Saudi Arabia Medical Imaging Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD5009

November 2024

93

About the Report

Saudi Arabia Medical Imaging Market Overview

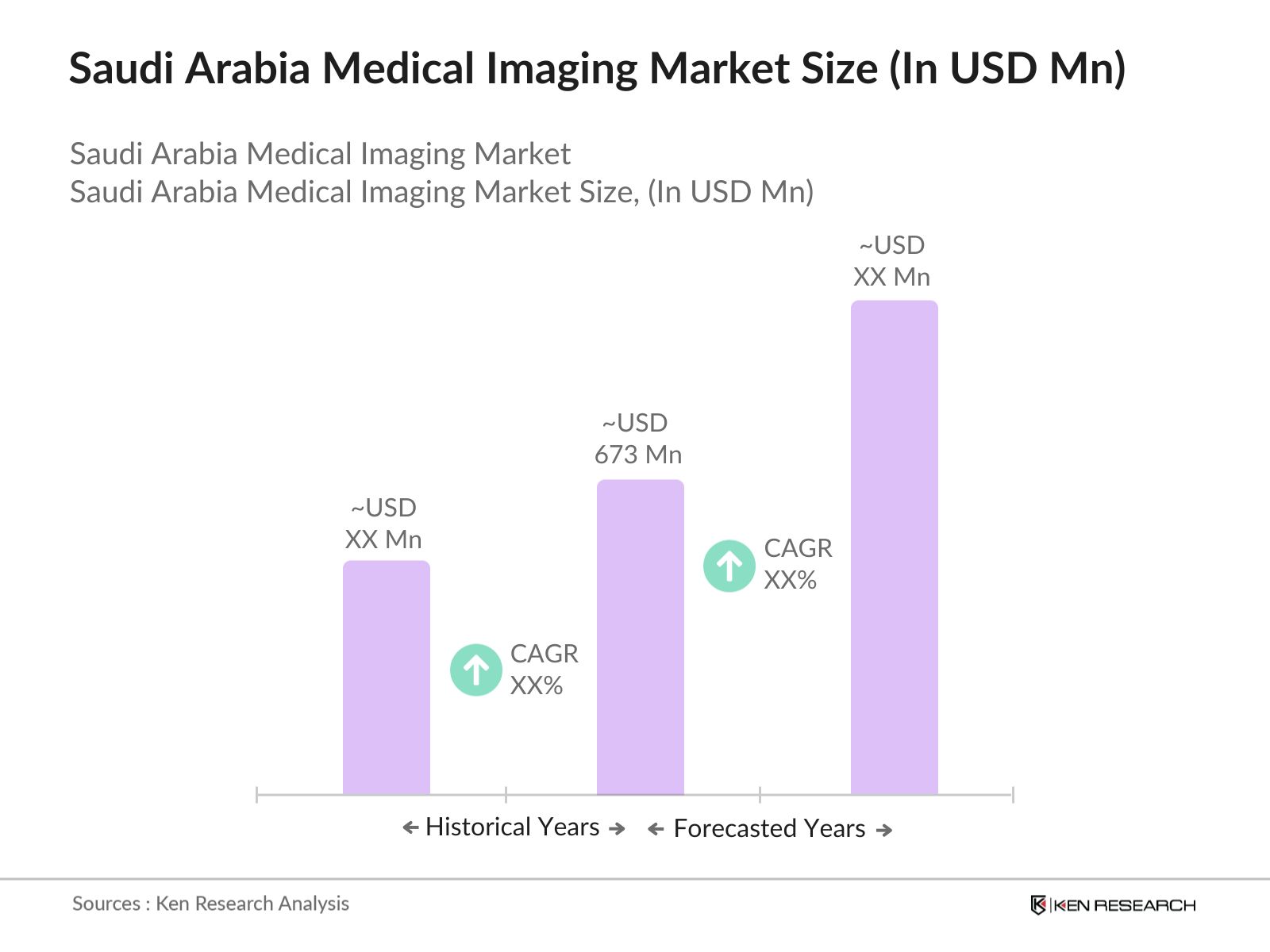

- The Saudi Arabia medical imaging market is valued at USD 673 million, driven primarily by the increasing prevalence of chronic diseases, advancements in medical imaging technologies, and significant investments in healthcare infrastructure. The government's Vision 2030 initiative aims to enhance healthcare services and facilities, further fueling demand for advanced imaging equipment..

- Key cities that dominate the Saudi Arabia medical imaging market include Riyadh, Jeddah, and the Eastern Province, owing to their advanced healthcare infrastructure and large urban population. Riyadh, the capital, is home to several leading hospitals and diagnostic centers, making it a hub for healthcare advancements.

- The Saudi Food and Drug Authority (SFDA) plays a critical role in regulating the medical imaging market. As of 2023, the SFDA requires all imported imaging equipment to comply with stringent safety and efficacy standards, particularly regarding radiation exposure. The authority also mandates that all new imaging technologies undergo rigorous testing before being approved for use in Saudi hospitals. These regulations ensure the safety and reliability of medical imaging devices in the country.

Saudi Arabia Medical Imaging Market Segmentation

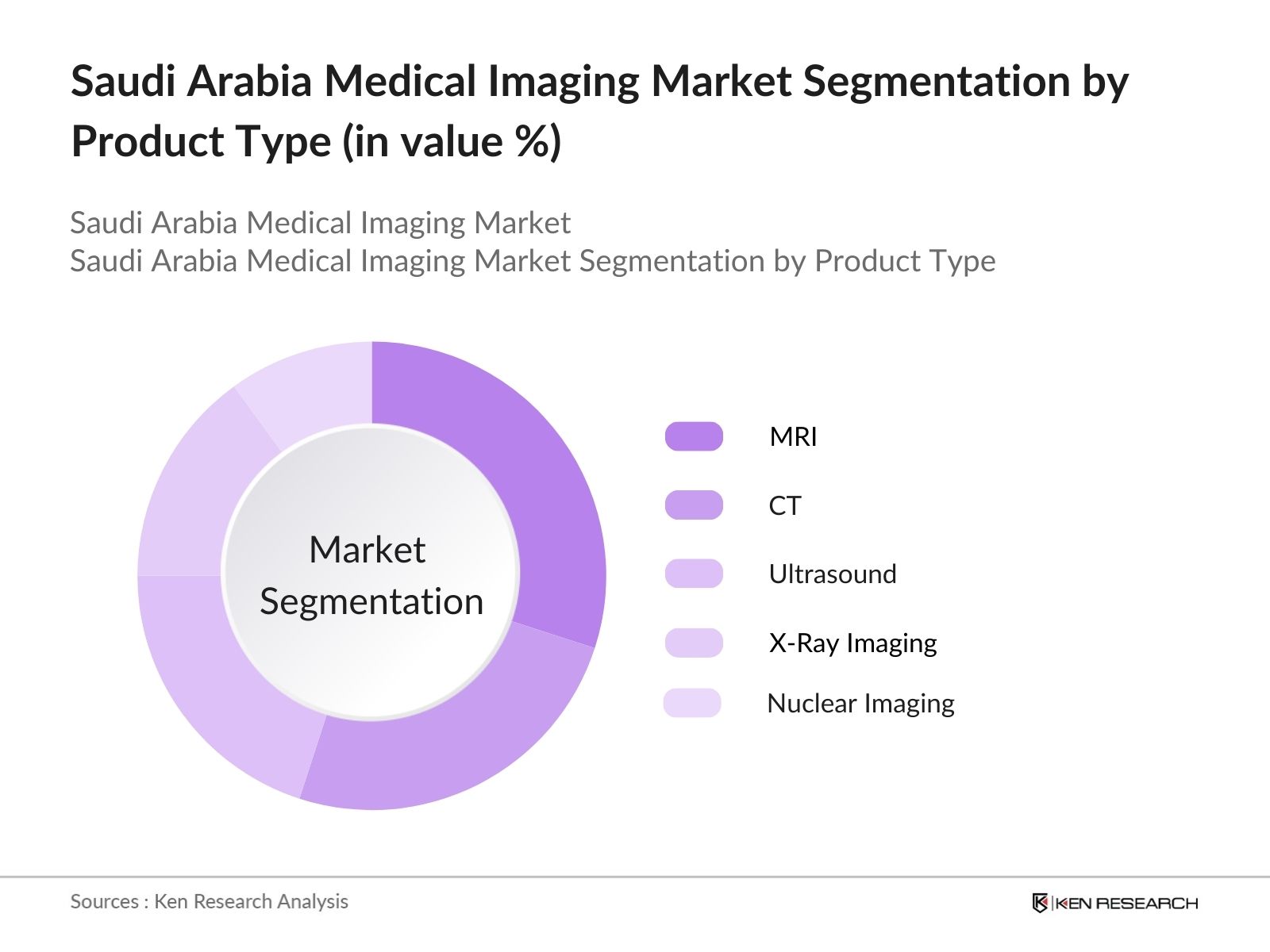

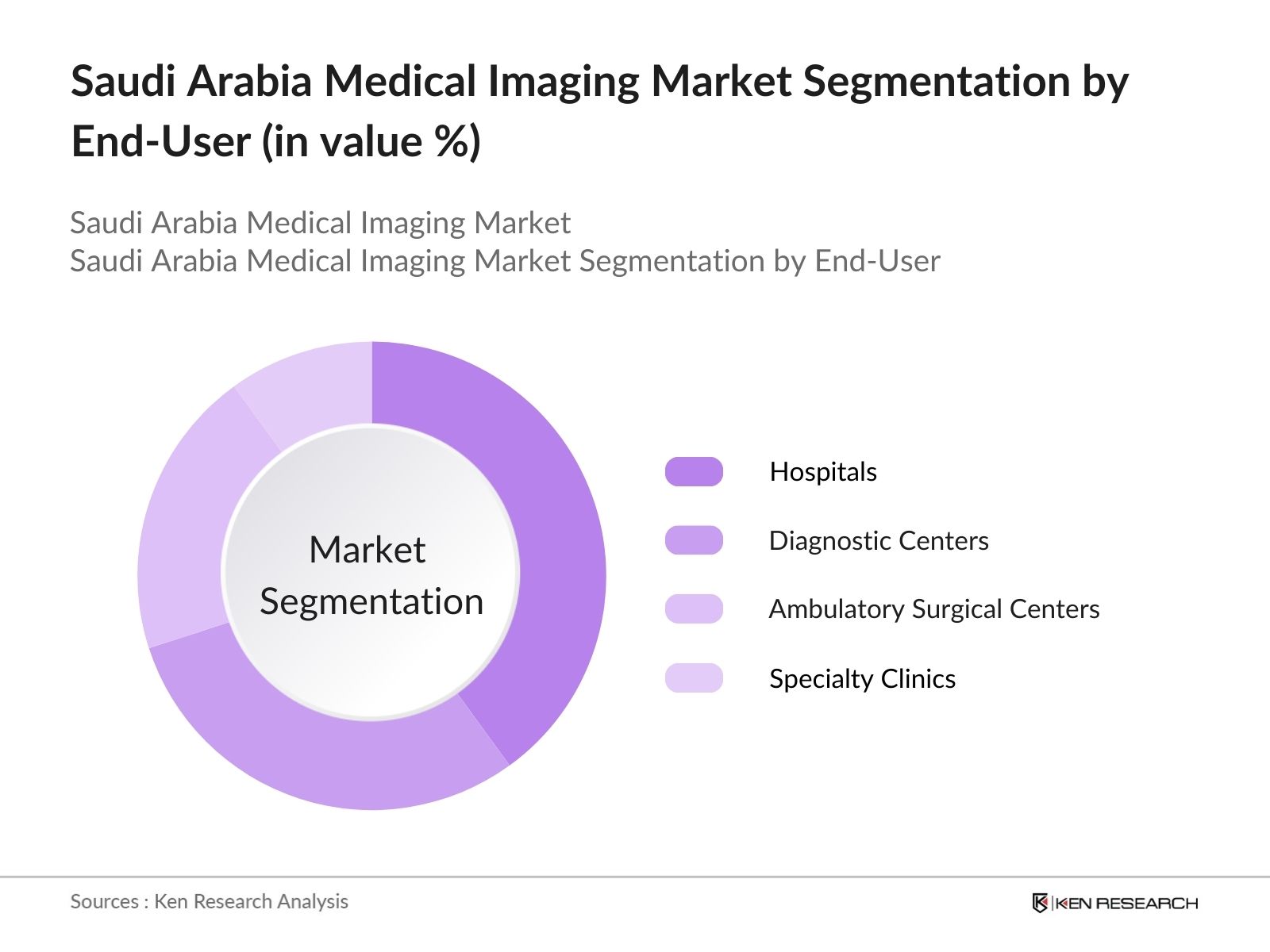

The Saudi Arabia medical imaging market is segmented by product type and by end user.

- By Product Type: The Saudi Arabia medical imaging market is segmented by product type into Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Ultrasound, X-Ray Imaging, and Nuclear Imaging (PET, SPECT). Among these, MRI holds the dominant market share due to its superior ability to diagnose a wide range of conditions, including neurological and musculoskeletal disorders. MRI's non-invasive nature, coupled with the rising demand for early and precise diagnosis, makes it the preferred imaging technique, especially in tertiary care hospitals and specialized diagnostic centers. Additionally, the growing availability of 3T and higher-field MRI machines enhances the diagnostic accuracy, making MRI a critical part of the country's medical imaging landscape.

- By End-User: The market is also segmented by end-users into Hospitals, Diagnostic Centers, Ambulatory Surgical Centers, and Specialty Clinics. Hospitals dominate this segment, accounting for the highest market share due to their extensive infrastructure, higher patient influx, and ability to provide a wide range of imaging services. The governments push towards increasing the number of hospitals under the Vision 2030 initiative has also significantly contributed to the high adoption of medical imaging equipment in these institutions. Furthermore, hospitals' access to larger budgets and advanced imaging technology has reinforced their dominance in the medical imaging market.

Saudi Arabia Medical Imaging Market Competitive Landscape

The Saudi Arabia medical imaging market is characterized by the presence of both local and international players, with some major companies holding significant influence. Companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems are key players due to their technological prowess and broad product portfolios. These companies offer a variety of imaging solutions, including MRI, CT, and ultrasound devices, which are critical to the market. The presence of established players and increasing competition has led to continuous innovation and investment in research and development. The strong foothold of these companies in the market is further bolstered by their extensive distribution networks and after-sales services.

|

Company |

Established Year |

Headquarters |

Market Penetration |

No. of Patents |

Revenue (USD) |

Key Products |

Certifications |

No. of Employees |

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

||||||

|

GE Healthcare |

1892 |

Chicago, USA |

||||||

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

||||||

|

Canon Medical Systems |

1930 |

Tokyo, Japan |

||||||

|

Hitachi Medical Systems |

1910 |

Tokyo, Japan |

Saudi Arabia Medical Imaging Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases: Saudi Arabia's medical imaging market is experiencing significant growth, largely due to the rising burden of chronic diseases like cardiovascular and neurological disorders. As of 2023, cardiovascular diseases were responsible for approximately 42% of deaths in Saudi Arabia, according to the World Health Organization (WHO). Neurological disorders, including stroke, account for a substantial portion of the disease burden, with stroke cases increasing by nearly 20% over the last five years. The growing incidence of these conditions is driving the demand for advanced diagnostic imaging to support early detection and management.

- Government Healthcare Initiatives: The Saudi governments Vision 2030 plan emphasizes substantial investment in healthcare infrastructure, a key driver for the medical imaging market. In 2022, Saudi Arabia allocated SAR 180 billion to its healthcare sector, an increase of 14% compared to the previous year. This budget supports the construction of new hospitals and the acquisition of modern diagnostic equipment. Moreover, the Health Sector Transformation Program aims to expand digital healthcare services, including imaging technologies. These government-backed initiatives provide a solid foundation for the growth of the medical imaging industry.

- Advancements in Imaging Technology: Technological advancements, such as the integration of artificial intelligence (AI) in diagnostics, are transforming the Saudi medical imaging landscape. In 2023, 15% of hospitals in Saudi Arabia adopted AI-based imaging systems, according to a report by the Ministry of Health. Machine learning algorithms are being used to enhance the accuracy of image interpretation, particularly in complex cases like oncology and neurology. These advancements are shortening diagnostic times, reducing errors, and contributing to better patient outcomes, thus driving market growth.

Market Challenges

- High Equipment Costs: The cost of acquiring advanced medical imaging equipment, such as MRI and PET-CT machines, presents a challenge for the Saudi market. As of 2023, the average cost of an MRI machine ranged from SAR 6 million to SAR 10 million, depending on its specifications. These high capital costs, coupled with maintenance expenses, hinder smaller healthcare facilities from adopting cutting-edge imaging technologies, limiting market penetration.

- Regulatory Hurdles in Equipment Approval: Obtaining regulatory approval for new imaging technologies in Saudi Arabia can be a lengthy and complex process. In 2023, the Saudi Food and Drug Authority (SFDA) introduced stricter guidelines for the approval of medical devices, including imaging equipment. These guidelines require manufacturers to meet rigorous standards in areas such as radiation safety and clinical effectiveness, extending the time needed for market entry. The SFDA's stringent regulations create delays and additional costs for both local and international manufacturers.

Saudi Arabia Medical Imaging Market Future Outlook

Over the next five years, the Saudi Arabia medical imaging market is expected to experience significant growth, driven by continuous government investments in healthcare infrastructure under the Vision 2030 initiative. The demand for advanced diagnostic technologies, particularly in urban centers like Riyadh and Jeddah, will increase due to the rising prevalence of chronic diseases, expanding medical tourism, and advancements in imaging technology such as artificial intelligence (AI) integration. Furthermore, the growing focus on early disease detection and preventive healthcare measures will continue to shape the market's trajectory, with a strong emphasis on non-invasive imaging techniques.

Market Opportunities

- Public-Private Partnerships for Healthcare Infrastructure: Public-private partnerships (PPPs) are emerging as a promising avenue for expanding healthcare infrastructure, including medical imaging facilities. In 2023, the Saudi Ministry of Health entered into multiple PPPs to develop imaging centers across the country, aiming to address gaps in healthcare access. For example, a SAR 1.5 billion agreement with a leading global healthcare provider will enhance diagnostic capabilities in several under-served regions. These collaborations are expected to boost the availability of advanced imaging technologies in the kingdom.

- Growing Medical Tourism in Saudi Arabia: Saudi Arabias growing reputation as a destination for medical tourism is creating new opportunities in the medical imaging market. In 2022, over 300,000 international patients sought medical treatment in Saudi Arabia, many requiring diagnostic imaging services. The governments Vision 2030 initiative includes plans to position the country as a regional hub for healthcare services, further driving demand for state-of-the-art imaging technologies in key cities like Riyadh and Jeddah.

Scope of the Report

|

||

|

By Application |

Oncology Cardiology Neurology Orthopedics Gynecology |

|

|

By End-User |

Hospitals Diagnostic Centers Ambulatory Surgical Centers Specialty Clinics |

|

|

By Technology |

|

|

|

By Region |

North East West South |

Products

Key Target Audience

Hospitals

Diagnostic Centers

Ambulatory Surgical Centers

Specialty Clinics

Government and Regulatory Bodies (Saudi Food and Drug Authority (SFDA), Ministry of Health)

Investors and Venture Capitalist Firms

Private Healthcare Providers

Medical Device Distributors

Companies

Players Mention in the Report:

Siemens Healthineers

GE Healthcare

Philips Healthcare

Canon Medical Systems

Hitachi Medical Systems

Fujifilm Healthcare

Mindray Medical International

Carestream Health

Shimadzu Corporation

Esaote S.p.A

Agfa Healthcare

Hologic Inc.

Samsung Medison

Barco NV

Toshiba Medical Systems

Table of Contents

1. Saudi Arabia Medical Imaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Medical Imaging Market Size (In SAR Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Medical Imaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Diseases (e.g., cardiovascular, neurological disorders)

3.1.2. Government Healthcare Initiatives (e.g., Vision 2030, healthcare infrastructure investments)

3.1.3. Advancements in Imaging Technology (AI integration, machine learning in diagnostics)

3.1.4. Rising Demand for Early Disease Diagnosis

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Regulatory Hurdles in Equipment Approval

3.2.3. Shortage of Trained Radiologists and Technicians

3.3. Opportunities

3.3.1. Public-Private Partnerships for Healthcare Infrastructure

3.3.2. Growing Medical Tourism in Saudi Arabia

3.3.3. Telemedicine and Remote Imaging Services

3.4. Trends

3.4.1. Adoption of AI in Radiology

3.4.2. Shift Towards Non-Invasive Imaging Techniques

3.4.3. Growth of Portable Imaging Devices

3.5. Government Regulation

3.5.1. Saudi Food and Drug Authority (SFDA) Guidelines

3.5.2. Health Sector Transformation Program

3.5.3. Imaging Equipment Import Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Saudi Arabia Medical Imaging Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Magnetic Resonance Imaging (MRI)

4.1.2. Computed Tomography (CT)

4.1.3. Ultrasound

4.1.4. X-Ray Imaging

4.1.5. Nuclear Imaging (PET, SPECT)

4.2. By Application (In Value %)

4.2.1. Oncology

4.2.2. Cardiology

4.2.3. Neurology

4.2.4. Orthopedics

4.2.5. Gynecology

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Centers

4.3.3. Ambulatory Surgical Centers

4.3.4. Specialty Clinics

4.4. By Technology (In Value %)

4.4.1. 2D Imaging

4.4.2. 3D Imaging

4.4.3. 4D Imaging

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Medical Imaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Healthineers

5.1.2. GE Healthcare

5.1.3. Philips Healthcare

5.1.4. Canon Medical Systems

5.1.5. Hitachi Medical Corporation

5.1.6. Fujifilm Healthcare

5.1.7. Mindray Medical International

5.1.8. Carestream Health

5.1.9. Shimadzu Corporation

5.1.10. Esaote S.p.A

5.1.11. Agfa Healthcare

5.1.12. Hologic Inc.

5.1.13. Samsung Medison

5.1.14. Barco NV

5.1.15. Toshiba Medical Systems

5.2. Cross Comparison Parameters (Market Presence, Product Portfolio, R&D Spend, Imaging Equipment Installed Base, Regional Market Share, No. of Patents, Customer Support Services, ISO Certification)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Medical Imaging Market Regulatory Framework

6.1. SFDA Imaging Equipment Approval Process

6.2. Compliance Requirements for Medical Devices

6.3. International Accreditation and Certification Standards

7. Saudi Arabia Medical Imaging Market Future Size (In SAR Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Medical Imaging Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Medical Imaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on constructing an ecosystem map encompassing all stakeholders in the Saudi Arabia medical imaging market. Extensive desk research is carried out using secondary and proprietary databases to gather relevant industry data and identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to assess market penetration, the ratio of imaging devices to service providers, and overall revenue generation. A detailed evaluation of healthcare infrastructure is also conducted to ensure accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with key players in the medical imaging market. These consultations provide operational and financial insights that are crucial for refining market data.

Step 4: Research Synthesis and Final Output

In the final stage, direct engagement with manufacturers and healthcare providers is carried out to verify the data collected. This ensures a comprehensive, accurate, and validated analysis of the Saudi Arabia medical imaging market.

Frequently Asked Questions

01. How big is the Saudi Arabia Medical Imaging Market?

The Saudi Arabia medical imaging market was valued at USD 673 million, driven by increased demand for advanced diagnostic tools and healthcare infrastructure investments.

02. What are the challenges in the Saudi Arabia Medical Imaging Market?

Key challenges in Saudi Arabia medical imaging market include high costs of advanced imaging equipment, regulatory hurdles for device approval, and a shortage of skilled radiologists and technicians.

03. Who are the major players in the Saudi Arabia Medical Imaging Market?

Major players in Saudi Arabia medical imaging market include Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, and Hitachi Medical Systems. These companies dominate due to their strong product portfolios and established presence in the region.

04. What are the growth drivers of the Saudi Arabia Medical Imaging Market?

The Saudi Arabia medical imaging market is driven by increasing cases of chronic diseases, advancements in imaging technology, and significant government investment under Vision 2030 to improve healthcare services.

05. Which cities dominate the Saudi Arabia Medical Imaging Market?

Riyadh, Jeddah, and the Eastern Province dominate the Saudi Arabia medical imaging market due to their advanced healthcare infrastructure and high concentration of diagnostic centers and hospitals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.