Saudi Arabia LED Lights Market Outlook to 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD7398

November 2024

92

About the Report

Saudi Arabia LED Lights Market Overview

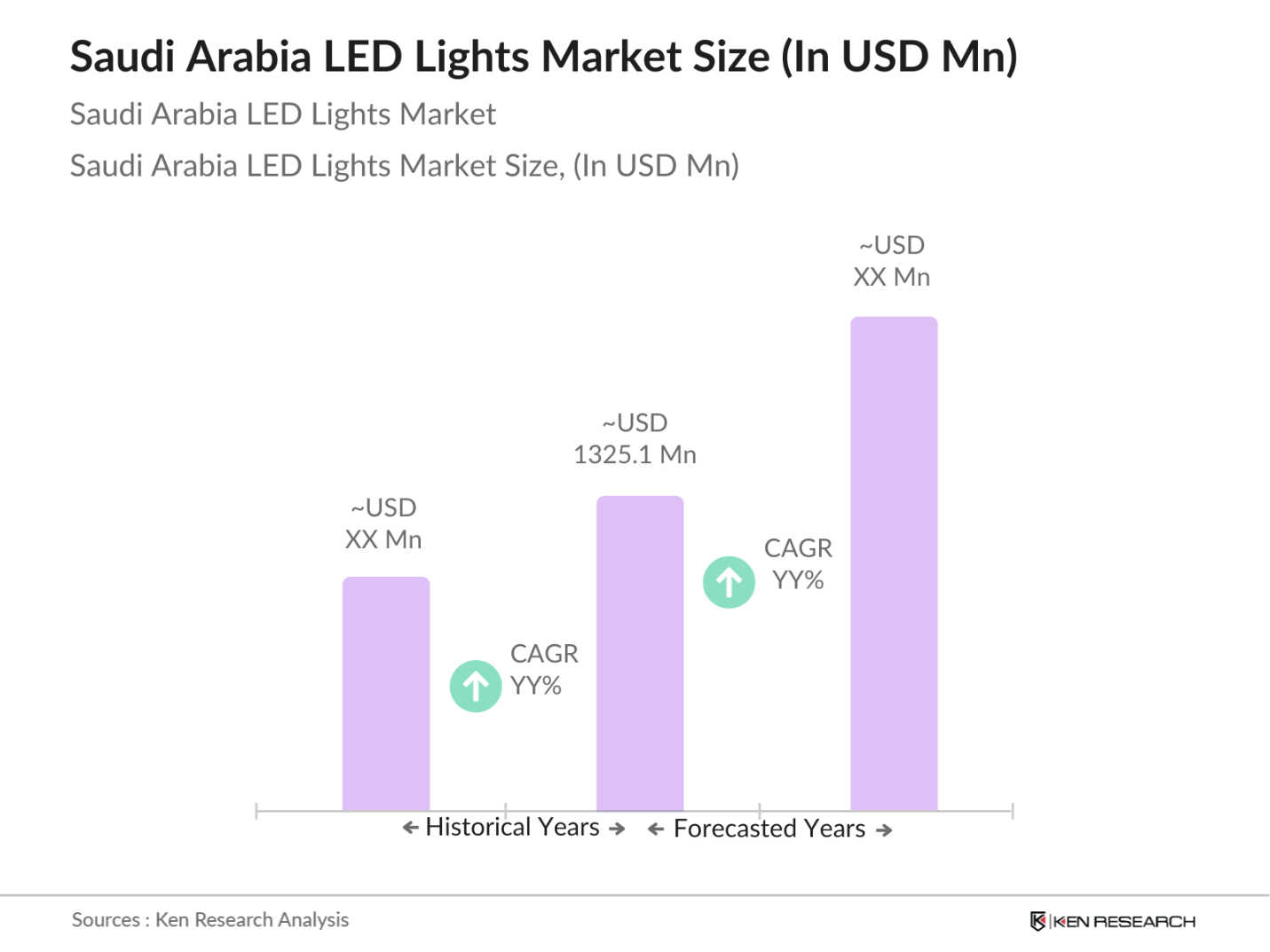

- The Saudi Arabia LED lights market is valued at approximately USD 1325.1 Million, grounded in a comprehensive five-year analysis which emphasizes energy efficiency and environmental sustainability. Government policies supporting energy-efficient technologies, combined with rising infrastructure projects in commercial and residential sectors, have played a critical role in shaping the demand for LED lighting in the country. The shift towards LED technology is also driven by increased awareness of energy conservation benefits, further fueling market growth.

- Key cities driving the LED lights market in Saudi Arabia include Riyadh, Jeddah, and Dammam. These cities lead the market due to rapid urbanization, extensive infrastructure development, and a high rate of adoption for energy-efficient technologies. Additionally, Riyadh, as the capital, has been at the forefront of large-scale governmental and commercial projects, significantly boosting the LED lights demand. Jeddah and Dammam follow closely due to their strategic commercial locations and ongoing public and private construction activities.

- The Saudi government has introduced specific energy efficiency requirements for LED lights, ensuring they meet defined standards. This regulatory push mandates that only LEDs meeting these standards can be installed in public buildings. Compliance checks have seen a 25% increase in 2023, reinforcing quality standards in LED lighting installations.

Saudi Arabia LED Lights Market Segmentation

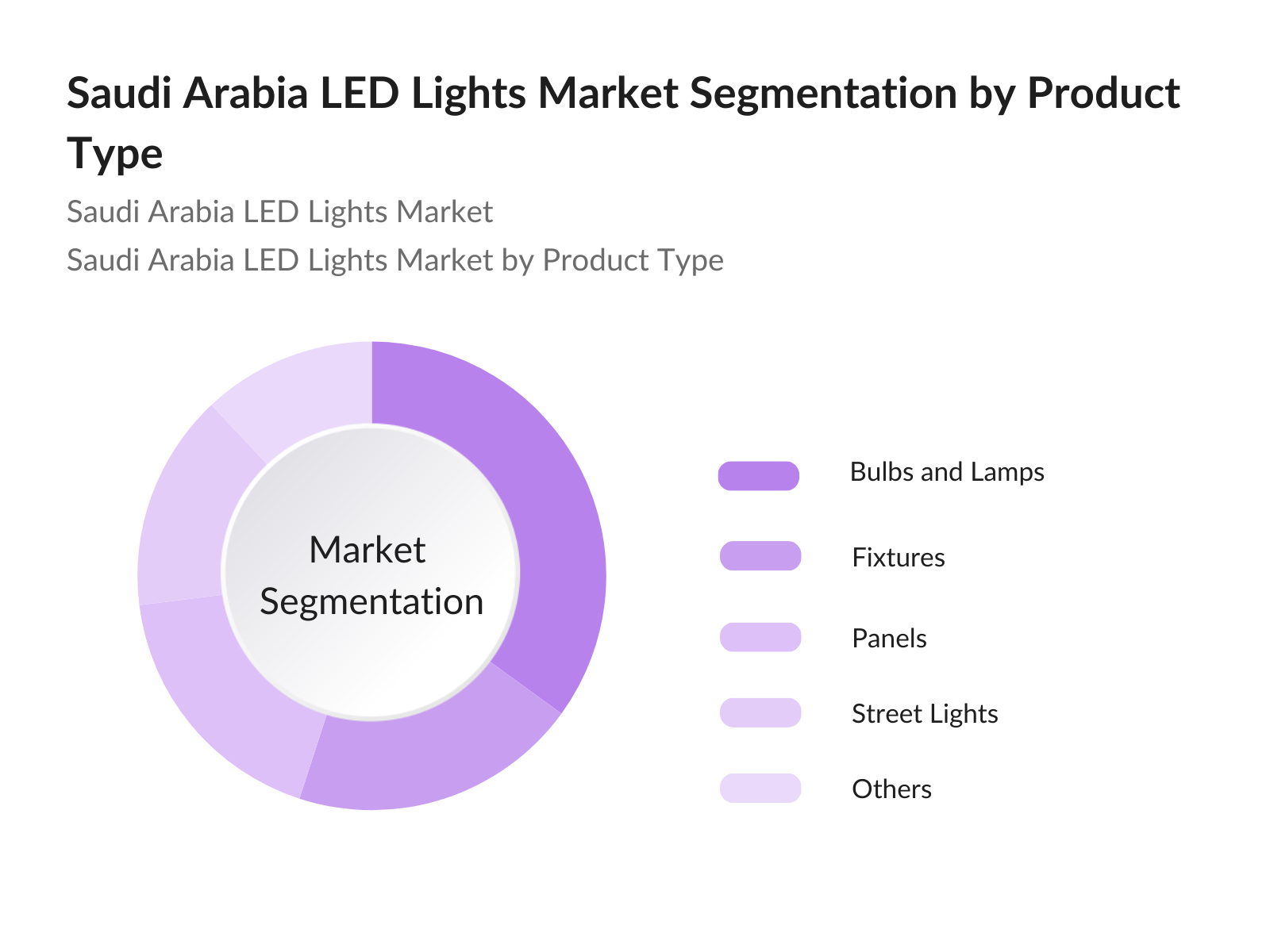

By Product Type: The Saudi Arabia LED lights market is segmented by product type into bulbs and lamps, fixtures, panels, street lights, and others. Recently, bulbs and lamps have a dominant market share under the product type segmentation. This dominance is due to the widespread use of LED bulbs in residential and commercial spaces, as well as their energy-saving benefits compared to traditional lighting options. The affordability and availability of LED bulbs have made them the preferred choice for households and small businesses.

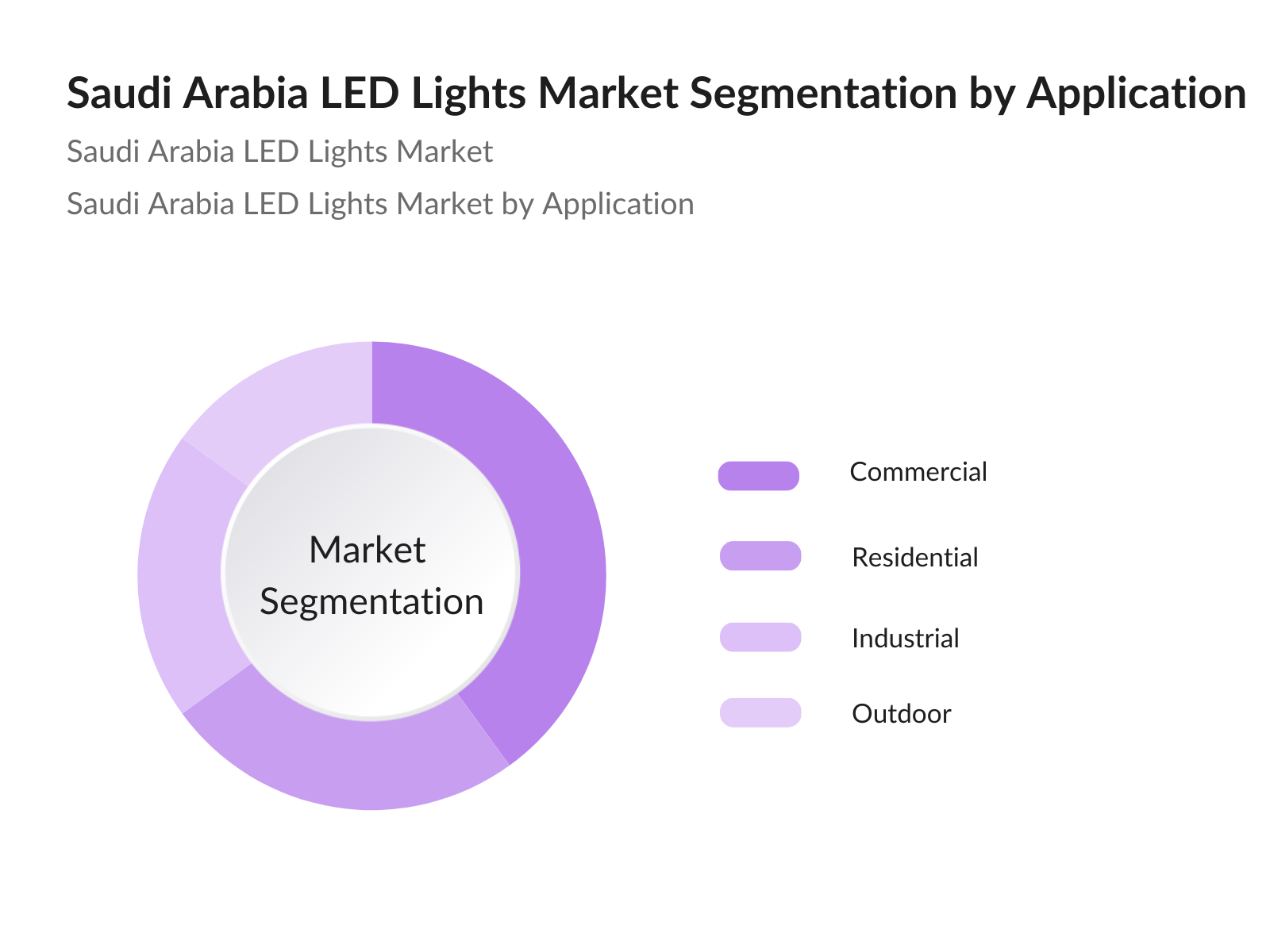

- By Application: The market is further segmented by application into residential, commercial, industrial, and outdoor use. Within this segmentation, commercial applications hold a dominant share due to the increasing adoption of LED lighting in office buildings, retail spaces, and public facilities. This trend is primarily due to the longer lifespan and energy efficiency of LED lighting, which makes it an ideal choice for large-scale commercial applications, significantly lowering maintenance and energy costs.

Saudi Arabia LED Lights Market Competitive Landscape

The Saudi Arabia LED lights market is dominated by both international and domestic players, including well-known global brands and local companies focused on customized solutions for the Saudi market. Key players in the market leverage technological advancements and energy-efficient products to maintain their competitive edge. The market consolidation highlights the significant influence of these leading companies.

|

Company |

Established |

Headquarters |

Product Portfolio |

Regional Presence |

Key Technologies |

Distribution Channels |

Sustainability Initiatives |

|

Philips Lighting |

1891 |

Netherlands |

|||||

|

General Electric (GE) |

1892 |

USA |

|||||

|

OSRAM Licht AG |

1919 |

Germany |

|||||

|

Zumtobel Group AG |

1950 |

Austria |

|||||

|

Cree Inc. |

1987 |

USA |

Saudi Arabia LED Lights Industry Analysis

Market Growth Drivers

- Government Energy Efficiency Initiatives: Saudi Arabias government has prioritized energy efficiency, aligning with its, which aims to reduce the countrys dependency on oil by implementing sustainable solutions. To enhance energy efficiency, the government has allocated substantial funds to energy-efficient projects, with a budget exceeding $10 billion dedicated to energy conservation. In residential and commercial sectors, reducing energy consumption has become a primary focus, directly boosting demand for LED lighting, which can significantly reduce electricity consumption.

- Increasing Infrastructure Projects: Saudi Arabia is witnessing unprecedented growth in infrastructure projects, especially in urban development initiatives like NEOM City and the Red Sea Project. The budget allocated for these mega-projects, exceeding $500 billion, includes lighting infrastructure. These projects are adopting LED lighting for its sustainability and longevity, further driving demand. In 2023, NEOM alone accounts for an estimated 50,000 LED lights in its initial phase, with projections to expand as construction continues.

- Rising Awareness on Energy Conservation: Awareness regarding energy conservation has increased significantly across Saudi Arabia, with campaigns led by the government and private sectors. Studies indicate that Saudi households could save an estimated $1 billion annually by transitioning to energy-efficient lighting, particularly LEDs. In educational institutions, workshops and campaigns have driven a 20% rise in LED adoption for campuses and administrative buildings by 2024.

Market Challenges:

- Competitive Pricing Pressure: The Saudi LED market faces competitive pricing pressure, with imported products from Asia offering lower-cost alternatives. Domestic manufacturers face challenges in balancing quality with cost efficiency, as the influx of cheaper imports affects market dynamics. This pricing competition can undermine the quality perception of locally produced LED solutions, impacting brand preference.

- Limited Availability of Raw Materials: Saudi Arabia relies heavily on imports for raw materials used in LED production, including phosphor and other key components. Global supply chain disruptions have caused delays and inflated prices for these materials, impacting local LED manufacturers production rates. National data reports a 15% rise in import costs in 2023 due to supply chain issues, affecting the overall production costs for LED lights.

Saudi Arabia LED Lights Market Future Outlook

Over the next five years, the Saudi Arabia LED lights market is projected to experience robust growth. This expansion is expected to be driven by government initiatives aligned with, a focus on reducing energy consumption, and increasing investments in smart cities. Additionally, advancements in LED technology and a shift in consumer preference toward energy-efficient lighting solutions will likely fuel further growth across residential, commercial, and industrial applications.

Market Opportunities:

- Technological Advancements in LED Lighting: Technological advancements, including color tuning and enhanced energy-saving features, are spurring interest in LEDs across various applications in Saudi Arabia. For example, tunable white LEDs that adjust to daylight are being introduced in hospitals and educational institutions, enhancing the well-being of occupants. Hospitals in Riyadh are reported to be adopting these advanced LEDs, creating a new demand stream within healthcare facilities.

- LED as Part of Smart City Projects: LED lighting plays a pivotal role in Saudi Arabias smart city initiatives. The NEOM project alone accounts for an expected 500,000 LED installations by 2025, emphasizing energy efficiency and connectivity. Smart city projects incorporating LED solutions are projected to save the country 300 gigawatt-hours (GWh) annually, further driving growth in this segment.

Scope of the Report

|

By Product Type |

Bulbs and Lamps Fixtures Panels Street Lights Others |

|

By Installation Type |

New Installation Retrofit Installation |

|

By Application |

Residential Commercial Industrial Outdoor |

|

By Distribution Channel |

Online Offline |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Residential and Commercial Builders

Urban Development Authorities

Energy Efficiency Regulators

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization, Ministry of Energy)

Retailers and Distributors of Lighting Products

Electrical and Lighting Contractors

Investments and Venture Capitalist Firms

Environmental Organizations and Advocacy Groups

Companies

Players Mentioned in the Market

Philips Lighting

General Electric (GE)

OSRAM Licht AG

Zumtobel Group AG

Cree Inc.

Fagerhult Group

LEDvance GmbH

NVC Lighting

Acuity Brands

Eaton Corporation

Hubbell Lighting Inc.

Dialight PLC

Panasonic Corporation

Toshiba Lighting & Technology Corporation

Syska LED

Table of Contents

1. Saudi Arabia LED Lights Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Lifecycle Stage

1.4. Market Segmentation Overview

2. Saudi Arabia LED Lights Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia LED Lights Market Dynamics

3.1. Growth Drivers

3.1.1. Government Energy Efficiency Initiatives

3.1.2. Increasing Infrastructure Projects

3.1.3. Rising Awareness on Energy Conservation

3.1.4. Shifts in Consumer Preferences

3.2. Market Challenges

3.2.1. High Initial Cost of LED Lights

3.2.2. Competitive Pricing Pressure

3.2.3. Limited Availability of Raw Materials

3.3. Opportunities

3.3.1. Expanding Commercial Sector

3.3.2. Technological Advancements in LED Lighting

3.3.3. Integration with Smart Lighting Solutions

3.4. Trends

3.4.1. Growing Adoption of IoT in Lighting

3.4.2. LED as Part of Smart City Projects

3.4.3. Emergence of Solar-Powered LED Solutions

3.5. Regulatory Landscape

3.5.1. Saudi Vision 2030 and Energy Standards

3.5.2. National LED Energy Efficiency Requirements

3.5.3. Environmental and Safety Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Saudi Arabia LED Lights Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Bulbs and Lamps

4.1.2. Fixtures

4.1.3. Panels

4.1.4. Street Lights

4.1.5. Others

4.2. By Installation Type (in Value %)

4.2.1. New Installation

4.2.2. Retrofit Installation

4.3. By Application (in Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Outdoor

4.4. By Distribution Channel (in Value %)

4.4.1. Online

4.4.2. Offline

4.5. By Region (in Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

4.5.5. Others

5. Saudi Arabia LED Lights Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Philips Lighting Saudi Arabia

5.1.2. General Electric Company (GE)

5.1.3. OSRAM Licht AG

5.1.4. Zumtobel Group AG

5.1.5. Cree Inc.

5.1.6. Fagerhult Group

5.1.7. LEDvance GmbH

5.1.8. NVC Lighting

5.1.9. Acuity Brands

5.1.10. Eaton Corporation

5.1.11. Hubbell Lighting Inc.

5.1.12. Dialight PLC

5.1.13. Panasonic Corporation

5.1.14. Toshiba Lighting & Technology Corporation

5.1.15. Syska LED

5.2. Cross Comparison Parameters (Number of Employees, Regional Presence, Product Portfolio Diversity, Key Distribution Channels, Technology Innovations, Market Share, Revenue Contributions, Partnerships/Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia LED Lights Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Saudi Arabia LED Lights Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia LED Lights Market Future Segmentation

8.1. By Product Type (in Value %)

8.2. By Installation Type (in Value %)

8.3. By Application (in Value %)

8.4. By Distribution Channel (in Value %)

8.5. By Region (in Value %)

9. Saudi Arabia LED Lights Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping the LED lighting ecosystem in Saudi Arabia, covering stakeholders from suppliers to end users. This includes initial data collection from secondary sources, which is then validated through proprietary databases. Key variables influencing the market, such as technological adoption rates and consumer preferences, are identified.

Step 2: Market Analysis and Data Compilation

This phase includes data analysis on historical and current market trends. A detailed examination of consumption rates in residential and commercial applications is conducted, providing insights into market drivers and potential barriers.

Step 3: Expert Consultation and Hypothesis Validation

Using CATI (computer-assisted telephone interviews) and in-depth interviews with industry professionals, we validate preliminary data and refine hypotheses. Feedback from experts ensures the accuracy and relevance of market insights.

Step 4: Data Synthesis and Report Compilation

The final stage involves consolidating quantitative and qualitative findings, focusing on the reliability of insights. Comprehensive market estimates are prepared, supported by primary and secondary data, which form the basis of the final analysis and strategic recommendations.

Frequently Asked Questions

01. How big is the Saudi Arabia LED lights market?

The Saudi Arabia LED lights market is valued at approximately USD 1325.1 Million. The market growth is fueled by energy-saving initiatives and increased adoption across residential and commercial sectors.

02. What are the primary growth drivers for the Saudi Arabia LED lights market?

The market growth is propelled by government policies promoting energy efficiency, the development of smart cities, and rising awareness of sustainable lighting solutions.

03. Who are the major players in the Saudi Arabia LED lights market?

Key players in the market include Philips Lighting, General Electric (GE), OSRAM Licht AG, Zumtobel Group AG, and Cree Inc., all of which have a significant presence in the LED sector due to innovative products and broad distribution networks.

04. Why is commercial application dominant in the Saudi Arabia LED lights market?

Commercial application is dominant due to the extensive use of LED lighting in offices, retail spaces, and public facilities. The longer lifespan and cost efficiency of LEDs make them an ideal choice for large commercial projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.