8.2. Customer Cohort Insights (Residential vs Commercial Preferences)

8.3. Strategic Marketing Initiatives

8.4. TAM/SAM/SOM Analysis

Research Methodology

Step 1: Identification of Key Variables

The process begins by identifying critical variables impacting the Saudi Arabia LED lighting market. This involves detailed desk research, assessing key factors like government initiatives, consumer demand, and energy-efficiency requirements.

Step 2: Market Analysis and Construction

Next, historical data is analyzed to construct market trends, assessing parameters such as LED adoption rates across different sectors, including commercial, residential, and industrial markets.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through direct consultation with industry experts. These consultations provide insights into product preferences, future technology adoption, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the gathered data, cross-referencing with industry insights, and compiling a detailed market report. This phase ensures a comprehensive and accurate analysis of the market's potential.

Frequently Asked Questions

01. How big is the Saudi Arabia LED Lighting Market?

The Saudi Arabia LED lighting market is valued at USD 72 billion, driven by government initiatives promoting sustainable infrastructure and a growing demand for energy-efficient solutions across residential and commercial sectors.

02. What are the challenges in the Saudi Arabia LED Lighting Market?

Challenges include the high initial investment costs for smart lighting systems, competition from traditional lighting solutions, and limited awareness among some sectors about the long-term benefits of LED technologies.

03. Who are the major players in the Saudi Arabia LED Lighting Market?

Key players in the market include Al Nasser Group, LEDVANCE GmbH, Alfanar Group, NVC International Holdings Limited, and Zumtobel Group AG, all of whom lead due to their wide range of products and strong market presence.

04. What are the growth drivers of the Saudi Arabia LED Lighting Market?

The market is driven by the nation's shift towards energy efficiency, large-scale infrastructure projects, and the adoption of smart lighting solutions in commercial and residential sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.