Saudi Arabia Logistics & Warehousing Market Outlook to 2030

Region:Middle East

Author(s):Author

Product Code:KROD56

September 2018

100

About the Report

Saudi Arabia Logistics & Warehousing Market Overview

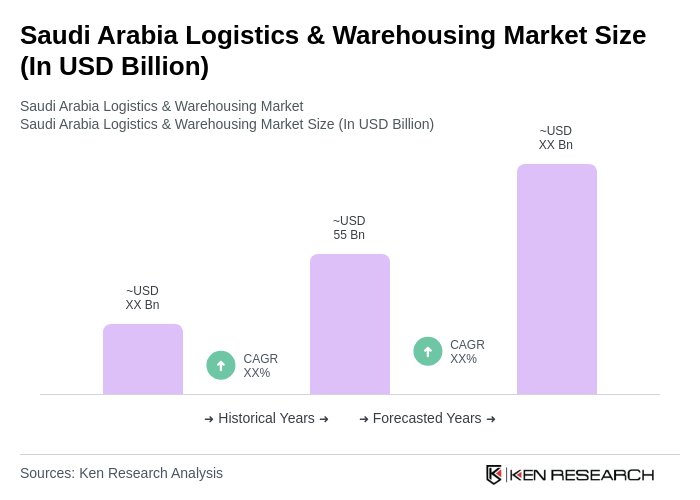

- The Saudi Arabia Logistics & Warehousing Market is valued at USD 55 billion, based on the most recent available industry data. This growth is primarily driven by the country's strategic location as a trade hub, increasing e-commerce activities, and significant investments in infrastructure development. The logistics sector is essential for supporting the Kingdom's Vision 2030 initiative, which aims to diversify the economy and enhance the logistics capabilities of the region.

- Key cities dominating the logistics and warehousing market include Riyadh, Jeddah, and Dammam. Riyadh serves as the political and administrative center, while Jeddah is a major port city facilitating international trade. Dammam, with its proximity to the Eastern Province's industrial zones, plays a crucial role in the supply chain, making these cities pivotal for logistics operations in the Kingdom.

- In 2023, the Saudi government implemented the National Industrial Development and Logistics Program (NIDLP), which aims to enhance the logistics infrastructure and streamline operations. This initiative includes investments in transportation networks, digital logistics solutions, and regulatory reforms to improve efficiency and attract foreign investment, thereby positioning Saudi Arabia as a global logistics hub.

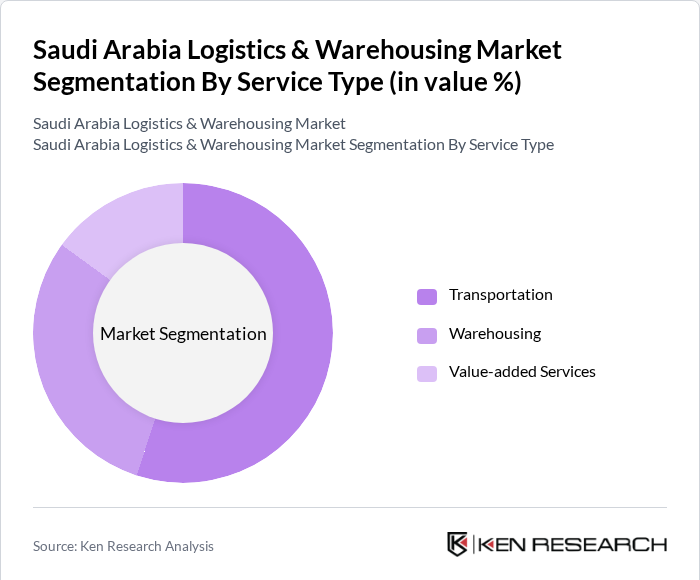

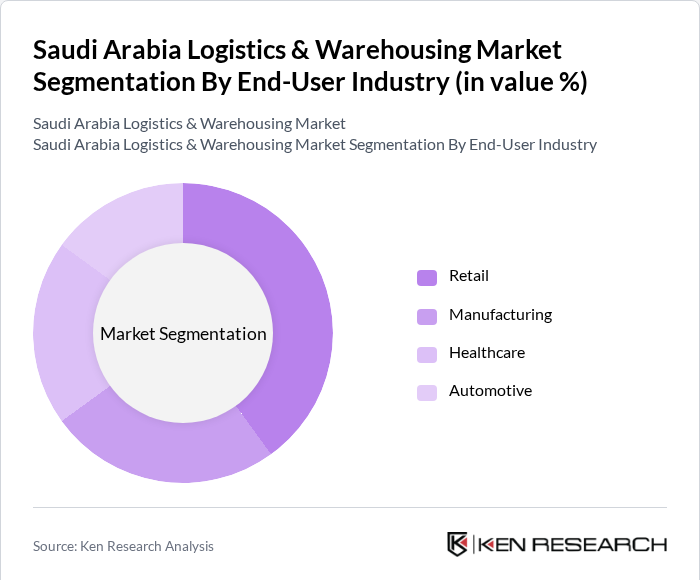

Saudi Arabia Logistics & Warehousing Market Segmentation

By Service Type: The logistics and warehousing market can be segmented into transportation, warehousing, and value-added services. Among these, the transportation segment dominates the market due to the increasing demand for efficient supply chain solutions. The rise of e-commerce has significantly influenced consumer behavior, leading to a surge in demand for fast and reliable transportation services. Companies are increasingly investing in last-mile delivery solutions to meet customer expectations, further solidifying the transportation segment's leading position.

By End-User Industry: The logistics and warehousing market is segmented by end-user industries, including retail, manufacturing, healthcare, and automotive. The retail sector is the dominant segment, driven by the rapid growth of e-commerce and changing consumer preferences. Retailers are increasingly relying on logistics providers to ensure timely deliveries and efficient inventory management. The shift towards online shopping has prompted investments in warehousing and distribution centers, making the retail industry a key player in the logistics landscape.

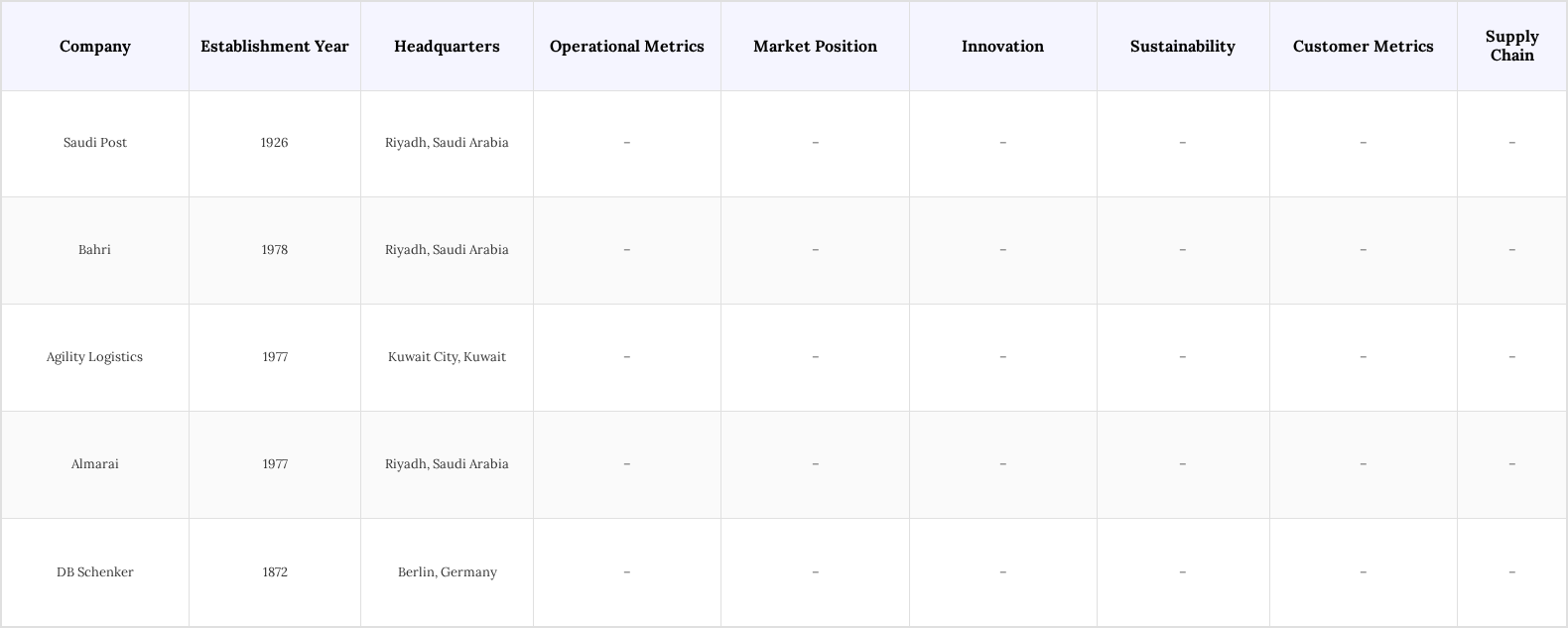

Saudi Arabia Logistics & Warehousing Market Competitive Landscape

The Saudi Arabia Logistics & Warehousing Market is characterized by a competitive landscape with several key players, including Saudi Post, Bahri, and Agility Logistics. These companies are leveraging advanced technologies and expanding their service offerings to enhance operational efficiency and customer satisfaction. The market is witnessing increased consolidation as companies seek to strengthen their market position and improve service delivery.

Saudi Arabia Logistics & Warehousing Market Industry Analysis

Growth Drivers

- Increasing E-commerce Activities: The e-commerce sector in Saudi Arabia is projected to reach USD 2.02 billion in 2024, with forecasts indicating growth to USD 3.32 billion by 2025. This surge in online shopping is prompting logistics companies to enhance their warehousing capabilities and distribution networks. The rise in consumer demand for faster delivery services is pushing investments in last-mile logistics solutions, which are essential for meeting customer expectations in the rapidly evolving retail landscape.

- Government Investments in Infrastructure: The Saudi government has allocated approximately USD 100 billion for infrastructure development as part of its Vision 2030 initiative. This investment focuses on enhancing transport networks, including roads, railways, and ports, which are crucial for logistics efficiency. Improved infrastructure is expected to reduce transit times and operational costs, thereby attracting more logistics companies to establish operations in the region, ultimately boosting the market's growth.

- Strategic Location as a Trade Hub: Saudi Arabia's geographical position at the crossroads of Europe, Asia, and Africa makes it a vital trade hub. The country is enhancing its logistics capabilities to capitalize on this strategic advantage, with the Red Sea ports handling over 10 million TEUs annually. This positioning facilitates international trade, encouraging foreign investments in logistics and warehousing, which are essential for supporting the growing demand for efficient supply chain solutions.

Market Challenges

- Regulatory Compliance Issues: The logistics sector in Saudi Arabia faces significant regulatory compliance challenges, with over 30 different regulatory bodies overseeing various aspects of logistics operations. Companies must navigate complex import/export regulations, which can lead to delays and increased costs. Non-compliance can result in hefty fines, making it essential for logistics providers to invest in compliance management systems to mitigate risks and ensure smooth operations.

- High Operational Costs: The logistics industry in Saudi Arabia is grappling with high operational costs, which can reach up to 30% of total logistics expenses. Factors contributing to these costs include fuel prices, labor expenses, and maintenance of aging infrastructure. These high costs can deter new entrants and limit the growth potential of existing players, necessitating innovative solutions to enhance operational efficiency and reduce expenses in the competitive market landscape.

Saudi Arabia Logistics & Warehousing Market Future Outlook

The Saudi logistics and warehousing market is poised for significant transformation, driven by advancements in technology and increasing demand for efficient supply chain solutions. The adoption of automation and IoT technologies is expected to streamline operations, enhancing productivity and reducing costs. Additionally, the expansion of free trade zones will facilitate international trade, attracting more foreign investments. As the market evolves, companies that embrace innovation and sustainability will likely gain a competitive edge, positioning themselves for long-term success in the dynamic logistics landscape.

Market Opportunities

- Adoption of Advanced Technologies: The integration of advanced technologies such as AI and blockchain in logistics operations presents a significant opportunity. These technologies can enhance supply chain transparency, improve inventory management, and reduce fraud, leading to increased efficiency. Companies investing in these innovations are likely to gain a competitive advantage, positioning themselves favorably in the rapidly evolving logistics market.

- Expansion of Free Trade Zones: The establishment of additional free trade zones in Saudi Arabia is expected to create new opportunities for logistics providers. These zones facilitate easier customs procedures and lower tariffs, attracting international businesses. As more companies set up operations in these zones, logistics demand will increase, providing a lucrative opportunity for service providers to expand their offerings and enhance their market presence.

Scope of the Report

| By Service Type |

Transportation Warehousing Value-added services |

| By End-User Industry |

Retail Manufacturing Healthcare Automotive |

| By Logistics Mode |

Road Rail Air Sea |

| By Technology Adoption |

Automation IoT Blockchain Artificial Intelligence |

| By Region |

Central Region Western Region Eastern Region Southern Region |

Products

Companies

Players Mentioned in the Report:

Saudi Post

Bahri

Agility Logistics

Almarai

DB Schenker

Desert Logistics Solutions

Red Sea Warehousing

Oasis Freight Services

Gulf Supply Chain Management

Riyadh Distribution Network

Table of Contents

1. Saudi Arabia Logistics & Warehousing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Logistics & Warehousing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Logistics & Warehousing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing E-commerce Activities

3.1.2. Government Investments in Infrastructure

3.1.3. Strategic Location as a Trade Hub

3.2. Market Challenges

3.2.1. Regulatory Compliance Issues

3.2.2. High Operational Costs

3.2.3. Limited Skilled Workforce

3.3. Opportunities

3.3.1. Adoption of Advanced Technologies

3.3.2. Expansion of Free Trade Zones

3.3.3. Growth in the Manufacturing Sector

3.4. Trends

3.4.1. Shift Towards Automation and Robotics

3.4.2. Increasing Demand for Cold Chain Logistics

3.4.3. Sustainability Initiatives in Logistics

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies

3.5.2. Import and Export Regulations

3.5.3. Safety and Environmental Regulations

3.5.4. Taxation Policies Affecting Logistics

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Saudi Arabia Logistics & Warehousing Market Segmentation

5. Saudi Arabia Logistics & Warehousing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Post

5.1.2. Bahri

5.1.3. Agility Logistics

5.1.4. Almarai

5.1.5. DB Schenker

5.1.6. Desert Logistics Solutions

5.1.7. Red Sea Warehousing

5.1.8. Oasis Freight Services

5.1.9. Gulf Supply Chain Management

5.1.10. Riyadh Distribution Network

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Service Offerings

5.2.4. Geographic Presence

5.2.5. Customer Base

5.2.6. Technology Adoption

5.2.7. Operational Efficiency

5.2.8. Sustainability Practices

6. Saudi Arabia Logistics & Warehousing Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Saudi Arabia Logistics & Warehousing Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Logistics & Warehousing Market Future Market Segmentation

8.1. By Service Type

8.1.1 Transportation

8.1.2 Warehousing

8.1.3 Value-added services

8.2. By End-User Industry

8.2.1 Retail

8.2.2 Manufacturing

8.2.3 Healthcare

8.2.4 Automotive

8.3. By Logistics Mode

8.3.1 Road

8.3.2 Rail

8.3.3 Air

8.3.4 Sea

8.4. By Technology Adoption

8.4.1 Automation

8.4.2 IoT

8.4.3 Blockchain

8.4.4 Artificial Intelligence

8.5. By Region

8.5.1 Central Region

8.5.2 Western Region

8.5.3 Eastern Region

8.5.4 Southern Region

9. Saudi Arabia Logistics & Warehousing Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia Logistics & Warehousing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Saudi Arabia Logistics & Warehousing Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia Logistics & Warehousing Market.

Frequently Asked Questions

01. How big is the Saudi Arabia Logistics & Warehousing Market?

The Saudi Arabia Logistics & Warehousing Market is valued at USD 55 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Saudi Arabia Logistics & Warehousing Market?

Key challenges in the Saudi Arabia Logistics & Warehousing Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Saudi Arabia Logistics & Warehousing Market?

Major players in the Saudi Arabia Logistics & Warehousing Market include Saudi Post, Bahri, Agility Logistics, Almarai, DB Schenker, among others.

04. What are the growth drivers for the Saudi Arabia Logistics & Warehousing Market?

The primary growth drivers for the Saudi Arabia Logistics & Warehousing Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.